Key Insights

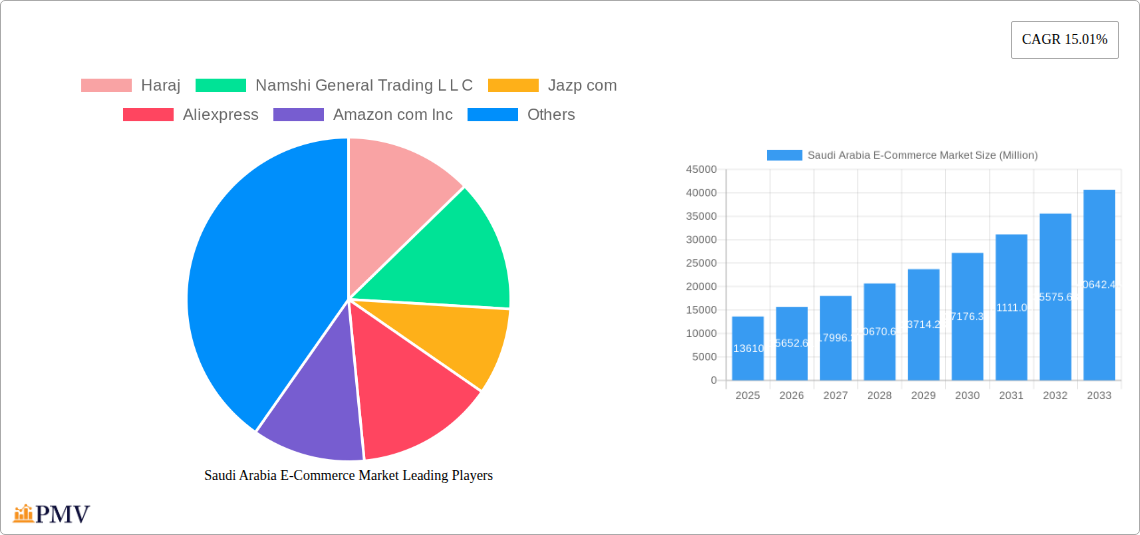

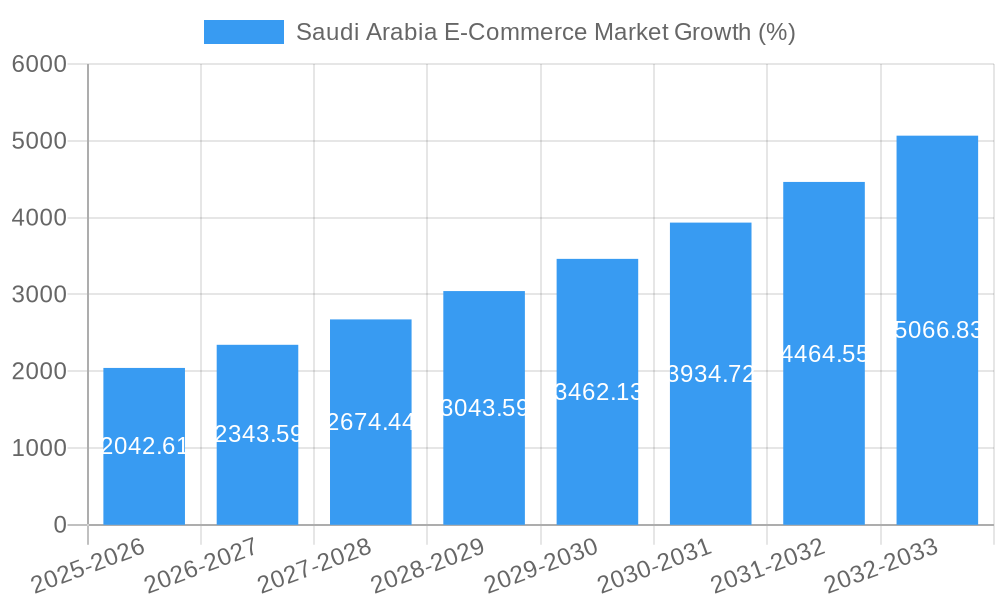

The Saudi Arabian e-commerce market, valued at $13.61 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 15.01% from 2025 to 2033. This surge is driven by several factors, including increasing internet and smartphone penetration, a young and digitally savvy population, government initiatives promoting digital transformation (such as Vision 2030), and the rising preference for convenient online shopping experiences. The market is segmented across diverse product categories, with Fashion & Apparel, Electronics, Grocery, Beauty & Personal Care, and Home Décor & Furniture leading the segments. The end-user segment comprises Individual Consumers, Businesses (B2B), and Government & Institutions, each contributing significantly to the overall market value. Key players like Haraj, Namshi, Jazp.com, AliExpress, Amazon, Carrefour, eBay, and Noon are fiercely competing, driving innovation and enhancing the consumer experience. The market's expansion is further facilitated by improved logistics and payment infrastructure, alongside increasing investment in e-commerce platforms and related technologies.

Significant growth opportunities exist within the Saudi Arabian e-commerce sector due to the substantial untapped potential in smaller cities and towns. The expansion of reliable delivery networks into these areas will be crucial for reaching wider consumer bases. Furthermore, continued investment in mobile payment solutions and cybersecurity infrastructure is essential for fostering trust and confidence amongst consumers. Addressing potential challenges, such as ensuring data privacy and security and managing customer expectations related to delivery times, will be vital for maintaining sustainable growth. The focus on providing personalized shopping experiences, incorporating augmented reality (AR) and virtual reality (VR) technologies, and integrating omnichannel strategies will further propel the market's expansion in the coming years. Competitive pricing strategies and diverse product offerings, coupled with effective marketing and customer service, will be key differentiators for success in this dynamic market.

Saudi Arabia E-Commerce Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Saudi Arabia e-commerce market, offering valuable insights for businesses, investors, and policymakers. Covering the period from 2019 to 2033, with a focus on 2025, this report dissects market structure, competitive dynamics, industry trends, and future growth prospects. The analysis includes detailed segmentations by product type and end-user, revealing dominant players and emerging opportunities within this rapidly evolving market.

Saudi Arabia E-Commerce Market Structure & Competitive Dynamics

This section analyzes the Saudi Arabia e-commerce market's competitive landscape, regulatory environment, and key market dynamics. The market exhibits a moderately concentrated structure, with a few dominant players and numerous smaller niche businesses. The presence of global giants like Amazon.com Inc and eBay Inc alongside regional players like Noon E-Commerce and Haraj creates a dynamic environment.

- Market Concentration: While precise market share data for each player is proprietary, Noon E-Commerce and Amazon.com Inc are likely to hold significant shares, followed by other players such as Haraj and Namshi General Trading L L C. The overall market concentration is estimated at xx%, indicating room for both competition and consolidation.

- Innovation Ecosystem: The Saudi Arabian government's Vision 2030 initiative is a major driver of innovation, fostering technological advancements and digital transformation. This is reflected in investments such as the USD 1.2 Million funding secured by Sideup in December 2022.

- Regulatory Framework: The regulatory environment is evolving, with a focus on consumer protection, data privacy, and fair competition. These regulations influence market dynamics and pose both challenges and opportunities for e-commerce businesses.

- Product Substitutes: Traditional retail remains a significant competitor, but the convenience and accessibility of e-commerce are driving increasing market penetration.

- End-User Trends: The shift towards online shopping is particularly prominent among younger demographics, driving growth in the individual consumer segment. The B2B and Government & Institutions segments are also experiencing growth, although at potentially slower rates.

- M&A Activities: Recent significant M&A activity, such as Noon's acquisition of Namshi for USD 335.2 Million in February 2023, illustrates the ongoing consolidation and expansion within the market. These activities shape market power and influence product offerings.

Saudi Arabia E-Commerce Market Industry Trends & Insights

The Saudi Arabia e-commerce market is experiencing significant growth, driven by several factors. The increasing smartphone penetration, rising internet usage, and a young, tech-savvy population contribute to this expansion. Government initiatives promoting digital transformation, such as Vision 2030, further accelerate market growth. Consumer preferences are shifting towards online shopping for convenience, wider product selection, and competitive pricing. Competitive dynamics are characterized by intense competition among established players and the emergence of new entrants, fostering innovation and price competition.

The market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), with market penetration expected to reach xx% by 2033. Technological disruptions, such as the adoption of Artificial Intelligence (AI) and improved logistics, are transforming the industry and enhancing the customer experience. These advancements are driving increased efficiency, personalized marketing, and improved delivery services.

Dominant Markets & Segments in Saudi Arabia E-Commerce Market

The Saudi Arabia e-commerce market is geographically concentrated, with major cities like Riyadh, Jeddah, and Dammam driving the majority of sales. However, the market is expanding into other regions as infrastructure improves and internet access expands.

Dominant Segments:

- Product Type Segmentation: Fashion & Apparel is likely the largest segment due to high demand and strong online presence of retailers. Electronics and Grocery are also significant segments experiencing considerable growth.

- End-User Segmentation: Individual Consumers represent the most substantial segment, with high growth potential in the B2B and Government & Institutions sectors.

Key Drivers of Segment Dominance:

- Economic Policies: Government initiatives supporting digitalization and e-commerce are key drivers.

- Infrastructure Development: Improvements in logistics and delivery infrastructure are crucial for segment expansion.

- Consumer Preferences: Changing buying habits and increasing adoption of online shopping contribute to segment growth.

Saudi Arabia E-Commerce Market Product Innovations

The Saudi Arabia e-commerce market witnesses constant innovation in product offerings, driven by technological advancements and changing consumer needs. We see an increased focus on personalized recommendations, AI-powered chatbots for customer service, improved payment gateways, and enhanced delivery options, including same-day delivery in major cities. These innovations are improving the overall customer experience and fostering market competition.

Report Segmentation & Scope

This report segments the Saudi Arabia e-commerce market by product type (Fashion & Apparel, Electronics, Grocery, Beauty & Personal Care, Home Décor & Furniture, Others) and end-user (Individual Consumers, Businesses (B2B), Government & Institutions). Each segment's growth projections, market sizes (in Millions), and competitive dynamics are analyzed in detail. The report provides detailed historical data (2019-2024), an estimated market size for 2025, and forecasts for the period 2025-2033.

Key Drivers of Saudi Arabia E-Commerce Market Growth

Several factors drive the growth of the Saudi Arabia e-commerce market: the rising internet and smartphone penetration, government initiatives promoting digital transformation (Vision 2030), increasing disposable incomes, and a young, tech-savvy population eager to adopt online shopping. The expansion of logistics infrastructure and the development of advanced payment systems also contribute significantly to market expansion.

Challenges in the Saudi Arabia E-Commerce Market Sector

The Saudi Arabia e-commerce market faces challenges including the need for further infrastructure development in some regions, concerns about online security and data privacy, and potential regulatory hurdles. The increasing competition from both established players and new entrants also presents challenges for market participants. Supply chain disruptions and fluctuations in oil prices can further impact market dynamics.

Leading Players in the Saudi Arabia E-Commerce Market Market

- Haraj

- Namshi General Trading L L C

- Jazp.com

- Aliexpress

- Amazon.com Inc

- Carrefour

- eBay Inc

- Noon Ad Holdings Ltd (Noon E-Commerce)

Key Developments in Saudi Arabia E-Commerce Market Sector

- December 2022: Sideup, an e-commerce platform developer, received USD 1.2 Million in funding, signifying investor confidence and potential market expansion.

- February 2023: Noon's acquisition of Namshi for USD 335.2 Million significantly impacts market share and strengthens Noon's position in the fashion and lifestyle segment.

Strategic Saudi Arabia E-Commerce Market Outlook

The Saudi Arabia e-commerce market presents significant growth potential. Continued government support for digital transformation, rising internet and smartphone penetration, and evolving consumer preferences will drive market expansion. Opportunities exist for companies to leverage technological advancements, enhance logistics networks, and cater to the specific needs of the Saudi Arabian market. The market is poised for further consolidation and innovation, creating exciting prospects for both established players and new entrants.

Saudi Arabia E-Commerce Market Segmentation

-

1. Product Type

- 1.1. Fashion & Apparel

- 1.2. Electronics

- 1.3. Grocery

- 1.4. Beauty & Personal Care

- 1.5. Home Décor & Furniture

- 1.6. Others

-

2. End-User

- 2.1. Individual Consumers

- 2.2. Businesses (B2B)

- 2.3. Government & Institutions

Saudi Arabia E-Commerce Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia E-Commerce Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 15.01% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increase in Internet Penetration and Smartphone Usage; Promotion of E-commerce by the Government Sector

- 3.2.2 including Measures to Strengthen Last-Mile Delivery and Improvise Distribution Centers

- 3.3. Market Restrains

- 3.3.1. Privacy and security concerns

- 3.4. Market Trends

- 3.4.1. Fashion and Apparel Segment is Expected to Grow Exponentially

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia E-Commerce Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Fashion & Apparel

- 5.1.2. Electronics

- 5.1.3. Grocery

- 5.1.4. Beauty & Personal Care

- 5.1.5. Home Décor & Furniture

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Individual Consumers

- 5.2.2. Businesses (B2B)

- 5.2.3. Government & Institutions

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. UAE Saudi Arabia E-Commerce Market Analysis, Insights and Forecast, 2019-2031

- 7. South Africa Saudi Arabia E-Commerce Market Analysis, Insights and Forecast, 2019-2031

- 8. Saudi Arabia Saudi Arabia E-Commerce Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of MEA Saudi Arabia E-Commerce Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Haraj

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Namshi General Trading L L C

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Jazp com

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Aliexpress

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Amazon com Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Carrefou

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 eBay Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Noon Ad Holdings Ltd (Noon E-Commerce)

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 Haraj

List of Figures

- Figure 1: Saudi Arabia E-Commerce Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Saudi Arabia E-Commerce Market Share (%) by Company 2024

List of Tables

- Table 1: Saudi Arabia E-Commerce Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Saudi Arabia E-Commerce Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Saudi Arabia E-Commerce Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: Saudi Arabia E-Commerce Market Volume K Unit Forecast, by Product Type 2019 & 2032

- Table 5: Saudi Arabia E-Commerce Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 6: Saudi Arabia E-Commerce Market Volume K Unit Forecast, by End-User 2019 & 2032

- Table 7: Saudi Arabia E-Commerce Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Saudi Arabia E-Commerce Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: Saudi Arabia E-Commerce Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Saudi Arabia E-Commerce Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: UAE Saudi Arabia E-Commerce Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: UAE Saudi Arabia E-Commerce Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 13: South Africa Saudi Arabia E-Commerce Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: South Africa Saudi Arabia E-Commerce Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Saudi Arabia Saudi Arabia E-Commerce Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Saudi Arabia Saudi Arabia E-Commerce Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Rest of MEA Saudi Arabia E-Commerce Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of MEA Saudi Arabia E-Commerce Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: Saudi Arabia E-Commerce Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 20: Saudi Arabia E-Commerce Market Volume K Unit Forecast, by Product Type 2019 & 2032

- Table 21: Saudi Arabia E-Commerce Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 22: Saudi Arabia E-Commerce Market Volume K Unit Forecast, by End-User 2019 & 2032

- Table 23: Saudi Arabia E-Commerce Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Saudi Arabia E-Commerce Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia E-Commerce Market?

The projected CAGR is approximately 15.01%.

2. Which companies are prominent players in the Saudi Arabia E-Commerce Market?

Key companies in the market include Haraj, Namshi General Trading L L C, Jazp com, Aliexpress, Amazon com Inc, Carrefou, eBay Inc, Noon Ad Holdings Ltd (Noon E-Commerce).

3. What are the main segments of the Saudi Arabia E-Commerce Market?

The market segments include Product Type , End-User .

4. Can you provide details about the market size?

The market size is estimated to be USD 13.61 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Internet Penetration and Smartphone Usage; Promotion of E-commerce by the Government Sector. including Measures to Strengthen Last-Mile Delivery and Improvise Distribution Centers.

6. What are the notable trends driving market growth?

Fashion and Apparel Segment is Expected to Grow Exponentially.

7. Are there any restraints impacting market growth?

Privacy and security concerns.

8. Can you provide examples of recent developments in the market?

February 2023: The online fashion retailer Namshi, which operated primarily in Saudi Arabia, was acquired by the e-commerce company Noon for a total cash consideration of USD 335.2 million, and this addition of more fashion and lifestyle brands to Noon's digital offering of goods and services in the country

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia E-Commerce Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia E-Commerce Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia E-Commerce Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia E-Commerce Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence