Key Insights

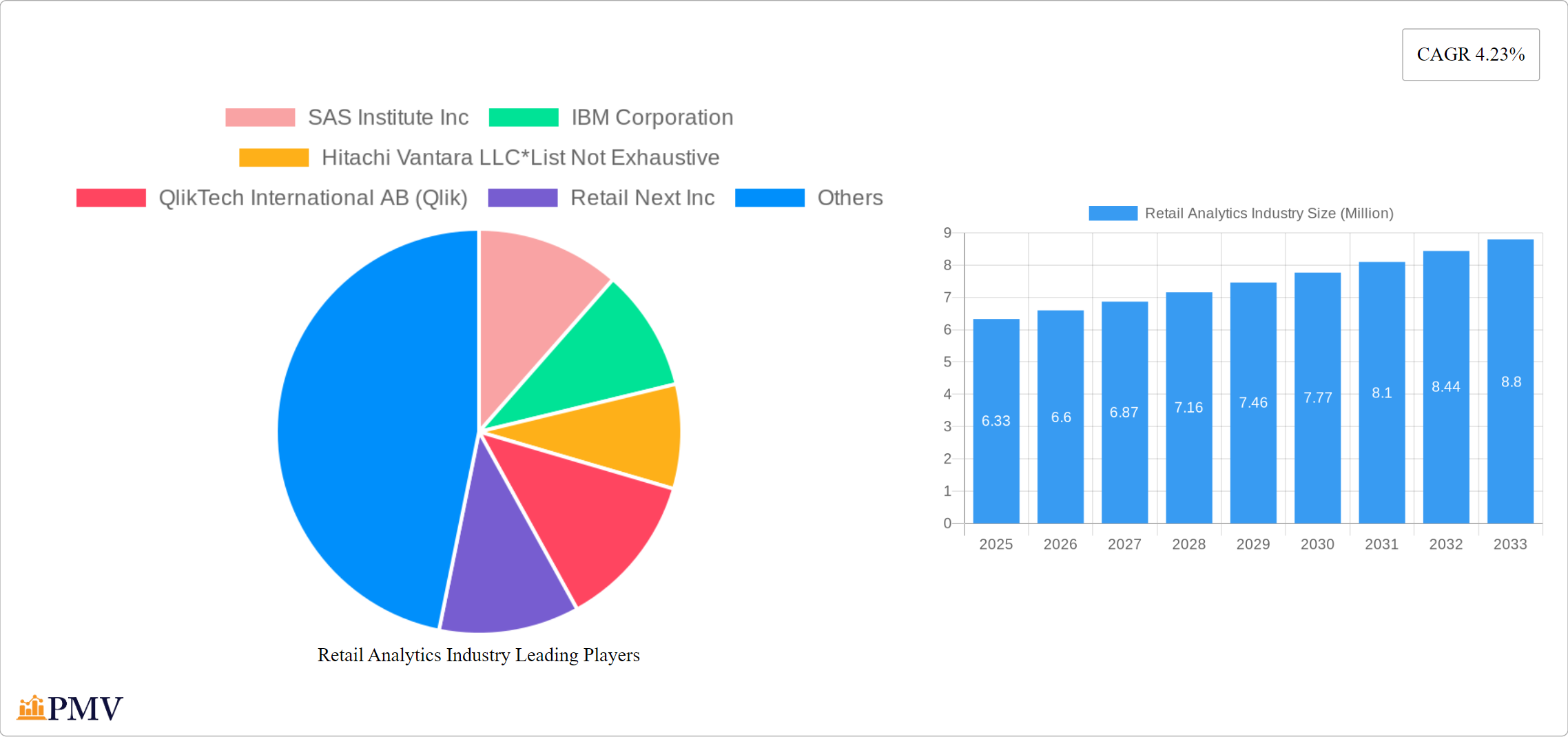

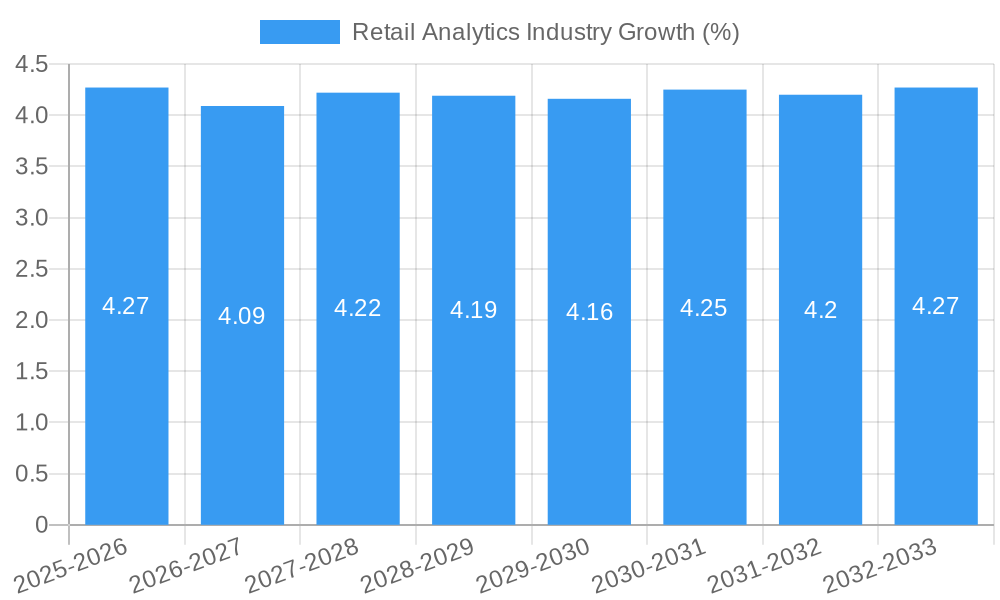

The Retail Analytics Industry, valued at $6.33 million in 2025, is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.23% during the forecast period from 2025 to 2033. This growth is driven by the increasing demand for data-driven decision-making in the retail sector, where solutions like software and services play crucial roles. The market segments by solution reveal that both software and services are essential, with software leading due to its scalability and ease of integration. In terms of deployment, the cloud segment is expected to grow faster than on-premise solutions, thanks to its flexibility and cost-effectiveness. Key functions within the market include customer management, in-store operations, supply chain management, and marketing and merchandising, with in-store operations, particularly inventory and performance management, being a significant driver of growth.

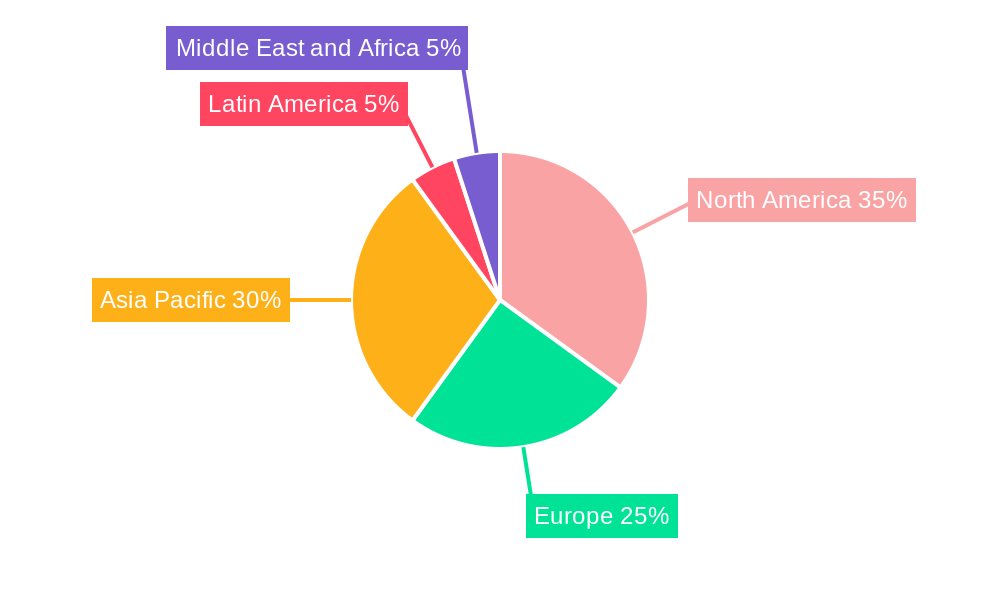

Regionally, North America, with major markets in the United States and Canada, holds a significant share of the global Retail Analytics market, supported by advanced technological infrastructure and the presence of key players like SAS Institute Inc, IBM Corporation, and Oracle Corporation. Europe and Asia Pacific are also notable regions, with countries like Germany, the United Kingdom, China, and Japan contributing substantially to market growth. The competitive landscape includes major companies such as Hitachi Vantara LLC, QlikTech International AB, and Salesforce.com Inc (Tableau Software Inc), which are continuously innovating to meet the evolving needs of the retail sector. The market's growth is further influenced by trends such as the integration of artificial intelligence and machine learning into retail analytics solutions, enhancing predictive analytics capabilities and operational efficiency.

Retail Analytics Industry Market Structure & Competitive Dynamics

The Retail Analytics Industry is characterized by a dynamic market structure and intense competitive dynamics, shaped by several key factors. The market concentration is moderate, with leading players such as SAS Institute Inc, IBM Corporation, and Hitachi Vantara LLC holding significant market shares. These companies, along with others like QlikTech International AB (Qlik), Retail Next Inc, Altair Engineering Inc, Alteryx Inc, Oracle Corporation, Salesforce.com Inc (Tableau Software Inc), and SAP SE, form a robust innovation ecosystem driving advancements in retail analytics solutions.

- Innovation Ecosystems: The industry benefits from a collaborative environment where companies invest heavily in R&D to develop cutting-edge solutions. For instance, IBM's Watson Analytics has revolutionized data analysis in retail, offering predictive insights that enhance decision-making.

- Regulatory Frameworks: Compliance with data protection regulations like GDPR and CCPA influences market dynamics, pushing companies to ensure their solutions meet these standards, thus affecting market entry and competitive positioning.

- Product Substitutes: Alternatives such as traditional data analysis tools and manual processes still exist, but the efficiency and scalability of retail analytics software are pushing their adoption.

- End-User Trends: Retailers are increasingly seeking solutions that offer real-time analytics and seamless integration with existing systems, driving demand for advanced retail analytics platforms.

- M&A Activities: The industry has seen significant M&A activities, with deal values reaching into the hundreds of millions. For example, the acquisition of Retailsoft by Priority Software in September 2023 for an estimated value of xx Million aimed at enhancing retail business efficiency.

Overall, the market's competitive dynamics are driven by innovation, regulatory compliance, and strategic acquisitions, shaping a landscape where adaptability and technological advancement are key to maintaining market share.

Retail Analytics Industry Industry Trends & Insights

The Retail Analytics Industry is experiencing robust growth, driven by several key trends and insights. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15% from 2025 to 2033, reaching a market size of xx Million by the end of the forecast period. Technological disruptions, particularly in areas such as artificial intelligence and big data analytics, are key growth drivers.

Retailers are increasingly adopting advanced analytics solutions to optimize operations and enhance customer experiences. For instance, the integration of AI in retail analytics has led to a market penetration of over 30% in leading retail markets, enabling personalized marketing strategies and predictive inventory management. Consumer preferences are shifting towards omnichannel shopping experiences, which necessitates sophisticated analytics to track and analyze customer behavior across multiple touchpoints.

Competitive dynamics are intensifying as companies like IBM and Oracle invest in cloud-based solutions to cater to the growing demand for scalable and flexible analytics platforms. The rise of autonomous shopping technologies, as seen in the partnership between AiFi and Microsoft in January 2023, is another significant trend. This collaboration introduced Smart Store Analytics, a service aimed at providing operational and shopper analytics for smart stores, further illustrating the industry's move towards automation and data-driven decision-making.

Economic factors, such as the recovery from global economic downturns and increased consumer spending, also play a crucial role in driving market growth. Additionally, the regulatory landscape is evolving, with stricter data privacy laws prompting companies to develop more secure and compliant analytics solutions. These trends collectively indicate a future where retail analytics will be integral to achieving competitive advantage in the retail sector.

Dominant Markets & Segments in Retail Analytics Industry

The Retail Analytics Industry is segmented by solution, deployment, and function, with each segment playing a crucial role in market dominance. The Software segment under By Solution is currently the leading segment, driven by the increasing demand for advanced analytics tools that can process large datasets and provide actionable insights.

Software Segment:

Economic Policies: Government initiatives promoting digital transformation in retail.

Infrastructure: Robust IT infrastructure supporting software deployment.

The software segment is expected to grow at a CAGR of 17% from 2025 to 2033, reaching a market size of xx Million by the end of the forecast period. This dominance is attributed to the scalability and flexibility of software solutions, enabling retailers to tailor analytics to their specific needs.

Cloud Deployment:

Economic Policies: Incentives for cloud adoption in retail.

Infrastructure: Availability of cloud service providers.

The Cloud segment under By Deployment is gaining traction, projected to grow at a CAGR of 20% from 2025 to 2033, reaching a market size of xx Million. Cloud solutions offer cost-effectiveness and scalability, making them attractive to retailers of all sizes.

In-store Operation Function:

Economic Policies: Support for inventory management technologies.

Infrastructure: Development of smart store technologies.

The In-store Operation segment, including Inventory Management and Performance Management, is a dominant function, expected to grow at a CAGR of 18% from 2025 to 2033, reaching a market size of xx Million. This segment's growth is driven by the need for real-time data to optimize store operations and enhance customer experiences.

The dominance of these segments is influenced by various factors, including technological advancements, economic policies, and infrastructure development. Retailers are increasingly recognizing the value of these segments in driving operational efficiency and competitive advantage.

Retail Analytics Industry Product Innovations

Product innovations in the Retail Analytics Industry are focused on leveraging advanced technologies to meet the evolving needs of retailers. Recent developments include the integration of AI and machine learning for predictive analytics, enabling retailers to anticipate customer behavior and optimize inventory. The launch of Smart Store Analytics by AiFi and Microsoft in January 2023 exemplifies this trend, offering real-time analytics for autonomous shopping environments. These innovations enhance market fit by providing solutions that are scalable, flexible, and capable of delivering actionable insights, thereby improving operational efficiency and customer satisfaction.

Report Segmentation & Scope

The Retail Analytics Industry report is segmented into several key categories to provide a comprehensive analysis of the market.

By Solution: The Software segment is projected to grow at a CAGR of 17% from 2025 to 2033, reaching a market size of xx Million. The Service segment, including consulting and implementation, is expected to grow at a CAGR of 14%, reaching a market size of xx Million. Competitive dynamics in this segment are driven by innovation and service quality.

By Deployment: The Cloud segment is anticipated to grow at a CAGR of 20%, reaching a market size of xx Million by 2033. The On-premise segment is expected to grow at a CAGR of 12%, reaching a market size of xx Million. The shift towards cloud solutions is influenced by cost-effectiveness and scalability.

By Function: The Customer Management segment is expected to grow at a CAGR of 16%, reaching a market size of xx Million. The In-store Operation segment, including Inventory Management and Performance Management, is projected to grow at a CAGR of 18%, reaching a market size of xx Million. Supply Chain Management is anticipated to grow at a CAGR of 15%, reaching a market size of xx Million. Marketing and Merchandizing, including Pricing and Yield Management, is expected to grow at a CAGR of 17%, reaching a market size of xx Million. Other Functions, such as Transportation Management and Order Management, are projected to grow at a CAGR of 13%, reaching a market size of xx Million. Competitive dynamics vary across functions, with each segment requiring specialized solutions.

Key Drivers of Retail Analytics Industry Growth

Several key drivers are propelling the growth of the Retail Analytics Industry:

- Technological Advancements: The integration of AI and machine learning in retail analytics solutions is enhancing predictive capabilities, enabling retailers to optimize inventory and personalize marketing strategies.

- Economic Factors: The global economic recovery and increased consumer spending are driving demand for retail analytics solutions to improve operational efficiency and customer experiences.

- Regulatory Compliance: Stricter data privacy laws are prompting companies to develop more secure and compliant analytics solutions, thereby increasing market demand.

These drivers collectively contribute to the industry's growth, with technological innovations playing a pivotal role in shaping market trends.

Challenges in the Retail Analytics Industry Sector

The Retail Analytics Industry faces several challenges that could impede growth:

- Regulatory Hurdles: Compliance with evolving data protection regulations like GDPR and CCPA requires significant investment in secure and compliant solutions, potentially slowing market expansion.

- Supply Chain Issues: Disruptions in the global supply chain can affect the implementation of retail analytics solutions, impacting market growth by xx% annually.

- Competitive Pressures: The industry's competitive landscape is intensifying, with companies vying for market share through innovation and strategic acquisitions, putting pressure on smaller players.

Addressing these challenges is crucial for sustained growth in the Retail Analytics Industry.

Leading Players in the Retail Analytics Industry Market

- SAS Institute Inc

- IBM Corporation

- Hitachi Vantara LLC

- QlikTech International AB (Qlik)

- Retail Next Inc

- Altair Engineering Inc

- Alteryx Inc

- Oracle Corporation

- Salesforce.com Inc (Tableau Software Inc)

- SAP SE

Key Developments in Retail Analytics Industry Sector

- September 2023: Priority Software acquired Retailsoft, a developer of innovative technology solutions for optimizing retail business efficiency and enhancing revenue growth. This acquisition expands the scope of Priority's Retail Management Products, integrating Retailsoft's dynamic platform with operational modules tailored to each organization's needs. The platform's features, such as work scheduling, communication tools, and real-time POS data access, empower businesses with trend analysis and strategy optimization, fostering data-driven decisions and competition among branches.

- January 2023: AiFi partnered with Microsoft to launch a preview of Smart Store Analytics, a cloud service providing shopper and operational analytics for fleets of "smart stores." AiFi handles store setup and logistics, while Microsoft delivers models for optimizing store payout, product recommendations, and inventory. This development enhances the market's move towards automation and data-driven decision-making.

Strategic Retail Analytics Industry Market Outlook

The strategic outlook for the Retail Analytics Industry is optimistic, with several growth accelerators poised to drive future market potential. The integration of AI and machine learning will continue to revolutionize retail analytics, enabling more personalized and efficient retail operations. The shift towards cloud-based solutions offers retailers scalability and cost-effectiveness, further boosting market growth. Strategic opportunities include expanding into emerging markets, where the adoption of retail analytics is still in its early stages, and investing in R&D to develop innovative solutions that address evolving consumer preferences and regulatory requirements. As the industry evolves, companies that can adapt to these trends and leverage strategic partnerships will be well-positioned to capitalize on the growing demand for advanced retail analytics solutions.

Retail Analytics Industry Segmentation

-

1. Solution

- 1.1. Software

- 1.2. Service

-

2. Deployment

- 2.1. Cloud

- 2.2. On-premise

-

3. Function

- 3.1. Customer Management

- 3.2. In-store

- 3.3. Supply Chain Management

- 3.4. Marketin

- 3.5. Other Fu

Retail Analytics Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Rest of Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Retail Analytics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.23% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Volumes of Data and Technological Advancements in AI and AR/VR; Increasing E-retail Sales

- 3.3. Market Restrains

- 3.3.1. Lack of General Awareness and Expertise in Emerging Regions; Standardization and Integration Issues

- 3.4. Market Trends

- 3.4.1. In-store Operation Hold Major Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Retail Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Solution

- 5.1.1. Software

- 5.1.2. Service

- 5.2. Market Analysis, Insights and Forecast - by Deployment

- 5.2.1. Cloud

- 5.2.2. On-premise

- 5.3. Market Analysis, Insights and Forecast - by Function

- 5.3.1. Customer Management

- 5.3.2. In-store

- 5.3.3. Supply Chain Management

- 5.3.4. Marketin

- 5.3.5. Other Fu

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Solution

- 6. North America Retail Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Solution

- 6.1.1. Software

- 6.1.2. Service

- 6.2. Market Analysis, Insights and Forecast - by Deployment

- 6.2.1. Cloud

- 6.2.2. On-premise

- 6.3. Market Analysis, Insights and Forecast - by Function

- 6.3.1. Customer Management

- 6.3.2. In-store

- 6.3.3. Supply Chain Management

- 6.3.4. Marketin

- 6.3.5. Other Fu

- 6.1. Market Analysis, Insights and Forecast - by Solution

- 7. Europe Retail Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Solution

- 7.1.1. Software

- 7.1.2. Service

- 7.2. Market Analysis, Insights and Forecast - by Deployment

- 7.2.1. Cloud

- 7.2.2. On-premise

- 7.3. Market Analysis, Insights and Forecast - by Function

- 7.3.1. Customer Management

- 7.3.2. In-store

- 7.3.3. Supply Chain Management

- 7.3.4. Marketin

- 7.3.5. Other Fu

- 7.1. Market Analysis, Insights and Forecast - by Solution

- 8. Asia Pacific Retail Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Solution

- 8.1.1. Software

- 8.1.2. Service

- 8.2. Market Analysis, Insights and Forecast - by Deployment

- 8.2.1. Cloud

- 8.2.2. On-premise

- 8.3. Market Analysis, Insights and Forecast - by Function

- 8.3.1. Customer Management

- 8.3.2. In-store

- 8.3.3. Supply Chain Management

- 8.3.4. Marketin

- 8.3.5. Other Fu

- 8.1. Market Analysis, Insights and Forecast - by Solution

- 9. Latin America Retail Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Solution

- 9.1.1. Software

- 9.1.2. Service

- 9.2. Market Analysis, Insights and Forecast - by Deployment

- 9.2.1. Cloud

- 9.2.2. On-premise

- 9.3. Market Analysis, Insights and Forecast - by Function

- 9.3.1. Customer Management

- 9.3.2. In-store

- 9.3.3. Supply Chain Management

- 9.3.4. Marketin

- 9.3.5. Other Fu

- 9.1. Market Analysis, Insights and Forecast - by Solution

- 10. Middle East and Africa Retail Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Solution

- 10.1.1. Software

- 10.1.2. Service

- 10.2. Market Analysis, Insights and Forecast - by Deployment

- 10.2.1. Cloud

- 10.2.2. On-premise

- 10.3. Market Analysis, Insights and Forecast - by Function

- 10.3.1. Customer Management

- 10.3.2. In-store

- 10.3.3. Supply Chain Management

- 10.3.4. Marketin

- 10.3.5. Other Fu

- 10.1. Market Analysis, Insights and Forecast - by Solution

- 11. North America Retail Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 12. Europe Retail Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Russia

- 12.1.5 Rest of Europe

- 13. Asia Pacific Retail Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 Rest of Asia Pacific

- 14. Latin America Retail Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East and Africa Retail Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 SAS Institute Inc

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 IBM Corporation

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Hitachi Vantara LLC*List Not Exhaustive

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 QlikTech International AB (Qlik)

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Retail Next Inc

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Altair Engineering Inc

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Alteryx Inc

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Oracle Corporation

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Salesforce com Inc (Tableau Software Inc )

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 SAP SE

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 SAS Institute Inc

List of Figures

- Figure 1: Global Retail Analytics Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Retail Analytics Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Retail Analytics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Retail Analytics Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Retail Analytics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Retail Analytics Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Retail Analytics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Retail Analytics Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Retail Analytics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Retail Analytics Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Retail Analytics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Retail Analytics Industry Revenue (Million), by Solution 2024 & 2032

- Figure 13: North America Retail Analytics Industry Revenue Share (%), by Solution 2024 & 2032

- Figure 14: North America Retail Analytics Industry Revenue (Million), by Deployment 2024 & 2032

- Figure 15: North America Retail Analytics Industry Revenue Share (%), by Deployment 2024 & 2032

- Figure 16: North America Retail Analytics Industry Revenue (Million), by Function 2024 & 2032

- Figure 17: North America Retail Analytics Industry Revenue Share (%), by Function 2024 & 2032

- Figure 18: North America Retail Analytics Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Retail Analytics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Retail Analytics Industry Revenue (Million), by Solution 2024 & 2032

- Figure 21: Europe Retail Analytics Industry Revenue Share (%), by Solution 2024 & 2032

- Figure 22: Europe Retail Analytics Industry Revenue (Million), by Deployment 2024 & 2032

- Figure 23: Europe Retail Analytics Industry Revenue Share (%), by Deployment 2024 & 2032

- Figure 24: Europe Retail Analytics Industry Revenue (Million), by Function 2024 & 2032

- Figure 25: Europe Retail Analytics Industry Revenue Share (%), by Function 2024 & 2032

- Figure 26: Europe Retail Analytics Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe Retail Analytics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific Retail Analytics Industry Revenue (Million), by Solution 2024 & 2032

- Figure 29: Asia Pacific Retail Analytics Industry Revenue Share (%), by Solution 2024 & 2032

- Figure 30: Asia Pacific Retail Analytics Industry Revenue (Million), by Deployment 2024 & 2032

- Figure 31: Asia Pacific Retail Analytics Industry Revenue Share (%), by Deployment 2024 & 2032

- Figure 32: Asia Pacific Retail Analytics Industry Revenue (Million), by Function 2024 & 2032

- Figure 33: Asia Pacific Retail Analytics Industry Revenue Share (%), by Function 2024 & 2032

- Figure 34: Asia Pacific Retail Analytics Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Asia Pacific Retail Analytics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Latin America Retail Analytics Industry Revenue (Million), by Solution 2024 & 2032

- Figure 37: Latin America Retail Analytics Industry Revenue Share (%), by Solution 2024 & 2032

- Figure 38: Latin America Retail Analytics Industry Revenue (Million), by Deployment 2024 & 2032

- Figure 39: Latin America Retail Analytics Industry Revenue Share (%), by Deployment 2024 & 2032

- Figure 40: Latin America Retail Analytics Industry Revenue (Million), by Function 2024 & 2032

- Figure 41: Latin America Retail Analytics Industry Revenue Share (%), by Function 2024 & 2032

- Figure 42: Latin America Retail Analytics Industry Revenue (Million), by Country 2024 & 2032

- Figure 43: Latin America Retail Analytics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 44: Middle East and Africa Retail Analytics Industry Revenue (Million), by Solution 2024 & 2032

- Figure 45: Middle East and Africa Retail Analytics Industry Revenue Share (%), by Solution 2024 & 2032

- Figure 46: Middle East and Africa Retail Analytics Industry Revenue (Million), by Deployment 2024 & 2032

- Figure 47: Middle East and Africa Retail Analytics Industry Revenue Share (%), by Deployment 2024 & 2032

- Figure 48: Middle East and Africa Retail Analytics Industry Revenue (Million), by Function 2024 & 2032

- Figure 49: Middle East and Africa Retail Analytics Industry Revenue Share (%), by Function 2024 & 2032

- Figure 50: Middle East and Africa Retail Analytics Industry Revenue (Million), by Country 2024 & 2032

- Figure 51: Middle East and Africa Retail Analytics Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Retail Analytics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Retail Analytics Industry Revenue Million Forecast, by Solution 2019 & 2032

- Table 3: Global Retail Analytics Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 4: Global Retail Analytics Industry Revenue Million Forecast, by Function 2019 & 2032

- Table 5: Global Retail Analytics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Retail Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Retail Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Retail Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Retail Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Germany Retail Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United Kingdom Retail Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: France Retail Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Russia Retail Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of Europe Retail Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Retail Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: China Retail Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Japan Retail Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: India Retail Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Rest of Asia Pacific Retail Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Global Retail Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Retail Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Global Retail Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 23: Retail Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Global Retail Analytics Industry Revenue Million Forecast, by Solution 2019 & 2032

- Table 25: Global Retail Analytics Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 26: Global Retail Analytics Industry Revenue Million Forecast, by Function 2019 & 2032

- Table 27: Global Retail Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: United States Retail Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Canada Retail Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Global Retail Analytics Industry Revenue Million Forecast, by Solution 2019 & 2032

- Table 31: Global Retail Analytics Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 32: Global Retail Analytics Industry Revenue Million Forecast, by Function 2019 & 2032

- Table 33: Global Retail Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Germany Retail Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: United Kingdom Retail Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: France Retail Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Russia Retail Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Rest of Europe Retail Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global Retail Analytics Industry Revenue Million Forecast, by Solution 2019 & 2032

- Table 40: Global Retail Analytics Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 41: Global Retail Analytics Industry Revenue Million Forecast, by Function 2019 & 2032

- Table 42: Global Retail Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 43: China Retail Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Japan Retail Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: India Retail Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Rest of Asia Pacific Retail Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Global Retail Analytics Industry Revenue Million Forecast, by Solution 2019 & 2032

- Table 48: Global Retail Analytics Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 49: Global Retail Analytics Industry Revenue Million Forecast, by Function 2019 & 2032

- Table 50: Global Retail Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 51: Global Retail Analytics Industry Revenue Million Forecast, by Solution 2019 & 2032

- Table 52: Global Retail Analytics Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 53: Global Retail Analytics Industry Revenue Million Forecast, by Function 2019 & 2032

- Table 54: Global Retail Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Retail Analytics Industry?

The projected CAGR is approximately 4.23%.

2. Which companies are prominent players in the Retail Analytics Industry?

Key companies in the market include SAS Institute Inc, IBM Corporation, Hitachi Vantara LLC*List Not Exhaustive, QlikTech International AB (Qlik), Retail Next Inc, Altair Engineering Inc, Alteryx Inc, Oracle Corporation, Salesforce com Inc (Tableau Software Inc ), SAP SE.

3. What are the main segments of the Retail Analytics Industry?

The market segments include Solution, Deployment, Function.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.33 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Volumes of Data and Technological Advancements in AI and AR/VR; Increasing E-retail Sales.

6. What are the notable trends driving market growth?

In-store Operation Hold Major Share.

7. Are there any restraints impacting market growth?

Lack of General Awareness and Expertise in Emerging Regions; Standardization and Integration Issues.

8. Can you provide examples of recent developments in the market?

September 2023 - Priority Software acquired Retailsoft, a developer of innovative technology solutions for optimizing retail business efficiency and enhancing revenue growth. In addition, Priority is expanding the scope of its Retail Management Products and delivering significant value to Retailers by integrating Retailsoft's solutions. Retailsoft provides a dynamic platform with operational modules tailored to each organization's needs. These modules comprise work scheduling, communication tools, objective setting, and real-time access to POS data across all locations. Such features empower businesses with trend analysis, monitoring, and strategy optimization, facilitating data-driven decisions, sales goal setting, and fostering competition among branches.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Retail Analytics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Retail Analytics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Retail Analytics Industry?

To stay informed about further developments, trends, and reports in the Retail Analytics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence