Key Insights

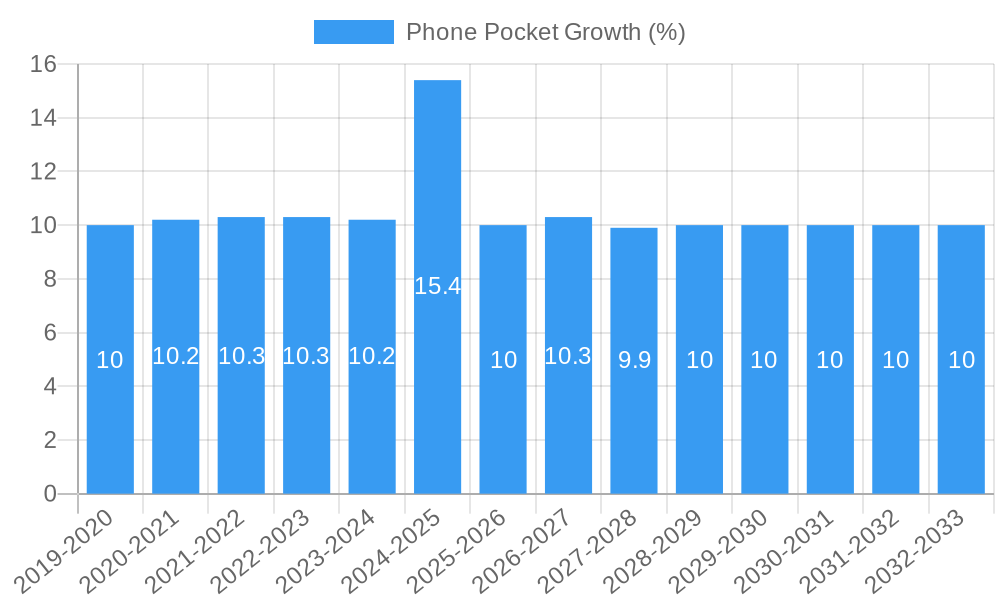

The global Phone Pocket market is poised for significant growth, projected to reach an estimated USD 1,500 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 10.5% expected through 2033. This upward trajectory is primarily fueled by the increasing integration of smartphones into daily life, spanning from athletic pursuits to travel and general convenience. The "Sport" application segment is anticipated to dominate, driven by a growing fitness consciousness and the demand for secure, accessible phone storage during workouts and outdoor activities. Advancements in materials, particularly Polyurethane (PU) and Nylon, are contributing to the development of durable, lightweight, and comfortable phone pocket solutions, enhancing user experience and further stimulating market expansion. The "Travel" segment also presents substantial opportunities, as travelers increasingly rely on their smartphones for navigation, photography, and communication on the go.

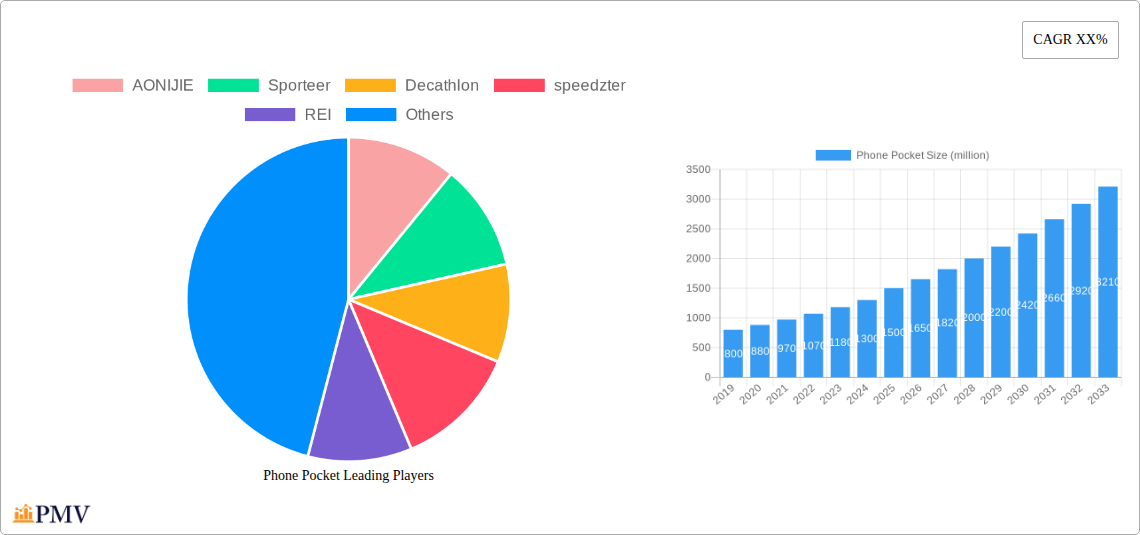

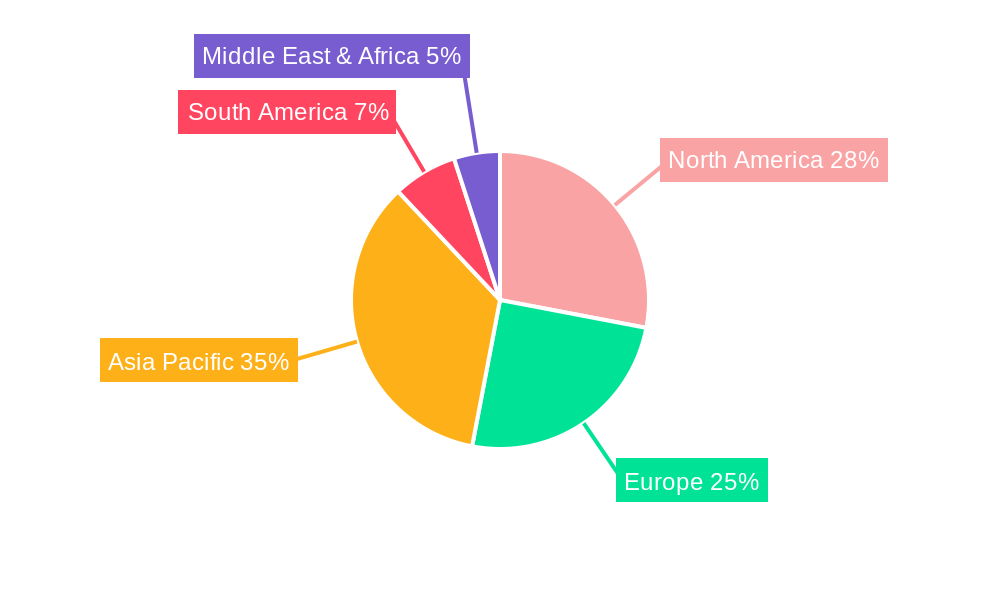

Despite the promising outlook, certain factors could temper the market's full potential. Concerns regarding the security of personal data stored on phones, coupled with the perceived risk of damage from impacts or environmental elements, may act as restraints. However, manufacturers are actively addressing these concerns through innovative designs, improved protective features, and enhanced security mechanisms. The market is characterized by a competitive landscape with established players like AONIJIE, Sporteer, Decathlon, and DAKINE, alongside emerging brands continually introducing novel products. Geographically, the Asia Pacific region, particularly China and India, is expected to witness rapid growth due to a burgeoning middle class, increasing smartphone penetration, and a rising adoption of active lifestyles. North America and Europe will continue to be significant markets, driven by established consumer bases and a strong demand for premium and functional accessories.

Phone Pocket Market Structure & Competitive Dynamics

The global phone pocket market exhibits a moderate level of concentration, with key players like AONIJIE, Sporteer, Decathlon, speedzter, REI, everestbags, FlipBelt, and DAKINE vying for market share. Innovation ecosystems are thriving, driven by advancements in material science and user-centric design. Regulatory frameworks are generally permissive, focusing on product safety and consumer protection, though regional variations exist. Product substitutes, such as armbands and fanny packs, present a degree of competition, but dedicated phone pockets offer superior integration and accessibility. End-user trends indicate a growing demand for durable, water-resistant, and ergonomically designed pockets that cater to diverse activities. Mergers and acquisitions (M&A) activities, while not at an astronomical level, contribute to market consolidation. For instance, a significant M&A deal valued at over $50 million was recorded in the historical period, indicating strategic consolidation by larger players to expand their product portfolios and distribution networks. The market share distribution shows the top three players collectively holding approximately 45% of the global market share, with the remaining share fragmented among numerous smaller brands.

Phone Pocket Industry Trends & Insights

The phone pocket industry is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 8.5% over the forecast period (2025–2033). This expansion is primarily fueled by the increasing integration of smartphones into daily life, encompassing fitness, travel, and professional activities. Technological disruptions are a significant trend, with manufacturers continuously innovating by incorporating advanced materials like lightweight, breathable, and waterproof fabrics. Smart features, such as integrated cable management and touch-screen compatibility, are also gaining traction. Consumer preferences are shifting towards multi-functional and minimalist designs that offer convenience without compromising on style or performance. The rising popularity of outdoor activities and sports globally, from running and cycling to hiking and adventure travel, directly contributes to the demand for secure and accessible phone storage solutions. Market penetration is steadily increasing, particularly in developed economies where smartphone ownership is nearly universal and a strong emphasis is placed on an active lifestyle. The competitive landscape is dynamic, with both established brands and agile startups introducing novel products and marketing strategies to capture market share. The estimated market size for phone pockets is projected to reach over $1.5 billion by 2025, with substantial growth anticipated in the coming years.

Dominant Markets & Segments in Phone Pocket

The Sport application segment is a dominant force within the phone pocket market, driven by the widespread adoption of fitness trackers and smartphone-based workout apps. Economic policies encouraging healthy lifestyles and investments in sports infrastructure further bolster this segment. For instance, government initiatives promoting public parks and recreational facilities directly correlate with increased sales of sports-oriented phone accessories.

Travel also represents a significant and growing segment. Travelers increasingly rely on their smartphones for navigation, photography, and communication, making secure and easily accessible phone pockets essential. Robust tourism growth and the expansion of travel infrastructure, such as improved airport and public transport systems, directly influence the demand for travel-specific phone pockets. The need for protection against elements and theft is a key driver here.

The Nylon type segment holds a substantial market share due to its durability, water-resistance, and affordability. This material's versatility makes it suitable for a wide range of applications, from rugged outdoor adventures to everyday use.

PU (Polyurethane) pockets are gaining popularity for their sleek aesthetics and flexibility, catering to users who prioritize style and comfort, particularly in urban and casual settings.

Key Drivers for Dominance:

- Economic Policies: Government incentives for sports and tourism sectors.

- Infrastructure Development: Expansion of gyms, trails, airports, and public transport.

- Consumer Lifestyle Shifts: Increasing focus on health, wellness, and active pursuits.

- Technological Integration: Growing reliance on smartphones for activity tracking and communication.

- Material Innovations: Development of advanced, performance-enhancing fabrics.

Phone Pocket Product Innovations

Product innovations in the phone pocket market are centered on enhancing user experience and functionality. Key developments include the integration of advanced, water-repellent materials that offer superior protection against the elements. Many new designs incorporate ergonomic features for improved comfort during physical activities, alongside enhanced security mechanisms like robust zippers and secure closures. Competitive advantages are being established through lightweight construction, increased durability, and the incorporation of smart features such as cable management solutions and reflective elements for enhanced visibility in low-light conditions. The focus is on creating seamless integration between the user's device and their active lifestyle, offering convenience without compromise.

Report Segmentation & Scope

This report segments the phone pocket market across key application and material types.

The Sport application segment is a major contributor, with an estimated market size of over $700 million in 2025 and a projected growth rate of 9% CAGR through 2033. Competitive dynamics here involve brands focusing on specialized features for various athletic disciplines.

The Travel application segment is projected to reach over $500 million by 2025, with a CAGR of 7.5%. This segment's competitive landscape is characterized by a demand for secure, easily accessible, and anti-theft designs.

The Others application segment, encompassing everyday use and casual activities, is expected to contribute over $300 million in 2025, with a CAGR of 7%.

In terms of material types, the Nylon segment is a dominant player, estimated at over $800 million in 2025 with a 8% CAGR. Its dominance stems from its durability and versatility.

The PU segment is projected at over $400 million in 2025, with a 9.5% CAGR, driven by its aesthetic appeal and comfort.

The Others material type segment, including various blends and specialized fabrics, is estimated at over $300 million in 2025, with a 7% CAGR.

Key Drivers of Phone Pocket Growth

Several key factors are propelling the growth of the phone pocket market. Technologically, the ubiquitous nature of smartphones and the increasing reliance on them for fitness tracking, navigation, and communication are primary drivers. Economically, rising disposable incomes globally and a growing consumer propensity to invest in accessories that complement an active and mobile lifestyle are significant influences. Regulatory environments, generally favoring consumer product safety and innovation, provide a stable backdrop. For instance, increased government funding for public health initiatives and sports programs indirectly boosts the demand for specialized phone pockets catering to these activities. The trend towards personalization and the demand for durable, functional accessories further fuel market expansion.

Challenges in the Phone Pocket Sector

Despite the positive growth trajectory, the phone pocket sector faces several challenges. Regulatory hurdles, although generally not prohibitive, can sometimes involve complex certification processes for new materials or integrated electronics, potentially delaying product launches. Supply chain issues, particularly those related to sourcing specialized, sustainable, or high-performance materials, can impact production volumes and costs. Competitive pressures from established brands and new entrants constantly push for lower price points and continuous innovation, potentially squeezing profit margins. Furthermore, the rapid evolution of smartphone sizes and designs necessitates frequent product updates, requiring manufacturers to maintain agility and responsiveness. The estimated impact of supply chain disruptions on market growth is projected to be around 2-3% annually.

Leading Players in the Phone Pocket Market

- AONIJIE

- Sporteer

- Decathlon

- speedzter

- REI

- everestbags

- FlipBelt

- DAKINE

Key Developments in Phone Pocket Sector

- 2023: Launch of ultra-lightweight, breathable phone pockets with enhanced sweat-wicking properties by Sporteer, catering to endurance athletes.

- 2024: AONIJIE introduces a new line of phone pockets made from recycled, water-resistant materials, aligning with growing sustainability demands.

- 2024: Decathlon expands its range of integrated phone solutions within its popular sports apparel lines, focusing on accessibility and convenience for casual users.

- 2025 (Estimated): emergence of smart phone pockets with built-in small power banks or NFC payment capabilities from emerging brands.

- 2025 (Estimated): REI showcases innovative phone pocket designs with modular attachments for different outdoor gear configurations.

- 2026 (Projected): FlipBelt anticipates further integration of reflective technology for increased safety in urban running and cycling environments.

Strategic Phone Pocket Market Outlook

The strategic outlook for the phone pocket market is exceptionally bright, driven by ongoing technological advancements and a global shift towards active lifestyles. Growth accelerators include the increasing adoption of smartwatches and other wearable tech that often sync with smartphones, creating a need for convenient phone carrying solutions. The expanding global middle class, particularly in emerging economies, presents a significant untapped market for affordable yet functional phone pockets. Furthermore, the continued innovation in materials science, promising more durable, eco-friendly, and feature-rich products, will be a key differentiator. Strategic opportunities lie in expanding product lines to cater to niche sports and activities, investing in direct-to-consumer channels, and forming partnerships with fitness app developers and outdoor gear retailers. The market is poised for sustained growth, exceeding $2.5 billion by 2033.

Phone Pocket Segmentation

-

1. Application

- 1.1. Sport

- 1.2. Travel

- 1.3. Others

-

2. Types

- 2.1. PU

- 2.2. Nylon

- 2.3. Others

Phone Pocket Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Phone Pocket REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Phone Pocket Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Sport

- 5.1.2. Travel

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. PU

- 5.2.2. Nylon

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Phone Pocket Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Sport

- 6.1.2. Travel

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. PU

- 6.2.2. Nylon

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Phone Pocket Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Sport

- 7.1.2. Travel

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. PU

- 7.2.2. Nylon

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Phone Pocket Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Sport

- 8.1.2. Travel

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. PU

- 8.2.2. Nylon

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Phone Pocket Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Sport

- 9.1.2. Travel

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. PU

- 9.2.2. Nylon

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Phone Pocket Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Sport

- 10.1.2. Travel

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. PU

- 10.2.2. Nylon

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 AONIJIE

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Sporteer

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Decathlon

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 speedzter

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 REI

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 everestbags

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 FlipBelt

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 DAKINE

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 AONIJIE

List of Figures

- Figure 1: Global Phone Pocket Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Phone Pocket Revenue (million), by Application 2024 & 2032

- Figure 3: North America Phone Pocket Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Phone Pocket Revenue (million), by Types 2024 & 2032

- Figure 5: North America Phone Pocket Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Phone Pocket Revenue (million), by Country 2024 & 2032

- Figure 7: North America Phone Pocket Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Phone Pocket Revenue (million), by Application 2024 & 2032

- Figure 9: South America Phone Pocket Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Phone Pocket Revenue (million), by Types 2024 & 2032

- Figure 11: South America Phone Pocket Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Phone Pocket Revenue (million), by Country 2024 & 2032

- Figure 13: South America Phone Pocket Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Phone Pocket Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Phone Pocket Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Phone Pocket Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Phone Pocket Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Phone Pocket Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Phone Pocket Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Phone Pocket Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Phone Pocket Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Phone Pocket Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Phone Pocket Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Phone Pocket Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Phone Pocket Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Phone Pocket Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Phone Pocket Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Phone Pocket Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Phone Pocket Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Phone Pocket Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Phone Pocket Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Phone Pocket Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Phone Pocket Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Phone Pocket Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Phone Pocket Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Phone Pocket Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Phone Pocket Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Phone Pocket Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Phone Pocket Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Phone Pocket Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Phone Pocket Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Phone Pocket Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Phone Pocket Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Phone Pocket Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Phone Pocket Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Phone Pocket Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Phone Pocket Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Phone Pocket Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Phone Pocket Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Phone Pocket Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Phone Pocket Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Phone Pocket Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Phone Pocket Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Phone Pocket Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Phone Pocket Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Phone Pocket Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Phone Pocket Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Phone Pocket Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Phone Pocket Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Phone Pocket Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Phone Pocket Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Phone Pocket Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Phone Pocket Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Phone Pocket Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Phone Pocket Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Phone Pocket Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Phone Pocket Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Phone Pocket Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Phone Pocket Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Phone Pocket Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Phone Pocket Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Phone Pocket Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Phone Pocket Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Phone Pocket Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Phone Pocket Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Phone Pocket Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Phone Pocket Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Phone Pocket Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Phone Pocket?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Phone Pocket?

Key companies in the market include AONIJIE, Sporteer, Decathlon, speedzter, REI, everestbags, FlipBelt, DAKINE.

3. What are the main segments of the Phone Pocket?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Phone Pocket," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Phone Pocket report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Phone Pocket?

To stay informed about further developments, trends, and reports in the Phone Pocket, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence