Key Insights

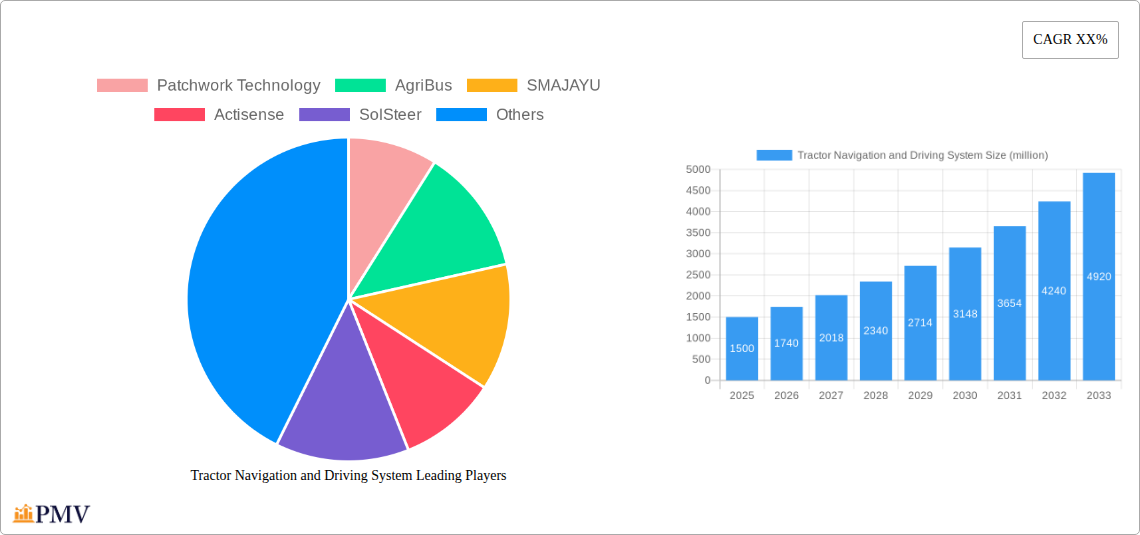

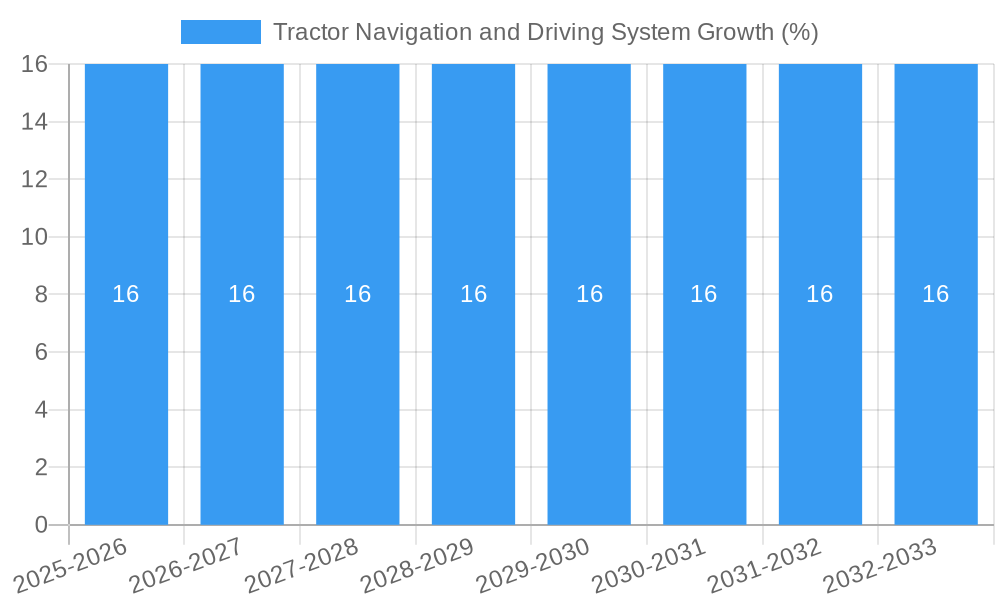

The global Tractor Navigation and Driving System market is poised for significant expansion, projected to reach an estimated market size of approximately USD 1,500 million in 2025. This robust growth is fueled by a Compound Annual Growth Rate (CAGR) of XX%, indicating a dynamic and rapidly evolving sector within agricultural technology. The adoption of these systems is primarily driven by the escalating need for enhanced operational efficiency in farming. Precise fertilization, which optimizes nutrient application and reduces waste, is a key application area, alongside advanced soil management techniques that promote sustainability and higher crop yields. Furthermore, the increasing demand for effective pest control solutions and the broader trend towards precision agriculture are compelling farmers to invest in intelligent navigation and driving systems. These technologies empower farmers to make data-driven decisions, minimize manual labor, and improve overall farm productivity.

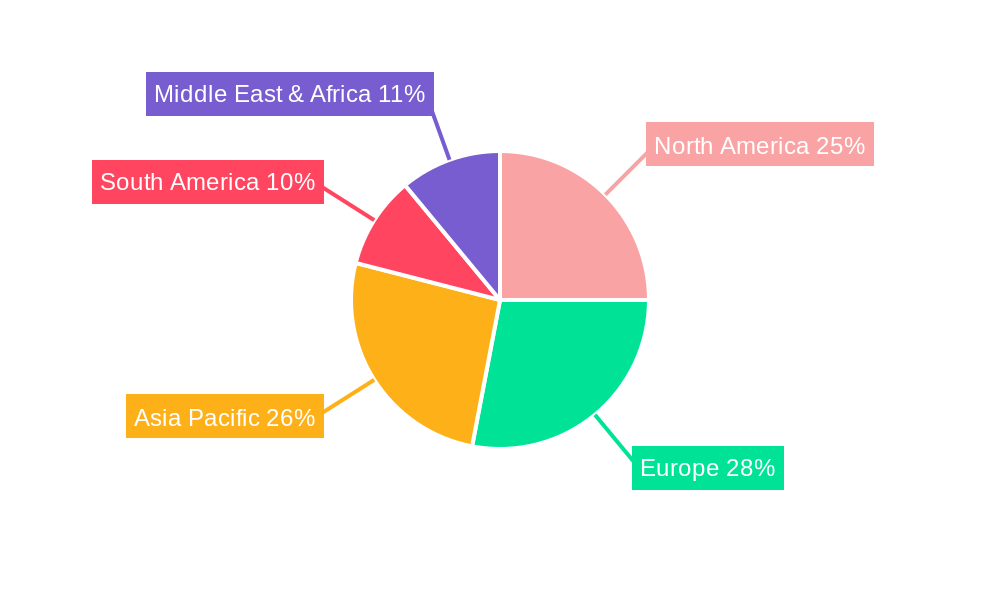

The market's trajectory is further shaped by emerging trends such as the integration of AI and machine learning for predictive analytics in farming operations, the growing adoption of cloud-based platforms for data management, and the continuous advancement in sensor technologies. These innovations are making tractor navigation systems more sophisticated and user-friendly. However, the market also faces certain restraints, including the high initial investment cost associated with advanced systems, which can be a barrier for small and medium-sized agricultural enterprises. Additionally, the need for skilled labor to operate and maintain these technologies, alongside concerns regarding data security and privacy, present challenges that need to be addressed for widespread adoption. The market is segmented by navigation system types, with GPS navigation systems currently holding a dominant share, while Beidou navigation systems are gaining traction, particularly in specific regions. Geographically, Asia Pacific is emerging as a significant growth region due to its large agricultural base and increasing adoption of modern farming practices.

This report delves into the comprehensive global Tractor Navigation and Driving System Market, a critical component of modern precision agriculture and smart farming. Analyzing market dynamics from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033, this study provides invaluable insights into market structure, competitive landscapes, technological advancements, and growth drivers. The report is meticulously segmented by key applications including Soil Management, Crop Production, Pest Control, and Precise Fertilization, and by navigation system types such as Beidou Navigation System and GPS Navigation System. This detailed analysis is essential for stakeholders looking to understand and capitalize on the burgeoning agricultural technology (AgriTech) sector, focusing on autonomous tractors, automated steering, and GPS guidance systems. The study examines key players like Patchwork Technology, AgriBus, SMAJAYU, Actisense, SolSteer, Ernest Doe Power, Navtech, Hexagon, Septentrio, Trimble GPS, Topcon Positioning Systems, and Geomatics Land Surveying.

Tractor Navigation and Driving System Market Structure & Competitive Dynamics

The Tractor Navigation and Driving System Market exhibits a dynamic structure characterized by a mix of established players and emerging innovators. Market concentration is moderately high, with a few key entities holding significant market share, particularly in the GPS Navigation System segment. However, the increasing adoption of Beidou Navigation System and the rise of specialized solution providers are fostering a more competitive environment. The innovation ecosystem is robust, driven by continuous advancements in sensor technology, AI for autonomous driving, and cloud-based data management for precision agriculture. Regulatory frameworks are evolving to support the integration of automated agricultural machinery, though standardization remains an ongoing discussion. Product substitutes are limited for core navigation functionalities, but integrated solutions offering advanced analytics and control are gaining traction. End-user trends highlight a strong preference for solutions that enhance operational efficiency, reduce labor costs, and improve crop yields. Merger and acquisition (M&A) activities are a significant aspect of market dynamics, with recent deal values estimated in the range of several hundred million to over a billion dollars, reflecting the strategic importance of acquiring innovative technologies and expanding market reach. For instance, acquisitions aimed at integrating RTK-level accuracy and advanced path planning algorithms are prevalent.

Tractor Navigation and Driving System Industry Trends & Insights

The Tractor Navigation and Driving System Industry is experiencing robust growth, propelled by a confluence of technological advancements and increasing demand for sustainable and efficient farming practices. The Compound Annual Growth Rate (CAGR) for this sector is projected to be substantial, estimated at over 15% during the forecast period. Market penetration for basic GPS guidance systems is already significant in developed agricultural economies, exceeding 60% in many regions. However, the adoption of more sophisticated autonomous driving systems and integrated precision fertilization modules is still in its early stages, presenting considerable room for expansion. Key growth drivers include the escalating need for higher agricultural productivity to feed a growing global population, coupled with the imperative to optimize resource utilization (water, fertilizers, pesticides) to mitigate environmental impact. Technological disruptions, such as the refinement of real-time kinematic (RTK) correction services and the integration of machine learning for predictive crop management, are transforming the capabilities of these systems. Consumer preferences are shifting towards user-friendly interfaces, enhanced data analytics for informed decision-making, and solutions that offer demonstrable ROI through increased yields and reduced operational costs. The competitive landscape is intensifying, with companies focusing on developing highly accurate, reliable, and cost-effective navigation solutions, ranging from basic auto-steer to fully autonomous tractor operations. The integration of IoT sensors and the development of robust data platforms are also key trends, enabling seamless data flow and remote monitoring.

Dominant Markets & Segments in Tractor Navigation and Driving System

The Tractor Navigation and Driving System Market is experiencing dominant growth across several key regions and segments, driven by distinct economic and technological factors. North America, particularly the United States and Canada, currently leads in market penetration and adoption of advanced precision agriculture technologies. This dominance is fueled by large-scale farming operations, significant government incentives for technological adoption, and a strong research and development ecosystem. Key drivers in this region include:

- Economic Policies: Subsidies and tax credits for adopting precision farming equipment significantly boost demand.

- Infrastructure: Widespread availability of high-speed internet and robust cellular networks supports real-time data transmission for RTK correction and cloud-based services.

- Technological Adoption Culture: Farmers are generally receptive to adopting new technologies that promise efficiency gains and increased profitability.

In terms of Application, Crop Production and Soil Management represent the largest and fastest-growing segments.

- Crop Production: Precise seed placement, variable rate seeding, and optimized planting patterns enabled by navigation systems lead to significant yield improvements. The global market for crop production solutions is estimated to be worth over fifty billion dollars.

- Soil Management: Technologies facilitating accurate soil sampling, targeted application of fertilizers, and efficient tillage operations contribute to better soil health and reduced input costs. The market for soil management solutions is valued in the tens of billions of dollars.

The Precise Fertilization application is also witnessing substantial growth, with farmers increasingly relying on these systems to apply fertilizers at exact rates and locations, minimizing waste and environmental runoff. This segment is expected to grow at a CAGR of over 18%.

Regarding Types, while GPS Navigation System remains the dominant technology, the Beidou Navigation System is rapidly gaining traction, especially in Asian markets and for specialized applications requiring multi-constellation support for enhanced accuracy and reliability. The global market for GPS Navigation Systems is currently valued at over thirty billion dollars, while the Beidou Navigation System segment is projected to reach over ten billion dollars by 2028. The increasing availability of Beidou-compatible receivers and growing government support for its use in agriculture are key factors driving its adoption. The development of integrated systems that leverage both GNSS constellations is a significant trend, offering superior performance in challenging environments.

Tractor Navigation and Driving System Product Innovations

Product innovations in the Tractor Navigation and Driving System Market are centered on enhancing accuracy, automation, and data integration. Companies are developing advanced algorithms for autonomous driving, enabling tractors to navigate fields with minimal human intervention, improving operational efficiency and safety. Innovations include sophisticated sensor fusion techniques combining GPS, LiDAR, and cameras for robust obstacle detection and precise path planning. Applications are expanding beyond simple steering to include automated implement control, allowing for real-time adjustments in depth, rate, and coverage based on field conditions. Competitive advantages are being built on the development of proprietary software for data analytics, predictive modeling, and seamless integration with farm management platforms. The market is witnessing a surge in subscription-based services offering RTK correction, cloud storage, and agronomic insights, providing recurring revenue streams and fostering customer loyalty.

Report Segmentation & Scope

This report meticulously segments the global Tractor Navigation and Driving System Market across critical dimensions to provide a granular analysis. The market is analyzed by Application, encompassing:

- Soil Management: Focusing on systems that enable precise soil sampling, mapping, and targeted application of soil amendments. Market projections suggest significant growth driven by the need for sustainable soil health practices.

- Crop Production: Covering solutions for optimized planting, seeding, and harvesting, leading to improved yields and efficiency. This segment is expected to maintain its leading market position.

- Pest Control: Investigating the use of navigation systems for precise application of pesticides and herbicides, minimizing environmental impact and chemical usage.

- Precise Fertilization: Examining systems that facilitate variable rate application of fertilizers, ensuring optimal nutrient delivery and reducing waste.

The market is also segmented by Types of navigation systems:

- Beidou Navigation System: Analyzing the growing adoption of China's indigenous satellite navigation system, particularly in Asia, and its integration into agricultural machinery for enhanced accuracy and independence.

- GPS Navigation System: Covering the widely adopted Global Positioning System, including its various augmentation services and its role as a foundational technology in precision agriculture.

Key Drivers of Tractor Navigation and Driving System Growth

The Tractor Navigation and Driving System Market is propelled by several interconnected drivers. Technologically, the relentless advancement in GNSS accuracy, including RTK and PPP technologies, combined with the development of sophisticated sensors and AI-powered algorithms for autonomous operation, is expanding the capabilities and appeal of these systems. Economically, the growing pressure to increase agricultural yields and profitability in the face of rising input costs and labor shortages is a significant catalyst. Governments worldwide are also implementing supportive policies and offering subsidies for precision agriculture technologies, further accelerating adoption. Regulatory frameworks are gradually adapting to accommodate automated agricultural machinery, creating a more favorable environment for market growth.

Challenges in the Tractor Navigation and Driving System Sector

Despite its strong growth trajectory, the Tractor Navigation and Driving System Sector faces several challenges. Regulatory hurdles, particularly concerning the safety and certification of fully autonomous tractors, can slow down widespread adoption in some regions. The initial high cost of advanced systems remains a barrier for smaller farm operations, impacting market penetration. Supply chain issues, including the availability of critical electronic components and skilled labor for installation and maintenance, can also affect production and service delivery. Furthermore, intense competitive pressures among numerous players are leading to price erosion for basic solutions, requiring companies to focus on value-added services and differentiated technologies.

Leading Players in the Tractor Navigation and Driving System Market

- Patchwork Technology

- AgriBus

- SMAJAYU

- Actisense

- SolSteer

- Ernest Doe Power

- Navtech

- Hexagon

- Septentrio

- Trimble GPS

- Topcon Positioning Systems

- Geomatics Land Surveying

Key Developments in Tractor Navigation and Driving System Sector

- 2023: Launch of enhanced RTK correction services by major providers, offering centimeter-level accuracy for improved autonomous driving capabilities.

- 2023: Introduction of AI-powered predictive analytics platforms integrated with navigation systems to optimize crop management strategies.

- 2022: Significant investment in R&D for Beidou Navigation System integration in agricultural machinery, particularly in emerging markets.

- 2022: Several M&A activities, with acquisitions focused on consolidating market share and acquiring cutting-edge autonomous steering technologies.

- 2021: Release of new software updates enhancing user interfaces and data visualization for farm management integration.

- 2020: Increased focus on developing cost-effective solutions for smaller farm operators to broaden market access.

- 2019: Introduction of advanced sensor fusion technologies for improved obstacle detection and safety in autonomous tractor operations.

Strategic Tractor Navigation and Driving System Market Outlook

The strategic outlook for the Tractor Navigation and Driving System Market is exceptionally positive, fueled by the ongoing digital transformation of agriculture. Growth accelerators include the increasing demand for food security, the push for sustainable farming practices, and continuous technological innovation. The development of integrated farm management systems that seamlessly combine navigation, implement control, and data analytics will be a key differentiator. Opportunities lie in expanding the adoption of autonomous driving technology, particularly in regions with labor shortages, and in leveraging Beidou Navigation System and multi-GNSS solutions for enhanced performance in diverse geographical conditions. Strategic partnerships between technology providers, equipment manufacturers, and agricultural cooperatives will be crucial for market expansion and the successful implementation of precision agriculture solutions. The market is poised for sustained growth, driven by the imperative to create a more efficient, productive, and environmentally responsible agricultural sector globally.

Tractor Navigation and Driving System Segmentation

-

1. Application

- 1.1. Soil Management

- 1.2. Crop Production

- 1.3. Pest Control

- 1.4. Precise Fertilization

-

2. Types

- 2.1. Beidou Navigation System

- 2.2. GPS Navigation System

Tractor Navigation and Driving System Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Tractor Navigation and Driving System REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Tractor Navigation and Driving System Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Soil Management

- 5.1.2. Crop Production

- 5.1.3. Pest Control

- 5.1.4. Precise Fertilization

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Beidou Navigation System

- 5.2.2. GPS Navigation System

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Tractor Navigation and Driving System Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Soil Management

- 6.1.2. Crop Production

- 6.1.3. Pest Control

- 6.1.4. Precise Fertilization

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Beidou Navigation System

- 6.2.2. GPS Navigation System

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Tractor Navigation and Driving System Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Soil Management

- 7.1.2. Crop Production

- 7.1.3. Pest Control

- 7.1.4. Precise Fertilization

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Beidou Navigation System

- 7.2.2. GPS Navigation System

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Tractor Navigation and Driving System Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Soil Management

- 8.1.2. Crop Production

- 8.1.3. Pest Control

- 8.1.4. Precise Fertilization

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Beidou Navigation System

- 8.2.2. GPS Navigation System

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Tractor Navigation and Driving System Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Soil Management

- 9.1.2. Crop Production

- 9.1.3. Pest Control

- 9.1.4. Precise Fertilization

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Beidou Navigation System

- 9.2.2. GPS Navigation System

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Tractor Navigation and Driving System Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Soil Management

- 10.1.2. Crop Production

- 10.1.3. Pest Control

- 10.1.4. Precise Fertilization

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Beidou Navigation System

- 10.2.2. GPS Navigation System

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Patchwork Technology

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 AgriBus

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 SMAJAYU

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Actisense

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 SolSteer

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Ernest Doe Power

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Navtech

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Hexagon

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Septentrio

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Trimble GPS

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Topcon Positioning Systems

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Geomatics Land Surveying

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Patchwork Technology

List of Figures

- Figure 1: Global Tractor Navigation and Driving System Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Tractor Navigation and Driving System Revenue (million), by Application 2024 & 2032

- Figure 3: North America Tractor Navigation and Driving System Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Tractor Navigation and Driving System Revenue (million), by Types 2024 & 2032

- Figure 5: North America Tractor Navigation and Driving System Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Tractor Navigation and Driving System Revenue (million), by Country 2024 & 2032

- Figure 7: North America Tractor Navigation and Driving System Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Tractor Navigation and Driving System Revenue (million), by Application 2024 & 2032

- Figure 9: South America Tractor Navigation and Driving System Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Tractor Navigation and Driving System Revenue (million), by Types 2024 & 2032

- Figure 11: South America Tractor Navigation and Driving System Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Tractor Navigation and Driving System Revenue (million), by Country 2024 & 2032

- Figure 13: South America Tractor Navigation and Driving System Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Tractor Navigation and Driving System Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Tractor Navigation and Driving System Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Tractor Navigation and Driving System Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Tractor Navigation and Driving System Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Tractor Navigation and Driving System Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Tractor Navigation and Driving System Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Tractor Navigation and Driving System Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Tractor Navigation and Driving System Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Tractor Navigation and Driving System Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Tractor Navigation and Driving System Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Tractor Navigation and Driving System Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Tractor Navigation and Driving System Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Tractor Navigation and Driving System Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Tractor Navigation and Driving System Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Tractor Navigation and Driving System Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Tractor Navigation and Driving System Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Tractor Navigation and Driving System Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Tractor Navigation and Driving System Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Tractor Navigation and Driving System Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Tractor Navigation and Driving System Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Tractor Navigation and Driving System Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Tractor Navigation and Driving System Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Tractor Navigation and Driving System Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Tractor Navigation and Driving System Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Tractor Navigation and Driving System Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Tractor Navigation and Driving System Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Tractor Navigation and Driving System Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Tractor Navigation and Driving System Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Tractor Navigation and Driving System Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Tractor Navigation and Driving System Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Tractor Navigation and Driving System Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Tractor Navigation and Driving System Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Tractor Navigation and Driving System Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Tractor Navigation and Driving System Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Tractor Navigation and Driving System Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Tractor Navigation and Driving System Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Tractor Navigation and Driving System Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Tractor Navigation and Driving System Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Tractor Navigation and Driving System Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Tractor Navigation and Driving System Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Tractor Navigation and Driving System Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Tractor Navigation and Driving System Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Tractor Navigation and Driving System Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Tractor Navigation and Driving System Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Tractor Navigation and Driving System Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Tractor Navigation and Driving System Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Tractor Navigation and Driving System Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Tractor Navigation and Driving System Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Tractor Navigation and Driving System Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Tractor Navigation and Driving System Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Tractor Navigation and Driving System Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Tractor Navigation and Driving System Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Tractor Navigation and Driving System Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Tractor Navigation and Driving System Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Tractor Navigation and Driving System Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Tractor Navigation and Driving System Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Tractor Navigation and Driving System Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Tractor Navigation and Driving System Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Tractor Navigation and Driving System Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Tractor Navigation and Driving System Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Tractor Navigation and Driving System Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Tractor Navigation and Driving System Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Tractor Navigation and Driving System Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Tractor Navigation and Driving System Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Tractor Navigation and Driving System Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Tractor Navigation and Driving System?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Tractor Navigation and Driving System?

Key companies in the market include Patchwork Technology, AgriBus, SMAJAYU, Actisense, SolSteer, Ernest Doe Power, Navtech, Hexagon, Septentrio, Trimble GPS, Topcon Positioning Systems, Geomatics Land Surveying.

3. What are the main segments of the Tractor Navigation and Driving System?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Tractor Navigation and Driving System," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Tractor Navigation and Driving System report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Tractor Navigation and Driving System?

To stay informed about further developments, trends, and reports in the Tractor Navigation and Driving System, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence