Key Insights

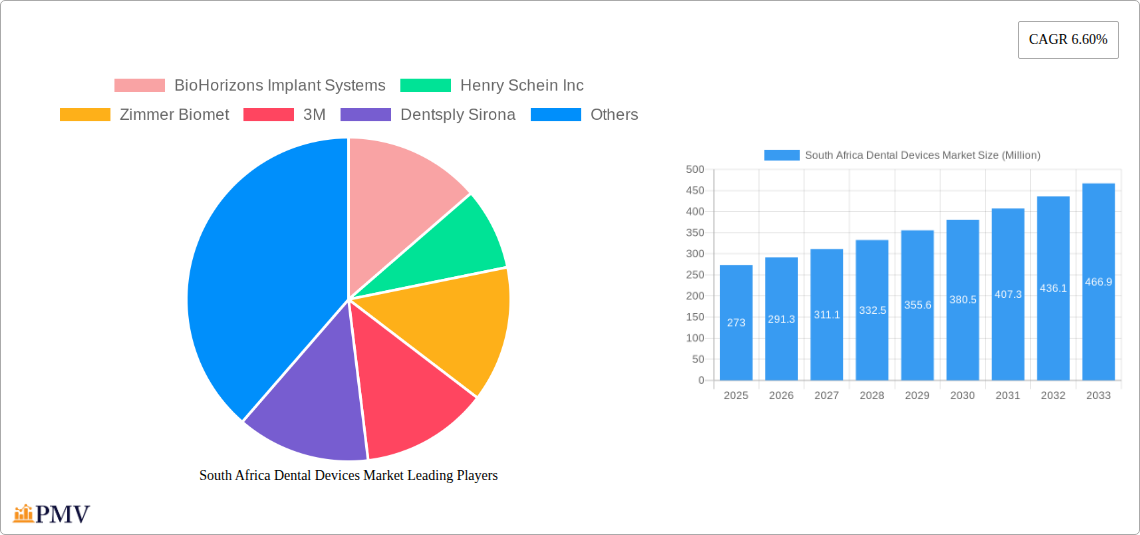

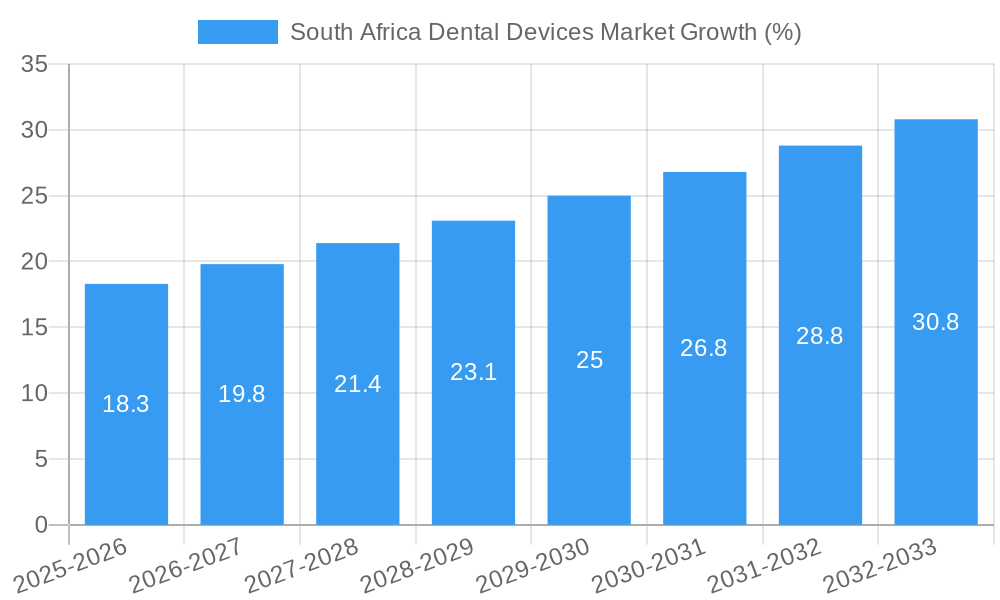

The South Africa dental devices market, valued at approximately $273 million in 2025, is projected to experience robust growth, driven by factors such as rising prevalence of dental diseases, increasing disposable incomes, and improved healthcare infrastructure. The market's Compound Annual Growth Rate (CAGR) of 6.60% from 2025 to 2033 signifies a significant expansion opportunity. Key segments driving this growth include consumables (dental materials, restorative materials, and infection control products), orthodontic treatments (braces, aligners), and endodontic treatments (root canals). The increasing number of dental clinics and hospitals, coupled with a growing awareness of oral hygiene, further fuels market expansion. While challenges such as high treatment costs and limited access to dental care in rural areas exist, the overall market outlook remains positive, especially with the government's ongoing efforts to improve healthcare accessibility. Major players like BioHorizons, Henry Schein, and Zimmer Biomet are expected to leverage these trends through product innovation, strategic partnerships, and expansion of their distribution networks within South Africa. The market’s segmentation by product type (equipment, consumables, treatments), treatment type (orthodontic, endodontic, periodontic, prosthodontic), and end-user (hospitals, clinics, other) provides a detailed understanding of specific growth areas. Focusing on advanced technologies like digital dentistry and minimally invasive procedures will be crucial for sustained growth in the coming years.

The South African dental devices market shows strong potential for growth in the coming years. Increased investment in dental infrastructure, coupled with a growing middle class and rising awareness of preventative dental care, are expected to boost market expansion. The market's segmentation offers opportunities for targeted strategies, allowing companies to focus on high-growth segments, such as consumables and specific dental treatments. The presence of established international players in the market signifies a competitive landscape, indicating healthy market conditions. However, to fully capitalize on the growth potential, companies need to navigate challenges like affordability and accessibility to ensure equitable access to dental care across the diverse South African population. Strategic partnerships with local healthcare providers and government initiatives will be essential for long-term market success and sustainable expansion.

South Africa Dental Devices Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the South Africa dental devices market, offering invaluable insights for stakeholders across the industry. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market size, segmentation, competitive dynamics, and future growth potential. The report utilizes rigorous data analysis to project a market value of xx Million by 2033, presenting a valuable resource for strategic decision-making.

South Africa Dental Devices Market Structure & Competitive Dynamics

The South Africa dental devices market exhibits a moderately concentrated structure, with key players like BioHorizons Implant Systems, Henry Schein Inc, Zimmer Biomet, 3M, Dentsply Sirona, NobelBiocare, Carestream Health, and Straumann Holding AG holding significant market share. Market concentration is influenced by factors such as regulatory approvals, technological advancements, and the strength of distribution networks. The innovation ecosystem is growing, driven by increasing investments in R&D and collaborations between established players and emerging technology firms. The regulatory framework, while generally supportive of market growth, presents certain compliance challenges for manufacturers and distributors. The market sees limited product substitutes, mostly in the form of less technologically advanced alternatives. End-user trends show a growing preference for technologically advanced devices and minimally invasive treatments. M&A activities have been relatively moderate, with deal values averaging xx Million in recent years. Key examples include:

- July 2022: Henry Schein's acquisition of Condor Dental Research Company SA boosted its distribution network.

- May 2022: Dentsply Sirona's launch of DS Core signifies a push towards digital dentistry.

These activities are likely to intensify as companies seek to expand their market reach and product portfolios. Market share analysis reveals that the top five players collectively account for approximately xx% of the total market.

South Africa Dental Devices Market Industry Trends & Insights

The South Africa dental devices market is experiencing robust growth, driven by factors such as rising prevalence of dental diseases, increasing disposable incomes, and growing awareness of dental hygiene. Technological advancements, particularly in digital dentistry, are significantly impacting market dynamics. The adoption of CAD/CAM technology, 3D printing, and AI-powered diagnostic tools is transforming treatment procedures and enhancing efficiency. Consumer preferences are shifting towards minimally invasive procedures, cosmetic dentistry, and technologically advanced solutions. Competitive dynamics are characterized by intense rivalry amongst established players and the emergence of innovative startups. The market is expected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), with market penetration rates steadily increasing.

Dominant Markets & Segments in South Africa Dental Devices Market

While comprehensive regional data is limited, the Gauteng province, owing to its higher concentration of dental clinics and hospitals, is likely the dominant market. Within the market segments, analysis suggests the following:

By Product Type: Consumables are currently the largest segment, driven by high demand for dental materials and disposables. However, the equipment segment is projected to witness faster growth due to ongoing technological upgrades. The treatments segment, largely dependent on the other two, will reflect their trends.

By Treatment: Prosthodontic treatments dominate, followed by Orthodontic and Endodontic treatments. The demand for cosmetic and restorative procedures contributes significantly to this dominance.

By End-User: Private clinics constitute the largest end-user segment, reflecting the high proportion of private healthcare spending. Hospitals hold a smaller but steadily growing share, particularly in the public healthcare sector.

Key Drivers of Segment Dominance:

- Economic policies: Government initiatives promoting healthcare access.

- Infrastructure: Concentration of healthcare facilities in urban areas.

- Technological advancements: Increased adoption of advanced equipment in private clinics.

South Africa Dental Devices Market Product Innovations

Recent product innovations are heavily focused on digital technologies, including CAD/CAM systems for crown and bridge fabrication, cone beam computed tomography (CBCT) for improved diagnostics, and intraoral scanners for precise impressions. These innovations deliver enhanced precision, efficiency, and minimally invasive procedures, improving patient experience and treatment outcomes. These products are enjoying strong market acceptance, owing to their improved efficiency and patient comfort, leading to faster growth compared to traditional counterparts.

Report Segmentation & Scope

This report segments the South Africa dental devices market by product type (equipment, consumables, treatments), treatment type (orthodontic, endodontic, periodontic, prosthodontic), and end-user (hospitals, clinics, other end-users). Each segment is analyzed based on historical data (2019-2024), estimated data (2025), and forecast data (2025-2033), providing a comprehensive understanding of market size, growth projections, and competitive dynamics within each segment. The equipment segment is expected to show xx Million growth, consumables xx Million, and treatments xx Million during the forecast period. The competitive landscape within each segment reflects a mix of established global players and local distributors.

Key Drivers of South Africa Dental Devices Market Growth

The South Africa dental devices market growth is primarily fueled by several factors:

- Rising prevalence of dental diseases: Increased incidence of caries, periodontal diseases, and malocclusions.

- Growing awareness of dental hygiene: Greater emphasis on preventative dental care and aesthetic dentistry.

- Increasing disposable incomes: Enhanced affordability of dental procedures among the middle class.

- Technological advancements: Adoption of digital technologies enhancing treatment efficacy and efficiency.

- Government initiatives: Policies supporting healthcare infrastructure development.

Challenges in the South Africa Dental Devices Market Sector

The South Africa dental devices market faces challenges such as:

- High cost of dental care: Limiting access for a significant portion of the population.

- Unequal distribution of dental professionals: Shortage of dentists in rural areas.

- Stringent regulatory requirements: Increasing compliance costs for manufacturers and distributors.

- Supply chain disruptions: Impacting availability and pricing of imported devices.

- Competition from generic and lower-cost alternatives: Pressuring margins for premium products. This pressure accounts for approximately xx% of the current market limitations.

Leading Players in the South Africa Dental Devices Market Market

- BioHorizons Implant Systems

- Henry Schein Inc

- Zimmer Biomet

- 3M

- Dentsply Sirona

- NobelBiocare

- Carestream Health

- Straumann Holding AG

Key Developments in South Africa Dental Devices Market Sector

- July 2022: Henry Schein completed the acquisition of Condor Dental Research Company SA, expanding its distribution reach in South Africa. This significantly impacted market share distribution.

- May 2022: Dentsply Sirona launched DS Core, a digital dentistry platform, enhancing workflow efficiency and driving innovation in the sector. This immediately boosted market share for the company in digital dental devices.

Strategic South Africa Dental Devices Market Outlook

The South Africa dental devices market presents significant opportunities for growth, driven by technological advancements, increasing demand for advanced treatments, and government investments in healthcare infrastructure. Focus on digital dentistry, minimally invasive procedures, and affordable solutions will be key for future success. Strategic partnerships, investments in R&D, and expansion into underserved markets offer substantial growth potential. The market is poised for continued expansion, presenting attractive opportunities for both established players and new entrants.

South Africa Dental Devices Market Segmentation

-

1. Product

-

1.1. General and Diagnostics Equipment

-

1.1.1. Dental Lasers

- 1.1.1.1. Soft Tissue Lasers

- 1.1.1.2. All Tissue Lasers

- 1.1.2. Radiology Equipment

- 1.1.3. Dental Chair and Equipment

- 1.1.4. Other General and Diagnostic Equipment

-

1.1.1. Dental Lasers

-

1.2. Dental Consumables

- 1.2.1. Dental Biomaterial

- 1.2.2. Dental Implants

- 1.2.3. Crowns and Bridges

- 1.2.4. Other Dental Consumables

- 1.3. Other Dental Devices

-

1.1. General and Diagnostics Equipment

-

2. Treatment

- 2.1. Orthodontic

- 2.2. Endodontic

- 2.3. Peridontic

- 2.4. Prosthodontic

-

3. End-User

- 3.1. Hospitals

- 3.2. Clinics

- 3.3. Other End-Users

South Africa Dental Devices Market Segmentation By Geography

- 1. South Africa

South Africa Dental Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Burden of Oral Diseases and Ageing Population; Technological Advancements in Dentistry

- 3.3. Market Restrains

- 3.3.1. Excessive Costs Involved in Private Health Insurance; Negligence Toward Oral Health

- 3.4. Market Trends

- 3.4.1. Prosthodontic Equipment is Expected to Witness Rapid Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Dental Devices Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. General and Diagnostics Equipment

- 5.1.1.1. Dental Lasers

- 5.1.1.1.1. Soft Tissue Lasers

- 5.1.1.1.2. All Tissue Lasers

- 5.1.1.2. Radiology Equipment

- 5.1.1.3. Dental Chair and Equipment

- 5.1.1.4. Other General and Diagnostic Equipment

- 5.1.1.1. Dental Lasers

- 5.1.2. Dental Consumables

- 5.1.2.1. Dental Biomaterial

- 5.1.2.2. Dental Implants

- 5.1.2.3. Crowns and Bridges

- 5.1.2.4. Other Dental Consumables

- 5.1.3. Other Dental Devices

- 5.1.1. General and Diagnostics Equipment

- 5.2. Market Analysis, Insights and Forecast - by Treatment

- 5.2.1. Orthodontic

- 5.2.2. Endodontic

- 5.2.3. Peridontic

- 5.2.4. Prosthodontic

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Hospitals

- 5.3.2. Clinics

- 5.3.3. Other End-Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. South Africa South Africa Dental Devices Market Analysis, Insights and Forecast, 2019-2031

- 7. Sudan South Africa Dental Devices Market Analysis, Insights and Forecast, 2019-2031

- 8. Uganda South Africa Dental Devices Market Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania South Africa Dental Devices Market Analysis, Insights and Forecast, 2019-2031

- 10. Kenya South Africa Dental Devices Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa South Africa Dental Devices Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 BioHorizons Implant Systems

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Henry Schein Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Zimmer Biomet

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 3M

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Dentsply Sirona

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 NobelBiocare

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Carestream Health

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Straumann Holding AG

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.1 BioHorizons Implant Systems

List of Figures

- Figure 1: South Africa Dental Devices Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South Africa Dental Devices Market Share (%) by Company 2024

List of Tables

- Table 1: South Africa Dental Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South Africa Dental Devices Market Volume K Units Forecast, by Region 2019 & 2032

- Table 3: South Africa Dental Devices Market Revenue Million Forecast, by Product 2019 & 2032

- Table 4: South Africa Dental Devices Market Volume K Units Forecast, by Product 2019 & 2032

- Table 5: South Africa Dental Devices Market Revenue Million Forecast, by Treatment 2019 & 2032

- Table 6: South Africa Dental Devices Market Volume K Units Forecast, by Treatment 2019 & 2032

- Table 7: South Africa Dental Devices Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 8: South Africa Dental Devices Market Volume K Units Forecast, by End-User 2019 & 2032

- Table 9: South Africa Dental Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: South Africa Dental Devices Market Volume K Units Forecast, by Region 2019 & 2032

- Table 11: South Africa Dental Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: South Africa Dental Devices Market Volume K Units Forecast, by Country 2019 & 2032

- Table 13: South Africa South Africa Dental Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: South Africa South Africa Dental Devices Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 15: Sudan South Africa Dental Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Sudan South Africa Dental Devices Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 17: Uganda South Africa Dental Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Uganda South Africa Dental Devices Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 19: Tanzania South Africa Dental Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Tanzania South Africa Dental Devices Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 21: Kenya South Africa Dental Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Kenya South Africa Dental Devices Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 23: Rest of Africa South Africa Dental Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Africa South Africa Dental Devices Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 25: South Africa Dental Devices Market Revenue Million Forecast, by Product 2019 & 2032

- Table 26: South Africa Dental Devices Market Volume K Units Forecast, by Product 2019 & 2032

- Table 27: South Africa Dental Devices Market Revenue Million Forecast, by Treatment 2019 & 2032

- Table 28: South Africa Dental Devices Market Volume K Units Forecast, by Treatment 2019 & 2032

- Table 29: South Africa Dental Devices Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 30: South Africa Dental Devices Market Volume K Units Forecast, by End-User 2019 & 2032

- Table 31: South Africa Dental Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: South Africa Dental Devices Market Volume K Units Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Dental Devices Market?

The projected CAGR is approximately 6.60%.

2. Which companies are prominent players in the South Africa Dental Devices Market?

Key companies in the market include BioHorizons Implant Systems, Henry Schein Inc, Zimmer Biomet, 3M, Dentsply Sirona, NobelBiocare, Carestream Health, Straumann Holding AG.

3. What are the main segments of the South Africa Dental Devices Market?

The market segments include Product, Treatment, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 273 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Burden of Oral Diseases and Ageing Population; Technological Advancements in Dentistry.

6. What are the notable trends driving market growth?

Prosthodontic Equipment is Expected to Witness Rapid Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

Excessive Costs Involved in Private Health Insurance; Negligence Toward Oral Health.

8. Can you provide examples of recent developments in the market?

In July 2022, Henry Schein announced the completion of Condor Dental Research Company SA, a dental distribution company that serves dental general practitioners, specialists and laboratories.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Dental Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Dental Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Dental Devices Market?

To stay informed about further developments, trends, and reports in the South Africa Dental Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence