Key Insights

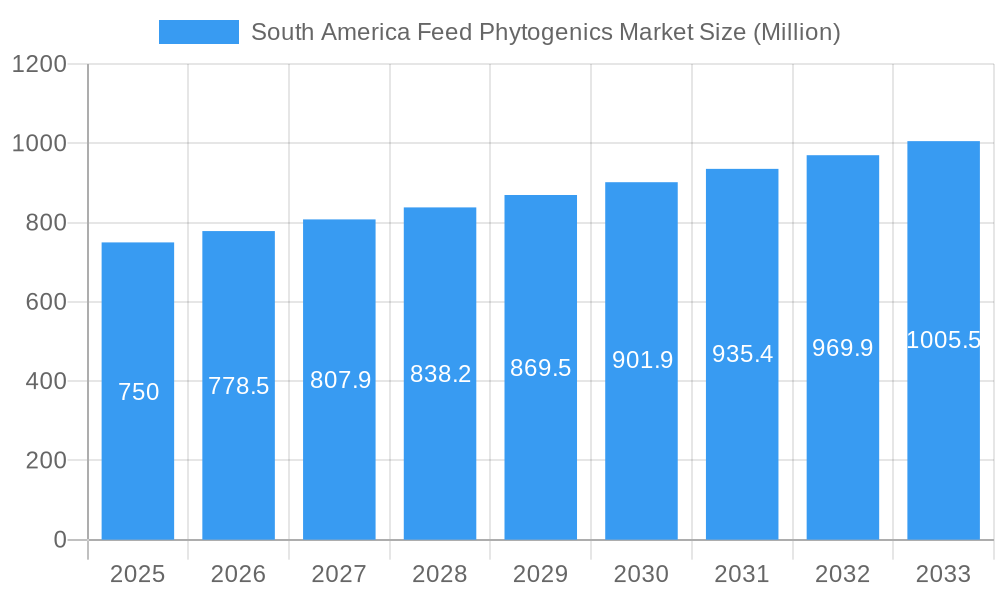

The South America Feed Phytogenics Market is poised for robust growth, projected to reach approximately $750 million by 2025, driven by an increasing demand for natural and sustainable animal feed additives. The market is anticipated to expand at a Compound Annual Growth Rate (CAGR) of 3.80% between 2025 and 2033, further solidifying its significance in the animal nutrition landscape. This expansion is primarily fueled by the growing awareness among livestock producers regarding the benefits of phytogenics in improving animal health, feed intake, and digestibility, thereby reducing reliance on conventional antibiotic growth promoters. Concerns surrounding antibiotic resistance and stringent regulatory frameworks are also compelling a shift towards these plant-derived solutions. Key segments contributing to this growth include herbs and spices, and essential oils, which offer a diverse range of bioactive compounds with antimicrobial, antioxidant, and anti-inflammatory properties. The application in feed intake and digestibility, alongside flavoring and aroma enhancement, represents the most prominent uses, directly impacting animal performance and welfare.

South America Feed Phytogenics Market Market Size (In Million)

Geographically, Brazil and Argentina are expected to lead the South American market, owing to their substantial livestock populations and progressive agricultural practices. The poultry and ruminant segments are particularly significant, as producers in these sectors actively seek innovative solutions to enhance productivity and ensure food safety. While the market benefits from strong growth drivers, certain restraints such as the initial cost of adoption for some phytogenic products and the need for standardized efficacy testing may present challenges. However, ongoing research and development, coupled with increasing market acceptance, are expected to mitigate these obstacles. Major companies like Cargill Incorporated, Biomin GmbH, and Dupont are actively investing in product innovation and strategic partnerships, further shaping the competitive landscape and driving market penetration across the region. The overarching trend is a decisive move towards natural, effective, and sustainable feed solutions, with phytogenics at the forefront of this transformation.

South America Feed Phytogenics Market Company Market Share

South America Feed Phytogenics Market: Comprehensive Market Analysis and Future Outlook (2019-2033)

This in-depth market report offers a detailed examination of the South America Feed Phytogenics Market, providing critical insights for stakeholders seeking to understand market dynamics, growth trajectories, and competitive landscapes. The study meticulously covers the study period of 2019–2033, with a base year of 2025 and an estimated year also in 2025, followed by a comprehensive forecast period from 2025–2033 and a historical period from 2019–2024. We explore the market's structure, key industry trends, dominant segments, product innovations, strategic outlook, and the leading players shaping the future of feed phytogenics in South America. Unlock opportunities in the burgeoning animal nutrition sector with this essential resource.

South America Feed Phytogenics Market Market Structure & Competitive Dynamics

The South America Feed Phytogenics Market is characterized by a moderately consolidated structure, with leading global players actively vying for market share. Key companies like Cargill Incorporated, Biomin GmbH, Delacon Biotechnik GmbH, DuPont, Adisseo France SAS, Kemin Industries Inc, Pancosma, and Natural Remedie are at the forefront of innovation and market penetration. The innovation ecosystem thrives on continuous research and development of novel phytogenic compounds and synergistic blends, driven by a growing demand for natural animal feed additives. Regulatory frameworks are evolving, with increasing government support for sustainable and antibiotic-free livestock production, creating a favorable environment for feed phytogenic solutions. Product substitutes, while present in the form of synthetic additives, are facing increasing scrutiny and consumer preference for natural alternatives. End-user trends are heavily influenced by the demand for healthier animal products, improved animal welfare, and reduced environmental impact, directly impacting the adoption of phytogenic feed ingredients. Mergers and acquisitions (M&A) are a notable aspect of the competitive landscape, with companies strategically acquiring smaller innovators to enhance their product portfolios and expand their geographical reach. For instance, recent M&A activities have seen deal values in the range of tens to hundreds of millions of dollars, signifying the strategic importance of this market. The overall market concentration, while present, allows for significant growth opportunities for specialized and innovative players.

South America Feed Phytogenics Market Industry Trends & Insights

The South America Feed Phytogenics Market is poised for significant expansion, driven by a confluence of technological advancements, evolving consumer preferences, and robust market growth drivers. The market is experiencing a projected Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period. This growth is underpinned by the escalating global demand for sustainable animal agriculture and a pronounced shift away from antibiotic growth promoters (AGPs) in animal feed. Phytogenic feed additives, derived from plants, are gaining immense traction due to their perceived safety, efficacy in improving feed intake and digestibility, and their ability to enhance animal health and performance without the risks associated with antibiotic resistance. Technological disruptions, such as advanced extraction techniques for essential oils and improved formulation technologies for herbs and spices, are enhancing the potency and bioavailability of these natural compounds. Consumer preferences are increasingly aligning with the ethical and health-conscious attributes of natural feed ingredients, leading to higher demand for meat, dairy, and egg products produced using such methods. The competitive dynamics are intensifying, with companies investing heavily in R&D to develop superior phytogenic formulations that offer specific benefits like improved gut health, enhanced immune response, and better stress management in livestock. Market penetration is projected to reach over 40% for key phytogenic ingredients in the poultry and swine sectors by the end of the forecast period. The growing awareness of the zoonotic disease potential of antibiotic use further fuels the adoption of phytogenic feed additives, positioning them as a critical component of modern animal nutrition strategies. The increasing adoption in aquaculture and ruminant segments also signals a broadening application scope.

Dominant Markets & Segments in South America Feed Phytogenics Market

The South America Feed Phytogenics Market exhibits distinct regional and segmental dominance.

Geography: Brazil stands out as the dominant geographical market, accounting for an estimated 45% of the total market revenue in 2025. This dominance is attributed to its massive livestock population, particularly in poultry and swine production, and a proactive regulatory environment encouraging the adoption of sustainable feed solutions. Argentina follows as a significant market, driven by its strong beef and poultry sectors. The Rest of South America, encompassing countries like Colombia, Chile, and Peru, represents a growing segment with substantial untapped potential.

Ingredients: Within the ingredients segment, Herbs and Spices currently hold the largest market share, estimated at around 55% in 2025. This is due to their widespread availability, diverse functional properties, and cost-effectiveness. Essential Oils constitute the second-largest segment, with an estimated market share of 30%, offering highly concentrated bioactive compounds. The "Others" segment, which includes plant extracts and other botanical derivatives, is expected to witness the fastest growth, driven by ongoing research and development.

Application: The Feed Intake and Digestibility application segment is the primary driver of market growth, capturing an estimated 60% of the market in 2025. Phytogenics’ proven ability to enhance nutrient utilization and gut health directly translates into improved animal performance and reduced feed costs. Flavoring and Aroma is another significant application, accounting for approximately 25% of the market, as phytogenics can improve palatability and encourage consistent feed consumption. The "Others" application segment, including immune modulation and antioxidant effects, is projected for robust expansion.

Animal Type: The Poultry segment is the dominant end-user, representing an estimated 40% of the market in 2025, owing to the high volume of feed consumed and the established benefits of phytogenics in this sector. Swine follows closely with an estimated 30% market share, driven by similar demands for improved feed efficiency and reduced reliance on antibiotics. The Ruminant segment is a rapidly growing area, expected to reach an 18% market share by 2025, as producers seek natural solutions for methane reduction and improved digestive health. Aquaculture and "Others" represent smaller but expanding segments.

South America Feed Phytogenics Market Product Innovations

Product innovations in the South America Feed Phytogenics Market are focused on enhancing efficacy, improving delivery systems, and expanding the range of applications. Companies are developing novel synergistic blends of plant extracts and essential oils to target specific animal health challenges, such as improving gut integrity and immune response in poultry and swine. Technological advancements in encapsulation and microencapsulation are leading to more stable and bioavailable phytogenic compounds, ensuring optimal release and absorption in the animal's digestive tract. These innovations offer competitive advantages by providing targeted solutions that address the evolving needs of the livestock industry for antibiotic-free production and improved animal welfare.

Report Segmentation & Scope

This report meticulously segments the South America Feed Phytogenics Market to provide a granular understanding of its dynamics.

Ingredients: The market is segmented into Herbs and Spices, Essential Oils, and Others (including plant extracts and botanical derivatives). This segmentation allows for an analysis of the demand and growth potential of each core ingredient type.

Application: Key applications include Feed Intake and Digestibility, Flavoring and Aroma, and Others (such as immune support and antioxidant properties). This breakdown highlights how phytogenics are utilized to achieve specific production goals.

Animal Type: The report analyzes the market across Ruminant, Poultry, Swine, Aquaculture, and Others. This segmentation reveals the primary end-user industries and their respective adoption rates.

Geography: The market is further divided into Brazil, Argentina, and the Rest of South America. This geographical segmentation is crucial for understanding regional market variations, economic influences, and local regulatory landscapes.

Key Drivers of South America Feed Phytogenics Market Growth

The South America Feed Phytogenics Market is propelled by several key drivers. The increasing global demand for antibiotic-free meat and animal products is a primary catalyst, as phytogenics offer a viable alternative to antibiotic growth promoters. Stringent regulations and growing consumer awareness regarding food safety and animal welfare are further bolstering this trend. Technological advancements in extraction and formulation techniques are enhancing the efficacy and cost-effectiveness of phytogenic solutions. Furthermore, government initiatives promoting sustainable agriculture and reduced reliance on synthetic additives are creating a favorable market environment. The economic benefits derived from improved feed conversion ratios and reduced mortality rates also contribute significantly to market expansion.

Challenges in the South America Feed Phytogenics Market Sector

Despite robust growth, the South America Feed Phytogenics Market faces certain challenges. Regulatory hurdles and the lack of standardized guidelines for phytogenic products in some South American countries can impede market entry and adoption. Supply chain complexities, including the sourcing of high-quality raw materials and ensuring consistent product availability, can also pose challenges. The initial cost of some advanced phytogenic formulations might be higher compared to traditional additives, requiring a clear demonstration of return on investment for producers. Furthermore, a lack of widespread awareness and technical expertise among some end-users regarding the optimal application and benefits of phytogenics can slow down market penetration.

Leading Players in the South America Feed Phytogenics Market Market

- Cargill Incorporated

- Biomin GmbH

- Delacon Biotechnik GmbH

- DuPont

- Adisseo France SAS

- Kemin Industries Inc

- Pancosma

- Natural Remedie

Key Developments in South America Feed Phytogenics Market Sector

- 2023/Q4: Launch of novel synergistic blend of essential oils for enhanced gut health in swine, demonstrating a 15% improvement in feed conversion ratio.

- 2023/Q3: Strategic partnership formed between a leading feed producer and a phytogenics innovator to develop customized solutions for the Brazilian poultry market.

- 2023/Q2: Introduction of a new line of encapsulated oregano extracts for aquaculture, enhancing disease resistance and growth performance.

- 2022/Q4: Acquisition of a regional phytogenics manufacturer by a global animal nutrition company, strengthening its presence in Argentina.

- 2022/Q3: Successful development of a phytogenic formulation targeting methane reduction in ruminants, showing promising results in field trials.

Strategic South America Feed Phytogenics Market Market Outlook

The South America Feed Phytogenics Market presents a highly promising strategic outlook, driven by the accelerating global trend towards sustainable and antibiotic-free animal agriculture. Growth accelerators include continued investments in research and development for novel applications, expansion into emerging markets within the "Rest of South America," and strategic collaborations between feed manufacturers, ingredient suppliers, and research institutions. The increasing focus on animal welfare and consumer demand for transparent food production systems will further propel the adoption of these natural solutions. Opportunities lie in developing tailored phytogenic blends for specific regional livestock breeds and prevailing environmental conditions, alongside enhancing educational initiatives to bridge knowledge gaps among producers.

South America Feed Phytogenics Market Segmentation

-

1. Ingredients

- 1.1. Herbs and Spices

- 1.2. Essential Oils

- 1.3. Others

-

2. Application

- 2.1. Feed Intake and Digestibility

- 2.2. Flavoring and Aroma

- 2.3. Others

-

3. Animal Type

- 3.1. Ruminant

- 3.2. Poultry

- 3.3. Swine

- 3.4. Aquaculture

- 3.5. Others

-

4. Geography

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

South America Feed Phytogenics Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Rest of South America

South America Feed Phytogenics Market Regional Market Share

Geographic Coverage of South America Feed Phytogenics Market

South America Feed Phytogenics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health

- 3.3. Market Restrains

- 3.3.1. Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth

- 3.4. Market Trends

- 3.4.1. Increasing Production of Animal Feed Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Feed Phytogenics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Ingredients

- 5.1.1. Herbs and Spices

- 5.1.2. Essential Oils

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Feed Intake and Digestibility

- 5.2.2. Flavoring and Aroma

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Animal Type

- 5.3.1. Ruminant

- 5.3.2. Poultry

- 5.3.3. Swine

- 5.3.4. Aquaculture

- 5.3.5. Others

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Rest of South America

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Brazil

- 5.5.2. Argentina

- 5.5.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Ingredients

- 6. Brazil South America Feed Phytogenics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Ingredients

- 6.1.1. Herbs and Spices

- 6.1.2. Essential Oils

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Feed Intake and Digestibility

- 6.2.2. Flavoring and Aroma

- 6.2.3. Others

- 6.3. Market Analysis, Insights and Forecast - by Animal Type

- 6.3.1. Ruminant

- 6.3.2. Poultry

- 6.3.3. Swine

- 6.3.4. Aquaculture

- 6.3.5. Others

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Brazil

- 6.4.2. Argentina

- 6.4.3. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Ingredients

- 7. Argentina South America Feed Phytogenics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Ingredients

- 7.1.1. Herbs and Spices

- 7.1.2. Essential Oils

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Feed Intake and Digestibility

- 7.2.2. Flavoring and Aroma

- 7.2.3. Others

- 7.3. Market Analysis, Insights and Forecast - by Animal Type

- 7.3.1. Ruminant

- 7.3.2. Poultry

- 7.3.3. Swine

- 7.3.4. Aquaculture

- 7.3.5. Others

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Brazil

- 7.4.2. Argentina

- 7.4.3. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Ingredients

- 8. Rest of South America South America Feed Phytogenics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Ingredients

- 8.1.1. Herbs and Spices

- 8.1.2. Essential Oils

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Feed Intake and Digestibility

- 8.2.2. Flavoring and Aroma

- 8.2.3. Others

- 8.3. Market Analysis, Insights and Forecast - by Animal Type

- 8.3.1. Ruminant

- 8.3.2. Poultry

- 8.3.3. Swine

- 8.3.4. Aquaculture

- 8.3.5. Others

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. Brazil

- 8.4.2. Argentina

- 8.4.3. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Ingredients

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Cargill Incorporated

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Biomin GmbH

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Delacon Biotechnik GmbH

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Dupont

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Adisseo France SAS

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Kemin Industries Inc

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Pancosma

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Natural Remedie

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.1 Cargill Incorporated

List of Figures

- Figure 1: South America Feed Phytogenics Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: South America Feed Phytogenics Market Share (%) by Company 2025

List of Tables

- Table 1: South America Feed Phytogenics Market Revenue undefined Forecast, by Ingredients 2020 & 2033

- Table 2: South America Feed Phytogenics Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: South America Feed Phytogenics Market Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 4: South America Feed Phytogenics Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 5: South America Feed Phytogenics Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: South America Feed Phytogenics Market Revenue undefined Forecast, by Ingredients 2020 & 2033

- Table 7: South America Feed Phytogenics Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 8: South America Feed Phytogenics Market Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 9: South America Feed Phytogenics Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 10: South America Feed Phytogenics Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 11: South America Feed Phytogenics Market Revenue undefined Forecast, by Ingredients 2020 & 2033

- Table 12: South America Feed Phytogenics Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 13: South America Feed Phytogenics Market Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 14: South America Feed Phytogenics Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 15: South America Feed Phytogenics Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: South America Feed Phytogenics Market Revenue undefined Forecast, by Ingredients 2020 & 2033

- Table 17: South America Feed Phytogenics Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 18: South America Feed Phytogenics Market Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 19: South America Feed Phytogenics Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 20: South America Feed Phytogenics Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Feed Phytogenics Market?

The projected CAGR is approximately 3.8%.

2. Which companies are prominent players in the South America Feed Phytogenics Market?

Key companies in the market include Cargill Incorporated, Biomin GmbH, Delacon Biotechnik GmbH, Dupont, Adisseo France SAS, Kemin Industries Inc, Pancosma, Natural Remedie.

3. What are the main segments of the South America Feed Phytogenics Market?

The market segments include Ingredients, Application, Animal Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health.

6. What are the notable trends driving market growth?

Increasing Production of Animal Feed Driving the Market.

7. Are there any restraints impacting market growth?

Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Feed Phytogenics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Feed Phytogenics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Feed Phytogenics Market?

To stay informed about further developments, trends, and reports in the South America Feed Phytogenics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence