Key Insights

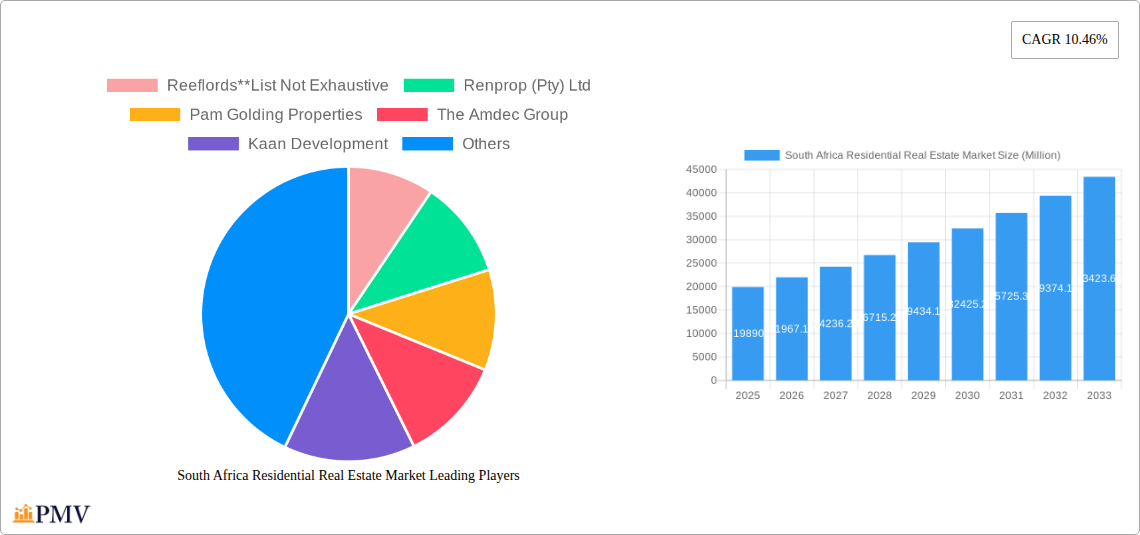

The South African residential real estate market, valued at $19.89 billion in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 10.46% from 2025 to 2033. This expansion is fueled by several key factors. Increasing urbanization, particularly in major cities like Johannesburg, Cape Town, and Durban, is driving demand for housing. A growing middle class with increased disposable income is also a significant contributor, alongside ongoing infrastructure development and government initiatives aimed at improving housing affordability. The market is segmented by property type (villas and landed houses, condominiums and apartments) and location, reflecting varying price points and demand across different regions. While constraints such as fluctuating interest rates and economic uncertainty might pose challenges, the overall positive economic outlook and sustained population growth are anticipated to outweigh these headwinds. The presence of established developers such as Reeflords, Renprop, Pam Golding Properties, and others, indicates a competitive but dynamic market with ample opportunities for investment and growth.

South Africa Residential Real Estate Market Market Size (In Billion)

The market's performance is expected to vary across different segments. The luxury villa and landed house segment is likely to witness stronger growth due to high demand from affluent buyers, while the condominium and apartment sector will experience steady growth driven by affordability and the increasing preference for urban living. Geographic variations are expected, with major metropolitan areas exhibiting higher growth rates compared to smaller cities and rural regions. Future projections indicate a continuous upward trend, though precise figures require further granular data. The expansion into the broader African market, with potential for development in countries like Sudan, Uganda, Tanzania, and Kenya, presents a promising avenue for future growth and investment for established South African developers. Analyzing historical data from 2019-2024, and considering the current CAGR, allows for a projection of a healthy and expanding South African residential real estate sector.

South Africa Residential Real Estate Market Company Market Share

South Africa Residential Real Estate Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the South Africa residential real estate market, covering the period 2019-2033, with a focus on 2025. It offers in-depth insights into market structure, competitive dynamics, industry trends, key segments, and future growth potential. This report is an essential resource for investors, developers, real estate professionals, and anyone seeking a thorough understanding of this dynamic market. The report leverages extensive data analysis and expert insights to deliver actionable intelligence for informed decision-making.

South Africa Residential Real Estate Market Structure & Competitive Dynamics

This section analyzes the South African residential real estate market's competitive landscape, encompassing market concentration, innovation, regulatory frameworks, product substitutes, end-user trends, and mergers and acquisitions (M&A) activities. The market is characterized by a mix of large national players and smaller regional firms. Market share is highly fragmented, with no single company holding a dominant position. However, several large firms, like Pam Golding Properties and Renprop (Pty) Ltd, command significant market presence in specific regions and segments.

- Market Concentration: Moderate, with a fragmented landscape featuring both large and small players. Market share data suggests that the top five players collectively control approximately xx% of the market, while the remaining xx% is distributed amongst numerous smaller firms.

- Innovation Ecosystem: The sector is witnessing increasing adoption of PropTech solutions, impacting marketing, property management, and transaction processes. Innovation is driven by both established firms and startups.

- Regulatory Framework: The South African government's policies on property ownership, zoning, and building regulations significantly influence market dynamics. Recent changes in regulations have xx impact on development activities and investment.

- Product Substitutes: Limited direct substitutes exist for residential properties. However, alternative housing solutions, like rental apartments and shared living spaces, are gaining traction, particularly in urban areas.

- End-User Trends: Demand is shaped by factors like demographic shifts, urbanization, and changing lifestyle preferences. The preference for specific property types (e.g., apartments versus houses) varies across regions.

- M&A Activities: The South African residential real estate market has experienced a moderate level of M&A activity in recent years, with deal values ranging from xx Million to xx Million. These activities are largely driven by consolidation efforts and expansion strategies of major players.

South Africa Residential Real Estate Market Industry Trends & Insights

This section delves into the key trends driving the South African residential real estate market's growth. Analysis includes market growth drivers, technological disruptions, evolving consumer preferences, and intensifying competition. The market is expected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033).

The market growth is primarily fueled by urbanization, population growth, and increasing disposable incomes. Technological disruptions, such as the use of online platforms for property listings and virtual tours, are transforming how properties are marketed and sold. Consumer preferences are shifting towards sustainable and energy-efficient housing, influencing construction and design trends. Competitive dynamics are marked by consolidation, technological advancements, and evolving consumer expectations. Market penetration of new technologies is at approximately xx% in 2025 and expected to reach xx% by 2033.

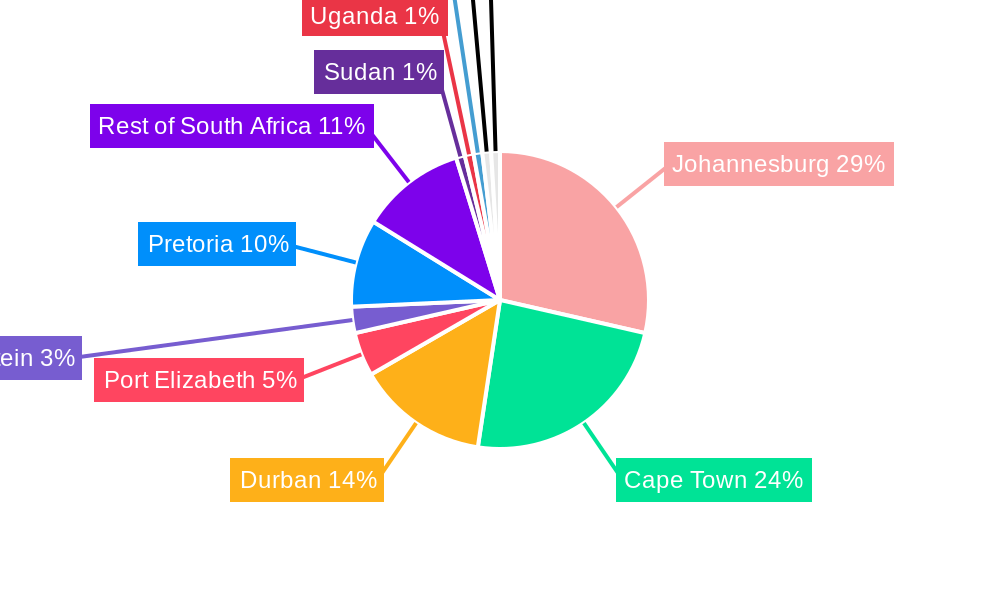

Dominant Markets & Segments in South Africa Residential Real Estate Market

This section identifies the dominant regions and property types within the South African residential real estate market.

By Key Cities: Johannesburg and Cape Town are the dominant markets, driven by strong economic activity, infrastructure development, and high population density. Pretoria and Durban also hold substantial market share, while Port Elizabeth and Bloemfontein display relatively lower activity. The “Rest of South Africa” segment exhibits moderate growth.

By Type: The demand for condominiums and apartments is increasing in urban areas, particularly in major cities, due to affordability and lifestyle preferences. Villas and landed houses remain dominant in suburban and peri-urban areas, influenced by land availability and consumer preferences.

Key Drivers of Dominance:

- Johannesburg & Cape Town: Strong economic activity, well-developed infrastructure, high population density, and significant investment in new developments.

- Villas & Landed Houses: Preference for larger living spaces, greater privacy, and potential for future appreciation.

- Condominiums & Apartments: Affordability, convenience, and attractive lifestyle features in urban areas.

South Africa Residential Real Estate Market Product Innovations

The South African residential real estate market is witnessing the integration of smart home technologies, sustainable building materials, and innovative design solutions. These innovations enhance property value, energy efficiency, and lifestyle appeal. The market is witnessing increasing adoption of modular construction and 3D printing techniques, which could revolutionize the speed and efficiency of the construction process. Green building certifications are becoming more prevalent, reflecting growing environmental consciousness among both developers and buyers.

Report Segmentation & Scope

This report segments the South African residential real estate market by key cities (Johannesburg, Cape Town, Durban, Port Elizabeth, Bloemfontein, Pretoria, and Rest of South Africa) and property types (villas and landed houses, condominiums and apartments). Each segment's growth projections, market size, and competitive dynamics are examined in detail. The report's historical period covers 2019-2024, the base year is 2025, and the forecast period spans 2025-2033. The market size in 2025 is estimated to be xx Million.

Key Drivers of South Africa Residential Real Estate Market Growth

Several key factors drive the growth of the South African residential real estate market. These include sustained economic growth, rising urbanization, increasing population, and government initiatives aimed at improving housing affordability. Technological advancements, such as the use of PropTech platforms and innovative construction techniques, also contribute to market expansion. Favorable interest rates and investment in infrastructure further stimulate demand.

Challenges in the South Africa Residential Real Estate Market Sector

Despite the growth potential, the South African residential real estate market faces various challenges. These include a shortage of affordable housing, land constraints in urban areas, and regulatory complexities. Infrastructure limitations in some regions and fluctuating interest rates also affect market stability. Competition from alternative housing solutions and economic uncertainty can impact investor confidence and development activity. The impact of these challenges is estimated to reduce annual growth by approximately xx% in certain segments.

Leading Players in the South Africa Residential Real Estate Market Market

- Reeflords

- Renprop (Pty) Ltd

- Pam Golding Properties

- The Amdec Group

- Kaan Development

- Pipilo Projects

- Devmark Property Group

- RDC Properties

- Harcourts International Ltd

- Legaro Property Development

Key Developments in South Africa Residential Real Estate Market Sector

- June 2022: Construction commenced on Rubik, a new mixed-use building in Cape Town's CBD, featuring luxury residential apartments. This signifies continued investment in high-end residential projects in prime locations.

- July 2022: The IFC's investment in Alleyroads to build over 1,000 rental apartments in Johannesburg highlights efforts to address the affordable housing shortage. This signals a positive trend towards increased supply in the affordable housing segment.

Strategic South Africa Residential Real Estate Market Outlook

The South African residential real estate market is poised for continued growth, driven by ongoing urbanization, economic expansion, and government initiatives. Strategic opportunities exist in developing affordable housing, sustainable housing solutions, and leveraging technology to improve market efficiency. Focusing on emerging markets and catering to evolving consumer preferences are crucial for long-term success. The market is projected to experience significant growth, particularly in the affordable housing and sustainable development segments.

South Africa Residential Real Estate Market Segmentation

-

1. Type

- 1.1. Villas and Landed Houses

- 1.2. Condominiums and Apartments

-

2. Key Cities

- 2.1. Johannesburg

- 2.2. Cape Town

- 2.3. Durban

- 2.4. Port Elizabeth

- 2.5. Bloemfontein

- 2.6. Pretoria

- 2.7. Rest of South Africa

South Africa Residential Real Estate Market Segmentation By Geography

- 1. South Africa

South Africa Residential Real Estate Market Regional Market Share

Geographic Coverage of South Africa Residential Real Estate Market

South Africa Residential Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.46% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 4.; Growing urbanisation in the countries4.; Increasing support of private sector to meet infrastructural growth in various sectors such as water

- 3.2.2 energy

- 3.2.3 transportation

- 3.2.4 and communications

- 3.3. Market Restrains

- 3.3.1. 4.; Lack of quality and quantity of infrastructure

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Sectional Title Living in South Africa

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Residential Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Villas and Landed Houses

- 5.1.2. Condominiums and Apartments

- 5.2. Market Analysis, Insights and Forecast - by Key Cities

- 5.2.1. Johannesburg

- 5.2.2. Cape Town

- 5.2.3. Durban

- 5.2.4. Port Elizabeth

- 5.2.5. Bloemfontein

- 5.2.6. Pretoria

- 5.2.7. Rest of South Africa

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Reeflords**List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Renprop (Pty) Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Pam Golding Properties

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 The Amdec Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Kaan Development

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Pipilo Projects

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Devmark Property Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 RDC Properties

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Harcourts International Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Legaro Property Development

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Reeflords**List Not Exhaustive

List of Figures

- Figure 1: South Africa Residential Real Estate Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South Africa Residential Real Estate Market Share (%) by Company 2025

List of Tables

- Table 1: South Africa Residential Real Estate Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: South Africa Residential Real Estate Market Revenue Million Forecast, by Key Cities 2020 & 2033

- Table 3: South Africa Residential Real Estate Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: South Africa Residential Real Estate Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: South Africa Residential Real Estate Market Revenue Million Forecast, by Key Cities 2020 & 2033

- Table 6: South Africa Residential Real Estate Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Residential Real Estate Market?

The projected CAGR is approximately 10.46%.

2. Which companies are prominent players in the South Africa Residential Real Estate Market?

Key companies in the market include Reeflords**List Not Exhaustive, Renprop (Pty) Ltd, Pam Golding Properties, The Amdec Group, Kaan Development, Pipilo Projects, Devmark Property Group, RDC Properties, Harcourts International Ltd, Legaro Property Development.

3. What are the main segments of the South Africa Residential Real Estate Market?

The market segments include Type, Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD 19.89 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing urbanisation in the countries4.; Increasing support of private sector to meet infrastructural growth in various sectors such as water. energy. transportation. and communications.

6. What are the notable trends driving market growth?

Increasing Demand for Sectional Title Living in South Africa.

7. Are there any restraints impacting market growth?

4.; Lack of quality and quantity of infrastructure.

8. Can you provide examples of recent developments in the market?

July 2022- To improve access to affordable and sustainable housing in South Africa, IFC (International Finance Corporation) announced an investment to help South African residential property developer Alleyroads build over 1,000 rental apartments in the Johannesburg area.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Residential Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Residential Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Residential Real Estate Market?

To stay informed about further developments, trends, and reports in the South Africa Residential Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence