Key Insights

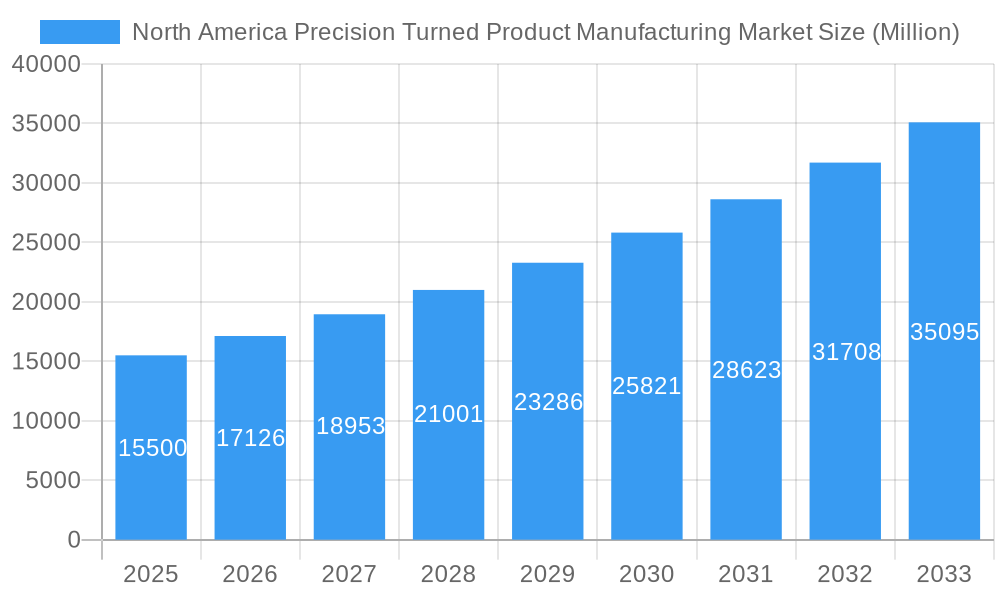

The North America Precision Turned Product Manufacturing Market is projected to achieve a substantial market size of $110.33 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 6.7% from 2025 to 2033. This significant growth is driven by increasing demand from key sectors including automotive, electronics, defense, and healthcare. Advancements in automotive systems and electric mobility, miniaturization in electronics, sophisticated defense equipment, and high-tolerance medical devices are key demand catalysts. The market is witnessing a strong shift towards advanced manufacturing, with CNC machining increasingly replacing manual methods due to superior precision and efficiency.

North America Precision Turned Product Manufacturing Market Market Size (In Billion)

Key market trends include the adoption of advanced materials and the integration of Industry 4.0 principles, enhancing productivity and reducing costs. While automatic screw and rotary transfer machines are essential for high-volume production, CNC lathes and turning centers are critical for complex components. Potential challenges include raw material price volatility and intensifying global competition. The North American region, supported by robust industrial infrastructure and strong end-user industries, is expected to lead the market.

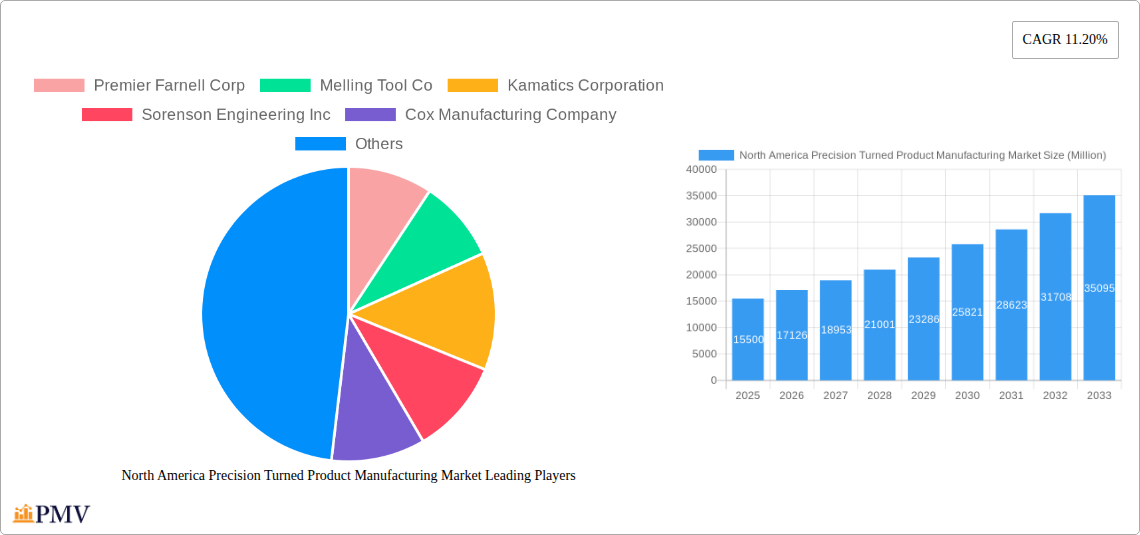

North America Precision Turned Product Manufacturing Market Company Market Share

This report offers a comprehensive analysis of the North America Precision Turned Product Manufacturing Market, detailing market size, growth drivers, trends, competitive landscape, and future projections. Covering the historical period (2019-2024), base year (2025), and forecast period (2025-2033), it provides actionable insights for stakeholders seeking to capitalize on market opportunities and navigate industry challenges.

North America Precision Turned Product Manufacturing Market Market Structure & Competitive Dynamics

The North America Precision Turned Product Manufacturing Market exhibits a moderately consolidated structure, with a significant number of small and medium-sized enterprises (SMEs) alongside larger, well-established players. Innovation ecosystems are driven by advancements in CNC technology, automation, and material science, fostering a competitive environment where precision, efficiency, and customization are paramount. Regulatory frameworks, particularly concerning quality control, safety standards (e.g., AS9100 for aerospace), and environmental compliance, significantly influence market operations. Product substitutes, while limited for highly specialized applications, can emerge from additive manufacturing or alternative material solutions in less demanding scenarios. End-user trends are diverse, with the automotive, electronics, defense, and healthcare sectors continuously demanding higher precision and tighter tolerances. Mergers and acquisitions (M&A) activity is a notable strategy for market expansion and capability enhancement, with deal values often in the tens of millions of dollars. For instance, recent M&A activities indicate a trend towards consolidation for greater market reach and technological integration, impacting overall market share distribution.

North America Precision Turned Product Manufacturing Market Industry Trends & Insights

The North America Precision Turned Product Manufacturing Market is experiencing robust growth, projected at a Compound Annual Growth Rate (CAGR) of approximately 5.5% through the forecast period. This expansion is fueled by several key industry trends. The increasing demand for complex, high-precision components across burgeoning sectors like electric vehicles (EVs), advanced electronics, and sophisticated medical devices is a primary market growth driver. Technological disruptions, particularly the widespread adoption of advanced Computer Numerically Controlled (CNC) machining, automation, and Industry 4.0 principles (including IoT and AI integration), are revolutionizing manufacturing processes, leading to enhanced efficiency, reduced lead times, and improved product quality. Consumer preferences are shifting towards lighter, more durable, and highly customized components, pushing manufacturers to invest in versatile machinery and advanced materials. Competitive dynamics are characterized by a race for technological superiority, cost optimization through automation, and the ability to offer bespoke solutions. Market penetration is deepening as more industries recognize the value proposition of precision turned products for their critical applications. The overall market size is estimated to reach over $25,000 million by 2030, driven by continuous innovation and strong end-user demand.

Dominant Markets & Segments in North America Precision Turned Product Manufacturing Market

The United States is the dominant market within North America for precision turned product manufacturing, driven by its strong industrial base, significant R&D investments, and substantial demand from key end-use industries.

Segments Driving Dominance:

- Operation: CNC Operation: This segment holds the largest market share due to the unparalleled precision, repeatability, and efficiency offered by CNC machines.

- Key Drivers: Technological advancements in CNC controllers, widespread availability of skilled operators, and the need for complex geometries in high-value applications.

- Machine Types: Computer Numerically Controlled (CNC) and Lathes or Turning Centers: These machine types are central to precision turning operations, forming the backbone of the industry.

- Key Drivers: Versatility in handling various materials and geometries, capacity for high-volume production, and continuous innovation in multi-axis capabilities.

- Material Type: Steel: Steel remains the dominant material due to its strength, durability, cost-effectiveness, and wide range of applications across industries.

- Key Drivers: Availability of various steel alloys (stainless steel, alloy steel) tailored for specific performance requirements, established supply chains, and its essential role in automotive and industrial machinery.

- End Use: Automobile: The automotive sector, particularly with the growth of electric vehicles and advanced driver-assistance systems (ADAS), represents the largest end-use market.

- Key Drivers: Demand for precision engine components, transmission parts, suspension systems, and specialized components for EV powertrains. Regulatory requirements for fuel efficiency and safety also drive the need for lighter, more precise parts.

Other significant segments include Plastic materials for lightweight applications, and the Electronics and Defense sectors, which consistently require highly specialized and extremely precise turned components. The Healthcare sector is also a growing contributor, demanding biocompatible materials and exceptionally tight tolerances for medical devices and implants.

North America Precision Turned Product Manufacturing Market Product Innovations

Recent product innovations in the North America Precision Turned Product Manufacturing Market focus on enhancing precision, optimizing material usage, and enabling faster production cycles. Advancements in multi-axis CNC machining allow for the creation of increasingly complex geometries with greater accuracy, catering to specialized demands in aerospace and advanced electronics. The development of specialized tooling and cutting strategies, coupled with improved cooling and lubrication systems, further boosts efficiency and surface finish quality. Innovations in material science are also leading to the use of novel alloys and composites that offer superior strength-to-weight ratios and resistance to extreme conditions, providing competitive advantages for manufacturers serving demanding end markets.

Report Segmentation & Scope

This report segments the North America Precision Turned Product Manufacturing Market across key operational, machine, material, and end-use categories. The Operation segment is divided into Manual Operation and CNC Operation, with CNC Operation projected for significant growth due to automation trends. The Machine Types segment includes Automatic Screw Machines, Rotary Transfer Machines, Computer Numerically Controlled (CNC), and Lathes or Turning Centers, with CNC and Lathes dominating market share. The Material Type segment covers Plastic, Steel, and Other Material Types, with Steel holding a substantial market presence. The End Use segment analyzes Automobile, Electronics, Defense, and Healthcare, with the Automobile sector leading market demand, followed closely by Electronics and Defense. Growth projections and market sizes are detailed for each segment, reflecting current competitive dynamics and future potential.

Key Drivers of North America Precision Turned Product Manufacturing Market Growth

The growth of the North America Precision Turned Product Manufacturing Market is propelled by several interconnected factors. Technological advancements, particularly the increasing sophistication and affordability of CNC machinery, coupled with widespread adoption of automation and digital manufacturing techniques (Industry 4.0), are significant drivers. The robust demand from critical end-use industries such as automotive (especially EVs), aerospace, defense, and healthcare, which require high-precision and reliable components, acts as a constant growth catalyst. Furthermore, increasing investments in research and development for innovative materials and manufacturing processes contribute to market expansion. Favorable economic policies and government initiatives supporting domestic manufacturing also play a crucial role.

Challenges in the North America Precision Turned Product Manufacturing Market Sector

Despite strong growth, the North America Precision Turned Product Manufacturing Market faces several challenges. Stringent quality control and regulatory compliance requirements, especially in sectors like aerospace and healthcare, necessitate significant investment in testing and certification. Skilled labor shortages remain a persistent issue, as the demand for experienced CNC machinists and technicians outpaces supply. Supply chain disruptions, fluctuating raw material costs (e.g., steel and specialized alloys), and increasing energy prices can impact profitability and lead times. Intense competition, both domestically and internationally, can lead to price pressures, requiring manufacturers to continuously optimize their operations for efficiency and cost-effectiveness.

Leading Players in the North America Precision Turned Product Manufacturing Market Market

- Premier Farnell Corp

- Melling Tool Co

- Kamatics Corporation

- Sorenson Engineering Inc

- Cox Manufacturing Company

- Nook Industries LLC

- Creed-Monarch Inc

- Camcraft Inc

- M & W Industries Inc

- Greystone of Lincoln Inc

- Swagelok Hy-Level Company

- Herker Industries Inc

- Supreme Screw Products Inc

Key Developments in North America Precision Turned Product Manufacturing Market Sector

- November 2022: Middle market private equity firm One Equity Partners announced the acquisition of precision machining service providers Evans Industries Inc. and Little Enterprises LLC by Momentum Manufacturing Group, a leading North American metal manufacturing services provider. The purchases will extend Momentum's capabilities, increase the company's exposure to mission-critical end markets, and add close to 160 qualified team members. This development signifies consolidation for enhanced market reach and service offerings.

- December 2021: A legally binding agreement was signed by the Reutte, Austria-based Plansee Group to buy the Indianapolis-based Mi-Tech Tungsten Metals. Nearly 100 individuals work for Mi-Tech, which is regarded as one of the top manufacturers of tungsten-based goods in the United States. It is strengthening its market position for tungsten goods in North America with the acquisition of Mi-Tech. This acquisition highlights strategic moves to bolster market presence and specialized material capabilities.

Strategic North America Precision Turned Product Manufacturing Market Market Outlook

The strategic outlook for the North America Precision Turned Product Manufacturing Market remains highly positive, driven by ongoing technological advancements and sustained demand from critical growth sectors. Manufacturers who invest in advanced automation, embrace digital manufacturing solutions, and focus on high-precision, complex component production will be well-positioned for success. The increasing emphasis on sustainable manufacturing practices and the development of eco-friendly materials will also present strategic opportunities. Expanding capabilities in specialized materials and catering to niche markets, such as advanced medical devices and next-generation aerospace components, will be crucial for long-term growth and competitive advantage. Collaborations and strategic partnerships will further enhance market penetration and innovation.

North America Precision Turned Product Manufacturing Market Segmentation

-

1. Operation

- 1.1. Manual Operation

- 1.2. CNC Operation

-

2. Machine Types

- 2.1. Automatic Screw Machines

- 2.2. Rotary Transfer Machines

- 2.3. Computer Numerically Controlled (CNC)

- 2.4. Lathes or Turning Centers

-

3. Material Type

- 3.1. Plastic

- 3.2. Steel

- 3.3. Other Material Types

-

4. End Use

- 4.1. Automobile

- 4.2. Electronics

- 4.3. Defense

- 4.4. Healthcare

North America Precision Turned Product Manufacturing Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Precision Turned Product Manufacturing Market Regional Market Share

Geographic Coverage of North America Precision Turned Product Manufacturing Market

North America Precision Turned Product Manufacturing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Manufacturing Sector is Being Transformed by the Internet Of Things (IoT)

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Precision Turned Product Manufacturing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Operation

- 5.1.1. Manual Operation

- 5.1.2. CNC Operation

- 5.2. Market Analysis, Insights and Forecast - by Machine Types

- 5.2.1. Automatic Screw Machines

- 5.2.2. Rotary Transfer Machines

- 5.2.3. Computer Numerically Controlled (CNC)

- 5.2.4. Lathes or Turning Centers

- 5.3. Market Analysis, Insights and Forecast - by Material Type

- 5.3.1. Plastic

- 5.3.2. Steel

- 5.3.3. Other Material Types

- 5.4. Market Analysis, Insights and Forecast - by End Use

- 5.4.1. Automobile

- 5.4.2. Electronics

- 5.4.3. Defense

- 5.4.4. Healthcare

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Operation

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Premier Farnell Corp

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Melling Tool Co

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Kamatics Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sorenson Engineering Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Cox Manufacturing Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nook Industries LLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Creed-Monarch Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Camcraft Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 M & W Industries Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Greystone of Lincoln Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Swagelok Hy-Level Company

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Herker Industries Inc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Supreme Screw Products Inc **List Not Exhaustive

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Premier Farnell Corp

List of Figures

- Figure 1: North America Precision Turned Product Manufacturing Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Precision Turned Product Manufacturing Market Share (%) by Company 2025

List of Tables

- Table 1: North America Precision Turned Product Manufacturing Market Revenue billion Forecast, by Operation 2020 & 2033

- Table 2: North America Precision Turned Product Manufacturing Market Revenue billion Forecast, by Machine Types 2020 & 2033

- Table 3: North America Precision Turned Product Manufacturing Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 4: North America Precision Turned Product Manufacturing Market Revenue billion Forecast, by End Use 2020 & 2033

- Table 5: North America Precision Turned Product Manufacturing Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: North America Precision Turned Product Manufacturing Market Revenue billion Forecast, by Operation 2020 & 2033

- Table 7: North America Precision Turned Product Manufacturing Market Revenue billion Forecast, by Machine Types 2020 & 2033

- Table 8: North America Precision Turned Product Manufacturing Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 9: North America Precision Turned Product Manufacturing Market Revenue billion Forecast, by End Use 2020 & 2033

- Table 10: North America Precision Turned Product Manufacturing Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: United States North America Precision Turned Product Manufacturing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Canada North America Precision Turned Product Manufacturing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Mexico North America Precision Turned Product Manufacturing Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Precision Turned Product Manufacturing Market?

The projected CAGR is approximately 6.7%.

2. Which companies are prominent players in the North America Precision Turned Product Manufacturing Market?

Key companies in the market include Premier Farnell Corp, Melling Tool Co, Kamatics Corporation, Sorenson Engineering Inc, Cox Manufacturing Company, Nook Industries LLC, Creed-Monarch Inc, Camcraft Inc, M & W Industries Inc, Greystone of Lincoln Inc, Swagelok Hy-Level Company, Herker Industries Inc, Supreme Screw Products Inc **List Not Exhaustive.

3. What are the main segments of the North America Precision Turned Product Manufacturing Market?

The market segments include Operation, Machine Types, Material Type, End Use .

4. Can you provide details about the market size?

The market size is estimated to be USD 110.33 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Manufacturing Sector is Being Transformed by the Internet Of Things (IoT).

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

November 2022: Middle market private equity firm One Equity Partners announced the acquisition of precision machining service providers Evans Industries Inc. and Little Enterprises LLC by Momentum Manufacturing Group, a leading North American metal manufacturing services provider. The purchases will extend Momentum's capabilities, increase the company's exposure to mission-critical end markets, and add close to 160 qualified team members.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Precision Turned Product Manufacturing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Precision Turned Product Manufacturing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Precision Turned Product Manufacturing Market?

To stay informed about further developments, trends, and reports in the North America Precision Turned Product Manufacturing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence