Key Insights

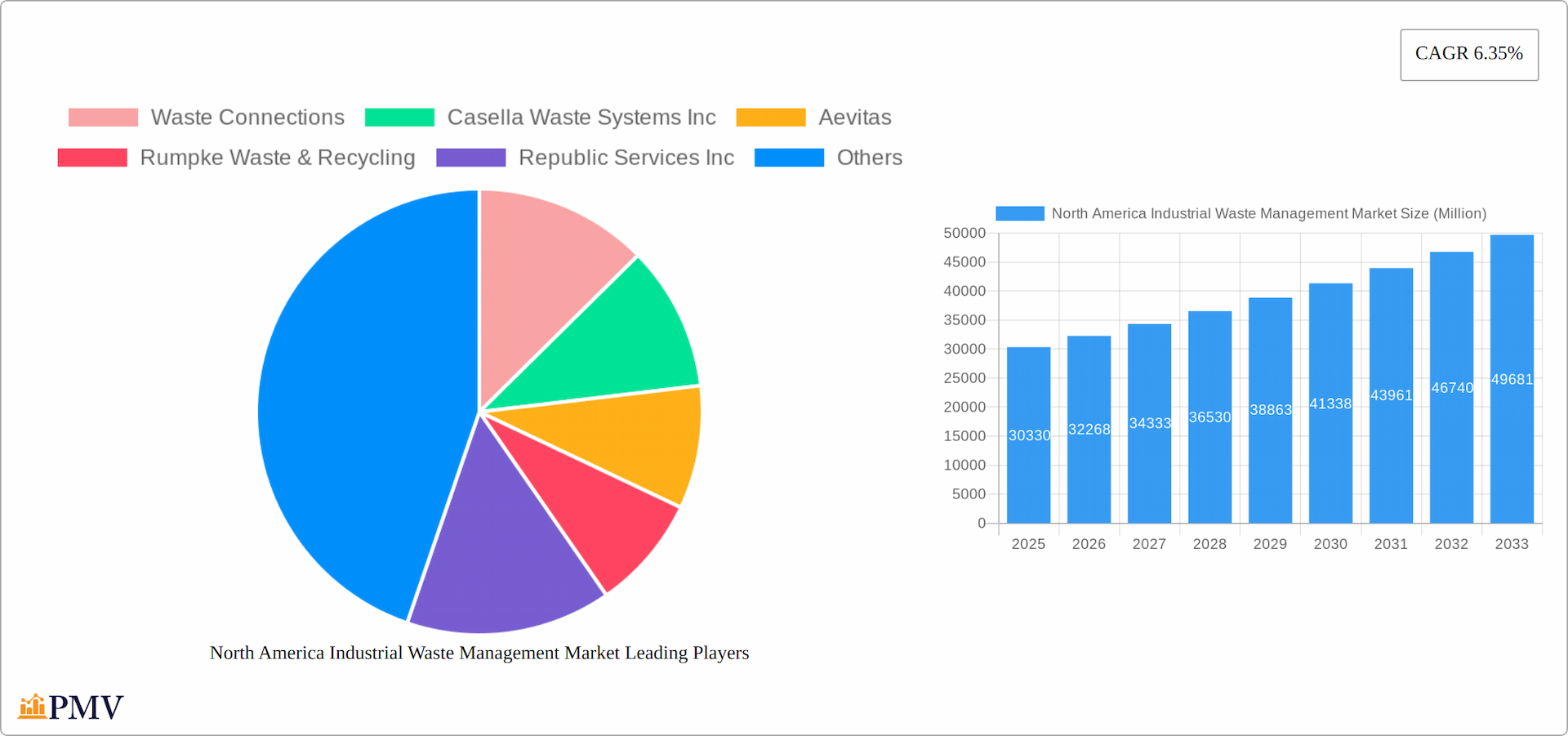

The North American industrial waste management market, valued at $30.33 billion in 2025, is projected to experience robust growth, driven by increasing industrial activity, stringent environmental regulations, and a rising focus on sustainable waste disposal practices. The market's Compound Annual Growth Rate (CAGR) of 6.35% from 2025 to 2033 indicates a significant expansion, with the market expected to surpass $50 billion by 2033. Key drivers include the growing manufacturing sector, particularly in automotive, electronics, and food processing, generating substantial waste volumes. Furthermore, governmental initiatives promoting recycling and waste reduction, coupled with heightened corporate social responsibility (CSR) commitments, are fueling demand for efficient and environmentally friendly waste management solutions. The market is segmented by waste type (hazardous and non-hazardous), treatment method (landfilling, incineration, recycling), and end-user industry (manufacturing, construction, healthcare). Competitive pressures among established players like Waste Management Inc., Republic Services Inc., and Waste Connections, alongside emerging technologies and innovative waste-to-energy solutions, will shape market dynamics.

North America Industrial Waste Management Market Market Size (In Billion)

Challenges include fluctuating raw material prices, transportation costs, and the need for continuous technological advancements to handle complex waste streams efficiently and economically. The market will see continued consolidation, with larger players acquiring smaller companies to expand their geographical reach and service offerings. Regional variations exist, with densely populated areas experiencing higher demand and more sophisticated waste management infrastructure. The forecast period will witness increasing adoption of advanced technologies like AI and machine learning for optimizing waste collection routes, improving sorting efficiency, and enhancing overall operational productivity. This transition, while requiring initial investment, promises significant long-term cost savings and sustainability improvements for companies within the industry.

North America Industrial Waste Management Market Company Market Share

North America Industrial Waste Management Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North America industrial waste management market, covering market size, growth drivers, competitive landscape, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report offers actionable insights for stakeholders across the value chain, including waste management companies, investors, and regulatory bodies.

North America Industrial Waste Management Market Structure & Competitive Dynamics

The North America industrial waste management market exhibits a moderately concentrated structure, with a few large players dominating the landscape. Market share is highly contested, with ongoing mergers and acquisitions (M&A) significantly shaping the competitive dynamics. The market is characterized by an evolving innovation ecosystem, driven by technological advancements in waste treatment and recycling. Stringent regulatory frameworks, including environmental regulations and waste disposal standards, play a crucial role in shaping market practices. The availability of substitute technologies and materials influences market choices. End-user trends, notably the growing emphasis on sustainability and circular economy principles, are reshaping the demand for environmentally responsible waste management solutions.

Key Aspects:

- Market Concentration: The top 5 players hold an estimated xx% market share in 2025, indicating moderate concentration.

- M&A Activity: Significant M&A activity has been observed, with deal values exceeding USD xx Million in the past five years. Recent acquisitions, like Veolia's purchase of U.S. Industrial Technologies, highlight the strategic importance of market consolidation.

- Innovation: Investments in advanced recycling technologies, such as pyrolysis and gasification, are increasing.

- Regulatory Landscape: Stringent environmental regulations drive demand for efficient and eco-friendly waste management solutions.

North America Industrial Waste Management Market Industry Trends & Insights

The North America industrial waste management market is poised for significant expansion, projecting a Compound Annual Growth Rate (CAGR) of an estimated 7.5% between 2024 and 2033. This upward trajectory is fueled by a confluence of critical factors. Escalating industrial production across various sectors, coupled with increasingly stringent governmental environmental regulations and policies, is creating a robust demand for sophisticated and compliant waste management solutions. Simultaneously, rapid technological advancements, particularly the integration of Artificial Intelligence (AI) for enhanced waste sorting, the adoption of advanced biological and chemical treatment technologies, and the development of smart waste tracking systems, are revolutionizing operational efficiency and sustainability within the sector. Furthermore, a heightened public consciousness regarding environmental preservation and the detrimental impacts of improper waste disposal is actively driving consumer and corporate demand for environmentally responsible and sustainable disposal and recycling methods. The competitive arena is notably dynamic, characterized by a healthy mix of organic expansion strategies and strategic mergers and acquisitions, which are collectively contributing to a steady trend of market consolidation and the emergence of key industry players.

Dominant Markets & Segments in North America Industrial Waste Management Market

The United States represents the dominant market within North America, driven by a large industrial base and robust regulatory frameworks. The hazardous waste segment exhibits significant growth, owing to stringent environmental regulations and increasing industrial activity.

Key Drivers of Market Dominance:

- United States:

- Large industrial base across diverse sectors.

- Stringent environmental regulations promoting sustainable waste management practices.

- Significant investments in advanced waste treatment infrastructure.

- Hazardous Waste Segment:

- Stricter environmental regulations and penalties for improper disposal.

- Growing awareness among industries about environmental and regulatory compliance.

- Increasing demand for specialized waste treatment and disposal services.

North America Industrial Waste Management Market Product Innovations

Pioneering innovations are significantly reshaping the North America industrial waste management landscape. These include the development and widespread adoption of highly efficient advanced recycling technologies capable of recovering a greater proportion of valuable materials, the deployment of AI-powered automated waste sorting systems for improved accuracy and speed, and the refinement of specialized hazardous waste treatment methods that minimize environmental risks and maximize safety. These advancements are not only enhancing operational efficiency and substantially reducing the environmental footprint of industrial activities but are also presenting more cost-effective and sustainable solutions to complex waste management challenges. This drive for innovation is actively creating new market opportunities, fostering competitive advantages for early adopters, and ultimately contributing to a circular economy model by improving sorting precision, diverting substantial volumes of waste from landfills, and facilitating the recovery of high-value resources from diverse industrial waste streams.

Report Segmentation & Scope

This comprehensive report meticulously segments the North America industrial waste management market, offering granular insights into its various facets. The segmentation is structured by waste type, encompassing hazardous waste, non-hazardous waste, and recyclable materials; by treatment method, including landfilling, incineration, recycling, and composting; and by end-user industry, with a focus on manufacturing, construction, healthcare, energy, and automotive sectors. For each of these segments, the report provides detailed growth projections, precise market size estimations, and an in-depth analysis of the prevailing competitive dynamics. The scope of the report ensures a holistic and thorough examination of the market, meticulously considering the unique growth trajectories, estimated market valuations, and the competitive landscape pertinent to every identified segment.

Key Drivers of North America Industrial Waste Management Market Growth

Several factors drive market growth: stringent environmental regulations, increasing industrial activity, growing consumer awareness of environmental sustainability, technological advancements in waste management and recycling, and increasing demand for efficient and environmentally responsible waste management practices. These factors fuel the growth of the North America industrial waste management market.

Challenges in the North America Industrial Waste Management Market Sector

The North America industrial waste management market faces challenges including stringent regulatory compliance costs, fluctuations in raw material prices impacting recycling economics, competition among established players, and ensuring sustainable supply chains for waste collection and disposal. These factors pose substantial challenges, affecting profitability and long-term market stability.

Leading Players in the North America Industrial Waste Management Market Market

- Waste Connections

- Casella Waste Systems Inc

- Aevitas

- Rumpke Waste & Recycling

- Republic Services Inc

- FCC Environment Limited

- Biffa

- Stericylce

- Veolia North America

- Waste Management Inc

- Covanta

- Clean Harbors Inc

- List Not Exhaustive

Key Developments in North America Industrial Waste Management Market Sector

- June 2023: Casella Waste Systems, Inc. acquired the assets of Consolidated Waste Services, LLC for approximately USD 219 Million.

- October 2023: Veolia North America completed the acquisition of U.S. Industrial Technologies, expanding its market share in the U.S.

Strategic North America Industrial Waste Management Market Outlook

The North America industrial waste management market presents significant growth opportunities driven by technological advancements, increasing regulatory stringency, and growing focus on sustainability. Strategic partnerships, investments in innovative technologies, and expansion into new geographic markets represent key avenues for future growth and market leadership. The market is ripe for further consolidation, innovation, and expansion into specialized niches.

North America Industrial Waste Management Market Segmentation

-

1. Type

- 1.1. Construction and Demolition Waste

- 1.2. Manufacturing Waste

- 1.3. Oil and Gas Waste

- 1.4. Other Wa

-

2. Service

- 2.1. Recycling

- 2.2. Landfill

- 2.3. Incineration

- 2.4. Other Services

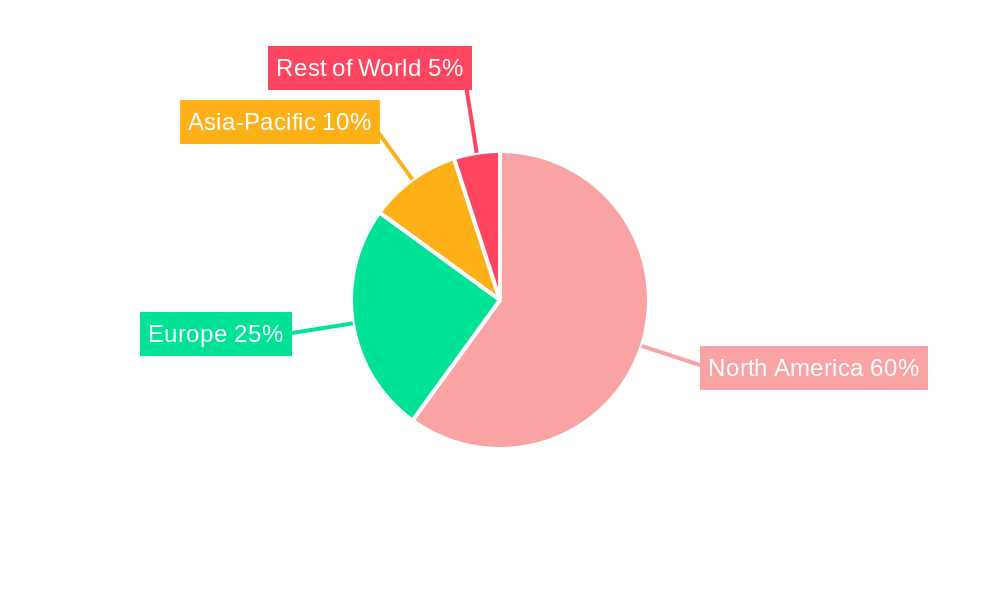

North America Industrial Waste Management Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Industrial Waste Management Market Regional Market Share

Geographic Coverage of North America Industrial Waste Management Market

North America Industrial Waste Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.35% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Stringent Government Regulations; Increasing Number of Industries

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations; Increasing Number of Industries

- 3.4. Market Trends

- 3.4.1. Oil and gas Production is Expected to Dominated the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Industrial Waste Management Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Construction and Demolition Waste

- 5.1.2. Manufacturing Waste

- 5.1.3. Oil and Gas Waste

- 5.1.4. Other Wa

- 5.2. Market Analysis, Insights and Forecast - by Service

- 5.2.1. Recycling

- 5.2.2. Landfill

- 5.2.3. Incineration

- 5.2.4. Other Services

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Waste Connections

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Casella Waste Systems Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Aevitas

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Rumpke Waste & Recycling

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Republic Services Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 FCC Environment Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Biffa

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Stericylce

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Veolia North America

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Waste Management Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Covanta

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Clean Harbors Inc **List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Waste Connections

List of Figures

- Figure 1: North America Industrial Waste Management Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Industrial Waste Management Market Share (%) by Company 2025

List of Tables

- Table 1: North America Industrial Waste Management Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: North America Industrial Waste Management Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: North America Industrial Waste Management Market Revenue Million Forecast, by Service 2020 & 2033

- Table 4: North America Industrial Waste Management Market Volume Billion Forecast, by Service 2020 & 2033

- Table 5: North America Industrial Waste Management Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: North America Industrial Waste Management Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: North America Industrial Waste Management Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: North America Industrial Waste Management Market Volume Billion Forecast, by Type 2020 & 2033

- Table 9: North America Industrial Waste Management Market Revenue Million Forecast, by Service 2020 & 2033

- Table 10: North America Industrial Waste Management Market Volume Billion Forecast, by Service 2020 & 2033

- Table 11: North America Industrial Waste Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: North America Industrial Waste Management Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: United States North America Industrial Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States North America Industrial Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Canada North America Industrial Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada North America Industrial Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: Mexico North America Industrial Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Mexico North America Industrial Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Industrial Waste Management Market?

The projected CAGR is approximately 6.35%.

2. Which companies are prominent players in the North America Industrial Waste Management Market?

Key companies in the market include Waste Connections, Casella Waste Systems Inc, Aevitas, Rumpke Waste & Recycling, Republic Services Inc, FCC Environment Limited, Biffa, Stericylce, Veolia North America, Waste Management Inc, Covanta, Clean Harbors Inc **List Not Exhaustive.

3. What are the main segments of the North America Industrial Waste Management Market?

The market segments include Type, Service.

4. Can you provide details about the market size?

The market size is estimated to be USD 30.33 Million as of 2022.

5. What are some drivers contributing to market growth?

Stringent Government Regulations; Increasing Number of Industries.

6. What are the notable trends driving market growth?

Oil and gas Production is Expected to Dominated the Market.

7. Are there any restraints impacting market growth?

Stringent Government Regulations; Increasing Number of Industries.

8. Can you provide examples of recent developments in the market?

October 2023: Veolia North America, one of the leading integrated providers of environmental services in the U.S. and Canada, announced that it completed the acquisition of U.S. Industrial Technologies, a Michigan-based provider of total waste and recycling services that managed industrial waste streams for automakers as well as other large manufacturers, medium and small businesses and governments and municipalities since 1996. The acquisition was likely to expand the U.S. market share for Veolia’s Environmental Solutions and Services (ESS) division, which is already recognized for its ability to provide customized integrated services for the management and treatment of hazardous, non-hazardous and recyclable waste for thousands of U.S. industrial, commercial and government customers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Industrial Waste Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Industrial Waste Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Industrial Waste Management Market?

To stay informed about further developments, trends, and reports in the North America Industrial Waste Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence