Key Insights

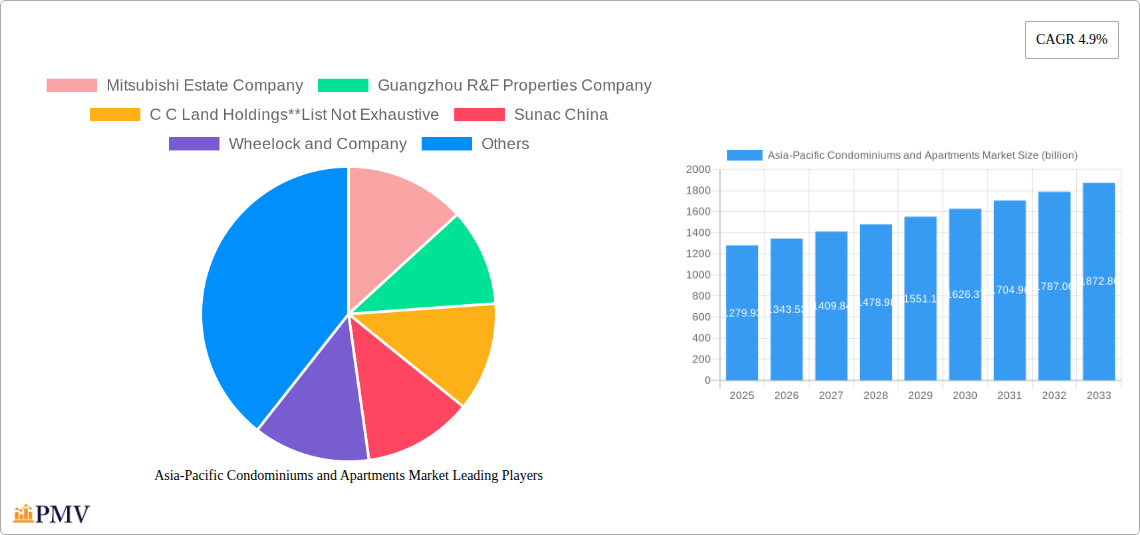

The Asia-Pacific Condominiums and Apartments Market is poised for robust expansion, with an estimated market size of USD 1279.93 billion in 2025, projecting a CAGR of 4.9% through 2033. This growth is fueled by a confluence of dynamic economic development, rapid urbanization, and a burgeoning middle class across key nations like China, India, and Southeast Asian countries. The increasing demand for modern, convenient, and affordable housing solutions, particularly in densely populated urban centers, is a primary driver. Furthermore, evolving lifestyle preferences, with a growing emphasis on community living, shared amenities, and reduced maintenance responsibilities, are significantly boosting the appeal of condominiums and apartments. Government initiatives promoting urban development and affordable housing schemes also play a crucial role in sustaining this upward trajectory. Production and consumption analyses are expected to show parallel growth, reflecting sustained demand. Import and export activities will likely be influenced by regional supply-demand imbalances and construction material costs, while price trends will be shaped by the interplay of supply, demand, and economic conditions.

Asia-Pacific Condominiums and Apartments Market Market Size (In Billion)

The market is characterized by significant investment from prominent real estate developers such as Mitsubishi Estate Company, Guangzhou R&F Properties Company, and DLF India, alongside specialized real estate investment trusts like e-Shang Redwood Group and GLP. These entities are actively engaged in developing and managing a diverse portfolio of residential properties, catering to various market segments. Trends point towards an increasing integration of smart home technologies, sustainable building practices, and the development of mixed-use complexes that combine residential, commercial, and retail spaces. While the market exhibits strong growth potential, potential restraints could include fluctuating construction costs, regulatory hurdles in certain regions, and the availability of land for development. Nonetheless, the underlying demographic shifts and economic progress in the Asia-Pacific region provide a strong foundation for sustained market expansion in the condominiums and apartments sector.

Asia-Pacific Condominiums and Apartments Market Company Market Share

This comprehensive report delivers an in-depth analysis of the Asia-Pacific condominiums and apartments market, a dynamic sector poised for significant growth driven by rapid urbanization, a burgeoning middle class, and evolving lifestyle preferences. Covering the historical period from 2019 to 2024 and projecting growth through 2033 with a base and estimated year of 2025, this research provides crucial insights into market structure, competitive dynamics, industry trends, and strategic outlooks. Explore detailed production analysis, consumption analysis, import market analysis (value & volume), export market analysis (value & volume), and price trend analysis to understand the multifaceted landscape of this expansive real estate market.

Asia-Pacific Condominiums and Apartments Market Market Structure & Competitive Dynamics

The Asia-Pacific condominiums and apartments market exhibits a moderately consolidated structure, with a mix of large, established developers and a growing number of regional and niche players. Innovation ecosystems are thriving, particularly in smart home technologies and sustainable building practices. Regulatory frameworks, including zoning laws, building codes, and foreign ownership restrictions, significantly influence market entry and development strategies. Product substitutes, such as traditional housing or rental accommodations, present a degree of competition, but the demand for owned condominium and apartment units remains robust due to perceived investment value and lifestyle benefits. End-user trends highlight a growing preference for amenity-rich developments, convenient locations, and flexible living spaces. Mergers and acquisitions (M&A) activities are increasingly prevalent as larger companies seek to expand their geographic reach and consolidate market share. For instance, recent M&A deals have seen significant market share shifts, with major players acquiring smaller developers to bolster their project pipelines.

Asia-Pacific Condominiums and Apartments Market Industry Trends & Insights

The Asia-Pacific condominiums and apartments market is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 7.5% over the forecast period. This expansion is fueled by several key drivers. Rapid urbanization across countries like China, India, and Southeast Asian nations is creating a sustained demand for housing solutions, with condominiums and apartments offering an attractive option for city dwellers. The rising disposable incomes and a burgeoning middle class are further empowering a larger segment of the population to invest in property ownership. Technological disruptions are reshaping the industry, with advancements in construction technology, smart home integration, and sustainable building materials becoming increasingly sought after. Consumer preferences are shifting towards smaller, more efficient living spaces that offer a high quality of life, abundant amenities, and proximity to commercial hubs. The competitive landscape is intensifying, with developers increasingly focusing on differentiation through unique designs, community features, and eco-friendly initiatives to capture market share. The market penetration of modern apartment living is steadily increasing, displacing older housing typologies in prime urban areas.

Dominant Markets & Segments in Asia-Pacific Condominiums and Apartments Market

The Asia-Pacific condominiums and apartments market is dominated by East Asian economies, particularly China, which commands the largest share in terms of both production and consumption. This dominance is underpinned by a combination of factors, including massive population density, rapid economic growth, and significant government investment in infrastructure development.

- Production Analysis: China leads in the sheer volume of new condominium and apartment constructions, driven by large-scale urban development projects and significant developer investments. Countries like Japan, South Korea, and Australia also contribute substantially to production, albeit with a focus on different market segments and price points.

- Consumption Analysis: Similar to production, China's vast population and expanding middle class make it the largest consumer of condominiums and apartments. South Korea and Japan also represent significant consumption markets, characterized by high demand for well-located, modern residential units.

- Import Market Analysis (Value & Volume): While intra-regional trade of completed units is less prominent, imports play a role in specific markets. For example, niche luxury developments in countries like Singapore and Australia may attract foreign buyers, contributing to the import value. The volume of imported raw materials and construction components is substantial across the region.

- Export Market Analysis (Value & Volume): The Asia-Pacific condominiums and apartments market is primarily an importer of expertise and construction materials rather than finished residential units. However, certain developers may engage in cross-border projects, contributing to the export value of real estate development services.

- Price Trend Analysis: Price trends vary significantly across sub-regions and cities. Prime urban areas in major economic hubs like Tokyo, Seoul, Shanghai, and Singapore consistently witness the highest property values. Factors such as land scarcity, economic policies, and investor sentiment heavily influence price appreciation, with steady growth anticipated in most major markets.

Asia-Pacific Condominiums and Apartments Market Product Innovations

Product innovations in the Asia-Pacific condominiums and apartments market are increasingly focused on enhancing livability and sustainability. Developers are integrating smart home technologies for convenience and energy efficiency, alongside adopting green building materials and designs to reduce environmental impact. Advanced modular construction techniques are also gaining traction, promising faster development cycles and cost savings. These innovations cater to evolving consumer demands for modern amenities, flexible living spaces, and a reduced carbon footprint, providing a competitive advantage in a crowded marketplace.

Report Segmentation & Scope

This report meticulously segments the Asia-Pacific condominiums and apartments market across Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), and Price Trend Analysis. Each segment is analyzed for its current market size, projected growth rates, and competitive dynamics. For instance, the Production Analysis segment offers insights into the volume and value of new residential constructions across key countries, projecting a healthy CAGR of over 6% for the forecast period. The Consumption Analysis segment explores the demand drivers and future market potential, with an estimated market size of over USD 800 billion by 2033. The import and export analyses detail cross-border transactions and their impact on regional trade balances.

Key Drivers of Asia-Pacific Condominiums and Apartments Market Growth

Key drivers propelling the Asia-Pacific condominiums and apartments market include robust economic growth across the region, leading to increased disposable incomes and a desire for homeownership. Rapid urbanization continues to fuel demand, as more people migrate to cities seeking employment and better living standards. Favorable government policies, such as urban renewal initiatives and housing subsidies in certain countries, also provide a significant impetus. Furthermore, the growing preference for modern, convenient, and amenity-rich living spaces in urban centers aligns perfectly with the offerings of condominiums and apartments.

Challenges in the Asia-Pacific Condominiums and Apartments Market Sector

Despite its growth, the Asia-Pacific condominiums and apartments market faces several challenges. Stringent regulatory hurdles and complex approval processes in some countries can lead to project delays and increased costs. Affordability remains a significant concern in many major cities, with rising land prices and construction costs impacting the accessibility of these properties for a broader segment of the population. Supply chain disruptions and labor shortages can also pose significant restraints, impacting development timelines and profitability. Intense competition among developers can also lead to price wars and reduced profit margins.

Leading Players in the Asia-Pacific Condominiums and Apartments Market Market

- Mitsubishi Estate Company

- Guangzhou R&F Properties Company

- C C Land Holdings

- Sunac China

- Wheelock and Company

- DLF India

- China Evergrande Group

- Frasers Property

- Henderson Land Development Company Limited

- e-Shang Redwood Group

- New World Development Co Ltd

- GLP

- Lodha Group

Key Developments in Asia-Pacific Condominiums and Apartments Market Sector

- October 2022: The USD 280 million Gold Coast condo development in Australia is a collaboration between Banda, a development and design studio founded by Princess Beatrice's husband, Edo Mapelli Mozzi, and Australian real estate expert Rory O'Brien. The new development will provide the most luxurious condos in the area. Banda Design Studio will create 28 units: 20 residences, five sky homes, two duplex sub-penthouses, and a super-penthouse.

- March 2022: Goldman Sachs may collaborate with trading firm Sojitz to acquire and renovate older apartments that would otherwise go unnoticed by real estate investors. By the summer, they plan to form a joint venture to focus on rental housing in major Japanese cities. Properties that have been improved will be sold in batches to financial institutions and investment funds. The partners intend to invest JPY 40-50 billion (USD 323-405 million) in the company each year.

Strategic Asia-Pacific Condominiums and Apartments Market Market Outlook

The strategic outlook for the Asia-Pacific condominiums and apartments market remains highly positive, with significant growth accelerators in place. Continued urbanization, coupled with a rising middle class and evolving lifestyle aspirations, will sustain robust demand. The increasing adoption of PropTech solutions, sustainable building practices, and innovative financing models will further enhance market efficiency and attractiveness. Opportunities lie in developing affordable housing solutions, catering to the growing senior living segment, and leveraging smart city initiatives to create integrated and desirable residential communities. Strategic partnerships and mergers will continue to shape the competitive landscape, driving consolidation and creating larger, more influential market players.

Asia-Pacific Condominiums and Apartments Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Asia-Pacific Condominiums and Apartments Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Condominiums and Apartments Market Regional Market Share

Geographic Coverage of Asia-Pacific Condominiums and Apartments Market

Asia-Pacific Condominiums and Apartments Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Investments in Infrastructure; Global Urbanization; Growth in International Trade and Logistics; Aging Infrastructure

- 3.3. Market Restrains

- 3.3.1. Funding Constraints; Skilled labor shortages; Land Acquisition and Right-of-Way Issues

- 3.4. Market Trends

- 3.4.1. Increase in Demand for Rental Properties

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Condominiums and Apartments Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Mitsubishi Estate Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Guangzhou R&F Properties Company

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 C C Land Holdings**List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sunac China

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Wheelock and Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 DLF India

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 China Evergrande Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Frasers Property

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Henderson Land Development Company Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 e-Shang Redwood Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 New World Development Co Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 GLP

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Lodha Group

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Mitsubishi Estate Company

List of Figures

- Figure 1: Asia-Pacific Condominiums and Apartments Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Condominiums and Apartments Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Condominiums and Apartments Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: Asia-Pacific Condominiums and Apartments Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Asia-Pacific Condominiums and Apartments Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Asia-Pacific Condominiums and Apartments Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Asia-Pacific Condominiums and Apartments Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Asia-Pacific Condominiums and Apartments Market Revenue billion Forecast, by Region 2020 & 2033

- Table 7: Asia-Pacific Condominiums and Apartments Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 8: Asia-Pacific Condominiums and Apartments Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Asia-Pacific Condominiums and Apartments Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Asia-Pacific Condominiums and Apartments Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Asia-Pacific Condominiums and Apartments Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Asia-Pacific Condominiums and Apartments Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: China Asia-Pacific Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Japan Asia-Pacific Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: South Korea Asia-Pacific Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: India Asia-Pacific Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Australia Asia-Pacific Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: New Zealand Asia-Pacific Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Indonesia Asia-Pacific Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Malaysia Asia-Pacific Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Singapore Asia-Pacific Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Thailand Asia-Pacific Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Vietnam Asia-Pacific Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Philippines Asia-Pacific Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Condominiums and Apartments Market?

The projected CAGR is approximately 4.9%.

2. Which companies are prominent players in the Asia-Pacific Condominiums and Apartments Market?

Key companies in the market include Mitsubishi Estate Company, Guangzhou R&F Properties Company, C C Land Holdings**List Not Exhaustive, Sunac China, Wheelock and Company, DLF India, China Evergrande Group, Frasers Property, Henderson Land Development Company Limited, e-Shang Redwood Group, New World Development Co Ltd, GLP, Lodha Group.

3. What are the main segments of the Asia-Pacific Condominiums and Apartments Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 1279.93 billion as of 2022.

5. What are some drivers contributing to market growth?

Government Investments in Infrastructure; Global Urbanization; Growth in International Trade and Logistics; Aging Infrastructure.

6. What are the notable trends driving market growth?

Increase in Demand for Rental Properties.

7. Are there any restraints impacting market growth?

Funding Constraints; Skilled labor shortages; Land Acquisition and Right-of-Way Issues.

8. Can you provide examples of recent developments in the market?

October 2022: The USD 280 million Gold Coast condo development in Australia is a collaboration between Banda, a development and design studio founded by Princess Beatrice's husband, Edo Mapelli Mozzi, and Australian real estate expert Rory O'Brien. The new development will provide the most luxurious condos in the area. Banda Design Studio will create 28 units: 20 residences, five sky homes, two duplex sub-penthouses, and a super-penthouse.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Condominiums and Apartments Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Condominiums and Apartments Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Condominiums and Apartments Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Condominiums and Apartments Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence