Key Insights

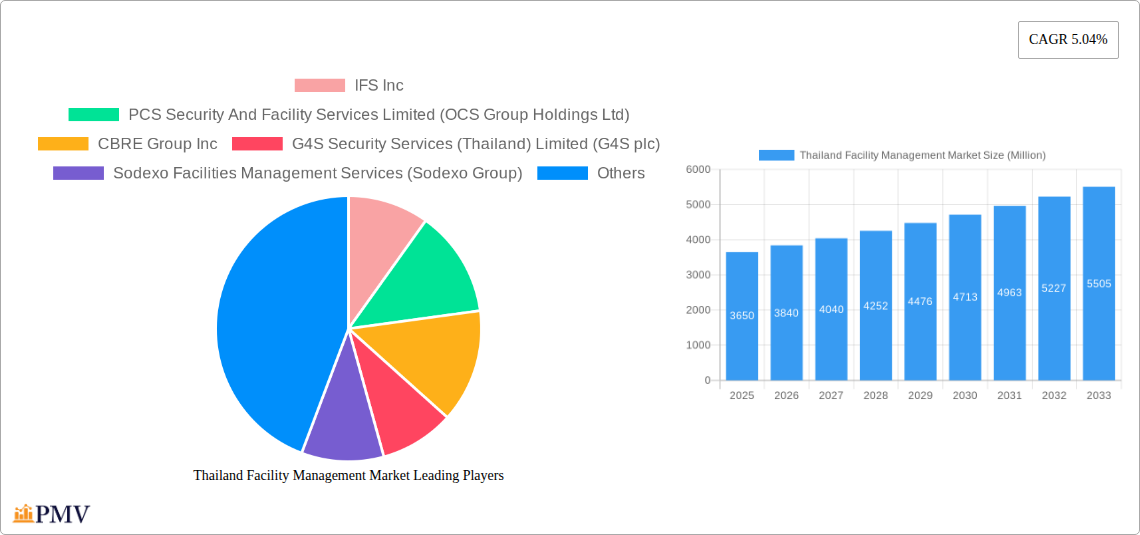

The Thailand facility management market, valued at approximately $3.65 billion in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 5.04% from 2025 to 2033. This expansion is fueled by several key factors. The burgeoning real estate sector, particularly in major urban centers like Bangkok, drives significant demand for professional facility management services. Increasing awareness of the importance of operational efficiency, cost optimization, and sustainable practices among businesses further contributes to market growth. Furthermore, the rise of outsourcing and the growing adoption of advanced technologies, including smart building solutions and facility management software, are accelerating market expansion. Competition is intensifying amongst established players like IFS Inc., OCS Group Holdings Ltd., CBRE Group Inc., and G4S plc, alongside local companies like Plus Property Co Ltd and Amata Facility Service Co Ltd. These companies are investing in technological advancements and expanding their service portfolios to meet evolving client needs.

The market segmentation within Thailand's facility management sector is likely diverse, encompassing services such as hard services (maintenance, repairs), soft services (cleaning, security), integrated facility management, and specialized services catering to specific industry verticals like healthcare and retail. Challenges facing the market include fluctuating economic conditions, potential labor shortages, and the need to comply with stringent environmental regulations. Despite these challenges, the long-term outlook remains positive, driven by sustained economic growth, urbanization, and increasing demand for efficient and sustainable facilities across diverse sectors. The market’s future growth will be significantly influenced by technological advancements, government policies promoting sustainable building practices, and the competitive landscape amongst both international and domestic firms.

Thailand Facility Management Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Thailand facility management market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages rigorous research and data analysis to provide a clear picture of current market dynamics and future growth trajectories. The market size in 2025 is estimated at xx Million USD.

Thailand Facility Management Market Market Structure & Competitive Dynamics

This section analyzes the structure and competitive landscape of the Thailand facility management market. We explore market concentration, revealing the market share held by key players such as IFS Inc, PCS Security And Facility Services Limited (OCS Group Holdings Ltd), CBRE Group Inc, G4S Security Services (Thailand) Limited (G4S plc), and Sodexo Facilities Management Services (Sodexo Group). The report assesses the level of competition, identifying the presence of both large multinational corporations and smaller, specialized firms. We examine innovation ecosystems, highlighting key technological advancements and their impact on market dynamics. The regulatory framework governing the facility management sector in Thailand is thoroughly analyzed, including relevant licenses, permits, and compliance standards. The report also assesses the influence of substitute products and services, considering their potential to disrupt the market. Furthermore, we delve into the prevailing end-user trends, including shifts in demand for specific facility management services across various sectors. Finally, a detailed overview of mergers and acquisitions (M&A) activities within the market is presented, including an analysis of deal values and their implications for market consolidation. We estimate that M&A activity in the past 5 years resulted in a total deal value of approximately xx Million USD. The report also identifies key factors driving market consolidation, including the pursuit of economies of scale and expansion into new geographical markets.

Thailand Facility Management Market Industry Trends & Insights

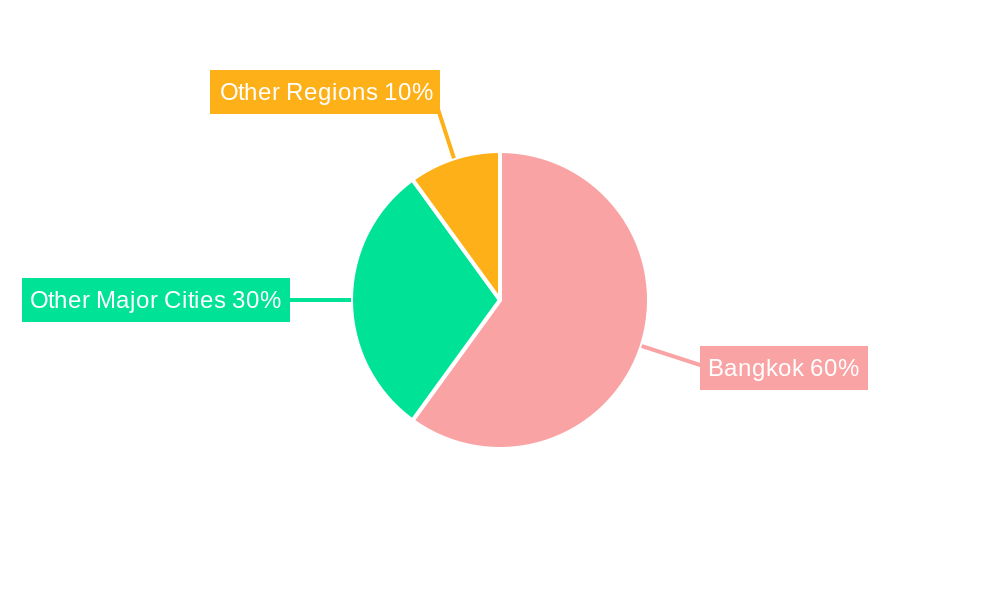

This section provides an in-depth analysis of prevailing industry trends and insights shaping the Thailand facility management market. We examine key growth drivers, including the burgeoning real estate sector, increasing urbanization, and the rising adoption of sustainable practices. The report also explores the disruptive impact of technological advancements, such as the Internet of Things (IoT), artificial intelligence (AI), and big data analytics, on operational efficiency and service delivery. Emerging consumer preferences towards specialized and integrated facility management solutions are analyzed, impacting the service offerings provided by companies like Plus Property Co Ltd and Swift Dynamics Co Ltd. Competitive dynamics within the market are also scrutinized, including strategies employed by leading players to maintain market share and capture new business opportunities. We project a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), with market penetration expected to reach xx% by 2033. The report will also include a detailed regional breakdown, highlighting disparities in market growth across different provinces and urban centers.

Dominant Markets & Segments in Thailand Facility Management Market

This section identifies the leading segments and regions within the Thailand facility management market. Through detailed analysis, we determine the most dominant segment and region. Key factors driving this dominance are identified using bullet points:

- Economic Policies: Government incentives promoting infrastructure development and foreign investment significantly influence market growth.

- Infrastructure Development: Expansion of commercial and residential spaces fuels demand for comprehensive facility management services.

- Tourism Sector Growth: The thriving tourism sector necessitates high-quality facility management for hotels, resorts, and related infrastructure.

- Industrial Expansion: The increasing presence of manufacturing and industrial facilities drives the demand for specialized industrial facility management services.

The dominance analysis delves into the specific market characteristics, competitive landscapes, and growth prospects of this leading segment, showcasing why it holds a significant position in the overall market. The report further breaks down the segment's composition and analyzes the interplay between various factors driving its dominance.

Thailand Facility Management Market Product Innovations

Recent innovations in facility management technologies, including AI-powered predictive maintenance and smart building solutions, are transforming the industry. Companies are incorporating these technologies to offer enhanced services, improve operational efficiency, and reduce costs. These innovations cater to the growing demand for data-driven insights and automation, which improves cost-efficiency and service delivery, leading to increased market competitiveness.

Report Segmentation & Scope

This report segments the Thailand facility management market based on service type (hard services, soft services, integrated facility management), end-user industry (commercial, industrial, residential, healthcare), and geography (Bangkok Metropolitan Region, other regions). Each segment is analyzed individually, providing growth projections, market sizes, and competitive dynamics. For example, the integrated facility management segment is expected to show strong growth due to increasing demand for comprehensive solutions, while the healthcare segment is projected to experience a steady rise owing to stricter hygiene standards and compliance requirements. The regional breakdown highlights the significant contribution of the Bangkok Metropolitan Region, driven by its dense population and concentration of commercial activities.

Key Drivers of Thailand Facility Management Market Growth

Several factors are propelling the growth of the Thailand facility management market. These include robust economic growth, increasing urbanization leading to a rise in commercial and residential spaces, and government initiatives promoting sustainable practices within the built environment. Furthermore, the rising adoption of technological advancements, such as AI and IoT-enabled systems, is streamlining operations and enhancing service delivery. The expanding tourism sector and the country's growing industrial base also contribute significantly to this market's expansion.

Challenges in the Thailand Facility Management Market Sector

Despite promising growth prospects, the Thailand facility management market faces certain challenges. These include a shortage of skilled labor, intense competition among established players and emerging companies, and the need for continuous adaptation to evolving technological advancements. Furthermore, regulatory compliance and ensuring adherence to stringent safety and environmental standards present significant operational challenges. Supply chain disruptions can also impact the availability and cost of materials and services, thereby affecting profitability.

Leading Players in the Thailand Facility Management Market Market

- IFS Inc

- PCS Security And Facility Services Limited (OCS Group Holdings Ltd)

- CBRE Group Inc

- G4S Security Services (Thailand) Limited (G4S plc)

- Sodexo Facilities Management Services (Sodexo Group)

- Plus Property Co Ltd

- Swift Dynamics Co Ltd

- Siam Piwat Company Limited

- NCH Asia Pacific

- Amata Facility Service Co Ltd (Amata Corporation)

- Jones Lang LaSalle (JLL)

Key Developments in Thailand Facility Management Market Sector

- June 2024: JLL announced the enhancement of its JLL Serve application with AI-driven technology, improving productivity and decision-making.

- August 2024: GJ Steel Public Company Limited (GJS) plans a THB 1.5 billion (USD 42 Million) investment to upgrade its production facility, boosting product quality and competitiveness.

Strategic Thailand Facility Management Market Market Outlook

The Thailand facility management market presents significant growth potential driven by continued economic expansion, infrastructure development, and technological advancements. Strategic opportunities exist for companies focusing on sustainable solutions, integrated services, and the adoption of innovative technologies. The market is poised for further consolidation, with larger players likely to acquire smaller firms to gain market share and expand their service offerings. Focus on skilled workforce development and adapting to evolving regulatory landscapes will be crucial for success in this dynamic market.

Thailand Facility Management Market Segmentation

-

1. Type

-

1.1. In-house Facility Management

-

1.1.1. Outsourced Facility Management

- 1.1.1.1. Single FM

- 1.1.1.2. Bundled FM

- 1.1.1.3. Integrated FM

-

1.1.1. Outsourced Facility Management

-

1.2. By Offering Type

- 1.2.1. Hard FM

- 1.2.2. Soft FM

-

1.3. By End User

- 1.3.1. Commercial

- 1.3.2. Public/Infrastructure

- 1.3.3. Industrial

- 1.3.4. Other End Users

-

1.1. In-house Facility Management

Thailand Facility Management Market Segmentation By Geography

- 1. Thailand

Thailand Facility Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.04% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Trend Toward Commoditization of FM; Increasing Investments in Infrastructure Development

- 3.3. Market Restrains

- 3.3.1. Growing Trend Toward Commoditization of FM; Increasing Investments in Infrastructure Development

- 3.4. Market Trends

- 3.4.1. In-house Facility Management to Witness Major Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Thailand Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. In-house Facility Management

- 5.1.1.1. Outsourced Facility Management

- 5.1.1.1.1. Single FM

- 5.1.1.1.2. Bundled FM

- 5.1.1.1.3. Integrated FM

- 5.1.1.1. Outsourced Facility Management

- 5.1.2. By Offering Type

- 5.1.2.1. Hard FM

- 5.1.2.2. Soft FM

- 5.1.3. By End User

- 5.1.3.1. Commercial

- 5.1.3.2. Public/Infrastructure

- 5.1.3.3. Industrial

- 5.1.3.4. Other End Users

- 5.1.1. In-house Facility Management

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Thailand

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 IFS Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 PCS Security And Facility Services Limited (OCS Group Holdings Ltd)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 CBRE Group Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 G4S Security Services (Thailand) Limited (G4S plc)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sodexo Facilities Management Services (Sodexo Group)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Plus Property Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Swift Dynamics Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Siam Piwat Company Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 NCH Asia Pacific

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Amata Facility Service Co Ltd (Amata Corporation)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Jones Lang LaSalle (JLL

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 IFS Inc

List of Figures

- Figure 1: Thailand Facility Management Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Thailand Facility Management Market Share (%) by Company 2024

List of Tables

- Table 1: Thailand Facility Management Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Thailand Facility Management Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Thailand Facility Management Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Thailand Facility Management Market Volume Billion Forecast, by Type 2019 & 2032

- Table 5: Thailand Facility Management Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Thailand Facility Management Market Volume Billion Forecast, by Region 2019 & 2032

- Table 7: Thailand Facility Management Market Revenue Million Forecast, by Type 2019 & 2032

- Table 8: Thailand Facility Management Market Volume Billion Forecast, by Type 2019 & 2032

- Table 9: Thailand Facility Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Thailand Facility Management Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Thailand Facility Management Market?

The projected CAGR is approximately 5.04%.

2. Which companies are prominent players in the Thailand Facility Management Market?

Key companies in the market include IFS Inc, PCS Security And Facility Services Limited (OCS Group Holdings Ltd), CBRE Group Inc, G4S Security Services (Thailand) Limited (G4S plc), Sodexo Facilities Management Services (Sodexo Group), Plus Property Co Ltd, Swift Dynamics Co Ltd, Siam Piwat Company Limited, NCH Asia Pacific, Amata Facility Service Co Ltd (Amata Corporation), Jones Lang LaSalle (JLL.

3. What are the main segments of the Thailand Facility Management Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.65 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Trend Toward Commoditization of FM; Increasing Investments in Infrastructure Development.

6. What are the notable trends driving market growth?

In-house Facility Management to Witness Major Growth.

7. Are there any restraints impacting market growth?

Growing Trend Toward Commoditization of FM; Increasing Investments in Infrastructure Development.

8. Can you provide examples of recent developments in the market?

August 2024 - GJ Steel Public Company Limited (GJS) is set to invest THB 1.5 billion (USD 42 million) over the next three years to upgrade its production facility. This move aims to bolster product quality and enhance cost competitiveness. With this investment, GJS aims to revitalize its performance and bolster the Thai economy. The company plans to meet the diverse steel demands in Thailand by supplying high-quality Hot Rolled Flat products.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Thailand Facility Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Thailand Facility Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Thailand Facility Management Market?

To stay informed about further developments, trends, and reports in the Thailand Facility Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence