Key Insights

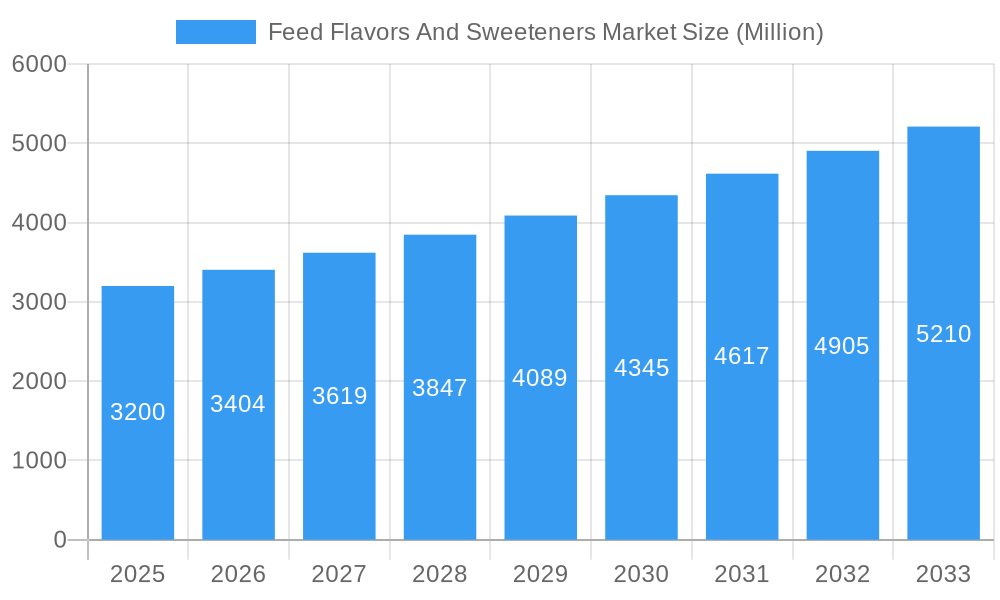

The global Feed Flavors and Sweeteners Market is projected for substantial growth, with an estimated market size by the end of the study period. Driven by a robust Compound Annual Growth Rate (CAGR) of 4.25%, the market exhibits consistent upward momentum. This expansion is primarily fueled by increasing global demand for animal protein, a consequence of population growth and evolving dietary habits. Growing consumer awareness regarding health and food safety is intensifying the focus on high-quality animal feed. Feed flavors and sweeteners are instrumental in improving feed palatability and intake, directly contributing to enhanced animal health, accelerated growth, and overall productivity. This, in turn, elevates the quality of end-products for human consumption. Advancements in feed additive technologies, including novel flavoring agents and natural sweeteners, further support market growth by offering more effective and sustainable solutions. Favorable regulatory support for feed additives that promote animal well-being and reduce antibiotic reliance also acts as a key market driver.

Feed Flavors And Sweeteners Market Market Size (In Billion)

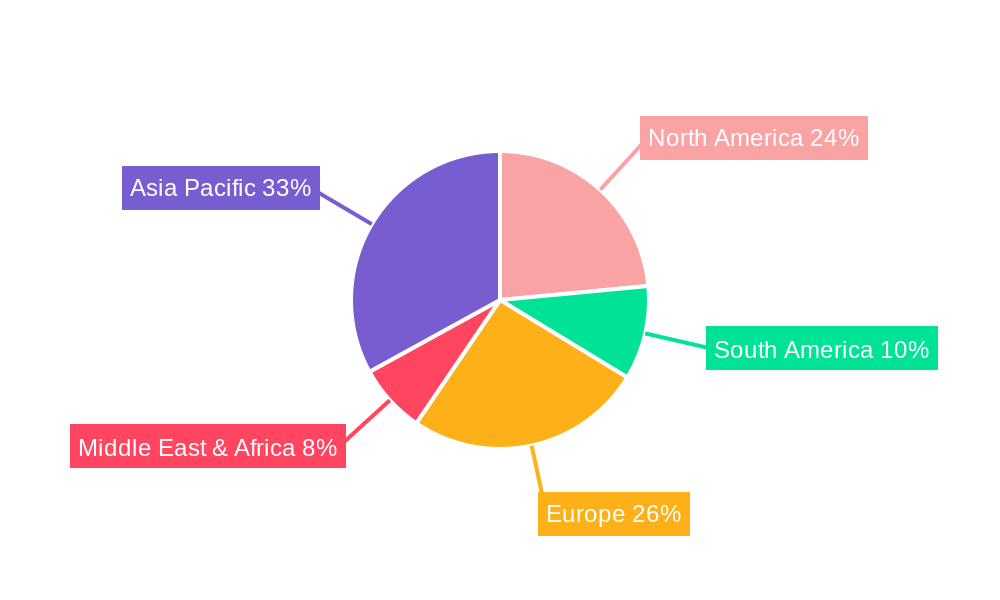

The market is segmented by animal type and sub-additive, addressing diverse application requirements. Ruminants, encompassing beef and dairy cattle, constitute a significant segment due to their substantial populations and high feed consumption volumes. The swine segment also contributes significantly to market demand. Flavors and sweeteners are critical sub-additives for improving feed efficiency and acceptance. Emerging trends include a rising preference for natural and organic feed ingredients, driven by consumer demand for cleaner labels and sustainable practices, leading to increased research into plant-derived flavors and natural sweeteners. Geographically, the Asia Pacific region is expected to experience the fastest growth, attributed to its large livestock population, increasing disposable incomes, and the rapid industrialization of the animal feed sector. North America and Europe, while mature markets, continue to demonstrate steady growth, fueled by technological innovations and a strong emphasis on animal welfare. Potential restraints include fluctuating raw material prices and stringent regulatory approval processes for new feed additives, underscoring the need for continuous innovation and strategic sourcing by key market participants.

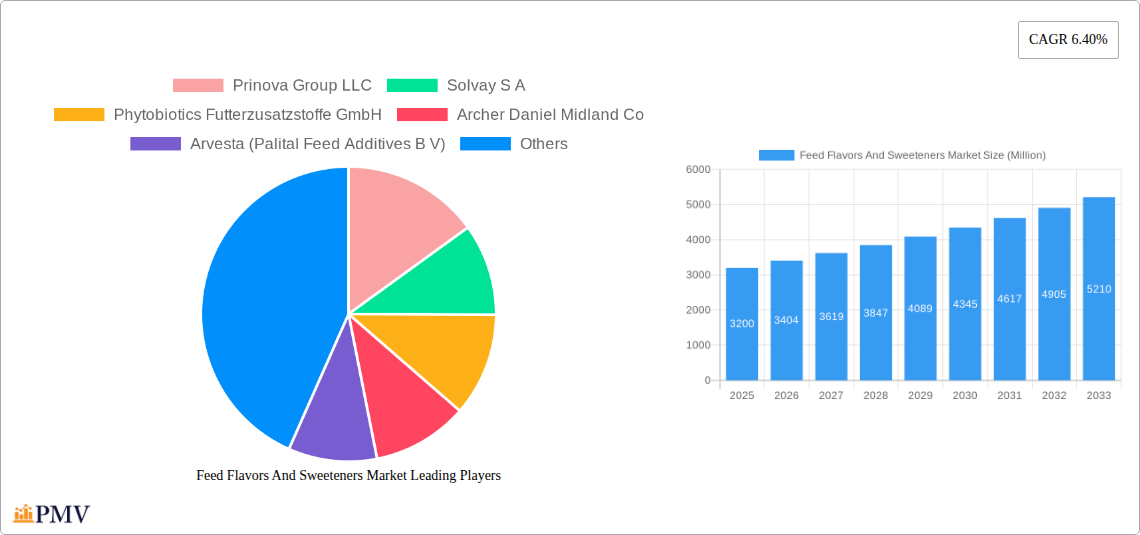

Feed Flavors And Sweeteners Market Company Market Share

This comprehensive market research report delivers an in-depth analysis of the global Feed Flavors and Sweeteners Market. Covering the historical period (2019–2024), the base year of 2025, and a detailed forecast period (2025–2033), the report provides actionable insights into market dynamics, key trends, dominant segments, and competitive strategies. Uncover critical information on animal feed additives, feed palatability enhancers, livestock nutrition, poultry feed ingredients, swine feed formulations, and ruminant feed solutions. Gain a significant competitive advantage through expert analysis of market drivers, challenges, and innovations shaping the future of the animal feed industry.

Study Period: 2019–2033 Base Year: 2025 Forecast Period: 2025–2033 Historical Period: 2019–2024

Feed Flavors And Sweeteners Market Market Structure & Competitive Dynamics

The global Feed Flavors and Sweeteners Market exhibits a moderately consolidated structure, with key players investing heavily in research and development to enhance product efficacy and consumer appeal. Innovation ecosystems are thriving, driven by the demand for specialized feed solutions catering to specific animal needs and performance objectives. Regulatory frameworks surrounding animal feed safety and efficacy play a crucial role in shaping market entry and product development strategies. The presence of product substitutes, while a factor, is mitigated by the unique benefits offered by specialized flavors and sweeteners in improving feed intake and animal performance. End-user trends are increasingly focused on sustainability, traceability, and the use of natural ingredients, prompting manufacturers to innovate in these areas. Mergers and acquisitions (M&A) are a significant feature of the market landscape, facilitating market expansion, technological integration, and increased market share. For instance, the Innovad acquisition of Scentarom in May 2022 underscores the strategic importance of consolidating expertise in feed palatability. M&A deal values are substantial, reflecting the strategic imperative for growth and market consolidation. Understanding these dynamics is vital for stakeholders aiming to navigate and capitalize on opportunities within this dynamic market.

Feed Flavors And Sweeteners Market Industry Trends & Insights

The Feed Flavors and Sweeteners Market is experiencing robust growth, driven by an escalating global demand for animal protein and a growing awareness among livestock producers regarding the critical role of nutrition in animal health and productivity. The Compound Annual Growth Rate (CAGR) for this market is projected to be substantial, fueled by advancements in feed formulation technologies and a deeper understanding of animal sensory perception. Technological disruptions are at the forefront, with the development of novel flavoring agents and sweeteners that not only mask undesirable tastes but also contribute to improved nutrient absorption and overall animal well-being. Consumer preferences are increasingly shifting towards sustainable and traceable animal husbandry practices, which, in turn, influences the demand for feed additives that support these goals. The market penetration of advanced feed flavors and sweeteners is steadily increasing across developed and emerging economies, as producers recognize the economic benefits of enhanced feed intake and reduced waste.

Key trends include:

- Growing demand for high-quality animal feed: As the global population rises, so does the demand for meat, dairy, and eggs, necessitating efficient and productive animal farming.

- Focus on animal welfare and performance: Producers are seeking feed solutions that improve animal health, reduce stress, and optimize growth rates.

- Technological advancements in flavor masking and enhancement: Innovations in encapsulation and controlled-release technologies are enhancing the efficacy of feed additives.

- Increasing adoption of natural and sustainable ingredients: Consumer pressure and regulatory initiatives are driving the demand for environmentally friendly feed solutions.

- Rise of precision nutrition: Tailoring feed formulations, including flavors and sweeteners, to specific animal life stages and physiological needs is becoming more prevalent.

- Globalization of livestock production: Expansion of the animal feed industry in emerging economies presents significant growth opportunities.

The competitive dynamics are characterized by a strong emphasis on product differentiation, strategic partnerships, and continuous innovation to meet evolving market demands and regulatory landscapes. Players are investing in R&D to develop palatable feed ingredients and cost-effective sweetening agents for animal feed.

Dominant Markets & Segments in Feed Flavors And Sweeteners Market

The Feed Flavors and Sweeteners Market is characterized by significant regional and segmental dominance, driven by distinct factors within each. North America and Europe currently represent dominant markets, owing to well-established livestock industries, advanced agricultural practices, and high consumer demand for animal protein. However, the Asia-Pacific region is projected to witness the fastest growth due to rapid industrialization of livestock farming and increasing disposable incomes leading to higher meat consumption.

Within the Sub Additive segment, Flavors hold a larger market share, driven by their crucial role in masking unpalatable ingredients, improving feed intake, and encouraging consumption, particularly in young animals or during periods of stress. Sweeteners, while a smaller segment, are gaining traction due to their ability to enhance palatability, stimulate appetite, and potentially contribute to improved nutrient utilization.

In terms of Animal segmentation, Ruminants constitute a significant market, with Dairy Cattle and Beef Cattle being major consumers. This is attributed to the large scale of dairy and beef production globally and the need for highly palatable and nutritious feed to optimize milk yield and meat quality. The Swine segment is also a substantial contributor, as efficient growth and feed conversion are paramount in pork production. Other Animals, including poultry and aquaculture, represent growing segments with specific flavor and sweetener requirements that are increasingly being addressed by specialized product offerings.

Key drivers for dominance in these segments include:

- Economic Policies: Government subsidies and incentives for livestock farming directly impact feed additive consumption.

- Infrastructure: Well-developed logistics networks facilitate the efficient distribution of feed ingredients and finished feed.

- Technological Adoption: Early and widespread adoption of advanced feed technologies by producers in leading regions.

- Consumer Demand: Strong consumer preference for animal protein drives the scale of livestock operations.

- Research & Development: Continuous investment in R&D by market leaders to develop innovative and effective solutions tailored to specific animal needs and production systems.

The dominance of certain regions and segments underscores the strategic importance of targeted market approaches for stakeholders in the Feed Flavors and Sweeteners Market.

Feed Flavors And Sweeteners Market Product Innovations

Product innovations in the Feed Flavors and Sweeteners Market are primarily focused on enhancing the palatability and acceptance of animal feed, leading to improved feed intake, growth performance, and animal health. Manufacturers are developing novel natural feed flavors derived from plant extracts and essential oils, catering to the growing demand for clean-label ingredients. Advanced encapsulation technologies are being employed to protect volatile flavor compounds, ensuring their efficacy throughout the feed manufacturing process and during storage. Furthermore, the development of high-intensity sweeteners allows for effective taste masking at lower inclusion rates, offering cost-effectiveness and improved palatability without compromising nutritional profiles. These innovations provide a competitive advantage by addressing specific challenges in animal nutrition and appealing to the evolving preferences of livestock producers seeking efficient and sustainable feed solutions.

Report Segmentation & Scope

This comprehensive report segments the Feed Flavors and Sweeteners Market by Sub Additive into Flavors and Sweeteners. The Flavors segment encompasses a wide range of aromatic compounds designed to mask undesirable tastes and stimulate appetite, contributing to improved feed intake and animal performance. The Sweeteners segment focuses on ingredients that enhance the palatability of feed, encouraging consumption and potentially improving nutrient utilization.

Further segmentation by Animal includes Ruminants, further broken down into Beef Cattle, Dairy Cattle, and Other Ruminants. This detailed analysis addresses the unique nutritional and palatability needs of these crucial livestock categories. The Swine segment is analyzed independently, recognizing the specific dietary requirements and production cycles of pigs. The Other Animals category covers a broad spectrum including poultry, aquaculture, and companion animals, highlighting the diverse applications of feed flavors and sweeteners. Growth projections and market sizes are analyzed for each segment, providing granular insights into competitive dynamics and future opportunities.

Key Drivers of Feed Flavors And Sweeteners Market Growth

Several key drivers are propelling the growth of the Feed Flavors and Sweeteners Market.

- Increasing global demand for animal protein: A rising world population and improving living standards directly translate to a higher demand for meat, dairy, and eggs, necessitating efficient livestock production and optimized feed.

- Growing awareness of the impact of palatability on animal performance: Livestock producers recognize that enhanced feed intake through appealing flavors and sweeteners leads to improved growth rates, better feed conversion ratios, and reduced instances of feed rejection.

- Technological advancements in flavor and sweetener development: Innovations in natural flavor extraction, synthetic flavor creation, and the development of novel sweetening agents offer more effective and cost-efficient solutions. For example, the development of high-potency sweeteners allows for significant palatability enhancement with minimal inclusion rates.

- Focus on animal health and welfare: The use of flavors can help reduce stress in animals, especially during weaning or dietary changes, leading to improved well-being and productivity.

- Expansion of livestock farming in emerging economies: Rapid industrialization of animal agriculture in regions like Asia-Pacific is creating substantial demand for feed additives.

- Regulatory support for feed quality and safety: Stringent regulations often encourage the use of high-quality feed ingredients, including those that ensure optimal nutrient intake.

Challenges in the Feed Flavors And Sweeteners Market Sector

Despite the positive growth trajectory, the Feed Flavors and Sweeteners Market faces several challenges.

- Fluctuating raw material prices: The cost and availability of natural ingredients used in flavor production can be subject to market volatility, impacting overall production costs and profitability.

- Stringent regulatory approvals: Obtaining regulatory approval for new feed additives can be a lengthy and complex process, varying significantly across different geographical regions.

- Consumer perception of artificial ingredients: While synthetic flavors offer cost and efficacy benefits, there is a growing consumer preference for natural and clean-label ingredients, creating a challenge for products perceived as artificial.

- Supply chain disruptions: Global events, such as pandemics or geopolitical issues, can disrupt the supply chain for raw materials and finished products, leading to delays and increased costs.

- Competition from generic products: The market faces competition from generic feed additives, which can put pressure on pricing and profit margins for branded products.

- Educating end-users on the benefits: While the benefits of feed flavors and sweeteners are recognized, ongoing education and demonstration of their economic advantages are crucial for broader adoption, especially among smaller producers.

Leading Players in the Feed Flavors And Sweeteners Market Market

- Prinova Group LLC

- Solvay S A

- Phytobiotics Futterzusatzstoffe GmbH

- Archer Daniel Midland Co

- Arvesta (Palital Feed Additives B V)

- Alltech Inc

- Innov Ad NV/SA

- Adisseo

- Biovet S A

Key Developments in Feed Flavors And Sweeteners Market Sector

- May 2022: Innovad acquired Scentarom, a developer and manufacturer of feed flavors and fragrances. This acquisition strengthened Innovad's position as a primary producer and increased its capacity to support the growing demand for feed palatability and essential oil products.

- June 2021: Phytobiotics established its own company, Phytobiotics Iberica, with its headquarters in Malaga. This strategic move was aimed at addressing the rapidly expanding Spain and Portugal market for premixed animal feed and plant production requirements.

- May 2021: Phytobiotics introduced Miracol, an innovative animal feed flavoring solution designed to effectively address issues related to animal feed intake problems, thereby enhancing palatability and consumption.

Strategic Feed Flavors And Sweeteners Market Market Outlook

The strategic outlook for the Feed Flavors and Sweeteners Market is exceptionally promising, driven by ongoing global trends in food security and sustainable animal agriculture. Future market potential lies in the continued development of natural and sustainable feed additives, catering to increasing consumer demand for ethically produced animal products. Strategic opportunities include expansion into rapidly growing emerging markets in Asia-Pacific and Latin America, where livestock production is industrializing. Furthermore, advancements in precision nutrition will create demand for highly specialized flavor and sweetener formulations tailored to specific animal breeds, life stages, and dietary requirements. Investments in research and development to create synergistic effects between flavors, sweeteners, and other feed additives will be crucial for market leaders. The integration of digital technologies for monitoring feed intake and animal response will also offer strategic advantages.

Feed Flavors And Sweeteners Market Segmentation

-

1. Sub Additive

- 1.1. Flavors

- 1.2. Sweeteners

-

2. Animal

-

2.1. Ruminants

-

2.1.1. By Sub Animal

- 2.1.1.1. Beef Cattle

- 2.1.1.2. Dairy Cattle

- 2.1.1.3. Other Ruminants

-

2.1.1. By Sub Animal

- 2.2. Swine

- 2.3. Other Animals

-

2.1. Ruminants

Feed Flavors And Sweeteners Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Feed Flavors And Sweeteners Market Regional Market Share

Geographic Coverage of Feed Flavors And Sweeteners Market

Feed Flavors And Sweeteners Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.25% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Livestock Population; Area Under Forage Production is Increasing; Increasing Demand for Animal Products

- 3.3. Market Restrains

- 3.3.1. Competition Amongst Industries and High Input Prices; Growing Shift Toward Vegan-Based Diet

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Feed Flavors And Sweeteners Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sub Additive

- 5.1.1. Flavors

- 5.1.2. Sweeteners

- 5.2. Market Analysis, Insights and Forecast - by Animal

- 5.2.1. Ruminants

- 5.2.1.1. By Sub Animal

- 5.2.1.1.1. Beef Cattle

- 5.2.1.1.2. Dairy Cattle

- 5.2.1.1.3. Other Ruminants

- 5.2.1.1. By Sub Animal

- 5.2.2. Swine

- 5.2.3. Other Animals

- 5.2.1. Ruminants

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Sub Additive

- 6. North America Feed Flavors And Sweeteners Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Sub Additive

- 6.1.1. Flavors

- 6.1.2. Sweeteners

- 6.2. Market Analysis, Insights and Forecast - by Animal

- 6.2.1. Ruminants

- 6.2.1.1. By Sub Animal

- 6.2.1.1.1. Beef Cattle

- 6.2.1.1.2. Dairy Cattle

- 6.2.1.1.3. Other Ruminants

- 6.2.1.1. By Sub Animal

- 6.2.2. Swine

- 6.2.3. Other Animals

- 6.2.1. Ruminants

- 6.1. Market Analysis, Insights and Forecast - by Sub Additive

- 7. South America Feed Flavors And Sweeteners Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Sub Additive

- 7.1.1. Flavors

- 7.1.2. Sweeteners

- 7.2. Market Analysis, Insights and Forecast - by Animal

- 7.2.1. Ruminants

- 7.2.1.1. By Sub Animal

- 7.2.1.1.1. Beef Cattle

- 7.2.1.1.2. Dairy Cattle

- 7.2.1.1.3. Other Ruminants

- 7.2.1.1. By Sub Animal

- 7.2.2. Swine

- 7.2.3. Other Animals

- 7.2.1. Ruminants

- 7.1. Market Analysis, Insights and Forecast - by Sub Additive

- 8. Europe Feed Flavors And Sweeteners Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Sub Additive

- 8.1.1. Flavors

- 8.1.2. Sweeteners

- 8.2. Market Analysis, Insights and Forecast - by Animal

- 8.2.1. Ruminants

- 8.2.1.1. By Sub Animal

- 8.2.1.1.1. Beef Cattle

- 8.2.1.1.2. Dairy Cattle

- 8.2.1.1.3. Other Ruminants

- 8.2.1.1. By Sub Animal

- 8.2.2. Swine

- 8.2.3. Other Animals

- 8.2.1. Ruminants

- 8.1. Market Analysis, Insights and Forecast - by Sub Additive

- 9. Middle East & Africa Feed Flavors And Sweeteners Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Sub Additive

- 9.1.1. Flavors

- 9.1.2. Sweeteners

- 9.2. Market Analysis, Insights and Forecast - by Animal

- 9.2.1. Ruminants

- 9.2.1.1. By Sub Animal

- 9.2.1.1.1. Beef Cattle

- 9.2.1.1.2. Dairy Cattle

- 9.2.1.1.3. Other Ruminants

- 9.2.1.1. By Sub Animal

- 9.2.2. Swine

- 9.2.3. Other Animals

- 9.2.1. Ruminants

- 9.1. Market Analysis, Insights and Forecast - by Sub Additive

- 10. Asia Pacific Feed Flavors And Sweeteners Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Sub Additive

- 10.1.1. Flavors

- 10.1.2. Sweeteners

- 10.2. Market Analysis, Insights and Forecast - by Animal

- 10.2.1. Ruminants

- 10.2.1.1. By Sub Animal

- 10.2.1.1.1. Beef Cattle

- 10.2.1.1.2. Dairy Cattle

- 10.2.1.1.3. Other Ruminants

- 10.2.1.1. By Sub Animal

- 10.2.2. Swine

- 10.2.3. Other Animals

- 10.2.1. Ruminants

- 10.1. Market Analysis, Insights and Forecast - by Sub Additive

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Prinova Group LLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Solvay S A

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Phytobiotics Futterzusatzstoffe GmbH

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Archer Daniel Midland Co

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Arvesta (Palital Feed Additives B V)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Alltech Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Innov Ad NV/SA

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Adisseo

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Biovet S A

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Prinova Group LLC

List of Figures

- Figure 1: Global Feed Flavors And Sweeteners Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Feed Flavors And Sweeteners Market Revenue (billion), by Sub Additive 2025 & 2033

- Figure 3: North America Feed Flavors And Sweeteners Market Revenue Share (%), by Sub Additive 2025 & 2033

- Figure 4: North America Feed Flavors And Sweeteners Market Revenue (billion), by Animal 2025 & 2033

- Figure 5: North America Feed Flavors And Sweeteners Market Revenue Share (%), by Animal 2025 & 2033

- Figure 6: North America Feed Flavors And Sweeteners Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Feed Flavors And Sweeteners Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Feed Flavors And Sweeteners Market Revenue (billion), by Sub Additive 2025 & 2033

- Figure 9: South America Feed Flavors And Sweeteners Market Revenue Share (%), by Sub Additive 2025 & 2033

- Figure 10: South America Feed Flavors And Sweeteners Market Revenue (billion), by Animal 2025 & 2033

- Figure 11: South America Feed Flavors And Sweeteners Market Revenue Share (%), by Animal 2025 & 2033

- Figure 12: South America Feed Flavors And Sweeteners Market Revenue (billion), by Country 2025 & 2033

- Figure 13: South America Feed Flavors And Sweeteners Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Feed Flavors And Sweeteners Market Revenue (billion), by Sub Additive 2025 & 2033

- Figure 15: Europe Feed Flavors And Sweeteners Market Revenue Share (%), by Sub Additive 2025 & 2033

- Figure 16: Europe Feed Flavors And Sweeteners Market Revenue (billion), by Animal 2025 & 2033

- Figure 17: Europe Feed Flavors And Sweeteners Market Revenue Share (%), by Animal 2025 & 2033

- Figure 18: Europe Feed Flavors And Sweeteners Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Feed Flavors And Sweeteners Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Feed Flavors And Sweeteners Market Revenue (billion), by Sub Additive 2025 & 2033

- Figure 21: Middle East & Africa Feed Flavors And Sweeteners Market Revenue Share (%), by Sub Additive 2025 & 2033

- Figure 22: Middle East & Africa Feed Flavors And Sweeteners Market Revenue (billion), by Animal 2025 & 2033

- Figure 23: Middle East & Africa Feed Flavors And Sweeteners Market Revenue Share (%), by Animal 2025 & 2033

- Figure 24: Middle East & Africa Feed Flavors And Sweeteners Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa Feed Flavors And Sweeteners Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Feed Flavors And Sweeteners Market Revenue (billion), by Sub Additive 2025 & 2033

- Figure 27: Asia Pacific Feed Flavors And Sweeteners Market Revenue Share (%), by Sub Additive 2025 & 2033

- Figure 28: Asia Pacific Feed Flavors And Sweeteners Market Revenue (billion), by Animal 2025 & 2033

- Figure 29: Asia Pacific Feed Flavors And Sweeteners Market Revenue Share (%), by Animal 2025 & 2033

- Figure 30: Asia Pacific Feed Flavors And Sweeteners Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Feed Flavors And Sweeteners Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Feed Flavors And Sweeteners Market Revenue billion Forecast, by Sub Additive 2020 & 2033

- Table 2: Global Feed Flavors And Sweeteners Market Revenue billion Forecast, by Animal 2020 & 2033

- Table 3: Global Feed Flavors And Sweeteners Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Feed Flavors And Sweeteners Market Revenue billion Forecast, by Sub Additive 2020 & 2033

- Table 5: Global Feed Flavors And Sweeteners Market Revenue billion Forecast, by Animal 2020 & 2033

- Table 6: Global Feed Flavors And Sweeteners Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Feed Flavors And Sweeteners Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Feed Flavors And Sweeteners Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Feed Flavors And Sweeteners Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Feed Flavors And Sweeteners Market Revenue billion Forecast, by Sub Additive 2020 & 2033

- Table 11: Global Feed Flavors And Sweeteners Market Revenue billion Forecast, by Animal 2020 & 2033

- Table 12: Global Feed Flavors And Sweeteners Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil Feed Flavors And Sweeteners Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina Feed Flavors And Sweeteners Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Feed Flavors And Sweeteners Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Feed Flavors And Sweeteners Market Revenue billion Forecast, by Sub Additive 2020 & 2033

- Table 17: Global Feed Flavors And Sweeteners Market Revenue billion Forecast, by Animal 2020 & 2033

- Table 18: Global Feed Flavors And Sweeteners Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Feed Flavors And Sweeteners Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany Feed Flavors And Sweeteners Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France Feed Flavors And Sweeteners Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy Feed Flavors And Sweeteners Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain Feed Flavors And Sweeteners Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia Feed Flavors And Sweeteners Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux Feed Flavors And Sweeteners Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics Feed Flavors And Sweeteners Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Feed Flavors And Sweeteners Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Feed Flavors And Sweeteners Market Revenue billion Forecast, by Sub Additive 2020 & 2033

- Table 29: Global Feed Flavors And Sweeteners Market Revenue billion Forecast, by Animal 2020 & 2033

- Table 30: Global Feed Flavors And Sweeteners Market Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey Feed Flavors And Sweeteners Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel Feed Flavors And Sweeteners Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC Feed Flavors And Sweeteners Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa Feed Flavors And Sweeteners Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa Feed Flavors And Sweeteners Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Feed Flavors And Sweeteners Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global Feed Flavors And Sweeteners Market Revenue billion Forecast, by Sub Additive 2020 & 2033

- Table 38: Global Feed Flavors And Sweeteners Market Revenue billion Forecast, by Animal 2020 & 2033

- Table 39: Global Feed Flavors And Sweeteners Market Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China Feed Flavors And Sweeteners Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India Feed Flavors And Sweeteners Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan Feed Flavors And Sweeteners Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea Feed Flavors And Sweeteners Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Feed Flavors And Sweeteners Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania Feed Flavors And Sweeteners Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Feed Flavors And Sweeteners Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Feed Flavors And Sweeteners Market?

The projected CAGR is approximately 4.25%.

2. Which companies are prominent players in the Feed Flavors And Sweeteners Market?

Key companies in the market include Prinova Group LLC, Solvay S A, Phytobiotics Futterzusatzstoffe GmbH, Archer Daniel Midland Co, Arvesta (Palital Feed Additives B V), Alltech Inc, Innov Ad NV/SA, Adisseo, Biovet S A.

3. What are the main segments of the Feed Flavors And Sweeteners Market?

The market segments include Sub Additive, Animal.

4. Can you provide details about the market size?

The market size is estimated to be USD 1 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Livestock Population; Area Under Forage Production is Increasing; Increasing Demand for Animal Products.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Competition Amongst Industries and High Input Prices; Growing Shift Toward Vegan-Based Diet.

8. Can you provide examples of recent developments in the market?

May 2022: Innovad acquired Scentarom, a developer and manufacturer of feed flavors and fragrances. Innovad's position as a primary producer will be strengthened by the acquisition, which will also increase capacity to support the growth in feed palatability and essential oil products.June 2021: Phytobiotics established its own company, Phytobiotics Iberica, with its headquarters in Malaga to address the rapidly expanding Spain and Portugal market for premixed animal feed and plant production requirements.May 2021: Phytobiotics introduced Miracol, an animal feed flavoring solution that addresses problems with animal feed intake.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Feed Flavors And Sweeteners Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Feed Flavors And Sweeteners Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Feed Flavors And Sweeteners Market?

To stay informed about further developments, trends, and reports in the Feed Flavors And Sweeteners Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence