Key Insights

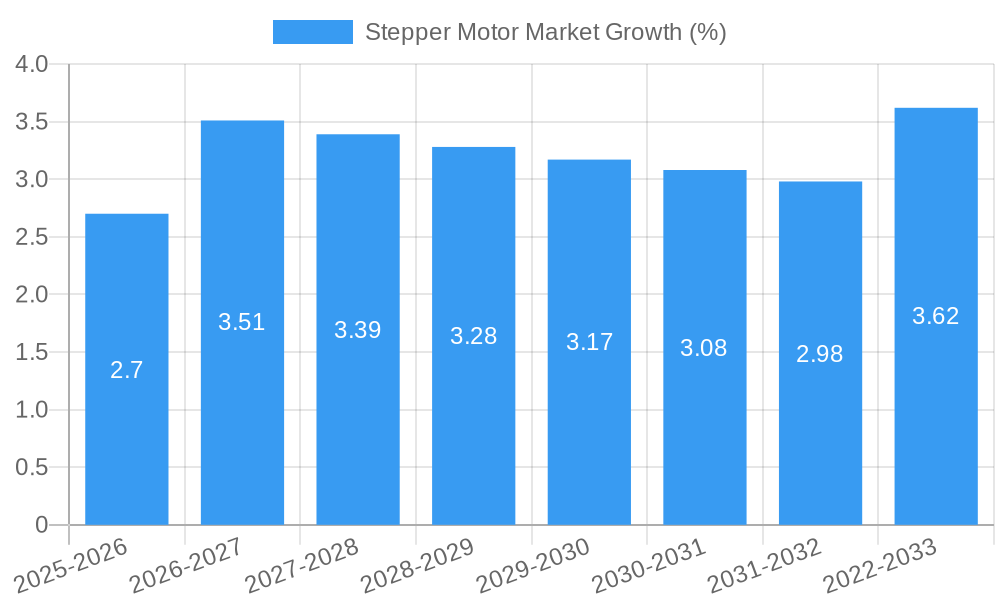

The Stepper Motor Market, valued at $1.11 million in 2025, is projected to grow at a Compound Annual Growth Rate (CAGR) of 3.08% through the forecast period of 2025-2033. This growth is driven by increasing demand across various sectors such as medical equipment, robotics, and industrial applications, where precision and control are paramount. The market is segmented by motor type into Hybrid, Permanent Magnet, and Variable Reluctance, and by application into Medical Equipment, Robotics, Industrial Equipment, Computing, and Other Applications. Key players like ASPINA Group, Minebea Mitsumi Inc, and Schneider Electric SE are leading the innovation and expansion in the market, particularly in regions like Asia, which is anticipated to hold a significant market share due to rapid industrialization and technological advancements.

Trends in the Stepper Motor Market include the increasing integration of stepper motors in smart devices and automation systems, enhancing efficiency and reducing energy consumption. However, challenges such as high initial costs and the need for regular maintenance can restrain market growth. Despite these hurdles, the market is poised for steady expansion, supported by technological advancements and the growing need for automation across industries. The market's growth is also influenced by regional dynamics, with North America and Europe expected to maintain robust growth due to their advanced manufacturing sectors, while Latin America, the Middle East, and Africa are likely to see gradual increases in demand as these regions develop their industrial bases.

Stepper Motor Market Market Structure & Competitive Dynamics

The Stepper Motor Market is characterized by a mix of established players and emerging companies, each vying for market share through innovation and strategic expansion. Market concentration is moderate, with the top five companies controlling approximately 45% of the global market. Key players such as ASPINA Group, Minebea Mitsumi Inc, and Shanghai MOONS Electric Co Ltd are at the forefront, driving innovation through R&D investments and patent filings. The innovation ecosystem is vibrant, with significant developments in motor technology, particularly in hybrid and permanent magnet types, which are gaining traction due to their efficiency and versatility.

Regulatory frameworks across different regions impact market dynamics, with stringent energy efficiency standards in Europe and North America pushing manufacturers to develop more advanced products. The presence of product substitutes, such as servo motors, challenges the market, although stepper motors remain preferred in applications requiring precise positioning and cost-effectiveness. End-user trends show a growing demand from the medical and robotics sectors, driven by the need for precision and reliability.

Mergers and acquisitions (M&A) activities have been notable, with deal values reaching around $1.2 Billion in the last three years. These activities aim to consolidate market positions and expand product portfolios. For instance, the acquisition of smaller specialized firms by larger conglomerates has enabled them to tap into niche markets and enhance their technological capabilities.

- Market Share: Top 5 companies hold 45% of the market.

- M&A Deal Value: Approximately $1.2 Billion over the last three years.

- Innovation Focus: Hybrid and Permanent Magnet stepper motors.

- Regulatory Impact: Energy efficiency standards in Europe and North America.

- End-User Trends: Increased demand from medical and robotics sectors.

Stepper Motor Market Industry Trends & Insights

The Stepper Motor Market is witnessing robust growth, driven by several key factors. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% from 2025 to 2033, reaching a market size of $xx Million by the end of the forecast period. Technological advancements are a primary growth driver, with innovations such as the development of high-resolution stepper motors enhancing performance and reliability. These advancements are particularly significant in applications requiring high precision, such as in medical equipment and robotics.

Consumer preferences are shifting towards more energy-efficient and compact solutions, which has spurred the development of smaller, yet powerful stepper motors. This trend is evident in the growing market penetration of stepper motors in the computing and industrial equipment sectors, where space and energy efficiency are critical.

Competitive dynamics in the market are intense, with companies like Oriental Motor Co Ltd and Shanghai MOONS Electric Co Ltd leading the charge in product innovation and market expansion. The introduction of new products, such as the EH Series 3-Finger Type electric gripper by Oriental Motor USA, underscores the focus on addressing specific application needs with advanced technology.

Technological disruptions, such as the integration of IoT and AI in stepper motor systems, are transforming the market. These technologies enable predictive maintenance and remote monitoring, enhancing the overall efficiency and reliability of stepper motor applications. The market's competitive landscape is also shaped by the entry of new players, particularly from Asia, which are leveraging lower production costs and increasing technological capabilities to gain market share.

- CAGR: 6.5% from 2025 to 2033.

- Market Size by 2033: $xx Million.

- Key Growth Drivers: Technological advancements, consumer preference for energy efficiency.

- Technological Disruptions: IoT and AI integration.

- Market Penetration: Increased use in computing and industrial equipment.

Dominant Markets & Segments in Stepper Motor Market

The Asia-Pacific region is the leading market for stepper motors, driven by robust industrial growth and technological advancements in countries like China and Japan. Within this region, China stands out due to its massive manufacturing sector and significant investments in automation technologies. The market in China is projected to reach $xx Million by 2033, growing at a CAGR of 7.2% during the forecast period.

In terms of segments, the hybrid stepper motor segment is dominant, accounting for over 50% of the market share. This segment's growth is fueled by its versatility and efficiency, making it suitable for a wide range of applications, including industrial equipment and robotics. The demand for hybrid stepper motors is expected to continue rising, driven by their ability to provide high torque at low speeds and precise positioning.

The application segment of robotics is also witnessing significant growth, with a projected market size of $xx Million by 2033. Robotics applications require high precision and reliability, making stepper motors an ideal choice. The growth in this segment is supported by the increasing adoption of automation in manufacturing and the healthcare sector, where robotic systems are used for surgical procedures and patient care.

- Leading Region: Asia-Pacific.

- Leading Country: China.

- Dominant Segment: Hybrid Stepper Motors.

- Key Application Segment: Robotics.

- Economic Policies: Government incentives for automation in China.

- Infrastructure: Expansion of manufacturing facilities in Asia-Pacific.

The dominance of the hybrid stepper motor segment is largely due to its adaptability across various applications. In industrial equipment, hybrid stepper motors are preferred for their ability to provide precise control over motion, which is crucial in manufacturing processes. The robotics segment's growth is driven by the increasing complexity of robotic systems, where stepper motors play a vital role in ensuring accurate and reliable operation. The Asia-Pacific region's market leadership is supported by favorable economic policies and infrastructure development, which facilitate the expansion of manufacturing capabilities and the adoption of advanced technologies.

Stepper Motor Market Product Innovations

Product innovations in the Stepper Motor Market are driven by the need for higher efficiency and precision in various applications. Recent developments include the introduction of the EH Series 3-Finger Type electric gripper by Oriental Motor USA, which utilizes the αSTEP AZ Series Motor to provide versatile gripping capabilities for irregularly shaped objects. This innovation highlights the trend towards more adaptable and user-friendly stepper motor solutions. Additionally, the integration of IoT and AI technologies is enhancing the functionality of stepper motors, enabling features like predictive maintenance and remote monitoring. These advancements are crucial in meeting the evolving demands of industries such as robotics and medical equipment, where precision and reliability are paramount.

Report Segmentation & Scope

The Stepper Motor Market report is segmented by type of motor and application, providing a comprehensive analysis of each segment's growth prospects and competitive dynamics.

By Type of Motor:

- Hybrid: The largest segment, expected to grow at a CAGR of 6.8% and reach a market size of $xx Million by 2033. Hybrid stepper motors are favored for their high torque and precision.

- Permanent Magnet: Projected to grow at a CAGR of 6.2%, reaching $xx Million by 2033. These motors are known for their efficiency and are widely used in applications requiring consistent performance.

- Variable Reluctance: Anticipated to grow at a CAGR of 5.9%, with a market size of $xx Million by 2033. This segment caters to applications needing robust and simple motor solutions.

By Application:

- Medical Equipment: Expected to reach $xx Million by 2033, growing at a CAGR of 7.1%. Stepper motors are crucial for precise control in medical devices.

- Robotics: Projected to grow at a CAGR of 7.5%, reaching $xx Million by 2033. The demand for high precision and reliability drives the use of stepper motors in robotics.

- Industrial Equipment: Anticipated to grow at a CAGR of 6.3%, with a market size of $xx Million by 2033. Stepper motors are integral to automation and manufacturing processes.

- Computing: Expected to reach $xx Million by 2033, growing at a CAGR of 6.0%. Stepper motors are used in printers and other computing devices for precise movement.

- Other Applications: Projected to grow at a CAGR of 5.8%, reaching $xx Million by 2033. This segment includes niche applications where stepper motors provide unique solutions.

Key Drivers of Stepper Motor Market Growth

The growth of the Stepper Motor Market is driven by several key factors. Technological advancements, such as the development of high-resolution stepper motors, are enhancing performance and reliability, meeting the growing demand from sectors like medical equipment and robotics. Economic factors, including the expansion of manufacturing in Asia-Pacific, particularly in China, are boosting the market. Additionally, regulatory policies promoting energy efficiency are encouraging the adoption of advanced stepper motor technologies. For instance, stringent energy efficiency standards in Europe and North America are pushing manufacturers to innovate, ensuring compliance and market competitiveness.

Challenges in the Stepper Motor Market Sector

The Stepper Motor Market faces several challenges that could impede growth. Regulatory hurdles, such as stringent energy efficiency standards, increase the cost of compliance for manufacturers. Supply chain disruptions, particularly in raw material sourcing, can lead to production delays and increased costs, impacting market dynamics. Additionally, intense competitive pressures from alternative technologies like servo motors pose a threat to market share. These challenges are estimated to reduce the market's growth rate by approximately 0.5% annually.

Leading Players in the Stepper Motor Market Market

- ASPINA Group (Shinano Kenshi Co Ltd)

- Minebea Mitsumi Inc

- Shanghai MOONS Electric Co Ltd

- Oriental Motor Co Ltd

- JVL AS

- Schneider Electric SE

- Changzhou Fulling Motor Co Ltd

- Faulhaber

- Nanotec Electronic GMBH & Co KG

- Kollmorgen (Regal Rexnord Corporation)

- Nippon Pulse America Inc

- I CH Motion

Key Developments in Stepper Motor Market Sector

- August 2023: Oriental Motor USA announced the release of the new electric gripper, the EH Series 3-Finger Type. This innovation enhances the market's ability to handle irregularly shaped objects, driving growth in the robotics and industrial equipment sectors.

- July 2023: MOONS' Electric Co. Ltd inaugurated its manufacturing facility in the VSIP Industrial Park in Haiphong, Vietnam. This development signifies MOONS' commitment to expanding its global footprint and is expected to increase production capacity, thereby boosting the market.

Strategic Stepper Motor Market Market Outlook

The future outlook for the Stepper Motor Market is promising, with significant growth accelerators on the horizon. The increasing adoption of automation across various industries, particularly in Asia-Pacific, is expected to drive demand for stepper motors. Technological advancements, such as the integration of IoT and AI, will further enhance the capabilities and applications of stepper motors, opening new market opportunities. Strategic opportunities lie in expanding into emerging markets and developing specialized products for niche applications, such as in the medical and robotics sectors. The market is poised to leverage these trends to achieve sustained growth and innovation in the coming years.

Stepper Motor Market Segmentation

-

1. Type of Mortor

- 1.1. Hybrid

- 1.2. Permanent Magnet

- 1.3. Variable Reluctance

-

2. Application

- 2.1. Medical Equipment

- 2.2. Robotics

- 2.3. Industrial Equipment

- 2.4. Computing

- 2.5. Other Applications

Stepper Motor Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Stepper Motor Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.08% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Adoption of Robotics and Automation Solutions; Increasing Usage of Stepper Motors in the Healthcare Industry

- 3.3. Market Restrains

- 3.3.1. Performance Limitations and Competition from Servo Motors

- 3.4. Market Trends

- 3.4.1. Hybrid Type of Motors to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Stepper Motor Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type of Mortor

- 5.1.1. Hybrid

- 5.1.2. Permanent Magnet

- 5.1.3. Variable Reluctance

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Medical Equipment

- 5.2.2. Robotics

- 5.2.3. Industrial Equipment

- 5.2.4. Computing

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type of Mortor

- 6. North America Stepper Motor Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type of Mortor

- 6.1.1. Hybrid

- 6.1.2. Permanent Magnet

- 6.1.3. Variable Reluctance

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Medical Equipment

- 6.2.2. Robotics

- 6.2.3. Industrial Equipment

- 6.2.4. Computing

- 6.2.5. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Type of Mortor

- 7. Europe Stepper Motor Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type of Mortor

- 7.1.1. Hybrid

- 7.1.2. Permanent Magnet

- 7.1.3. Variable Reluctance

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Medical Equipment

- 7.2.2. Robotics

- 7.2.3. Industrial Equipment

- 7.2.4. Computing

- 7.2.5. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Type of Mortor

- 8. Asia Stepper Motor Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type of Mortor

- 8.1.1. Hybrid

- 8.1.2. Permanent Magnet

- 8.1.3. Variable Reluctance

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Medical Equipment

- 8.2.2. Robotics

- 8.2.3. Industrial Equipment

- 8.2.4. Computing

- 8.2.5. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Type of Mortor

- 9. Australia and New Zealand Stepper Motor Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type of Mortor

- 9.1.1. Hybrid

- 9.1.2. Permanent Magnet

- 9.1.3. Variable Reluctance

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Medical Equipment

- 9.2.2. Robotics

- 9.2.3. Industrial Equipment

- 9.2.4. Computing

- 9.2.5. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Type of Mortor

- 10. Latin America Stepper Motor Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type of Mortor

- 10.1.1. Hybrid

- 10.1.2. Permanent Magnet

- 10.1.3. Variable Reluctance

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Medical Equipment

- 10.2.2. Robotics

- 10.2.3. Industrial Equipment

- 10.2.4. Computing

- 10.2.5. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Type of Mortor

- 11. Middle East and Africa Stepper Motor Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Type of Mortor

- 11.1.1. Hybrid

- 11.1.2. Permanent Magnet

- 11.1.3. Variable Reluctance

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Medical Equipment

- 11.2.2. Robotics

- 11.2.3. Industrial Equipment

- 11.2.4. Computing

- 11.2.5. Other Applications

- 11.1. Market Analysis, Insights and Forecast - by Type of Mortor

- 12. North America Stepper Motor Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Europe Stepper Motor Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Asia Stepper Motor Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Australia and New Zealand Stepper Motor Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Latin America Stepper Motor Market Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1.

- 17. Middle East And Africa Stepper Motor Market Analysis, Insights and Forecast, 2019-2031

- 17.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 17.1.1.

- 18. Competitive Analysis

- 18.1. Global Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 ASPINA Group (Shinano Kenshi Co Ltd)

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 Minebea Mitsumi Inc

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 Shanghai MOONS Electric Co Ltd

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 Oriental Motor Co Ltd

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 JVL AS

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Schneider Electric SE

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 Changzhou Fulling Motor Co Ltd

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 Faulhaber

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 Nanotec Electronic GMBH & Co KG

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 Kollmorgen (Regal Rexnord Corporation)

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.11 Nippon Pulse America Inc *List Not Exhaustive

- 18.2.11.1. Overview

- 18.2.11.2. Products

- 18.2.11.3. SWOT Analysis

- 18.2.11.4. Recent Developments

- 18.2.11.5. Financials (Based on Availability)

- 18.2.12 I CH Motion

- 18.2.12.1. Overview

- 18.2.12.2. Products

- 18.2.12.3. SWOT Analysis

- 18.2.12.4. Recent Developments

- 18.2.12.5. Financials (Based on Availability)

- 18.2.1 ASPINA Group (Shinano Kenshi Co Ltd)

List of Figures

- Figure 1: Global Stepper Motor Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Stepper Motor Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Stepper Motor Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Stepper Motor Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Stepper Motor Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Stepper Motor Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Stepper Motor Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Australia and New Zealand Stepper Motor Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Australia and New Zealand Stepper Motor Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Latin America Stepper Motor Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Latin America Stepper Motor Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: Middle East And Africa Stepper Motor Market Revenue (Million), by Country 2024 & 2032

- Figure 13: Middle East And Africa Stepper Motor Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Stepper Motor Market Revenue (Million), by Type of Mortor 2024 & 2032

- Figure 15: North America Stepper Motor Market Revenue Share (%), by Type of Mortor 2024 & 2032

- Figure 16: North America Stepper Motor Market Revenue (Million), by Application 2024 & 2032

- Figure 17: North America Stepper Motor Market Revenue Share (%), by Application 2024 & 2032

- Figure 18: North America Stepper Motor Market Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Stepper Motor Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Stepper Motor Market Revenue (Million), by Type of Mortor 2024 & 2032

- Figure 21: Europe Stepper Motor Market Revenue Share (%), by Type of Mortor 2024 & 2032

- Figure 22: Europe Stepper Motor Market Revenue (Million), by Application 2024 & 2032

- Figure 23: Europe Stepper Motor Market Revenue Share (%), by Application 2024 & 2032

- Figure 24: Europe Stepper Motor Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe Stepper Motor Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Stepper Motor Market Revenue (Million), by Type of Mortor 2024 & 2032

- Figure 27: Asia Stepper Motor Market Revenue Share (%), by Type of Mortor 2024 & 2032

- Figure 28: Asia Stepper Motor Market Revenue (Million), by Application 2024 & 2032

- Figure 29: Asia Stepper Motor Market Revenue Share (%), by Application 2024 & 2032

- Figure 30: Asia Stepper Motor Market Revenue (Million), by Country 2024 & 2032

- Figure 31: Asia Stepper Motor Market Revenue Share (%), by Country 2024 & 2032

- Figure 32: Australia and New Zealand Stepper Motor Market Revenue (Million), by Type of Mortor 2024 & 2032

- Figure 33: Australia and New Zealand Stepper Motor Market Revenue Share (%), by Type of Mortor 2024 & 2032

- Figure 34: Australia and New Zealand Stepper Motor Market Revenue (Million), by Application 2024 & 2032

- Figure 35: Australia and New Zealand Stepper Motor Market Revenue Share (%), by Application 2024 & 2032

- Figure 36: Australia and New Zealand Stepper Motor Market Revenue (Million), by Country 2024 & 2032

- Figure 37: Australia and New Zealand Stepper Motor Market Revenue Share (%), by Country 2024 & 2032

- Figure 38: Latin America Stepper Motor Market Revenue (Million), by Type of Mortor 2024 & 2032

- Figure 39: Latin America Stepper Motor Market Revenue Share (%), by Type of Mortor 2024 & 2032

- Figure 40: Latin America Stepper Motor Market Revenue (Million), by Application 2024 & 2032

- Figure 41: Latin America Stepper Motor Market Revenue Share (%), by Application 2024 & 2032

- Figure 42: Latin America Stepper Motor Market Revenue (Million), by Country 2024 & 2032

- Figure 43: Latin America Stepper Motor Market Revenue Share (%), by Country 2024 & 2032

- Figure 44: Middle East and Africa Stepper Motor Market Revenue (Million), by Type of Mortor 2024 & 2032

- Figure 45: Middle East and Africa Stepper Motor Market Revenue Share (%), by Type of Mortor 2024 & 2032

- Figure 46: Middle East and Africa Stepper Motor Market Revenue (Million), by Application 2024 & 2032

- Figure 47: Middle East and Africa Stepper Motor Market Revenue Share (%), by Application 2024 & 2032

- Figure 48: Middle East and Africa Stepper Motor Market Revenue (Million), by Country 2024 & 2032

- Figure 49: Middle East and Africa Stepper Motor Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Stepper Motor Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Stepper Motor Market Revenue Million Forecast, by Type of Mortor 2019 & 2032

- Table 3: Global Stepper Motor Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Global Stepper Motor Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Stepper Motor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Stepper Motor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Stepper Motor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Stepper Motor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Stepper Motor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Stepper Motor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Stepper Motor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Stepper Motor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Stepper Motor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Stepper Motor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Stepper Motor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Stepper Motor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global Stepper Motor Market Revenue Million Forecast, by Type of Mortor 2019 & 2032

- Table 18: Global Stepper Motor Market Revenue Million Forecast, by Application 2019 & 2032

- Table 19: Global Stepper Motor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Global Stepper Motor Market Revenue Million Forecast, by Type of Mortor 2019 & 2032

- Table 21: Global Stepper Motor Market Revenue Million Forecast, by Application 2019 & 2032

- Table 22: Global Stepper Motor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 23: Global Stepper Motor Market Revenue Million Forecast, by Type of Mortor 2019 & 2032

- Table 24: Global Stepper Motor Market Revenue Million Forecast, by Application 2019 & 2032

- Table 25: Global Stepper Motor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Global Stepper Motor Market Revenue Million Forecast, by Type of Mortor 2019 & 2032

- Table 27: Global Stepper Motor Market Revenue Million Forecast, by Application 2019 & 2032

- Table 28: Global Stepper Motor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 29: Global Stepper Motor Market Revenue Million Forecast, by Type of Mortor 2019 & 2032

- Table 30: Global Stepper Motor Market Revenue Million Forecast, by Application 2019 & 2032

- Table 31: Global Stepper Motor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Global Stepper Motor Market Revenue Million Forecast, by Type of Mortor 2019 & 2032

- Table 33: Global Stepper Motor Market Revenue Million Forecast, by Application 2019 & 2032

- Table 34: Global Stepper Motor Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Stepper Motor Market?

The projected CAGR is approximately 3.08%.

2. Which companies are prominent players in the Stepper Motor Market?

Key companies in the market include ASPINA Group (Shinano Kenshi Co Ltd), Minebea Mitsumi Inc, Shanghai MOONS Electric Co Ltd, Oriental Motor Co Ltd, JVL AS, Schneider Electric SE, Changzhou Fulling Motor Co Ltd, Faulhaber, Nanotec Electronic GMBH & Co KG, Kollmorgen (Regal Rexnord Corporation), Nippon Pulse America Inc *List Not Exhaustive, I CH Motion.

3. What are the main segments of the Stepper Motor Market?

The market segments include Type of Mortor, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.11 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Adoption of Robotics and Automation Solutions; Increasing Usage of Stepper Motors in the Healthcare Industry.

6. What are the notable trends driving market growth?

Hybrid Type of Motors to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Performance Limitations and Competition from Servo Motors.

8. Can you provide examples of recent developments in the market?

August 2023 - Oriental Motor USA announced the release of the new electric gripper, the EH Series 3-Finger Type. This new 3-finger type electric gripper can gently grip irregularly shaped objects, such as spheres and cylinders, like human fingertips. The key features of the new electric gripper EH Series 3-Finger Type are equipped with an αSTEP AZ Series Motor, suitable for gripping cylinders, complex shapes, and sphere shape objects; compact and lightweight and available with an installation cover, gripper arms are not included.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Stepper Motor Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Stepper Motor Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Stepper Motor Market?

To stay informed about further developments, trends, and reports in the Stepper Motor Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence