Key Insights

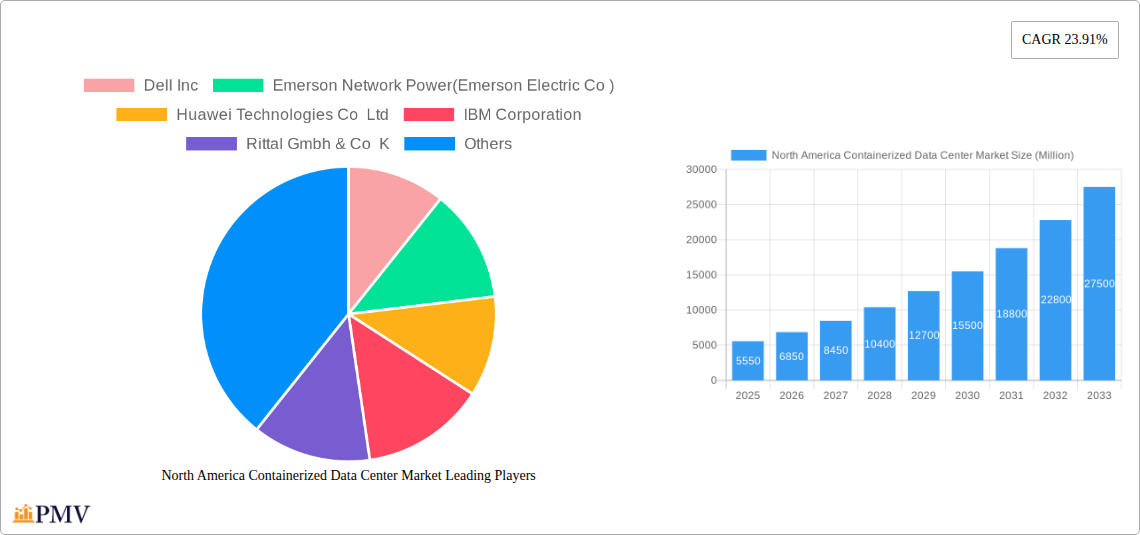

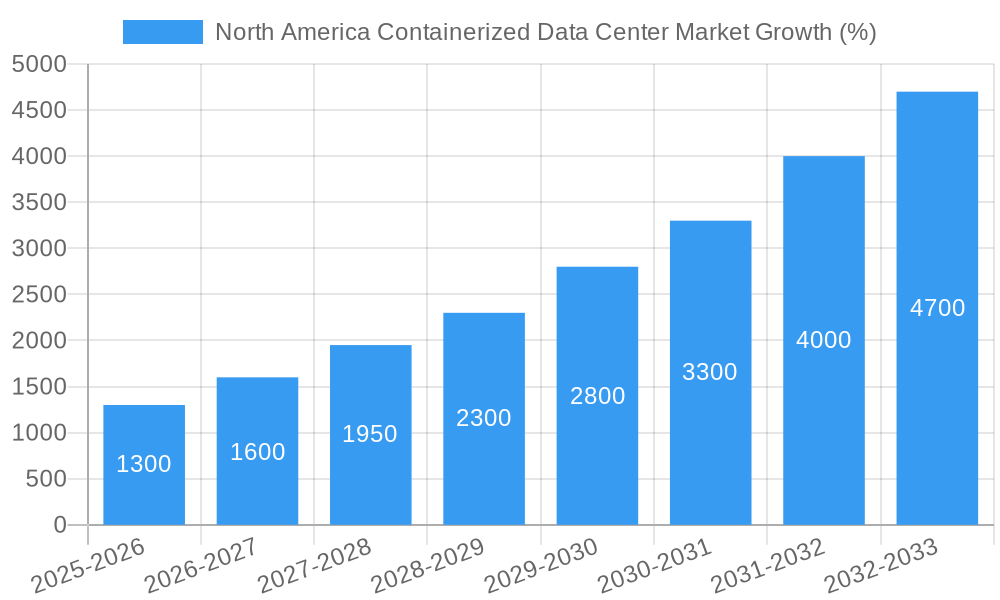

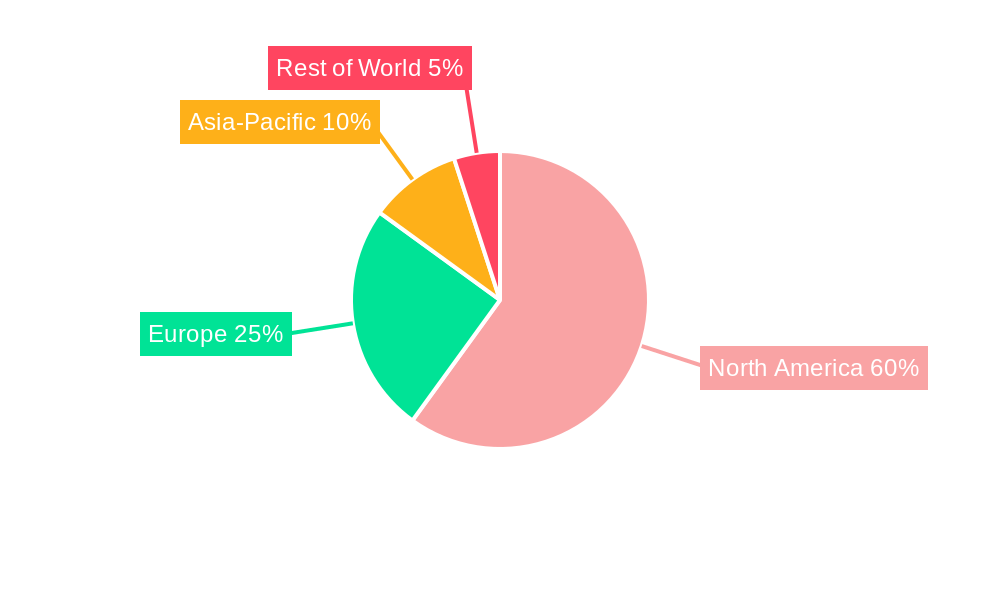

The North America containerized data center market is experiencing robust growth, projected to reach a market size of $5.55 billion in 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 23.91% from 2019 to 2033. This surge is driven by several key factors. Increasing demand for edge computing, coupled with the need for rapid deployment and scalability, fuels the adoption of containerized solutions. Businesses seek efficient and flexible infrastructure to accommodate fluctuating data demands and support digital transformation initiatives. Furthermore, the rising adoption of cloud computing and the growing need for disaster recovery solutions are significant contributors to market expansion. The IT & Telecommunications sector represents a major end-user industry, followed by BFSI (Banking, Financial Services, and Insurance) and the Government sector, each driving specific deployment patterns based on their unique infrastructure requirements. Companies like Dell, Emerson, Huawei, IBM, Rittal, Hewlett Packard Enterprise, Schneider Electric, and Cisco are key players, constantly innovating to meet the evolving needs of the market. North America, particularly the United States and Canada, represent the largest regional markets within this sector, benefiting from a robust technological infrastructure and a high concentration of data-intensive industries.

Looking ahead to the forecast period (2025-2033), continued growth is anticipated, although the CAGR may moderate slightly as the market matures. The increasing focus on sustainable data center operations and the integration of advanced technologies like AI and IoT will shape future market trends. However, potential restraints could include the high initial investment costs associated with containerized data centers and the need for skilled personnel to manage these complex systems. Despite these challenges, the overall outlook for the North American containerized data center market remains positive, with substantial growth opportunities expected throughout the forecast period. The market’s ability to offer efficient, scalable, and flexible solutions positions it for continued success in the rapidly evolving landscape of data management and processing.

North America Containerized Data Center Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the North America containerized data center market, covering the period 2019-2033. It offers valuable insights into market size, growth drivers, challenges, competitive landscape, and future outlook, empowering businesses to make informed strategic decisions. The report meticulously examines key segments, including end-user industries (IT & Telecommunications, BFSI, Government, and Other End-users) and geographic regions (The United States and Canada). With a base year of 2025 and a forecast period spanning 2025-2033, this report is an essential resource for industry stakeholders, investors, and market analysts seeking a clear understanding of this rapidly evolving market. The estimated market size in 2025 is xx Million.

North America Containerized Data Center Market Structure & Competitive Dynamics

The North American containerized data center market exhibits a moderately concentrated structure, with key players holding significant market share. The market is characterized by a dynamic innovation ecosystem, fueled by ongoing technological advancements and the increasing adoption of cloud computing and edge computing strategies. Regulatory frameworks, particularly concerning data privacy and security, significantly impact market operations. Product substitutes, such as traditional data centers, face growing competition from the cost-effectiveness and scalability offered by containerized solutions. End-user trends towards agility, flexibility, and reduced capital expenditure drive market growth. Mergers and acquisitions (M&A) activity has been notable, with significant deals impacting market consolidation and the introduction of new technologies and services. While precise M&A deal values are not publicly available for all transactions, several significant acquisitions have shaped the landscape. For example, Schneider Electric SE's acquisition of AST Modular significantly broadened its market reach. Market share data indicates that the top 5 players hold approximately xx% of the market, with individual market shares varying depending on specific segments and technologies.

North America Containerized Data Center Market Industry Trends & Insights

The North American containerized data center market is experiencing robust growth, driven by several key factors. The increasing demand for edge computing, fueled by the proliferation of IoT devices and the need for low-latency applications, is a major catalyst. The market's Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is projected to be xx%, reflecting a significant expansion. Technological disruptions, particularly in areas like AI-powered management and automation, are further accelerating market growth. Consumer preferences are shifting towards flexible, scalable, and cost-effective solutions, which containerized data centers readily provide. Competitive dynamics are intense, with companies constantly innovating to enhance their offerings. Market penetration continues to grow, particularly within the IT & Telecommunications sector, indicating a high level of acceptance among key industries.

Dominant Markets & Segments in North America Containerized Data Center Market

The United States represents the dominant market within North America, driven by robust economic growth, a well-developed IT infrastructure, and the presence of major technology companies and data centers.

Key Drivers in the United States: Strong government support for digital infrastructure, a large pool of skilled IT professionals, and significant investments in cloud computing initiatives.

Key Drivers in Canada: Growing investments in digital infrastructure modernization, strong government policies promoting technological innovation, and a focus on developing smart cities.

The IT & Telecommunications sector is the leading end-user industry segment, exhibiting significant demand for containerized solutions due to the need for rapid deployment and scalability. Other end-user segments, including BFSI and Government, show considerable growth potential, driven by increasing data volumes and the need for enhanced security and resilience.

North America Containerized Data Center Market Product Innovations

Recent innovations focus on improving energy efficiency, enhancing security features, and integrating advanced management tools. Modular designs allow for easy expansion and customization, while advances in cooling technology address the heat generated by high-density computing equipment. These advancements enhance the competitiveness of containerized data centers compared to traditional solutions, driving market adoption.

Report Segmentation & Scope

This report segments the North American containerized data center market by end-user industry (IT & Telecommunications, BFSI, Government, Other End-users) and geography (The United States, Canada).

By End-user Industry: Each segment’s growth trajectory and market size are analyzed, highlighting the unique challenges and opportunities within each sector. Competitive dynamics, including market share distribution among key players, are also examined.

By Country: The report delves into the specific market dynamics within the United States and Canada, analyzing factors driving growth or hindering expansion in each region. Comparative analyses provide insights into regional differences and growth potential.

Key Drivers of North America Containerized Data Center Market Growth

Several factors fuel market growth. The increasing demand for edge computing and the need for rapid deployment of IT infrastructure are major drivers. Furthermore, the cost-effectiveness and scalability offered by containerized data centers make them attractive to businesses of all sizes. Government initiatives aimed at promoting digital transformation are also contributing to market expansion.

Challenges in the North America Containerized Data Center Market Sector

The market faces challenges including the need for skilled labor for deployment and management, potential supply chain disruptions impacting the availability of components, and stringent regulatory compliance requirements affecting data security and privacy. These factors can impact project timelines and increase overall costs.

Leading Players in the North America Containerized Data Center Market Market

- Dell Inc

- Emerson Network Power (Emerson Electric Co)

- Huawei Technologies Co Ltd

- IBM Corporation

- Rittal GmbH & Co KG

- Hewlett Packard Enterprise Company

- Schneider Electric SE

- Cisco Systems Inc

Key Developments in North America Containerized Data Center Market Sector

September 2022: Dell announced its partnership with Red Hat to launch containerized solutions for multi-cloud environments, enhancing on-premise infrastructure management.

February 2023: Amazon Web Services (AWS) unveiled a new modular data center design (MDC) offering enhanced mobility and scalability, particularly relevant for military applications and remote locations.

Strategic North America Containerized Data Center Market Outlook

The North America containerized data center market is poised for continued strong growth, driven by increasing demand for edge computing, cloud adoption, and the need for flexible, scalable IT infrastructure. Strategic opportunities exist for companies focusing on innovation in areas such as AI-powered management, improved energy efficiency, and enhanced security features. The market presents significant potential for both established players and new entrants who can offer competitive solutions catering to the evolving needs of various industry sectors.

North America Containerized Data Center Market Segmentation

-

1. End-user Industry

- 1.1. IT & Telecommunications

- 1.2. BFSI

- 1.3. Government

- 1.4. Other End-users

North America Containerized Data Center Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Containerized Data Center Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 23.91% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Need for Portability and Increasing Demand for Scalable Data Center Solutions; Rising Demand for Energy Efficient Data Centers

- 3.3. Market Restrains

- 3.3.1. Limited Computing Performance

- 3.4. Market Trends

- 3.4.1. Government Sector Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Containerized Data Center Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. IT & Telecommunications

- 5.1.2. BFSI

- 5.1.3. Government

- 5.1.4. Other End-users

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. United States North America Containerized Data Center Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Containerized Data Center Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Containerized Data Center Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Containerized Data Center Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Dell Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Emerson Network Power(Emerson Electric Co )

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Huawei Technologies Co Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 IBM Corporation

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Rittal Gmbh & Co K

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Hewlett Packard Enterprise Company

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Schneider Electric SE (acquired AST Modular)

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Cisco Systems Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 Dell Inc

List of Figures

- Figure 1: North America Containerized Data Center Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Containerized Data Center Market Share (%) by Company 2024

List of Tables

- Table 1: North America Containerized Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Containerized Data Center Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 3: North America Containerized Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: North America Containerized Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: United States North America Containerized Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Canada North America Containerized Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Mexico North America Containerized Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Rest of North America North America Containerized Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: North America Containerized Data Center Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 10: North America Containerized Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: United States North America Containerized Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Canada North America Containerized Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Mexico North America Containerized Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Containerized Data Center Market?

The projected CAGR is approximately 23.91%.

2. Which companies are prominent players in the North America Containerized Data Center Market?

Key companies in the market include Dell Inc, Emerson Network Power(Emerson Electric Co ), Huawei Technologies Co Ltd, IBM Corporation, Rittal Gmbh & Co K, Hewlett Packard Enterprise Company, Schneider Electric SE (acquired AST Modular), Cisco Systems Inc.

3. What are the main segments of the North America Containerized Data Center Market?

The market segments include End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.55 Million as of 2022.

5. What are some drivers contributing to market growth?

Need for Portability and Increasing Demand for Scalable Data Center Solutions; Rising Demand for Energy Efficient Data Centers.

6. What are the notable trends driving market growth?

Government Sector Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Limited Computing Performance.

8. Can you provide examples of recent developments in the market?

February 2023: Amazon Web Services (AWS) developed a new type of data center that can be used to gain military advantage anywhere in the world. It is primarily a shipping container with the ability to access many of Amazon's cloud-based services and easily expand upon with more (shipping container) modules. Each modular data center (MDC) houses a self-contained data center with internal networking, cooling, and power distribution equipment.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Containerized Data Center Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Containerized Data Center Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Containerized Data Center Market?

To stay informed about further developments, trends, and reports in the North America Containerized Data Center Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence