Key Insights

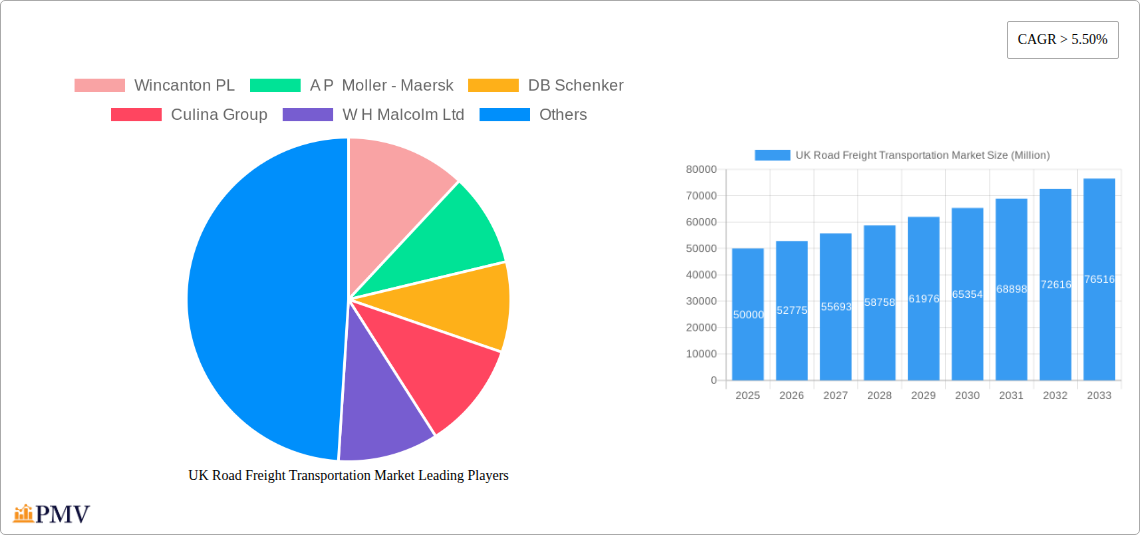

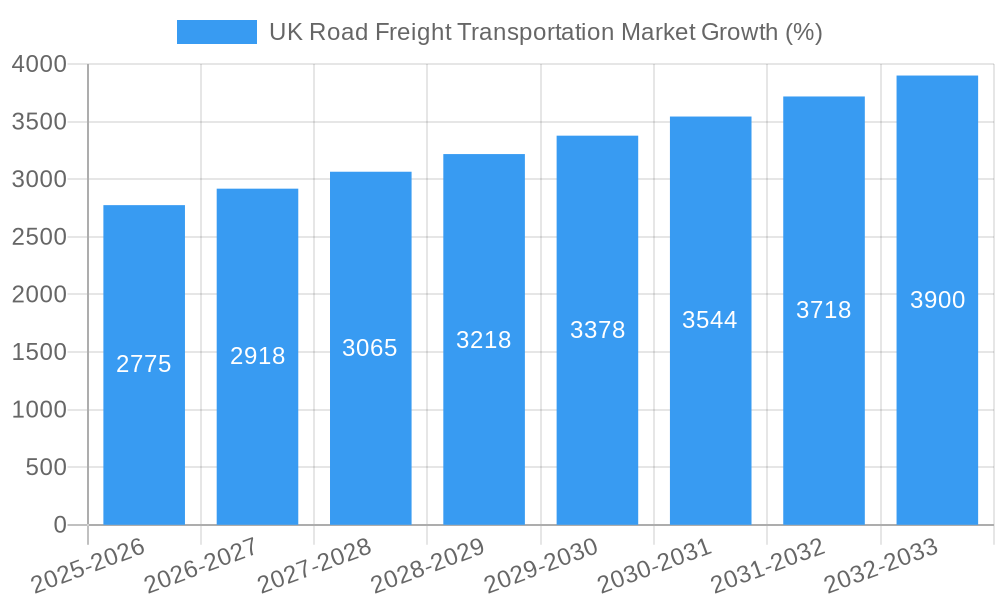

The UK road freight transportation market, valued at approximately £XX million in 2025, is experiencing robust growth, with a compound annual growth rate (CAGR) exceeding 5.5%. This expansion is driven by several key factors. The burgeoning e-commerce sector fuels demand for efficient last-mile delivery solutions, significantly impacting the LTL segment. Simultaneously, the growth of manufacturing and construction contributes to a high demand for FTL services, particularly in long-haul transportation. Increased cross-border trade within the UK and with European partners further stimulates the international freight segment. While fluctuating fuel prices and driver shortages pose challenges, technological advancements, such as improved route optimization software and the adoption of electric vehicles, are mitigating these constraints. The market is segmented by end-user industry (Agriculture, Construction, Manufacturing, Oil & Gas, Mining, Wholesale & Retail, etc.), transportation mode (FTL, LTL), containerization, distance (long/short haul), goods configuration (fluid/solid), and temperature control. The competitive landscape includes both large multinational players like Maersk and DHL, and regional operators like Wincanton and Culina, suggesting a mix of economies of scale and specialized service offerings.

The forecast period (2025-2033) anticipates continued market expansion, fueled by ongoing economic growth and evolving logistical requirements. However, the market’s trajectory will be influenced by macroeconomic conditions, government regulations related to emissions and driver safety, and technological innovations that reshape operational efficiency and sustainability. Growth in specific segments, like temperature-controlled transportation for pharmaceuticals and food products, is expected to outpace the overall market average. Strategic partnerships, mergers, and acquisitions among existing players are likely to further consolidate the market and enhance service offerings. Focus on sustainability and reducing carbon emissions will play an increasingly important role in shaping the future of the UK road freight transportation market.

UK Road Freight Transportation Market: A Comprehensive Report (2019-2033)

This in-depth report provides a detailed analysis of the UK road freight transportation market, offering crucial insights for businesses, investors, and policymakers. Covering the period 2019-2033, with a focus on 2025, this report unveils market size, segmentation, competitive dynamics, and future growth prospects. The report leverages rigorous research methodologies, encompassing both qualitative and quantitative data, to deliver actionable intelligence for strategic decision-making within this vital sector.

UK Road Freight Transportation Market Structure & Competitive Dynamics

The UK road freight transportation market exhibits a moderately concentrated structure, with several large players commanding significant market share. Wincanton PLC, A.P. Moller-Maersk, DB Schenker, and DHL Group are among the leading operators, often engaging in mergers and acquisitions (M&A) to expand their market reach and service portfolios. The market is also characterized by a dynamic landscape of smaller, specialized firms catering to niche segments.

Innovation in areas such as fleet management technology, route optimization software, and sustainable transportation solutions is increasingly shaping competitive advantage. Regulatory frameworks, particularly those concerning emissions standards, driver regulations, and infrastructure development, significantly influence market dynamics. Substitute modes of transport, such as rail and sea freight, exert competitive pressure, particularly for long-haul movements. End-user trends, such as the growth of e-commerce and the increasing demand for time-sensitive deliveries, are driving demand for flexible and efficient road freight solutions.

- Market Concentration: High concentration in FTL segment, moderate in LTL. xx% market share controlled by top 5 players in 2025.

- M&A Activity: Significant M&A activity observed between 2019-2024, with a total deal value of approximately £xx Million. Consolidation is expected to continue.

- Regulatory Landscape: Stringent regulations on driver hours, emissions, and safety are shaping operational strategies and investment decisions.

- Innovation Ecosystems: Significant investment in technology, including telematics, route optimization, and autonomous vehicles.

UK Road Freight Transportation Market Industry Trends & Insights

The UK road freight transportation market is poised for significant growth driven by robust economic activity, increasing e-commerce penetration, and expansion of the manufacturing and retail sectors. The market is witnessing a compound annual growth rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several key factors, including:

- Increasing demand for faster and more reliable delivery services, particularly for time-sensitive goods.

- The rise of e-commerce and omnichannel retailing, driving up demand for last-mile delivery services.

- Ongoing investments in road infrastructure improvements, facilitating smoother and more efficient transportation.

- Technological advancements in fleet management, route optimization, and transportation management systems (TMS) leading to improved efficiency and reduced costs.

- Growing adoption of sustainable transportation practices, including the use of alternative fuels and electric vehicles. Market penetration of electric trucks is projected to reach xx% by 2033.

- Increased focus on supply chain resilience and diversification in response to global events and disruptions.

However, challenges such as driver shortages, fuel price volatility, and Brexit-related complexities need to be addressed. The market is also becoming increasingly competitive, with both established players and new entrants vying for market share.

Dominant Markets & Segments in UK Road Freight Transportation Market

The UK road freight transportation market is segmented by end-user industry, destination, truckload specification, containerization, distance, goods configuration, and temperature control. The Wholesale and Retail Trade sector is the dominant end-user industry, followed by Manufacturing and Construction. The Domestic market segment is larger than the International market segment. Full-Truck-Load (FTL) services account for a significant portion of the total market volume.

- Key Drivers of Segment Dominance:

- Wholesale and Retail Trade: Driven by the boom in e-commerce and the need for efficient last-mile delivery.

- Domestic Market: Strong intra-UK trade and the concentration of manufacturing and retail in specific regions.

- FTL: Cost-effectiveness for larger shipments and dedicated transportation requirements.

- Detailed Dominance Analysis: The concentration of major logistics hubs and distribution centers in specific regions fuels the dominance of certain geographic areas. The high volume of goods shipped within the UK contributes to the dominance of the domestic market. The cost-effectiveness and efficiency of FTL services for large-scale shipments make it a key segment within the market.

UK Road Freight Transportation Market Product Innovations

Recent product innovations focus on enhancing efficiency, sustainability, and safety within the road freight sector. This includes the adoption of advanced telematics systems for real-time tracking and fleet management, route optimization software to reduce fuel consumption and improve delivery times, and the increasing integration of electric and alternative fuel vehicles. The market is also seeing innovations in containerization and temperature-controlled solutions to meet the specific needs of various goods. These innovations are driven by the need to improve operational efficiency, reduce costs, and meet increasingly stringent environmental regulations.

Report Segmentation & Scope

This report segments the UK road freight transportation market based on the following criteria:

- End-User Industry: Agriculture, Fishing, and Forestry; Construction; Manufacturing; Oil and Gas; Mining and Quarrying; Wholesale and Retail Trade; Others. Each segment's growth projection and market size are detailed within the report.

- Destination: Domestic; International. Growth rates and market sizes are projected for each segment, analyzing competitive landscapes.

- Truckload Specification: Full-Truck-Load (FTL); Less-than-Truck-Load (LTL). Competitive analysis examines pricing strategies and service offerings within each segment.

- Containerization: Containerized; Non-Containerized. Specific market trends and future outlook are discussed.

- Distance: Long Haul; Short Haul. Market size and growth projections are detailed for each haul type, revealing insights into dominant player strategies.

- Goods Configuration: Fluid Goods; Solid Goods. The report analyzes the specific challenges and opportunities within each goods category.

- Temperature Control: Non-Temperature Controlled; Temperature Controlled. This section examines the specialized logistics and infrastructure required for this segment.

Key Drivers of UK Road Freight Transportation Market Growth

Several factors drive the growth of the UK road freight transportation market. Technological advancements, such as the introduction of telematics and route optimization software, improve efficiency and reduce costs. Economic growth across various sectors increases demand for transportation services. Favorable government policies and investments in infrastructure further contribute to market expansion. The shift towards e-commerce and the need for faster delivery also create a significant demand for efficient road freight solutions.

Challenges in the UK Road Freight Transportation Market Sector

The UK road freight transportation market faces numerous challenges. Driver shortages pose a significant threat to operational capacity, impacting delivery times and costs. Fuel price volatility creates uncertainty in operating budgets. Stringent environmental regulations necessitate investments in cleaner technologies and increase operating costs. Brexit-related complexities and potential trade barriers also present risks to the industry. These challenges impact the overall profitability and sustainability of the market.

Leading Players in the UK Road Freight Transportation Market

- Wincanton PLC

- A.P. Moller - Maersk

- DB Schenker

- Culina Group

- W H Malcolm Ltd

- DHL Group

- DSV A/S (De Sammensluttede Vognmænd af Air and Sea)

- Dachser

- United Parcel Service of America Inc (UPS)

- Gregory Distribution (Holdings)

- Kinaxia Logistics Limited

- Gist Ltd

- Howard Tenens

- Turners (Soham) Limited

- Hoyer GmbH

- Ryder System Inc

Key Developments in UK Road Freight Transportation Market Sector

- September 2023: DHL Supply Chain invests €80 Million in a biomethane production facility, fueling up to 150 trucks and reducing carbon emissions by 15,000 tonnes annually.

- September 2023: DB Schenker acquires a new 2.3-acre site in Trafford Park, Manchester, enhancing its operational capabilities.

- August 2023: DSV expands its all-electric Volta Zero fleet for last-mile deliveries in London and the Southeast, promoting sustainability and safety.

Strategic UK Road Freight Transportation Market Outlook

The UK road freight transportation market presents significant growth potential. Continued investment in technological advancements, coupled with a focus on sustainability and efficiency, will drive market expansion. Strategic partnerships and acquisitions will continue to reshape the competitive landscape. The focus on resilient supply chains, addressing driver shortages, and navigating evolving regulatory frameworks will be crucial for success in the years to come. The market is expected to maintain a strong growth trajectory, presenting attractive opportunities for both established players and new entrants.

UK Road Freight Transportation Market Segmentation

-

1. End User Industry

- 1.1. Agriculture, Fishing, and Forestry

- 1.2. Construction

- 1.3. Manufacturing

- 1.4. Oil and Gas, Mining and Quarrying

- 1.5. Wholesale and Retail Trade

- 1.6. Others

-

2. Destination

- 2.1. Domestic

- 2.2. International

-

3. Truckload Specification

- 3.1. Full-Truck-Load (FTL)

- 3.2. Less than-Truck-Load (LTL)

-

4. Containerization

- 4.1. Containerized

- 4.2. Non-Containerized

-

5. Distance

- 5.1. Long Haul

- 5.2. Short Haul

-

6. Goods Configuration

- 6.1. Fluid Goods

- 6.2. Solid Goods

-

7. Temperature Control

- 7.1. Non-Temperature Controlled

UK Road Freight Transportation Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UK Road Freight Transportation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Rise in Demand for Specialty Chemicals in ASEAN Countries Increasing Trade Logistics Activity; Partnerships and Collaborations Between Major Players in the Chemical Logistics Market are Being Formed for the Creation of Innovative Goods and Technologically Enhanced Services

- 3.3. Market Restrains

- 3.3.1. Complexities Related to Chemical Logistics; High Cost Involved in the Transportation of Chemicals

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UK Road Freight Transportation Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Agriculture, Fishing, and Forestry

- 5.1.2. Construction

- 5.1.3. Manufacturing

- 5.1.4. Oil and Gas, Mining and Quarrying

- 5.1.5. Wholesale and Retail Trade

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Destination

- 5.2.1. Domestic

- 5.2.2. International

- 5.3. Market Analysis, Insights and Forecast - by Truckload Specification

- 5.3.1. Full-Truck-Load (FTL)

- 5.3.2. Less than-Truck-Load (LTL)

- 5.4. Market Analysis, Insights and Forecast - by Containerization

- 5.4.1. Containerized

- 5.4.2. Non-Containerized

- 5.5. Market Analysis, Insights and Forecast - by Distance

- 5.5.1. Long Haul

- 5.5.2. Short Haul

- 5.6. Market Analysis, Insights and Forecast - by Goods Configuration

- 5.6.1. Fluid Goods

- 5.6.2. Solid Goods

- 5.7. Market Analysis, Insights and Forecast - by Temperature Control

- 5.7.1. Non-Temperature Controlled

- 5.8. Market Analysis, Insights and Forecast - by Region

- 5.8.1. North America

- 5.8.2. South America

- 5.8.3. Europe

- 5.8.4. Middle East & Africa

- 5.8.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. North America UK Road Freight Transportation Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by End User Industry

- 6.1.1. Agriculture, Fishing, and Forestry

- 6.1.2. Construction

- 6.1.3. Manufacturing

- 6.1.4. Oil and Gas, Mining and Quarrying

- 6.1.5. Wholesale and Retail Trade

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by Destination

- 6.2.1. Domestic

- 6.2.2. International

- 6.3. Market Analysis, Insights and Forecast - by Truckload Specification

- 6.3.1. Full-Truck-Load (FTL)

- 6.3.2. Less than-Truck-Load (LTL)

- 6.4. Market Analysis, Insights and Forecast - by Containerization

- 6.4.1. Containerized

- 6.4.2. Non-Containerized

- 6.5. Market Analysis, Insights and Forecast - by Distance

- 6.5.1. Long Haul

- 6.5.2. Short Haul

- 6.6. Market Analysis, Insights and Forecast - by Goods Configuration

- 6.6.1. Fluid Goods

- 6.6.2. Solid Goods

- 6.7. Market Analysis, Insights and Forecast - by Temperature Control

- 6.7.1. Non-Temperature Controlled

- 6.1. Market Analysis, Insights and Forecast - by End User Industry

- 7. South America UK Road Freight Transportation Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by End User Industry

- 7.1.1. Agriculture, Fishing, and Forestry

- 7.1.2. Construction

- 7.1.3. Manufacturing

- 7.1.4. Oil and Gas, Mining and Quarrying

- 7.1.5. Wholesale and Retail Trade

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by Destination

- 7.2.1. Domestic

- 7.2.2. International

- 7.3. Market Analysis, Insights and Forecast - by Truckload Specification

- 7.3.1. Full-Truck-Load (FTL)

- 7.3.2. Less than-Truck-Load (LTL)

- 7.4. Market Analysis, Insights and Forecast - by Containerization

- 7.4.1. Containerized

- 7.4.2. Non-Containerized

- 7.5. Market Analysis, Insights and Forecast - by Distance

- 7.5.1. Long Haul

- 7.5.2. Short Haul

- 7.6. Market Analysis, Insights and Forecast - by Goods Configuration

- 7.6.1. Fluid Goods

- 7.6.2. Solid Goods

- 7.7. Market Analysis, Insights and Forecast - by Temperature Control

- 7.7.1. Non-Temperature Controlled

- 7.1. Market Analysis, Insights and Forecast - by End User Industry

- 8. Europe UK Road Freight Transportation Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by End User Industry

- 8.1.1. Agriculture, Fishing, and Forestry

- 8.1.2. Construction

- 8.1.3. Manufacturing

- 8.1.4. Oil and Gas, Mining and Quarrying

- 8.1.5. Wholesale and Retail Trade

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by Destination

- 8.2.1. Domestic

- 8.2.2. International

- 8.3. Market Analysis, Insights and Forecast - by Truckload Specification

- 8.3.1. Full-Truck-Load (FTL)

- 8.3.2. Less than-Truck-Load (LTL)

- 8.4. Market Analysis, Insights and Forecast - by Containerization

- 8.4.1. Containerized

- 8.4.2. Non-Containerized

- 8.5. Market Analysis, Insights and Forecast - by Distance

- 8.5.1. Long Haul

- 8.5.2. Short Haul

- 8.6. Market Analysis, Insights and Forecast - by Goods Configuration

- 8.6.1. Fluid Goods

- 8.6.2. Solid Goods

- 8.7. Market Analysis, Insights and Forecast - by Temperature Control

- 8.7.1. Non-Temperature Controlled

- 8.1. Market Analysis, Insights and Forecast - by End User Industry

- 9. Middle East & Africa UK Road Freight Transportation Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by End User Industry

- 9.1.1. Agriculture, Fishing, and Forestry

- 9.1.2. Construction

- 9.1.3. Manufacturing

- 9.1.4. Oil and Gas, Mining and Quarrying

- 9.1.5. Wholesale and Retail Trade

- 9.1.6. Others

- 9.2. Market Analysis, Insights and Forecast - by Destination

- 9.2.1. Domestic

- 9.2.2. International

- 9.3. Market Analysis, Insights and Forecast - by Truckload Specification

- 9.3.1. Full-Truck-Load (FTL)

- 9.3.2. Less than-Truck-Load (LTL)

- 9.4. Market Analysis, Insights and Forecast - by Containerization

- 9.4.1. Containerized

- 9.4.2. Non-Containerized

- 9.5. Market Analysis, Insights and Forecast - by Distance

- 9.5.1. Long Haul

- 9.5.2. Short Haul

- 9.6. Market Analysis, Insights and Forecast - by Goods Configuration

- 9.6.1. Fluid Goods

- 9.6.2. Solid Goods

- 9.7. Market Analysis, Insights and Forecast - by Temperature Control

- 9.7.1. Non-Temperature Controlled

- 9.1. Market Analysis, Insights and Forecast - by End User Industry

- 10. Asia Pacific UK Road Freight Transportation Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by End User Industry

- 10.1.1. Agriculture, Fishing, and Forestry

- 10.1.2. Construction

- 10.1.3. Manufacturing

- 10.1.4. Oil and Gas, Mining and Quarrying

- 10.1.5. Wholesale and Retail Trade

- 10.1.6. Others

- 10.2. Market Analysis, Insights and Forecast - by Destination

- 10.2.1. Domestic

- 10.2.2. International

- 10.3. Market Analysis, Insights and Forecast - by Truckload Specification

- 10.3.1. Full-Truck-Load (FTL)

- 10.3.2. Less than-Truck-Load (LTL)

- 10.4. Market Analysis, Insights and Forecast - by Containerization

- 10.4.1. Containerized

- 10.4.2. Non-Containerized

- 10.5. Market Analysis, Insights and Forecast - by Distance

- 10.5.1. Long Haul

- 10.5.2. Short Haul

- 10.6. Market Analysis, Insights and Forecast - by Goods Configuration

- 10.6.1. Fluid Goods

- 10.6.2. Solid Goods

- 10.7. Market Analysis, Insights and Forecast - by Temperature Control

- 10.7.1. Non-Temperature Controlled

- 10.1. Market Analysis, Insights and Forecast - by End User Industry

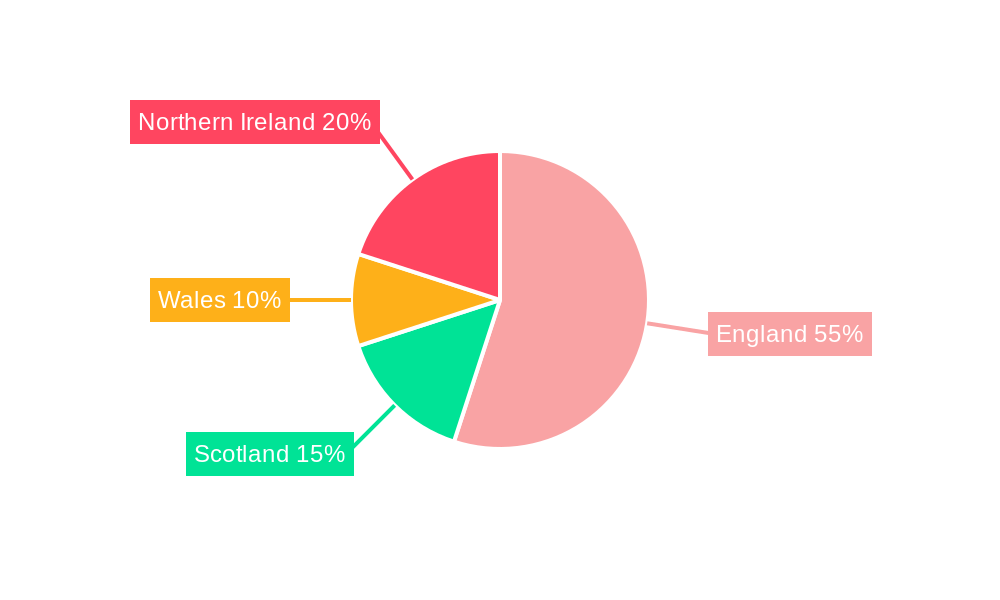

- 11. England UK Road Freight Transportation Market Analysis, Insights and Forecast, 2019-2031

- 12. Wales UK Road Freight Transportation Market Analysis, Insights and Forecast, 2019-2031

- 13. Scotland UK Road Freight Transportation Market Analysis, Insights and Forecast, 2019-2031

- 14. Northern UK Road Freight Transportation Market Analysis, Insights and Forecast, 2019-2031

- 15. Ireland UK Road Freight Transportation Market Analysis, Insights and Forecast, 2019-2031

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Wincanton PL

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 A P Moller - Maersk

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 DB Schenker

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Culina Group

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 W H Malcolm Ltd

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 DHL Group

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 DSV A/S (De Sammensluttede Vognmænd af Air and Sea)

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Dachser

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 United Parcel Service of America Inc (UPS)

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Gregory Distribution (Holdings)

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Kinaxia Logistics Limited

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Gist Ltd

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 Howard Tenens

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.14 Turners (Soham) Limited

- 16.2.14.1. Overview

- 16.2.14.2. Products

- 16.2.14.3. SWOT Analysis

- 16.2.14.4. Recent Developments

- 16.2.14.5. Financials (Based on Availability)

- 16.2.15 Hoyer GmbH

- 16.2.15.1. Overview

- 16.2.15.2. Products

- 16.2.15.3. SWOT Analysis

- 16.2.15.4. Recent Developments

- 16.2.15.5. Financials (Based on Availability)

- 16.2.16 Ryder System Inc

- 16.2.16.1. Overview

- 16.2.16.2. Products

- 16.2.16.3. SWOT Analysis

- 16.2.16.4. Recent Developments

- 16.2.16.5. Financials (Based on Availability)

- 16.2.1 Wincanton PL

List of Figures

- Figure 1: Global UK Road Freight Transportation Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: United kingdom Region UK Road Freight Transportation Market Revenue (Million), by Country 2024 & 2032

- Figure 3: United kingdom Region UK Road Freight Transportation Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America UK Road Freight Transportation Market Revenue (Million), by End User Industry 2024 & 2032

- Figure 5: North America UK Road Freight Transportation Market Revenue Share (%), by End User Industry 2024 & 2032

- Figure 6: North America UK Road Freight Transportation Market Revenue (Million), by Destination 2024 & 2032

- Figure 7: North America UK Road Freight Transportation Market Revenue Share (%), by Destination 2024 & 2032

- Figure 8: North America UK Road Freight Transportation Market Revenue (Million), by Truckload Specification 2024 & 2032

- Figure 9: North America UK Road Freight Transportation Market Revenue Share (%), by Truckload Specification 2024 & 2032

- Figure 10: North America UK Road Freight Transportation Market Revenue (Million), by Containerization 2024 & 2032

- Figure 11: North America UK Road Freight Transportation Market Revenue Share (%), by Containerization 2024 & 2032

- Figure 12: North America UK Road Freight Transportation Market Revenue (Million), by Distance 2024 & 2032

- Figure 13: North America UK Road Freight Transportation Market Revenue Share (%), by Distance 2024 & 2032

- Figure 14: North America UK Road Freight Transportation Market Revenue (Million), by Goods Configuration 2024 & 2032

- Figure 15: North America UK Road Freight Transportation Market Revenue Share (%), by Goods Configuration 2024 & 2032

- Figure 16: North America UK Road Freight Transportation Market Revenue (Million), by Temperature Control 2024 & 2032

- Figure 17: North America UK Road Freight Transportation Market Revenue Share (%), by Temperature Control 2024 & 2032

- Figure 18: North America UK Road Freight Transportation Market Revenue (Million), by Country 2024 & 2032

- Figure 19: North America UK Road Freight Transportation Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: South America UK Road Freight Transportation Market Revenue (Million), by End User Industry 2024 & 2032

- Figure 21: South America UK Road Freight Transportation Market Revenue Share (%), by End User Industry 2024 & 2032

- Figure 22: South America UK Road Freight Transportation Market Revenue (Million), by Destination 2024 & 2032

- Figure 23: South America UK Road Freight Transportation Market Revenue Share (%), by Destination 2024 & 2032

- Figure 24: South America UK Road Freight Transportation Market Revenue (Million), by Truckload Specification 2024 & 2032

- Figure 25: South America UK Road Freight Transportation Market Revenue Share (%), by Truckload Specification 2024 & 2032

- Figure 26: South America UK Road Freight Transportation Market Revenue (Million), by Containerization 2024 & 2032

- Figure 27: South America UK Road Freight Transportation Market Revenue Share (%), by Containerization 2024 & 2032

- Figure 28: South America UK Road Freight Transportation Market Revenue (Million), by Distance 2024 & 2032

- Figure 29: South America UK Road Freight Transportation Market Revenue Share (%), by Distance 2024 & 2032

- Figure 30: South America UK Road Freight Transportation Market Revenue (Million), by Goods Configuration 2024 & 2032

- Figure 31: South America UK Road Freight Transportation Market Revenue Share (%), by Goods Configuration 2024 & 2032

- Figure 32: South America UK Road Freight Transportation Market Revenue (Million), by Temperature Control 2024 & 2032

- Figure 33: South America UK Road Freight Transportation Market Revenue Share (%), by Temperature Control 2024 & 2032

- Figure 34: South America UK Road Freight Transportation Market Revenue (Million), by Country 2024 & 2032

- Figure 35: South America UK Road Freight Transportation Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Europe UK Road Freight Transportation Market Revenue (Million), by End User Industry 2024 & 2032

- Figure 37: Europe UK Road Freight Transportation Market Revenue Share (%), by End User Industry 2024 & 2032

- Figure 38: Europe UK Road Freight Transportation Market Revenue (Million), by Destination 2024 & 2032

- Figure 39: Europe UK Road Freight Transportation Market Revenue Share (%), by Destination 2024 & 2032

- Figure 40: Europe UK Road Freight Transportation Market Revenue (Million), by Truckload Specification 2024 & 2032

- Figure 41: Europe UK Road Freight Transportation Market Revenue Share (%), by Truckload Specification 2024 & 2032

- Figure 42: Europe UK Road Freight Transportation Market Revenue (Million), by Containerization 2024 & 2032

- Figure 43: Europe UK Road Freight Transportation Market Revenue Share (%), by Containerization 2024 & 2032

- Figure 44: Europe UK Road Freight Transportation Market Revenue (Million), by Distance 2024 & 2032

- Figure 45: Europe UK Road Freight Transportation Market Revenue Share (%), by Distance 2024 & 2032

- Figure 46: Europe UK Road Freight Transportation Market Revenue (Million), by Goods Configuration 2024 & 2032

- Figure 47: Europe UK Road Freight Transportation Market Revenue Share (%), by Goods Configuration 2024 & 2032

- Figure 48: Europe UK Road Freight Transportation Market Revenue (Million), by Temperature Control 2024 & 2032

- Figure 49: Europe UK Road Freight Transportation Market Revenue Share (%), by Temperature Control 2024 & 2032

- Figure 50: Europe UK Road Freight Transportation Market Revenue (Million), by Country 2024 & 2032

- Figure 51: Europe UK Road Freight Transportation Market Revenue Share (%), by Country 2024 & 2032

- Figure 52: Middle East & Africa UK Road Freight Transportation Market Revenue (Million), by End User Industry 2024 & 2032

- Figure 53: Middle East & Africa UK Road Freight Transportation Market Revenue Share (%), by End User Industry 2024 & 2032

- Figure 54: Middle East & Africa UK Road Freight Transportation Market Revenue (Million), by Destination 2024 & 2032

- Figure 55: Middle East & Africa UK Road Freight Transportation Market Revenue Share (%), by Destination 2024 & 2032

- Figure 56: Middle East & Africa UK Road Freight Transportation Market Revenue (Million), by Truckload Specification 2024 & 2032

- Figure 57: Middle East & Africa UK Road Freight Transportation Market Revenue Share (%), by Truckload Specification 2024 & 2032

- Figure 58: Middle East & Africa UK Road Freight Transportation Market Revenue (Million), by Containerization 2024 & 2032

- Figure 59: Middle East & Africa UK Road Freight Transportation Market Revenue Share (%), by Containerization 2024 & 2032

- Figure 60: Middle East & Africa UK Road Freight Transportation Market Revenue (Million), by Distance 2024 & 2032

- Figure 61: Middle East & Africa UK Road Freight Transportation Market Revenue Share (%), by Distance 2024 & 2032

- Figure 62: Middle East & Africa UK Road Freight Transportation Market Revenue (Million), by Goods Configuration 2024 & 2032

- Figure 63: Middle East & Africa UK Road Freight Transportation Market Revenue Share (%), by Goods Configuration 2024 & 2032

- Figure 64: Middle East & Africa UK Road Freight Transportation Market Revenue (Million), by Temperature Control 2024 & 2032

- Figure 65: Middle East & Africa UK Road Freight Transportation Market Revenue Share (%), by Temperature Control 2024 & 2032

- Figure 66: Middle East & Africa UK Road Freight Transportation Market Revenue (Million), by Country 2024 & 2032

- Figure 67: Middle East & Africa UK Road Freight Transportation Market Revenue Share (%), by Country 2024 & 2032

- Figure 68: Asia Pacific UK Road Freight Transportation Market Revenue (Million), by End User Industry 2024 & 2032

- Figure 69: Asia Pacific UK Road Freight Transportation Market Revenue Share (%), by End User Industry 2024 & 2032

- Figure 70: Asia Pacific UK Road Freight Transportation Market Revenue (Million), by Destination 2024 & 2032

- Figure 71: Asia Pacific UK Road Freight Transportation Market Revenue Share (%), by Destination 2024 & 2032

- Figure 72: Asia Pacific UK Road Freight Transportation Market Revenue (Million), by Truckload Specification 2024 & 2032

- Figure 73: Asia Pacific UK Road Freight Transportation Market Revenue Share (%), by Truckload Specification 2024 & 2032

- Figure 74: Asia Pacific UK Road Freight Transportation Market Revenue (Million), by Containerization 2024 & 2032

- Figure 75: Asia Pacific UK Road Freight Transportation Market Revenue Share (%), by Containerization 2024 & 2032

- Figure 76: Asia Pacific UK Road Freight Transportation Market Revenue (Million), by Distance 2024 & 2032

- Figure 77: Asia Pacific UK Road Freight Transportation Market Revenue Share (%), by Distance 2024 & 2032

- Figure 78: Asia Pacific UK Road Freight Transportation Market Revenue (Million), by Goods Configuration 2024 & 2032

- Figure 79: Asia Pacific UK Road Freight Transportation Market Revenue Share (%), by Goods Configuration 2024 & 2032

- Figure 80: Asia Pacific UK Road Freight Transportation Market Revenue (Million), by Temperature Control 2024 & 2032

- Figure 81: Asia Pacific UK Road Freight Transportation Market Revenue Share (%), by Temperature Control 2024 & 2032

- Figure 82: Asia Pacific UK Road Freight Transportation Market Revenue (Million), by Country 2024 & 2032

- Figure 83: Asia Pacific UK Road Freight Transportation Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global UK Road Freight Transportation Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global UK Road Freight Transportation Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 3: Global UK Road Freight Transportation Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 4: Global UK Road Freight Transportation Market Revenue Million Forecast, by Truckload Specification 2019 & 2032

- Table 5: Global UK Road Freight Transportation Market Revenue Million Forecast, by Containerization 2019 & 2032

- Table 6: Global UK Road Freight Transportation Market Revenue Million Forecast, by Distance 2019 & 2032

- Table 7: Global UK Road Freight Transportation Market Revenue Million Forecast, by Goods Configuration 2019 & 2032

- Table 8: Global UK Road Freight Transportation Market Revenue Million Forecast, by Temperature Control 2019 & 2032

- Table 9: Global UK Road Freight Transportation Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Global UK Road Freight Transportation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: England UK Road Freight Transportation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Wales UK Road Freight Transportation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Scotland UK Road Freight Transportation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Northern UK Road Freight Transportation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Ireland UK Road Freight Transportation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global UK Road Freight Transportation Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 17: Global UK Road Freight Transportation Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 18: Global UK Road Freight Transportation Market Revenue Million Forecast, by Truckload Specification 2019 & 2032

- Table 19: Global UK Road Freight Transportation Market Revenue Million Forecast, by Containerization 2019 & 2032

- Table 20: Global UK Road Freight Transportation Market Revenue Million Forecast, by Distance 2019 & 2032

- Table 21: Global UK Road Freight Transportation Market Revenue Million Forecast, by Goods Configuration 2019 & 2032

- Table 22: Global UK Road Freight Transportation Market Revenue Million Forecast, by Temperature Control 2019 & 2032

- Table 23: Global UK Road Freight Transportation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: United States UK Road Freight Transportation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Canada UK Road Freight Transportation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Mexico UK Road Freight Transportation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Global UK Road Freight Transportation Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 28: Global UK Road Freight Transportation Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 29: Global UK Road Freight Transportation Market Revenue Million Forecast, by Truckload Specification 2019 & 2032

- Table 30: Global UK Road Freight Transportation Market Revenue Million Forecast, by Containerization 2019 & 2032

- Table 31: Global UK Road Freight Transportation Market Revenue Million Forecast, by Distance 2019 & 2032

- Table 32: Global UK Road Freight Transportation Market Revenue Million Forecast, by Goods Configuration 2019 & 2032

- Table 33: Global UK Road Freight Transportation Market Revenue Million Forecast, by Temperature Control 2019 & 2032

- Table 34: Global UK Road Freight Transportation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 35: Brazil UK Road Freight Transportation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Argentina UK Road Freight Transportation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Rest of South America UK Road Freight Transportation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Global UK Road Freight Transportation Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 39: Global UK Road Freight Transportation Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 40: Global UK Road Freight Transportation Market Revenue Million Forecast, by Truckload Specification 2019 & 2032

- Table 41: Global UK Road Freight Transportation Market Revenue Million Forecast, by Containerization 2019 & 2032

- Table 42: Global UK Road Freight Transportation Market Revenue Million Forecast, by Distance 2019 & 2032

- Table 43: Global UK Road Freight Transportation Market Revenue Million Forecast, by Goods Configuration 2019 & 2032

- Table 44: Global UK Road Freight Transportation Market Revenue Million Forecast, by Temperature Control 2019 & 2032

- Table 45: Global UK Road Freight Transportation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 46: United Kingdom UK Road Freight Transportation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Germany UK Road Freight Transportation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: France UK Road Freight Transportation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Italy UK Road Freight Transportation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Spain UK Road Freight Transportation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Russia UK Road Freight Transportation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Benelux UK Road Freight Transportation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Nordics UK Road Freight Transportation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Rest of Europe UK Road Freight Transportation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Global UK Road Freight Transportation Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 56: Global UK Road Freight Transportation Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 57: Global UK Road Freight Transportation Market Revenue Million Forecast, by Truckload Specification 2019 & 2032

- Table 58: Global UK Road Freight Transportation Market Revenue Million Forecast, by Containerization 2019 & 2032

- Table 59: Global UK Road Freight Transportation Market Revenue Million Forecast, by Distance 2019 & 2032

- Table 60: Global UK Road Freight Transportation Market Revenue Million Forecast, by Goods Configuration 2019 & 2032

- Table 61: Global UK Road Freight Transportation Market Revenue Million Forecast, by Temperature Control 2019 & 2032

- Table 62: Global UK Road Freight Transportation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 63: Turkey UK Road Freight Transportation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: Israel UK Road Freight Transportation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 65: GCC UK Road Freight Transportation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: North Africa UK Road Freight Transportation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 67: South Africa UK Road Freight Transportation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 68: Rest of Middle East & Africa UK Road Freight Transportation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 69: Global UK Road Freight Transportation Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 70: Global UK Road Freight Transportation Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 71: Global UK Road Freight Transportation Market Revenue Million Forecast, by Truckload Specification 2019 & 2032

- Table 72: Global UK Road Freight Transportation Market Revenue Million Forecast, by Containerization 2019 & 2032

- Table 73: Global UK Road Freight Transportation Market Revenue Million Forecast, by Distance 2019 & 2032

- Table 74: Global UK Road Freight Transportation Market Revenue Million Forecast, by Goods Configuration 2019 & 2032

- Table 75: Global UK Road Freight Transportation Market Revenue Million Forecast, by Temperature Control 2019 & 2032

- Table 76: Global UK Road Freight Transportation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 77: China UK Road Freight Transportation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 78: India UK Road Freight Transportation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 79: Japan UK Road Freight Transportation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 80: South Korea UK Road Freight Transportation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 81: ASEAN UK Road Freight Transportation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 82: Oceania UK Road Freight Transportation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 83: Rest of Asia Pacific UK Road Freight Transportation Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UK Road Freight Transportation Market?

The projected CAGR is approximately > 5.50%.

2. Which companies are prominent players in the UK Road Freight Transportation Market?

Key companies in the market include Wincanton PL, A P Moller - Maersk, DB Schenker, Culina Group, W H Malcolm Ltd, DHL Group, DSV A/S (De Sammensluttede Vognmænd af Air and Sea), Dachser, United Parcel Service of America Inc (UPS), Gregory Distribution (Holdings), Kinaxia Logistics Limited, Gist Ltd, Howard Tenens, Turners (Soham) Limited, Hoyer GmbH, Ryder System Inc.

3. What are the main segments of the UK Road Freight Transportation Market?

The market segments include End User Industry, Destination, Truckload Specification, Containerization, Distance, Goods Configuration, Temperature Control.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

The Rise in Demand for Specialty Chemicals in ASEAN Countries Increasing Trade Logistics Activity; Partnerships and Collaborations Between Major Players in the Chemical Logistics Market are Being Formed for the Creation of Innovative Goods and Technologically Enhanced Services.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Complexities Related to Chemical Logistics; High Cost Involved in the Transportation of Chemicals.

8. Can you provide examples of recent developments in the market?

September 2023: DHL Supply Chain has announced plans to begin operating biomethane fuelled trucks with an investment worth €80 million into a dedicated biomethane production facility in Cork, run by Stream BioEnergy. Biomethane is a renewable gas with the capacity to be carbon neutral. The new facility will provide fuel for up to 150 trucks, resulting in an annual carbon reduction of 15,000 tonnes, the equivalent of more than 38 million miles driven by an average petrol-powered passenger vehicle.September 2023: DB Schenker has purchased a new 2.3-acre site at Trafford Park, Manchester. The new facility will have various features to support DB Schenker's operations and employee needs. It will contain designated zones for consolidating shipments across all transport modes.August 2023: DSV is pleased to announce that an expansion is underway of the all-new 16-tonne all-electric medium-duty Volta Zero, which has departed the gates of the Southern hub, Purfleet, for the very first time. The all-electric Volta Zero will be operating last-mile groupage deliveries in London and the Southeast making city centres safer and more sustainable for everyone. With a battery capacity of 150-225 kWh, depending on specification, the Volta Zero returns a real-world pure electric range of 95–125 miles on a single charge and is anticipated to be operating between the hours of 06.00hrs and 19.00hrs, with overnight charging back at the main depot.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UK Road Freight Transportation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UK Road Freight Transportation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UK Road Freight Transportation Market?

To stay informed about further developments, trends, and reports in the UK Road Freight Transportation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence