Key Insights

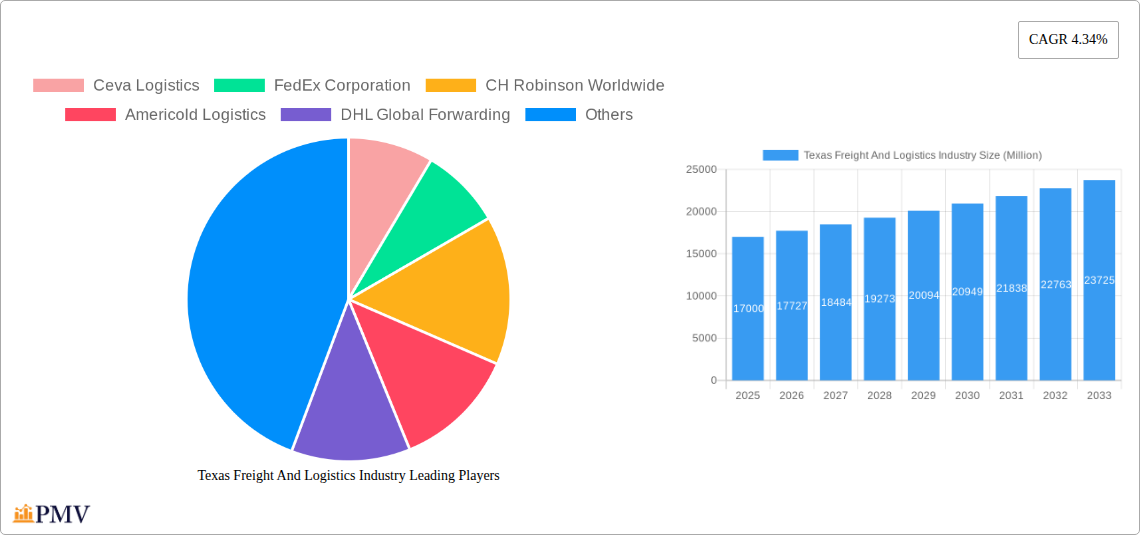

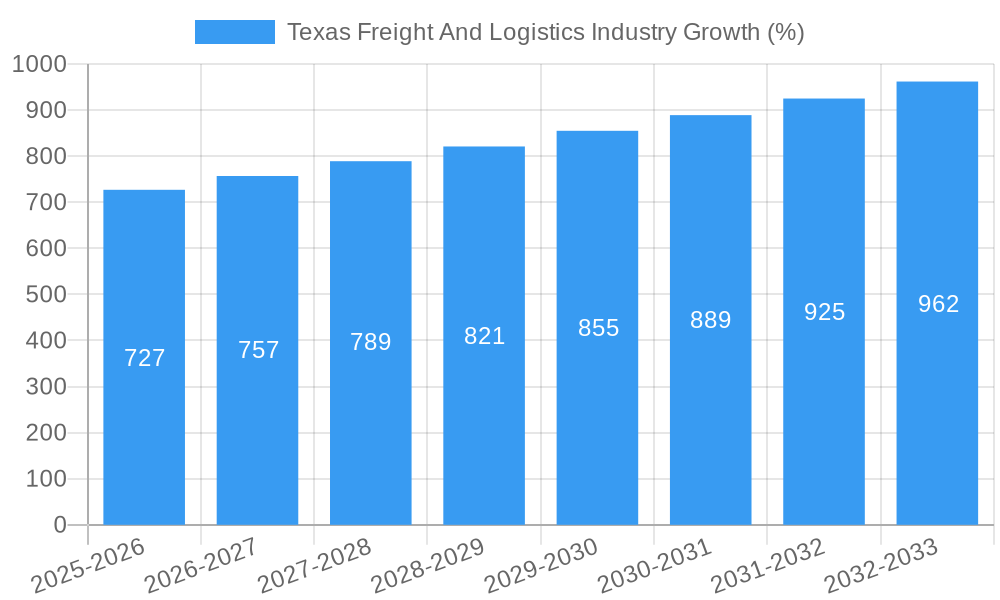

The Texas freight and logistics industry, a vital component of the state's robust economy, is experiencing significant growth, fueled by a burgeoning e-commerce sector, increasing industrial activity, and expanding cross-border trade with Mexico. While precise market size data for Texas is unavailable, we can extrapolate from the global market size of $93.07 billion (2025) and a compound annual growth rate (CAGR) of 4.34%. Considering Texas's substantial contribution to the US economy and its strategic geographic location, a reasonable estimate for the Texas freight and logistics market size in 2025 would be between $15 and $20 billion. Key growth drivers include the continued expansion of the energy sector (oil and gas), the robust agricultural industry, and the burgeoning manufacturing and automotive sectors. Furthermore, advancements in technology, such as improved transportation management systems and autonomous vehicles, are enhancing efficiency and driving down costs. However, challenges persist, including driver shortages, infrastructure limitations (particularly in certain regions), and increasing fuel prices. These factors necessitate strategic investment in infrastructure upgrades and workforce development initiatives to sustain the industry's growth trajectory.

The segmentation within the Texas freight and logistics market mirrors national trends. Freight transport, warehousing, and value-added services (like packaging and labeling) constitute the largest functional segments. Major end-users include construction, oil and gas, agriculture, manufacturing, and retail distribution. Leading companies, including some with significant Texas operations (though not exclusively Texas-focused), are leveraging technological advancements and strategic partnerships to maintain a competitive edge. The regional dynamics within Texas itself are complex, with major hubs such as Dallas-Fort Worth, Houston, and San Antonio experiencing disproportionately higher activity compared to more rural areas. This necessitates tailored solutions considering regional infrastructural capacities and specific industry concentrations. Future growth will depend on effective regulatory frameworks, investments in sustainable practices, and a continued focus on innovation to address evolving market demands.

Texas Freight & Logistics Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Texas freight and logistics industry, covering market structure, competitive dynamics, industry trends, leading players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for businesses, investors, and policymakers operating within this dynamic sector. The report projects a market size of xx Million for 2025, with a CAGR of xx% during the forecast period.

Texas Freight And Logistics Industry Market Structure & Competitive Dynamics

The Texas freight and logistics market is characterized by a moderately concentrated structure, with a few large players holding significant market share. However, a multitude of smaller, specialized firms also contribute significantly to the overall market volume. Market share data for 2024 indicates that FedEx Corporation and CH Robinson Worldwide hold approximately xx% and xx% respectively, while other major players like Ceva Logistics, DHL Global Forwarding, and XPO Logistics Inc. collectively contribute to a substantial portion of the remaining market. The industry exhibits a high degree of innovation, driven by technological advancements in transportation management systems (TMS), route optimization software, and autonomous vehicles.

The regulatory framework, primarily governed by the Federal Motor Carrier Safety Administration (FMCSA) and the Texas Department of Transportation (TxDOT), significantly impacts market operations. Regulations concerning driver hours of service, safety standards, and environmental compliance influence operational costs and efficiency. Product substitutes, such as rail transport and pipelines, compete for market share, particularly in bulk commodities. End-user trends toward e-commerce and just-in-time delivery systems are reshaping logistics demands, demanding greater agility and speed from freight and logistics providers. The mergers and acquisitions (M&A) landscape reveals significant activity, with deal values exceeding xx Million in recent years, driven by consolidation and expansion strategies amongst larger players and a drive for scale by the smaller firms. Recent notable acquisitions include Quantix's acquisition of several companies in late 2022, expanding its reach across the Gulf Coast, adding over 140 trucks to its fleet.

Texas Freight And Logistics Industry Industry Trends & Insights

The Texas freight and logistics industry is experiencing robust growth, driven by several key factors. The state's strong economic performance, particularly in sectors such as manufacturing, energy, and agriculture, fuels demand for efficient transportation and logistics solutions. Technological disruptions, including the adoption of advanced analytics, AI-powered route optimization, and the integration of blockchain technology for improved supply chain transparency, are transforming industry operations, increasing efficiency and reducing costs. Changing consumer preferences, including the rise of e-commerce and same-day delivery expectations, are placing immense pressure on logistics providers to adapt and innovate. The competitive landscape continues to evolve, with larger players engaging in strategic acquisitions and partnerships to expand their service offerings and geographical reach. The industry's CAGR during the historical period (2019-2024) was xx%, with market penetration of xx% in major metropolitan areas. The growth is expected to be sustained in the future.

Dominant Markets & Segments in Texas Freight And Logistics Industry

By Function:

- Freight Transport: Road freight dominates, fueled by the extensive highway network and the large number of trucking companies operating within Texas. This segment is predicted to retain its leading position, benefiting from ongoing investments in infrastructure.

- Air Freight Forwarding: Significant due to the presence of major airports in Dallas/Fort Worth and Houston, serving as crucial hubs for both domestic and international shipments. Growth is expected to be driven by the increasing demand for fast delivery solutions.

- Warehousing: Texas's strategic location and robust infrastructure make it an attractive location for warehousing facilities. Growth is driven by the expansion of e-commerce and the need for efficient inventory management.

- Value-Added Services: This segment is experiencing rapid growth, driven by the increasing demand for customized logistics solutions including packaging, labeling, and inventory management.

By End-User:

- Manufacturing and Automotive: This segment represents a major driver of freight and logistics activity, with the substantial presence of manufacturing facilities across Texas. Growth is influenced by manufacturing sector investments and auto production activities.

- Oil and Gas and Quarrying: A significant sector, particularly in the western part of Texas, driving demand for specialized transportation services for handling bulk commodities. This segment's growth is closely tied to energy prices and production levels.

- Distributive Trade: The retail sector contributes substantially, particularly with the growth of e-commerce, driving growth in last-mile delivery services. The industry's growth is linked to retail sales performance and e-commerce expansion.

Texas Freight And Logistics Industry Product Innovations

The Texas freight and logistics industry is witnessing significant product innovation. The introduction of advanced Transportation Management Systems (TMS) facilitates real-time tracking, route optimization, and enhanced supply chain visibility. The integration of Artificial Intelligence (AI) and Machine Learning (ML) is improving efficiency in route planning and predictive maintenance, reducing operational costs and improving delivery times. The adoption of autonomous vehicles and drones for last-mile delivery holds substantial potential for future growth, streamlining deliveries and cutting down on expenses. These innovations align perfectly with industry demands for increased efficiency, reduced costs, and enhanced customer satisfaction.

Report Segmentation & Scope

This report segments the Texas freight and logistics industry by function (Freight Transport, Air Freight Forwarding, Warehousing, Value-added Services) and end-user (Construction, Oil and Gas and Quarrying, Agriculture, Fishing, and Forestry, Manufacturing and Automotive, Distributive Trade, Other End Users). Each segment’s growth projections, market size estimations, and competitive landscape are detailed within the report. Growth projections for each segment vary, based on its specific market dynamics and future trends. The report provides a detailed overview of market size, share, competitive intensity and growth potential for each identified segment.

Key Drivers of Texas Freight And Logistics Industry Growth

The Texas freight and logistics industry's growth is fueled by several factors. The state's robust economy, particularly in key sectors like manufacturing and energy, creates significant demand for transportation services. Significant infrastructure investments, such as improvements to highways and ports, enhance logistics efficiency. Technological advancements, including the adoption of TMS and automation technologies, are improving operational efficiency and reducing costs. Government policies promoting trade and economic development further support industry growth.

Challenges in the Texas Freight And Logistics Industry Sector

The Texas freight and logistics sector faces challenges such as driver shortages, leading to increased labor costs and capacity constraints. Fluctuating fuel prices significantly impact operational costs. Increasing regulatory compliance requirements add complexity and expenses for businesses. Intense competition from established players and new entrants exerts pressure on profit margins. Supply chain disruptions, such as those witnessed during the pandemic, highlight vulnerability to external shocks, impacting operations and overall profitability.

Leading Players in the Texas Freight And Logistics Industry Market

- Ceva Logistics

- FedEx Corporation

- CH Robinson Worldwide

- Americold Logistics

- DHL Global Forwarding

- Expeditors International of Washington

- XPO Logistics Inc

- DSV Air & Sea Inc

- Bollore Logistics

- Kintetsu World Express

Key Developments in Texas Freight And Logistics Industry Sector

- November 2022: Quantix's acquisition of five companies and expansion of its fleet by over 140 trucks significantly increases its market share and capacity across the Gulf Coast. This expansion strengthens Quantix's presence in the region and provides greater service to their clients.

- October 2022: E2open's partnership expansion with Uber Freight enhances real-time rate comparison capabilities within its TMS application, providing shippers with improved visibility and cost optimization options. This improves efficiency and potentially attracts new clients to e2open's TMS.

Strategic Texas Freight And Logistics Industry Market Outlook

The Texas freight and logistics industry is poised for continued growth, driven by strong economic fundamentals, technological advancements, and infrastructure investments. Strategic opportunities exist in leveraging technological innovations like AI and automation to enhance efficiency and reduce costs. Expanding into specialized niche markets and focusing on value-added services will create further growth potential for companies. Addressing challenges such as driver shortages through workforce development initiatives will be critical for sustainable growth. The development and implementation of sustainable logistics solutions will become increasingly important, creating additional opportunities within the sector.

Texas Freight And Logistics Industry Segmentation

-

1. Function

-

1.1. Freight Transport

- 1.1.1. Road

- 1.1.2. Rail

- 1.1.3. Sea and Inland

- 1.1.4. Air

- 1.2. Freight Forwarding

- 1.3. Warehousing

- 1.4. Value-added Services

-

1.1. Freight Transport

-

2. End-User

- 2.1. Construction

- 2.2. Oil and Gas and Quarrying

- 2.3. Agriculture, Fishing, and Forestry

- 2.4. Manufacturing and Automotive

- 2.5. Distributive Trade

- 2.6. Other End Users

Texas Freight And Logistics Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Texas Freight And Logistics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.34% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Expansion of online apparel sales; The demand for faster delivery and quicker time to market

- 3.3. Market Restrains

- 3.3.1. Highly perishable fashion trends; High cost of technology and infrastructure

- 3.4. Market Trends

- 3.4.1. Increase in value-added services in the country driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Texas Freight And Logistics Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Function

- 5.1.1. Freight Transport

- 5.1.1.1. Road

- 5.1.1.2. Rail

- 5.1.1.3. Sea and Inland

- 5.1.1.4. Air

- 5.1.2. Freight Forwarding

- 5.1.3. Warehousing

- 5.1.4. Value-added Services

- 5.1.1. Freight Transport

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Construction

- 5.2.2. Oil and Gas and Quarrying

- 5.2.3. Agriculture, Fishing, and Forestry

- 5.2.4. Manufacturing and Automotive

- 5.2.5. Distributive Trade

- 5.2.6. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Function

- 6. North America Texas Freight And Logistics Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Function

- 6.1.1. Freight Transport

- 6.1.1.1. Road

- 6.1.1.2. Rail

- 6.1.1.3. Sea and Inland

- 6.1.1.4. Air

- 6.1.2. Freight Forwarding

- 6.1.3. Warehousing

- 6.1.4. Value-added Services

- 6.1.1. Freight Transport

- 6.2. Market Analysis, Insights and Forecast - by End-User

- 6.2.1. Construction

- 6.2.2. Oil and Gas and Quarrying

- 6.2.3. Agriculture, Fishing, and Forestry

- 6.2.4. Manufacturing and Automotive

- 6.2.5. Distributive Trade

- 6.2.6. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Function

- 7. South America Texas Freight And Logistics Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Function

- 7.1.1. Freight Transport

- 7.1.1.1. Road

- 7.1.1.2. Rail

- 7.1.1.3. Sea and Inland

- 7.1.1.4. Air

- 7.1.2. Freight Forwarding

- 7.1.3. Warehousing

- 7.1.4. Value-added Services

- 7.1.1. Freight Transport

- 7.2. Market Analysis, Insights and Forecast - by End-User

- 7.2.1. Construction

- 7.2.2. Oil and Gas and Quarrying

- 7.2.3. Agriculture, Fishing, and Forestry

- 7.2.4. Manufacturing and Automotive

- 7.2.5. Distributive Trade

- 7.2.6. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Function

- 8. Europe Texas Freight And Logistics Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Function

- 8.1.1. Freight Transport

- 8.1.1.1. Road

- 8.1.1.2. Rail

- 8.1.1.3. Sea and Inland

- 8.1.1.4. Air

- 8.1.2. Freight Forwarding

- 8.1.3. Warehousing

- 8.1.4. Value-added Services

- 8.1.1. Freight Transport

- 8.2. Market Analysis, Insights and Forecast - by End-User

- 8.2.1. Construction

- 8.2.2. Oil and Gas and Quarrying

- 8.2.3. Agriculture, Fishing, and Forestry

- 8.2.4. Manufacturing and Automotive

- 8.2.5. Distributive Trade

- 8.2.6. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Function

- 9. Middle East & Africa Texas Freight And Logistics Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Function

- 9.1.1. Freight Transport

- 9.1.1.1. Road

- 9.1.1.2. Rail

- 9.1.1.3. Sea and Inland

- 9.1.1.4. Air

- 9.1.2. Freight Forwarding

- 9.1.3. Warehousing

- 9.1.4. Value-added Services

- 9.1.1. Freight Transport

- 9.2. Market Analysis, Insights and Forecast - by End-User

- 9.2.1. Construction

- 9.2.2. Oil and Gas and Quarrying

- 9.2.3. Agriculture, Fishing, and Forestry

- 9.2.4. Manufacturing and Automotive

- 9.2.5. Distributive Trade

- 9.2.6. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Function

- 10. Asia Pacific Texas Freight And Logistics Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Function

- 10.1.1. Freight Transport

- 10.1.1.1. Road

- 10.1.1.2. Rail

- 10.1.1.3. Sea and Inland

- 10.1.1.4. Air

- 10.1.2. Freight Forwarding

- 10.1.3. Warehousing

- 10.1.4. Value-added Services

- 10.1.1. Freight Transport

- 10.2. Market Analysis, Insights and Forecast - by End-User

- 10.2.1. Construction

- 10.2.2. Oil and Gas and Quarrying

- 10.2.3. Agriculture, Fishing, and Forestry

- 10.2.4. Manufacturing and Automotive

- 10.2.5. Distributive Trade

- 10.2.6. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Function

- 11. Asia Pacific Texas Freight And Logistics Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 China

- 11.1.2 Japan

- 11.1.3 India

- 11.1.4 South Korea

- 11.1.5 ASEAN

- 11.1.6 Rest of Asia Pacific

- 12. North America Texas Freight And Logistics Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United States

- 12.1.2 Canada

- 12.1.3 Brazil

- 12.1.4 Mexico

- 12.1.5 Rest of Americas

- 13. Europe Texas Freight And Logistics Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 United Kingdom

- 13.1.2 Germany

- 13.1.3 Italy

- 13.1.4 Spain

- 13.1.5 France

- 13.1.6 Rest of Europe

- 14. Middle East and Africa Texas Freight And Logistics Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Saudi Arabia

- 14.1.2 South Africa

- 14.1.3 Rest of Middle East and Africa

- 15. Competitive Analysis

- 15.1. Global Market Share Analysis 2024

- 15.2. Company Profiles

- 15.2.1 Ceva Logistics

- 15.2.1.1. Overview

- 15.2.1.2. Products

- 15.2.1.3. SWOT Analysis

- 15.2.1.4. Recent Developments

- 15.2.1.5. Financials (Based on Availability)

- 15.2.2 FedEx Corporation

- 15.2.2.1. Overview

- 15.2.2.2. Products

- 15.2.2.3. SWOT Analysis

- 15.2.2.4. Recent Developments

- 15.2.2.5. Financials (Based on Availability)

- 15.2.3 CH Robinson Worldwide

- 15.2.3.1. Overview

- 15.2.3.2. Products

- 15.2.3.3. SWOT Analysis

- 15.2.3.4. Recent Developments

- 15.2.3.5. Financials (Based on Availability)

- 15.2.4 Americold Logistics

- 15.2.4.1. Overview

- 15.2.4.2. Products

- 15.2.4.3. SWOT Analysis

- 15.2.4.4. Recent Developments

- 15.2.4.5. Financials (Based on Availability)

- 15.2.5 DHL Global Forwarding

- 15.2.5.1. Overview

- 15.2.5.2. Products

- 15.2.5.3. SWOT Analysis

- 15.2.5.4. Recent Developments

- 15.2.5.5. Financials (Based on Availability)

- 15.2.6 Expeditors International of Washington**List Not Exhaustive

- 15.2.6.1. Overview

- 15.2.6.2. Products

- 15.2.6.3. SWOT Analysis

- 15.2.6.4. Recent Developments

- 15.2.6.5. Financials (Based on Availability)

- 15.2.7 XPO Logistics Inc

- 15.2.7.1. Overview

- 15.2.7.2. Products

- 15.2.7.3. SWOT Analysis

- 15.2.7.4. Recent Developments

- 15.2.7.5. Financials (Based on Availability)

- 15.2.8 DSV Air & Sea Inc

- 15.2.8.1. Overview

- 15.2.8.2. Products

- 15.2.8.3. SWOT Analysis

- 15.2.8.4. Recent Developments

- 15.2.8.5. Financials (Based on Availability)

- 15.2.9 Bollore Logistics

- 15.2.9.1. Overview

- 15.2.9.2. Products

- 15.2.9.3. SWOT Analysis

- 15.2.9.4. Recent Developments

- 15.2.9.5. Financials (Based on Availability)

- 15.2.10 Kintetsu World Express

- 15.2.10.1. Overview

- 15.2.10.2. Products

- 15.2.10.3. SWOT Analysis

- 15.2.10.4. Recent Developments

- 15.2.10.5. Financials (Based on Availability)

- 15.2.1 Ceva Logistics

List of Figures

- Figure 1: Global Texas Freight And Logistics Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Asia Pacific Texas Freight And Logistics Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: Asia Pacific Texas Freight And Logistics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Texas Freight And Logistics Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: North America Texas Freight And Logistics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Europe Texas Freight And Logistics Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Europe Texas Freight And Logistics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Middle East and Africa Texas Freight And Logistics Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Middle East and Africa Texas Freight And Logistics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Texas Freight And Logistics Industry Revenue (Million), by Function 2024 & 2032

- Figure 11: North America Texas Freight And Logistics Industry Revenue Share (%), by Function 2024 & 2032

- Figure 12: North America Texas Freight And Logistics Industry Revenue (Million), by End-User 2024 & 2032

- Figure 13: North America Texas Freight And Logistics Industry Revenue Share (%), by End-User 2024 & 2032

- Figure 14: North America Texas Freight And Logistics Industry Revenue (Million), by Country 2024 & 2032

- Figure 15: North America Texas Freight And Logistics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 16: South America Texas Freight And Logistics Industry Revenue (Million), by Function 2024 & 2032

- Figure 17: South America Texas Freight And Logistics Industry Revenue Share (%), by Function 2024 & 2032

- Figure 18: South America Texas Freight And Logistics Industry Revenue (Million), by End-User 2024 & 2032

- Figure 19: South America Texas Freight And Logistics Industry Revenue Share (%), by End-User 2024 & 2032

- Figure 20: South America Texas Freight And Logistics Industry Revenue (Million), by Country 2024 & 2032

- Figure 21: South America Texas Freight And Logistics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: Europe Texas Freight And Logistics Industry Revenue (Million), by Function 2024 & 2032

- Figure 23: Europe Texas Freight And Logistics Industry Revenue Share (%), by Function 2024 & 2032

- Figure 24: Europe Texas Freight And Logistics Industry Revenue (Million), by End-User 2024 & 2032

- Figure 25: Europe Texas Freight And Logistics Industry Revenue Share (%), by End-User 2024 & 2032

- Figure 26: Europe Texas Freight And Logistics Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe Texas Freight And Logistics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Middle East & Africa Texas Freight And Logistics Industry Revenue (Million), by Function 2024 & 2032

- Figure 29: Middle East & Africa Texas Freight And Logistics Industry Revenue Share (%), by Function 2024 & 2032

- Figure 30: Middle East & Africa Texas Freight And Logistics Industry Revenue (Million), by End-User 2024 & 2032

- Figure 31: Middle East & Africa Texas Freight And Logistics Industry Revenue Share (%), by End-User 2024 & 2032

- Figure 32: Middle East & Africa Texas Freight And Logistics Industry Revenue (Million), by Country 2024 & 2032

- Figure 33: Middle East & Africa Texas Freight And Logistics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 34: Asia Pacific Texas Freight And Logistics Industry Revenue (Million), by Function 2024 & 2032

- Figure 35: Asia Pacific Texas Freight And Logistics Industry Revenue Share (%), by Function 2024 & 2032

- Figure 36: Asia Pacific Texas Freight And Logistics Industry Revenue (Million), by End-User 2024 & 2032

- Figure 37: Asia Pacific Texas Freight And Logistics Industry Revenue Share (%), by End-User 2024 & 2032

- Figure 38: Asia Pacific Texas Freight And Logistics Industry Revenue (Million), by Country 2024 & 2032

- Figure 39: Asia Pacific Texas Freight And Logistics Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Texas Freight And Logistics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Texas Freight And Logistics Industry Revenue Million Forecast, by Function 2019 & 2032

- Table 3: Global Texas Freight And Logistics Industry Revenue Million Forecast, by End-User 2019 & 2032

- Table 4: Global Texas Freight And Logistics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Texas Freight And Logistics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Japan Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: India Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Korea Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: ASEAN Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Asia Pacific Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Texas Freight And Logistics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United States Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Brazil Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Mexico Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Rest of Americas Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Global Texas Freight And Logistics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 19: United Kingdom Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Germany Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Italy Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Spain Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: France Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Europe Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Global Texas Freight And Logistics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Saudi Arabia Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: South Africa Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Middle East and Africa Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Global Texas Freight And Logistics Industry Revenue Million Forecast, by Function 2019 & 2032

- Table 30: Global Texas Freight And Logistics Industry Revenue Million Forecast, by End-User 2019 & 2032

- Table 31: Global Texas Freight And Logistics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 32: United States Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Canada Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Mexico Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Global Texas Freight And Logistics Industry Revenue Million Forecast, by Function 2019 & 2032

- Table 36: Global Texas Freight And Logistics Industry Revenue Million Forecast, by End-User 2019 & 2032

- Table 37: Global Texas Freight And Logistics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Brazil Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Argentina Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Rest of South America Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Global Texas Freight And Logistics Industry Revenue Million Forecast, by Function 2019 & 2032

- Table 42: Global Texas Freight And Logistics Industry Revenue Million Forecast, by End-User 2019 & 2032

- Table 43: Global Texas Freight And Logistics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 44: United Kingdom Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Germany Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: France Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Italy Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Spain Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Russia Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Benelux Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Nordics Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Rest of Europe Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Global Texas Freight And Logistics Industry Revenue Million Forecast, by Function 2019 & 2032

- Table 54: Global Texas Freight And Logistics Industry Revenue Million Forecast, by End-User 2019 & 2032

- Table 55: Global Texas Freight And Logistics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 56: Turkey Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: Israel Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: GCC Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: North Africa Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: South Africa Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: Rest of Middle East & Africa Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: Global Texas Freight And Logistics Industry Revenue Million Forecast, by Function 2019 & 2032

- Table 63: Global Texas Freight And Logistics Industry Revenue Million Forecast, by End-User 2019 & 2032

- Table 64: Global Texas Freight And Logistics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 65: China Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: India Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 67: Japan Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 68: South Korea Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 69: ASEAN Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 70: Oceania Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 71: Rest of Asia Pacific Texas Freight And Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Texas Freight And Logistics Industry?

The projected CAGR is approximately 4.34%.

2. Which companies are prominent players in the Texas Freight And Logistics Industry?

Key companies in the market include Ceva Logistics, FedEx Corporation, CH Robinson Worldwide, Americold Logistics, DHL Global Forwarding, Expeditors International of Washington**List Not Exhaustive, XPO Logistics Inc, DSV Air & Sea Inc, Bollore Logistics, Kintetsu World Express.

3. What are the main segments of the Texas Freight And Logistics Industry?

The market segments include Function, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 93.07 Million as of 2022.

5. What are some drivers contributing to market growth?

Expansion of online apparel sales; The demand for faster delivery and quicker time to market.

6. What are the notable trends driving market growth?

Increase in value-added services in the country driving the market.

7. Are there any restraints impacting market growth?

Highly perishable fashion trends; High cost of technology and infrastructure.

8. Can you provide examples of recent developments in the market?

November 2022- Quantix, a portfolio company of Wind Point Partners in Chicago, has acquired five companies: Dobbins Enterprises, C&S Express, Chancelor Transportation, T&K Chancelor Enterprises, and Templet Transit. Quantix also announced the addition of a new agent, L.D. McCloud Transportation, to its liquid and plastics transportation division, added more than 140 trucks and ancillary equipment. Customers will be served by the new trucks all along the Gulf Coast, including Houston, Baton Rouge and Port Allen, Louisiana, and Meridian, Mississippi.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Texas Freight And Logistics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Texas Freight And Logistics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Texas Freight And Logistics Industry?

To stay informed about further developments, trends, and reports in the Texas Freight And Logistics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence