Key Insights

The Bangladesh textile market, valued at $19.04 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 5.81% from 2025 to 2033. This growth is driven by several key factors. Firstly, Bangladesh's established position as a major global apparel exporter benefits from its low labor costs and access to raw materials. Secondly, increasing investments in advanced textile technologies, including automation and sustainable manufacturing practices, are enhancing productivity and competitiveness. Furthermore, rising domestic consumption fueled by a growing middle class and a young population contributes to market expansion. While challenges exist, such as supply chain vulnerabilities and rising energy costs, the government's continued support for the industry, including initiatives focusing on skills development and infrastructure improvements, mitigates these risks. The market is segmented by various fiber types (cotton, jute, synthetic), product types (garments, fabrics, home textiles), and export destinations. Leading players like Ha-meem Group, Noman Group, and Beximco Textile Division Limited dominate the landscape, showcasing the industry's concentration. The forecast period of 2025-2033 anticipates continued expansion, driven by a strategic focus on higher value-added products and diversification into niche markets.

Bangladesh Textile Market Market Size (In Billion)

The competitive landscape is characterized by both large established players and smaller, specialized companies. The ongoing investment in research and development, along with strategic collaborations and mergers, are shaping the market structure. Future growth will depend on the ability of companies to adapt to evolving consumer preferences, embrace sustainable practices, and manage supply chain complexities efficiently. The country's strong focus on sustainable and ethical manufacturing will also influence the trajectory of the market, attracting environmentally conscious buyers. Maintaining its competitive edge requires continued investment in technology, skills development, and a proactive response to global economic shifts. The government's role in providing supportive policies and infrastructure remains crucial for sustained growth.

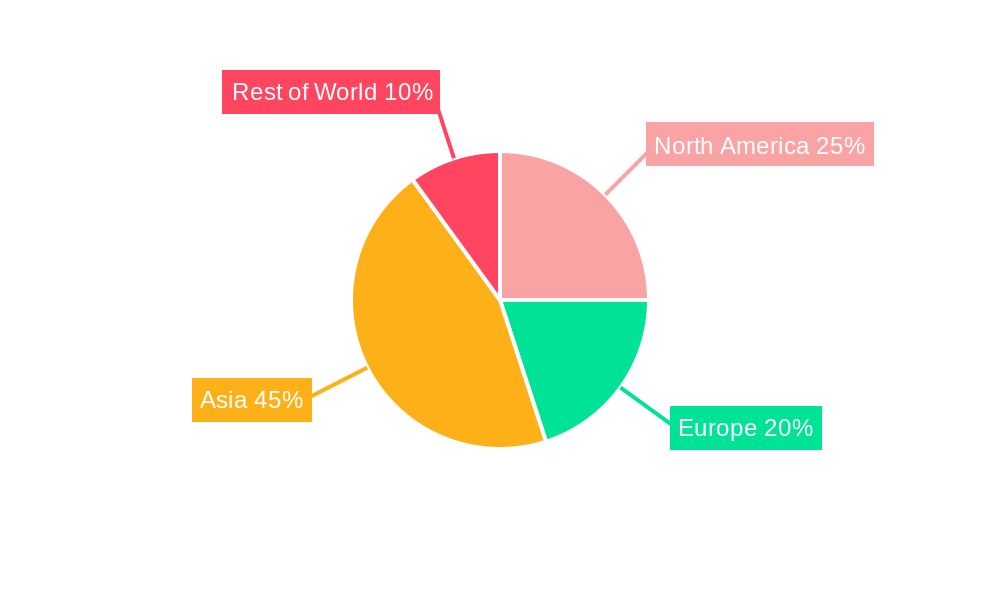

Bangladesh Textile Market Company Market Share

Bangladesh Textile Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Bangladesh textile market, encompassing market structure, competitive dynamics, industry trends, and future growth prospects. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period spans 2025-2033, and the historical period encompasses 2019-2024. This report is crucial for businesses, investors, and stakeholders seeking to understand and capitalize on opportunities within this dynamic market. The report is valued at xx Million and is expected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Bangladesh Textile Market Market Structure & Competitive Dynamics

The Bangladesh textile market is characterized by a moderately concentrated structure, with several large players holding significant market share. Key players like Ha-meem Group, Noman Group, Beximco Textile Division Limited, Square Textile Ltd, DBL Group, Thermax Group, Viyellatex Group, Epyllion Group, Mohammadi Group, Fakir Group, Akij Textile Mills Ltd, Pakiza Group, and Masco Industries Limited (list not exhaustive) compete intensely, driving innovation and influencing market dynamics. The market share of these leading players is estimated to be around xx% collectively in 2025.

The regulatory framework, while evolving, plays a critical role, influencing compliance costs and market access. The presence of substitute products, such as synthetic fabrics, presents a challenge, impacting market demand. End-user trends, including a growing preference for sustainable and ethically sourced textiles, are reshaping the industry landscape.

M&A activities have been observed, though data on deal values remains incomplete. However, strategic partnerships and collaborations are increasing, indicating a shift towards consolidation and expansion in the sector. Innovation ecosystems are nascent but show potential for growth, with investments in research and development focusing on sustainable technologies and improved production processes.

Bangladesh Textile Market Industry Trends & Insights

The Bangladesh textile market exhibits robust growth, driven by factors such as increasing domestic consumption, rising export demand, and government initiatives promoting the industry. Technological advancements, including automation and the adoption of Industry 4.0 technologies, are boosting efficiency and productivity. Consumer preferences are shifting towards higher-quality, sustainable, and ethically produced textiles, placing pressure on manufacturers to adopt environmentally friendly practices. The market is characterized by intense competition, pushing companies to innovate and differentiate their products and services. The CAGR of the market is projected to be xx% during the forecast period, fueled by a growing middle class and increasing disposable incomes within Bangladesh. Market penetration of high-value textile products is increasing, driven by changing consumer preferences and rising purchasing power.

Dominant Markets & Segments in Bangladesh Textile Market

The ready-made garment (RMG) segment dominates the Bangladesh textile market, accounting for a significant portion of the overall market value. The key drivers behind this dominance include:

- Favorable Government Policies: Government initiatives aimed at promoting the RMG sector, including tax incentives and export promotion schemes.

- Robust Infrastructure: Development of industrial zones and improved infrastructure has facilitated the growth of the RMG industry.

- Abundant Labor Force: Bangladesh's large and relatively low-cost labor force provides a competitive advantage in the global RMG market.

- Global Demand: High global demand for ready-made garments, particularly from developed economies.

Other significant segments include home textiles and industrial textiles, each exhibiting unique growth trajectories and market characteristics. Regional variations in market size and growth rates also exist, with certain regions exhibiting faster growth than others.

Bangladesh Textile Market Product Innovations

Recent product innovations in the Bangladesh textile market focus on sustainability, functionality, and enhanced aesthetics. This includes the development of eco-friendly fabrics, such as organic cotton and recycled materials, as well as the incorporation of innovative technologies to improve the performance and durability of textiles. These innovations are essential for meeting the evolving demands of consumers and maintaining competitiveness in the global market. The market is seeing an increasing adoption of technologies such as 3D printing and digital textile printing, allowing for greater design flexibility and customization.

Report Segmentation & Scope

This report segments the Bangladesh textile market based on product type (e.g., woven fabrics, knit fabrics, ready-made garments, home textiles, technical textiles), fiber type (e.g., cotton, jute, synthetic fibers), end-use industry (e.g., apparel, home furnishings, industrial applications), and region. Each segment is analyzed in terms of historical and projected market size, growth rate, and competitive landscape. The report also delves into the import and export dynamics of each segment, providing insights into trade flows and market trends.

Key Drivers of Bangladesh Textile Market Growth

Several factors propel the growth of the Bangladesh textile market. These include:

- Rising Domestic Consumption: A growing middle class with increased disposable income fuels domestic demand for textiles and apparel.

- Government Support: Government initiatives to promote the textile industry, including tax breaks and infrastructure development.

- Low Labor Costs: Bangladesh's competitive labor costs compared to other countries provide a significant advantage in global markets.

- Technological Advancements: Adoption of modern technologies enhances production efficiency and product quality.

- Increased Export Demand: Growth in global demand for ready-made garments and other textile products.

Challenges in the Bangladesh Textile Market Sector

Despite its growth potential, the Bangladesh textile market faces certain challenges:

- Supply Chain Disruptions: Global supply chain disruptions can impact raw material availability and timely delivery of finished goods. Quantifiable impacts can include delays in production and increased costs.

- Competition: Intense competition from other textile-producing countries requires constant innovation and cost optimization.

- Sustainability Concerns: Growing concerns over environmental sustainability and labor practices demand improvements in ethical sourcing and production processes. This can lead to increased compliance costs.

- Infrastructure Gaps: Addressing infrastructure limitations, especially reliable power supply, remains crucial.

Leading Players in the Bangladesh Textile Market Market

- Ha-meem Group

- Noman Group

- Beximco Textile Division Limited

- Square Textile Ltd

- DBL Group

- Thermax Group

- Viyellatex Group

- Epyllion Group

- Mohammadi Group

- Fakir Group

- Akij Textile Mills Ltd

- Pakiza Group

- Masco Industries Limited

Key Developments in Bangladesh Textile Market Sector

- December 2022: The Asian Development Bank (ADB) provided a USD 11.2 Million facility to Envoy Textiles Limited for energy-efficient machinery, promoting sustainable production and job creation.

- March 2022: The AAFA and BGMEA signed an MoU to enhance trade access to the US market, improve purchasing practices, and boost sustainability collaborations. This fosters closer US-Bangladesh industry ties and opens new market opportunities.

Strategic Bangladesh Textile Market Market Outlook

The Bangladesh textile market holds substantial growth potential, driven by continued economic development, rising consumer demand, and government support. Strategic opportunities lie in investing in sustainable technologies, focusing on niche product segments, and strengthening partnerships with international brands. The market's future success hinges on addressing challenges related to sustainability, infrastructure, and supply chain resilience. Further exploration of new markets and diversifying exports will also enhance market competitiveness.

Bangladesh Textile Market Segmentation

-

1. Application

- 1.1. Clothing Application

- 1.2. Industrial Application

- 1.3. Household Application

-

2. Material

- 2.1. Cotton

- 2.2. Jute

- 2.3. Silk

- 2.4. Wool

- 2.5. Synthetic

- 2.6. Other Materials

-

3. Process

- 3.1. Woven

- 3.2. Non-woven

Bangladesh Textile Market Segmentation By Geography

- 1. Bangladesh

Bangladesh Textile Market Regional Market Share

Geographic Coverage of Bangladesh Textile Market

Bangladesh Textile Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.81% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Natural Fibers

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Bangladesh Textile Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Clothing Application

- 5.1.2. Industrial Application

- 5.1.3. Household Application

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Cotton

- 5.2.2. Jute

- 5.2.3. Silk

- 5.2.4. Wool

- 5.2.5. Synthetic

- 5.2.6. Other Materials

- 5.3. Market Analysis, Insights and Forecast - by Process

- 5.3.1. Woven

- 5.3.2. Non-woven

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Bangladesh

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Ha-meem Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Noman Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Beximco Textile Division Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Square Textile Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 DBL Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Thermax Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Viyellatex Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Epyllion Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mohammadi Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Fakir Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Akij Textile Mills Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Pakiza Group

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Masco Industries Limited**List Not Exhaustive

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Ha-meem Group

List of Figures

- Figure 1: Bangladesh Textile Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Bangladesh Textile Market Share (%) by Company 2025

List of Tables

- Table 1: Bangladesh Textile Market Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Bangladesh Textile Market Volume Billion Forecast, by Application 2020 & 2033

- Table 3: Bangladesh Textile Market Revenue Million Forecast, by Material 2020 & 2033

- Table 4: Bangladesh Textile Market Volume Billion Forecast, by Material 2020 & 2033

- Table 5: Bangladesh Textile Market Revenue Million Forecast, by Process 2020 & 2033

- Table 6: Bangladesh Textile Market Volume Billion Forecast, by Process 2020 & 2033

- Table 7: Bangladesh Textile Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Bangladesh Textile Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Bangladesh Textile Market Revenue Million Forecast, by Application 2020 & 2033

- Table 10: Bangladesh Textile Market Volume Billion Forecast, by Application 2020 & 2033

- Table 11: Bangladesh Textile Market Revenue Million Forecast, by Material 2020 & 2033

- Table 12: Bangladesh Textile Market Volume Billion Forecast, by Material 2020 & 2033

- Table 13: Bangladesh Textile Market Revenue Million Forecast, by Process 2020 & 2033

- Table 14: Bangladesh Textile Market Volume Billion Forecast, by Process 2020 & 2033

- Table 15: Bangladesh Textile Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Bangladesh Textile Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Bangladesh Textile Market?

The projected CAGR is approximately 5.81%.

2. Which companies are prominent players in the Bangladesh Textile Market?

Key companies in the market include Ha-meem Group, Noman Group, Beximco Textile Division Limited, Square Textile Ltd, DBL Group, Thermax Group, Viyellatex Group, Epyllion Group, Mohammadi Group, Fakir Group, Akij Textile Mills Ltd, Pakiza Group, Masco Industries Limited**List Not Exhaustive.

3. What are the main segments of the Bangladesh Textile Market?

The market segments include Application, Material, Process.

4. Can you provide details about the market size?

The market size is estimated to be USD 19.04 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increasing Demand for Natural Fibers.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

December 2022: The Asian Development Bank (ADB) signed a EUR 10.8 million (USD 11.2 million) facility agreement with the Bangladeshi manufacturer of fashion denim, Envoy Textiles Limited, to support and finance the purchase and installation of energy-efficient spinning machinery and other equipment. This move is expected to enhance sustainable textile production and generate local jobs. The proceeds of the loan will be used to fund a second yarn spinning unit at Envoy's manufacturing plant in Jamirdia, Bangladesh.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Bangladesh Textile Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Bangladesh Textile Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Bangladesh Textile Market?

To stay informed about further developments, trends, and reports in the Bangladesh Textile Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence