Key Insights

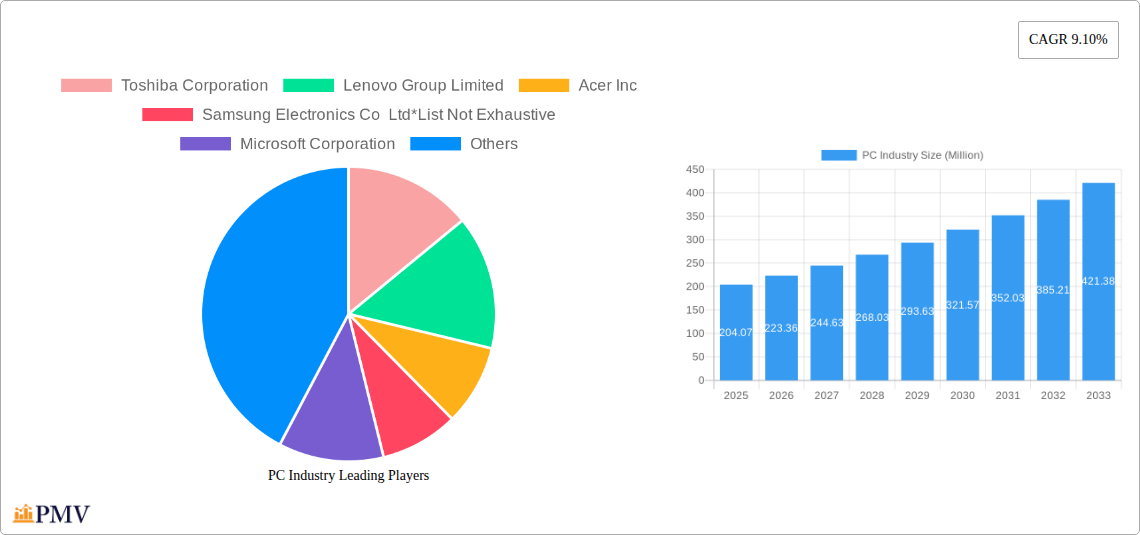

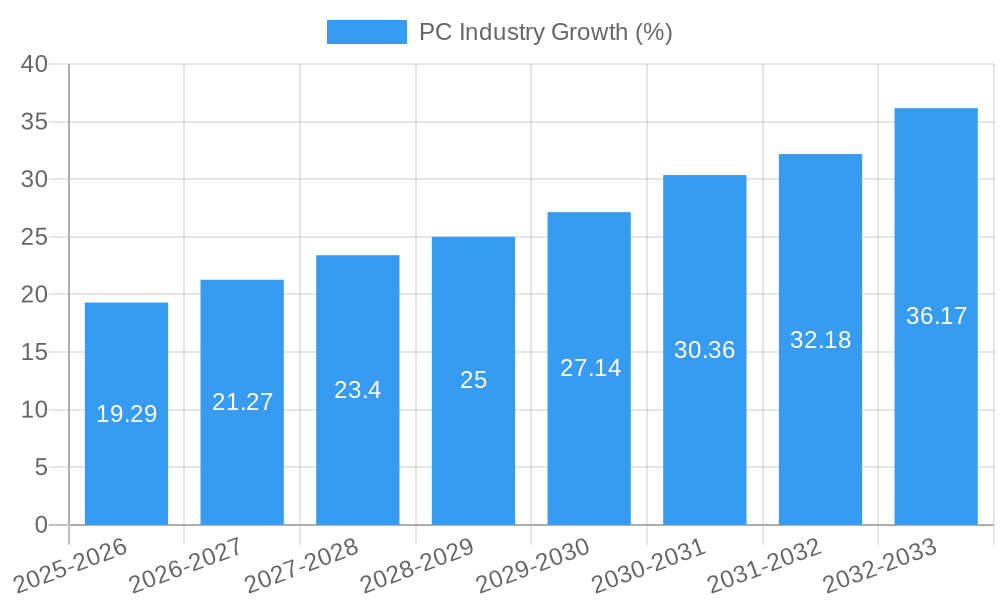

The global PC market, valued at $204.07 million in 2025, is projected to experience robust growth, driven by several key factors. The increasing demand for high-performance computing across various sectors, including gaming, content creation, and business applications, fuels market expansion. Technological advancements, such as the introduction of more powerful processors, enhanced graphics capabilities, and improved energy efficiency, are further stimulating demand. The rising adoption of hybrid work models also contributes significantly, necessitating reliable and versatile computing solutions for both professional and personal use. While supply chain disruptions and component shortages have posed challenges in recent years, these constraints are gradually easing, paving the way for sustained growth. The market is segmented by type, encompassing laptops, desktop PCs, all-in-one stations, and tablets, each catering to specific user needs and preferences. Major players like Lenovo, HP, Dell, Apple, and Acer are intensely competing, driving innovation and price competitiveness.

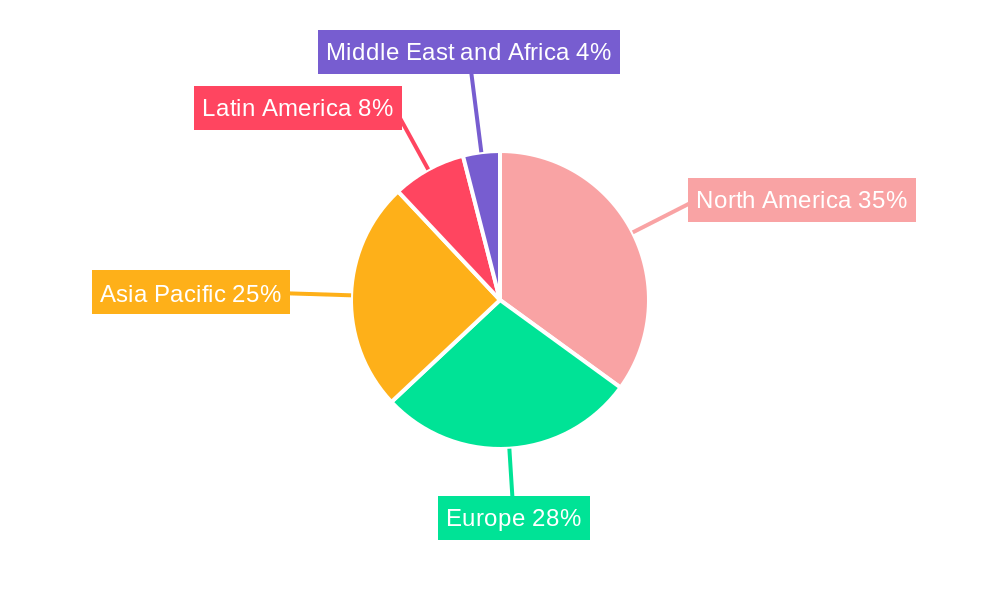

Growth is expected to continue, albeit at a potentially moderating pace, reflecting market saturation in certain segments and the increasing popularity of mobile devices. However, the ongoing demand for advanced computing power in fields like artificial intelligence and machine learning will likely sustain strong growth in high-end PC segments. Regional variations exist, with North America and Europe currently holding significant market shares due to high per capita income and established technological infrastructure. However, the Asia-Pacific region is poised for significant growth, driven by increasing disposable incomes and rising internet penetration. The continued evolution of PC technology, including advancements in foldable designs, mini-LED displays, and improved battery life, will play a crucial role in shaping future market dynamics and maintaining consumer interest in the years to come. The forecast period of 2025-2033 anticipates a steady expansion, propelled by these interconnected factors.

PC Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the global PC industry, covering the period from 2019 to 2033. With a focus on market structure, competitive dynamics, technological advancements, and future growth prospects, this report is an invaluable resource for industry professionals, investors, and anyone seeking a deep understanding of this ever-evolving sector. The report projects a xx Million USD market value by 2033, representing a substantial CAGR of xx% during the forecast period (2025-2033). The base year for this analysis is 2025.

PC Industry Market Structure & Competitive Dynamics

The global PC industry is characterized by a complex interplay of factors influencing market concentration, innovation, and competition. Key players, including Toshiba Corporation, Lenovo Group Limited, Acer Inc, Samsung Electronics Co Ltd, Microsoft Corporation, Dell Inc, Micro-Star International Co, ASUSTek Computer Inc, Razer Inc, The Hewlett-Packard Company (HP), and Apple Inc, compete across various segments, leading to a dynamic market landscape. Market concentration is moderate, with a few dominant players holding significant market share, while numerous smaller players cater to niche markets.

- Market Share: Lenovo holds approximately xx% of the global PC market, followed by HP with xx%, and Dell with xx%. (These figures are estimates for 2024).

- Innovation Ecosystems: Collaboration between hardware manufacturers, software developers, and component suppliers drives innovation. Open-source initiatives and industry standards further contribute to technological advancements.

- Regulatory Frameworks: Government regulations concerning data privacy, cybersecurity, and environmental standards impact the industry. Trade policies and tariffs also influence the global supply chain.

- Product Substitutes: The rise of tablets and smartphones poses a challenge to traditional PCs, although the market for high-performance PCs remains strong.

- End-User Trends: Demand for lightweight and portable laptops is increasing, driven by remote work and mobile lifestyles. The growing adoption of cloud computing is transforming how users interact with PCs.

- M&A Activities: Consolidation through mergers and acquisitions (M&A) is a recurring theme in the PC industry, with deal values exceeding xx Million USD in recent years. These activities aim to expand market reach, enhance product portfolios, and access new technologies.

PC Industry Industry Trends & Insights

The PC industry is experiencing a period of both challenges and opportunities. While the overall market growth has slowed compared to previous decades, specific segments are thriving. The rise of hybrid work models has boosted demand for high-performance laptops, while the gaming industry continues to drive innovation in desktop PCs. Technological disruptions like the introduction of advanced processors (e.g., Apple's M-series chips) and the increasing integration of AI and machine learning are reshaping the market. Consumer preferences are shifting towards devices with enhanced portability, longer battery life, and improved security features. The competitive landscape is intense, with manufacturers constantly striving to differentiate their products through design, performance, and pricing. The global PC market is expected to reach xx Million USD by 2033, showcasing a CAGR of xx% during the forecast period. Market penetration is expected to be xx% by 2033, driven primarily by emerging markets and the increasing affordability of PCs.

Dominant Markets & Segments in PC Industry

The North American market continues to dominate the global PC industry, followed by the Asia-Pacific region. Within segments, laptops hold the largest market share, driven by their portability and versatility.

Key Drivers of Laptop Dominance:

- Increased remote work and education.

- Growing demand for mobile productivity.

- Continuous innovation in lightweight and powerful designs.

Desktop PC Market: While the growth rate is slower than laptops, the desktop PC segment remains significant, especially in gaming and professional applications.

- Key Drivers of Desktop PC Market: Gaming and professional applications (design and engineering), continued demand for high processing power.

All-in-One Stations: This segment is experiencing moderate growth, appealing to consumers seeking a space-saving and aesthetically pleasing solution.

- Key drivers: compact design, integrated functionality.

Tablets: The tablet market is relatively mature, but still maintains a stable presence in consumer and enterprise applications.

- Key drivers: continued usability and affordability, particularly in education.

The dominance of these regions and segments is attributed to various factors, including strong economic growth, robust infrastructure, and high levels of technology adoption. Government initiatives promoting digital literacy and infrastructure development further contribute to market expansion in key regions.

PC Industry Product Innovations

Recent innovations in the PC industry focus on enhanced processing power, improved battery life, lightweight designs, and advanced security features. The integration of AI and machine learning capabilities is also gaining traction, enabling more intelligent and personalized user experiences. The market is seeing a shift towards more sustainable and eco-friendly designs, incorporating recycled materials and energy-efficient components. These innovations cater to evolving consumer preferences and address the challenges of a competitive market.

Report Segmentation & Scope

This report segments the PC market by type: Laptops, Desktop PCs, All-in-One Stations, and Tablets. Each segment is analyzed in terms of its market size, growth projections, and competitive dynamics. The report considers the historical period (2019-2024), the base year (2025), and the forecast period (2025-2033). Detailed regional and country-level analysis is included. The report projects significant growth in the laptop segment, driven by increasing demand for mobile computing, with a projected market size of xx Million USD by 2033. Desktop PCs are expected to maintain a stable market share, particularly within the gaming and professional markets. The all-in-one segment is expected to experience modest growth due to its space-saving design and affordability, with a predicted market size of xx Million USD by 2033. The tablet market is projected to grow at a moderate rate, driven by ongoing demand in the education sector and enterprise mobility needs, projecting to xx Million USD in 2033.

Key Drivers of PC Industry Growth

Several factors contribute to the growth of the PC industry. Technological advancements, such as the development of faster processors, improved graphics cards, and enhanced battery technology, drive demand for more powerful and efficient devices. Economic growth and rising disposable incomes in emerging markets fuel PC adoption. Government initiatives promoting digital literacy and infrastructure development further stimulate market expansion. The increasing need for remote work and online education also boosts demand for PCs across various segments.

Challenges in the PC Industry Sector

The PC industry faces several challenges, including increasing component costs, supply chain disruptions, and intense competition. Regulatory hurdles related to data privacy and environmental regulations also pose significant challenges. The ongoing impact of the global chip shortage is expected to continue affecting production capacity, with potential constraints resulting in higher device costs. Intense competition among manufacturers puts pressure on pricing and margins, making innovation and efficiency crucial for success.

Leading Players in the PC Industry Market

- Toshiba Corporation

- Lenovo Group Limited

- Acer Inc

- Samsung Electronics Co Ltd

- Microsoft Corporation

- Dell Inc

- Micro-Star International Co

- ASUSTek Computer Inc

- Razer Inc

- The Hewlett-Packard Company (HP)

- Apple Inc

Key Developments in PC Industry Sector

- June 2022: Apple launched the MacBook Air 2022 with the M2 chip, offering a 40% performance improvement over its predecessor. This launch significantly impacted the premium laptop segment, boosting Apple's market share and setting a new benchmark for performance.

- June 2022: Dell Technologies introduced a new lineup of business laptops, targeting the hybrid work market. This expansion strengthened Dell's position in the enterprise segment and showcased its commitment to supporting evolving work styles.

Strategic PC Industry Market Outlook

The PC industry is poised for continued growth, driven by technological innovation, evolving consumer preferences, and increasing demand in emerging markets. Opportunities exist for manufacturers to capitalize on the growing demand for high-performance laptops, specialized gaming PCs, and sustainable and eco-friendly designs. Strategic partnerships and investments in research and development will be crucial for players to maintain a competitive edge in this dynamic market. The focus on enhanced security features and user privacy will also play a vital role in future growth.

PC Industry Segmentation

-

1. Type

- 1.1. Laptops

- 1.2. Desktop PCs

- 1.3. All-In-One Stations

- 1.4. Tablets

PC Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

PC Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Robust Demand of Laptop; Impacts of Digitalization Across the Globe

- 3.3. Market Restrains

- 3.3.1. Inflation Hurts The Overall Market

- 3.4. Market Trends

- 3.4.1. Laptop Demand Boosting the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. PC Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Laptops

- 5.1.2. Desktop PCs

- 5.1.3. All-In-One Stations

- 5.1.4. Tablets

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America PC Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Laptops

- 6.1.2. Desktop PCs

- 6.1.3. All-In-One Stations

- 6.1.4. Tablets

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe PC Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Laptops

- 7.1.2. Desktop PCs

- 7.1.3. All-In-One Stations

- 7.1.4. Tablets

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific PC Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Laptops

- 8.1.2. Desktop PCs

- 8.1.3. All-In-One Stations

- 8.1.4. Tablets

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America PC Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Laptops

- 9.1.2. Desktop PCs

- 9.1.3. All-In-One Stations

- 9.1.4. Tablets

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa PC Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Laptops

- 10.1.2. Desktop PCs

- 10.1.3. All-In-One Stations

- 10.1.4. Tablets

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. North America PC Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe PC Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific PC Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Latin America PC Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East and Africa PC Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Toshiba Corporation

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Lenovo Group Limited

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Acer Inc

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Samsung Electronics Co Ltd*List Not Exhaustive

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Microsoft Corporation

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Dell Inc

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Micro-Star International Co

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 ASUSTek Computer Inc

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Razer Inc

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 The Hewlett-Packard Company(HP)

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Apple Inc

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.1 Toshiba Corporation

List of Figures

- Figure 1: PC Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: PC Industry Share (%) by Company 2024

List of Tables

- Table 1: PC Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: PC Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: PC Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: PC Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: PC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: PC Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: PC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: PC Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: PC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: PC Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: PC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: PC Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: PC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: PC Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 15: PC Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: PC Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 17: PC Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: PC Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 19: PC Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: PC Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 21: PC Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: PC Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 23: PC Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the PC Industry?

The projected CAGR is approximately 9.10%.

2. Which companies are prominent players in the PC Industry?

Key companies in the market include Toshiba Corporation, Lenovo Group Limited, Acer Inc, Samsung Electronics Co Ltd*List Not Exhaustive, Microsoft Corporation, Dell Inc, Micro-Star International Co, ASUSTek Computer Inc, Razer Inc, The Hewlett-Packard Company(HP), Apple Inc.

3. What are the main segments of the PC Industry?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 204.07 Million as of 2022.

5. What are some drivers contributing to market growth?

Robust Demand of Laptop; Impacts of Digitalization Across the Globe.

6. What are the notable trends driving market growth?

Laptop Demand Boosting the Market.

7. Are there any restraints impacting market growth?

Inflation Hurts The Overall Market.

8. Can you provide examples of recent developments in the market?

June 2022: Apple, the leading telephone brand in the world, launched the MacBook Air 2022 with the latest design and M2 chip. Apple's new M2 processor helps the 2022 Air function 40% better than its predecessor.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "PC Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the PC Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the PC Industry?

To stay informed about further developments, trends, and reports in the PC Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence