Key Insights

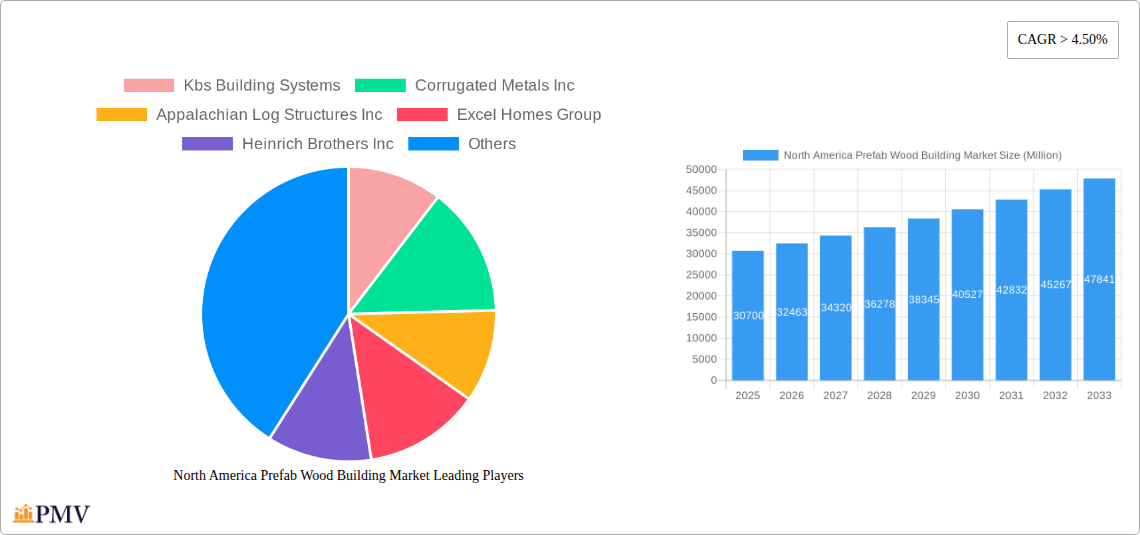

The North America Prefab Wood Building Market is poised for robust growth, with an estimated market size of USD 30.7 billion in 2025. This expansion is driven by an anticipated Compound Annual Growth Rate (CAGR) of 5.82% throughout the forecast period of 2025-2033. The increasing demand for sustainable and eco-friendly construction solutions is a primary catalyst, aligning with growing environmental consciousness and regulatory pressures to reduce carbon footprints in the building sector. Prefabricated wood structures offer a compelling alternative to traditional construction methods, characterized by faster build times, reduced waste, and enhanced quality control through factory-based production. The market is witnessing significant adoption across various applications, including single-family and multi-family residential projects, as well as commercial spaces like offices and hospitality venues. Innovations in wood panel systems, such as Cross-laminated timber (CLT), Nail-laminated timber (NLT), and Dowel-laminated timber (DLT), are further enhancing the structural integrity and design flexibility of prefabricated wood buildings, making them increasingly competitive for a wider range of construction needs.

North America Prefab Wood Building Market Market Size (In Billion)

The market dynamics are further shaped by evolving construction trends, including a greater emphasis on modular and offsite construction techniques to address labor shortages and project delays. While the inherent sustainability of wood is a significant driver, the market also faces certain restraints. These include the perceived higher upfront costs compared to some traditional materials, potential challenges in building code adoption for innovative wood products in certain regions, and the availability of skilled labor proficient in handling and assembling prefabricated timber components. Nevertheless, the long-term outlook remains highly positive. The consistent investment in research and development for advanced wood construction technologies, coupled with increasing consumer and developer preference for faster, more sustainable, and cost-effective building solutions, are expected to propel the North America Prefab Wood Building Market to new heights. Key players are actively innovating and expanding their offerings to capitalize on this burgeoning demand, positioning prefabricated wood construction as a mainstream and desirable option for the future of building.

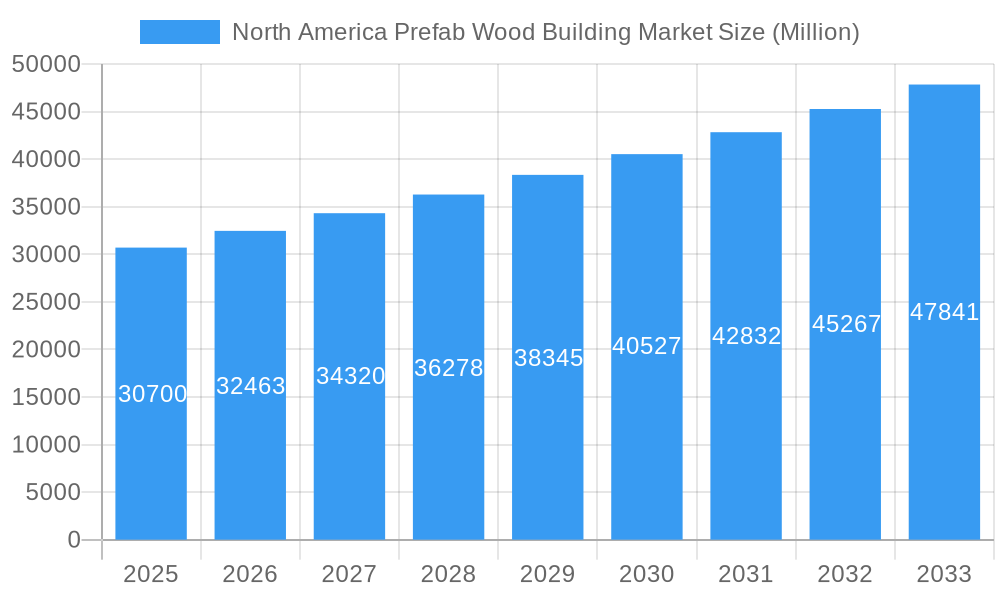

North America Prefab Wood Building Market Company Market Share

This in-depth market research report provides an exhaustive analysis of the North America Prefab Wood Building Market, covering historical trends, current dynamics, and future projections from 2019 to 2033. With a base year of 2025, the report meticulously details market segmentation, key drivers, challenges, and leading players, offering actionable insights for stakeholders in the modular construction, prefabricated homes, wood building solutions, and sustainable construction sectors. The North American prefab wood building market is anticipated to reach an impressive $XX billion by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of XX% during the forecast period.

North America Prefab Wood Building Market Market Structure & Competitive Dynamics

The North America Prefab Wood Building Market exhibits a moderately concentrated structure, with a mix of established large-scale manufacturers and agile niche players. Innovation ecosystems are thriving, driven by advancements in cross-laminated timber (CLT) technology and digital design tools. Regulatory frameworks are evolving, with increasing emphasis on building codes supporting sustainable materials and energy-efficient construction. Product substitutes, while present in traditional construction methods, are increasingly challenged by the speed, cost-effectiveness, and environmental benefits of prefab wood. End-user trends indicate a strong preference for single-family residential and multi-family residential applications, with growing interest in office and hospitality sectors. Mergers and acquisitions (M&A) activities are shaping the competitive landscape, with strategic consolidations aimed at expanding production capacity and market reach. Significant M&A deal values, estimated to be in the billions of dollars, underscore the strategic importance and growth potential of this market.

- Market Concentration: Moderate, with key players holding significant market share.

- Innovation Ecosystems: Driven by advanced wood technologies and digital integration.

- Regulatory Frameworks: Increasingly supportive of sustainable and prefab building.

- Product Substitutes: Traditional construction methods facing competition from prefab efficiency.

- End-User Trends: Strong demand in residential, growing interest in commercial sectors.

- M&A Activities: Strategic consolidations and expansions shaping the market.

North America Prefab Wood Building Market Industry Trends & Insights

The North America Prefab Wood Building Market is experiencing unprecedented growth, fueled by a confluence of compelling industry trends and evolving consumer preferences. The escalating demand for sustainable construction materials and green building practices is a primary growth driver, positioning prefab wood as an environmentally responsible alternative to conventional building methods. The inherent sustainability of wood, coupled with its carbon sequestration properties, resonates strongly with environmentally conscious consumers and increasingly stringent environmental regulations. Furthermore, the persistent shortage of skilled labor in the traditional construction industry significantly bolsters the adoption of prefabricated wood solutions. Prefabrication offers a controlled factory environment, reducing on-site labor requirements and mitigating project delays associated with labor scarcity.

Technological disruptions are continuously reshaping the market. Advances in mass timber construction, particularly Cross-Laminated Timber (CLT), Nail-Laminated Timber (NLT), and Dowel-Laminated Timber (DLT), have unlocked new possibilities for structural integrity, design flexibility, and architectural expression in wood buildings. These engineered wood products offer comparable strength to steel and concrete, enabling the construction of taller and more complex structures using wood. The integration of Building Information Modeling (BIM) and advanced manufacturing technologies in the prefabrication process further enhances precision, efficiency, and customization, leading to reduced material waste and improved project timelines.

Consumer preferences are shifting towards faster, more affordable, and aesthetically pleasing housing solutions. Prefabricated wood buildings excel in delivering projects within shorter timeframes and often at a lower overall cost compared to traditional site-built homes. The inherent warmth, natural beauty, and design versatility of wood also contribute to their growing appeal, allowing for personalized and modern living spaces. The single-family residential segment remains a dominant force, driven by a growing desire for homeownership and the ability to create bespoke living environments. However, the multi-family residential sector is witnessing rapid expansion, addressing the critical need for affordable and efficient housing in urban centers. The office and hospitality sectors are also increasingly exploring prefab wood solutions for their speed of construction, design flexibility, and sustainability credentials, aiming to create unique and eco-friendly spaces. The market penetration of prefabricated wood buildings is steadily increasing across North America, reflecting its growing acceptance and proven value proposition. The projected CAGR of XX% signifies a sustained and robust expansion trajectory for this dynamic market.

Dominant Markets & Segments in North America Prefab Wood Building Market

The North America Prefab Wood Building Market is characterized by the significant dominance of specific regions, countries, and product segments, driven by a combination of economic policies, infrastructure development, and evolving consumer demands. The United States currently holds the largest market share, attributed to its robust economy, extensive housing demand, and supportive government initiatives promoting sustainable construction. Canada follows closely, with a growing appreciation for eco-friendly building solutions and increasing investment in the prefabricated sector.

Within the Panel Systems segment, Cross-Laminated Timber (CLT) panels are emerging as a frontrunner. Their superior structural capabilities, fire resistance, and sustainability profile make them ideal for a wide range of applications, from residential dwellings to mid-rise commercial buildings. The ease of prefabrication and rapid on-site assembly of CLT panels significantly reduces construction time and labor costs. Nail-Laminated Timber (NLT) panels and Dowel-Laminated Timber (DLT) panels also command substantial market presence, offering cost-effective solutions for various structural and non-structural applications. Glue-Laminated Timber (GLT) columns and beams continue to be vital components, providing the necessary structural support and design flexibility for larger timber structures.

In terms of Application, the Single Family Residential segment remains the bedrock of the North America Prefab Wood Building Market. This dominance is fueled by ongoing demographic shifts, a desire for homeownership, and the inherent appeal of customizability and affordability offered by prefabricated solutions. The Multi-Family Residential segment is experiencing exponential growth, directly addressing the critical housing affordability crisis in urban areas across the continent. Prefabricated wood construction offers an efficient and cost-effective means to deliver much-needed housing units rapidly. The Office segment is witnessing a considerable uptake, with companies increasingly recognizing the sustainability benefits, faster project delivery, and unique aesthetic appeal of wood-based prefabricated structures for their corporate campuses and commercial spaces. The Hospitality sector is also actively adopting these solutions for boutique hotels, lodges, and eco-resorts, leveraging the natural ambiance and quick deployment capabilities.

- Dominant Regions & Countries:

- United States: Largest market share due to strong economy and demand.

- Canada: Growing adoption driven by sustainability and investment.

- Dominant Panel Systems:

- Cross-Laminated Timber (CLT) panels: Leading due to structural strength, sustainability, and fire resistance.

- Key Drivers: Growing demand for tall timber buildings, enhanced design flexibility, reduced construction timelines.

- Nail-Laminated Timber (NLT) panels: Cost-effective and versatile for various structural needs.

- Key Drivers: Affordability, widespread availability, proven performance in diverse applications.

- Dowel-Laminated Timber (DLT) panels: Efficient and environmentally friendly structural components.

- Key Drivers: Sustainable sourcing, lightweight nature, simplified assembly.

- Glue-Laminated Timber (GLT) columns and beams: Essential for large-span structures and complex designs.

- Key Drivers: High load-bearing capacity, aesthetic appeal, design freedom.

- Cross-Laminated Timber (CLT) panels: Leading due to structural strength, sustainability, and fire resistance.

- Dominant Applications:

- Single Family Residential: Largest segment driven by homeownership demand and customization.

- Key Drivers: Affordability, speed of construction, personalized designs, perceived value.

- Multi-Family Residential: Rapidly growing segment addressing housing shortages.

- Key Drivers: Urbanization, need for affordable housing, efficient construction timelines, scalable solutions.

- Office: Increasing adoption for sustainability and faster project completion.

- Key Drivers: Corporate sustainability goals, demand for unique workspace designs, reduced operational costs.

- Hospitality: Preferred for unique designs and quick deployment.

- Key Drivers: Growing demand for eco-lodges and boutique hotels, aesthetic appeal of natural materials, rapid return on investment.

- Single Family Residential: Largest segment driven by homeownership demand and customization.

North America Prefab Wood Building Market Product Innovations

Product innovations in the North America Prefab Wood Building Market are primarily focused on enhancing the performance, sustainability, and application versatility of wood-based building systems. Advancements in engineered wood products like CLT and glulam are enabling taller, more complex structures with improved fire safety and structural integrity. The development of pre-finished and modular wall systems, integrated with insulation, windows, and interior finishes, further streamlines on-site assembly and reduces construction time. Smart home technologies are increasingly being integrated into prefabricated wood units, offering enhanced energy efficiency and user convenience. The focus on circular economy principles is also driving innovation in material sourcing and waste reduction, making prefab wood buildings even more environmentally appealing.

Report Segmentation & Scope

This report segments the North America Prefab Wood Building Market by Panel Systems, including Cross-Laminated Timber (CLT) panels, Nail-Laminated Timber (NLT) panels, Dowel-Laminated Timber (DLT) panels, and Glue-Laminated Timber (GLT) columns and beams. The market is also segmented by Application, encompassing Single Family Residential, Multi-Family Residential, Office, Hospitality, and Others. The scope of the report covers historical data from 2019-2024, base year 2025, and forecast period 2025-2033, providing comprehensive market size, growth projections, and competitive landscape analysis for each segment.

- Panel Systems Segmentation:

- Cross-Laminated Timber (CLT) panels: Projected to experience a CAGR of XX% during the forecast period, driven by increasing demand for sustainable and structurally robust building solutions.

- Nail-Laminated Timber (NLT) panels: Expected to maintain a steady growth trajectory, offering a cost-effective and versatile option.

- Dowel-Laminated Timber (DLT) panels: Anticipated to see robust growth, fueled by advancements in manufacturing and increasing adoption in eco-friendly construction.

- Glue-Laminated Timber (GLT) columns and beams: Essential for large-scale projects, with consistent demand expected.

- Application Segmentation:

- Single Family Residential: To continue as the largest segment, with a projected CAGR of XX%.

- Multi-Family Residential: Expected to witness the highest growth rate, addressing housing shortages and urban density.

- Office: Growing adoption for corporate sustainability initiatives and faster project delivery.

- Hospitality: Niche segment with strong growth potential for unique and eco-friendly developments.

- Others: Including educational, healthcare, and industrial applications, exhibiting moderate growth.

Key Drivers of North America Prefab Wood Building Market Growth

The North America Prefab Wood Building Market is propelled by several key drivers. Growing environmental consciousness and the demand for sustainable building materials significantly favor wood construction, with its lower carbon footprint. Technological advancements in mass timber engineering, such as CLT and glulam, are enabling larger and more complex wood structures. The shortage of skilled labor in traditional construction and the desire for faster project completion times make prefabricated solutions highly attractive. Government incentives for green building and housing initiatives also play a crucial role in market expansion.

Challenges in the North America Prefab Wood Building Market Sector

Despite its strong growth, the North America Prefab Wood Building Market faces certain challenges. Stringent and evolving building codes in some regions can create hurdles for innovative wood construction. Perception issues and lack of awareness among some consumers and developers regarding the capabilities of modern wood buildings can slow adoption. Supply chain disruptions and fluctuating raw material costs can impact project timelines and profitability. Furthermore, competition from traditional construction methods and the need for specialized transportation and installation equipment can pose logistical challenges.

Leading Players in the North America Prefab Wood Building Market Market

- Kbs Building Systems

- Corrugated Metals Inc

- Appalachian Log Structures Inc

- Excel Homes Group

- Heinrich Brothers Inc

- Clayton Homes Inc

- Speed Space

- R P Crawford Co Inc

- Guerdon Modular Buildings

- Alta-Fab Structures

Key Developments in North America Prefab Wood Building Market Sector

- November 2022: In Canada, a 40m2 tiny prefabricated steel and wood house has been installed for vacations and short stays. Designed by Lloyoll Prefabs, this modular home was delivered by truck and set on a concrete slab. Its open floor plan maximizes space, featuring a kitchen, bathroom, master bedroom, and a loft bedroom. The design emphasizes a minimal ecological footprint and large windows for enhanced outdoor connectivity.

- August 2022: Volumetric Building Companies, a Philadelphia-based modular construction firm, acquired a manufacturing facility in Berwick, Pennsylvania. This strategic acquisition aims to expand their operations in the northeastern U.S., with a focus on producing multi-family housing units, including both steel and wood components, for buildings ranging from three to 20 stories.

Strategic North America Prefab Wood Building Market Market Outlook

The strategic outlook for the North America Prefab Wood Building Market is highly promising, driven by a clear trajectory of sustained growth and increasing market penetration. The ongoing shift towards sustainable and energy-efficient construction practices positions prefabricated wood solutions at the forefront of the industry. Key growth accelerators include the continuous innovation in mass timber technologies, the growing acceptance of modular construction as a viable and superior alternative to traditional building, and supportive government policies aimed at addressing housing shortages and promoting green building. Strategic opportunities lie in expanding production capacity, developing new product applications for commercial and institutional sectors, and fostering greater collaboration across the value chain to streamline the adoption of prefab wood buildings. The market is poised for significant expansion, offering substantial returns for investors and stakeholders aligned with these forward-looking trends.

North America Prefab Wood Building Market Segmentation

-

1. Panel Systems

- 1.1. Cross-laminated timber (CLT) panels

- 1.2. Nail-laminated timber (NLT) panels

- 1.3. Dowel-laminated timber (DLT) panels

- 1.4. Glue-laminated timber (GLT) columns and beams

-

2. Application

- 2.1. Single Family Residential

- 2.2. Multi-family Residential

- 2.3. Office

- 2.4. Hospitality

- 2.5. Others

North America Prefab Wood Building Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Prefab Wood Building Market Regional Market Share

Geographic Coverage of North America Prefab Wood Building Market

North America Prefab Wood Building Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.82% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing demand for green construction to reduce carbon footprint4.; Introduction of technology for manufactruing the of building construction material

- 3.3. Market Restrains

- 3.3.1. 4.; High cost of purchasing the equipment for development and manufacturing of various construction material

- 3.4. Market Trends

- 3.4.1. Increasing Government Initiative is assisting Canada's Prefab growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Prefab Wood Building Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Panel Systems

- 5.1.1. Cross-laminated timber (CLT) panels

- 5.1.2. Nail-laminated timber (NLT) panels

- 5.1.3. Dowel-laminated timber (DLT) panels

- 5.1.4. Glue-laminated timber (GLT) columns and beams

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Single Family Residential

- 5.2.2. Multi-family Residential

- 5.2.3. Office

- 5.2.4. Hospitality

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Panel Systems

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kbs Building Systems

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Corrugated Metals Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Appalachian Log Structures Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Excel Homes Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Heinrich Brothers Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Clayton Homes Inc **List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Speed Space

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 R P Crawford Co Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Guerdon Modular Buildings

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Alta-Fab Structures

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Kbs Building Systems

List of Figures

- Figure 1: North America Prefab Wood Building Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: North America Prefab Wood Building Market Share (%) by Company 2025

List of Tables

- Table 1: North America Prefab Wood Building Market Revenue undefined Forecast, by Panel Systems 2020 & 2033

- Table 2: North America Prefab Wood Building Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: North America Prefab Wood Building Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: North America Prefab Wood Building Market Revenue undefined Forecast, by Panel Systems 2020 & 2033

- Table 5: North America Prefab Wood Building Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: North America Prefab Wood Building Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States North America Prefab Wood Building Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada North America Prefab Wood Building Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico North America Prefab Wood Building Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Prefab Wood Building Market?

The projected CAGR is approximately 5.82%.

2. Which companies are prominent players in the North America Prefab Wood Building Market?

Key companies in the market include Kbs Building Systems, Corrugated Metals Inc, Appalachian Log Structures Inc, Excel Homes Group, Heinrich Brothers Inc, Clayton Homes Inc **List Not Exhaustive, Speed Space, R P Crawford Co Inc, Guerdon Modular Buildings, Alta-Fab Structures.

3. What are the main segments of the North America Prefab Wood Building Market?

The market segments include Panel Systems, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing demand for green construction to reduce carbon footprint4.; Introduction of technology for manufactruing the of building construction material.

6. What are the notable trends driving market growth?

Increasing Government Initiative is assisting Canada's Prefab growth.

7. Are there any restraints impacting market growth?

4.; High cost of purchasing the equipment for development and manufacturing of various construction material.

8. Can you provide examples of recent developments in the market?

November 2022 - In Canada, a 40m2 tiny prefabricated steel and wood house has been installed for vacations and short stays. It was designed by Lloyoll Prefabs, a manufacturer of Premium Modular Homes brought to the site on a truck and set on a concrete slab. The open floor layout makes the most of every square inch, with a kitchen, bathroom, master bedroom, and loft bedroom with two more beds. It has a little ecological imprint, and its large apertures provide a better connection to the outside world.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Prefab Wood Building Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Prefab Wood Building Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Prefab Wood Building Market?

To stay informed about further developments, trends, and reports in the North America Prefab Wood Building Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence