Key Insights

The South American weight management products market, a segment including meal replacements, beverages, and supplements, is poised for substantial expansion. This growth is propelled by heightened health awareness, escalating obesity rates, and a greater understanding of weight management's role in mitigating chronic conditions such as diabetes and cardiovascular disease. The increasing adoption of e-commerce channels complements traditional distribution networks, further stimulating market penetration.

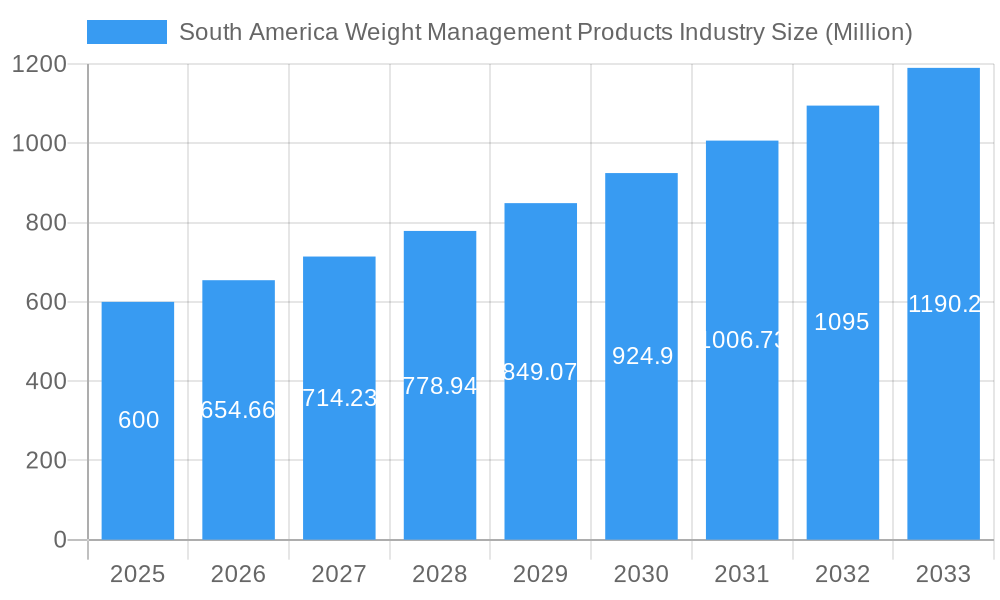

South America Weight Management Products Industry Market Size (In Billion)

The market size was valued at $163.13 billion in the base year 2024 and is projected to expand at a Compound Annual Growth Rate (CAGR) of 8.3%. The forecast period, from 2025 to 2033, anticipates sustained growth driven by product innovation, targeted health-focused marketing, and rising disposable incomes in key South American economies. Significant populations in Brazil and Argentina are expected to contribute significantly to market value.

South America Weight Management Products Industry Company Market Share

Market expansion is tempered by pricing sensitivities for premium products among lower-income demographics. Additionally, varying regulatory frameworks across South American nations for dietary supplements and weight management solutions present operational challenges for manufacturers seeking broad regional market access. Despite these restraints, the market demonstrates a positive growth trajectory. The rising consumer preference for natural and organic offerings, combined with the adoption of personalized weight management approaches, indicates continued expansion and diversification. Leading companies such as NatureWise, Herbalife International, and Nestle are actively influencing the market through strategic product introductions and expansion initiatives. The expanding reach of online retailers offers additional avenues for growth.

South America Weight Management Products Industry: 2019-2033 Market Report

This comprehensive report provides an in-depth analysis of the South America weight management products industry, covering the period 2019-2033. It offers invaluable insights into market dynamics, competitive landscapes, and future growth prospects, empowering businesses to make informed strategic decisions. The report leverages extensive data analysis and industry expertise to provide a clear understanding of this rapidly evolving market. With a focus on key players like Herbalife International Inc, Nestlé SA, and others, this report is essential for industry stakeholders, investors, and market researchers.

South America Weight Management Products Industry Market Structure & Competitive Dynamics

This section analyzes the South America weight management products market's competitive landscape, encompassing market concentration, innovation, regulatory frameworks, product substitutes, end-user trends, and mergers & acquisitions (M&A) activity. The market is moderately concentrated, with several key players holding significant market share. However, numerous smaller companies and regional players contribute to a dynamic competitive environment.

- Market Concentration: The top 5 players account for approximately xx% of the total market share in 2025 (Estimated Year). This indicates a moderately consolidated market with opportunities for both established players and new entrants.

- Innovation Ecosystems: The industry is characterized by continuous innovation in product formulations, delivery systems, and marketing strategies. Companies invest heavily in research and development to offer more effective and appealing weight management solutions.

- Regulatory Frameworks: Regulatory bodies in various South American countries influence product labeling, ingredient approvals, and advertising regulations. Navigating these frameworks is crucial for success in the market. Variations in regulations across countries add complexity to market entry and operations.

- Product Substitutes: The weight management market faces competition from other weight loss methods, including diet programs, exercise regimes, and surgical interventions. These substitutes present both opportunities and challenges for existing companies.

- End-User Trends: Growing health consciousness and increasing prevalence of obesity in several South American countries are driving demand for effective weight management products. Consumer preferences are shifting towards natural, organic, and scientifically-backed solutions.

- M&A Activities: The industry has witnessed several significant M&A deals in recent years, such as Nestlé Health Science's acquisition of Puravida in May 2022. These activities reshape market dynamics and competitive landscapes, often leading to increased market concentration. The total value of M&A deals in the historical period (2019-2024) was approximately $xx Million.

South America Weight Management Products Industry Industry Trends & Insights

The South American weight management products market is experiencing robust growth driven by several factors. The rising prevalence of obesity and related health issues is a primary driver. Increasing disposable incomes and greater awareness of health and wellness are further boosting market expansion. Technological advancements in product development and marketing also play a significant role.

The market is projected to exhibit a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), expanding from an estimated market size of $xx Million in 2025 (Estimated Year) to $xx Million by 2033. Market penetration is expected to increase with growing awareness and availability of a wider variety of products. E-commerce channels are rapidly gaining popularity, enhancing accessibility and convenience for consumers. However, challenges such as economic instability in some regions and regulatory hurdles can impact market growth. The rising popularity of personalized nutrition plans and digitally-driven weight management solutions presents both opportunities and challenges for the industry. Competitive dynamics continue to evolve, with established players facing pressure from new entrants and disruptive technologies.

Dominant Markets & Segments in South America Weight Management Products Industry

Brazil stands as the dominant market within South America for weight management products, driven by factors including a large and growing population, increasing disposable incomes, and a high prevalence of obesity. The supplements segment dominates the market by type, reflecting consumer preference for convenient and targeted solutions. Online retail channels are experiencing rapid growth, fueled by increased internet penetration and e-commerce adoption.

- Key Drivers in Brazil:

- High prevalence of obesity and related health issues.

- Rising disposable incomes and health consciousness.

- Favorable regulatory environment.

- Strong distribution infrastructure.

- Dominant Segment Analysis:

- By Type: The supplements segment is the largest, accounting for approximately xx% of the market in 2025 (Estimated Year). This is driven by consumer preference for convenient and targeted solutions. Meal replacements and beverages represent other important segments.

- By Distribution Channel: Online retail stores are experiencing rapid growth, increasing in market share from xx% in 2025 (Estimated Year) to xx% by 2033, fueled by enhanced convenience and broad product reach. Hypermarkets/supermarkets maintain a significant share due to their established presence and wide customer reach.

South America Weight Management Products Industry Product Innovations

Recent innovations focus on developing natural and science-backed weight management products. Herbalife's introduction of a prickly pear cactus fiber-based product exemplifies this trend. Companies are also focusing on personalized nutrition solutions and using technological advancements to improve product efficacy and user experience. This includes the use of smart apps, wearable tech integration, and personalized recommendations based on user data. The focus is on providing products with high consumer acceptance, supported by scientific research and proven efficacy.

Report Segmentation & Scope

This report segments the South America weight management products market by type (Meal Replacements, Beverages, Supplements) and by distribution channel (Hypermarkets/Supermarkets, Convenience Stores, Online Retail Stores, Other Distribution Channels). Each segment’s growth projections, market size, and competitive dynamics are thoroughly examined. The report covers the historical period (2019-2024), the base year (2025), and the forecast period (2025-2033), offering a holistic view of market evolution.

- By Type: Each type (Meal Replacements, Beverages, Supplements) exhibits unique growth trajectories, influenced by consumer preferences and product innovation. Growth rates vary by type, with supplements anticipated to remain the fastest-growing segment.

- By Distribution Channel: Online Retail Stores are expected to show significant growth, surpassing traditional channels. Hypermarkets/Supermarkets will continue to maintain a substantial presence.

Key Drivers of South America Weight Management Products Industry Growth

Several factors are driving the growth of the South America weight management products industry. The rising prevalence of obesity and related health problems is a major driver. Increasing disposable incomes, coupled with growing health awareness among consumers, fuels demand for effective solutions. Technological advancements lead to the development of more effective and appealing weight management products. Government initiatives promoting healthy lifestyles also contribute to market growth.

Challenges in the South America Weight Management Products Industry Sector

The industry faces challenges, including regulatory hurdles across diverse South American markets, requiring companies to navigate varying regulations and compliance requirements. Supply chain complexities and disruptions can impact product availability and pricing. Intense competition from both established and emerging players necessitates continuous innovation and strategic adaptation. Economic volatility in certain regions can influence consumer spending and market growth.

Leading Players in the South America Weight Management Products Industry Market

- NatureWise

- IAF Network S r l

- Carson Life Inc

- BPI Sports LLC

- Herbalife International Inc

- Nestle SA

- The Hut com Limited (Myprotein)

- Ultimate Nutrition inc

- N V Perricone LLC

- California Medical Weight Management LLC

Key Developments in South America Weight Management Products Industry Sector

- July 2022: Herbalife launched a new weight management product featuring prickly pear cactus fiber, backed by clinical trials. This underscores a trend toward science-backed products.

- May 2022: Nestlé Health Science acquired Puravida, strengthening its position in the Brazilian dietary supplement market. This acquisition exemplifies strategic consolidation within the industry.

- April 2023: Herbalife unveiled 106 new wellness products globally, including in Brazil, expanding its portfolio and addressing various well-being needs. This demonstrates a significant investment in product diversification and market expansion.

Strategic South America Weight Management Products Industry Market Outlook

The South America weight management products market presents significant growth potential, driven by ongoing trends toward health and wellness. Strategic opportunities exist for companies that effectively address the rising prevalence of obesity, cater to diverse consumer preferences, and navigate regulatory landscapes. Innovation in product development, coupled with effective marketing strategies, will be crucial for success. The expanding e-commerce sector presents a significant channel for growth. Companies prioritizing science-backed products and personalized solutions are expected to gain a competitive edge.

South America Weight Management Products Industry Segmentation

-

1. Type

- 1.1. Meal

- 1.2. Beverage

- 1.3. Supplements

-

2. Distribution Channel

- 2.1. Hypermarkets/Supermarkets

- 2.2. Convenience Stores

- 2.3. Online Retail Stores

- 2.4. Other Distribution Channels

-

3. Geography

- 3.1. Brazil

- 3.2. Argentina

- 3.3. Rest of the South America

South America Weight Management Products Industry Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Rest of the South America

South America Weight Management Products Industry Regional Market Share

Geographic Coverage of South America Weight Management Products Industry

South America Weight Management Products Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Prevalence of Obesity; Growing Number of Fitness Enthusiasts or Health-Conscious Consumers

- 3.3. Market Restrains

- 3.3.1. Penetration of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Rising Obesity Incidence and Weight Consciousness

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Weight Management Products Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Meal

- 5.1.2. Beverage

- 5.1.3. Supplements

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Hypermarkets/Supermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Online Retail Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Rest of the South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Rest of the South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Brazil South America Weight Management Products Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Meal

- 6.1.2. Beverage

- 6.1.3. Supplements

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Hypermarkets/Supermarkets

- 6.2.2. Convenience Stores

- 6.2.3. Online Retail Stores

- 6.2.4. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Argentina

- 6.3.3. Rest of the South America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Argentina South America Weight Management Products Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Meal

- 7.1.2. Beverage

- 7.1.3. Supplements

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Hypermarkets/Supermarkets

- 7.2.2. Convenience Stores

- 7.2.3. Online Retail Stores

- 7.2.4. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Argentina

- 7.3.3. Rest of the South America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Rest of the South America South America Weight Management Products Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Meal

- 8.1.2. Beverage

- 8.1.3. Supplements

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Hypermarkets/Supermarkets

- 8.2.2. Convenience Stores

- 8.2.3. Online Retail Stores

- 8.2.4. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Argentina

- 8.3.3. Rest of the South America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 NatureWise

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 IAF Network S r l

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Carson Life Inc

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 BPI Sports LLC

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Herbalife International Inc

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Nestle SA*List Not Exhaustive

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 The Hut com Limited (Myprotein)

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Ultimate Nutrition inc

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 N V Perricone LLC

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 California Medical Weight Management LLC

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 NatureWise

List of Figures

- Figure 1: South America Weight Management Products Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South America Weight Management Products Industry Share (%) by Company 2025

List of Tables

- Table 1: South America Weight Management Products Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: South America Weight Management Products Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: South America Weight Management Products Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: South America Weight Management Products Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: South America Weight Management Products Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 6: South America Weight Management Products Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: South America Weight Management Products Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: South America Weight Management Products Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: South America Weight Management Products Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 10: South America Weight Management Products Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: South America Weight Management Products Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: South America Weight Management Products Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: South America Weight Management Products Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 14: South America Weight Management Products Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 15: South America Weight Management Products Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: South America Weight Management Products Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Weight Management Products Industry?

The projected CAGR is approximately 8.3%.

2. Which companies are prominent players in the South America Weight Management Products Industry?

Key companies in the market include NatureWise, IAF Network S r l, Carson Life Inc, BPI Sports LLC, Herbalife International Inc, Nestle SA*List Not Exhaustive, The Hut com Limited (Myprotein), Ultimate Nutrition inc, N V Perricone LLC, California Medical Weight Management LLC.

3. What are the main segments of the South America Weight Management Products Industry?

The market segments include Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 163.13 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Prevalence of Obesity; Growing Number of Fitness Enthusiasts or Health-Conscious Consumers.

6. What are the notable trends driving market growth?

Rising Obesity Incidence and Weight Consciousness.

7. Are there any restraints impacting market growth?

Penetration of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

April 2023: Herbalife unveiled 106 innovative Wellness Products on a global scale, catering to a diverse audience spanning 95 markets where the company maintains a strong presence, including Brazil. These new product additions are strategically designed to address various facets of well-being, including nutrient supplementation, weight management, digestion, and other essential segments.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Weight Management Products Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Weight Management Products Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Weight Management Products Industry?

To stay informed about further developments, trends, and reports in the South America Weight Management Products Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence