Key Insights

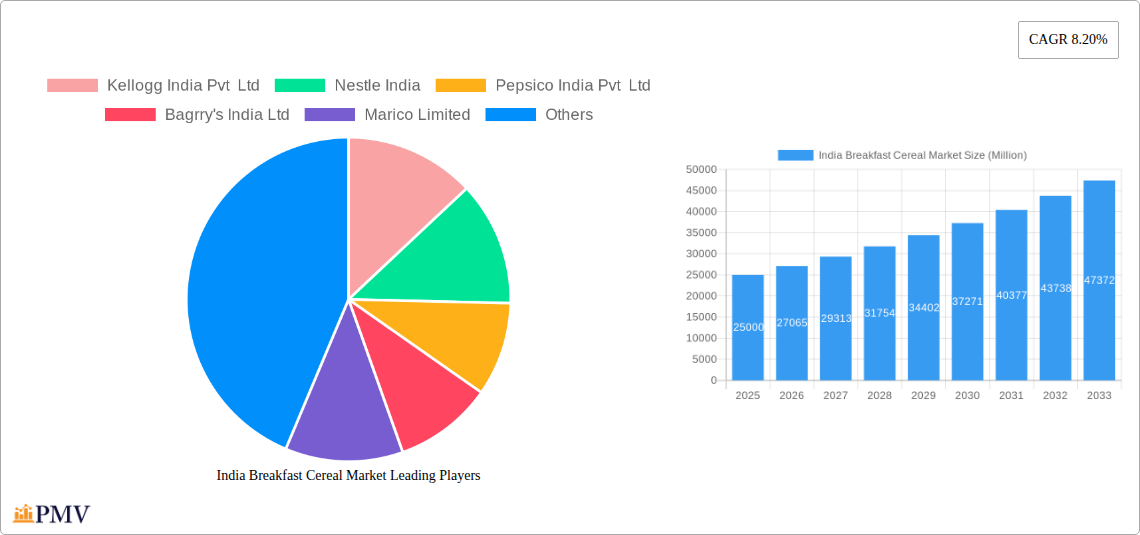

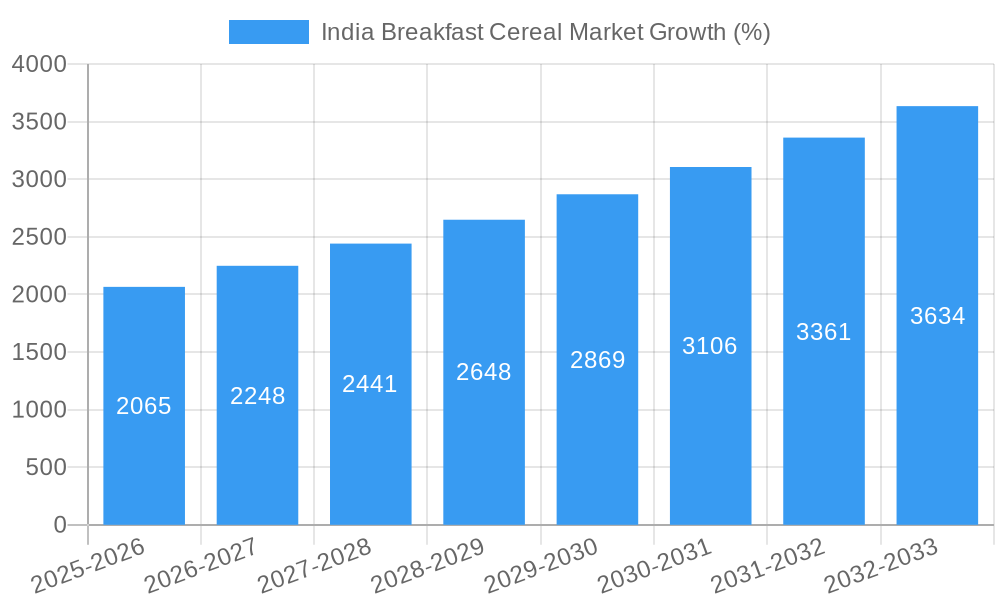

The India breakfast cereal market, valued at approximately ₹25 billion (estimated based on a global market size and India's relative consumption patterns) in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 8.20% from 2025 to 2033. This expansion is fueled by several key drivers. Increasing disposable incomes, particularly within the burgeoning middle class, are enabling consumers to incorporate more convenient and nutritious breakfast options into their diets. The rising awareness of health and wellness, coupled with the convenience factor of ready-to-eat cereals, is further bolstering market demand. Changing lifestyles and increasingly hectic schedules are also contributing to the popularity of breakfast cereals as a quick and easy meal solution. Furthermore, aggressive marketing campaigns by established players like Kellogg's, Nestle, and PepsiCo, alongside the entry of new players like Patanjali Ayurved offering more traditional and indigenous options, are significantly shaping market dynamics. The market is segmented by product type (e.g., ready-to-eat, hot cereals), distribution channels (e.g., supermarkets, online retailers), and region, with significant growth anticipated across urban and semi-urban areas.

However, certain restraints are also present. The market faces challenges from traditional breakfast choices deeply ingrained in Indian culture, such as idli, dosa, and paratha. Price sensitivity among a significant portion of the population could limit consumption, particularly for premium brands. Furthermore, concerns regarding high sugar content and processed ingredients in some cereals could hinder market growth. The successful companies will likely need to focus on offering healthier, more affordable options, perhaps incorporating traditional Indian flavors and ingredients to cater to existing preferences while maintaining the convenience aspect that appeals to modern lifestyles. The market is poised for considerable expansion as consumer preferences continue to evolve, reflecting a combination of convenience, health consciousness, and cultural tastes.

India Breakfast Cereal Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the India breakfast cereal market, offering invaluable insights for businesses, investors, and stakeholders. The study covers the period 2019-2033, with a focus on the base year 2025 and a forecast period of 2025-2033. The report utilizes a robust methodology, incorporating historical data from 2019-2024, to deliver accurate and actionable market intelligence. The market size is estimated to be xx Million in 2025 and is expected to reach xx Million by 2033. This report is crucial for understanding the dynamic landscape of the Indian breakfast cereal market, including its growth drivers, challenges, and opportunities.

India Breakfast Cereal Market Market Structure & Competitive Dynamics

The Indian breakfast cereal market exhibits a moderately concentrated structure, with key players like Kellogg India Pvt Ltd, Nestle India, Pepsico India Pvt Ltd, Bagrry's India Ltd, Marico Limited, Patanjali Ayurved Limited, Shanti's, General Mills, Future Consumer Enterprise Ltd, and B&G Foods holding significant market share. However, the market also features numerous smaller players and regional brands, contributing to its vibrant competitive landscape.

Market Concentration: The top five players collectively hold approximately xx% of the market share in 2025, indicating a moderate level of concentration. This leaves significant room for growth and expansion for both existing and new entrants.

Innovation Ecosystem: The market displays a robust innovation ecosystem characterized by continuous product launches, reformulations catering to health-conscious consumers, and expansion into new segments like muesli and energy bars.

Regulatory Framework: The regulatory framework governing the food industry in India, while evolving, provides a relatively stable environment for breakfast cereal manufacturers. However, compliance with labeling regulations and food safety standards remains critical.

Product Substitutes: The market faces competition from traditional Indian breakfast foods like idli, dosa, paratha, and upma. The rise of healthier alternatives and increased awareness of nutrition also influence consumer choices.

End-User Trends: A significant shift towards health-conscious choices, coupled with rising disposable incomes, is driving demand for nutritious and convenient breakfast options. This trend benefits the growth of segments like muesli and high-protein cereals.

M&A Activities: The Indian breakfast cereal market has witnessed a moderate level of M&A activity in recent years, with some larger players acquiring smaller regional brands to enhance their market presence and product portfolio. The total value of M&A deals in the period 2019-2024 is estimated to be approximately xx Million.

India Breakfast Cereal Market Industry Trends & Insights

The Indian breakfast cereal market is experiencing robust growth, driven primarily by changing lifestyles, rising disposable incomes, and increased awareness of the importance of breakfast. The market's Compound Annual Growth Rate (CAGR) during the historical period (2019-2024) was estimated at xx%, and is projected to maintain a healthy growth trajectory during the forecast period (2025-2033). Market penetration remains relatively low compared to developed markets, presenting significant potential for future expansion.

Technological disruptions are also transforming the market. Innovations in packaging, distribution, and product formulation are optimizing the consumer experience and extending shelf life. The increasing adoption of e-commerce platforms expands market reach.

Consumer preferences show a clear shift towards healthier options, with a growing demand for high-protein, low-sugar, and whole-grain cereals. This trend presents opportunities for manufacturers to develop and market products that cater to the evolving health consciousness of Indian consumers.

Competitive dynamics are shaped by intense product innovation, marketing strategies, and pricing strategies. The market has a diverse range of products and brands targeting different segments and price points.

Dominant Markets & Segments in India Breakfast Cereal Market

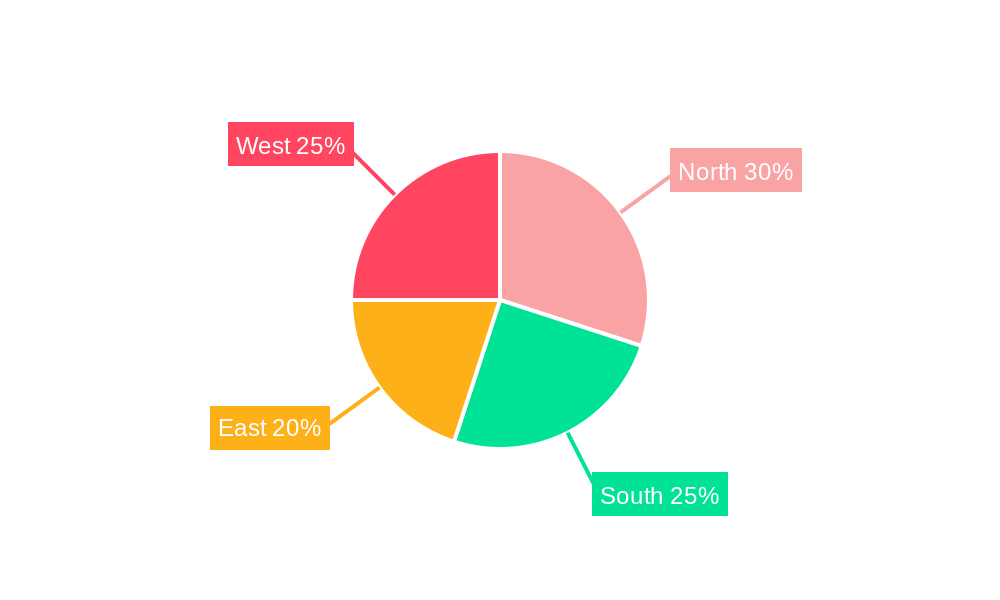

The Indian breakfast cereal market is predominantly driven by urban areas, particularly in the major metropolitan cities. This dominance is primarily attributed to increased disposable incomes, westernized lifestyles, and higher awareness of breakfast's nutritional benefits. Rural markets exhibit growing potential, although penetration rates remain lower.

Key Drivers in Urban Markets:

- Higher disposable incomes.

- Exposure to Western food culture.

- Increased awareness of health and nutrition.

- Better distribution networks.

- Rising adoption of convenience food.

Key Drivers in Rural Markets:

- Growing urbanization and migration.

- Rising disposable incomes.

- Improved distribution networks.

- Government initiatives to promote nutrition.

The segment of ready-to-eat cereals, particularly muesli and high-protein options, is experiencing rapid growth. The convenience factor and health benefits attract a growing number of consumers. This segment is expected to dominate the market in the coming years.

India Breakfast Cereal Market Product Innovations

Recent product innovations in the Indian breakfast cereal market focus on catering to health-conscious consumers and providing convenient options. Manufacturers are launching new products with added nutrients, such as high protein muesli, gluten-free options, and cereals fortified with vitamins and minerals. The incorporation of traditional Indian ingredients into cereals and the introduction of new flavors are other key trends. Technological advancements are enabling the creation of healthier and more sustainable products, enhancing market fit.

Report Segmentation & Scope

This report segments the India breakfast cereal market based on various parameters, including product type (ready-to-eat cereals, hot cereals), distribution channel (supermarkets, hypermarkets, online retailers), and region (urban, rural). Each segment's growth projections, market size, and competitive dynamics are thoroughly analyzed. The report provides insights into the various segments, highlighting their growth rates, market sizes, and competitive landscapes, enabling informed strategic decision-making.

Key Drivers of India Breakfast Cereal Market Growth

The growth of the India breakfast cereal market is propelled by several factors: rising disposable incomes, increasing urbanization, changing lifestyles favoring convenient food choices, and enhanced health awareness. Government initiatives promoting nutrition also contribute to market expansion. The growing popularity of fitness and wellness also supports the preference for fortified and healthy breakfast cereals.

Challenges in the India Breakfast Cereal Market Sector

The market faces challenges including intense competition from traditional breakfast foods, price sensitivity among consumers, and the need to overcome perceptions of breakfast cereals as an expensive or imported product. Supply chain complexities, especially in reaching rural markets, pose further difficulties. Maintaining product quality and complying with strict food safety and labeling regulations present ongoing hurdles. The influence of seasonal factors on raw material availability and price fluctuations also need to be considered.

Leading Players in the India Breakfast Cereal Market Market

- Kellogg India Pvt Ltd

- Nestle India

- Pepsico India Pvt Ltd

- Bagrry's India Ltd

- Marico Limited

- Patanjali Ayurved Limited

- Shanti's

- General Mills

- Future Consumer Enterprise Ltd

- B&G Foods

- *List Not Exhaustive

Key Developments in India Breakfast Cereal Market Sector

- August 2021: Kellogg's launched Froot Loops, a multigrain cereal. Kellogg's also introduced K Energy Bars, expanding beyond traditional breakfast occasions. Tata Soulfull launched Ragi Bites Snacks, furthering this trend.

- September 2022: Quacker Oats (Pepsico) launched Quacker Oats Muesli in Fruit & Nut and Berries & Seeds flavors.

- October 2022: Kellogg's India launched Kellogg's Pro Muesli, a high-protein, 100% plant-based muesli.

Strategic India Breakfast Cereal Market Market Outlook

The Indian breakfast cereal market holds substantial growth potential. Strategic opportunities exist in targeting rural markets, expanding product portfolios with innovative healthy options, and leveraging digital marketing to reach a wider consumer base. Focusing on value-added products catering to specific health needs and emphasizing convenience will attract health-conscious consumers. Collaborations with local businesses to enhance distribution networks will improve market penetration.

India Breakfast Cereal Market Segmentation

-

1. Product Type

- 1.1. Ready-to-cook Cereals

- 1.2. Ready-to-eat Cereals

-

2. Distribution Channel

- 2.1. Convenience Stores

- 2.2. Supermarkets/Hypermarkets

- 2.3. Specialty Stores

- 2.4. Independent Retailers

- 2.5. Online Retail Stores

- 2.6. Other Distribution Channels

India Breakfast Cereal Market Segmentation By Geography

- 1. India

India Breakfast Cereal Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increasing Growth of Hot Cereal Meals

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Breakfast Cereal Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Ready-to-cook Cereals

- 5.1.2. Ready-to-eat Cereals

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Convenience Stores

- 5.2.2. Supermarkets/Hypermarkets

- 5.2.3. Specialty Stores

- 5.2.4. Independent Retailers

- 5.2.5. Online Retail Stores

- 5.2.6. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Kellogg India Pvt Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nestle India

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Pepsico India Pvt Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bagrry's India Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Marico Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Patanjali Ayurved Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Shanti's

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 General Mills

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Future Consumer Enterprise Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 B&G Foods*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Kellogg India Pvt Ltd

List of Figures

- Figure 1: India Breakfast Cereal Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Breakfast Cereal Market Share (%) by Company 2024

List of Tables

- Table 1: India Breakfast Cereal Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Breakfast Cereal Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: India Breakfast Cereal Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: India Breakfast Cereal Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: India Breakfast Cereal Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 6: India Breakfast Cereal Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 7: India Breakfast Cereal Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Breakfast Cereal Market?

The projected CAGR is approximately 8.20%.

2. Which companies are prominent players in the India Breakfast Cereal Market?

Key companies in the market include Kellogg India Pvt Ltd, Nestle India, Pepsico India Pvt Ltd, Bagrry's India Ltd, Marico Limited, Patanjali Ayurved Limited, Shanti's, General Mills, Future Consumer Enterprise Ltd, B&G Foods*List Not Exhaustive.

3. What are the main segments of the India Breakfast Cereal Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increasing Growth of Hot Cereal Meals.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

October 2022: Kellogg's India launched 'Kellogg's Pro Muesli', a high protein muesli that is 100% plant-based. Kellogg's Pro Muesli with 200 ml milk provides 29% of an adult's (sedentary woman's) protein requirement for the day.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Breakfast Cereal Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Breakfast Cereal Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Breakfast Cereal Market?

To stay informed about further developments, trends, and reports in the India Breakfast Cereal Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence