Key Insights

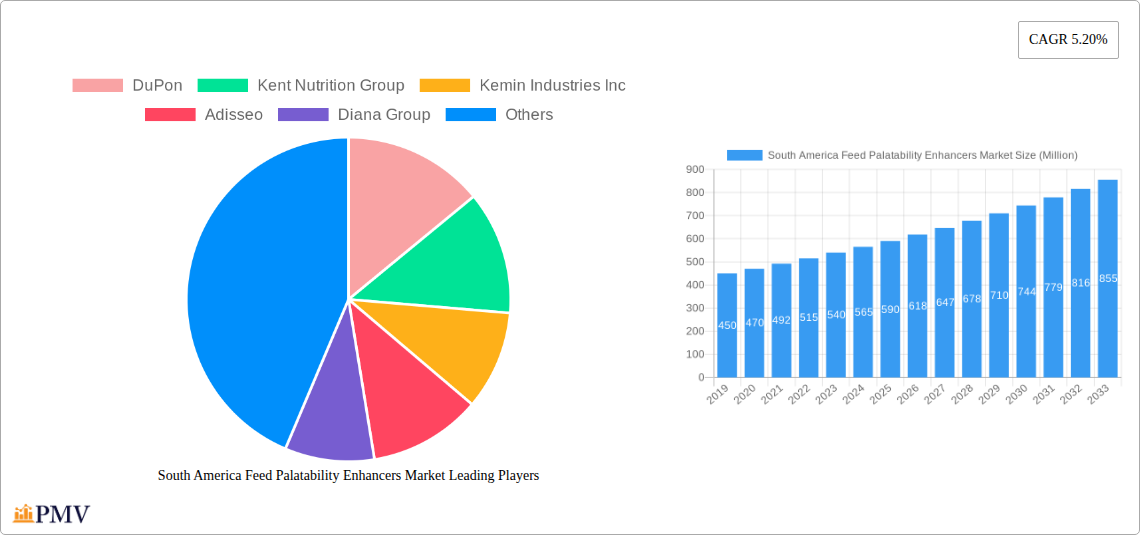

The South America Feed Palatability Enhancers Market is poised for significant expansion, projected to reach a valuation of approximately $600 million by 2025, with a steady Compound Annual Growth Rate (CAGR) of 5.20% expected through 2033. This robust growth is primarily driven by the escalating demand for high-quality animal feed, fueled by the burgeoning meat and dairy consumption across the region, particularly in key markets like Brazil and Argentina. The increasing adoption of advanced animal husbandry practices and a greater focus on animal welfare and productivity are also contributing to the adoption of feed palatability enhancers. These additives play a crucial role in improving feed intake, nutrient absorption, and overall animal health, leading to enhanced growth rates and better feed conversion ratios. The market is witnessing a strong shift towards innovative solutions that not only boost palatability but also offer additional nutritional benefits, aligning with the evolving needs of modern animal agriculture.

South America Feed Palatability Enhancers Market Market Size (In Million)

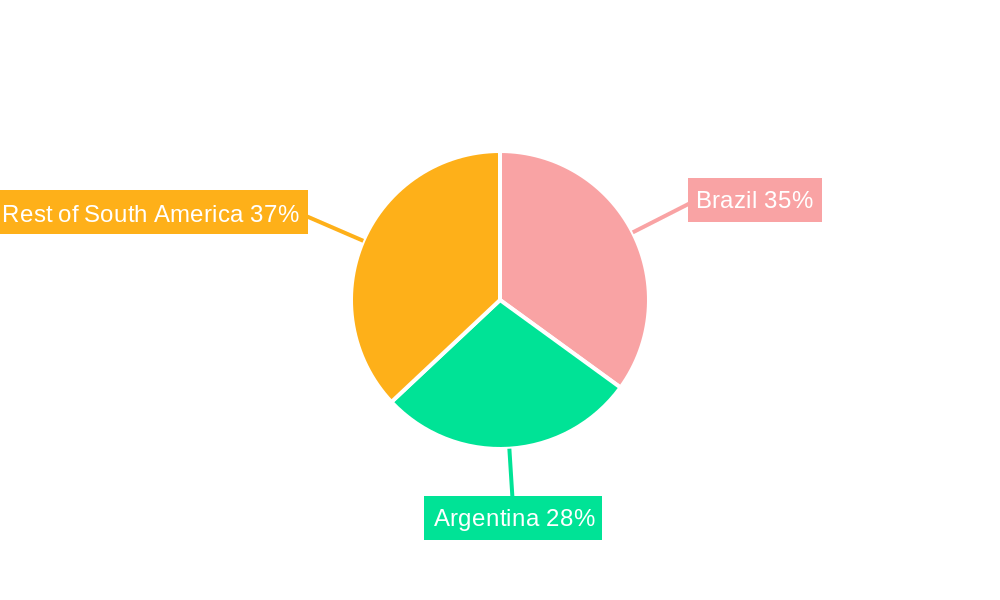

The market segmentation reveals a dynamic landscape. Within the 'Type' segment, Flavors are anticipated to dominate, driven by consumer preferences for specific taste profiles in animal products and the need to mask undesirable tastes in feed formulations. Aroma enhancers and sweeteners are also expected to see substantial growth as they contribute significantly to the overall attractiveness of the feed. On the animal type front, Poultry and Ruminants are the largest consumers of feed palatability enhancers, reflecting their dominant positions in the regional livestock industry. Swine and Aquaculture segments are also exhibiting promising growth trajectories, indicating a broader adoption across diverse animal agriculture sectors. Geographically, Brazil and Argentina are leading the market, owing to their established agricultural infrastructure and significant livestock populations. The 'Rest of South America' region also presents considerable untapped potential, with growing investments in animal agriculture and a rising demand for efficient feed solutions. Key industry players like DuPont, Kemin Industries Inc., and Adisseo are at the forefront, driving innovation and market expansion through strategic investments and product development.

South America Feed Palatability Enhancers Market Company Market Share

South America Feed Palatability Enhancers Market: Comprehensive Report Description

This in-depth market research report offers an exhaustive analysis of the South America Feed Palatability Enhancers Market. Covering the Study Period: 2019–2033, with Base Year: 2025, Estimated Year: 2025, and Forecast Period: 2025–2033, alongside a detailed Historical Period: 2019–2024, this report provides critical insights for stakeholders navigating this dynamic sector. The market is segmented by Type (Flavors, Sweeteners, Aroma Enhancers), Animal Type (Ruminants, Poultry, Swine, Aquaculture, Other Animal Types), and Geography (Brazil, Argentina, Rest of South America). Key players including DuPont, Kent Nutrition Group, Kemin Industries Inc., Adisseo, Diana Group, Pancosma, Kerry Inc., and Tanke International Group are profiled.

South America Feed Palatability Enhancers Market Market Structure & Competitive Dynamics

The South America Feed Palatability Enhancers Market exhibits a moderate to high level of market concentration, driven by the presence of both established global chemical giants and specialized regional players. Innovation ecosystems are rapidly developing, with increasing investments in R&D focused on novel formulations and sustainable ingredient sourcing. Regulatory frameworks, while evolving, play a crucial role in shaping market entry and product approvals, particularly concerning animal health and feed safety standards. Product substitutes, while limited in direct replacement, can emerge from alternative feed additives or improved feed processing techniques. End-user trends are strongly influenced by the growing demand for efficient animal protein production, leading to a higher adoption rate of palatability enhancers to optimize feed intake and conversion ratios. Mergers and acquisition (M&A) activities are anticipated to intensify as key players seek to expand their market reach and consolidate their offerings. For instance, a significant M&A deal in the forecast period could involve a market leader acquiring a niche producer to gain access to specific flavor technologies, potentially valued at over $50 Million.

- Market Share Analysis: Detailed breakdowns of market share for key segments and leading companies.

- Innovation Ecosystems: Overview of research centers, university collaborations, and startup incubators driving new product development.

- Regulatory Landscape: Analysis of key regulations impacting feed additive approvals and usage in major South American countries.

- M&A Activity: Identification of potential targets and strategic rationale for consolidation within the market, with an estimated deal value of $20 Million to $75 Million for significant transactions.

- Product Substitutes: Assessment of alternative solutions and their impact on market share.

South America Feed Palatability Enhancers Market Industry Trends & Insights

The South America Feed Palatability Enhancers Market is poised for robust growth, driven by several interconnected industry trends and insights. The escalating global demand for animal protein, coupled with a burgeoning middle class in South America, is a primary growth accelerator, necessitating enhanced feed efficiency in livestock, poultry, and aquaculture operations. This trend directly fuels the demand for feed palatability enhancers, particularly flavors and aroma enhancers, designed to increase feed intake and reduce wastage. Technological disruptions, such as advancements in encapsulation technologies and the development of natural or nature-identical palatants, are reshaping product offerings. Furthermore, a growing emphasis on animal welfare and the reduction of stress in farming practices also contributes to the adoption of palatability enhancers, which can help improve nutrient absorption and overall animal health. Consumer preferences are increasingly leaning towards sustainable and ethically produced animal products, indirectly influencing feed formulation choices towards those that promote optimal animal performance and minimize environmental impact. Competitive dynamics are characterized by an intensified focus on product differentiation through efficacy, cost-effectiveness, and the development of customized solutions for specific animal types and dietary needs. The CAGR for the South America Feed Palatability Enhancers Market is estimated to be around 6.5% for the forecast period. Market penetration of advanced palatability enhancers is expected to rise from approximately 35% in the base year to over 50% by 2033, particularly in the poultry and swine segments. The increasing sophistication of animal nutrition science is pushing the boundaries of what palatability enhancers can achieve, moving beyond simple taste masking to actively influencing gut health and immune responses.

Dominant Markets & Segments in South America Feed Palatability Enhancers Market

The South America Feed Palatability Enhancers Market is witnessing significant dominance from specific regions and animal types, reflecting the agricultural landscape and economic priorities of the continent. Brazil stands out as the dominant geographical market, owing to its massive scale in livestock production, particularly in poultry and swine, and its significant presence in the global beef export market, driving demand for ruminant feed additives. Argentina also plays a crucial role, especially in its extensive cattle ranching operations. The Rest of South America segment, while collectively smaller, comprises markets with substantial growth potential, driven by emerging economies and increasing investments in agricultural modernization.

Within the segmentation by Type, Flavors are currently the most dominant, followed closely by Aroma Enhancers, as they directly address the core need for increased feed intake. Sweeteners also hold a significant share, particularly in formulations for young animals where their appeal is most pronounced.

By Animal Type, Poultry and Swine represent the largest and fastest-growing segments. The high metabolic rates and rapid growth cycles of these animals necessitate precise nutritional management, making palatability enhancers indispensable for optimizing feed conversion and profitability. The Aquaculture segment, while smaller, is exhibiting exceptional growth rates, fueled by the expansion of fish and shrimp farming across the continent. Ruminants constitute a substantial segment, particularly in beef and dairy production, where the management of feed intake is critical for sustained productivity.

- Dominant Region: Brazil:

- Key Drivers: Extensive scale of poultry, swine, and beef production; strong export market for animal protein; government support for agricultural innovation.

- Market Size Projection: Expected to account for over 45% of the total South American market by 2033.

- Dominant Animal Type: Poultry & Swine:

- Key Drivers: High feed conversion ratios required; rapid growth cycles; consistent demand for meat products; cost-effectiveness of enhancers.

- Market Share: These segments are projected to collectively hold over 60% of the market share by 2033.

- Dominant Type: Flavors:

- Key Drivers: Direct impact on feed consumption; broad applicability across animal types; increasing sophistication in flavor profiles.

- Market Dynamics: Continuous innovation in natural and artificial flavorings to cater to specific animal preferences.

- High-Growth Segment: Aquaculture:

- Key Drivers: Expansion of aquaculture operations; need for specialized feed formulations; increasing investment in sustainable farming practices.

- Growth Rate: Projected to experience a CAGR of over 8% during the forecast period.

South America Feed Palatability Enhancers Market Product Innovations

Product innovations in the South America Feed Palatability Enhancers Market are primarily focused on enhancing efficacy, sustainability, and animal-specific appeal. Developments include advanced flavor encapsulation techniques for extended release and improved stability in feed processing, as well as the creation of complex aroma blends that mimic natural feed sources to stimulate appetite. The emergence of natural and organic palatability enhancers, derived from plant-based sources, is a key trend, catering to the growing consumer demand for cleaner labels and reduced reliance on synthetic additives. Furthermore, research is increasingly directed towards understanding the sensory perceptions of different animal species to develop highly targeted and effective formulations. These innovations provide competitive advantages by offering solutions that not only improve feed intake but also contribute to overall animal health and well-being.

Report Segmentation & Scope

This report meticulously segments the South America Feed Palatability Enhancers Market by Type, Animal Type, and Geography.

- Segmentation by Type:

- Flavors: Encompasses a wide range of sweet, savory, and aromatic compounds designed to mask undesirable tastes and aromas in feed, thereby increasing palatability. Expected market size of over $250 Million by 2033.

- Sweeteners: Includes natural and artificial sweeteners that enhance the taste profile of feed, particularly crucial for young animals. Projected market share of approximately 20%.

- Aroma Enhancers: Focuses on volatile compounds that stimulate olfactory senses, triggering feeding responses and increasing feed intake. Expected to witness a CAGR of around 7%.

- Segmentation by Animal Type:

- Ruminants: Covers cattle, sheep, and goats, where enhancers are used to improve intake of roughage-based diets.

- Poultry: Includes chickens, turkeys, and ducks, a major segment due to high feed conversion efficiency demands.

- Swine: Encompasses pigs, another significant segment driven by the global demand for pork.

- Aquaculture: Covers fish and shellfish farming, a rapidly growing area with specialized palatability needs.

- Other Animal Types: Includes companion animals and niche livestock.

- Segmentation by Geography:

- Brazil: The largest and most influential market, driven by its vast agricultural sector.

- Argentina: A significant player, particularly in beef and grain production.

- Rest of South America: Includes all other countries, offering diverse growth opportunities.

Key Drivers of South America Feed Palatability Enhancers Market Growth

The growth of the South America Feed Palatability Enhancers Market is propelled by a confluence of economic, technological, and regulatory factors.

- Economic Factors: Rising disposable incomes across South America are increasing the demand for animal protein, necessitating more efficient animal husbandry practices. This economic uplift directly translates to increased investment in animal nutrition, including palatability enhancers, to optimize feed utilization and reduce production costs.

- Technological Advancements: Innovations in feed formulation, ingredient processing, and delivery systems are enhancing the efficacy and application of palatability enhancers. Research into animal sensory perception and the development of natural and sustainable ingredients are also key technological drivers.

- Growing Livestock Population: The expanding populations of poultry, swine, and aquaculture species across South America create a consistent and growing demand for feed additives that improve feed intake and conversion ratios.

- Focus on Animal Health and Welfare: Increasing awareness and adoption of best practices in animal health and welfare are leading farmers to seek solutions that improve nutrient absorption and reduce stress, where palatability enhancers play a supportive role.

Challenges in the South America Feed Palatability Enhancers Market Sector

Despite its growth trajectory, the South America Feed Palatability Enhancers Market faces several challenges that can impede its expansion.

- Regulatory Hurdles: Navigating the diverse and sometimes stringent regulatory approval processes for feed additives across different South American countries can be complex and time-consuming, impacting market entry for new products.

- Cost Sensitivity: In a price-sensitive agricultural market, the perceived cost-effectiveness of palatability enhancers can be a barrier, especially for smaller-scale farmers. Demonstrating a clear return on investment is crucial.

- Supply Chain Volatility: Fluctuations in raw material availability and pricing, as well as logistical challenges within the region, can disrupt the supply chain and impact the consistent availability of enhancer products.

- Limited Awareness and Technical Expertise: In certain sub-regions or among smaller producers, there may be a lack of awareness regarding the benefits and optimal application of advanced palatability enhancers, requiring targeted education and technical support.

Leading Players in the South America Feed Palatability Enhancers Market Market

- DuPont

- Kent Nutrition Group

- Kemin Industries Inc.

- Adisseo

- Diana Group

- Pancosma

- Kerry Inc.

- Tanke International Group

Key Developments in South America Feed Palatability Enhancers Market Sector

- 2023 October: Launch of a new natural flavor blend for poultry feed by Adisseo, focusing on improved palatability and reduced antibiotic reliance.

- 2024 January: Kemin Industries Inc. announces strategic partnership with a Brazilian feed producer to enhance R&D for aquaculture palatability solutions.

- 2024 March: DuPont introduces a novel sweetener formulation for swine diets, demonstrating a significant improvement in feed intake in early trials.

- 2024 June: Diana Group expands its R&D facility in Argentina, with a focus on developing regionally specific aroma enhancers for ruminants.

- 2025 February: Kerry Inc. acquires a smaller South American competitor specializing in aroma enhancers, strengthening its market position in the region.

Strategic South America Feed Palatability Enhancers Market Market Outlook

The strategic outlook for the South America Feed Palatability Enhancers Market is highly positive, driven by continuous innovation and increasing adoption rates. Key growth accelerators include the development of sustainable and natural palatability solutions, tailored formulations for specific animal life stages and breeds, and the integration of digital technologies for precision feeding recommendations. Companies that invest in robust R&D to address emerging animal health concerns and evolving consumer preferences for animal products will be well-positioned. Furthermore, strategic collaborations and partnerships with local feed manufacturers and distributors will be crucial for expanding market penetration and providing localized technical support. The market's future lies in offering comprehensive solutions that not only enhance palatability but also contribute to animal welfare, feed efficiency, and overall farm profitability.

South America Feed Palatability Enhancers Market Segmentation

-

1. Type

- 1.1. Flavors

- 1.2. Sweeteners

- 1.3. Aroma Enhancers

-

2. Animal Type

- 2.1. Ruminants

- 2.2. Poultry

- 2.3. Swine

- 2.4. Aquaculture

- 2.5. Other Animal Types

-

3. Geography

- 3.1. Brazil

- 3.2. Argentina

- 3.3. Rest of South America

South America Feed Palatability Enhancers Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Rest of South America

South America Feed Palatability Enhancers Market Regional Market Share

Geographic Coverage of South America Feed Palatability Enhancers Market

South America Feed Palatability Enhancers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health

- 3.3. Market Restrains

- 3.3.1. Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth

- 3.4. Market Trends

- 3.4.1. Rising Demand for Animal Sourced Proteins

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Feed Palatability Enhancers Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Flavors

- 5.1.2. Sweeteners

- 5.1.3. Aroma Enhancers

- 5.2. Market Analysis, Insights and Forecast - by Animal Type

- 5.2.1. Ruminants

- 5.2.2. Poultry

- 5.2.3. Swine

- 5.2.4. Aquaculture

- 5.2.5. Other Animal Types

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Rest of South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Brazil South America Feed Palatability Enhancers Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Flavors

- 6.1.2. Sweeteners

- 6.1.3. Aroma Enhancers

- 6.2. Market Analysis, Insights and Forecast - by Animal Type

- 6.2.1. Ruminants

- 6.2.2. Poultry

- 6.2.3. Swine

- 6.2.4. Aquaculture

- 6.2.5. Other Animal Types

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Argentina

- 6.3.3. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Argentina South America Feed Palatability Enhancers Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Flavors

- 7.1.2. Sweeteners

- 7.1.3. Aroma Enhancers

- 7.2. Market Analysis, Insights and Forecast - by Animal Type

- 7.2.1. Ruminants

- 7.2.2. Poultry

- 7.2.3. Swine

- 7.2.4. Aquaculture

- 7.2.5. Other Animal Types

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Argentina

- 7.3.3. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Rest of South America South America Feed Palatability Enhancers Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Flavors

- 8.1.2. Sweeteners

- 8.1.3. Aroma Enhancers

- 8.2. Market Analysis, Insights and Forecast - by Animal Type

- 8.2.1. Ruminants

- 8.2.2. Poultry

- 8.2.3. Swine

- 8.2.4. Aquaculture

- 8.2.5. Other Animal Types

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Argentina

- 8.3.3. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 DuPon

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Kent Nutrition Group

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Kemin Industries Inc

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Adisseo

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Diana Group

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Pancosma

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Kerry Inc

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Tanke International Group

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.1 DuPon

List of Figures

- Figure 1: South America Feed Palatability Enhancers Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: South America Feed Palatability Enhancers Market Share (%) by Company 2025

List of Tables

- Table 1: South America Feed Palatability Enhancers Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: South America Feed Palatability Enhancers Market Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 3: South America Feed Palatability Enhancers Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 4: South America Feed Palatability Enhancers Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: South America Feed Palatability Enhancers Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: South America Feed Palatability Enhancers Market Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 7: South America Feed Palatability Enhancers Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 8: South America Feed Palatability Enhancers Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: South America Feed Palatability Enhancers Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 10: South America Feed Palatability Enhancers Market Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 11: South America Feed Palatability Enhancers Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 12: South America Feed Palatability Enhancers Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: South America Feed Palatability Enhancers Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 14: South America Feed Palatability Enhancers Market Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 15: South America Feed Palatability Enhancers Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 16: South America Feed Palatability Enhancers Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Feed Palatability Enhancers Market?

The projected CAGR is approximately 8.7%.

2. Which companies are prominent players in the South America Feed Palatability Enhancers Market?

Key companies in the market include DuPon, Kent Nutrition Group, Kemin Industries Inc, Adisseo, Diana Group, Pancosma, Kerry Inc, Tanke International Group.

3. What are the main segments of the South America Feed Palatability Enhancers Market?

The market segments include Type, Animal Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health.

6. What are the notable trends driving market growth?

Rising Demand for Animal Sourced Proteins.

7. Are there any restraints impacting market growth?

Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Feed Palatability Enhancers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Feed Palatability Enhancers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Feed Palatability Enhancers Market?

To stay informed about further developments, trends, and reports in the South America Feed Palatability Enhancers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence