Key Insights

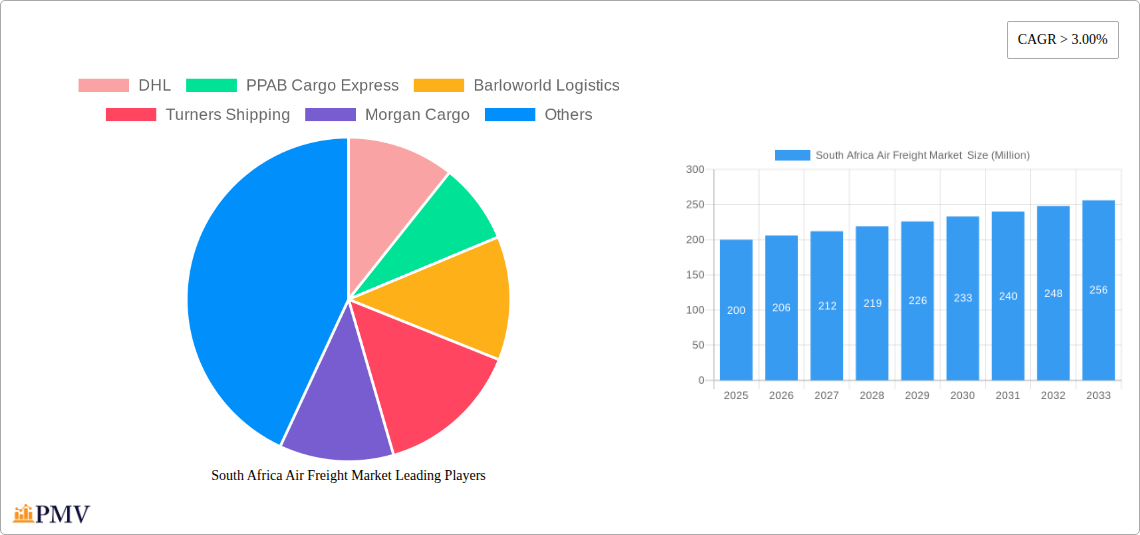

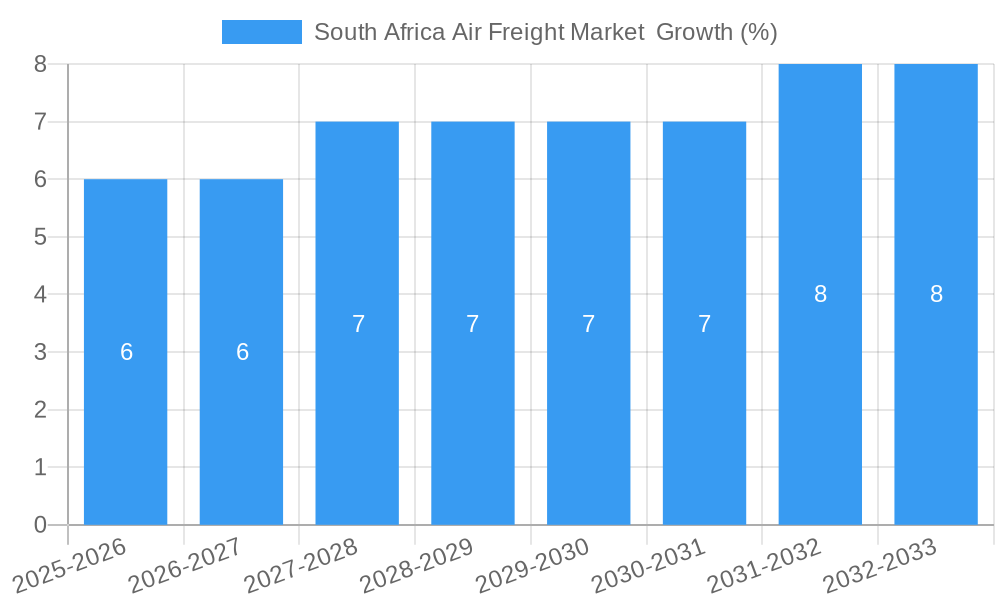

The South African air freight market, valued at approximately $X million in 2025 (a reasonable estimation based on similar-sized markets and the provided CAGR of >3%), is projected to experience robust growth through 2033. This expansion is driven by several key factors. The burgeoning e-commerce sector within South Africa and the increasing demand for time-sensitive goods are significantly contributing to the rising volume of air freight shipments. Furthermore, the growth of several key industries, including manufacturing and agriculture, which rely on efficient air freight logistics for export, fuels market expansion. Improved airport infrastructure and the development of specialized air cargo handling facilities further enhance operational efficiency and attract more businesses to utilize air freight services. The market segmentation reveals a dynamic landscape, with international shipments likely dominating due to South Africa's role in global trade. The preference for freighter aircraft over belly cargo, while likely varying depending on commodity type and route, reflects the growing demand for dedicated cargo capacity and reliability. Competitive pressures from established players like DHL and local companies such as PPAB Cargo Express and Barloworld Logistics are shaping the market, driving innovations in logistics and pricing strategies.

However, the South African air freight market also faces some challenges. Fluctuations in global fuel prices can directly impact operating costs for airlines and freight forwarders, affecting price stability and profitability. Furthermore, potential regulatory hurdles and infrastructural limitations in certain regions of the country could pose constraints to growth. Addressing these challenges will require collaboration among stakeholders, including government agencies, airlines, freight forwarders, and cargo handlers, to enhance efficiency and ensure the sustained growth of the air freight sector. The forecast period of 2025-2033 represents a promising outlook for the industry, with a continued rise in demand driven by both domestic and international trade activities. The market’s diverse range of services, including forwarding, airlines, and mail services, reflects a mature and well-established ecosystem catering to varied customer needs.

South Africa Air Freight Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the South Africa air freight market, covering market size, segmentation, competitive landscape, key trends, and future growth prospects. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report offers invaluable insights for businesses operating in, or planning to enter, this dynamic market. The South Africa air freight market is projected to reach xx Million by 2033.

South Africa Air Freight Market Structure & Competitive Dynamics

The South African air freight market exhibits a moderately concentrated structure, with a mix of large multinational players and smaller regional operators. Market share is currently dominated by a few key players, with DHL holding a significant lead, followed by Barloworld Logistics and others. However, smaller companies like Suid Cargo (launched in February 2023) are emerging, potentially disrupting the established order. Innovation within the sector is driven by investments in technology, particularly in areas such as tracking and logistics management systems. The regulatory framework, though largely supportive of growth, faces challenges in keeping up with rapid technological advancements. Product substitutes, primarily sea freight, are gaining traction, especially in the automotive sector following the trend of falling sea freight rates and improved ocean reliability (March 2023, Air Cargo Africa Conference). End-user trends reveal a growing demand for faster and more reliable air freight solutions, particularly for high-value and time-sensitive goods. M&A activity has been relatively moderate in recent years, with deal values averaging around xx Million annually. However, future consolidation is anticipated as larger players seek to expand their market share.

- Market Concentration: Moderately concentrated, with DHL holding a leading market share.

- Innovation Ecosystem: Focus on technological advancements in tracking and logistics management.

- Regulatory Framework: Supportive but facing challenges in adapting to rapid technological change.

- Product Substitutes: Sea freight posing increasing competition.

- M&A Activity: Relatively moderate, with potential for future consolidation.

South Africa Air Freight Market Industry Trends & Insights

The South Africa air freight market is witnessing substantial growth, driven primarily by the expansion of e-commerce, increased cross-border trade, and the growth of specific industries such as pharmaceuticals and perishables. Technological advancements, including the adoption of blockchain technology and AI-powered logistics solutions, are streamlining operations and enhancing efficiency. Consumer preferences are shifting towards faster and more reliable delivery options, creating a strong demand for premium air freight services. Competitive dynamics are characterized by price competition, capacity constraints, and ongoing investments in technology and infrastructure. The market is expected to exhibit a CAGR of xx% during the forecast period (2025-2033), with significant market penetration gains anticipated in the international segment. The emergence of Suid Cargo showcases the growing interest in specialized cargo airlines within the country.

Dominant Markets & Segments in South Africa Air Freight Market

By Service: Forwarding services currently dominate the market due to their flexibility and comprehensive solutions. Airlines are a significant segment, but increasingly face pressure from the rise of specialized cargo airlines. Mail services are a smaller but stable segment, while 'other services' (such as customs brokerage) are experiencing growth as a complement to core air freight activities.

By Destination: The international segment constitutes the largest portion of the market, driven by South Africa's significant import and export activities. The domestic segment is comparatively smaller but exhibits consistent growth, fueled by expanding domestic trade and e-commerce.

By Carrier Type: Belly cargo continues to dominate due to cost-effectiveness for smaller shipments. However, the increasing need for dedicated capacity is driving the growth of freighter services, especially for time-sensitive and high-value goods. Suid Cargo's entry into the market reinforces this trend.

Key Drivers:

- Economic Policies: Government support for infrastructure development and trade facilitation.

- Infrastructure: Investments in airports and logistics infrastructure across South Africa.

- E-commerce growth: driving demand for fast delivery across domestic and international routes.

South Africa Air Freight Market Product Innovations

Recent innovations in the South African air freight market focus on improving efficiency, transparency, and security. This includes the integration of advanced tracking systems, the use of predictive analytics for optimized routing, and the exploration of drone technology for last-mile delivery. These advancements cater to the growing demand for faster, more reliable, and traceable air freight solutions, enhancing the overall competitiveness of the market. The launch of Suid Cargo demonstrates a move towards dedicated cargo airlines and specialized services to address market demands.

Report Segmentation & Scope

This report segments the South African air freight market across several key dimensions:

By Service: Forwarding, Airlines, Mail, Other Services. Each segment is analyzed for its growth projections, market size, and competitive dynamics, focusing on specific service offerings and customer needs.

By Destination: Domestic and International. The report assesses market size, growth projections, and key drivers for each segment, considering the specific logistical challenges and opportunities.

By Carrier Type: Belly Cargo and Freighter. An analysis of cost-efficiency, capacity, and specialized service capabilities of each carrier type provides insights into the market's structure.

Key Drivers of South Africa Air Freight Market Growth

The South Africa air freight market is experiencing substantial growth due to several factors. Expanding e-commerce activities require fast and reliable delivery, boosting demand. Increased foreign trade and the development of specialized industries such as pharmaceuticals create strong demand for air freight. Finally, government investments in infrastructure, such as airport modernization and improvements to customs processes, ease logistical challenges and stimulate market growth.

Challenges in the South Africa Air Freight Market Sector

The South Africa air freight market faces challenges including high operational costs, fuel price volatility, and stringent regulatory requirements. Infrastructure limitations in certain regions, alongside potential security concerns, impact efficiency and reliability. Furthermore, competition from sea freight and the need to maintain competitive pricing add further pressure on businesses. These challenges require innovative solutions and strategic adaptations for companies operating in the market.

Leading Players in the South Africa Air Freight Market

- DHL

- PPAB Cargo Express

- Barloworld Logistics

- Turners Shipping

- Morgan Cargo

- Sebenza Freight

- Transmarine Logistics

- Sky Air Freight

- Intra Speed South Africa Pty Ltd

- ACS Africa Container Shipping

- Freight First

- 6 3 Other Companies in the Market

- Trans Air Freight

Key Developments in South Africa Air Freight Market Sector

- February 2023: Launch of Suid Cargo, South Africa's new cargo airline, signifies a move towards specialized services and increased competition. This signals a potential shift in market share within the airline segment.

- March 2023: A shift away from air freight in the automotive industry is observed due to falling sea freight rates and improved ocean reliability. This trend is expected to impact the overall market size and segment-specific growth in the coming years.

Strategic South Africa Air Freight Market Outlook

The South Africa air freight market presents substantial long-term growth opportunities. Continued investment in infrastructure, technological advancements, and the expansion of e-commerce are key drivers of future growth. Strategic partnerships, focusing on specialized services and leveraging technology to enhance efficiency and transparency, will be crucial for businesses to succeed in this dynamic environment. The potential for further consolidation through mergers and acquisitions remains a significant factor shaping the market's competitive landscape.

South Africa Air Freight Market Segmentation

-

1. Service

- 1.1. Forwarding

- 1.2. Airlines

- 1.3. Mail

- 1.4. Other Services

-

2. Destination

- 2.1. Domestic

- 2.2. International

-

3. Carrier Type

- 3.1. Belly Cargo

- 3.2. Freighter

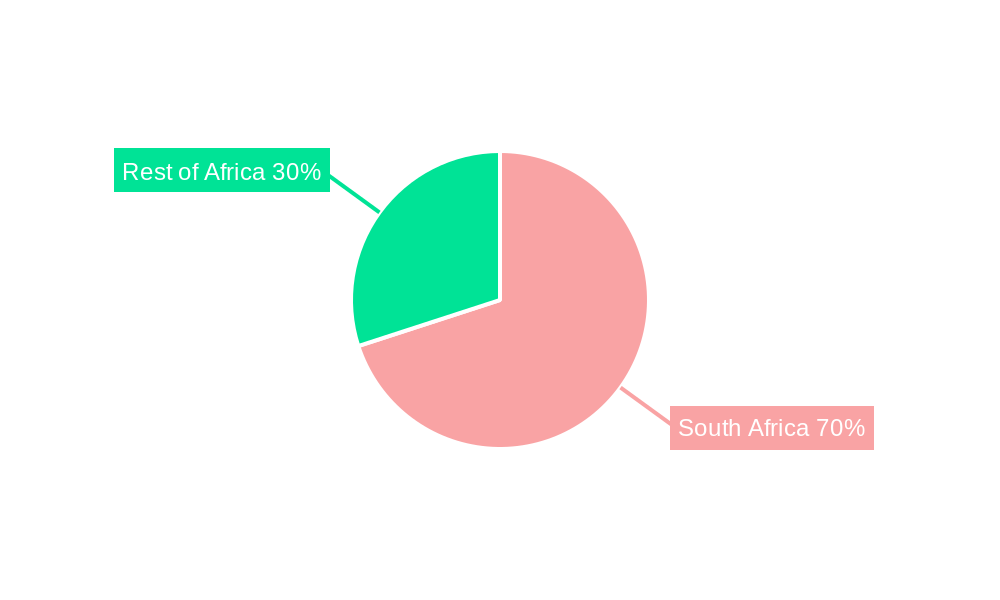

South Africa Air Freight Market Segmentation By Geography

- 1. South Africa

South Africa Air Freight Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing trade relations; Increased demand for perishable goods

- 3.3. Market Restrains

- 3.3.1. Cargo theft; High cost of maintainig

- 3.4. Market Trends

- 3.4.1. E-commerce Expansion Possibilities for Growth in the Air Freight Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Air Freight Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Forwarding

- 5.1.2. Airlines

- 5.1.3. Mail

- 5.1.4. Other Services

- 5.2. Market Analysis, Insights and Forecast - by Destination

- 5.2.1. Domestic

- 5.2.2. International

- 5.3. Market Analysis, Insights and Forecast - by Carrier Type

- 5.3.1. Belly Cargo

- 5.3.2. Freighter

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. South Africa South Africa Air Freight Market Analysis, Insights and Forecast, 2019-2031

- 7. Sudan South Africa Air Freight Market Analysis, Insights and Forecast, 2019-2031

- 8. Uganda South Africa Air Freight Market Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania South Africa Air Freight Market Analysis, Insights and Forecast, 2019-2031

- 10. Kenya South Africa Air Freight Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa South Africa Air Freight Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 DHL

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 PPAB Cargo Express

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Barloworld Logistics

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Turners Shipping

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Morgan Cargo

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Sebenza Freight

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Transmarine Logistics

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Sky Air Freight

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Intra Speed South Africa Pty Ltd

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 ACS Africa Container Shipping

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Freight First**List Not Exhaustive 6 3 Other Companies in the Marke

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Trans Air Freight

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.1 DHL

List of Figures

- Figure 1: South Africa Air Freight Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South Africa Air Freight Market Share (%) by Company 2024

List of Tables

- Table 1: South Africa Air Freight Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South Africa Air Freight Market Revenue Million Forecast, by Service 2019 & 2032

- Table 3: South Africa Air Freight Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 4: South Africa Air Freight Market Revenue Million Forecast, by Carrier Type 2019 & 2032

- Table 5: South Africa Air Freight Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: South Africa Air Freight Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: South Africa South Africa Air Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Sudan South Africa Air Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Uganda South Africa Air Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Tanzania South Africa Air Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Kenya South Africa Air Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Africa South Africa Air Freight Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: South Africa Air Freight Market Revenue Million Forecast, by Service 2019 & 2032

- Table 14: South Africa Air Freight Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 15: South Africa Air Freight Market Revenue Million Forecast, by Carrier Type 2019 & 2032

- Table 16: South Africa Air Freight Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Air Freight Market ?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the South Africa Air Freight Market ?

Key companies in the market include DHL, PPAB Cargo Express, Barloworld Logistics, Turners Shipping, Morgan Cargo, Sebenza Freight, Transmarine Logistics, Sky Air Freight, Intra Speed South Africa Pty Ltd, ACS Africa Container Shipping, Freight First**List Not Exhaustive 6 3 Other Companies in the Marke, Trans Air Freight.

3. What are the main segments of the South Africa Air Freight Market ?

The market segments include Service, Destination, Carrier Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing trade relations; Increased demand for perishable goods.

6. What are the notable trends driving market growth?

E-commerce Expansion Possibilities for Growth in the Air Freight Sector.

7. Are there any restraints impacting market growth?

Cargo theft; High cost of maintainig.

8. Can you provide examples of recent developments in the market?

March 2023: As importers and exporters look to falling sea freight rates and improved ocean reliability, South Africa is about to transition away from air freight. At the Air Cargo Africa conference last week in Johannesburg, attendees learned that the air will be used less and less by the automotive industry.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Air Freight Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Air Freight Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Air Freight Market ?

To stay informed about further developments, trends, and reports in the South Africa Air Freight Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence