Key Insights

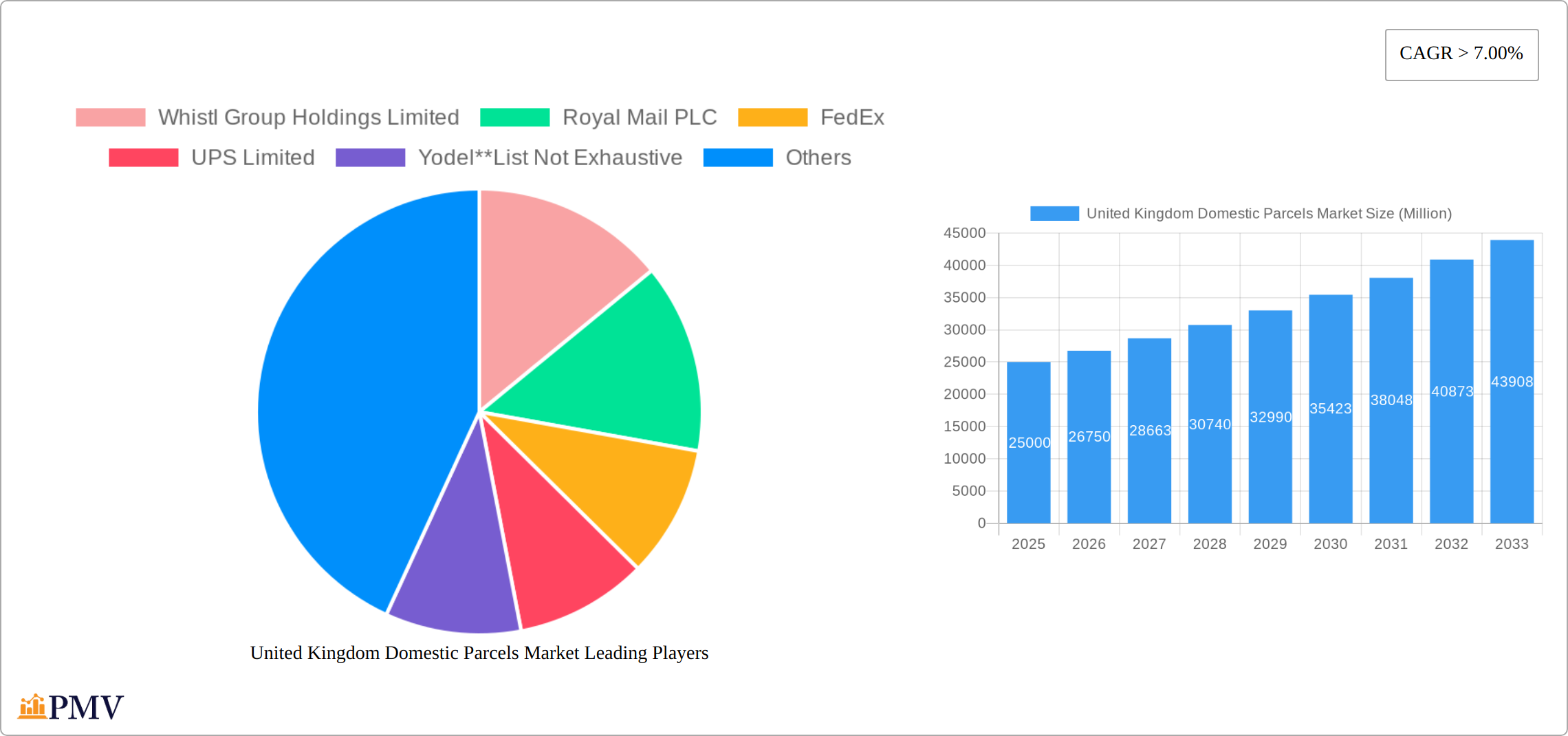

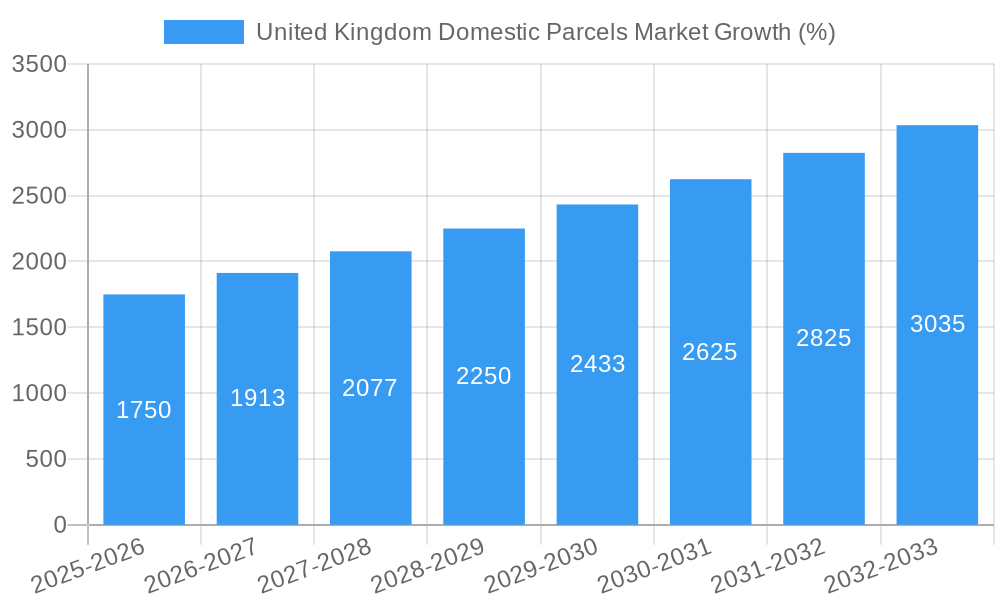

The United Kingdom domestic parcels market, currently valued at approximately £X billion (assuming a reasonable market size based on comparable European markets and the provided CAGR), exhibits robust growth potential, projected to exceed a compound annual growth rate (CAGR) of 7% from 2025 to 2033. This expansion is fueled by several key drivers. The rise of e-commerce, particularly within the B2C segment, continues to be a significant catalyst, with consumers increasingly relying on online shopping for convenience. Furthermore, the growth of B2B e-commerce, driven by supply chain optimization and efficient inventory management strategies across various sectors (services, wholesale/retail, healthcare, and industrial manufacturing), is significantly contributing to market growth. Technological advancements, including improved delivery tracking systems and automated sorting facilities, are enhancing operational efficiency and customer satisfaction. The increasing demand for faster and more reliable delivery options, such as same-day and next-day delivery services, is also driving market expansion.

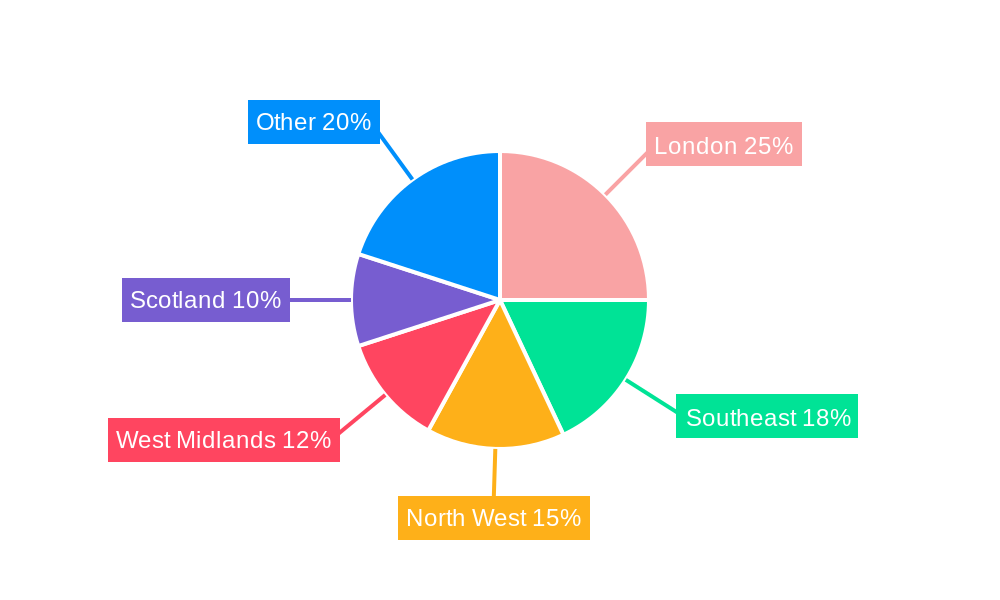

However, the market faces certain restraints. Fluctuating fuel prices and labor costs pose significant operational challenges, impacting profitability and potentially leading to price adjustments. Increased competition amongst established players like Royal Mail, FedEx, UPS, and newer entrants necessitates strategic differentiation and operational excellence. Stringent regulatory compliance, particularly concerning environmental sustainability and data privacy, demands ongoing investment and adaptation. The market is segmented by business model (B2B, B2C, C2C), type (e-commerce, non-e-commerce), and end-user (the sectors listed above). A detailed analysis of these segments reveals varying growth rates, with B2C e-commerce currently dominating but B2B experiencing faster growth due to ongoing digital transformation across industries. The regional distribution across the UK also presents opportunities for targeted growth strategies, focusing on areas with high population density and e-commerce penetration.

United Kingdom Domestic Parcels Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the United Kingdom domestic parcels market, encompassing market size, segmentation, competitive landscape, and future growth projections. The study period covers 2019-2033, with 2025 as the base and estimated year. The report is essential for businesses, investors, and stakeholders seeking a thorough understanding of this dynamic market.

United Kingdom Domestic Parcels Market Market Structure & Competitive Dynamics

The UK domestic parcels market is characterized by a moderately concentrated structure, with a few major players holding significant market share. Key players like Royal Mail PLC, FedEx, UPS Limited, and DHL Parcel UK Limited compete intensely, driving innovation and influencing pricing strategies. The market is further shaped by a robust regulatory framework, including competition laws and environmental regulations impacting operational practices. Significant M&A activity has occurred in recent years, although precise deal values are often confidential. The estimated combined market share of the top five players in 2025 is approximately xx%.

- Market Concentration: Moderately concentrated, with top players holding significant shares (estimated xx% combined in 2025).

- Innovation Ecosystems: Driven by technological advancements in automation, tracking, and delivery optimization, fostering competitive differentiation.

- Regulatory Frameworks: Influence operations, particularly around environmental sustainability and competition laws.

- Product Substitutes: Limited direct substitutes, primarily alternative delivery methods (e.g., in-person collection) for specific niche segments.

- End-User Trends: Growth in e-commerce drives demand, with increasing expectations for speed, convenience, and delivery options.

- M&A Activities: Frequent consolidation, though precise deal values are often unavailable, impacting market structure and competitive dynamics. The total M&A deal value for the period 2019-2024 is estimated at xx Million.

United Kingdom Domestic Parcels Market Industry Trends & Insights

The UK domestic parcels market exhibits robust growth, driven primarily by the burgeoning e-commerce sector and expanding consumer demand for faster and more convenient delivery options. Technological advancements, including automation and sophisticated logistics software, enhance efficiency and optimize delivery networks. However, competitive pressures, fluctuating fuel costs, and evolving consumer preferences present ongoing challenges. The market is expected to witness a CAGR of xx% during the forecast period (2025-2033). Market penetration of next-day delivery services is estimated at xx% in 2025.

Dominant Markets & Segments in United Kingdom Domestic Parcels Market

The B2C segment within the e-commerce sector dominates the UK domestic parcels market, fueled by the rapid growth of online shopping. London and other major metropolitan areas exhibit the highest parcel volumes due to concentrated populations and high e-commerce activity.

Key Drivers for B2C E-commerce Dominance:

- Rapid growth of online retail.

- Increasing consumer preference for home delivery.

- Enhanced logistics infrastructure in urban areas.

Other Significant Segments:

- B2B: Significant volume, driven by supply chain activities within various industries.

- C2C: Growing steadily, driven by online marketplaces and peer-to-peer transactions.

- Non-e-commerce: Remains a substantial portion of the market, linked to traditional retail and other sectors.

- End-user segments such as Wholesale and Retail Trade, and Services demonstrate the highest growth potential.

United Kingdom Domestic Parcels Market Product Innovations

Significant innovation focuses on enhancing delivery speed, efficiency, and sustainability. This includes the adoption of automated sorting systems, route optimization software, and electric vehicle fleets. Companies are also increasingly investing in last-mile delivery solutions, such as smart lockers and drone delivery for niche applications, to improve convenience and reduce costs.

Report Segmentation & Scope

The report segments the market based on business model (B2B, B2C, C2C), type (e-commerce, non-e-commerce), and end-user (Services, Wholesale and Retail Trade, Healthcare, Industrial Manufacturing, Other End-Users). Each segment's growth projections, market size, and competitive dynamics are analyzed in detail. The B2C segment is projected to maintain its dominance throughout the forecast period. E-commerce is expected to experience substantial growth, exceeding xx Million in 2033. The Wholesale and Retail Trade segment is also anticipated to show substantial growth, exceeding xx Million in 2033.

Key Drivers of United Kingdom Domestic Parcels Market Growth

Key growth drivers include the rapid expansion of e-commerce, increasing consumer demand for convenient and faster deliveries, technological advancements in logistics and delivery networks, and favorable government policies supporting infrastructure development and digitalization. The growth of online marketplaces and the increasing penetration of smartphones have further fuelled market growth.

Challenges in the United Kingdom Domestic Parcels Market Sector

Challenges include intense competition, fluctuating fuel costs impacting operational expenses, regulatory hurdles regarding environmental sustainability and delivery restrictions in certain areas, and maintaining efficient supply chains amid global disruptions. The increasing demand for faster and cheaper deliveries creates competitive pressure to maintain profitability.

Leading Players in the United Kingdom Domestic Parcels Market Market

- Whistl Group Holdings Limited

- Royal Mail PLC

- FedEx

- UPS Limited

- Yodel

- Aramex (UK) Limited

- Dx Network Services Limited

- The Delivery Group Limited

- Skynet World Wide Express Limited

- DHL Parcel UK Limited

Key Developments in United Kingdom Domestic Parcels Market Sector

- December 2022: DHL Parcel UK invested £64 Million in a green heavy fleet, including six 16-ton electric Volvo trucks and 30 liquefied natural gas-powered Volvo tractor units, showcasing a commitment to sustainability.

- September 2022: DHL Parcel UK partnered with Quadient to expand smart locker parcel pick-up options across the UK, enhancing customer convenience.

Strategic United Kingdom Domestic Parcels Market Market Outlook

The UK domestic parcels market is poised for continued growth, driven by the sustained expansion of e-commerce and technological advancements. Strategic opportunities lie in investing in sustainable delivery solutions, enhancing last-mile delivery capabilities, and leveraging data analytics to optimize operations and meet evolving customer expectations. Focusing on niche markets and providing specialized delivery services will also present opportunities for growth.

United Kingdom Domestic Parcels Market Segmentation

-

1. Business Model

- 1.1. Business-to-Business (B2B)

- 1.2. Business-to-Customer (B2C)

- 1.3. Customer-to-Customer (C2C)

-

2. Type

- 2.1. E-commerce

- 2.2. Non-e-commerce

-

3. End-User

- 3.1. Services

- 3.2. Wholesale and Retail Trade

- 3.3. Healthcare

- 3.4. Industrial Manufacturing

- 3.5. Other End-Users

United Kingdom Domestic Parcels Market Segmentation By Geography

- 1. United Kingdom

United Kingdom Domestic Parcels Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 7.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Demand For Project Logistics From Renewable Energy Projects4.; Increasing Investments In Infrastructure

- 3.3. Market Restrains

- 3.3.1. 4.; High Initial Capital Investment

- 3.4. Market Trends

- 3.4.1. Increasing E-commerce Penetration is Anticipated to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom Domestic Parcels Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Business Model

- 5.1.1. Business-to-Business (B2B)

- 5.1.2. Business-to-Customer (B2C)

- 5.1.3. Customer-to-Customer (C2C)

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. E-commerce

- 5.2.2. Non-e-commerce

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Services

- 5.3.2. Wholesale and Retail Trade

- 5.3.3. Healthcare

- 5.3.4. Industrial Manufacturing

- 5.3.5. Other End-Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Business Model

- 6. Asia Pacific United Kingdom Domestic Parcels Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. Americas United Kingdom Domestic Parcels Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. Europe United Kingdom Domestic Parcels Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. Middle East and Africa United Kingdom Domestic Parcels Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Whistl Group Holdings Limited

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Royal Mail PLC

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 FedEx

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 UPS Limited

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Yodel**List Not Exhaustive

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Aramex (UK) Limited

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Dx Network Services Limited

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 The Delivery Group Limited

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Skynet World Wide Express Limited

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 DHL Parcel UK Limited

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Whistl Group Holdings Limited

List of Figures

- Figure 1: United Kingdom Domestic Parcels Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United Kingdom Domestic Parcels Market Share (%) by Company 2024

List of Tables

- Table 1: United Kingdom Domestic Parcels Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United Kingdom Domestic Parcels Market Revenue Million Forecast, by Business Model 2019 & 2032

- Table 3: United Kingdom Domestic Parcels Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: United Kingdom Domestic Parcels Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 5: United Kingdom Domestic Parcels Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: United Kingdom Domestic Parcels Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United Kingdom Domestic Parcels Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: United Kingdom Domestic Parcels Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United Kingdom Domestic Parcels Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Domestic Parcels Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: United Kingdom Domestic Parcels Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom Domestic Parcels Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United Kingdom Domestic Parcels Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: United Kingdom Domestic Parcels Market Revenue Million Forecast, by Business Model 2019 & 2032

- Table 15: United Kingdom Domestic Parcels Market Revenue Million Forecast, by Type 2019 & 2032

- Table 16: United Kingdom Domestic Parcels Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 17: United Kingdom Domestic Parcels Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom Domestic Parcels Market?

The projected CAGR is approximately > 7.00%.

2. Which companies are prominent players in the United Kingdom Domestic Parcels Market?

Key companies in the market include Whistl Group Holdings Limited, Royal Mail PLC, FedEx, UPS Limited, Yodel**List Not Exhaustive, Aramex (UK) Limited, Dx Network Services Limited, The Delivery Group Limited, Skynet World Wide Express Limited, DHL Parcel UK Limited.

3. What are the main segments of the United Kingdom Domestic Parcels Market?

The market segments include Business Model, Type, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Demand For Project Logistics From Renewable Energy Projects4.; Increasing Investments In Infrastructure.

6. What are the notable trends driving market growth?

Increasing E-commerce Penetration is Anticipated to Drive the Market.

7. Are there any restraints impacting market growth?

4.; High Initial Capital Investment.

8. Can you provide examples of recent developments in the market?

December 2022: DHL Parcel UK has received six 16-ton entirely electric Volvo trucks, and 30 liquefied natural gas-powered Volvo tractor units will go into service later this year.The fully electric Volvo trucks will begin operating in London in January 2023. Both deployments are part of a €74 million (£64 million) UK investment in a green heavy fleet in line with the Deutsche Post DHL Group's sustainability strategy.This is a significant step forward in DHL Parcel UK's decarbonization goals and the Deutsche Post DHL Group's goal of achieving net-zero emissions logistics by 2050.By 2030 alone, the group will invest more than €7 billion (£6 billion) in clean technology and sustainable fuels to get there.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom Domestic Parcels Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom Domestic Parcels Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom Domestic Parcels Market?

To stay informed about further developments, trends, and reports in the United Kingdom Domestic Parcels Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence