Key Insights

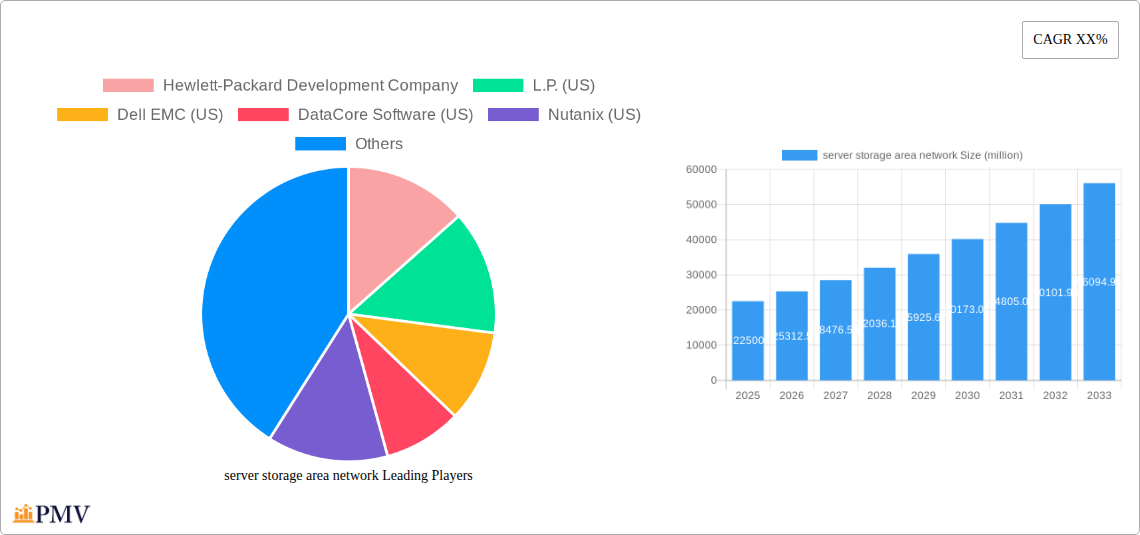

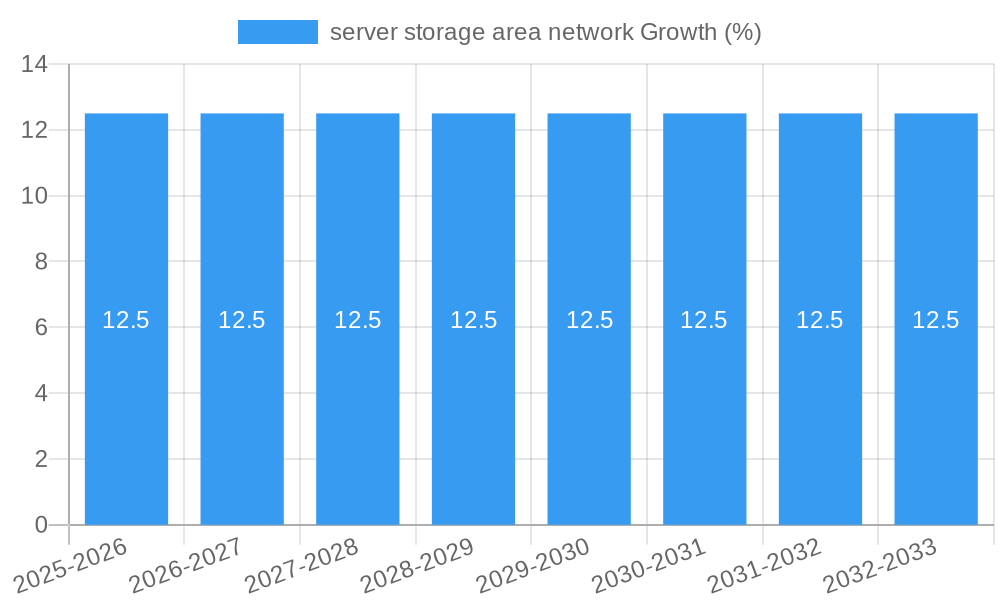

The global Server Storage Area Network (SAN) market is poised for substantial growth, projected to reach approximately $45 billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 12.5% from 2019-2033. This expansion is primarily fueled by the escalating demand for high-performance, reliable, and scalable storage solutions across all enterprise segments. Small and medium-sized enterprises (SMEs) are increasingly adopting SAN technologies to enhance data accessibility, improve disaster recovery capabilities, and optimize operational efficiency, mirroring the robust adoption seen in large enterprises. The increasing proliferation of data, driven by digital transformation initiatives, cloud adoption, and the explosion of unstructured data from IoT devices and advanced analytics, acts as a significant catalyst for SAN market expansion. Furthermore, the continuous evolution of SAN technologies, including the adoption of NVMe over Fabrics and the integration of AI for intelligent storage management, is addressing performance bottlenecks and simplifying complex storage environments, thus driving further market penetration.

The market is segmented into Hyperscale Server SAN and Enterprise Server SAN, with both segments experiencing strong demand. Hyperscale deployments, catering to the massive storage needs of cloud providers and large tech companies, are characterized by their sheer scale and advanced features. Enterprise Server SAN, on the other hand, is witnessing a surge in adoption by businesses of all sizes seeking robust, centralized storage that can support critical applications and virtualized environments. Key players such as Hewlett-Packard Development Company, Dell EMC, and Nutanix are at the forefront of innovation, offering comprehensive SAN solutions that cater to diverse needs. Restraints in the market include the initial capital investment associated with SAN deployment and the need for specialized IT expertise for management. However, the growing availability of software-defined storage (SDS) solutions and converged infrastructure offerings is mitigating these concerns, making SAN technology more accessible and cost-effective for a wider range of businesses. Emerging trends like flash storage integration, hyperconverged infrastructure (HCI), and hybrid cloud storage strategies are further shaping the SAN landscape, promising enhanced performance, agility, and cost optimization.

Detailed Report: server storage area network Market Analysis & Strategic Outlook (2019-2033)

This comprehensive report provides an in-depth analysis of the global server storage area network (SAN) market, offering critical insights into market structure, competitive dynamics, industry trends, and future projections. Covering the historical period of 2019-2024, base year 2025, and a forecast period extending to 2033, this report is an essential resource for understanding the evolution and strategic opportunities within this vital technology sector. With a focus on high-ranking keywords, this description aims to boost search visibility and engage industry professionals, decision-makers, and investors.

server storage area network Market Structure & Competitive Dynamics

The server storage area network (SAN) market is characterized by a moderately consolidated structure, with major players like Hewlett-Packard Development Company, L.P. (US), Dell EMC (US), and Hitachi, Ltd (Japan) holding significant market share. The innovation ecosystem thrives on continuous advancements in flash storage, software-defined storage, and cloud integration, driven by companies such as DataCore Software (US) and Nutanix (US). Regulatory frameworks, while generally supportive of technological advancements, can influence data residency requirements and compliance mandates. Product substitutes, including direct-attached storage (DAS) and Network Attached Storage (NAS), offer alternative solutions but often lack the performance and scalability of SAN. End-user trends highlight a growing demand for high-performance, scalable, and secure storage solutions to support data-intensive applications, AI/ML workloads, and hybrid cloud environments. Mergers and acquisitions (M&A) activities are prevalent as larger entities seek to expand their SAN portfolios and acquire innovative technologies. For instance, M&A deal values in the SAN sector have consistently ranged from tens of millions to several billion dollars over the study period, reflecting strategic consolidation. The market share distribution sees leading vendors collectively accounting for over 70% of the total market value.

- Market Concentration: Moderately consolidated with key global players.

- Innovation Ecosystem: Driven by flash, software-defined storage (SDS), and cloud convergence.

- Regulatory Frameworks: Impact on data sovereignty and compliance standards.

- Product Substitutes: Direct-Attached Storage (DAS), Network Attached Storage (NAS) with varying performance and scalability.

- End-User Trends: Demand for performance, scalability, security, and hybrid cloud readiness.

- M&A Activities: Strategic acquisitions for portfolio expansion and technological integration.

server storage area network Industry Trends & Insights

The server storage area network (SAN) industry is experiencing robust growth, propelled by an escalating demand for robust and high-performance data storage solutions across all enterprise segments. The Compound Annual Growth Rate (CAGR) for the SAN market is projected to be approximately 8.5% from 2025 to 2033, indicating significant expansion. This growth is largely fueled by the explosion of data generated by digital transformation initiatives, the proliferation of IoT devices, and the increasing adoption of Artificial Intelligence (AI) and Machine Learning (ML) workloads, all of which necessitate sophisticated storage infrastructure. Technological disruptions are a constant feature, with the rapid advancement and cost reduction of Solid-State Drives (SSDs) driving the widespread adoption of all-flash SAN arrays, delivering unprecedented IOPS and reduced latency. Software-defined storage (SDS) solutions are gaining significant traction, offering greater flexibility, scalability, and cost-efficiency by abstracting storage hardware from management. Hyperscale server SAN solutions are emerging as a critical component for large cloud providers and enterprises managing massive datasets, while enterprise server SAN continues to be the backbone for mission-critical applications in medium and large enterprises. Consumer preferences are shifting towards solutions that offer seamless integration with cloud environments, enhanced data protection capabilities, and intelligent data management features. Competitive dynamics are intensifying, with vendors focusing on differentiating through superior performance, advanced data services (e.g., deduplication, compression, snapshots), robust security features, and comprehensive management software. Market penetration of advanced SAN technologies continues to rise, especially within large enterprises adopting next-generation data centers. The increasing reliance on data for business intelligence and operational efficiency is a fundamental driver, making efficient and reliable storage paramount. The ongoing digital transformation across industries, from healthcare and finance to manufacturing and retail, directly translates to higher SAN market penetration and value.

Dominant Markets & Segments in server storage area network

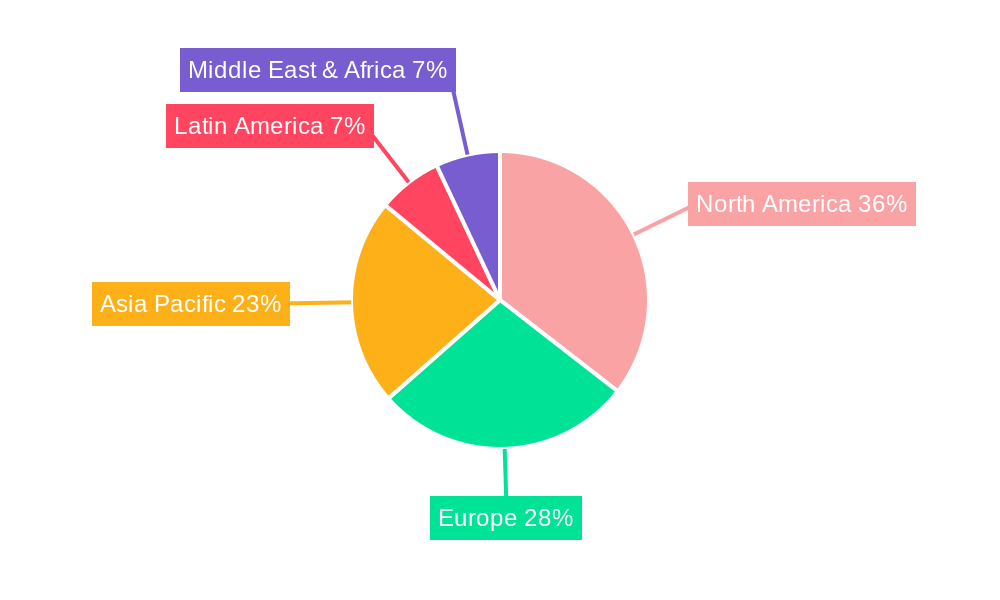

The server storage area network (SAN) market exhibits distinct dominance across geographical regions and enterprise segments, driven by a confluence of economic policies, technological infrastructure, and industry-specific needs. North America, particularly the United States, currently leads the SAN market due to its high concentration of technology-driven enterprises, robust IT spending, and early adoption of advanced storage solutions. The presence of major technology hubs and a strong innovation landscape contribute significantly to this leadership.

Within the Application segment, Large Enterprise stands out as the dominant force. These organizations manage vast amounts of critical data for complex operations, analytics, and customer-facing applications. Their substantial IT budgets and the imperative for high availability, performance, and scalability make them the primary consumers of sophisticated SAN solutions. Growth drivers for this segment include the need to support big data analytics, AI/ML initiatives, and extensive virtualized environments.

Regarding Types, Enterprise Server SAN currently commands the largest market share. These solutions are designed to meet the stringent requirements of mission-critical applications, offering features such as high availability, robust data protection, and advanced management capabilities. Economic policies supporting digital infrastructure development and cybersecurity initiatives further bolster the demand for enterprise-grade SAN.

The Medium-sized Enterprise segment is also a significant growth engine, exhibiting a strong upward trajectory as these businesses increasingly invest in digital transformation and require more advanced storage capabilities than basic solutions can offer. Key drivers include the need for cost-effective scalability, simplified management, and improved application performance.

Hyperscale Server SAN is a rapidly emerging and increasingly important segment, particularly driven by cloud service providers and massive internet companies. While its current market share might be smaller than traditional Enterprise Server SAN, its growth rate is exceptional, fueled by the exponential increase in global data traffic and the demand for highly scalable and efficient storage infrastructure for cloud-native applications and services. Economic policies that encourage cloud adoption and data center expansion directly influence the growth of this segment.

- Leading Region: North America, driven by US technological prowess and enterprise adoption.

- Dominant Application Segment: Large Enterprise, fueled by big data, AI/ML, and virtualization.

- Key Drivers: High IT budgets, mission-critical application support, extensive data management needs.

- Dominant Type Segment: Enterprise Server SAN, offering high availability and robust data protection.

- Key Drivers: Need for reliable storage for core business operations, stringent performance requirements.

- High-Growth Application Segment: Medium-sized Enterprise, driven by digital transformation and cost-effective scalability.

- High-Growth Type Segment: Hyperscale Server SAN, propelled by cloud growth and massive data generation.

server storage area network Product Innovations

Recent product innovations in the server storage area network (SAN) market are centered on enhancing performance, agility, and intelligence. All-flash arrays are becoming standard, offering near-instantaneous data access. Software-defined storage (SDS) solutions are maturing, enabling greater flexibility and hardware independence. Key developments include advanced data reduction technologies (deduplication, compression), intelligent tiering for optimized cost and performance, and seamless integration with hybrid and multi-cloud environments. These innovations provide competitive advantages by reducing operational costs, improving application responsiveness, and simplifying storage management for enterprises of all sizes.

Report Segmentation & Scope

This report segments the server storage area network (SAN) market based on critical factors to provide granular insights.

Application:

- Small Enterprise: Characterized by evolving storage needs, prioritizing cost-effectiveness and ease of deployment. This segment is expected to see steady growth as small businesses digitalize.

- Medium-sized Enterprise: Representing a significant growth opportunity, these enterprises demand scalable, performant, and manageable SAN solutions to support expanding operations and applications.

- Large Enterprise: The largest segment, requiring high-capacity, high-performance, and highly available SANs for mission-critical workloads and extensive data analytics.

Types:

- Hyperscale Server SAN: Designed for massive scale, primarily used by cloud providers and large internet companies for extreme data volumes and agility. Expected to witness the highest growth rate.

- Enterprise Server SAN: The established standard for traditional data centers, offering robust features for core business applications. This segment will continue to be a significant contributor to market value.

Key Drivers of server storage area network Growth

The growth of the server storage area network (SAN) market is primarily propelled by the exponential increase in data generation, fueled by digital transformation initiatives across industries. The escalating adoption of cloud computing and hybrid cloud architectures necessitates robust, scalable, and high-performance storage solutions. Furthermore, the burgeoning demand for advanced analytics, Artificial Intelligence (AI), and Machine Learning (ML) workloads, which require low-latency, high-throughput storage, is a significant growth accelerator. Increasing investments in IT infrastructure by enterprises of all sizes, coupled with the continuous evolution of storage technologies like flash and software-defined storage, also contribute to market expansion.

- Data Explosion: Rapid growth of structured and unstructured data.

- Cloud Adoption: Hybrid and multi-cloud strategies driving demand for integrated storage.

- AI/ML & Big Data: Need for high-performance storage for data-intensive workloads.

- Technological Advancements: Flash storage and Software-Defined Storage (SDS) innovations.

- IT Infrastructure Investment: Continued spending on modernizing data centers.

Challenges in the server storage area network Sector

Despite robust growth, the server storage area network (SAN) sector faces several challenges. The increasing complexity of SAN management, especially in multi-vendor environments, can lead to higher operational costs and require specialized expertise. Data security and compliance requirements, particularly concerning data residency and privacy regulations like GDPR and CCPA, add significant complexity and can increase deployment costs. The initial capital investment for high-performance SAN solutions can be a barrier for small and medium-sized enterprises. Furthermore, the rapid pace of technological change necessitates continuous upgrades and can lead to concerns about vendor lock-in and future compatibility. Supply chain disruptions, though easing, can still impact the availability and pricing of critical components.

- Management Complexity: Difficulties in managing heterogeneous SAN environments.

- Data Security & Compliance: Stringent regulations and evolving threat landscapes.

- High Initial Capital Investment: Cost barrier for smaller organizations.

- Rapid Technological Obsolescence: Need for frequent upgrades and concerns about vendor lock-in.

- Supply Chain Vulnerabilities: Potential disruptions impacting availability and pricing.

Leading Players in the server storage area network Market

- Hewlett-Packard Development Company, L.P. (US)

- Dell EMC (US)

- DataCore Software (US)

- Nutanix (US)

- Citrix Systems, Inc (US)

- Hitachi, Ltd (Japan)

- Scale Computing (US)

- StorMagic Ltd. (U.K)

Key Developments in server storage area network Sector

- 2023/Q4: Nutanix launches enhanced hyperconverged infrastructure (HCI) solutions with integrated storage, simplifying SAN management for enterprises.

- 2024/Q1: Dell EMC introduces new all-flash PowerStore models offering increased performance and scalability for demanding workloads.

- 2024/Q2: DataCore Software unveils significant updates to its SAN software-defined storage platform, enhancing cloud integration and data mobility.

- 2024/Q3: Hewlett-Packard Development Company, L.P. announces strategic partnerships to accelerate its hybrid cloud storage offerings.

- 2024/Q4: Hitachi, Ltd. expands its enterprise SAN portfolio with new solutions optimized for AI and analytics.

Strategic server storage area network Market Outlook

The strategic outlook for the server storage area network (SAN) market remains exceptionally positive, driven by ongoing digital transformation and the ever-increasing importance of data. Growth accelerators include the continued advancement of flash storage, the maturation of software-defined storage (SDS) solutions, and the increasing adoption of hyperconverged infrastructure (HCI) and composable infrastructure. The market will witness further innovation in areas like AI-driven storage management, enhanced data resilience, and seamless integration across on-premises, edge, and multi-cloud environments. Strategic opportunities lie in developing solutions that offer simplified management, cost optimization, and robust security to cater to the diverse needs of small, medium, and large enterprises, as well as the rapidly expanding hyperscale segment. Vendors focusing on agility, scalability, and intelligent data services are well-positioned for sustained success in this dynamic market.

server storage area network Segmentation

-

1. Application

- 1.1. Small Enterprise

- 1.2. Medium-sized Enterprise

- 1.3. Large Enterprise

-

2. Types

- 2.1. Hyperscale Server SAN

- 2.2. Enterprise Server SAN

server storage area network Segmentation By Geography

- 1. CA

server storage area network REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. server storage area network Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Small Enterprise

- 5.1.2. Medium-sized Enterprise

- 5.1.3. Large Enterprise

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Hyperscale Server SAN

- 5.2.2. Enterprise Server SAN

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. CA

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Hewlett-Packard Development Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 L.P. (US)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Dell EMC (US)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 DataCore Software (US)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Nutanix (US)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Citrix Systems

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Inc (US)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Hitachi

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Ltd (Japan)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Scale Computing (US)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 StorMagic Ltd. (U.K)

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Hewlett-Packard Development Company

List of Figures

- Figure 1: server storage area network Revenue Breakdown (million, %) by Product 2024 & 2032

- Figure 2: server storage area network Share (%) by Company 2024

List of Tables

- Table 1: server storage area network Revenue million Forecast, by Region 2019 & 2032

- Table 2: server storage area network Revenue million Forecast, by Application 2019 & 2032

- Table 3: server storage area network Revenue million Forecast, by Types 2019 & 2032

- Table 4: server storage area network Revenue million Forecast, by Region 2019 & 2032

- Table 5: server storage area network Revenue million Forecast, by Application 2019 & 2032

- Table 6: server storage area network Revenue million Forecast, by Types 2019 & 2032

- Table 7: server storage area network Revenue million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the server storage area network?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the server storage area network?

Key companies in the market include Hewlett-Packard Development Company, L.P. (US), Dell EMC (US), DataCore Software (US), Nutanix (US), Citrix Systems, Inc (US), Hitachi, Ltd (Japan), Scale Computing (US), StorMagic Ltd. (U.K).

3. What are the main segments of the server storage area network?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3400.00, USD 5100.00, and USD 6800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "server storage area network," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the server storage area network report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the server storage area network?

To stay informed about further developments, trends, and reports in the server storage area network, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence