Key Insights

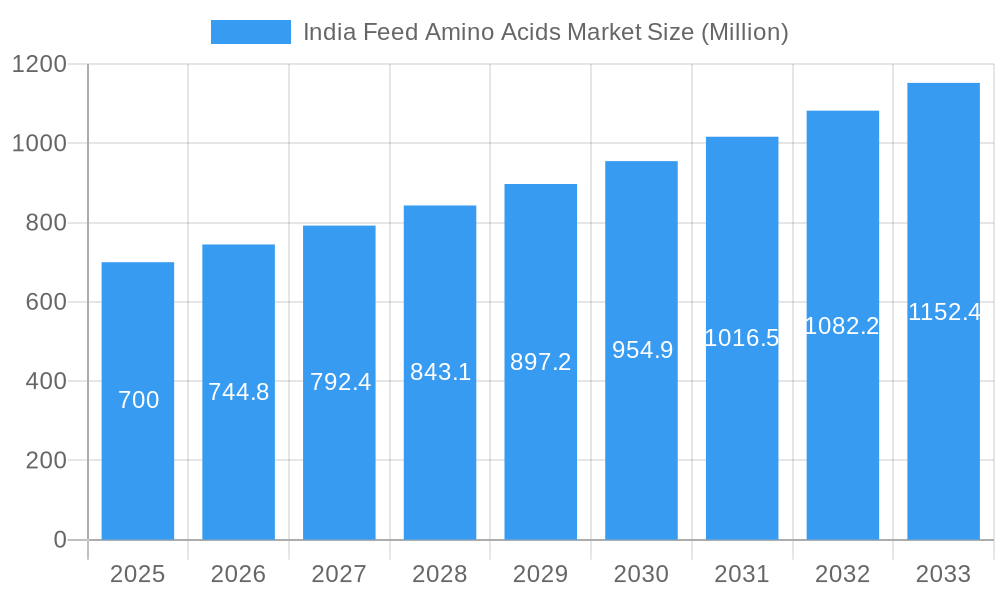

The Indian Feed Amino Acids Market is poised for substantial expansion, driven by increasing demand for high-quality animal protein and the widespread adoption of modern animal husbandry. The market is projected to reach $33.72 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 8.3% through 2033. This robust growth is fueled by the thriving poultry and aquaculture sectors, alongside heightened farmer awareness of amino acid supplementation benefits for animal nutrition. Lysine, Methionine, and Threonine are expected to lead market share, optimizing animal growth, feed conversion, and health. The drive for sustainable animal farming further emphasizes the need for precise nutritional solutions, which amino acids effectively deliver.

India Feed Amino Acids Market Market Size (In Billion)

Evolving consumer preferences for healthier animal products are encouraging feed manufacturers to enhance formulations. While significant growth is anticipated, challenges like raw material price volatility and farmer education on optimal amino acid usage may arise. However, the market outlook remains highly positive, supported by government initiatives in animal husbandry and aquaculture, and continuous innovation from leading companies such as Kemin Industries, Evonik Industries AG, and Ajinomoto Co. Inc. These players are crucial in supplying diverse feed-grade amino acids, meeting the specific needs of aquaculture, poultry, ruminants, and swine, thus promoting an efficient and sustainable animal protein supply chain in India.

India Feed Amino Acids Market Company Market Share

Gain comprehensive insights into the Indian Feed Amino Acids Market, a vital sector for animal nutrition and sustainable livestock. This detailed analysis covers market size, growth drivers, challenges, and competitive landscapes, with a specific focus on Lysine, Methionine, Threonine, and Tryptophan across Poultry, Aquaculture, Ruminants, and Swine. Explore market dynamics, technological advancements, and the influence of key industry players shaping the future of animal feed in India.

India Feed Amino Acids Market Market Structure & Competitive Dynamics

The India feed amino acids market is characterized by a moderate to high level of market concentration, with a mix of established global players and emerging domestic manufacturers. Innovation ecosystems are thriving, driven by increasing R&D investments in novel amino acid production techniques and precision nutrition solutions. Regulatory frameworks are evolving, with a growing emphasis on animal welfare, food safety, and environmental sustainability influencing product development and market access. Product substitutes, while present in traditional feed ingredients, are increasingly being outperformed by the targeted efficacy of specific amino acids in optimizing animal growth and health. End-user trends are heavily influenced by the growing demand for animal protein, the rising adoption of advanced animal husbandry practices, and a heightened awareness of the nutritional requirements of various animal species. Mergers and acquisitions (M&A) activities are anticipated to play a significant role in market consolidation and expansion. Key players are strategically investing in production capacity expansion and technology integration to gain market share and enhance their competitive edge. The M&A deal values are projected to rise as companies seek to broaden their product portfolios and geographic reach within the Indian subcontinent.

- Market Concentration: Dominated by a few key global manufacturers with significant production capacities and strong distribution networks.

- Innovation Ecosystems: Fueled by collaborations between feed manufacturers, ingredient suppliers, and research institutions focusing on biotechnological advancements and precision feeding.

- Regulatory Frameworks: Increasingly stringent regulations concerning feed safety, quality, and traceability are shaping manufacturing standards and product approvals.

- Product Substitutes: Limited in efficacy compared to essential amino acids for specific performance enhancements in animal diets.

- End-User Trends: Driven by the growing Indian population's demand for meat, milk, and eggs, leading to increased demand for high-quality animal feed.

- M&A Activities: Strategic acquisitions and partnerships are expected to intensify, driven by the pursuit of market dominance and portfolio diversification.

India Feed Amino Acids Market Industry Trends & Insights

The India feed amino acids market is poised for robust growth, propelled by a confluence of compelling industry trends and evolving consumer preferences. The escalating demand for animal protein, driven by a rapidly growing population and increasing disposable incomes, stands as a primary growth catalyst. This surge necessitates more efficient and sustainable animal production, directly fueling the need for feed amino acids to optimize animal growth, reduce feed conversion ratios, and minimize environmental impact. Technological disruptions are revolutionizing the sector, with advancements in fermentation technology and synthetic biology enabling more cost-effective and environmentally friendly production of essential amino acids like lysine, methionine, and threonine. Digitalization, including AI-driven feed formulation and precision nutrition platforms, is gaining traction, allowing for tailored amino acid supplementation based on specific animal needs, thereby enhancing efficacy and reducing wastage. Consumer preferences are shifting towards healthier and sustainably produced animal products, prompting feed manufacturers to adopt superior nutritional strategies. This includes a greater emphasis on feed additives that not only promote growth but also enhance animal health and well-being, reducing the reliance on antibiotics. The competitive dynamics within the market are intensifying, with both global giants and nimble domestic players vying for market share. Strategic partnerships and collaborations, such as those between established companies and technology startups, are becoming increasingly common to leverage specialized expertise and expand market reach. The market penetration of essential amino acids is steadily increasing across all animal segments, reflecting a growing understanding of their nutritional importance among farmers and feed producers. The projected Compound Annual Growth Rate (CAGR) for the India feed amino acids market is robust, indicating a significant expansion trajectory over the forecast period. This growth is underpinned by government initiatives promoting animal husbandry, increasing investments in modern feed milling infrastructure, and a rising awareness of the economic benefits of utilizing amino acid supplements in animal diets. The overall trend points towards a more sophisticated and performance-driven animal feed industry in India, with amino acids playing a central role in achieving these objectives.

Dominant Markets & Segments in India Feed Amino Acids Market

The India feed amino acids market exhibits distinct dominance patterns across its various segments, driven by a combination of economic policies, infrastructure development, and inherent animal husbandry practices.

Poultry remains the most dominant animal segment, accounting for a substantial share of the feed amino acids market.

- Broiler Production: The sheer volume of broiler meat consumed in India, coupled with a highly efficient production cycle, makes it a prime market for amino acid supplementation. Farmers prioritize rapid growth and optimal feed conversion ratios, directly benefiting from the precise inclusion of lysine, methionine, and threonine. Government support for poultry farming, including subsidies and improved disease management protocols, further fuels this dominance.

- Layer Production: The increasing demand for eggs as an affordable source of protein also contributes significantly to the poultry segment's prominence. Amino acids are crucial for egg production, shell quality, and overall hen health, making them indispensable for commercial layer operations.

- Other Poultry Birds: While smaller in scale, the growing interest in niche poultry products also contributes to the overall demand.

Swine represents another significant and rapidly growing segment within the India feed amino acids market.

- Economic Policies: Government initiatives aimed at boosting the piggery sector, particularly in certain states, have led to increased investment and modernization. This translates to a greater adoption of scientifically formulated feeds, including essential amino acids for optimal piglet development and growth.

- Market Penetration: As understanding of precise nutrient requirements grows among swine farmers, the demand for specific amino acids to improve lean meat yield and reduce nitrogen excretion is on the rise.

Aquaculture is emerging as a high-growth potential segment, with increasing contributions to the feed amino acids market.

- Fish and Shrimp Production: India's vast coastline and extensive inland water bodies support a thriving aquaculture industry. The intensification of fish and shrimp farming practices necessitates balanced nutrition to achieve faster growth rates and improved survival. Methionine and lysine are particularly crucial for efficient protein synthesis in these aquatic species.

- Infrastructure Development: Investments in aquaculture infrastructure, including advanced hatcheries and feed mills, are creating a more conducive environment for the adoption of high-quality feed additives.

Ruminants, particularly Dairy Cattle, represent a segment with significant, albeit slower-paced, growth.

- Dairy Cattle: The focus on improving milk yield and quality in dairy herds drives the demand for amino acids, especially those that enhance protein synthesis and overall animal health. While ruminants have the ability to synthesize some amino acids, supplementation with specific limiting amino acids, such as methionine and lysine, can significantly improve milk production and reproductive performance. The growth in this segment is tied to dairy industry modernization and farmer education.

- Other Ruminants: While less significant, the demand from the sheep and goat sectors for improved meat and wool production also contributes to the overall ruminant segment.

Other Animals, encompassing pet food and specialty livestock, represent a niche but growing segment. The increasing pet ownership and the demand for premium pet food formulations, which often incorporate amino acids for optimal health and coat condition, are contributing to this segment's expansion.

India Feed Amino Acids Market Product Innovations

The India feed amino acids market is witnessing a wave of innovation focused on enhancing product efficacy, sustainability, and cost-effectiveness. Key developments include advancements in microbial fermentation techniques for producing lysine, methionine, and threonine with reduced environmental footprints. Innovations in coated and slow-release amino acid formulations are gaining traction, ensuring better nutrient absorption and minimizing wastage in animal diets. Furthermore, research into novel amino acid derivatives and combinations tailored for specific animal life stages and production goals is a significant trend. These product developments aim to provide targeted nutritional solutions that optimize animal performance, improve gut health, and reduce the reliance on traditional feed ingredients, thereby offering a competitive advantage to manufacturers and a higher return on investment for farmers.

Report Segmentation & Scope

This comprehensive report segments the India feed amino acids market based on key product categories and animal types, offering a granular view of market dynamics.

The report covers Sub Additives including Lysine, Methionine, Threonine, Tryptophan, and Other Amino Acids. Each of these essential amino acids plays a distinct role in animal nutrition, with Lysine and Methionine often being the most limiting in common feed ingredients, leading to higher demand. The market size and growth projections for each sub-additive are detailed.

The Animal segmentation includes Aquaculture (Fish, Shrimp, Other Aquaculture Species), Poultry (Broiler, Layer, Other Poultry Birds), Ruminants (Dairy Cattle, Other Ruminants), Swine, and Other Animals. The report analyzes the specific nutritional requirements and market penetration of amino acids within each of these categories, highlighting the dominant animal segments and their growth trajectories. Competitive dynamics within each segment, including the influence of specific feed formulations and farming practices, are also discussed.

Key Drivers of India Feed Amino Acids Market Growth

The India feed amino acids market is propelled by several key drivers, fostering its expansion and increasing adoption.

- Growing Demand for Animal Protein: A rising population and increasing disposable incomes are escalating the consumption of meat, milk, and eggs, necessitating increased and more efficient animal production.

- Technological Advancements in Feed Production: Innovations in feed formulation and manufacturing, including precision nutrition and biotechnological production of amino acids, are enhancing efficacy and reducing costs.

- Government Initiatives and Policies: Supportive government policies promoting animal husbandry, dairy farming, and aquaculture are creating a favorable environment for the feed industry.

- Increasing Awareness of Animal Nutrition: Farmers and feed manufacturers are becoming more aware of the critical role of essential amino acids in optimizing animal growth, health, and productivity, leading to higher adoption rates.

- Focus on Sustainable Animal Production: The need to reduce the environmental impact of livestock farming, such as lower nitrogen excretion, is driving the demand for amino acid-supplemented feeds that improve nutrient utilization.

Challenges in the India Feed Amino Acids Market Sector

Despite its promising growth, the India feed amino acids market faces several challenges that can impede its full potential.

- Volatility in Raw Material Prices: Fluctuations in the prices of key raw materials used in amino acid production, such as corn and soy, can impact manufacturing costs and final product pricing.

- Supply Chain Disruptions: Logistical challenges and infrastructure limitations in certain regions of India can lead to delays and increased costs in the supply chain.

- Limited Awareness and Education Among Smallholder Farmers: A significant portion of India's livestock is managed by smallholder farmers who may have limited access to information and resources on the benefits of amino acid supplementation.

- Stringent Regulatory Approvals: Navigating the complex and sometimes lengthy regulatory approval processes for new feed additives can be a barrier to market entry for some players.

- Price Sensitivity of the Indian Market: The cost-effectiveness of amino acid supplementation is a crucial factor for many farmers, necessitating competitive pricing strategies.

Leading Players in the India Feed Amino Acids Market Market

- Prinova Group LLC

- Kemin Industries

- Evonik Industries AG

- SHV (Nutreco NV

- Ajinomoto Co Inc

- Archer Daniel Midland Co

- Lonza Group Ltd

- Alltech Inc

- IFF(Danisco Animal Nutrition)

- Adisseo

Key Developments in India Feed Amino Acids Market Sector

- October 2022: Evonik and BASF formed a partnership granting Evonik non-exclusive licensing rights to OpteinicsTM, a digital solution aimed at improving comprehension and reducing the environmental impact of the animal protein and feed industries.

- December 2021: Nutreco partnered with the tech start-up Stellapps, granting the company access to sell feed products, premixes, and feed additives to three million smallholder farmers utilizing Stellapps’ technology.

- February 2021: IFF collaborated with DuPont’s Nutrition & Biosciences, continuing operations under the IFF banner. This merger created a combined company valued at USD 45.4 billion on an enterprise value basis, forming leading ingredients and solutions for customers worldwide.

Strategic India Feed Amino Acids Market Market Outlook

The strategic outlook for the India feed amino acids market is overwhelmingly positive, driven by sustained demand for animal protein, technological advancements, and supportive industry trends. Key growth accelerators include the expanding poultry and aquaculture sectors, which are increasingly adopting scientifically formulated feeds. The rising adoption of precision nutrition and digital solutions will further optimize amino acid utilization, leading to improved animal health and reduced environmental impact. Strategic opportunities lie in catering to the evolving needs of smallholder farmers through accessible and cost-effective solutions, as well as in further research and development of novel amino acid applications. Companies that can effectively navigate regulatory landscapes, ensure robust supply chains, and foster strong relationships with end-users are well-positioned to capitalize on the significant market potential and achieve sustained growth in this dynamic sector.

India Feed Amino Acids Market Segmentation

-

1. Sub Additive

- 1.1. Lysine

- 1.2. Methionine

- 1.3. Threonine

- 1.4. Tryptophan

- 1.5. Other Amino Acids

-

2. Animal

-

2.1. Aquaculture

-

2.1.1. By Sub Animal

- 2.1.1.1. Fish

- 2.1.1.2. Shrimp

- 2.1.1.3. Other Aquaculture Species

-

2.1.1. By Sub Animal

-

2.2. Poultry

- 2.2.1. Broiler

- 2.2.2. Layer

- 2.2.3. Other Poultry Birds

-

2.3. Ruminants

- 2.3.1. Dairy Cattle

- 2.3.2. Other Ruminants

- 2.4. Swine

- 2.5. Other Animals

-

2.1. Aquaculture

India Feed Amino Acids Market Segmentation By Geography

- 1. India

India Feed Amino Acids Market Regional Market Share

Geographic Coverage of India Feed Amino Acids Market

India Feed Amino Acids Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Livestock Population; Area Under Forage Production is Increasing; Increasing Demand for Animal Products

- 3.3. Market Restrains

- 3.3.1. Competition Amongst Industries and High Input Prices; Growing Shift Toward Vegan-Based Diet

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Feed Amino Acids Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sub Additive

- 5.1.1. Lysine

- 5.1.2. Methionine

- 5.1.3. Threonine

- 5.1.4. Tryptophan

- 5.1.5. Other Amino Acids

- 5.2. Market Analysis, Insights and Forecast - by Animal

- 5.2.1. Aquaculture

- 5.2.1.1. By Sub Animal

- 5.2.1.1.1. Fish

- 5.2.1.1.2. Shrimp

- 5.2.1.1.3. Other Aquaculture Species

- 5.2.1.1. By Sub Animal

- 5.2.2. Poultry

- 5.2.2.1. Broiler

- 5.2.2.2. Layer

- 5.2.2.3. Other Poultry Birds

- 5.2.3. Ruminants

- 5.2.3.1. Dairy Cattle

- 5.2.3.2. Other Ruminants

- 5.2.4. Swine

- 5.2.5. Other Animals

- 5.2.1. Aquaculture

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Sub Additive

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Prinova Group LLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Kemin Industries

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Evonik Industries AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 SHV (Nutreco NV

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Ajinomoto Co Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Archer Daniel Midland Co

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Lonza Group Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Alltech Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 IFF(Danisco Animal Nutrition)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Adisseo

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Prinova Group LLC

List of Figures

- Figure 1: India Feed Amino Acids Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India Feed Amino Acids Market Share (%) by Company 2025

List of Tables

- Table 1: India Feed Amino Acids Market Revenue billion Forecast, by Sub Additive 2020 & 2033

- Table 2: India Feed Amino Acids Market Revenue billion Forecast, by Animal 2020 & 2033

- Table 3: India Feed Amino Acids Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: India Feed Amino Acids Market Revenue billion Forecast, by Sub Additive 2020 & 2033

- Table 5: India Feed Amino Acids Market Revenue billion Forecast, by Animal 2020 & 2033

- Table 6: India Feed Amino Acids Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Feed Amino Acids Market?

The projected CAGR is approximately 8.3%.

2. Which companies are prominent players in the India Feed Amino Acids Market?

Key companies in the market include Prinova Group LLC, Kemin Industries, Evonik Industries AG, SHV (Nutreco NV, Ajinomoto Co Inc, Archer Daniel Midland Co, Lonza Group Ltd, Alltech Inc, IFF(Danisco Animal Nutrition), Adisseo.

3. What are the main segments of the India Feed Amino Acids Market?

The market segments include Sub Additive, Animal.

4. Can you provide details about the market size?

The market size is estimated to be USD 33.72 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Livestock Population; Area Under Forage Production is Increasing; Increasing Demand for Animal Products.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Competition Amongst Industries and High Input Prices; Growing Shift Toward Vegan-Based Diet.

8. Can you provide examples of recent developments in the market?

October 2022: The partnership between Evonik and BASF allowed Evonik certain non-exclusive licensing rights to OpteinicsTM, a digital solution to improve comprehension and reduce the environmental impact of the animal protein and feed industries.December 2021: Nutreco partnered with the tech start-up Stellapps. This will give accessibility for the company to sell feed products, premixes, and feed additives to three million smallholder farmers using Stellapps’ technology.February 2021: IFF collaborated with DuPont’s Nutrition & Biosciences and continues to operate under IFF. The deal values the combined company at USD 45.4 billion on an enterprise value basis. The definitive agreement for the merger will create leading ingredients and solutions for customers worldwide.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Feed Amino Acids Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Feed Amino Acids Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Feed Amino Acids Market?

To stay informed about further developments, trends, and reports in the India Feed Amino Acids Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence