Key Insights

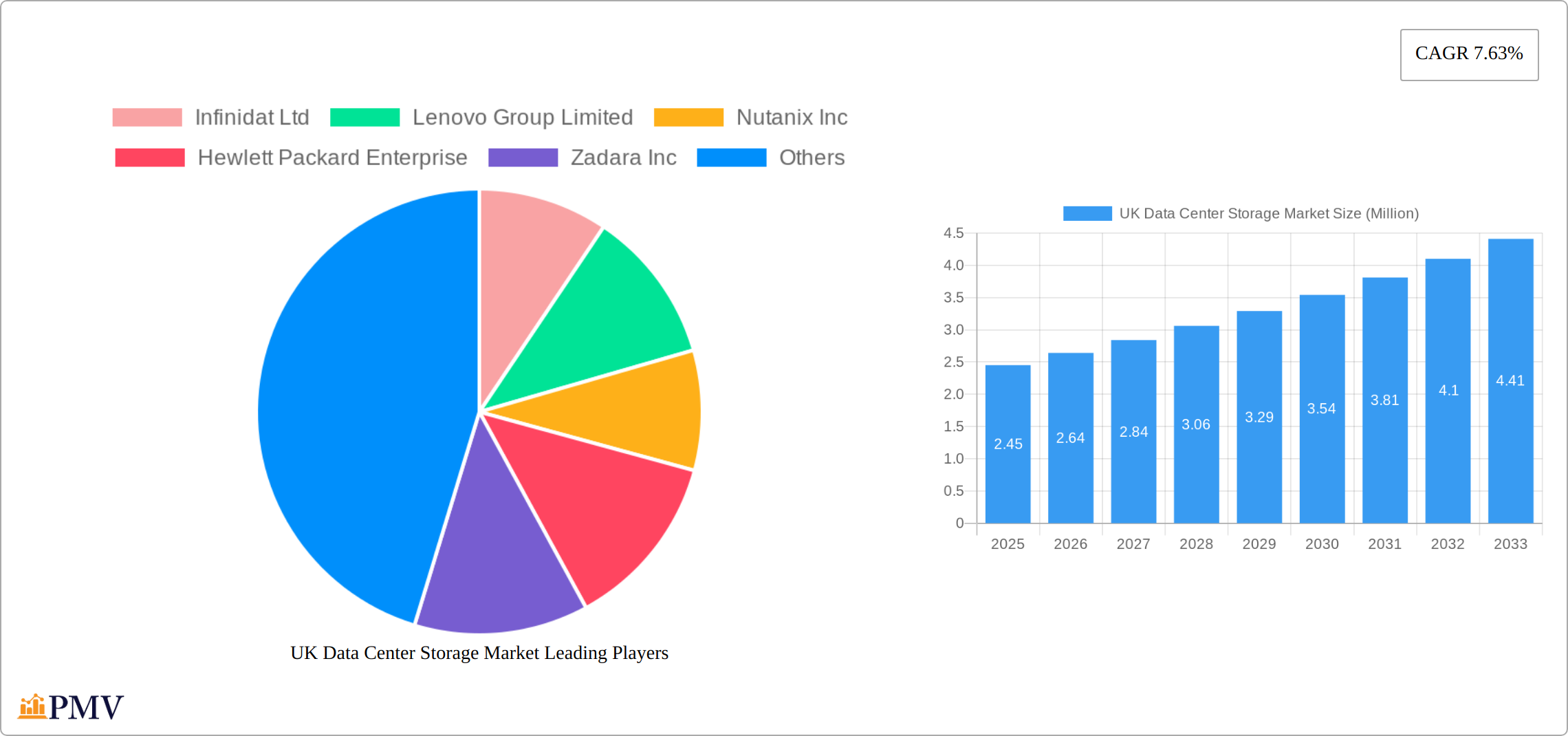

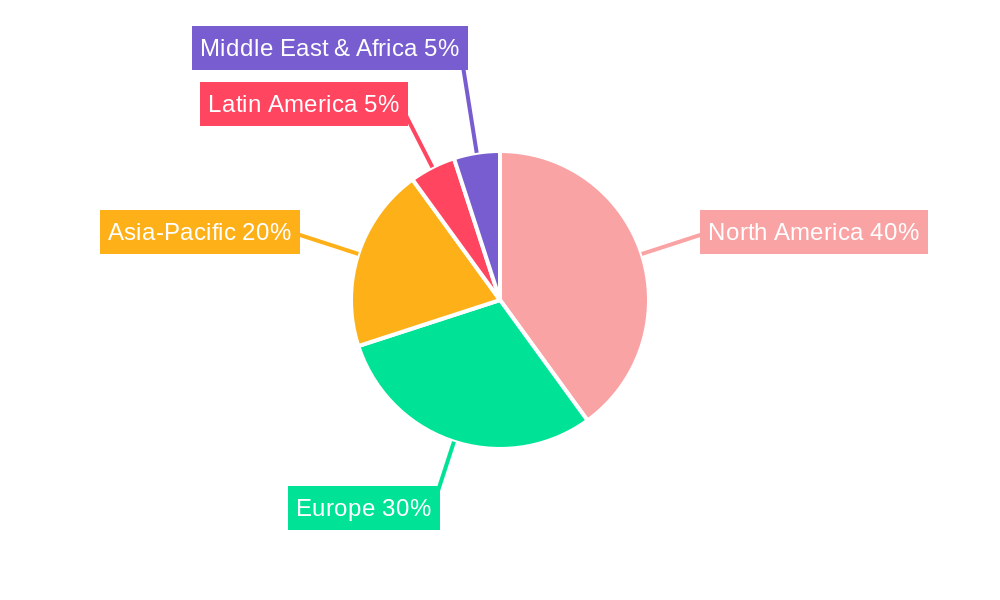

The UK Data Center Storage Market is poised for significant growth, with an estimated market size of $2.45 million in 2025 and a Compound Annual Growth Rate (CAGR) of 7.63% projected through to 2033. This growth is driven by increasing demand for data storage solutions across various sectors including IT & Telecommunication, BFSI, Government, and Media & Entertainment. Key drivers include the rapid digitalization of businesses, the proliferation of data-intensive applications such as big data analytics and AI, and the need for efficient, scalable storage solutions. The market is segmented by storage technology into Network Attached Storage (NAS), Storage Area Network (SAN), Direct Attached Storage (DAS), and other technologies, with each segment catering to different needs and use cases. Additionally, the market is categorized by storage type into Traditional Storage, All-Flash Storage, and Hybrid Storage, reflecting the diverse options available to meet varying performance and cost requirements.

Trends shaping the market include the increasing adoption of cloud and hybrid storage solutions, which offer flexibility and scalability to businesses. The rise of all-flash storage is also notable, as it provides faster data access and reduced latency, critical for high-performance computing environments. However, the market faces restraints such as high initial costs and the complexity of managing advanced storage systems. Despite these challenges, leading companies like Infinidat Ltd, Lenovo Group Limited, Nutanix Inc, and Hewlett Packard Enterprise are investing in innovative solutions to address these issues and capture a larger market share. Regionally, England is expected to dominate the UK market, followed by Scotland, Wales, and Northern Ireland, with each region showing unique growth patterns driven by local economic and technological developments.

UK Data Center Storage Market Market Structure & Competitive Dynamics

The UK Data Center Storage Market exhibits a competitive landscape with a blend of established and emerging players. Market concentration is moderate, with key players like Dell Inc and Hewlett Packard Enterprise holding significant shares, estimated at 20% and 15% respectively. The innovation ecosystem thrives on continuous R&D, with companies investing in advanced storage technologies such as All-Flash and Hybrid solutions. Regulatory frameworks are stringent, ensuring data privacy and security, which influences market dynamics. Product substitutes, such as cloud storage solutions, pose a challenge, yet traditional data center storage remains pivotal for sectors requiring high data control.

End-user trends show a surge in demand from the IT & Telecommunication sector, driven by the need for robust data management solutions. M&A activities have been prominent, with deals valued at around xx Million in the last year, indicating consolidation efforts to strengthen market positions. The regulatory environment is evolving, with GDPR compliance becoming a critical factor for data center operations. This has led to innovations in data management and security protocols, further shaping the competitive landscape.

- Market Concentration: Moderate, with Dell and HP leading.

- Innovation Ecosystem: Strong, focused on advanced storage solutions.

- Regulatory Frameworks: Stringent, with GDPR influencing market strategies.

- Product Substitutes: Cloud storage, yet traditional storage remains essential.

- End-User Trends: High demand from IT & Telecommunication.

- M&A Activities: Valued at xx Million, indicating market consolidation.

UK Data Center Storage Market Industry Trends & Insights

The UK Data Center Storage Market is experiencing robust growth, fueled by the increasing adoption of cloud computing, big data analytics, and the burgeoning demand for efficient and scalable storage solutions. The market is projected to exhibit a Compound Annual Growth Rate (CAGR) of 7.5% between 2025 and 2033, with 2025 serving as the base year. This expansion is significantly driven by technological advancements, particularly the rise of All-Flash Storage, which offers substantial improvements in performance and latency compared to traditional HDD-based systems. The transition to All-Flash is reshaping the market landscape, pushing the boundaries of speed and efficiency.

Sustainability is a key concern, influencing consumer preferences and driving investment in energy-efficient data center technologies. The competitive landscape is highly dynamic, with leading vendors like NetApp and Huawei continuously innovating and vying for market share. Market penetration for All-Flash Storage is anticipated to reach 35% by 2033, reflecting its widespread adoption across diverse sectors. This growth is further accelerated by the increasing demand for faster data access and reduced latency, critical factors for modern, high-performance applications.

Several key sectors are driving this growth. The IT & Telecommunications industry remains a dominant force, fueled by the need for scalable and reliable storage to support its digital transformation initiatives. The BFSI (Banking, Financial Services, and Insurance) sector also contributes significantly, driven by stringent data security and compliance requirements. Furthermore, government initiatives focused on digital transformation are stimulating investment in data center infrastructure to enhance public services. This confluence of factors indicates a significant and sustained period of growth for the UK Data Center Storage Market.

In summary, the UK Data Center Storage Market is undergoing a transformative period, characterized by technological innovation, evolving consumer preferences, and a growing emphasis on sustainability. Organizations adept at adapting to these market dynamics and offering cutting-edge solutions are well-positioned to thrive in this competitive yet lucrative market.

Dominant Markets & Segments in UK Data Center Storage Market

The UK Data Center Storage Market exhibits diverse segment dominance. In the Storage Technology category, Network Attached Storage (NAS) maintains a substantial market share due to its cost-effectiveness and ease of implementation. Storage Area Networks (SANs) are also experiencing growth, particularly amongst enterprises demanding high-speed data transfer capabilities. Direct Attached Storage (DAS) continues to serve smaller setups, while newer technologies like object storage are emerging as disruptive forces.

Regarding Storage Type, All-Flash Storage is rapidly becoming the dominant technology, propelled by its superior performance and efficiency. While traditional storage solutions still hold a considerable market share, they are progressively losing ground to more advanced alternatives. Hybrid Storage solutions, balancing cost and performance, are also witnessing increased adoption.

The IT & Telecommunications sector leads as the primary end-user, driven by the imperative to manage data effectively to support their ongoing digital transformation strategies. The BFSI sector is also a key player, with rigorous data security and compliance mandates stimulating demand for sophisticated storage solutions. The Government and Media & Entertainment sectors also represent significant contributors, each with specific data storage and management requirements.

Key drivers across these segments include:

- Economic Policies: Government incentives fostering digital infrastructure development.

- Infrastructure Expansion: The ongoing expansion of data centers to accommodate the rising volume of data.

- Technological Innovation: The continuous evolution of storage technologies.

- Regulatory Compliance: The need to meet stringent data security and privacy regulations (e.g., GDPR).

The dominance of NAS stems from its scalability and affordability, making it an attractive option for many organizations. SANs are experiencing growth due to their crucial role in high-performance, data-intensive applications. The ascendancy of All-Flash Storage is directly linked to its capacity to provide faster data access and significantly lower latency, essential for modern applications. The IT & Telecommunications sector's leading position reflects its commitment to digital transformation, necessitating advanced storage infrastructure to support its evolving needs.

UK Data Center Storage Market Product Innovations

Recent product innovations within the UK Data Center Storage Market are focused on enhancing performance, efficiency, and scalability. Huawei's introduction of the F2F2X architecture in June 2023, offering a versatile solution tailored for financial institutions, exemplifies this trend. NetApp's expansion of its AFF C-Series and the launch of the AFF A150 in February 2023 further underscore the market's transition towards cost-effective, high-performance storage. These and other innovations directly address the market's increasing demand for reliable, scalable, and secure data management systems, positioning companies at the forefront of technological advancements within the industry.

Report Segmentation & Scope

The UK Data Center Storage Market is segmented into various categories to provide a comprehensive view of the industry. In the Storage Technology segment, Network Attached Storage (NAS) is projected to grow at a CAGR of 6.5%, reaching a market size of xx Million by 2033. Storage Area Network (SAN) is expected to grow at a CAGR of 8%, with a market size of xx Million. Direct Attached Storage (DAS) will see a steady growth rate of 5%, while other technologies like object storage are poised for rapid expansion.

For Storage Type, Traditional Storage is projected to maintain a market size of xx Million by 2033, albeit with a declining share. All-Flash Storage is expected to grow at a CAGR of 10%, reaching xx Million, driven by its performance benefits. Hybrid Storage will see a CAGR of 7%, with a market size of xx Million.

In the End-User segment, IT & Telecommunication is expected to reach a market size of xx Million by 2033, growing at a CAGR of 8.5%. The BFSI sector is projected to grow at a CAGR of 7%, reaching xx Million. Government and Media & Entertainment sectors will see growth rates of 6% and 5.5%, respectively, with market sizes of xx Million and xx Million by 2033.

The competitive dynamics within these segments are intense, with companies vying to offer innovative solutions tailored to specific needs.

Key Drivers of UK Data Center Storage Market Growth

The growth of the UK Data Center Storage Market is being propelled by several crucial factors. Technological advancements, including the adoption of All-Flash and Hybrid Storage, are significantly improving data processing capabilities and speed. Economic factors, such as the widespread digital transformation of businesses, are escalating the demand for scalable and robust storage solutions. Regulatory drivers, such as GDPR compliance, are prompting organizations to invest in secure and compliant data management systems. The IT & Telecommunications sector's transition towards cloud-based solutions serves as a major growth catalyst, driving a substantial need for robust and adaptable storage infrastructure.

Challenges in the UK Data Center Storage Market Sector

The UK Data Center Storage Market faces several challenges that could impede growth. Regulatory hurdles, such as stringent data protection laws, increase compliance costs for companies. Supply chain issues, exacerbated by global disruptions, can lead to delays in product delivery and increased costs. Competitive pressures are intense, with numerous players vying for market share, leading to price wars and reduced margins. These challenges have quantifiable impacts, with compliance costs estimated at xx Million annually and supply chain disruptions causing delays of up to 3 months.

Leading Players in the UK Data Center Storage Market Market

- Infinidat Ltd

- Lenovo Group Limited

- Nutanix Inc

- Hewlett Packard Enterprise

- Zadara Inc

- Fujitsu Limited

- Dell Inc

- NetApp Inc

- Kingston Technology Company Inc

- Huawei Technologies Co Ltd

- Oracle Corporation

- Commvault Systems Inc

- Pure Storage Inc

- Hitachi Vantara LLC

Key Developments in UK Data Center Storage Market Sector

- June 2023: Huawei announced the launch of its new innovative data center data infrastructure architecture, F2F2X (Flash-to-Flash-to-Anything). It assists financial institutions in tackling new data, new applications, and new resilience challenges; this architecture serves as a reliable source of information. This development enhances Huawei's position in the financial sector, driving demand for advanced storage solutions.

- February 2023: NetApp, a significant, cloud-led, data-centric software company, announced the expansion of NetApp AFF C-Series, a new product line of capacity flash storage that delivers lower-cost all-flash storage, and NetApp AFF A150, a new entry-level storage system in the AFF A-Series line of all-flash systems. These product launches are expected to increase NetApp's market penetration, particularly in cost-sensitive segments.

Strategic UK Data Center Storage Market Market Outlook

The future outlook for the UK Data Center Storage Market is promising, with several growth accelerators on the horizon. The continued adoption of cloud computing and big data analytics will drive demand for advanced storage solutions. Strategic opportunities lie in the development of sustainable and energy-efficient data centers, aligning with consumer preferences for green technology. Companies that focus on innovation and adaptability will be well-positioned to capitalize on these trends, with potential market growth reaching xx Million by 2033.

UK Data Center Storage Market Segmentation

-

1. Storage Technology

- 1.1. Network Attached Storage (NAS)

- 1.2. Storage Area Network (SAN)

- 1.3. Direct Attached Storage (DAS)

- 1.4. Other Technologies

-

2. Storage Type

- 2.1. Traditional Storage

- 2.2. All-Flash Storage

- 2.3. Hybrid Storage

-

3. End-User

- 3.1. IT & Telecommunication

- 3.2. BFSI

- 3.3. Government

- 3.4. Media & Entertainment

- 3.5. Other End-User

UK Data Center Storage Market Segmentation By Geography

- 1. United Kingdom

UK Data Center Storage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.63% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Expansion of IT infrastructure in the Country Drives the Market Growth; Increase in the Demand for Energy-Efficient and Cost-Effective Data Centers Drives the Market Growth

- 3.3. Market Restrains

- 3.3.1. High Initial Investments

- 3.4. Market Trends

- 3.4.1. IT & Telecommunication Segment Holds the Major Share.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. UK Data Center Storage Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Storage Technology

- 5.1.1. Network Attached Storage (NAS)

- 5.1.2. Storage Area Network (SAN)

- 5.1.3. Direct Attached Storage (DAS)

- 5.1.4. Other Technologies

- 5.2. Market Analysis, Insights and Forecast - by Storage Type

- 5.2.1. Traditional Storage

- 5.2.2. All-Flash Storage

- 5.2.3. Hybrid Storage

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. IT & Telecommunication

- 5.3.2. BFSI

- 5.3.3. Government

- 5.3.4. Media & Entertainment

- 5.3.5. Other End-User

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Storage Technology

- 6. England UK Data Center Storage Market Analysis, Insights and Forecast, 2019-2031

- 7. Wales UK Data Center Storage Market Analysis, Insights and Forecast, 2019-2031

- 8. Scotland UK Data Center Storage Market Analysis, Insights and Forecast, 2019-2031

- 9. Northern UK Data Center Storage Market Analysis, Insights and Forecast, 2019-2031

- 10. Ireland UK Data Center Storage Market Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Infinidat Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Lenovo Group Limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Nutanix Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Hewlett Packard Enterprise

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Zadara Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Fujitsu Limited

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Dell Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 NetApp Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Kingston Technology Company Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Huawei Technologies Co Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Oracle Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Commvault Systems Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Pure Storage Inc

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Hitachi Vantara LLC

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Infinidat Ltd

List of Figures

- Figure 1: UK Data Center Storage Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: UK Data Center Storage Market Share (%) by Company 2024

List of Tables

- Table 1: UK Data Center Storage Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: UK Data Center Storage Market Revenue Million Forecast, by Storage Technology 2019 & 2032

- Table 3: UK Data Center Storage Market Revenue Million Forecast, by Storage Type 2019 & 2032

- Table 4: UK Data Center Storage Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 5: UK Data Center Storage Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: UK Data Center Storage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: England UK Data Center Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Wales UK Data Center Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Scotland UK Data Center Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Northern UK Data Center Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Ireland UK Data Center Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: UK Data Center Storage Market Revenue Million Forecast, by Storage Technology 2019 & 2032

- Table 13: UK Data Center Storage Market Revenue Million Forecast, by Storage Type 2019 & 2032

- Table 14: UK Data Center Storage Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 15: UK Data Center Storage Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UK Data Center Storage Market?

The projected CAGR is approximately 7.63%.

2. Which companies are prominent players in the UK Data Center Storage Market?

Key companies in the market include Infinidat Ltd, Lenovo Group Limited, Nutanix Inc, Hewlett Packard Enterprise, Zadara Inc, Fujitsu Limited, Dell Inc, NetApp Inc, Kingston Technology Company Inc, Huawei Technologies Co Ltd, Oracle Corporation, Commvault Systems Inc , Pure Storage Inc, Hitachi Vantara LLC.

3. What are the main segments of the UK Data Center Storage Market?

The market segments include Storage Technology, Storage Type, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.45 Million as of 2022.

5. What are some drivers contributing to market growth?

The Expansion of IT infrastructure in the Country Drives the Market Growth; Increase in the Demand for Energy-Efficient and Cost-Effective Data Centers Drives the Market Growth.

6. What are the notable trends driving market growth?

IT & Telecommunication Segment Holds the Major Share..

7. Are there any restraints impacting market growth?

High Initial Investments.

8. Can you provide examples of recent developments in the market?

June 2023: Huawei announced the launch of its new innovative data center data infrastructure architecture, F2F2X (Flash-to-Flash-to-Anything). It assists financial institutions in tackling new data, new applications, and new resilience challenges; this architecture serves as a reliable source of information.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UK Data Center Storage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UK Data Center Storage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UK Data Center Storage Market?

To stay informed about further developments, trends, and reports in the UK Data Center Storage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence