Key Insights

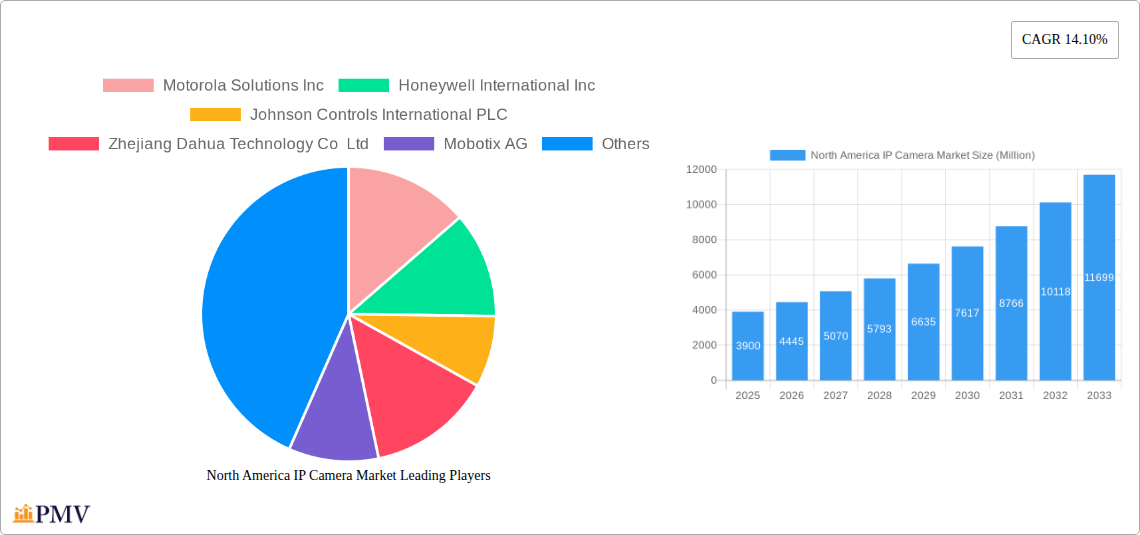

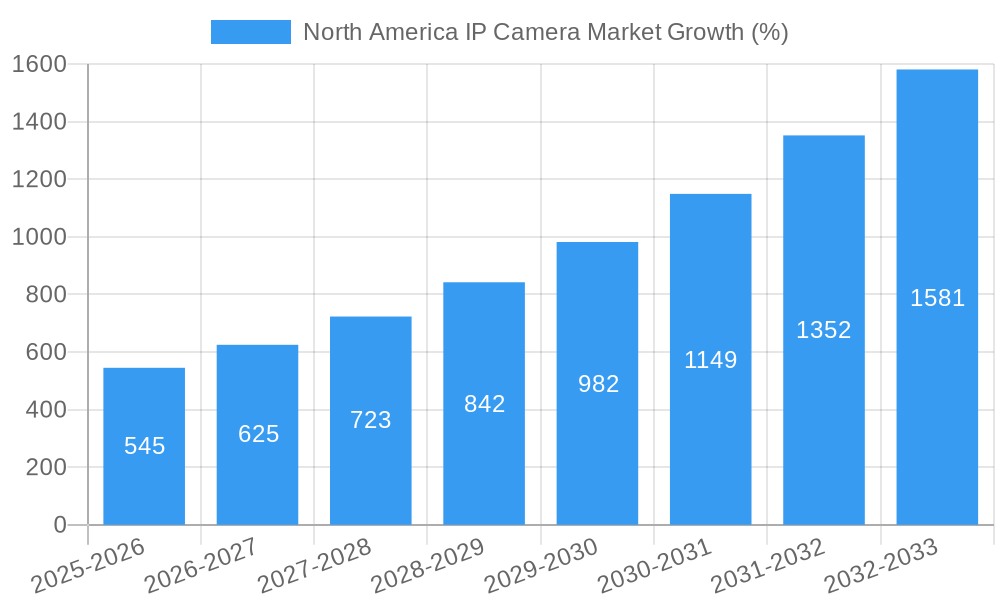

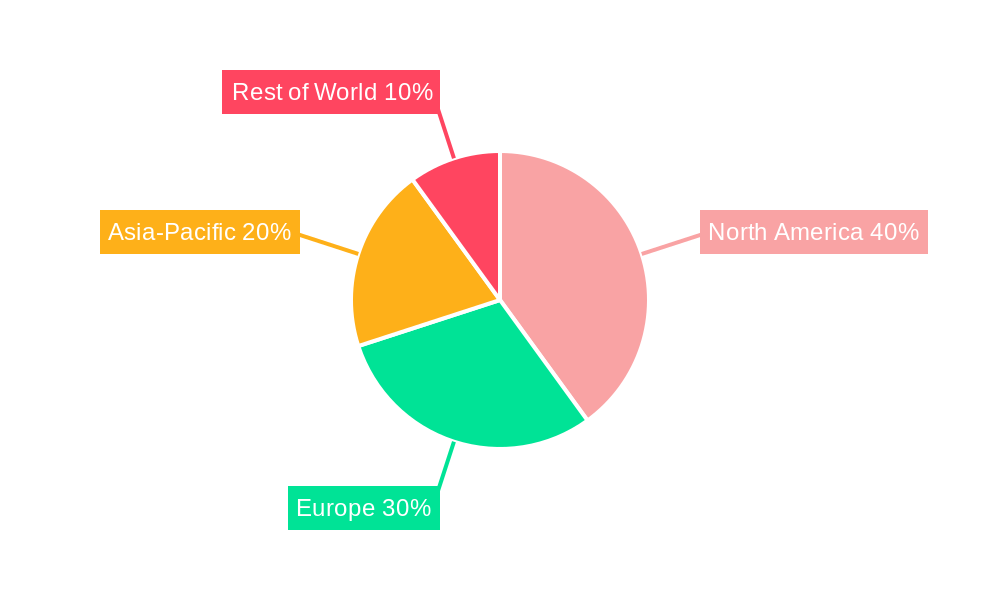

The North American IP camera market, valued at $3.9 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 14.10% from 2025 to 2033. This expansion is driven by several key factors. Increased adoption of smart home and building technologies fuels demand for advanced security and surveillance solutions. The rising prevalence of cybercrime and the need for robust security measures are further bolstering market growth. Furthermore, technological advancements, such as the integration of artificial intelligence (AI) and analytics capabilities into IP cameras, are enhancing their functionality and appeal across diverse sectors. Government initiatives promoting public safety and infrastructure modernization also contribute significantly to market expansion. Key segments contributing to this growth include the commercial sector (particularly BFSI, education, and healthcare), driven by the need for enhanced security and operational efficiency. The residential segment is also growing rapidly due to increased affordability and convenience of IP camera systems. Major players like Motorola Solutions, Honeywell, and Hikvision are actively driving innovation and market penetration through strategic partnerships and product launches.

The United States and Canada represent the largest markets within North America, benefiting from high levels of technological adoption and a strong security infrastructure. However, factors such as data privacy concerns and the complexity of integrating IP camera systems into existing infrastructure may act as minor restraints on market growth. Nonetheless, the overall positive outlook suggests a continuous upward trajectory for the North American IP camera market, with significant opportunities for both established and emerging players. The increasing demand for higher resolution cameras, improved analytics, and cloud-based solutions points towards a future characterized by enhanced security and smarter surveillance solutions. The market's growth is expected to continue to be influenced by technological advancements, regulatory changes, and the evolving needs of diverse end-user industries.

North America IP Camera Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North America IP camera market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Spanning the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market dynamics, competitive landscapes, and future growth prospects. The market size is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

North America IP Camera Market Market Structure & Competitive Dynamics

This section delves into the intricate structure of the North America IP camera market, analyzing market concentration, innovation ecosystems, regulatory frameworks, product substitutes, end-user trends, and M&A activities. The market exhibits a moderately concentrated structure, with key players holding significant market shares. For instance, Honeywell International Inc and Motorola Solutions Inc collectively hold an estimated xx% market share in 2025, driven by their strong brand recognition and comprehensive product portfolios. The market is characterized by a dynamic innovation ecosystem, with continuous advancements in image sensor technology, AI-powered analytics, and cloud-based solutions. Regulatory frameworks, particularly concerning data privacy and cybersecurity, are evolving, shaping market practices and influencing vendor strategies. The increasing adoption of smart home technologies and the growing demand for enhanced security solutions across various end-user industries are key factors propelling market growth. M&A activities have played a significant role in shaping the competitive landscape, with deal values exceeding xx Million in the past five years. Examples include [mention specific M&A activities with values if available, otherwise state "Specific details on recent M&A activities are limited in publicly available information"].

North America IP Camera Market Industry Trends & Insights

This section explores the key industry trends and insights shaping the North America IP camera market. The market is experiencing robust growth driven by factors such as increasing security concerns across residential, commercial, and industrial sectors, the rising adoption of IoT devices, and the proliferation of cloud-based video surveillance solutions. Technological disruptions, such as the integration of artificial intelligence (AI) and machine learning (ML) in IP cameras, are enhancing functionalities and expanding market applications. Consumer preferences are shifting towards high-resolution cameras, advanced analytics capabilities, and user-friendly interfaces. The competitive landscape remains fiercely contested, with established players and new entrants vying for market share. The market penetration of IP cameras is increasing steadily, particularly in commercial and industrial sectors. This is fueled by government initiatives promoting smart city infrastructure, rising concerns regarding workplace safety, and the growing adoption of remote monitoring solutions. The market is expected to continue its strong growth trajectory, with a projected CAGR of xx% during the forecast period, driven by the aforementioned factors.

Dominant Markets & Segments in North America IP Camera Market

This section analyzes the leading regions, countries, and segments within the North America IP camera market.

By Country: The United States dominates the North America IP camera market, accounting for xx% of the total market value in 2025. This dominance is attributed to factors such as a robust economy, high technological adoption rates, and a well-developed security infrastructure. Canada represents a significant, though smaller, portion of the market.

By Type: The fixed IP camera segment holds the largest market share, driven by its cost-effectiveness and suitability for various applications. However, the PTZ (Pan-Tilt-Zoom) segment is witnessing significant growth due to its versatility and enhanced monitoring capabilities. Varifocal cameras also contribute significantly to market growth due to their adaptability and wide-range viewing.

By End-User Industry: The commercial sector, specifically BFSI (Banking, Financial Services, and Insurance), education, and healthcare, represent the largest end-user segments. These industries are increasingly adopting IP cameras to enhance security, improve operational efficiency, and ensure compliance with regulatory requirements. The residential segment is also experiencing substantial growth as consumers prioritize home security. The industrial segment and government and law enforcement are adopting advanced analytics solutions.

Key drivers for dominance in these segments include robust economic growth in the US, increasing government funding for security infrastructure, and advancements in technologies such as cloud computing and AI. The strong focus on security and surveillance in both public and private sectors fuels continuous growth in these segments.

North America IP Camera Market Product Innovations

Recent product innovations in the North America IP camera market have focused on enhancing video quality, improving analytics capabilities, and integrating advanced features such as facial recognition, license plate recognition, and object detection. The integration of AI and ML has enabled the development of intelligent cameras that can automate tasks such as intrusion detection and threat assessment. The introduction of compact, wireless cameras and increased focus on cybersecurity features are also gaining traction, addressing the evolving demands of the market. These innovations are driving the growth of the market by providing tailored solutions for various applications and increasing the overall efficiency and effectiveness of security systems.

Report Segmentation & Scope

This report segments the North America IP camera market across multiple parameters:

By Type: Fixed, Pan-Tilt-Zoom (PTZ), Varifocal. Each segment's growth projections and competitive landscape are analyzed.

By End-User Industry: Residential, Commercial (BFSI, Education, Healthcare, Real Estate, Retail), Industrial, Government and Law Enforcement. Market size and growth potential for each segment are detailed.

By Country: United States, Canada. Regional differences in market dynamics and growth drivers are discussed.

The report provides a comprehensive overview of the market, including historical data (2019-2024), current estimates (2025), and future forecasts (2025-2033). Competitive dynamics, including market share analysis of key players, are also discussed for each segment.

Key Drivers of North America IP Camera Market Growth

The North America IP camera market's growth is fueled by several factors. Firstly, rising security concerns across various sectors are driving the demand for advanced surveillance solutions. Secondly, technological advancements, like AI-powered analytics and cloud-based platforms, are enhancing camera capabilities and making them more accessible. Thirdly, supportive government regulations promoting smart city initiatives and infrastructure development are fostering market expansion. Finally, increasing affordability and the integration of IP cameras into smart home ecosystems are contributing to widespread adoption.

Challenges in the North America IP Camera Market Sector

The North America IP camera market faces challenges such as cybersecurity threats, data privacy concerns, and the complexity of integrating diverse systems. Supply chain disruptions can also impact market stability, while competition from low-cost manufacturers can put pressure on pricing. Regulatory compliance requirements pose hurdles for companies, increasing compliance costs. Addressing these issues is crucial for sustainable market growth.

Leading Players in the North America IP Camera Market Market

- Motorola Solutions Inc

- Honeywell International Inc

- Johnson Controls International PLC

- Zhejiang Dahua Technology Co Ltd

- Mobotix AG

- Cisco Systems Inc

- Hangzhou Hikvision Digital Technology Co Ltd

- Panasonic Corporation

- Bosch Security Systems GmbH

- Sony Corporation

Key Developments in North America IP Camera Market Sector

- [Month, Year]: [Company Name] launches a new line of AI-powered IP cameras with enhanced analytics capabilities. This significantly impacted market competitiveness.

- [Month, Year]: [Company Name] and [Company Name] announce a strategic partnership to integrate their respective technologies, expanding market reach.

- [Month, Year]: A new government regulation is introduced to address data privacy concerns related to IP camera usage. This changed market practices concerning data storage and transmission.

- [Add more bullet points with specific details as available]

Strategic North America IP Camera Market Market Outlook

The North America IP camera market presents significant growth opportunities for companies that can adapt to evolving technological advancements and consumer demands. The focus on AI-driven analytics, cloud-based solutions, and improved cybersecurity measures will continue to drive market expansion. Strategic partnerships, innovation in product design, and effective marketing strategies will be crucial for success in this competitive market. The integration of IP cameras into broader smart city and smart home initiatives will create new avenues for growth and enhance market potential.

North America IP Camera Market Segmentation

-

1. Type

- 1.1. Fixed

- 1.2. Pan-Tilt-Zoom (PTZ)

- 1.3. Varifocal

-

2. End-User Industry

- 2.1. Residential

- 2.2. Commerci

- 2.3. Industrial

- 2.4. Government and law enforcement

North America IP Camera Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America IP Camera Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 14.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing integration of IP cameras with smart home technologies and expansion of smart cities; Rising demand for security surveillance; Growing demand for high-resolution cameras

- 3.3. Market Restrains

- 3.3.1. Data privacy and security concerns; High installation and maintenance costs

- 3.4. Market Trends

- 3.4.1. The PTZ Segment is Expected to Drive the Market's Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America IP Camera Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Fixed

- 5.1.2. Pan-Tilt-Zoom (PTZ)

- 5.1.3. Varifocal

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Residential

- 5.2.2. Commerci

- 5.2.3. Industrial

- 5.2.4. Government and law enforcement

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America IP Camera Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America IP Camera Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America IP Camera Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America IP Camera Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Motorola Solutions Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Honeywell International Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Johnson Controls International PLC

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Zhejiang Dahua Technology Co Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Mobotix AG

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Cisco Systems Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Hangzhou Hikvision Digital Technology Co Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Panasonic Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Bosch Security Systems GmbH

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Sony Corporation

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Motorola Solutions Inc

List of Figures

- Figure 1: North America IP Camera Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America IP Camera Market Share (%) by Company 2024

List of Tables

- Table 1: North America IP Camera Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America IP Camera Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: North America IP Camera Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 4: North America IP Camera Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: North America IP Camera Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States North America IP Camera Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada North America IP Camera Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico North America IP Camera Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America North America IP Camera Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: North America IP Camera Market Revenue Million Forecast, by Type 2019 & 2032

- Table 11: North America IP Camera Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 12: North America IP Camera Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United States North America IP Camera Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada North America IP Camera Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Mexico North America IP Camera Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America IP Camera Market?

The projected CAGR is approximately 14.10%.

2. Which companies are prominent players in the North America IP Camera Market?

Key companies in the market include Motorola Solutions Inc, Honeywell International Inc, Johnson Controls International PLC, Zhejiang Dahua Technology Co Ltd, Mobotix AG, Cisco Systems Inc, Hangzhou Hikvision Digital Technology Co Ltd, Panasonic Corporation, Bosch Security Systems GmbH, Sony Corporation.

3. What are the main segments of the North America IP Camera Market?

The market segments include Type, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.9 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing integration of IP cameras with smart home technologies and expansion of smart cities; Rising demand for security surveillance; Growing demand for high-resolution cameras.

6. What are the notable trends driving market growth?

The PTZ Segment is Expected to Drive the Market's Growth.

7. Are there any restraints impacting market growth?

Data privacy and security concerns; High installation and maintenance costs.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America IP Camera Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America IP Camera Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America IP Camera Market?

To stay informed about further developments, trends, and reports in the North America IP Camera Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence