Key Insights

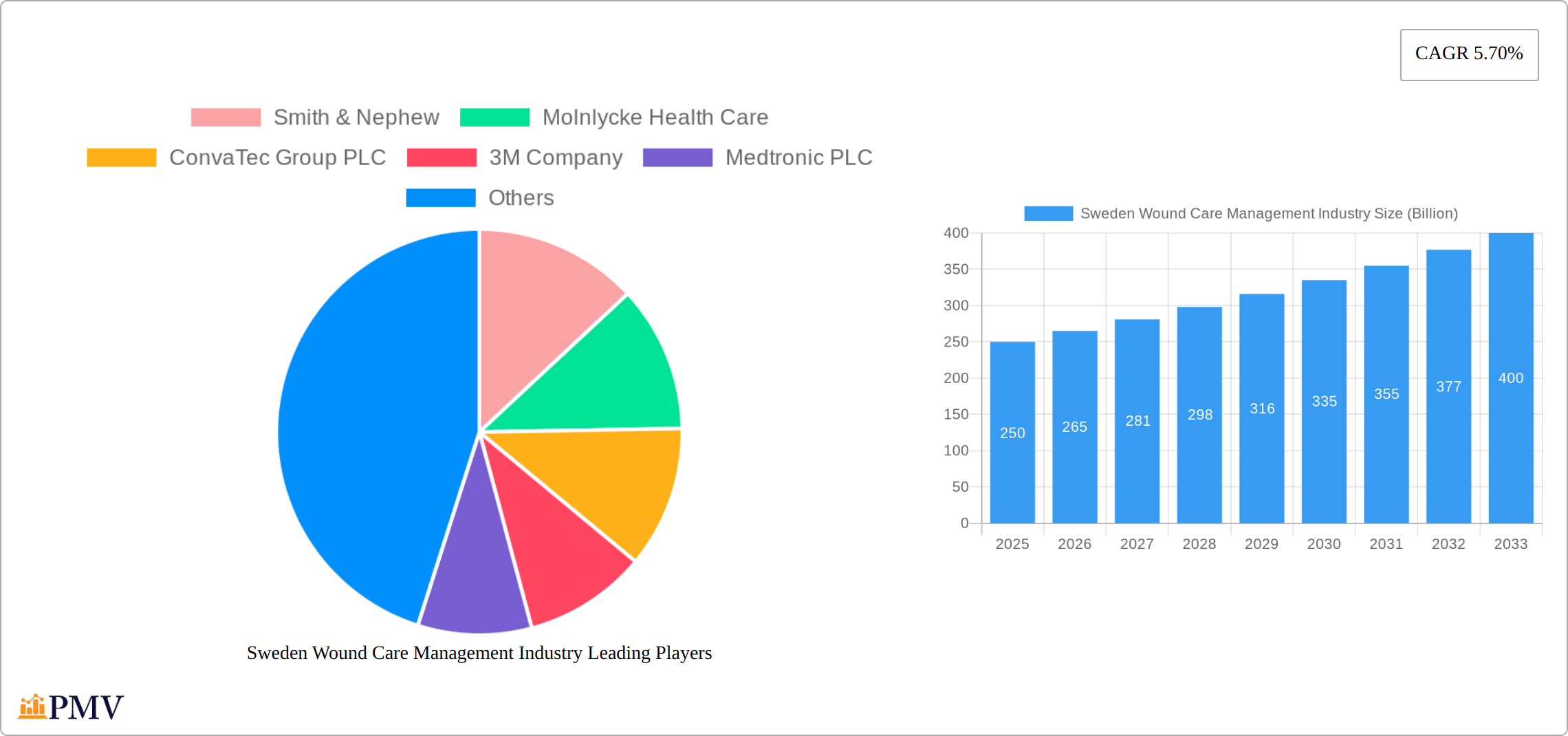

The Sweden wound care management market, valued at approximately $XX billion in 2025, is projected to experience robust growth with a Compound Annual Growth Rate (CAGR) of 5.70% from 2025 to 2033. This growth is fueled by several key factors. The increasing prevalence of chronic wounds, particularly diabetic foot ulcers and pressure ulcers, among an aging population is a significant driver. Furthermore, advancements in wound care technologies, such as negative pressure wound therapy and advanced wound dressings (including foam, hydrocolloid, and hydrogel dressings), are improving treatment outcomes and reducing healthcare costs. The rising incidence of surgical procedures also contributes to market expansion, increasing demand for surgical wound care products like sutures, staples, and tissue adhesives. The preference for minimally invasive procedures and improved patient outcomes drives adoption of advanced technologies in hospitals and specialty clinics, thereby boosting market growth. However, the market faces challenges such as stringent regulatory approvals for new products and the high cost of advanced wound care therapies, potentially limiting access for some patients. The market is segmented by product type (advanced dressings, surgical wound care, traditional wound care, and wound therapy devices), wound type (chronic and acute wounds), and end-user (hospitals, clinics, home healthcare, etc.). Competition is intense, with major players like Smith & Nephew, Mölnlycke Health Care, and ConvaTec Group PLC vying for market share through product innovation and strategic partnerships.

The Swedish wound care market's segmentation offers further insight into its dynamics. The advanced wound dressings segment is expected to hold a significant share, driven by their efficacy in managing chronic wounds. The surgical wound care segment benefits from increasing surgical procedures, while traditional wound care products maintain their importance in basic wound management. The strong presence of healthcare providers and a well-established healthcare infrastructure in Sweden support the market's growth. The home healthcare segment is also expected to experience notable growth as an increasing number of patients opt for at-home treatment, further driving market expansion. Future market growth hinges on sustained technological advancements, increasing healthcare expenditure, and the government's focus on improving patient outcomes.

Sweden Wound Care Management Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Sweden wound care management industry, offering valuable insights into market dynamics, competitive landscapes, and future growth prospects. With a focus on market size, segmentation, and key players, this report is an essential resource for businesses, investors, and stakeholders operating within or seeking to enter this dynamic sector. The report covers the period 2019-2033, with 2025 as the base year and a forecast period of 2025-2033. The total market value is predicted to reach xx Billion by 2033.

Sweden Wound Care Management Industry Market Structure & Competitive Dynamics

The Swedish wound care management market exhibits a moderately concentrated structure, with several multinational corporations holding significant market share. Key players like Smith & Nephew, Mölnlycke Health Care, and ConvaTec Group PLC dominate the market, leveraging their established brand recognition, extensive product portfolios, and robust distribution networks. The market is characterized by intense competition driven by innovation in advanced wound dressings, surgical wound care products, and wound therapy devices. Regulatory frameworks, particularly those related to medical device approvals and reimbursement policies, significantly influence market dynamics. The industry benefits from a supportive innovation ecosystem, with collaborations between research institutions, healthcare providers, and medical device companies fostering the development of new technologies and treatment approaches. The prevalence of chronic wounds, coupled with an aging population, fuels demand for advanced wound care solutions. Mergers and acquisitions (M&A) activity has been relatively modest in recent years, with deal values averaging around xx Billion annually. However, strategic partnerships and collaborations are increasingly common, reflecting the desire for companies to expand their product portfolios and market reach.

- Market Concentration: Moderately concentrated, with a few key players dominating.

- Innovation Ecosystem: Strong collaboration between research institutions, healthcare providers, and companies.

- Regulatory Framework: Significant influence on market dynamics; details on specific regulations are included in the full report.

- Product Substitutes: Presence of substitute products influences pricing and market share. (Specific examples and impact are detailed in the full report)

- M&A Activity: Moderate activity with average deal values of approximately xx Billion annually. (Specific details of significant M&A activities are included in the full report)

- End-User Trends: Increasing demand for advanced wound care solutions driven by aging population and prevalence of chronic wounds.

Sweden Wound Care Management Industry Industry Trends & Insights

The Swedish wound care management market is experiencing robust growth, fueled by a confluence of factors. The aging population, a significant demographic shift, contributes to a rising prevalence of chronic wounds like diabetic foot ulcers and pressure ulcers, creating substantial demand. This is further amplified by advancements in wound care technologies. Innovative solutions such as advanced wound dressings with enhanced biocompatibility and antimicrobial properties, sophisticated negative pressure wound therapy (NPWT) systems incorporating smart sensors for remote monitoring, and other cutting-edge therapies are transforming treatment efficacy and patient outcomes. A parallel trend is the increasing preference for minimally invasive procedures that reduce healthcare costs and improve patient experiences. The market's Compound Annual Growth Rate (CAGR) is projected at xx% during the forecast period (2025-2033), reflecting this sustained expansion. This growth is bolstered by heightened awareness of effective wound care among healthcare professionals and the public, coupled with proactive government initiatives focused on improving healthcare accessibility and quality. The market penetration of advanced wound care solutions is steadily increasing, driven by their demonstrated efficacy and improved cost-effectiveness compared to traditional methods. The competitive landscape remains dynamic, with companies continuously investing in research and development to introduce innovative products and services.

Dominant Markets & Segments in Sweden Wound Care Management Industry

The Swedish wound care management market shows diverse dominance across segments. Within product types, advanced wound dressings, particularly foam dressings and hydrocolloids, dominate due to their versatility and efficacy in treating a range of wound types. Surgical wound care, including sutures and staples, also represents a significant market segment, reflecting the substantial volume of surgical procedures performed annually. In terms of wound types, chronic wounds (diabetic foot ulcers, pressure ulcers, and venous leg ulcers) represent a larger market share than acute wounds, mainly due to their prevalence and prolonged treatment periods. Hospitals and specialty clinics constitute the largest end-use segment, but the home healthcare sector is witnessing significant growth due to the increasing preference for at-home treatment options.

- Key Drivers:

- Increasing prevalence of chronic wounds.

- Aging population.

- Technological advancements in wound care products.

- Rising awareness of wound care management.

- Government initiatives to improve healthcare access and quality.

- Dominance Analysis: The detailed dominance analysis of each segment (product type, wound type, end-use) including market size and share, is provided in the full report.

Sweden Wound Care Management Industry Product Innovations

The Swedish wound care market is a hotbed of innovation. Significant advancements are being made in advanced wound dressings, featuring improved biocompatibility, antimicrobial properties, and superior moisture retention. The development of next-generation wound therapy devices, such as NPWT systems integrated with smart sensors for real-time data monitoring and remote patient management, are improving treatment effectiveness and reducing hospital readmissions. These innovative solutions contribute to improved patient outcomes, reduced healthcare costs, and enhanced patient convenience, fostering a competitive environment where companies that successfully introduce these technologies gain a significant market advantage. The focus is shifting towards personalized medicine, with dressings and therapies tailored to individual patient needs and wound characteristics.

Report Segmentation & Scope

This report provides a comprehensive segmentation of the Swedish wound care market, analyzing key parameters to provide a granular understanding of market dynamics. The market is segmented by Product Type: Advanced Wound Dressings (Foam, Hydrocolloid, Film, Alginate, Hydrogel, Collagen, Others); Surgical Wound Care (Sutures, Staples, Tissue Adhesives, Anti-infective Dressings); Traditional Wound Care (Tapes, Bandages, Gauzes, Sponges, Cleansing Agents); and Wound Therapy Devices (Negative Pressure Wound Therapy, Oxygen/Hyperbaric Equipment, Electric Stimulation, Pressure Relief Devices, Others). Further segmentation is provided by Wound Type: Chronic Wounds (Diabetic foot ulcers, Pressure ulcers, Venous leg ulcers, Other chronic wounds); and Acute Wounds (Surgical & traumatic wounds, Burns). Finally, the market is analyzed by End-use: Hospitals, Specialty Clinics, Home Healthcare, Physician’s Offices, Nursing Homes, and Others. The report details growth projections, market size, and a competitive landscape analysis for each segment.

Key Drivers of Sweden Wound Care Management Industry Growth

The growth trajectory of Sweden's wound care market is driven by a combination of compelling factors. The rapidly aging population is a key driver, leading to a higher incidence of chronic wounds requiring specialized care. This is further accelerated by significant technological advancements in wound care products and therapies, including bioengineered dressings and sophisticated wound therapy devices that demonstrably improve treatment outcomes and reduce healing times. Increased healthcare expenditure and rising awareness among both healthcare professionals and patients regarding the importance of effective wound management serve as additional growth catalysts. Government initiatives promoting preventative care and improved access to quality healthcare also play a vital role in this market expansion.

Challenges in the Sweden Wound Care Management Industry Sector

Despite its promising growth, the Swedish wound care market faces several challenges. Stringent regulatory requirements for medical device approvals can lengthen the product launch timelines and increase costs, potentially delaying access to innovative technologies. The high cost of advanced wound care products and therapies presents an accessibility barrier for some patients, highlighting the need for cost-effective solutions and improved reimbursement policies. Intense competition from both established players and emerging companies creates pressure on margins and necessitates continuous innovation to maintain a competitive edge. Furthermore, supply chain disruptions, particularly regarding raw materials used in wound care product manufacturing, can negatively impact market stability and product availability. A detailed quantitative analysis of these challenges and their impact is provided in the full report.

Leading Players in the Sweden Wound Care Management Industry Market

- Smith & Nephew (Smith & Nephew)

- Molnlycke Health Care (Molnlycke Health Care)

- ConvaTec Group PLC (ConvaTec Group PLC)

- 3M Company (3M Company)

- Medtronic PLC (Medtronic PLC)

- Johnson & Johnson (Johnson & Johnson)

- Integra LifeSciences (Integra LifeSciences)

- B Braun SE (B Braun SE)

- Essity Aktiebolag (Essity Aktiebolag)

- Coloplast (Coloplast)

Key Developments in Sweden Wound Care Management Industry Sector

- September 2022: Ilya Pharma AB partnered with the US defense to accelerate wound healing product development.

- January 2022: Mölnlycke planned a major shift towards next-generation wound care technology, focusing on customer-centric products and collaborations with other industries.

Strategic Sweden Wound Care Management Industry Market Outlook

The Swedish wound care market presents substantial growth potential. Continued innovation in wound care products and technologies, coupled with the increasing prevalence of chronic wounds and an aging population, will drive market expansion. Strategic partnerships and collaborations among companies, research institutions, and healthcare providers will further accelerate growth. Companies focusing on personalized medicine and remote patient monitoring solutions are well-positioned to capture significant market share. The market's future success hinges on addressing challenges related to regulatory hurdles, cost-effectiveness, and ensuring equitable access to advanced wound care solutions.

Sweden Wound Care Management Industry Segmentation

-

1. Product

-

1.1. Wound Care

- 1.1.1. Dressings

- 1.1.2. Wound Care Devices

- 1.1.3. Topical Agents

- 1.1.4. Others

-

1.2. Wound Closure

- 1.2.1. Sutures

- 1.2.2. Surgical Staplers

- 1.2.3. Tissue Adhesives, Strips, Sealants, and Glue

-

1.1. Wound Care

-

2. Wound Type

- 2.1. Chronic Wound

- 2.2. Acute Wound

Sweden Wound Care Management Industry Segmentation By Geography

- 1. Sweden

Sweden Wound Care Management Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Burden of Chronic Wounds and Surgical Procedures; Increasing Aging Population

- 3.3. Market Restrains

- 3.3.1. Stringent Regulatory Framework

- 3.4. Market Trends

- 3.4.1. Surgical Staples in Wound Closure Segment May Show Significant Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Sweden Wound Care Management Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Wound Care

- 5.1.1.1. Dressings

- 5.1.1.2. Wound Care Devices

- 5.1.1.3. Topical Agents

- 5.1.1.4. Others

- 5.1.2. Wound Closure

- 5.1.2.1. Sutures

- 5.1.2.2. Surgical Staplers

- 5.1.2.3. Tissue Adhesives, Strips, Sealants, and Glue

- 5.1.1. Wound Care

- 5.2. Market Analysis, Insights and Forecast - by Wound Type

- 5.2.1. Chronic Wound

- 5.2.2. Acute Wound

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Sweden

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Smith & Nephew

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Molnlycke Health Care

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ConvaTec Group PLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 3M Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Medtronic PLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Johnson & Johnson

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Integra LifeSciences

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 B Braun SE

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Essity Aktiebolag

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Coloplast

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Smith & Nephew

List of Figures

- Figure 1: Sweden Wound Care Management Industry Revenue Breakdown (Billion, %) by Product 2024 & 2032

- Figure 2: Sweden Wound Care Management Industry Share (%) by Company 2024

List of Tables

- Table 1: Sweden Wound Care Management Industry Revenue Billion Forecast, by Region 2019 & 2032

- Table 2: Sweden Wound Care Management Industry Revenue Billion Forecast, by Product 2019 & 2032

- Table 3: Sweden Wound Care Management Industry Revenue Billion Forecast, by Wound Type 2019 & 2032

- Table 4: Sweden Wound Care Management Industry Revenue Billion Forecast, by Region 2019 & 2032

- Table 5: Sweden Wound Care Management Industry Revenue Billion Forecast, by Country 2019 & 2032

- Table 6: Sweden Wound Care Management Industry Revenue Billion Forecast, by Product 2019 & 2032

- Table 7: Sweden Wound Care Management Industry Revenue Billion Forecast, by Wound Type 2019 & 2032

- Table 8: Sweden Wound Care Management Industry Revenue Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sweden Wound Care Management Industry?

The projected CAGR is approximately 5.70%.

2. Which companies are prominent players in the Sweden Wound Care Management Industry?

Key companies in the market include Smith & Nephew, Molnlycke Health Care, ConvaTec Group PLC, 3M Company, Medtronic PLC, Johnson & Johnson, Integra LifeSciences, B Braun SE, Essity Aktiebolag, Coloplast.

3. What are the main segments of the Sweden Wound Care Management Industry?

The market segments include Product, Wound Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Burden of Chronic Wounds and Surgical Procedures; Increasing Aging Population.

6. What are the notable trends driving market growth?

Surgical Staples in Wound Closure Segment May Show Significant Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

Stringent Regulatory Framework.

8. Can you provide examples of recent developments in the market?

In September 2022, Ilya Pharma AB, Sweden-based a clinical stage immunotherapy company, entered a partnership with the US defence to accelerate the development of wound healing products.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sweden Wound Care Management Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sweden Wound Care Management Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sweden Wound Care Management Industry?

To stay informed about further developments, trends, and reports in the Sweden Wound Care Management Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence