Key Insights

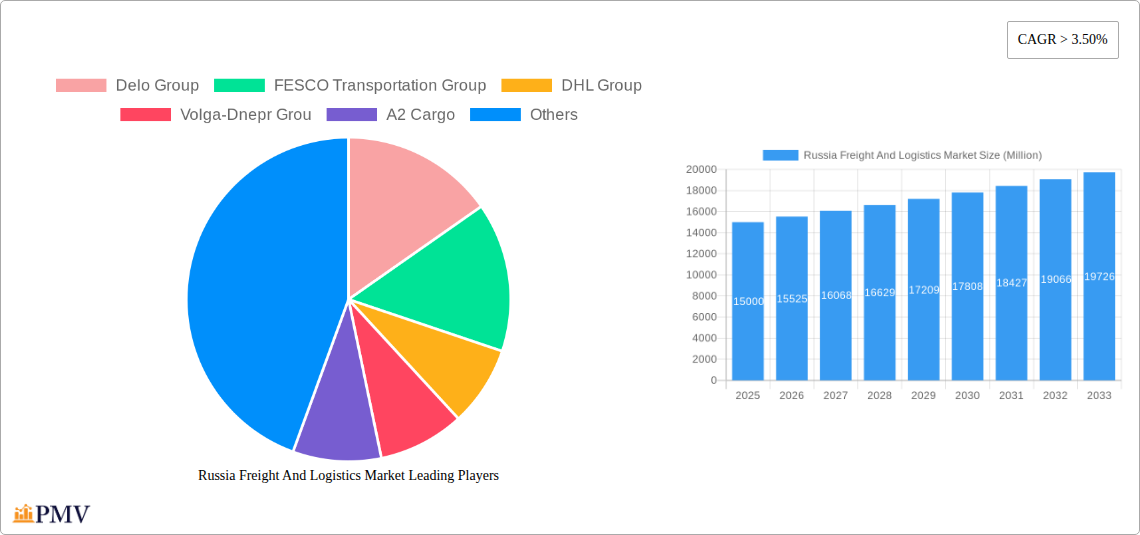

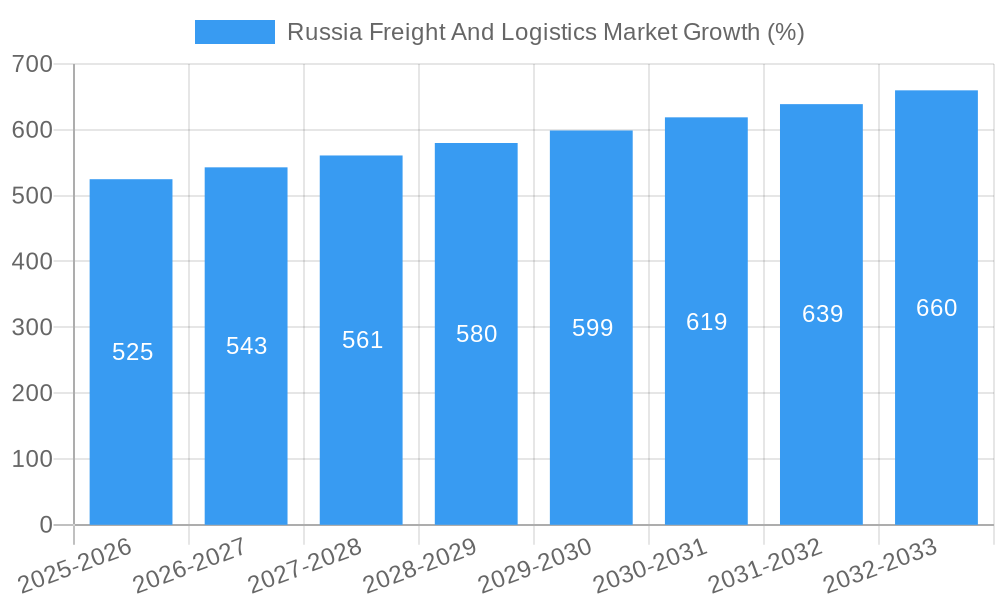

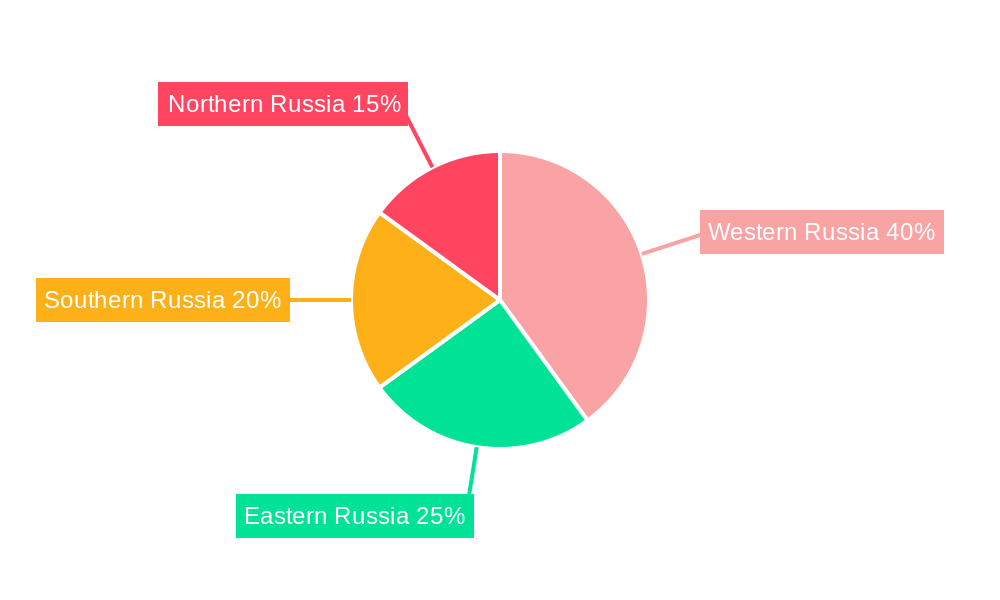

The Russia freight and logistics market, exhibiting a CAGR exceeding 3.50%, presents a compelling investment landscape. Driven by robust growth in sectors like manufacturing, oil and gas, and e-commerce, the market is projected to expand significantly over the forecast period (2025-2033). Key growth drivers include increasing industrial output, rising cross-border trade, and the ongoing development of Russia's infrastructure, particularly its transportation networks. The market is segmented by temperature-controlled services, general freight, and specialized logistics, catering to diverse end-user industries including agriculture, construction, mining, and retail. While geopolitical factors and economic fluctuations pose potential restraints, the market's inherent resilience and substantial growth potential are expected to offset these challenges. The dominance of major players like Delo Group, FESCO Transportation Group, and DHL Group, alongside the emergence of regional players, fosters a competitive yet dynamic market environment. The regional breakdown, encompassing Western, Eastern, Southern, and Northern Russia, highlights geographical variations in market growth influenced by infrastructure development and industrial concentration. Expansion within the temperature-controlled logistics segment is particularly noteworthy, reflecting the growing demand for efficient and secure transportation of perishable goods. The market's substantial size and projected growth indicate significant opportunities for both established and emerging players.

The forecast period of 2025-2033 anticipates continued market expansion, fueled by government initiatives aimed at modernizing transportation infrastructure and fostering economic diversification. The burgeoning e-commerce sector is a significant contributor to this growth, increasing demand for efficient last-mile delivery solutions. While challenges remain, including navigating regulatory complexities and adapting to evolving geopolitical dynamics, the long-term outlook for the Russia freight and logistics market remains positive. The strong presence of established multinational companies alongside a growing number of domestic firms suggests a robust and adaptable market capable of responding to shifting demands and opportunities. Strategic investments in technology and infrastructure are expected to further enhance efficiency and connectivity within the logistics network, supporting continued market expansion.

Russia Freight & Logistics Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Russia freight and logistics market, covering historical performance (2019-2024), current estimates (2025), and future forecasts (2025-2033). It delves into market structure, competitive dynamics, industry trends, dominant segments, product innovations, and key challenges, offering actionable insights for businesses operating or seeking to enter this dynamic market. The report leverages extensive data and analysis to provide a 360-degree view of this crucial sector, with a focus on key players like Delo Group, FESCO Transportation Group, DHL Group, Volga-Dnepr Group, A2 Cargo, Sovtransavto Group, Volga Shipping, Eurosib Group, Delko, and STS Logistics. The market is segmented by logistics function (Courier, Express, and Parcel (CEP); Temperature Controlled; Other Services), and end-user industry (Agriculture, Fishing, and Forestry; Construction; Manufacturing; Oil and Gas; Mining and Quarrying; Wholesale and Retail Trade; Others).

Russia Freight And Logistics Market Market Structure & Competitive Dynamics

The Russian freight and logistics market exhibits a moderately concentrated structure, with a few large players dominating specific segments. Delo Group, FESCO Transportation Group, and Sovtransavto Group hold significant market share, particularly in rail and intermodal transportation. The market is characterized by an evolving innovation ecosystem, driven by technological advancements in areas such as digital logistics platforms, autonomous vehicles, and improved tracking technologies. Regulatory frameworks, while undergoing reform, continue to present both opportunities and challenges for market participants. Product substitutes, particularly in the last-mile delivery segment, are emerging and increasing competition. End-user trends, notably the growth of e-commerce and the increasing demand for efficient supply chains, are driving market expansion. Mergers and acquisitions (M&A) activity remains relatively modest, with deal values estimated at around xx Million in the past five years, indicating potential for further consolidation in the future.

- Market Concentration: Delo Group holds an estimated xx% market share in the container shipping segment, while FESCO Transportation Group controls approximately xx% of the rail freight market.

- Innovation Ecosystem: Investments in digital logistics solutions are expected to reach xx Million by 2033.

- Regulatory Framework: Ongoing reforms aim to streamline customs procedures and improve infrastructure.

- M&A Activity: Recent M&A deals have focused on expanding service offerings and geographical reach.

Russia Freight And Logistics Market Industry Trends & Insights

The Russian freight and logistics market is experiencing significant growth, driven by factors such as increased domestic and international trade, infrastructure development, and technological advancements. The market's Compound Annual Growth Rate (CAGR) is projected to be xx% during the forecast period (2025-2033). Technological disruptions, particularly the implementation of digital solutions for tracking and optimization, are significantly enhancing efficiency and transparency throughout the supply chain. Consumer preferences are shifting toward faster, more reliable, and more sustainable logistics solutions. The competitive landscape is dynamic, with existing players investing heavily in technology and expansion while new entrants challenge the status quo. Market penetration of digital logistics platforms is expected to reach xx% by 2033.

Dominant Markets & Segments in Russia Freight And Logistics Market

The Moscow and St. Petersburg regions represent the most dominant markets, driven by high population density, industrial activity, and extensive infrastructure networks. Within segments, the temperature-controlled logistics segment exhibits robust growth, fueled by the increasing demand for the transportation of perishable goods. The oil and gas sector is a major end-user, due to its significant logistical requirements.

- Key Drivers for Dominant Segments:

- Temperature Controlled: Growing demand for food and pharmaceutical products requiring specific temperature conditions during transportation.

- Oil and Gas: The large-scale operations and complex logistical needs of the oil and gas industry.

- Moscow & St. Petersburg Regions: Concentrated population, industrial activity, and well-developed infrastructure.

Russia Freight And Logistics Market Product Innovations

Recent innovations focus on leveraging technology for improved efficiency, visibility, and sustainability. This includes the implementation of digital tracking systems, the adoption of autonomous vehicles for last-mile delivery, and the development of sustainable transportation solutions to reduce environmental impact. These innovations aim to enhance customer satisfaction, streamline operations, and improve overall competitiveness in a demanding market.

Report Segmentation & Scope

This report segments the Russia freight and logistics market based on various criteria:

Logistics Function: Courier, Express, and Parcel (CEP), Temperature Controlled, and Other Services. The CEP segment is projected to experience a CAGR of xx%, driven by the rapid growth of e-commerce. The temperature-controlled segment is anticipated to grow at a CAGR of xx%, driven by increased demand for cold chain logistics. The "Other Services" segment encompasses warehousing, freight forwarding, and other related services.

End-User Industry: Agriculture, Fishing, and Forestry, Construction, Manufacturing, Oil and Gas, Mining and Quarrying, Wholesale and Retail Trade, and Others. The Oil and Gas sector is expected to account for xx% of the total market, given its large-scale transportation needs. Manufacturing and Wholesale & Retail Trade are other significant end-user segments.

Key Drivers of Russia Freight And Logistics Market Growth

Several factors contribute to the growth of the Russian freight and logistics market: expanding e-commerce, increasing cross-border trade, government initiatives to improve infrastructure (such as road and rail networks), and the adoption of technological advancements like automation and digitization. The development of special economic zones and free trade agreements further stimulates growth, while government policies encouraging investment and modernization contribute to positive market dynamics.

Challenges in the Russia Freight And Logistics Market Sector

Key challenges include geographical vastness and varying infrastructure quality across regions. Seasonal variations and extreme weather conditions can disrupt transportation. Bureaucracy and regulatory complexities can lead to delays and increased costs. Geopolitical factors also significantly impact market stability and operations. Competition from established players and new market entrants poses a continuous challenge, requiring ongoing innovation and efficiency improvements.

Leading Players in the Russia Freight And Logistics Market Market

- Delo Group

- FESCO Transportation Group

- DHL Group

- Volga-Dnepr Group

- A2 Cargo

- Sovtransavto Group

- Volga Shipping

- Eurosib Group

- Delko

- STS Logistics

Key Developments in Russia Freight And Logistics Market Sector

- November 2022: Eurosib Group and EFKO-Cascade CRC LLC signed a service contract for transport logistics.

- November 2022: DHL extended its partnership with the German Bobsleigh, Luge, and Skeleton Federation.

- February 2023: DHL Global Forwarding implemented sustainable logistics solutions for Grundfos.

Strategic Russia Freight And Logistics Market Market Outlook

The Russia freight and logistics market offers significant long-term growth potential. Continued investments in infrastructure, technological advancements, and supportive government policies will drive market expansion. Strategic opportunities exist for companies focusing on sustainable solutions, technological innovation, and specialized service offerings to cater to specific industry needs. The market's growth trajectory is positive, particularly within sectors experiencing strong growth such as e-commerce and specialized logistics services.

Russia Freight And Logistics Market Segmentation

-

1. End User Industry

- 1.1. Agriculture, Fishing, and Forestry

- 1.2. Construction

- 1.3. Manufacturing

- 1.4. Oil and Gas, Mining and Quarrying

- 1.5. Wholesale and Retail Trade

- 1.6. Others

-

2. Logistics Function

-

2.1. Courier, Express, and Parcel (CEP)

-

2.1.1. By Destination Type

- 2.1.1.1. Domestic

- 2.1.1.2. International

-

2.1.1. By Destination Type

-

2.2. Freight Forwarding

-

2.2.1. By Mode Of Transport

- 2.2.1.1. Air

- 2.2.1.2. Sea and Inland Waterways

- 2.2.1.3. Others

-

2.2.1. By Mode Of Transport

-

2.3. Freight Transport

- 2.3.1. Pipelines

- 2.3.2. Rail

- 2.3.3. Road

-

2.4. Warehousing and Storage

-

2.4.1. By Temperature Control

- 2.4.1.1. Non-Temperature Controlled

-

2.4.1. By Temperature Control

- 2.5. Other Services

-

2.1. Courier, Express, and Parcel (CEP)

Russia Freight And Logistics Market Segmentation By Geography

- 1. Russia

Russia Freight And Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing volume of international trade4.; The rise of trade agreements between nations

- 3.3. Market Restrains

- 3.3.1. 4.; Surge in fuel costs affecting the market4.; Increasing trade tension

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russia Freight And Logistics Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Agriculture, Fishing, and Forestry

- 5.1.2. Construction

- 5.1.3. Manufacturing

- 5.1.4. Oil and Gas, Mining and Quarrying

- 5.1.5. Wholesale and Retail Trade

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Logistics Function

- 5.2.1. Courier, Express, and Parcel (CEP)

- 5.2.1.1. By Destination Type

- 5.2.1.1.1. Domestic

- 5.2.1.1.2. International

- 5.2.1.1. By Destination Type

- 5.2.2. Freight Forwarding

- 5.2.2.1. By Mode Of Transport

- 5.2.2.1.1. Air

- 5.2.2.1.2. Sea and Inland Waterways

- 5.2.2.1.3. Others

- 5.2.2.1. By Mode Of Transport

- 5.2.3. Freight Transport

- 5.2.3.1. Pipelines

- 5.2.3.2. Rail

- 5.2.3.3. Road

- 5.2.4. Warehousing and Storage

- 5.2.4.1. By Temperature Control

- 5.2.4.1.1. Non-Temperature Controlled

- 5.2.4.1. By Temperature Control

- 5.2.5. Other Services

- 5.2.1. Courier, Express, and Parcel (CEP)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. Western Russia Russia Freight And Logistics Market Analysis, Insights and Forecast, 2019-2031

- 7. Eastern Russia Russia Freight And Logistics Market Analysis, Insights and Forecast, 2019-2031

- 8. Southern Russia Russia Freight And Logistics Market Analysis, Insights and Forecast, 2019-2031

- 9. Northern Russia Russia Freight And Logistics Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Delo Group

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 FESCO Transportation Group

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 DHL Group

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Volga-Dnepr Grou

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 A2 Cargo

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Sovtransavto Group

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Volga Shipping

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Eurosib Group

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Delko

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 STS Logistics

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Delo Group

List of Figures

- Figure 1: Russia Freight And Logistics Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Russia Freight And Logistics Market Share (%) by Company 2024

List of Tables

- Table 1: Russia Freight And Logistics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Russia Freight And Logistics Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 3: Russia Freight And Logistics Market Revenue Million Forecast, by Logistics Function 2019 & 2032

- Table 4: Russia Freight And Logistics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Russia Freight And Logistics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Western Russia Russia Freight And Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Eastern Russia Russia Freight And Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Southern Russia Russia Freight And Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Northern Russia Russia Freight And Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Russia Freight And Logistics Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 11: Russia Freight And Logistics Market Revenue Million Forecast, by Logistics Function 2019 & 2032

- Table 12: Russia Freight And Logistics Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russia Freight And Logistics Market?

The projected CAGR is approximately > 3.50%.

2. Which companies are prominent players in the Russia Freight And Logistics Market?

Key companies in the market include Delo Group, FESCO Transportation Group, DHL Group, Volga-Dnepr Grou, A2 Cargo, Sovtransavto Group, Volga Shipping, Eurosib Group, Delko, STS Logistics.

3. What are the main segments of the Russia Freight And Logistics Market?

The market segments include End User Industry, Logistics Function.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing volume of international trade4.; The rise of trade agreements between nations.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

4.; Surge in fuel costs affecting the market4.; Increasing trade tension.

8. Can you provide examples of recent developments in the market?

February 2023: DHL Global Forwarding, the air and ocean freight specialist division of Deutsche Post DHL Group, successfully implemented sustainable logistics solutions for its customer Grundfos.November 2022: DHL prolonged its partnership with the German Bobsleigh, Luge, and Skeleton Federation (BSD) for another four years. The premium and logistics partnership has been in place since the 2014-2015 winter season, and it includes logistics for all equipment during the seasons, along with the branding of sports equipment and clothing of athletes.November 2022: Eurosib Group and EFKO-Cascade CRC LLC signed a service contract to provide transport logistics to enterprises belonging to the EFKO Group of Companies.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russia Freight And Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russia Freight And Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russia Freight And Logistics Market?

To stay informed about further developments, trends, and reports in the Russia Freight And Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence