Key Insights

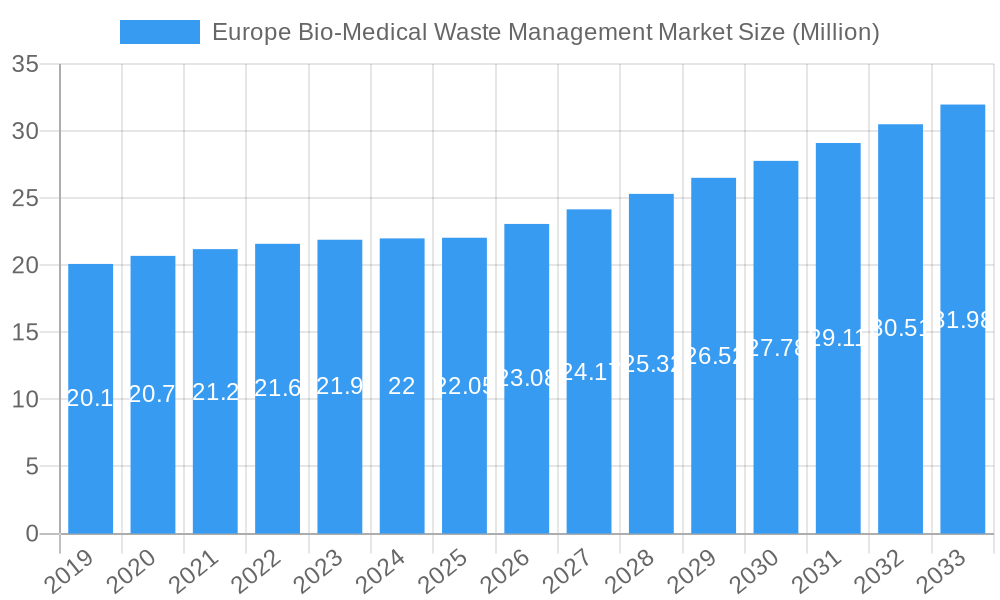

The European bio-medical waste management market is poised for significant expansion, projected to reach a substantial valuation by 2033. The market's current size, estimated at USD 22.05 million in the base year of 2025, is expected to witness a healthy Compound Annual Growth Rate (CAGR) of 4.61% throughout the forecast period (2025-2033). This growth is underpinned by a confluence of factors, including increasingly stringent healthcare regulations concerning the safe disposal of bio-medical waste, a growing volume of medical procedures and associated waste generation, and a rising awareness among healthcare providers and the public about the environmental and public health risks posed by improper waste handling. Hazardous waste management, in particular, is a critical segment driving this expansion due to its inherent risks and the specialized treatment and disposal methods required.

Europe Bio-Medical Waste Management Market Market Size (In Million)

The market's trajectory is further shaped by advancements in waste treatment and disposal technologies, offering more efficient and environmentally sound solutions. Companies are investing in innovation, developing advanced incineration, autoclaving, and chemical disinfection techniques. The collection, transportation, and storage segments are also crucial, requiring specialized logistics and infrastructure to ensure containment and prevent cross-contamination. Key players like SUEZ Group and Veolia Environmental Services are actively involved in offering comprehensive waste management solutions across Europe. While the market exhibits robust growth, potential restraints include the high capital expenditure required for state-of-the-art waste management facilities, complex regulatory landscapes that vary by country, and the ongoing need for skilled personnel to manage bio-medical waste safely and effectively. Geographically, Europe, with its developed healthcare infrastructure and strong environmental policies, represents a dominant region, with the United Kingdom, Germany, and France being key contributors to market value and growth.

Europe Bio-Medical Waste Management Market Company Market Share

This in-depth report provides a granular analysis of the Europe Bio-Medical Waste Management Market, offering critical insights into market dynamics, growth drivers, segmentation, and competitive landscapes. Covering the study period from 2019 to 2033, with a base year of 2025, this report is an indispensable resource for stakeholders seeking to navigate the evolving healthcare waste management sector. Our analysis delves into medical waste disposal trends, hazardous medical waste management, and the growing demand for sustainable bio-medical waste treatment solutions across the continent.

Europe Bio-Medical Waste Management Market Market Structure & Competitive Dynamics

The Europe Bio-Medical Waste Management Market exhibits a moderately concentrated structure, with key players like SUEZ Group, Veolia Environmental Services, and Remondis Medison dominating significant market shares. The innovation ecosystem is driven by advancements in treatment technologies and digital solutions for waste tracking and compliance. Stringent regulatory frameworks across EU member states, focusing on healthcare waste compliance and environmental protection, significantly influence market entry and operational strategies. While product substitutes are limited due to the specialized nature of bio-medical waste, the industry is witnessing a rise in integrated service providers offering end-to-end medical waste solutions. End-user trends highlight a growing preference for cost-effective, environmentally responsible, and compliant bio-medical waste management services. Mergers and acquisitions (M&A) are playing a pivotal role in market consolidation. For instance, the acquisition of Stericycle by Waste Management Inc. in June 2024, valued at approximately USD 7.2 billion (including Stericycle's net debt of around USD 1.4 billion), signifies a major consolidation trend aimed at expanding environmental solutions portfolios. This strategic move, along with others, is reshaping the competitive landscape and driving the demand for advanced bio-medical waste management companies.

Europe Bio-Medical Waste Management Market Industry Trends & Insights

The Europe Bio-Medical Waste Management Market is experiencing robust growth, fueled by escalating healthcare expenditures, a rising volume of bio-medical waste, and increasingly stringent environmental regulations. The average annual growth rate (CAGR) for the forecast period is projected at approximately 5.8%, reflecting a substantial expansion in market penetration. This growth is underpinned by several key trends: the increasing prevalence of infectious diseases and chronic conditions leading to a higher generation of regulated medical waste, the growing awareness among healthcare facilities regarding the environmental and health risks associated with improper disposal, and government initiatives promoting sustainable bio-medical waste treatment methods. Technological disruptions are at the forefront, with significant investments in advanced medical waste sterilization technologies, such as autoclaving, incineration with energy recovery, and newer methods like plasma gasification, aiming to reduce the environmental footprint of bio-medical waste disposal. The shift towards digital platforms for waste tracking, compliance reporting, and logistics management is also gaining momentum. Consumer preferences within the healthcare sector are leaning towards service providers offering comprehensive, reliable, and compliant bio-medical waste management solutions, prioritizing safety and adherence to regulations. The competitive dynamics are characterized by strategic partnerships, technological innovation, and a focus on operational efficiency to manage the complexities of hazardous waste management within healthcare settings. The market penetration of advanced treatment technologies is steadily increasing, driven by both regulatory mandates and a growing corporate social responsibility among healthcare providers.

Dominant Markets & Segments in Europe Bio-Medical Waste Management Market

The Europe Bio-Medical Waste Management Market is characterized by the dominance of specific regions and segments driven by a confluence of economic policies, robust healthcare infrastructure, and stringent environmental regulations.

Dominant Region: Germany currently holds a significant share of the Europe Bio-Medical Waste Management Market. This dominance is attributed to its well-established healthcare system, a high volume of medical procedures, and proactive government policies mandating compliant medical waste management. The presence of leading healthcare institutions and research facilities further contributes to the substantial generation of bio-medical waste requiring expert disposal.

Dominant Waste Type: Hazardous Bio-Medical Waste constitutes the largest segment within the market. This is primarily due to the infectious nature of much of the waste generated by hospitals, clinics, and laboratories, including sharps, contaminated materials, and pathological waste. The rigorous handling, treatment, and disposal protocols required for hazardous waste necessitate specialized services, driving higher market value.

Dominant Service Type: Treatment and Disposal services command the largest market share. This segment encompasses the critical processes of rendering bio-medical waste safe for the environment and public health, including sterilization, incineration, and landfilling for treated residues. The demand for advanced and compliant treatment technologies, such as those offered by companies like Bertin Medical Waste, is a key driver.

Key Drivers for Dominance:

- Economic Policies: Favorable government incentives and subsidies for sustainable waste management practices in key European nations encourage investment in advanced bio-medical waste treatment facilities and services.

- Infrastructure: Developed healthcare infrastructure across countries like Germany, the UK, and France leads to higher generation of bio-medical waste, necessitating robust management systems.

- Regulatory Frameworks: Strict EU directives and national regulations on healthcare waste management and disposal of bio-medical waste enforce the use of professional services and advanced technologies.

- Public Health Concerns: Growing awareness about the risks associated with improper medical waste disposal drives demand for compliant and safe solutions.

The dominance of these segments and regions underscores the critical need for specialized expertise, advanced technology, and adherence to strict compliance standards in the Europe Bio-Medical Waste Management Market.

Europe Bio-Medical Waste Management Market Product Innovations

Product innovations in the Europe Bio-Medical Waste Management Market are centered on enhancing efficiency, safety, and environmental sustainability in bio-medical waste treatment and disposal. Companies are developing advanced sterilization technologies that reduce treatment times and energy consumption, such as microwave and steam-based systems. Furthermore, smart waste bins with integrated tracking and reporting capabilities are emerging, improving medical waste logistics and compliance. The development of mobile bio-medical waste treatment units offers flexibility for remote locations or during emergencies. These innovations aim to provide cost-effective, compliant, and eco-friendly solutions, giving companies a competitive edge in the healthcare waste management sector by addressing specific challenges in hazardous waste disposal and promoting circular economy principles in medical waste recycling.

Report Segmentation & Scope

This report segments the Europe Bio-Medical Waste Management Market based on:

Waste Type:

- Hazardous Bio-Medical Waste: Includes infectious waste, pathological waste, sharps, and pharmaceutical waste. This segment is projected to exhibit strong growth due to increasing awareness and stringent regulations on handling and disposal.

- Non-hazardous Bio-Medical Waste: Comprises general waste from healthcare facilities. While smaller in market value compared to hazardous waste, its volume is significant and requires efficient management.

Service Type:

- Collection, Transportation, and Storage: Encompasses the logistics of safely moving waste from its source to treatment facilities. Growth in this segment is driven by the need for specialized vehicles and trained personnel.

- Treatment and Disposal: Covers sterilization, incineration, chemical treatment, and secure landfilling. This is the largest segment, driven by technological advancements and compliance requirements.

- Other Service Types: Includes consulting, waste audits, and training services, which are gaining traction as healthcare providers seek comprehensive compliance solutions.

The scope of this report covers all EU member states, with detailed analysis of key markets and their respective regulatory environments impacting the bio-medical waste management sector.

Key Drivers of Europe Bio-Medical Waste Management Market Growth

The Europe Bio-Medical Waste Management Market is propelled by several interconnected drivers:

- Strict Regulatory Compliance: EU directives and national laws mandating safe and environmentally sound bio-medical waste disposal are forcing healthcare facilities to invest in professional services and advanced treatment technologies.

- Increasing Healthcare Expenditures: Rising healthcare spending across Europe leads to a greater volume of medical procedures and consequently, more bio-medical waste generation.

- Technological Advancements: Innovations in medical waste sterilization and treatment methods, such as autoclaving and plasma gasification, offer more efficient and sustainable disposal options.

- Growing Environmental Awareness: Increased focus on environmental sustainability and public health risks associated with improper healthcare waste management is driving demand for responsible disposal solutions.

- Expansion of Healthcare Infrastructure: Growth in the number of hospitals, clinics, and diagnostic centers directly contributes to the increased generation of bio-medical waste.

Challenges in the Europe Bio-Medical Waste Management Market Sector

Despite robust growth, the Europe Bio-Medical Waste Management Market faces several challenges:

- High Initial Investment Costs: The capital expenditure required for advanced bio-medical waste treatment facilities and specialized equipment can be a significant barrier for smaller providers and healthcare facilities.

- Complex Regulatory Landscape: Navigating the diverse and evolving regulatory frameworks across different European countries can be challenging and costly for companies operating across borders.

- Transportation and Logistics: The safe and compliant transportation of hazardous medical waste over long distances presents logistical complexities and associated costs.

- Public Perception and Acceptance: Ensuring public acceptance of treatment facilities, particularly those involving incineration, can be an ongoing challenge.

- Emergence of New Waste Streams: The increasing use of single-use medical devices and novel pharmaceuticals generates new types of bio-medical waste that require adaptive management strategies.

Leading Players in the Europe Bio-Medical Waste Management Market Market

- SUEZ Group

- Veolia Environmental Services

- Remondis Medison

- WM Intellectual Property Holdings LLC

- Bertin Technologies

- Cleansing Service Group (CSG)

- Rhenus Group

- Initial Medical Services

- Biffa

- Cannon Hygiene

- Cleanaway

- Grundon Waste Management

- Viridor

Key Developments in Europe Bio-Medical Waste Management Market Sector

- June 2024: Waste Management Inc. and Stericycle confirmed a definitive agreement, with Waste Management acquiring all outstanding shares of Stericycle at USD 62.00 per share in cash. This deal, totaling approximately USD 7.2 billion, accounts for Stericycle's net debt of around USD 1.4 billion. With this acquisition, Waste Management is expected to broaden its environmental solutions portfolio by incorporating Stericycle's prominent assets in the lucrative medical waste and secure information destruction industries.

- September 2023: LabCycle, a company co-founded by a University of Bath graduate, unveiled its pilot plant capable of recycling up to 60% of plastic lab waste. With ambitions to expand, the company targets recycling waste from labs, healthcare, research, and commercial sectors.

- January 2023: Bertin Medical Waste's Sterilwave solution earned accolades from the United Nations Industrial Development Organization (UNIDO) in 2022. This recognition came during the UNIDO Global Call, specifically in the Medical & Health category. UNIDO lauded Sterilwave for its innovative and responsible approach to medical waste treatment.

Strategic Europe Bio-Medical Waste Management Market Market Outlook

The Europe Bio-Medical Waste Management Market is poised for sustained growth, driven by ongoing regulatory enforcement, increasing healthcare demands, and technological innovation. Strategic opportunities lie in the adoption of advanced bio-medical waste treatment technologies that enhance sustainability and cost-efficiency. The trend towards integrated service offerings, encompassing collection, transportation, treatment, and disposal, will continue to shape the competitive landscape. Furthermore, the growing focus on circular economy principles in healthcare is opening avenues for medical waste recycling initiatives. Companies that invest in digital solutions for waste management optimization and compliance reporting will gain a significant competitive advantage. The market is expected to witness further consolidation through strategic M&A activities as larger players seek to expand their service portfolios and geographical reach, ensuring robust growth for the healthcare waste management sector.

Europe Bio-Medical Waste Management Market Segmentation

-

1. Waste Type

- 1.1. Hazardous

- 1.2. Non-hazardous

-

2. Service Type

- 2.1. Collection

- 2.2. Transportation and Storage

- 2.3. Treatment and Disposal

- 2.4. Other Service Types

Europe Bio-Medical Waste Management Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Bio-Medical Waste Management Market Regional Market Share

Geographic Coverage of Europe Bio-Medical Waste Management Market

Europe Bio-Medical Waste Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.61% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Surging Demand for Healthcare Services; Rise in Surgical Procedures

- 3.3. Market Restrains

- 3.3.1. Surging Demand for Healthcare Services; Rise in Surgical Procedures

- 3.4. Market Trends

- 3.4.1. The Bio-medical Waste Management Market is Set for Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Bio-Medical Waste Management Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Waste Type

- 5.1.1. Hazardous

- 5.1.2. Non-hazardous

- 5.2. Market Analysis, Insights and Forecast - by Service Type

- 5.2.1. Collection

- 5.2.2. Transportation and Storage

- 5.2.3. Treatment and Disposal

- 5.2.4. Other Service Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Waste Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 SUEZ Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Veolia Environmental Services

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Remondis Medison

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 WM Intellectual Property Holdings LLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bertin Technologies

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Cleansing Service Group (CSG)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Rhenus Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Initial Medical Services

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Biffa

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Cannon Hygiene

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Cleanaway

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Grundon Waste Management

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Viridor*List Not Exhaustive

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 SUEZ Group

List of Figures

- Figure 1: Europe Bio-Medical Waste Management Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Bio-Medical Waste Management Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Bio-Medical Waste Management Market Revenue Million Forecast, by Waste Type 2020 & 2033

- Table 2: Europe Bio-Medical Waste Management Market Volume Billion Forecast, by Waste Type 2020 & 2033

- Table 3: Europe Bio-Medical Waste Management Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 4: Europe Bio-Medical Waste Management Market Volume Billion Forecast, by Service Type 2020 & 2033

- Table 5: Europe Bio-Medical Waste Management Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Europe Bio-Medical Waste Management Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Europe Bio-Medical Waste Management Market Revenue Million Forecast, by Waste Type 2020 & 2033

- Table 8: Europe Bio-Medical Waste Management Market Volume Billion Forecast, by Waste Type 2020 & 2033

- Table 9: Europe Bio-Medical Waste Management Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 10: Europe Bio-Medical Waste Management Market Volume Billion Forecast, by Service Type 2020 & 2033

- Table 11: Europe Bio-Medical Waste Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Europe Bio-Medical Waste Management Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: United Kingdom Europe Bio-Medical Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Europe Bio-Medical Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Germany Europe Bio-Medical Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Europe Bio-Medical Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: France Europe Bio-Medical Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Europe Bio-Medical Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Italy Europe Bio-Medical Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Italy Europe Bio-Medical Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Spain Europe Bio-Medical Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Spain Europe Bio-Medical Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Netherlands Europe Bio-Medical Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Netherlands Europe Bio-Medical Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Belgium Europe Bio-Medical Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Belgium Europe Bio-Medical Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Sweden Europe Bio-Medical Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Sweden Europe Bio-Medical Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Norway Europe Bio-Medical Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Norway Europe Bio-Medical Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Poland Europe Bio-Medical Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Poland Europe Bio-Medical Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Denmark Europe Bio-Medical Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Denmark Europe Bio-Medical Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Bio-Medical Waste Management Market?

The projected CAGR is approximately 4.61%.

2. Which companies are prominent players in the Europe Bio-Medical Waste Management Market?

Key companies in the market include SUEZ Group, Veolia Environmental Services, Remondis Medison, WM Intellectual Property Holdings LLC, Bertin Technologies, Cleansing Service Group (CSG), Rhenus Group, Initial Medical Services, Biffa, Cannon Hygiene, Cleanaway, Grundon Waste Management, Viridor*List Not Exhaustive.

3. What are the main segments of the Europe Bio-Medical Waste Management Market?

The market segments include Waste Type, Service Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 22.05 Million as of 2022.

5. What are some drivers contributing to market growth?

Surging Demand for Healthcare Services; Rise in Surgical Procedures.

6. What are the notable trends driving market growth?

The Bio-medical Waste Management Market is Set for Significant Growth.

7. Are there any restraints impacting market growth?

Surging Demand for Healthcare Services; Rise in Surgical Procedures.

8. Can you provide examples of recent developments in the market?

June 2024: Waste Management Inc. and Stericycle confirmed a definitive agreement, with Waste Management acquiring all outstanding shares of Stericycle at USD 62.00 per share in cash. This deal, totaling approximately USD 7.2 billion, accounts for Stericycle's net debt of around USD 1.4 billion. With this acquisition, Waste Management is expected to broaden its environmental solutions portfolio by incorporating Stericycle's prominent assets in the lucrative medical waste and secure information destruction industries.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Bio-Medical Waste Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Bio-Medical Waste Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Bio-Medical Waste Management Market?

To stay informed about further developments, trends, and reports in the Europe Bio-Medical Waste Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence