Key Insights

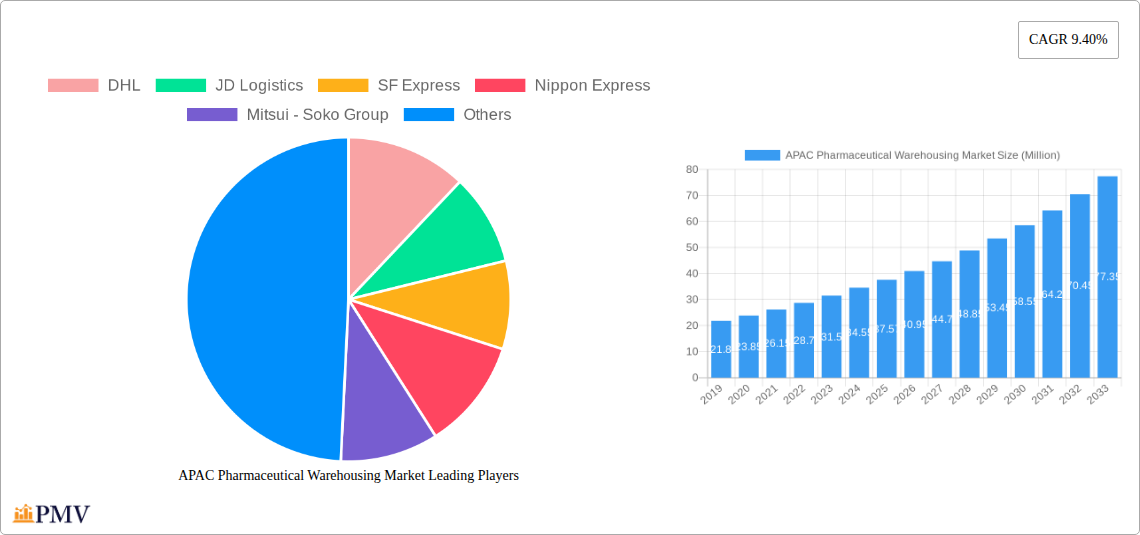

The APAC Pharmaceutical Warehousing Market is poised for significant expansion, projected to reach $37.57 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 9.40% through 2033. This dynamic growth is primarily propelled by escalating healthcare expenditure across the region, a burgeoning demand for sophisticated pharmaceutical products, and the increasing complexity of supply chains that necessitate specialized warehousing solutions. Key drivers include the widespread adoption of advanced technologies for inventory management and tracking, coupled with a growing emphasis on compliance with stringent regulatory requirements for pharmaceutical storage. The market is witnessing a clear shift towards specialized cold chain warehousing facilities, essential for preserving the efficacy of temperature-sensitive biologics and vaccines, further fueling market expansion. Trends such as the integration of IoT devices for real-time temperature monitoring, the adoption of automation for enhanced efficiency, and the development of integrated logistics solutions are reshaping the operational landscape of pharmaceutical warehousing in APAC.

APAC Pharmaceutical Warehousing Market Market Size (In Million)

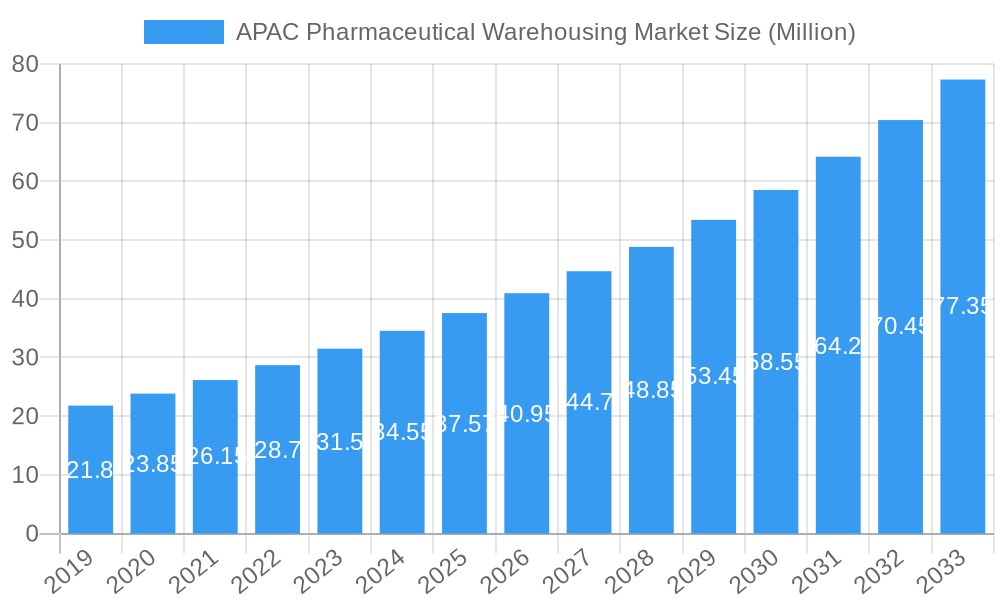

Despite the optimistic outlook, certain restraints could temper growth, including the high capital investment required for establishing and maintaining advanced pharmaceutical warehousing infrastructure, and the ongoing shortage of skilled labor proficient in handling specialized pharmaceutical logistics. Geographically, the Asia-Pacific region, encompassing countries like China, India, Japan, and Australia, represents a substantial and rapidly growing market for pharmaceutical warehousing services. Within this region, China and India are emerging as major hubs due to their large populations, increasing pharmaceutical production, and expanding healthcare access. The market is segmented by type into Cold Chain Warehouses and Non-Cold Chain Warehouses, with cold chain solutions dominating due to the rise of biologics. Applications span pharmaceutical factories, pharmacies, hospitals, and other related sectors, all contributing to the overall demand for secure and compliant warehousing. Major players like DHL, JD Logistics, and SF Express are actively investing in expanding their capabilities and geographical reach to capitalize on these opportunities.

APAC Pharmaceutical Warehousing Market Company Market Share

APAC Pharmaceutical Warehousing Market: Comprehensive Analysis and Future Outlook (2019-2033)

This detailed report offers an in-depth analysis of the APAC Pharmaceutical Warehousing Market, a critical sector driven by increasing healthcare demands, stringent regulatory compliance, and advanced logistics solutions. The study covers the historical period (2019-2024), base year (2025), and provides an extensive forecast period (2025-2033), projecting significant growth for cold chain pharmaceutical logistics and 3PL pharmaceutical warehousing across the Asia-Pacific region. We explore key market segments, dominant geographies, and strategic imperatives for stakeholders operating within this dynamic industry.

APAC Pharmaceutical Warehousing Market Market Structure & Competitive Dynamics

The APAC Pharmaceutical Warehousing Market exhibits a moderately concentrated structure, with leading global logistics providers and emerging regional players vying for market share. Innovation ecosystems are rapidly evolving, driven by investments in cold chain technology, temperature-controlled warehousing, and pharmaceutical supply chain optimization. Regulatory frameworks, particularly concerning drug storage and distribution compliance, are robust and continuously updated, influencing operational strategies and demanding high standards. Product substitutes are limited in the core warehousing function, but advancements in transportation and inventory management software present indirect competitive alternatives. End-user trends highlight a growing demand for end-to-end logistics solutions, including medical device warehousing and specialty pharmaceutical storage. Mergers & Acquisitions (M&A) activities are a significant driver of market consolidation, with companies seeking to expand their geographical reach and service offerings. Notable M&A deals, valued in the hundreds of millions of dollars, have reshaped the competitive landscape, enhancing capabilities in areas like last-mile pharmaceutical delivery and biologics warehousing. Market share among top players is closely contested, with emphasis on service reliability and adherence to Good Distribution Practices (GDP).

APAC Pharmaceutical Warehousing Market Industry Trends & Insights

The APAC Pharmaceutical Warehousing Market is experiencing robust expansion, propelled by a confluence of factors that are reshaping its future. The CAGR is projected to be in the high single digits over the forecast period, indicating substantial market penetration and sustained growth. A primary growth driver is the escalating demand for pharmaceuticals and healthcare services across the densely populated Asia-Pacific region, fueled by an aging population, rising disposable incomes, and increasing prevalence of chronic diseases. This surge in demand necessitates more sophisticated and expansive pharmaceutical logistics infrastructure.

Technological disruptions are playing a pivotal role, with advancements in IoT (Internet of Things) for real-time temperature monitoring, AI (Artificial Intelligence) for predictive analytics in inventory management and route optimization, and blockchain for enhanced supply chain transparency and traceability. These technologies are crucial for maintaining the integrity of sensitive pharmaceutical products, especially within cold chain pharmaceutical logistics.

Consumer preferences are shifting towards greater convenience and accessibility in healthcare, driving the need for efficient last-mile pharmaceutical delivery and specialized warehousing solutions for pharmacies and hospitals. The increasing focus on patient safety and drug efficacy further amplifies the importance of secure and compliant pharmaceutical warehousing.

Competitive dynamics are intensifying, with both established global logistics giants and agile local players investing heavily in capacity expansion, technology adoption, and service diversification. The emphasis is increasingly on offering 3PL pharmaceutical warehousing services that go beyond mere storage to encompass value-added services like kitting, labeling, and customs clearance. The drive for operational excellence and cost-efficiency in pharmaceutical supply chain management is a constant undercurrent, pushing companies to innovate and optimize their warehousing networks. The market penetration of advanced warehousing solutions, particularly for cold chain pharmaceutical logistics, is steadily increasing as companies recognize the critical need for specialized infrastructure.

Dominant Markets & Segments in APAC Pharmaceutical Warehousing Market

The APAC Pharmaceutical Warehousing Market is characterized by distinct regional strengths and segment dominance. China stands out as the most dominant geography, driven by its massive pharmaceutical manufacturing base, a rapidly growing domestic healthcare market, and significant government investments in logistics infrastructure. Its vast population and expanding middle class contribute to a consistently high demand for pharmaceutical products, necessitating extensive warehousing capabilities.

Within the Geography segment:

- China: Leads in overall market size and growth potential, supported by extensive manufacturing and a burgeoning domestic market.

- India: Shows remarkable growth, driven by its status as a major pharmaceutical exporter and an increasing focus on domestic healthcare access. Economic policies supporting manufacturing and exports are key.

- Japan: Exhibits maturity and high standards in pharmaceutical warehousing, with a strong emphasis on quality and regulatory compliance, particularly for cold chain pharmaceutical logistics. Its advanced infrastructure and strict regulatory frameworks set a benchmark.

- Rest-of-APAC: Encompasses rapidly developing economies like Indonesia and Vietnam, which present significant untapped potential due to growing populations and improving healthcare systems. Infrastructure development and supportive government initiatives are crucial drivers in these markets.

By Type:

- Cold Chain Warehouse: This segment is experiencing the highest growth rates due to the increasing production and distribution of biologics, vaccines, and temperature-sensitive medications. The strict requirements for maintaining specific temperature ranges (refrigerated and frozen) make this a technologically demanding but highly valuable segment. Drivers include stringent regulatory compliance and the growing pipeline of temperature-sensitive drugs.

- Non-Cold Chain Warehouse: While still substantial, this segment's growth is more moderate, catering to a broader range of pharmaceutical products. Efficiency and cost-effectiveness are key competitive factors.

By Application:

- Pharmaceutical Factory: This segment is crucial, as manufacturers require secure and compliant storage for raw materials, work-in-progress, and finished goods. Proximity to manufacturing hubs and integrated logistics solutions are paramount.

- Pharmacy: The increasing demand for efficient distribution to retail pharmacies and a focus on last-mile pharmaceutical delivery make this segment vital. The need for timely and accurate inventory management is a key driver.

- Hospital: Hospitals require specialized warehousing to manage a diverse range of medical supplies, medications, and equipment, often with specific storage conditions. The trend towards centralized hospital pharmacies and robust inventory management systems boosts demand.

- Other Applications: This includes clinical research organizations, diagnostic laboratories, and medical device manufacturers, all of whom have unique warehousing needs.

APAC Pharmaceutical Warehousing Market Product Innovations

Product innovations in the APAC Pharmaceutical Warehousing Market are heavily focused on enhancing efficiency, security, and compliance. The integration of advanced automation, such as robotic picking systems and automated storage and retrieval systems (AS/RS), is transforming warehouse operations. Furthermore, the development of smart warehousing solutions, utilizing IoT sensors for real-time environmental monitoring (temperature, humidity, light), provides unparalleled control and data logging, crucial for cold chain pharmaceutical logistics. Innovations in software platforms offer enhanced visibility, predictive analytics for inventory management, and seamless integration with client systems, streamlining pharmaceutical supply chain management. These advancements create a significant competitive advantage by reducing errors, improving delivery times, and ensuring the integrity of sensitive pharmaceutical products.

Report Segmentation & Scope

This report meticulously segments the APAC Pharmaceutical Warehousing Market to provide granular insights into its diverse landscape. The analysis covers key areas to offer a comprehensive market overview.

The market is segmented BY Type into Cold Chain Warehouse and Non-Cold Chain Warehouse. The Cold Chain Warehouse segment is projected to exhibit substantial growth due to the increasing demand for temperature-sensitive pharmaceuticals and vaccines, requiring specialized infrastructure and handling protocols. The Non-Cold Chain Warehouse segment caters to a broader range of pharmaceutical products where temperature control is less critical, focusing on efficient storage and handling.

Further segmentation is conducted BY Application, including Pharmaceutical Factory, Pharmacy, Hospital, and Other Applications. The Pharmaceutical Factory segment is vital for manufacturers requiring robust storage solutions for raw materials and finished goods. The Pharmacy segment focuses on the efficient distribution of medications to retail outlets, emphasizing last-mile pharmaceutical delivery. The Hospital segment caters to the critical storage needs of healthcare facilities for a wide array of medical supplies. Other Applications encompass areas like clinical research and medical device storage.

Geographically, the report focuses on the Asia-Pacific region, with detailed analysis of Australia, China, India, Indonesia, Japan, Malaysia, Vietnam, and Thailand, along with a broader Rest-of-APAC category. Each geographic segment presents unique market dynamics, growth drivers, and regulatory considerations impacting the pharmaceutical warehousing landscape.

Key Drivers of APAC Pharmaceutical Warehousing Market Growth

Several key drivers are propelling the growth of the APAC Pharmaceutical Warehousing Market. The rapidly expanding healthcare sector across Asia-Pacific, fueled by rising incomes, aging populations, and increased healthcare spending, is a primary catalyst. This surge in demand necessitates enhanced pharmaceutical logistics capabilities. Technological advancements, including the adoption of IoT for real-time monitoring, AI for predictive analytics, and automation in warehouses, are improving efficiency and compliance for cold chain pharmaceutical logistics. Stringent regulatory requirements for drug storage and distribution, such as GDP compliance, are pushing companies to invest in state-of-the-art warehousing solutions. Furthermore, the growing focus on 3PL pharmaceutical warehousing and integrated pharmaceutical supply chain management services by pharmaceutical manufacturers is a significant growth accelerator. The increasing prevalence of chronic diseases also drives demand for specialized storage and distribution of associated medications.

Challenges in the APAC Pharmaceutical Warehousing Market Sector

Despite robust growth, the APAC Pharmaceutical Warehousing Market faces several significant challenges. The high cost of setting up and maintaining specialized cold chain pharmaceutical logistics infrastructure, including advanced temperature-controlled facilities and equipment, poses a substantial barrier to entry, particularly for smaller players. Navigating diverse and evolving regulatory landscapes across different APAC countries can be complex and resource-intensive, demanding constant vigilance and adaptation. Skilled labor shortages for operating sophisticated warehousing technology and ensuring compliance with stringent pharmaceutical handling protocols are also a concern. Furthermore, supply chain disruptions, exacerbated by geopolitical events or natural disasters, can impact the timely and secure delivery of pharmaceutical products, highlighting the need for resilient pharmaceutical warehousing strategies. Intense competition among logistics providers can also lead to price pressures, affecting profitability.

Leading Players in the APAC Pharmaceutical Warehousing Market Market

- DHL

- JD Logistics

- SF Express

- Nippon Express

- Mitsui - Soko Group

- Yunda Holding

- Sankyu

- SG Holdings

- Goke Hengtai (Beijing) Medical Technology Co Ltd

- Kerry Logistics

- Yamato Holdings

- Sinopharm Logistics

- CJ Rokin Logistics

- DSV

Key Developments in APAC Pharmaceutical Warehousing Market Sector

- July 2023: JD established a 10,000-square-meter warehouse in Shenyang to meet the increasing demand for pharmaceutical products. This facility provides 3PL (3rd party logistics) services specifically for medicines and medical equipment. With distinct temperature zones catering to various drug requirements, including cold, room temperature, fridge, and freezer, this expansion significantly enhances JD's capacity for cold chain pharmaceutical logistics and 3PL pharmaceutical warehousing in Northeast China.

- April 2022: GEODIS, a global logistics operator, strengthened its temperature-controlled pharma air freight shipments in Asia-Pacific (APAC) & Middle East (ME) by obtaining the Center of Excellence for Independent Validators in Pharmaceutical Logistics (CEIV) Pharma certification. This certification underscores GEODIS' commitment to high standards in pharmaceutical logistics and enhances its capabilities in providing secure cold chain pharmaceutical logistics for sensitive medicinal products across the region.

Strategic APAC Pharmaceutical Warehousing Market Market Outlook

The strategic outlook for the APAC Pharmaceutical Warehousing Market is exceptionally positive, driven by sustained demand for healthcare and the increasing sophistication of logistics services. Key growth accelerators include further investment in advanced cold chain pharmaceutical logistics infrastructure, driven by the expanding biologics and vaccine markets. The continued adoption of digital technologies, such as AI-powered inventory management and blockchain for supply chain traceability, will be critical for enhancing operational efficiency and compliance. Expansion into emerging markets within the APAC region, coupled with strategic partnerships and M&A activities, will enable companies to broaden their geographical reach and service portfolios. The growing trend towards end-to-end 3PL pharmaceutical warehousing solutions, offering integrated services from manufacturing to patient delivery, presents significant opportunities for market leadership and value creation. Emphasis on sustainability and green logistics practices will also become increasingly important.

APAC Pharmaceutical Warehousing Market Segmentation

-

1. BY Type

- 1.1. Cold Chain Warehouse

- 1.2. Non-Cold Chain Warehouse

-

2. Application

- 2.1. Pharmaceutical Factory

- 2.2. Pharmacy

- 2.3. Hospital

- 2.4. Other Applications

-

3. Geography

-

3.1. Asia-Pacific

- 3.1.1. Australia

- 3.1.2. China

- 3.1.3. India

- 3.1.4. Indonesia

- 3.1.5. Japan

- 3.1.6. Malaysia

- 3.1.7. Vietnam

- 3.1.8. Thailand

- 3.1.9. Rest-of-APAC

-

3.1. Asia-Pacific

APAC Pharmaceutical Warehousing Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. Australia

- 1.2. China

- 1.3. India

- 1.4. Indonesia

- 1.5. Japan

- 1.6. Malaysia

- 1.7. Vietnam

- 1.8. Thailand

- 1.9. Rest of APAC

APAC Pharmaceutical Warehousing Market Regional Market Share

Geographic Coverage of APAC Pharmaceutical Warehousing Market

APAC Pharmaceutical Warehousing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.40% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rapidly Expanding Pharmaceutical Industry4.; Government Regulations and Intiatives

- 3.3. Market Restrains

- 3.3.1. 4.; Supply Chain Disruptions4.; Temperature Controlled and Cold Chain Management

- 3.4. Market Trends

- 3.4.1. Increase in Cold Storage Warehouses is driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. APAC Pharmaceutical Warehousing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by BY Type

- 5.1.1. Cold Chain Warehouse

- 5.1.2. Non-Cold Chain Warehouse

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Pharmaceutical Factory

- 5.2.2. Pharmacy

- 5.2.3. Hospital

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Asia-Pacific

- 5.3.1.1. Australia

- 5.3.1.2. China

- 5.3.1.3. India

- 5.3.1.4. Indonesia

- 5.3.1.5. Japan

- 5.3.1.6. Malaysia

- 5.3.1.7. Vietnam

- 5.3.1.8. Thailand

- 5.3.1.9. Rest-of-APAC

- 5.3.1. Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by BY Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DHL

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 JD Logistics

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 SF Express

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Nippon Express

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Mitsui - Soko Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Yunda Holding

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sankyu

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 SG Holdings

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Goke Hengtai (Beijing) Medical Technology Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Kerry Logistics

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Yamato Holdings

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Sinopharm Logistics

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 CJ Rokin Logistics

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 DSV

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 DHL

List of Figures

- Figure 1: APAC Pharmaceutical Warehousing Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: APAC Pharmaceutical Warehousing Market Share (%) by Company 2025

List of Tables

- Table 1: APAC Pharmaceutical Warehousing Market Revenue Million Forecast, by BY Type 2020 & 2033

- Table 2: APAC Pharmaceutical Warehousing Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: APAC Pharmaceutical Warehousing Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: APAC Pharmaceutical Warehousing Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: APAC Pharmaceutical Warehousing Market Revenue Million Forecast, by BY Type 2020 & 2033

- Table 6: APAC Pharmaceutical Warehousing Market Revenue Million Forecast, by Application 2020 & 2033

- Table 7: APAC Pharmaceutical Warehousing Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: APAC Pharmaceutical Warehousing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Australia APAC Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: China APAC Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: India APAC Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Indonesia APAC Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Japan APAC Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Malaysia APAC Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Vietnam APAC Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Thailand APAC Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Rest of APAC APAC Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Pharmaceutical Warehousing Market?

The projected CAGR is approximately 9.40%.

2. Which companies are prominent players in the APAC Pharmaceutical Warehousing Market?

Key companies in the market include DHL, JD Logistics, SF Express, Nippon Express, Mitsui - Soko Group, Yunda Holding, Sankyu, SG Holdings, Goke Hengtai (Beijing) Medical Technology Co Ltd, Kerry Logistics, Yamato Holdings, Sinopharm Logistics, CJ Rokin Logistics, DSV.

3. What are the main segments of the APAC Pharmaceutical Warehousing Market?

The market segments include BY Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 37.57 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Rapidly Expanding Pharmaceutical Industry4.; Government Regulations and Intiatives.

6. What are the notable trends driving market growth?

Increase in Cold Storage Warehouses is driving the market.

7. Are there any restraints impacting market growth?

4.; Supply Chain Disruptions4.; Temperature Controlled and Cold Chain Management.

8. Can you provide examples of recent developments in the market?

July 2023: JD established a 10,000-square-meter warehouse in Shenyang to meet the increasing demand for pharmaceutical products. This facility provides 3PL (3rd party logistics) services specifically for medicines and medical equipment. With distinct temperature zones catering to various drug requirements, including cold, room temperature, fridge, and freezer.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Pharmaceutical Warehousing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Pharmaceutical Warehousing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Pharmaceutical Warehousing Market?

To stay informed about further developments, trends, and reports in the APAC Pharmaceutical Warehousing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence