Key Insights

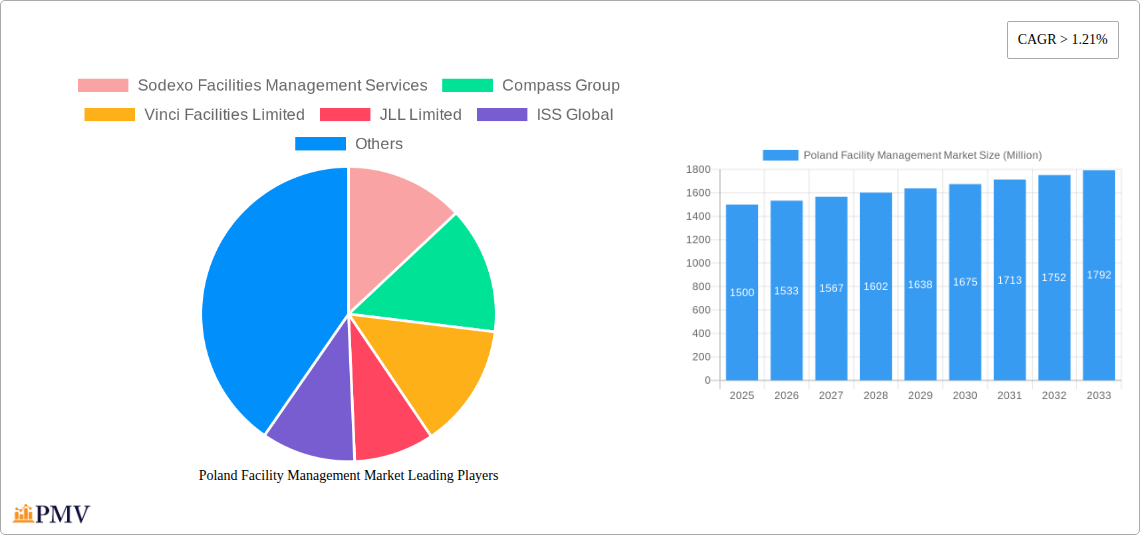

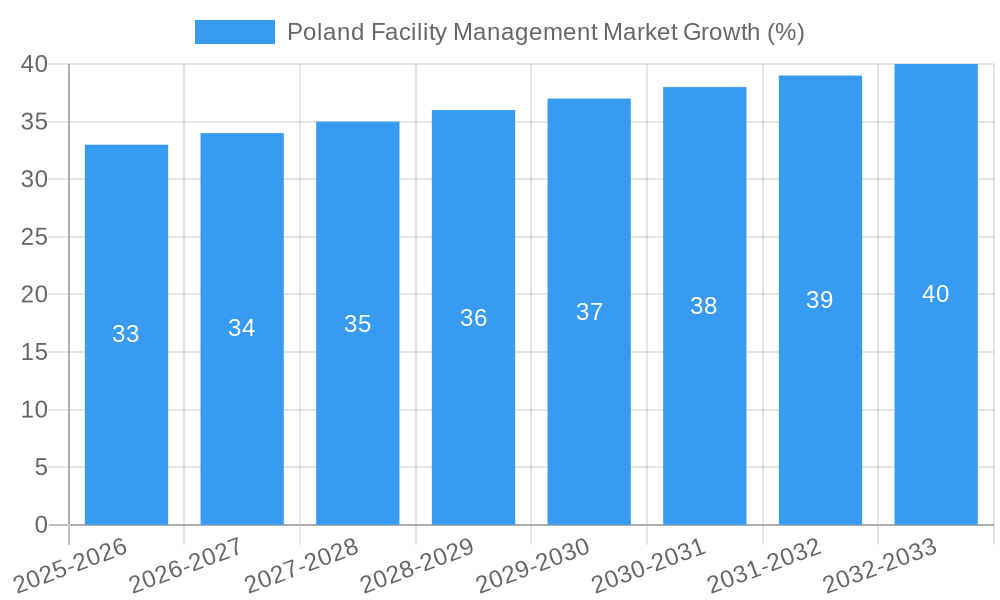

The Poland Facility Management (FM) market is experiencing robust growth, driven by increasing urbanization, a burgeoning commercial real estate sector, and a rising demand for efficient and cost-effective building operations. The market's expansion is fueled by a shift towards outsourced FM services, particularly among large corporations seeking to optimize resource allocation and focus on core business functions. Strong growth is observed in both Hard FM (technical services like HVAC and building maintenance) and Soft FM (services such as cleaning, security, and catering), reflecting a holistic approach to property management. The commercial sector dominates market share, followed by institutional and industrial segments. While the in-house FM model still holds a significant presence, the outsourced model is experiencing faster growth due to its scalability and access to specialized expertise. The presence of established international players like Sodexo, Compass Group, and JLL, alongside local firms, ensures a competitive landscape, promoting innovation and service quality. Government initiatives promoting sustainable building practices are further bolstering demand for environmentally conscious FM solutions. The forecast period of 2025-2033 anticipates sustained expansion, driven by continuous growth in the commercial and industrial sectors, coupled with an increasing awareness of the long-term value proposition of professional facility management.

Growth within the Polish FM market is projected to continue at a considerable pace through 2033. This expansion is underpinned by a number of factors, including government investments in infrastructure development, the rising adoption of smart building technologies which require specialized maintenance, and a growing focus on workplace optimization to enhance employee productivity. Competition among providers is likely to intensify, with both established multinational corporations and smaller, specialized firms vying for market share. The market segmentation by facility type, offering type, and end-user will continue to evolve, with tailored service packages increasingly meeting the diverse needs of clients. Companies are likely to invest in technological advancements, such as predictive maintenance and IoT-based solutions, to improve efficiency and enhance service delivery. The market's future trajectory suggests a consistent upward trend, influenced by Poland's sustained economic growth and a growing understanding of the strategic importance of efficient facility management for businesses across various sectors.

Poland Facility Management Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Poland Facility Management Market, offering valuable insights into market size, segmentation, growth drivers, challenges, and key players. The report covers the period 2019-2033, with a focus on 2025 as the base and estimated year. This meticulously researched report is designed for industry professionals, investors, and strategic decision-makers seeking a detailed understanding of this dynamic market.

Poland Facility Management Market Structure & Competitive Dynamics

The Poland Facility Management market exhibits a moderately consolidated structure, with several multinational and domestic players vying for market share. The market's competitive landscape is characterized by intense rivalry, driven by factors such as price competition, service differentiation, and technological innovation. Market concentration is moderate, with the top five players holding an estimated xx% market share in 2025. Innovation ecosystems are evolving rapidly, particularly in areas like smart building technologies and sustainable FM solutions. The regulatory framework governing the industry is relatively stable, with ongoing efforts to standardize practices and enhance transparency. Product substitutes, such as in-house facility management teams, exert a degree of competitive pressure, especially for smaller organizations. End-user trends towards outsourcing non-core functions and focusing on core business activities are boosting demand for outsourced facility management services. Mergers and acquisitions (M&A) activity has been relatively moderate in recent years, with deal values ranging from xx Million to xx Million. Key M&A activities include [Insert specific examples of M&A if data is available, otherwise use “xx” or predicted value].

- Market Concentration: Moderate, top 5 players holding xx% market share (2025).

- M&A Activity: Moderate, with deal values ranging from xx Million to xx Million.

- Innovation Ecosystems: Rapidly evolving, driven by smart building technologies and sustainable solutions.

- Regulatory Framework: Stable, with ongoing efforts for standardization and transparency.

Poland Facility Management Market Industry Trends & Insights

The Poland Facility Management market is experiencing robust growth, driven by several key factors. The increasing adoption of outsourcing strategies by businesses across various sectors is a major contributor to market expansion. Furthermore, the rising demand for efficient and sustainable facility management practices is fueling the market's growth trajectory. Technological advancements, such as the integration of IoT devices and AI-powered solutions, are transforming the sector and creating new opportunities for growth. The market is witnessing a shift towards integrated facility management services, offering comprehensive solutions that encompass hard and soft FM aspects. Consumer preferences are increasingly leaning towards sustainable and technologically advanced facility management practices, influencing the market's trajectory. Competitive dynamics are characterized by intense rivalry and continuous innovation, with leading players investing heavily in research and development. The CAGR for the forecast period (2025-2033) is projected to be xx%. Market penetration of outsourced facility management is estimated at xx% in 2025.

Dominant Markets & Segments in Poland Facility Management Market

The Polish Facility Management market is broadly segmented by facility type, offering type, and end-user. While data on precise regional dominance is limited, the analysis suggests a strong demand across major metropolitan areas.

By Type of Facility Management: Outsourced Facility Management is the dominant segment, driven by the increasing preference for cost-efficiency and expertise. Inhouse Facility Management retains a significant share, particularly among large corporations with dedicated resources.

By Offering Type: Hard FM (hardware-related services) and Soft FM (people-related services) both hold significant market share, with a growing trend toward integrated solutions. Hard FM is slightly larger due to infrastructure needs, but Soft FM is showing faster growth.

By End User: The Commercial sector holds the largest market share, followed by the Institutional and Public/Infrastructure sectors. The Industrial sector is experiencing steady growth, driven by increasing demand for efficient facility management practices in manufacturing and logistics.

Key Drivers:

- Strong economic growth in Poland.

- Increasing investments in infrastructure development.

- Growing demand for sustainable and technologically advanced facility management practices.

- Favorable government policies promoting sustainable development.

Poland Facility Management Market Product Innovations

Recent product innovations in the Poland Facility Management market focus on integrating smart technologies to enhance operational efficiency, sustainability, and cost optimization. These advancements include the adoption of IoT sensors for real-time monitoring, AI-driven predictive maintenance systems, and energy management software. These technologies aim to optimize resource allocation, reduce operational costs, and enhance the overall customer experience, creating a strong competitive advantage for providers.

Report Segmentation & Scope

This report segments the Poland Facility Management market in detail based on the following criteria:

By Type of Facility Management: Inhouse Facility Management and Outsourced Facility Management. Outsourced FM is projected for faster growth due to increasing demand for specialized expertise. Market sizes for both are xx Million (Inhouse) and xx Million (Outsourced) in 2025.

By Offering Type: Hard FM (covering areas like HVAC, building maintenance) and Soft FM (covering catering, cleaning, security). Both are experiencing growth, but Soft FM might show higher growth rate in the coming years. The market size for Hard FM in 2025 is xx Million and for Soft FM is xx Million.

By End User: Commercial, Institutional, Public/Infrastructure, Industrial, and Other End Users. Commercial sector is currently dominant, but public and institutional segments present significant growth opportunities. The market size for commercial is xx Million in 2025, and for the others xx Million each (predicted values for 2025).

Key Drivers of Poland Facility Management Market Growth

Several factors contribute to the growth of the Poland Facility Management market: the increasing adoption of outsourcing strategies by companies, especially SMEs, seeking to focus on core competencies; strong economic growth and infrastructure development across the nation, leading to higher demand for efficient and sustainable facility management solutions; and the rising adoption of smart technologies, creating operational efficiencies and reducing costs. Government initiatives promoting sustainable building practices also positively impact market growth.

Challenges in the Poland Facility Management Market Sector

The Poland Facility Management market faces certain challenges, including: the scarcity of skilled professionals, potentially leading to higher labor costs and difficulty finding qualified staff; the need for continuous investment in advanced technologies to stay competitive; and economic fluctuations that can impact investment in facility management services. These factors pose risks and may impact market growth in the short to medium term. The competitive landscape and pressure on pricing also represents a significant challenge for smaller players.

Leading Players in the Poland Facility Management Market Market

- Sodexo Facilities Management Services

- Compass Group

- Vinci Facilities Limited

- JLL Limited

- ISS Global

- ATALIAN Global Services

- CBRE Group

- OKIN Facility (OKIN Group)

- Engie FM Limited Cofely AG

- Apleona GmbH

Key Developments in Poland Facility Management Market Sector

- December 2021: CBRE Group expands its office space in Mlynska, Poznan, creating new jobs. This reflects positive market sentiment and investment in the sector.

- August 2021: CBRE Group is selected as the exclusive agent for the Mogilska 35 office building in Krakow, indicating significant investment in commercial real estate and increased demand for related facility management services.

Strategic Poland Facility Management Market Outlook

The Poland Facility Management market is poised for continued growth, driven by increasing urbanization, economic development, and technological advancements. Strategic opportunities exist for companies that can offer integrated, sustainable, and technologically advanced solutions. Focusing on talent acquisition and development will be crucial for companies to meet the growing demand for skilled professionals. Those who successfully navigate these opportunities will capture a significant share of this expanding market.

Poland Facility Management Market Segmentation

-

1. Type of Facility Management

- 1.1. Inhouse Facility Management

-

1.2. Outsourced Facility Management

- 1.2.1. Single FM

- 1.2.2. Bundled FM

- 1.2.3. Integrated FM

-

2. Offering Type

- 2.1. Hard FM

- 2.2. Soft FM

-

3. End User

- 3.1. Commercial

- 3.2. Institutional

- 3.3. Public/Infrastructure

- 3.4. Industrial

- 3.5. Other End Users

Poland Facility Management Market Segmentation By Geography

- 1. Poland

Poland Facility Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 1.21% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Construction Boom Owing To The Growing Clout Of Multinational Conglomerates; Increasing Emphasis On Green Building Practices; Growing Demand For Soft Fm Practices

- 3.3. Market Restrains

- 3.3.1. Regulatory and Legal Changes; Growing Competition Expected to Impact Profit Margins of Existing Vendors

- 3.4. Market Trends

- 3.4.1. Single Facility Management to have a significant share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Poland Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type of Facility Management

- 5.1.1. Inhouse Facility Management

- 5.1.2. Outsourced Facility Management

- 5.1.2.1. Single FM

- 5.1.2.2. Bundled FM

- 5.1.2.3. Integrated FM

- 5.2. Market Analysis, Insights and Forecast - by Offering Type

- 5.2.1. Hard FM

- 5.2.2. Soft FM

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Commercial

- 5.3.2. Institutional

- 5.3.3. Public/Infrastructure

- 5.3.4. Industrial

- 5.3.5. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Poland

- 5.1. Market Analysis, Insights and Forecast - by Type of Facility Management

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Sodexo Facilities Management Services

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Compass Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Vinci Facilities Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 JLL Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ISS Global

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ATALIAN Global Services

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 CBRE Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 OKIN Facility (OKIN Group)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Engie FM Limited Cofely AG

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Apleona GmbH

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Sodexo Facilities Management Services

List of Figures

- Figure 1: Poland Facility Management Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Poland Facility Management Market Share (%) by Company 2024

List of Tables

- Table 1: Poland Facility Management Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Poland Facility Management Market Revenue Million Forecast, by Type of Facility Management 2019 & 2032

- Table 3: Poland Facility Management Market Revenue Million Forecast, by Offering Type 2019 & 2032

- Table 4: Poland Facility Management Market Revenue Million Forecast, by End User 2019 & 2032

- Table 5: Poland Facility Management Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Poland Facility Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Poland Facility Management Market Revenue Million Forecast, by Type of Facility Management 2019 & 2032

- Table 8: Poland Facility Management Market Revenue Million Forecast, by Offering Type 2019 & 2032

- Table 9: Poland Facility Management Market Revenue Million Forecast, by End User 2019 & 2032

- Table 10: Poland Facility Management Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Poland Facility Management Market?

The projected CAGR is approximately > 1.21%.

2. Which companies are prominent players in the Poland Facility Management Market?

Key companies in the market include Sodexo Facilities Management Services, Compass Group, Vinci Facilities Limited, JLL Limited, ISS Global, ATALIAN Global Services, CBRE Group, OKIN Facility (OKIN Group), Engie FM Limited Cofely AG, Apleona GmbH.

3. What are the main segments of the Poland Facility Management Market?

The market segments include Type of Facility Management, Offering Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Construction Boom Owing To The Growing Clout Of Multinational Conglomerates; Increasing Emphasis On Green Building Practices; Growing Demand For Soft Fm Practices.

6. What are the notable trends driving market growth?

Single Facility Management to have a significant share.

7. Are there any restraints impacting market growth?

Regulatory and Legal Changes; Growing Competition Expected to Impact Profit Margins of Existing Vendors.

8. Can you provide examples of recent developments in the market?

Dec 2021 - CBRE Group is expanding its office space in Mlynska due to the development of CBRE in Poznan. The new CBRE office has 80 square meters and has been arranged in such a way to create more jobs for the employees.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Poland Facility Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Poland Facility Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Poland Facility Management Market?

To stay informed about further developments, trends, and reports in the Poland Facility Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence