Key Insights

The Sweden cold chain logistics market is poised for significant expansion, propelled by escalating demand for temperature-sensitive goods, including fresh produce, pharmaceuticals, and high-quality food products. The burgeoning e-commerce sector and the widespread adoption of online grocery delivery services are key growth catalysts. The market is projected to reach a size of $1.93 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 5.16%. Key market segments include services (storage, transport, and value-added services like blast freezing and inventory management), temperature types (chilled, frozen, ambient), and applications (horticulture, dairy, fish, meat, processed food, pharmaceuticals, and others). The value-added services segment is demonstrating particularly robust growth, driven by the increasing need for enhanced supply chain visibility and operational efficiency.

Sweden Cold Chain Logistics Market Market Size (In Billion)

The competitive environment features established global logistics providers such as DHL and DB Schenker, alongside prominent regional players like Nordic Cold Chain Solutions and Kyl & Frysexpressen AB. Industry participants are actively investing in advanced technologies, including sophisticated temperature-monitoring systems and optimized transportation networks, to elevate service quality and ensure compliance with stringent regulations. Challenges to market growth encompass substantial infrastructure investment, the inherent risks of supply chain disruptions, and the requirement for specialized labor. To sustain profitability and market leadership, cold chain providers in Sweden must prioritize operational optimization, technological advancement, and strategic industry partnerships. Future expansion will be contingent on the development of innovative solutions and adaptability to evolving consumer demands, including a growing preference for sustainable logistics practices. The long-term market outlook remains highly optimistic, supported by sustained e-commerce growth and consistent demand for temperature-controlled products.

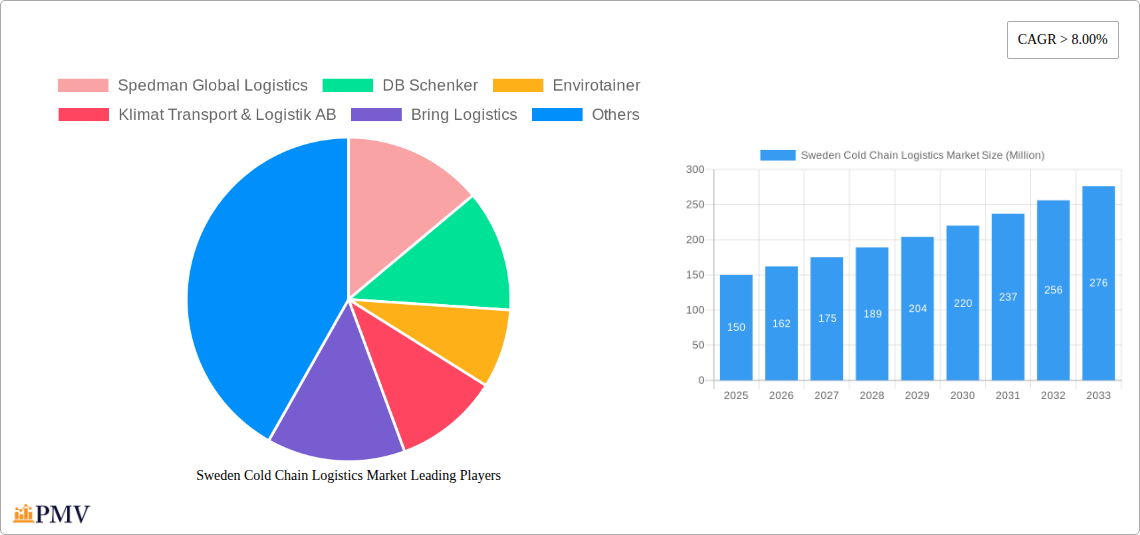

Sweden Cold Chain Logistics Market Company Market Share

Sweden Cold Chain Logistics Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Sweden cold chain logistics market, offering invaluable insights for businesses operating within or considering entry into this dynamic sector. Covering the period from 2019 to 2033, with a focus on 2025, this report delves into market structure, competitive dynamics, industry trends, and future growth potential. The report utilizes a robust data-driven approach, incorporating market size estimations in Millions, CAGR projections, and key performance indicators to provide a clear and actionable understanding of the market landscape.

Sweden Cold Chain Logistics Market Market Structure & Competitive Dynamics

The Sweden cold chain logistics market exhibits a moderately concentrated structure, with several key players vying for market share. The market is characterized by a mix of large multinational corporations and smaller, specialized providers. Innovation is driven by technological advancements in temperature-controlled transportation and storage, along with a growing emphasis on sustainable practices. The regulatory framework is largely compliant with EU standards, focusing on food safety and environmental protection. Product substitutes, primarily traditional transportation methods lacking temperature control, are losing market share due to increasing demand for quality and freshness preservation. End-user trends indicate a shift towards increased demand for value-added services and sophisticated supply chain solutions. M&A activity in the sector has been moderate, with deals primarily focusing on expanding geographic reach or service capabilities. The estimated total market value in 2025 is xx Million. Key players hold the following estimated market shares (2025):

- DHL Logistics: 15%

- DB Schenker: 12%

- Bring Logistics: 10%

- Spedman Global Logistics: 8%

- Others: 55%

Significant M&A activity in the recent past includes (values are estimated):

- Deal A (2023): xx Million

- Deal B (2022): xx Million

Sweden Cold Chain Logistics Market Industry Trends & Insights

The Sweden cold chain logistics market is experiencing robust growth, driven by factors such as increasing consumer demand for fresh and processed food, growth in the e-commerce sector (particularly for perishable goods), and stringent regulations regarding food safety and quality. Technological disruptions, including the adoption of IoT sensors for real-time temperature monitoring, automated warehousing solutions, and advanced route optimization software, are transforming operational efficiency and reducing costs. Consumer preferences are increasingly focused on sustainability and traceability, putting pressure on companies to adopt eco-friendly practices and transparent supply chains. The competitive landscape is characterized by intense rivalry, prompting companies to invest in innovation and value-added services to differentiate themselves. The market is projected to grow at a CAGR of xx% during the forecast period (2025-2033), with significant penetration in the food and pharmaceutical sectors.

Dominant Markets & Segments in Sweden Cold Chain Logistics Market

The Swedish cold chain logistics market is dominated by the following segments:

By Service: Transportation currently holds the largest market share, driven by high demand for efficient delivery of perishable goods. Value-added services like blast freezing and inventory management are growing rapidly as companies seek to enhance supply chain efficiency and product quality. Storage solutions are essential and the market is seeing investment in modernized facilities.

By Temperature: The chilled segment constitutes the largest portion of the market, reflecting high demand for fresh produce and dairy products. The frozen segment also shows significant growth potential, particularly with the expansion of the frozen food sector. The ambient segment, while smaller, plays a crucial role in transporting less temperature-sensitive goods within the broader supply chain.

By Application: The food and beverage sector is the dominant application, with horticulture (fresh fruits and vegetables) and dairy products leading the way. The pharmaceutical segment, driven by the need for stringent temperature control for sensitive medications, also represents significant growth. Fish, meat and poultry also contribute substantially.

Key drivers contributing to the dominance of these segments include:

- Strong domestic agricultural production and food processing industries

- Growing demand for imported food products

- Expanding pharmaceutical and healthcare sectors

- Favorable government policies supporting food safety and logistics infrastructure

Sweden Cold Chain Logistics Market Product Innovations

Recent product innovations focus on enhancing temperature control precision, real-time monitoring capabilities, and automation across the cold chain. Companies are investing in IoT-enabled sensors, GPS tracking systems, and data analytics platforms to optimize logistics and minimize waste. The integration of blockchain technology for enhanced traceability is also gaining traction. These innovations align with the market's growing focus on sustainability and end-to-end supply chain visibility.

Report Segmentation & Scope

This report segments the Sweden cold chain logistics market by service (storage, transport, value-added services), temperature (chilled, frozen, ambient), and application (horticulture, dairy, fish, meat, processed food, pharmaceuticals, others). Each segment's market size, growth projections, and competitive dynamics are analyzed in detail. The study period covers 2019-2033, with a base year of 2025 and forecast period of 2025-2033. Historical data from 2019-2024 is also included. The report provides insights into market drivers, challenges, and leading players. Specific growth projections are provided for each segment, reflecting expected market expansion and competitive pressures.

Key Drivers of Sweden Cold Chain Logistics Market Growth

The growth of the Sweden cold chain logistics market is driven by a confluence of factors:

- Rising disposable incomes: Increasing purchasing power boosts demand for fresh and processed foods, driving cold chain needs.

- E-commerce expansion: Online grocery shopping and the delivery of perishable goods are major growth catalysts.

- Stringent food safety regulations: These regulations necessitate the use of cold chain solutions to maintain product quality.

- Technological advancements: IoT sensors, automation, and advanced analytics enhance efficiency and reduce costs.

Challenges in the Sweden Cold Chain Logistics Market Sector

Challenges faced by the Sweden cold chain logistics market include:

- High infrastructure costs: Investment in cold storage facilities and specialized transportation vehicles is substantial.

- Fuel price volatility: Fluctuations impact transport costs, affecting profitability.

- Sustainability concerns: Reducing carbon footprint and improving energy efficiency are key challenges.

- Skilled labor shortages: Finding and retaining qualified personnel is crucial for efficient operations.

Leading Players in the Sweden Cold Chain Logistics Market Market

- Spedman Global Logistics

- DB Schenker

- Envirotainer

- Klimat Transport & Logistik AB

- Bring Logistics

- DHL logistics

- Nordic Cold Chain Solutions

- Agility logistics

- Kyl & Frysexpressen AB

- Toll Group

Key Developments in Sweden Cold Chain Logistics Market Sector

- November 2022: DHL Supply Chain established a 400,000 sqm carbon-neutral real estate portfolio across six European Tier 1 markets, enhancing its capacity and sustainability efforts.

- May 2022: DHL Supply Chain announced the construction of a 44,000 sqm multi-user logistics center in Sipoo, Finland, expanding its cold chain infrastructure in the region.

Strategic Sweden Cold Chain Logistics Market Market Outlook

The Sweden cold chain logistics market presents significant opportunities for growth, driven by sustained demand for fresh food, increasing e-commerce penetration, and ongoing technological advancements. Strategic investments in sustainable infrastructure, innovative technologies, and value-added services will be key differentiators. Companies focusing on efficient operations, superior temperature control, and transparent supply chains will be well-positioned to capitalize on the market's future growth potential. Expansion into specialized niche applications within the food and pharmaceutical sectors promises additional growth avenues.

Sweden Cold Chain Logistics Market Segmentation

-

1. Service

- 1.1. Storage

- 1.2. Transport

- 1.3. Value-Ad

-

2. Temparature

- 2.1. Chilled

- 2.2. Frozen

- 2.3. Ambient

-

3. Application

- 3.1. Horticulture (Fresh Fruits & Vegetables)

- 3.2. Dairy Pr

- 3.3. Fish, Meat and Poultry

- 3.4. Processed Food

- 3.5. Pharmaceutical (Including Biopharma)

- 3.6. Other Applications

Sweden Cold Chain Logistics Market Segmentation By Geography

- 1. Sweden

Sweden Cold Chain Logistics Market Regional Market Share

Geographic Coverage of Sweden Cold Chain Logistics Market

Sweden Cold Chain Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.16% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Pharmaceutical Industry Demands Advanced Cold-Chain Services; E-commerce driving the cold chain logistics

- 3.3. Market Restrains

- 3.3.1. Damaged Goods; Increasing Transportation Cost

- 3.4. Market Trends

- 3.4.1. Pharmaceutical Industry Demands Advanced Cold-Chain Services

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Sweden Cold Chain Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Storage

- 5.1.2. Transport

- 5.1.3. Value-Ad

- 5.2. Market Analysis, Insights and Forecast - by Temparature

- 5.2.1. Chilled

- 5.2.2. Frozen

- 5.2.3. Ambient

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Horticulture (Fresh Fruits & Vegetables)

- 5.3.2. Dairy Pr

- 5.3.3. Fish, Meat and Poultry

- 5.3.4. Processed Food

- 5.3.5. Pharmaceutical (Including Biopharma)

- 5.3.6. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Sweden

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Spedman Global Logistics

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DB Schenker

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Envirotainer

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Klimat Transport & Logistik AB

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bring Logistics

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 DHL logistics

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Nordic Cold Chain Solutions

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Agility logistics

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Kyl & Frysexpressen AB

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Toll Group**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Spedman Global Logistics

List of Figures

- Figure 1: Sweden Cold Chain Logistics Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Sweden Cold Chain Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: Sweden Cold Chain Logistics Market Revenue billion Forecast, by Service 2020 & 2033

- Table 2: Sweden Cold Chain Logistics Market Revenue billion Forecast, by Temparature 2020 & 2033

- Table 3: Sweden Cold Chain Logistics Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Sweden Cold Chain Logistics Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Sweden Cold Chain Logistics Market Revenue billion Forecast, by Service 2020 & 2033

- Table 6: Sweden Cold Chain Logistics Market Revenue billion Forecast, by Temparature 2020 & 2033

- Table 7: Sweden Cold Chain Logistics Market Revenue billion Forecast, by Application 2020 & 2033

- Table 8: Sweden Cold Chain Logistics Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sweden Cold Chain Logistics Market?

The projected CAGR is approximately 5.16%.

2. Which companies are prominent players in the Sweden Cold Chain Logistics Market?

Key companies in the market include Spedman Global Logistics, DB Schenker, Envirotainer, Klimat Transport & Logistik AB, Bring Logistics, DHL logistics, Nordic Cold Chain Solutions, Agility logistics, Kyl & Frysexpressen AB, Toll Group**List Not Exhaustive.

3. What are the main segments of the Sweden Cold Chain Logistics Market?

The market segments include Service, Temparature, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.93 billion as of 2022.

5. What are some drivers contributing to market growth?

Pharmaceutical Industry Demands Advanced Cold-Chain Services; E-commerce driving the cold chain logistics.

6. What are the notable trends driving market growth?

Pharmaceutical Industry Demands Advanced Cold-Chain Services.

7. Are there any restraints impacting market growth?

Damaged Goods; Increasing Transportation Cost.

8. Can you provide examples of recent developments in the market?

November 2022: To serve customers' expansion needs across six European Tier 1 markets, DHL Supply Chain, the top contract logistics provider in the world, has established a 400,000 sqm carbon-neutral real estate portfolio. All of the locations, which are strategically located in logistics hubs, will have strong multi-modal transport connectivity to meet the needs of a variety of clients.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sweden Cold Chain Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sweden Cold Chain Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sweden Cold Chain Logistics Market?

To stay informed about further developments, trends, and reports in the Sweden Cold Chain Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence