Key Insights

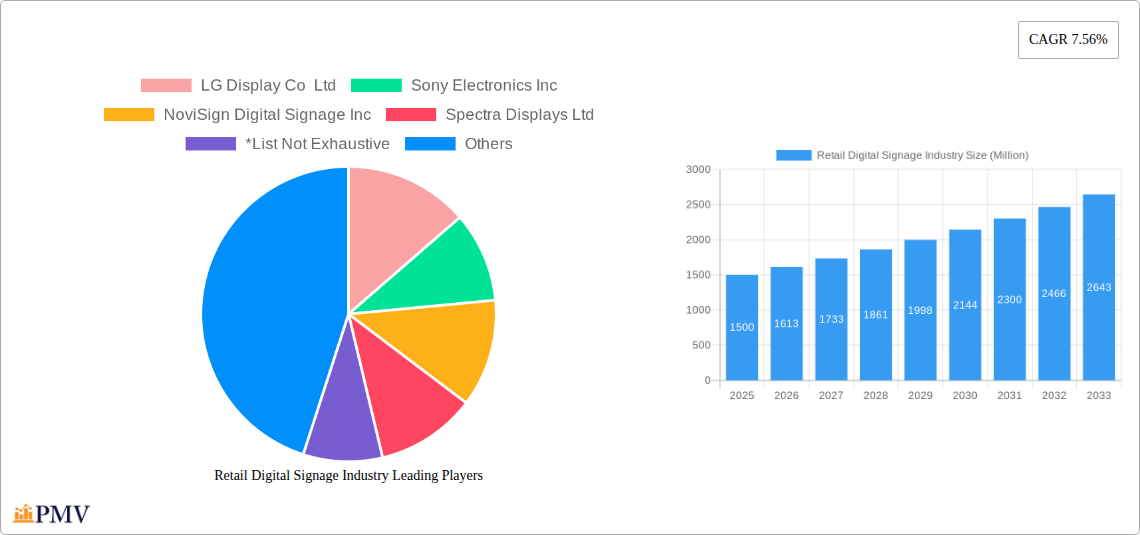

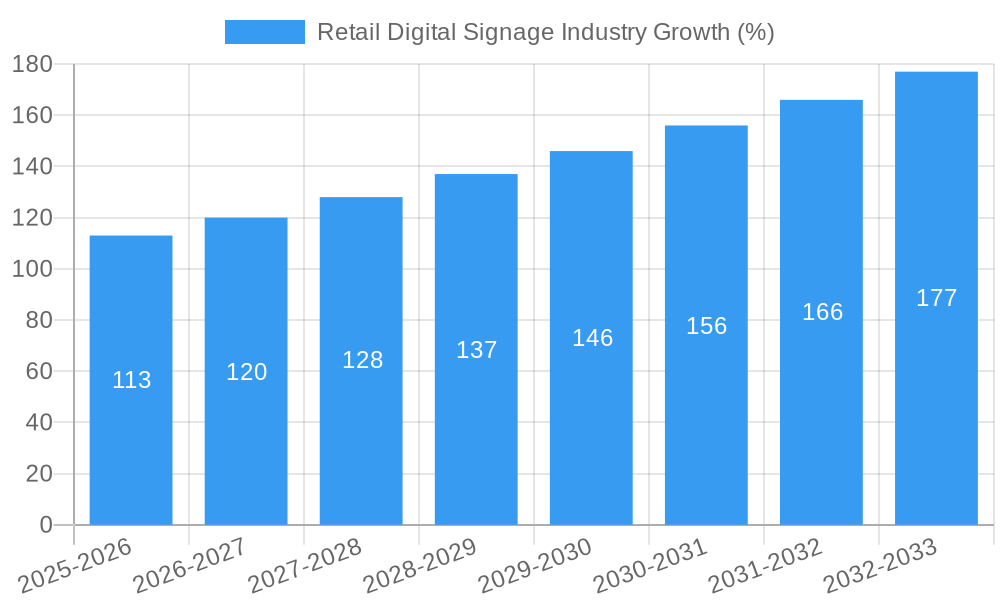

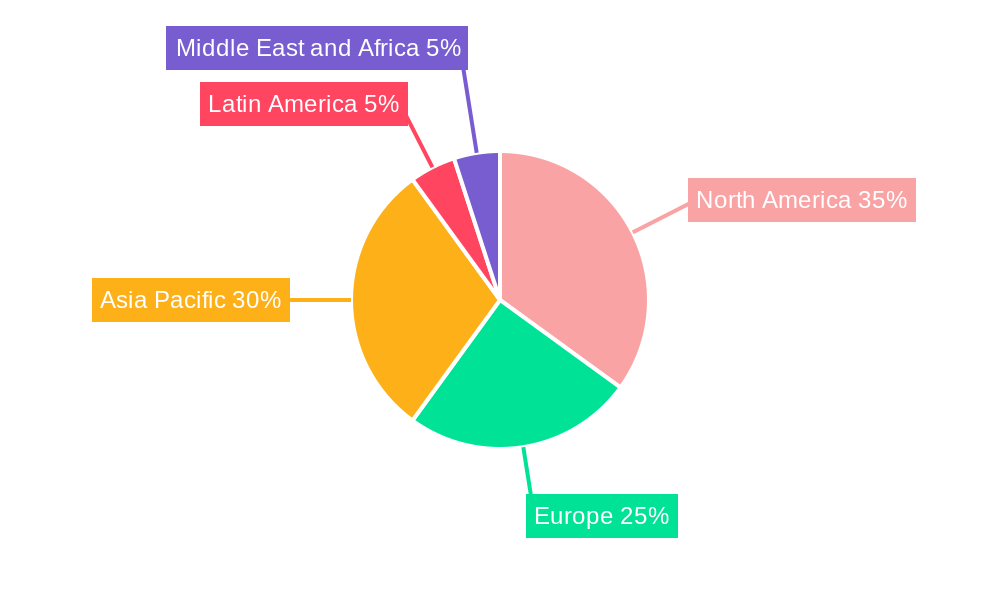

The retail digital signage market is experiencing robust growth, driven by the increasing adoption of advanced technologies like AI and interactive displays to enhance customer engagement and drive sales. The market's 7.56% CAGR from 2019-2033 suggests a significant expansion, with a projected market size exceeding $XX million by 2033 (assuming a 2025 market size of $YY million, a logical estimate based on the provided CAGR and typical market growth trajectories for this sector). Key drivers include the need for retailers to improve in-store experiences, personalized marketing campaigns, and efficient inventory management. Trends such as the integration of omnichannel strategies, the use of dynamic content, and the rise of interactive kiosks are further accelerating market growth. While data limitations prevent precise regional breakdowns, it's reasonable to assume that North America and Asia Pacific currently hold the largest market shares, driven by strong retail sectors and technological advancements. However, significant growth opportunities exist in emerging markets within Europe, Latin America, and the Middle East and Africa as digital adoption continues to increase. Competitive pressures from established players like Samsung Electronics Co and LG Display Co Ltd, alongside innovative entrants like NoviSign Digital Signage Inc, ensure a dynamic and evolving market landscape. The growth is further supported by the increasing demand for software and services which are integral to the effective operation and maintenance of these systems.

The retail digital signage market is segmented into hardware, software, and services. While hardware constitutes a major portion, the software and services segments are experiencing rapid growth due to the increasing demand for customized solutions, analytics, and remote management capabilities. This trend points towards a shift towards integrated solutions that provide a complete ecosystem for retailers, from hardware installation to content management and data analysis. This comprehensive approach facilitates more effective campaign management and allows for data-driven decision-making, optimizing returns on investment. The limitations in available data make a precise analysis of individual segment growth challenging; however, given the trends, we can reasonably infer that the software and services segments will see disproportionately high growth compared to the hardware segment over the forecast period.

Retail Digital Signage Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Retail Digital Signage industry, offering valuable insights for stakeholders, investors, and industry professionals. The report covers the period from 2019 to 2033, with a focus on the forecast period from 2025 to 2033, and utilizes 2025 as the base and estimated year. The market size is valued in Millions.

Retail Digital Signage Industry Market Structure & Competitive Dynamics

The Retail Digital Signage market exhibits a moderately consolidated structure, with key players like LG Display Co Ltd, Sony Electronics Inc, NoviSign Digital Signage Inc, Planar Systems Inc, Samsung Electronics Co, Scala Digital Signage, Hanshow Technology, SIS Digital Media Limited, Luminati, and Panasonic Corporation holding significant market share. However, the presence of numerous smaller players and startups indicates a competitive landscape. The market share of the top five players is estimated at xx%.

Innovation ecosystems are thriving, fueled by advancements in display technology, software capabilities, and content management systems. Regulatory frameworks, varying by region, influence deployment and data privacy aspects. Product substitutes, such as traditional print advertising and in-store promotions, still exist but face increasing competition from digital signage's dynamic capabilities. End-user trends towards personalized experiences and data-driven marketing are driving adoption. M&A activities, while not frequent, have played a role in consolidating market share. Recent deals totaled approximately $xx Million, signifying strategic investments.

Retail Digital Signage Industry Industry Trends & Insights

The Retail Digital Signage market is experiencing robust growth, driven by the increasing need for enhanced customer engagement, improved brand communication, and data-driven decision-making. The Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is projected to be xx%. Market penetration is steadily increasing, with xx% of retail establishments currently utilizing digital signage. Technological advancements, particularly in areas like high-resolution displays, interactive kiosks, and AI-powered analytics, are fueling further market expansion. Consumer preferences are shifting towards personalized and immersive retail experiences, directly impacting the demand for advanced digital signage solutions. Competitive dynamics are largely shaped by product innovation, pricing strategies, and service offerings, resulting in constant improvement of products and services.

Dominant Markets & Segments in Retail Digital Signage Industry

The North American region currently dominates the Retail Digital Signage market, primarily driven by high technological adoption rates and a developed retail infrastructure. Key drivers include:

- Robust economic conditions: High disposable incomes and consumer spending fuel investment in advanced retail technologies.

- Advanced retail infrastructure: Established supply chains and logistics networks facilitate the seamless deployment of digital signage solutions.

- Favorable government policies: Regulatory support for technological advancements promotes market growth.

Other significant markets include Europe and Asia-Pacific, experiencing rapid growth due to increasing urbanization and the expansion of retail chains. In terms of segments, the Hardware segment currently holds the largest market share, followed by Software and Services. This is primarily due to the higher initial investment required for hardware infrastructure. The Software and Services segments are experiencing faster growth rates compared to the hardware segment, driven by increasing demand for sophisticated content management systems and data analytics platforms.

Retail Digital Signage Industry Product Innovations

Recent product innovations include advancements in LED and LCD technologies, resulting in higher resolution displays with improved brightness and energy efficiency. Interactive kiosks and touch screen displays are gaining popularity, enhancing customer engagement. Integration of AI and machine learning capabilities enables personalized messaging and data analytics for optimized marketing strategies. These innovations create competitive advantages by offering unique value propositions to retailers, such as increased sales conversion rates, improved brand awareness, and streamlined operations.

Report Segmentation & Scope

The report segments the Retail Digital Signage market by:

By Solution: Hardware (Displays, Media Players, Software, Kiosks), Software (Content Management Systems, Analytics Platforms, and other software) and Services (Installation, Maintenance, and other services). Each segment is analyzed for its growth projections, market size (in Millions), and competitive dynamics.

Key Drivers of Retail Digital Signage Industry Growth

Several factors are driving the growth of the Retail Digital Signage market. These include:

- Technological advancements in display technology and software capabilities.

- Increasing demand for enhanced customer experiences and brand personalization.

- Growing adoption of data-driven marketing strategies.

- Rising investments in retail infrastructure modernization.

- Favorable government regulations promoting digital transformation.

Challenges in the Retail Digital Signage Industry Sector

The Retail Digital Signage market faces several challenges:

- High initial investment costs for hardware infrastructure.

- Complexity in integrating digital signage solutions with existing retail systems.

- Concerns about data security and privacy.

- Competition from traditional advertising channels and emerging technologies.

- Maintenance and support costs.

Leading Players in the Retail Digital Signage Industry Market

- LG Display Co Ltd

- Sony Electronics Inc

- NoviSign Digital Signage Inc

- Spectra Displays Ltd

- Scala Digital Signage

- Samsung Electronics Co

- Planar Systems Inc

- Hanshow Technology

- SIS Digital Media Limited

- Luminati

- Panasonic Corporation

Key Developments in Retail Digital Signage Industry Sector

- July 2021: Sony Corporation joined a collaborative alliance program, expanding its capabilities in integrated hardware and software solutions for various markets, including retail. This strategic move is expected to significantly enhance Sony's presence and market share in the Retail Digital Signage sector.

Strategic Retail Digital Signage Industry Market Outlook

The Retail Digital Signage market is poised for significant growth in the coming years. Continued technological innovation, increasing demand for personalized retail experiences, and the growing adoption of data-driven marketing strategies will fuel this expansion. Opportunities exist for companies to innovate in areas such as interactive displays, AI-powered analytics, and integrated solutions. Strategic partnerships and acquisitions will play a key role in shaping market dynamics and driving growth.

Retail Digital Signage Industry Segmentation

-

1. Solution

-

1.1. Hardware

- 1.1.1. Display Technology

- 1.1.2. Media Players

- 1.1.3. Projectors

- 1.1.4. Other Hardwares

- 1.2. Software

- 1.3. Services

-

1.1. Hardware

Retail Digital Signage Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Retail Digital Signage Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.56% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Steady increase in Advertising to Supplement Market Growth

- 3.3. Market Restrains

- 3.3.1. Cost related constraints

- 3.4. Market Trends

- 3.4.1. Hardware segment to have significant market growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Retail Digital Signage Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Solution

- 5.1.1. Hardware

- 5.1.1.1. Display Technology

- 5.1.1.2. Media Players

- 5.1.1.3. Projectors

- 5.1.1.4. Other Hardwares

- 5.1.2. Software

- 5.1.3. Services

- 5.1.1. Hardware

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Solution

- 6. North America Retail Digital Signage Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Solution

- 6.1.1. Hardware

- 6.1.1.1. Display Technology

- 6.1.1.2. Media Players

- 6.1.1.3. Projectors

- 6.1.1.4. Other Hardwares

- 6.1.2. Software

- 6.1.3. Services

- 6.1.1. Hardware

- 6.1. Market Analysis, Insights and Forecast - by Solution

- 7. Europe Retail Digital Signage Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Solution

- 7.1.1. Hardware

- 7.1.1.1. Display Technology

- 7.1.1.2. Media Players

- 7.1.1.3. Projectors

- 7.1.1.4. Other Hardwares

- 7.1.2. Software

- 7.1.3. Services

- 7.1.1. Hardware

- 7.1. Market Analysis, Insights and Forecast - by Solution

- 8. Asia Pacific Retail Digital Signage Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Solution

- 8.1.1. Hardware

- 8.1.1.1. Display Technology

- 8.1.1.2. Media Players

- 8.1.1.3. Projectors

- 8.1.1.4. Other Hardwares

- 8.1.2. Software

- 8.1.3. Services

- 8.1.1. Hardware

- 8.1. Market Analysis, Insights and Forecast - by Solution

- 9. Latin America Retail Digital Signage Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Solution

- 9.1.1. Hardware

- 9.1.1.1. Display Technology

- 9.1.1.2. Media Players

- 9.1.1.3. Projectors

- 9.1.1.4. Other Hardwares

- 9.1.2. Software

- 9.1.3. Services

- 9.1.1. Hardware

- 9.1. Market Analysis, Insights and Forecast - by Solution

- 10. Middle East and Africa Retail Digital Signage Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Solution

- 10.1.1. Hardware

- 10.1.1.1. Display Technology

- 10.1.1.2. Media Players

- 10.1.1.3. Projectors

- 10.1.1.4. Other Hardwares

- 10.1.2. Software

- 10.1.3. Services

- 10.1.1. Hardware

- 10.1. Market Analysis, Insights and Forecast - by Solution

- 11. North America Retail Digital Signage Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Retail Digital Signage Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific Retail Digital Signage Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Latin America Retail Digital Signage Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East and Africa Retail Digital Signage Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 LG Display Co Ltd

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Sony Electronics Inc

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 NoviSign Digital Signage Inc

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Spectra Displays Ltd

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 *List Not Exhaustive

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Scala Digital Signage

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Samsung Electronics Co

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Planar Systems Inc

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Hanshow Technology

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 SIS Digital Media Limited

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Luminati

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Panasonic Corporation

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.1 LG Display Co Ltd

List of Figures

- Figure 1: Global Retail Digital Signage Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Retail Digital Signage Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Retail Digital Signage Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Retail Digital Signage Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Retail Digital Signage Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Retail Digital Signage Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Retail Digital Signage Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Retail Digital Signage Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Retail Digital Signage Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Retail Digital Signage Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Retail Digital Signage Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Retail Digital Signage Industry Revenue (Million), by Solution 2024 & 2032

- Figure 13: North America Retail Digital Signage Industry Revenue Share (%), by Solution 2024 & 2032

- Figure 14: North America Retail Digital Signage Industry Revenue (Million), by Country 2024 & 2032

- Figure 15: North America Retail Digital Signage Industry Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Retail Digital Signage Industry Revenue (Million), by Solution 2024 & 2032

- Figure 17: Europe Retail Digital Signage Industry Revenue Share (%), by Solution 2024 & 2032

- Figure 18: Europe Retail Digital Signage Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: Europe Retail Digital Signage Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Asia Pacific Retail Digital Signage Industry Revenue (Million), by Solution 2024 & 2032

- Figure 21: Asia Pacific Retail Digital Signage Industry Revenue Share (%), by Solution 2024 & 2032

- Figure 22: Asia Pacific Retail Digital Signage Industry Revenue (Million), by Country 2024 & 2032

- Figure 23: Asia Pacific Retail Digital Signage Industry Revenue Share (%), by Country 2024 & 2032

- Figure 24: Latin America Retail Digital Signage Industry Revenue (Million), by Solution 2024 & 2032

- Figure 25: Latin America Retail Digital Signage Industry Revenue Share (%), by Solution 2024 & 2032

- Figure 26: Latin America Retail Digital Signage Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Latin America Retail Digital Signage Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Middle East and Africa Retail Digital Signage Industry Revenue (Million), by Solution 2024 & 2032

- Figure 29: Middle East and Africa Retail Digital Signage Industry Revenue Share (%), by Solution 2024 & 2032

- Figure 30: Middle East and Africa Retail Digital Signage Industry Revenue (Million), by Country 2024 & 2032

- Figure 31: Middle East and Africa Retail Digital Signage Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Retail Digital Signage Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Retail Digital Signage Industry Revenue Million Forecast, by Solution 2019 & 2032

- Table 3: Global Retail Digital Signage Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Retail Digital Signage Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Retail Digital Signage Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Global Retail Digital Signage Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Retail Digital Signage Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Retail Digital Signage Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Retail Digital Signage Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Retail Digital Signage Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Retail Digital Signage Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Retail Digital Signage Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Retail Digital Signage Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Retail Digital Signage Industry Revenue Million Forecast, by Solution 2019 & 2032

- Table 15: Global Retail Digital Signage Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global Retail Digital Signage Industry Revenue Million Forecast, by Solution 2019 & 2032

- Table 17: Global Retail Digital Signage Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Retail Digital Signage Industry Revenue Million Forecast, by Solution 2019 & 2032

- Table 19: Global Retail Digital Signage Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Global Retail Digital Signage Industry Revenue Million Forecast, by Solution 2019 & 2032

- Table 21: Global Retail Digital Signage Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global Retail Digital Signage Industry Revenue Million Forecast, by Solution 2019 & 2032

- Table 23: Global Retail Digital Signage Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Retail Digital Signage Industry?

The projected CAGR is approximately 7.56%.

2. Which companies are prominent players in the Retail Digital Signage Industry?

Key companies in the market include LG Display Co Ltd, Sony Electronics Inc, NoviSign Digital Signage Inc, Spectra Displays Ltd, *List Not Exhaustive, Scala Digital Signage, Samsung Electronics Co, Planar Systems Inc, Hanshow Technology, SIS Digital Media Limited, Luminati, Panasonic Corporation.

3. What are the main segments of the Retail Digital Signage Industry?

The market segments include Solution.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Steady increase in Advertising to Supplement Market Growth.

6. What are the notable trends driving market growth?

Hardware segment to have significant market growth.

7. Are there any restraints impacting market growth?

Cost related constraints.

8. Can you provide examples of recent developments in the market?

July 2021 - Sony Corporation has joined a collaborative alliance program that enables the company to offer more capabilities by providing integrated solutions through alignment with other companies in the Audio Video industry. With the alliance, the company is focused on integrating and optimizing hardware and software products for the corporate, education, government, healthcare, faith, retail, entertainment, and transportation markets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Retail Digital Signage Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Retail Digital Signage Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Retail Digital Signage Industry?

To stay informed about further developments, trends, and reports in the Retail Digital Signage Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence