Key Insights

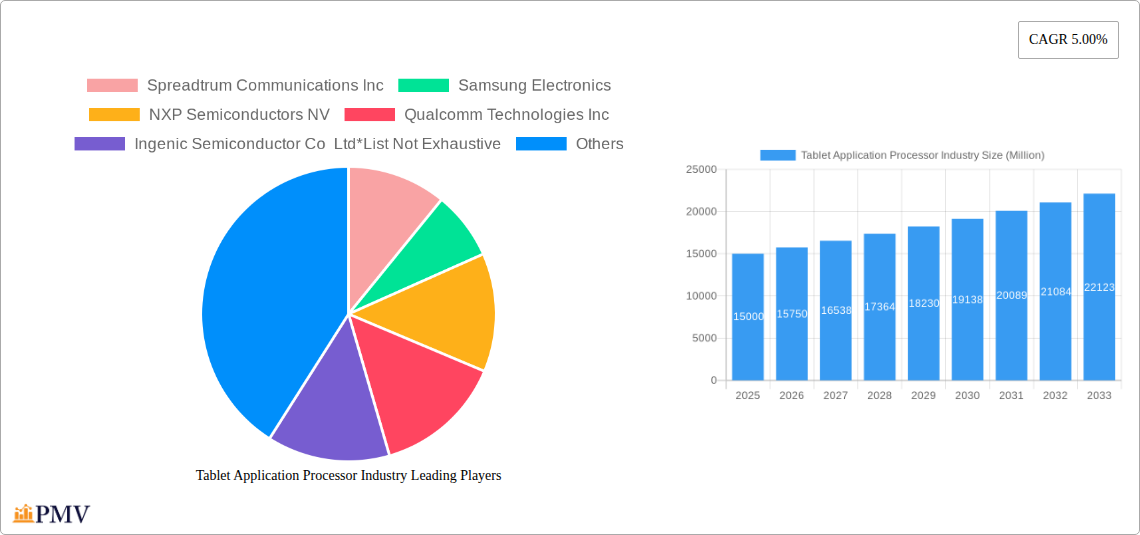

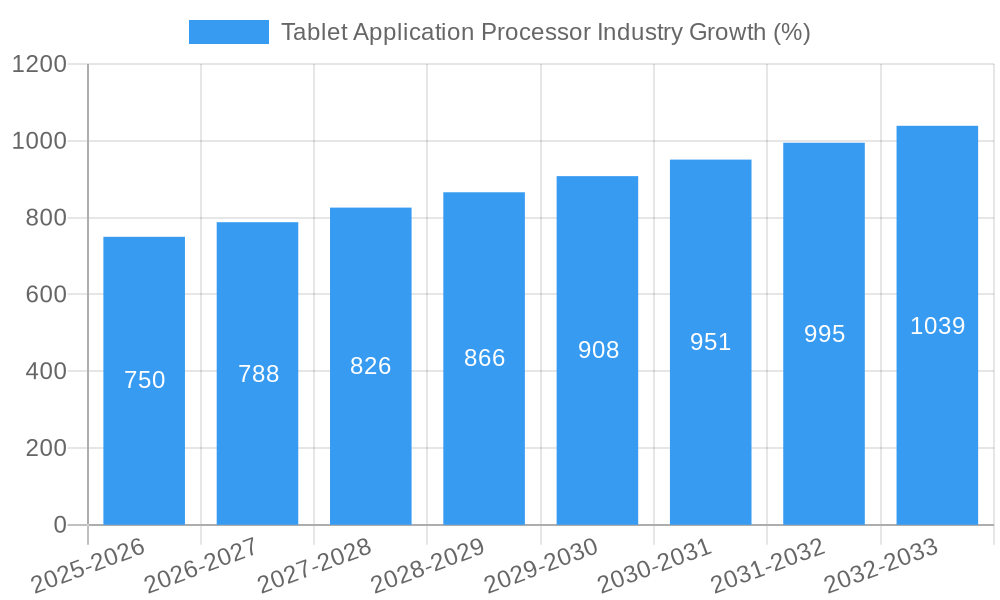

The global tablet application processor (AP) market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.00% from 2025 to 2033. This expansion is fueled by several key drivers. The increasing demand for high-performance tablets across diverse end-user segments, including households and commercial applications, is a significant catalyst. The continuous evolution of operating systems like Android, iOS, and Windows, each catering to specific user preferences and functionalities, further fuels market growth. Advancements in processor technology, particularly the shift towards 64-bit processors and multi-core architectures, enhance processing power and energy efficiency, driving adoption. Furthermore, the proliferation of multimedia-rich applications and the rise of mobile gaming are boosting the demand for high-performance tablet APs. While factors such as fluctuating component costs and intense competition among major players like Qualcomm, MediaTek, and Apple could pose challenges, the overall market outlook remains positive, driven by technological innovations and increasing tablet penetration across various regions.

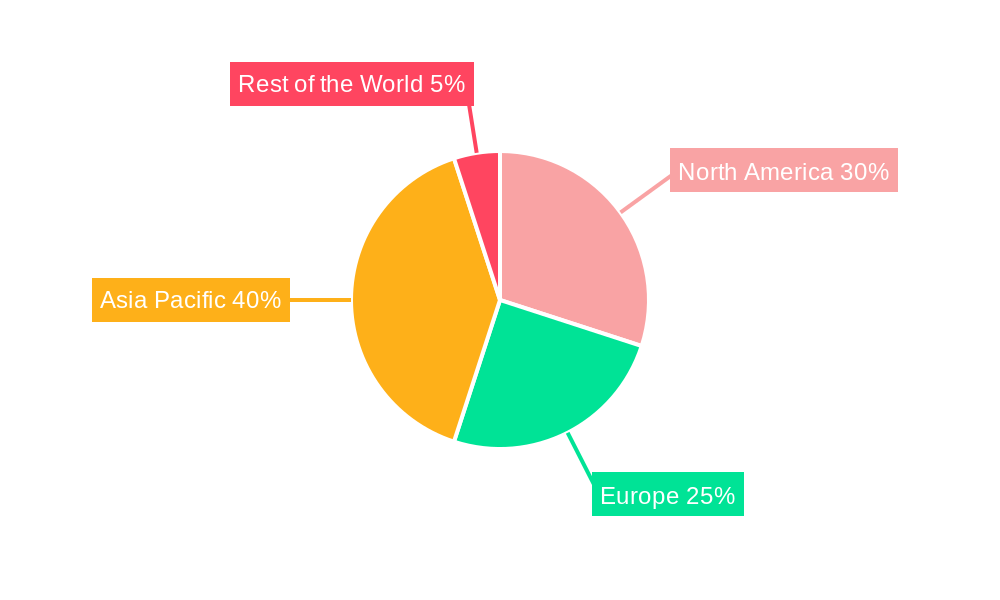

The market segmentation reveals a dynamic landscape. Android continues to dominate the operating system segment, reflecting its widespread adoption in budget-friendly and mid-range tablets. However, iOS maintains a strong presence in the premium tablet segment. The household segment represents a substantial portion of the end-user market, while the commercial segment shows promising growth potential due to increasing deployment of tablets in educational institutions and corporate environments. The prevalence of 64-bit processors is expected to increase significantly during the forecast period, reflecting a broader industry shift towards enhanced performance and capabilities. Geographically, the Asia-Pacific region, particularly China and India, is poised for significant expansion, driven by increasing consumer spending and rising smartphone penetration. North America and Europe will continue to contribute substantially to the market, maintaining steady growth fueled by technological advancements and established consumer bases.

Tablet Application Processor Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the global Tablet Application Processor industry, offering invaluable insights for stakeholders seeking to understand market dynamics, competitive landscapes, and future growth opportunities. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The forecast period covers 2025-2033, while the historical period encompasses 2019-2024. Key players analyzed include Spreadtrum Communications Inc, Samsung Electronics, NXP Semiconductors NV, Qualcomm Technologies Inc, Ingenic Semiconductor Co Ltd, Texas Instruments Incorporated, MediaTek Inc, Nvidia Corporation, Apple Inc, and HiSilicon Technologies Co Ltd. This is not an exhaustive list. The report segments the market by operating system (Android, Apple iOS, Windows), end-user (household, commercial, other), type (32-bit, 64-bit, other), and core type (single-core, multi-core). The report projects a total market value of xx Million by 2033.

Tablet Application Processor Industry Market Structure & Competitive Dynamics

The tablet application processor market exhibits a moderately concentrated structure, with a few dominant players commanding significant market share. Qualcomm Technologies Inc and MediaTek Inc hold substantial market leadership, while other key players, including Samsung Electronics, Apple Inc, and HiSilicon Technologies Co Ltd, fiercely compete for market share. The industry's innovation ecosystem is highly dynamic, driven by advancements in chip architecture, processing power, and power efficiency. Regulatory frameworks, particularly concerning data privacy and security, significantly influence market dynamics. Product substitutes, such as alternative computing platforms, pose a limited threat, given the widespread adoption of tablets. End-user trends, including the growing demand for high-performance tablets for gaming and professional use, fuel market expansion. M&A activities have been moderate, with deal values averaging xx Million annually over the historical period.

- Market Concentration: High (Top 5 players account for approximately xx% of market share)

- Innovation Ecosystem: Highly dynamic, driven by advancements in semiconductor technology.

- M&A Activity: Moderate, with average annual deal values of approximately xx Million during 2019-2024.

- Regulatory Landscape: Stringent data privacy regulations are increasing.

Tablet Application Processor Industry Industry Trends & Insights

The tablet application processor market is experiencing robust growth, driven primarily by increasing tablet adoption across various sectors. Technological disruptions, such as the introduction of 5G connectivity and advancements in artificial intelligence (AI), are further propelling market expansion. Consumer preferences for high-resolution displays, faster processing speeds, and longer battery life are shaping product development and innovation. The market's competitive dynamics are characterized by intense competition among leading players, focusing on technological differentiation, cost optimization, and strategic partnerships. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is estimated at xx%, with market penetration increasing steadily across different geographical regions. The industry is witnessing a shift towards higher-core processors and advanced technologies like AI acceleration. This growth is significantly influenced by emerging markets and increasing adoption of tablets in education and enterprise.

Dominant Markets & Segments in Tablet Application Processor Industry

The Android operating system dominates the tablet application processor market, driven by its open-source nature and widespread device compatibility. The household segment represents the largest end-user market, followed by the commercial segment, with growth in both segments projected. The 64-bit processor type is witnessing increasing adoption, surpassing 32-bit processors in terms of market share. Multi-core processors are the preferred choice for enhanced performance capabilities. North America and Asia Pacific regions lead in terms of market size and growth.

- Key Drivers for Android Dominance: Open-source nature, extensive developer ecosystem, large device compatibility.

- Key Drivers for Household Segment Dominance: Affordability, ease of use, entertainment.

- Key Drivers for 64-bit Processor Type Growth: Enhanced performance and memory capacity.

- Key Drivers for Multi-core Processor Dominance: Superior processing speed, multitasking capabilities.

- Key Drivers for North America/Asia-Pacific Dominance: Strong consumer demand, technological infrastructure.

Tablet Application Processor Industry Product Innovations

Recent product developments focus on enhanced processing power, improved energy efficiency, and advanced multimedia capabilities. Innovative features like integrated AI accelerators and support for high-resolution displays are gaining traction. These innovations offer competitive advantages by enabling superior performance in gaming, augmented reality (AR), and virtual reality (VR) applications. The market is seeing a trend toward system-on-a-chip (SoC) designs that integrate multiple components onto a single chip, optimizing performance and reducing costs.

Report Segmentation & Scope

This report segments the tablet application processor market across multiple dimensions:

- Operating System: Android, Apple iOS, Windows (Each segment’s growth projection, market size, and competitive landscape are discussed in detail).

- End User: Household, Commercial, Other (Market size, growth projections, and key player analysis are provided for each segment).

- Type: 32-bit, 64-bit, Other (Analysis of each segment including growth rate and future predictions are presented).

- Core Type: Single-core, Multi-core (The dominance of multi-core processors is extensively examined, including the market size and growth).

Key Drivers of Tablet Application Processor Industry Growth

Several factors drive the tablet application processor market’s growth, including technological advancements such as AI integration and 5G connectivity, increased affordability of tablets, expanding applications across education and healthcare sectors, and government initiatives promoting digital literacy and technology adoption. Economic growth in emerging markets also significantly fuels this expansion.

Challenges in the Tablet Application Processor Industry Sector

The industry faces challenges including intense competition, increasing component costs, maintaining supply chain stability, and stringent regulatory requirements impacting design and manufacturing processes. These factors can affect profitability and limit market expansion potential. For instance, xx% increase in component costs in 2024 resulted in an estimated xx Million loss in industry revenue.

Leading Players in the Tablet Application Processor Industry Market

- Spreadtrum Communications Inc

- Samsung Electronics

- NXP Semiconductors NV

- Qualcomm Technologies Inc

- Ingenic Semiconductor Co Ltd

- Texas Instruments Incorporated

- MediaTek Inc

- Nvidia Corporation

- Apple Inc

- HiSilicon Technologies Co Ltd

Key Developments in Tablet Application Processor Industry Sector

- Jan 2023: Qualcomm announces the Snapdragon 8 Gen 3, a significant improvement in performance and power efficiency.

- Oct 2022: MediaTek launches the Dimensity 9200, focusing on enhanced gaming capabilities.

- Mar 2021: Apple introduces the M1 chip, impacting the high-end tablet market.

Strategic Tablet Application Processor Industry Market Outlook

The future of the tablet application processor market is promising, with sustained growth anticipated over the forecast period. Strategic opportunities lie in developing innovative, energy-efficient processors leveraging AI capabilities. Focusing on emerging market penetration, strategic partnerships, and technological advancements will be crucial for long-term success in this competitive industry. The increasing adoption of tablets in various sectors and ongoing technological progress will continue to fuel industry expansion.

Tablet Application Processor Industry Segmentation

-

1. Type

- 1.1. 32 Bit

- 1.2. 64 Bit

- 1.3. Other Types

-

2. Core Type

- 2.1. Single Core

- 2.2. Multi-core

-

3. Operating System

- 3.1. Android

- 3.2. Apple iOS

- 3.3. Windows

-

4. End User

- 4.1. Household

- 4.2. Commercial

- 4.3. Other End Users

Tablet Application Processor Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. Latin America

- 4.2. Middle East and Africa

Tablet Application Processor Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. High Adoption of Octa-Core Application Processors; Increasing Adoption of Navigation Application in Automotive

- 3.3. Market Restrains

- 3.3.1. Concerns Regarding the Impact of COVID-19 On Supply Chain

- 3.4. Market Trends

- 3.4.1. Apple iOS to Witness Significant Growth Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Tablet Application Processor Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. 32 Bit

- 5.1.2. 64 Bit

- 5.1.3. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Core Type

- 5.2.1. Single Core

- 5.2.2. Multi-core

- 5.3. Market Analysis, Insights and Forecast - by Operating System

- 5.3.1. Android

- 5.3.2. Apple iOS

- 5.3.3. Windows

- 5.4. Market Analysis, Insights and Forecast - by End User

- 5.4.1. Household

- 5.4.2. Commercial

- 5.4.3. Other End Users

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Tablet Application Processor Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. 32 Bit

- 6.1.2. 64 Bit

- 6.1.3. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Core Type

- 6.2.1. Single Core

- 6.2.2. Multi-core

- 6.3. Market Analysis, Insights and Forecast - by Operating System

- 6.3.1. Android

- 6.3.2. Apple iOS

- 6.3.3. Windows

- 6.4. Market Analysis, Insights and Forecast - by End User

- 6.4.1. Household

- 6.4.2. Commercial

- 6.4.3. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Tablet Application Processor Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. 32 Bit

- 7.1.2. 64 Bit

- 7.1.3. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Core Type

- 7.2.1. Single Core

- 7.2.2. Multi-core

- 7.3. Market Analysis, Insights and Forecast - by Operating System

- 7.3.1. Android

- 7.3.2. Apple iOS

- 7.3.3. Windows

- 7.4. Market Analysis, Insights and Forecast - by End User

- 7.4.1. Household

- 7.4.2. Commercial

- 7.4.3. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Tablet Application Processor Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. 32 Bit

- 8.1.2. 64 Bit

- 8.1.3. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Core Type

- 8.2.1. Single Core

- 8.2.2. Multi-core

- 8.3. Market Analysis, Insights and Forecast - by Operating System

- 8.3.1. Android

- 8.3.2. Apple iOS

- 8.3.3. Windows

- 8.4. Market Analysis, Insights and Forecast - by End User

- 8.4.1. Household

- 8.4.2. Commercial

- 8.4.3. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Tablet Application Processor Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. 32 Bit

- 9.1.2. 64 Bit

- 9.1.3. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Core Type

- 9.2.1. Single Core

- 9.2.2. Multi-core

- 9.3. Market Analysis, Insights and Forecast - by Operating System

- 9.3.1. Android

- 9.3.2. Apple iOS

- 9.3.3. Windows

- 9.4. Market Analysis, Insights and Forecast - by End User

- 9.4.1. Household

- 9.4.2. Commercial

- 9.4.3. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. North America Tablet Application Processor Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 United States

- 10.1.2 Canada

- 11. Europe Tablet Application Processor Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 Germany

- 11.1.2 United Kingdom

- 11.1.3 France

- 11.1.4 Italy

- 11.1.5 Rest of Europe

- 12. Asia Pacific Tablet Application Processor Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 India

- 12.1.2 China

- 12.1.3 Japan

- 12.1.4 South Korea

- 12.1.5 Rest of Asia Pacific

- 13. Rest of the World Tablet Application Processor Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 Latin America

- 13.1.2 Middle East and Africa

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Spreadtrum Communications Inc

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Samsung Electronics

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 NXP Semiconductors NV

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Qualcomm Technologies Inc

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Ingenic Semiconductor Co Ltd*List Not Exhaustive

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Texas Instruments Incorporated

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 MediaTek Inc

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Nvidia Corporation

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Apple Inc

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 HiSilicon Technologies Co Ltd

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 Spreadtrum Communications Inc

List of Figures

- Figure 1: Global Tablet Application Processor Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Tablet Application Processor Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Tablet Application Processor Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Tablet Application Processor Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Tablet Application Processor Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Tablet Application Processor Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Tablet Application Processor Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Tablet Application Processor Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Tablet Application Processor Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Tablet Application Processor Industry Revenue (Million), by Type 2024 & 2032

- Figure 11: North America Tablet Application Processor Industry Revenue Share (%), by Type 2024 & 2032

- Figure 12: North America Tablet Application Processor Industry Revenue (Million), by Core Type 2024 & 2032

- Figure 13: North America Tablet Application Processor Industry Revenue Share (%), by Core Type 2024 & 2032

- Figure 14: North America Tablet Application Processor Industry Revenue (Million), by Operating System 2024 & 2032

- Figure 15: North America Tablet Application Processor Industry Revenue Share (%), by Operating System 2024 & 2032

- Figure 16: North America Tablet Application Processor Industry Revenue (Million), by End User 2024 & 2032

- Figure 17: North America Tablet Application Processor Industry Revenue Share (%), by End User 2024 & 2032

- Figure 18: North America Tablet Application Processor Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Tablet Application Processor Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Tablet Application Processor Industry Revenue (Million), by Type 2024 & 2032

- Figure 21: Europe Tablet Application Processor Industry Revenue Share (%), by Type 2024 & 2032

- Figure 22: Europe Tablet Application Processor Industry Revenue (Million), by Core Type 2024 & 2032

- Figure 23: Europe Tablet Application Processor Industry Revenue Share (%), by Core Type 2024 & 2032

- Figure 24: Europe Tablet Application Processor Industry Revenue (Million), by Operating System 2024 & 2032

- Figure 25: Europe Tablet Application Processor Industry Revenue Share (%), by Operating System 2024 & 2032

- Figure 26: Europe Tablet Application Processor Industry Revenue (Million), by End User 2024 & 2032

- Figure 27: Europe Tablet Application Processor Industry Revenue Share (%), by End User 2024 & 2032

- Figure 28: Europe Tablet Application Processor Industry Revenue (Million), by Country 2024 & 2032

- Figure 29: Europe Tablet Application Processor Industry Revenue Share (%), by Country 2024 & 2032

- Figure 30: Asia Pacific Tablet Application Processor Industry Revenue (Million), by Type 2024 & 2032

- Figure 31: Asia Pacific Tablet Application Processor Industry Revenue Share (%), by Type 2024 & 2032

- Figure 32: Asia Pacific Tablet Application Processor Industry Revenue (Million), by Core Type 2024 & 2032

- Figure 33: Asia Pacific Tablet Application Processor Industry Revenue Share (%), by Core Type 2024 & 2032

- Figure 34: Asia Pacific Tablet Application Processor Industry Revenue (Million), by Operating System 2024 & 2032

- Figure 35: Asia Pacific Tablet Application Processor Industry Revenue Share (%), by Operating System 2024 & 2032

- Figure 36: Asia Pacific Tablet Application Processor Industry Revenue (Million), by End User 2024 & 2032

- Figure 37: Asia Pacific Tablet Application Processor Industry Revenue Share (%), by End User 2024 & 2032

- Figure 38: Asia Pacific Tablet Application Processor Industry Revenue (Million), by Country 2024 & 2032

- Figure 39: Asia Pacific Tablet Application Processor Industry Revenue Share (%), by Country 2024 & 2032

- Figure 40: Rest of the World Tablet Application Processor Industry Revenue (Million), by Type 2024 & 2032

- Figure 41: Rest of the World Tablet Application Processor Industry Revenue Share (%), by Type 2024 & 2032

- Figure 42: Rest of the World Tablet Application Processor Industry Revenue (Million), by Core Type 2024 & 2032

- Figure 43: Rest of the World Tablet Application Processor Industry Revenue Share (%), by Core Type 2024 & 2032

- Figure 44: Rest of the World Tablet Application Processor Industry Revenue (Million), by Operating System 2024 & 2032

- Figure 45: Rest of the World Tablet Application Processor Industry Revenue Share (%), by Operating System 2024 & 2032

- Figure 46: Rest of the World Tablet Application Processor Industry Revenue (Million), by End User 2024 & 2032

- Figure 47: Rest of the World Tablet Application Processor Industry Revenue Share (%), by End User 2024 & 2032

- Figure 48: Rest of the World Tablet Application Processor Industry Revenue (Million), by Country 2024 & 2032

- Figure 49: Rest of the World Tablet Application Processor Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Tablet Application Processor Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Tablet Application Processor Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Tablet Application Processor Industry Revenue Million Forecast, by Core Type 2019 & 2032

- Table 4: Global Tablet Application Processor Industry Revenue Million Forecast, by Operating System 2019 & 2032

- Table 5: Global Tablet Application Processor Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 6: Global Tablet Application Processor Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Global Tablet Application Processor Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United States Tablet Application Processor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Canada Tablet Application Processor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Tablet Application Processor Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Germany Tablet Application Processor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom Tablet Application Processor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: France Tablet Application Processor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Italy Tablet Application Processor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of Europe Tablet Application Processor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Tablet Application Processor Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 17: India Tablet Application Processor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: China Tablet Application Processor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Japan Tablet Application Processor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: South Korea Tablet Application Processor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Rest of Asia Pacific Tablet Application Processor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Global Tablet Application Processor Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 23: Latin America Tablet Application Processor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Middle East and Africa Tablet Application Processor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Global Tablet Application Processor Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 26: Global Tablet Application Processor Industry Revenue Million Forecast, by Core Type 2019 & 2032

- Table 27: Global Tablet Application Processor Industry Revenue Million Forecast, by Operating System 2019 & 2032

- Table 28: Global Tablet Application Processor Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 29: Global Tablet Application Processor Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 30: United States Tablet Application Processor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Canada Tablet Application Processor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Global Tablet Application Processor Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 33: Global Tablet Application Processor Industry Revenue Million Forecast, by Core Type 2019 & 2032

- Table 34: Global Tablet Application Processor Industry Revenue Million Forecast, by Operating System 2019 & 2032

- Table 35: Global Tablet Application Processor Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 36: Global Tablet Application Processor Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 37: Germany Tablet Application Processor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: United Kingdom Tablet Application Processor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: France Tablet Application Processor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Italy Tablet Application Processor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Rest of Europe Tablet Application Processor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Global Tablet Application Processor Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 43: Global Tablet Application Processor Industry Revenue Million Forecast, by Core Type 2019 & 2032

- Table 44: Global Tablet Application Processor Industry Revenue Million Forecast, by Operating System 2019 & 2032

- Table 45: Global Tablet Application Processor Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 46: Global Tablet Application Processor Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 47: India Tablet Application Processor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: China Tablet Application Processor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Japan Tablet Application Processor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: South Korea Tablet Application Processor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Rest of Asia Pacific Tablet Application Processor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Global Tablet Application Processor Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 53: Global Tablet Application Processor Industry Revenue Million Forecast, by Core Type 2019 & 2032

- Table 54: Global Tablet Application Processor Industry Revenue Million Forecast, by Operating System 2019 & 2032

- Table 55: Global Tablet Application Processor Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 56: Global Tablet Application Processor Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 57: Latin America Tablet Application Processor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Middle East and Africa Tablet Application Processor Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Tablet Application Processor Industry?

The projected CAGR is approximately 5.00%.

2. Which companies are prominent players in the Tablet Application Processor Industry?

Key companies in the market include Spreadtrum Communications Inc, Samsung Electronics, NXP Semiconductors NV, Qualcomm Technologies Inc, Ingenic Semiconductor Co Ltd*List Not Exhaustive, Texas Instruments Incorporated, MediaTek Inc, Nvidia Corporation, Apple Inc, HiSilicon Technologies Co Ltd.

3. What are the main segments of the Tablet Application Processor Industry?

The market segments include Type, Core Type, Operating System, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

High Adoption of Octa-Core Application Processors; Increasing Adoption of Navigation Application in Automotive.

6. What are the notable trends driving market growth?

Apple iOS to Witness Significant Growth Rate.

7. Are there any restraints impacting market growth?

Concerns Regarding the Impact of COVID-19 On Supply Chain.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Tablet Application Processor Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Tablet Application Processor Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Tablet Application Processor Industry?

To stay informed about further developments, trends, and reports in the Tablet Application Processor Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence