Key Insights

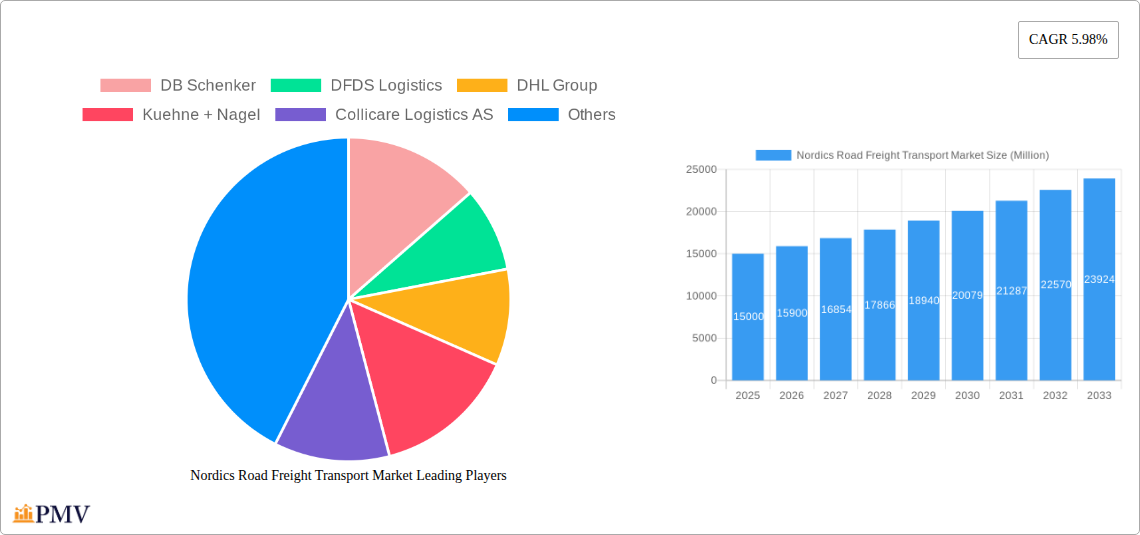

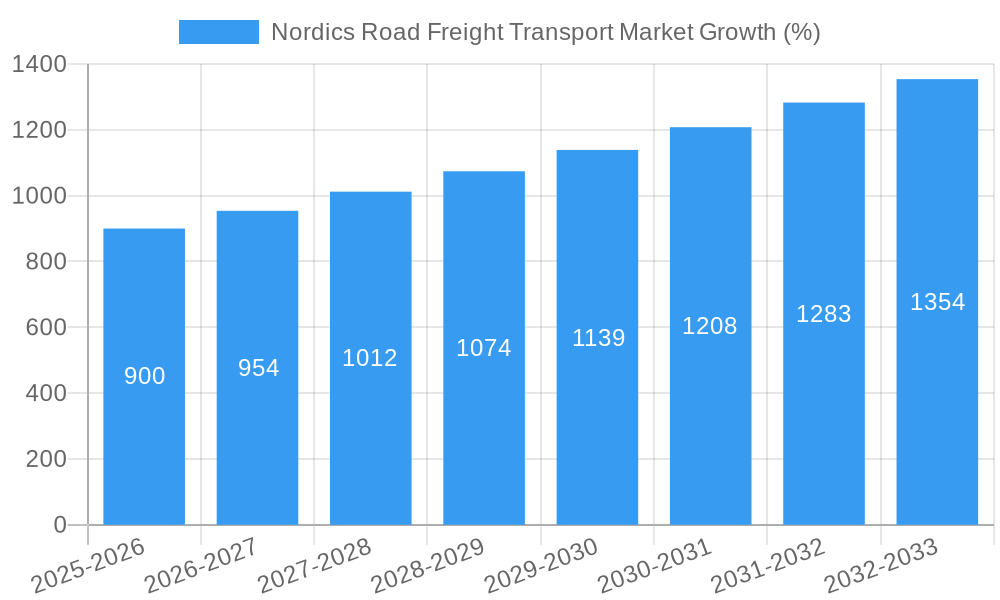

The Nordics road freight transport market, encompassing Denmark, Finland, Iceland, Norway, and Sweden, presents a robust and growing opportunity. Driven by increasing e-commerce activity, expanding cross-border trade within the region, and the burgeoning need for efficient logistics solutions across diverse sectors like manufacturing, agriculture, and construction, the market is experiencing significant expansion. The market's 5.98% CAGR signifies healthy growth, projected to continue throughout the forecast period (2025-2033). Key segments like temperature-controlled transportation for perishable goods (food and pharmaceuticals) and full-truckload (FTL) services for higher volume shipments are contributing significantly to this growth. The dominance of established players such as DB Schenker, DHL Group, and Kuehne + Nagel indicates a competitive landscape, yet also signifies the presence of significant expertise and infrastructure. However, challenges remain, including fluctuating fuel prices, driver shortages, and increasing regulatory complexities related to sustainability and emissions.

Growth within the market is further segmented by goods type (fluid vs. solid), transportation needs (temperature controlled vs. non-temperature controlled), end-user industry (e.g., the strong agricultural sector in some Nordic countries), and transportation specifications (FTL, LTL, domestic vs. international). The market’s continued expansion will likely be fueled by investments in advanced logistics technology, such as improved route optimization software and real-time tracking systems. While precise market sizing data is not provided, a reasonable estimation, based on industry reports and the given CAGR, would place the 2025 market size in the range of several billion dollars, reflecting the significant economic activity and infrastructure within the Nordic region. This projection anticipates continued growth, driven by the factors outlined above, albeit with potential volatility influenced by macroeconomic conditions and geopolitical events.

Nordics Road Freight Transport Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Nordics road freight transport market, covering the period from 2019 to 2033. It delves into market structure, competitive dynamics, industry trends, dominant segments, and future growth prospects, providing actionable insights for businesses operating in or seeking to enter this dynamic sector. The report utilizes data from 2019-2024 as historical data, with 2025 as the base year and forecasts extending to 2033. Key market players such as DB Schenker, DFDS Logistics, DHL Group, and Kuehne + Nagel are analyzed, alongside emerging players. The report also explores the impact of recent industry developments on the market's trajectory.

Nordics Road Freight Transport Market Market Structure & Competitive Dynamics

The Nordics road freight transport market exhibits a moderately concentrated structure, with a few major players holding significant market share. However, a considerable number of smaller, regional operators also contribute to the overall market volume. The market's competitive landscape is characterized by intense rivalry, driven by factors such as price competition, service differentiation, and technological advancements. Innovation plays a crucial role, with companies investing heavily in fleet modernization, route optimization software, and sustainable transportation solutions. The regulatory framework, while relatively stable, is subject to ongoing changes related to environmental regulations and driver safety standards. Product substitutes, such as rail and maritime transport, pose a competitive threat, particularly for long-haul routes. End-user trends towards e-commerce and just-in-time delivery are reshaping logistics requirements. Mergers and acquisitions (M&A) activity is moderate, reflecting both consolidation efforts and strategic expansions within the sector. For instance, the recent merger of several NTG entities into NTG Road AB illustrates a move towards economies of scale. Precise M&A deal values are not publicly available for all transactions, but we estimate the total value of significant M&A deals in the period 2019-2024 to be around xx Million. Market share data indicates that the top 5 players account for approximately xx% of the total market.

Nordics Road Freight Transport Market Industry Trends & Insights

The Nordics road freight transport market is witnessing significant growth, driven by robust economic activity across the region, particularly within the manufacturing, wholesale, and retail sectors. The Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is estimated at xx%, indicating strong potential for expansion. This growth is further fueled by increasing e-commerce penetration, demanding efficient and timely delivery solutions. Technological disruptions, such as the adoption of telematics, route optimization software, and electric vehicles, are transforming operational efficiency and sustainability practices. Consumer preferences for faster, more reliable, and environmentally friendly delivery options are influencing market dynamics. Competitive dynamics are shaped by factors like pricing strategies, service quality, and technological capabilities. Market penetration of advanced logistics technologies, such as AI-powered route planning, is currently at approximately xx%, and is expected to increase significantly over the next decade. The rise of sustainable transport initiatives is altering the competitive landscape, with companies increasingly focusing on reducing their carbon footprint.

Dominant Markets & Segments in Nordics Road Freight Transport Market

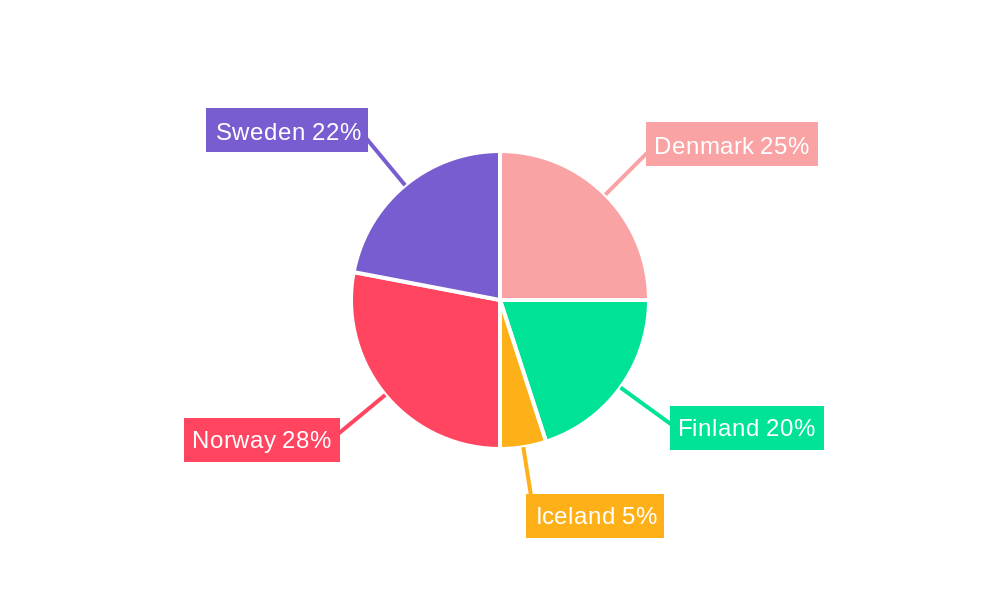

- Leading Country: Sweden, due to its robust manufacturing sector and well-developed infrastructure.

- Leading Goods Configuration: Solid goods account for the largest share, driven by high manufacturing and retail activity.

- Leading Temperature Control: Non-temperature controlled transportation holds the larger market share.

- Leading End-User Industry: Wholesale and retail trade is the dominant end-user, followed by manufacturing.

- Leading Destination: Domestic transportation dominates due to robust intra-Nordic trade.

- Leading Truckload Specification: Full-Truck-Load (FTL) transportation remains the most prevalent mode.

- Leading Containerization: Non-containerized transport holds the majority, owing to the nature of many goods transported.

- Leading Distance: Short-haul transportation is the most prominent segment.

Sweden’s dominance is largely attributed to its strong economic performance and advanced logistics infrastructure. The key drivers include government policies promoting efficient logistics, extensive road networks, and a high concentration of manufacturing and distribution centers. The prevalence of solid goods reflects the significant volume of manufactured products transported across the region. The dominance of domestic transportation underscores the importance of intra-Nordic trade.

Nordics Road Freight Transport Market Product Innovations

Recent product innovations focus on enhancing efficiency, sustainability, and safety. The adoption of electric and alternative fuel vehicles is gaining momentum, driven by environmental concerns and government regulations. Technological advancements in telematics, fleet management software, and route optimization tools are improving operational efficiency and reducing transportation costs. These innovations offer competitive advantages by enhancing service quality, reducing operational costs, and improving environmental performance, aligning with growing market demand for sustainable and efficient transportation solutions.

Report Segmentation & Scope

This report segments the Nordics road freight transport market based on several key parameters:

- Goods Configuration: Fluid Goods and Solid Goods, each with their own growth projections and competitive dynamics.

- Temperature Control: Non-Temperature Controlled and Temperature Controlled shipments, analyzed for market size and future growth.

- Country: Denmark, Finland, Iceland, Norway, and Sweden, providing a detailed country-wise market overview.

- End-User Industry: Agriculture, Fishing and Forestry, Construction, Manufacturing, Oil and Gas, Mining and Quarrying, Wholesale and Retail Trade, and Others, assessing industry-specific transportation needs.

- Destination: Domestic and International shipments, considering their differing market characteristics.

- Truckload Specification: Full-Truck-Load (FTL) and Less-than-Truck-Load (LTL) transportation, outlining their distinct market segments.

- Containerization: Containerized and Non-Containerized freight, examining their respective transportation dynamics.

- Distance: Long Haul and Short Haul transportation, analyzing their specific market requirements and challenges.

Each segment provides detailed market size estimations, growth projections, and an analysis of the competitive landscape.

Key Drivers of Nordics Road Freight Transport Market Growth

Several key factors are driving the growth of the Nordics road freight transport market. Strong economic growth across the region, particularly in manufacturing and retail, fuels demand for efficient transportation solutions. The rise of e-commerce and the associated need for last-mile delivery services are significant contributors. Government initiatives to improve infrastructure and promote sustainable transportation are also supportive. The increasing adoption of advanced technologies, such as telematics and route optimization software, enhances efficiency and profitability.

Challenges in the Nordics Road Freight Transport Market Sector

The Nordics road freight transport market faces several challenges. Driver shortages are a significant issue, impacting operational capacity and potentially leading to higher transportation costs. Fluctuations in fuel prices represent a major cost factor affecting profitability. Stringent environmental regulations necessitate investments in cleaner technologies, adding to operational expenses. Increased competition from other modes of transport, such as rail and sea freight, also presents a challenge. The total impact of these challenges on market growth is estimated to be around xx Million annually.

Leading Players in the Nordics Road Freight Transport Market Market

- DB Schenker

- DFDS Logistics

- DHL Group

- Kuehne + Nagel

- Collicare Logistics AS

- Scan Global Logistics

- Stena A

- Allcargo Logistics Ltd

- NTG Nordic Transport Group

- FREJA Transport & Logistics A/S

- Danske Fragtmænd A/S

Key Developments in Nordics Road Freight Transport Market Sector

- September 2023: DB Schenker in Norway tested Volta Zero electric trucks, furthering its commitment to sustainable transportation.

- September 2023: Scan Global Logistics and Alfa Laval launched their first electric truck, demonstrating a collaborative approach to emissions reduction.

- July 2023: NTG East AB, NTG Cargorange AB, NTG Continent AB, and NTG Solution AB merged to form NTG Road AB, creating a larger, more integrated road freight provider in Sweden.

These developments signify a shift toward sustainable and technologically advanced transport solutions within the Nordics market.

Strategic Nordics Road Freight Transport Market Market Outlook

The Nordics road freight transport market is poised for sustained growth, driven by ongoing economic expansion, e-commerce proliferation, and the adoption of innovative technologies. Strategic opportunities lie in investing in sustainable transportation solutions, leveraging technological advancements to enhance efficiency, and focusing on specialized niche markets. Companies that successfully adapt to evolving consumer preferences and regulatory requirements are best positioned to capture significant market share and drive profitability in the years to come. The long-term outlook remains positive, suggesting a promising future for players able to navigate the challenges and capitalize on the opportunities within this dynamic market.

Nordics Road Freight Transport Market Segmentation

-

1. End User Industry

- 1.1. Agriculture, Fishing, and Forestry

- 1.2. Construction

- 1.3. Manufacturing

- 1.4. Oil and Gas, Mining and Quarrying

- 1.5. Wholesale and Retail Trade

- 1.6. Others

-

2. Destination

- 2.1. Domestic

- 2.2. International

-

3. Truckload Specification

- 3.1. Full-Truck-Load (FTL)

- 3.2. Less than-Truck-Load (LTL)

-

4. Containerization

- 4.1. Containerized

- 4.2. Non-Containerized

-

5. Distance

- 5.1. Long Haul

- 5.2. Short Haul

-

6. Goods Configuration

- 6.1. Fluid Goods

- 6.2. Solid Goods

-

7. Temperature Control

- 7.1. Non-Temperature Controlled

Nordics Road Freight Transport Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Nordics Road Freight Transport Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.98% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing trade relations; Increased demand for perishable goods

- 3.3. Market Restrains

- 3.3.1. Cargo theft; High cost of maintainig

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Nordics Road Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Agriculture, Fishing, and Forestry

- 5.1.2. Construction

- 5.1.3. Manufacturing

- 5.1.4. Oil and Gas, Mining and Quarrying

- 5.1.5. Wholesale and Retail Trade

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Destination

- 5.2.1. Domestic

- 5.2.2. International

- 5.3. Market Analysis, Insights and Forecast - by Truckload Specification

- 5.3.1. Full-Truck-Load (FTL)

- 5.3.2. Less than-Truck-Load (LTL)

- 5.4. Market Analysis, Insights and Forecast - by Containerization

- 5.4.1. Containerized

- 5.4.2. Non-Containerized

- 5.5. Market Analysis, Insights and Forecast - by Distance

- 5.5.1. Long Haul

- 5.5.2. Short Haul

- 5.6. Market Analysis, Insights and Forecast - by Goods Configuration

- 5.6.1. Fluid Goods

- 5.6.2. Solid Goods

- 5.7. Market Analysis, Insights and Forecast - by Temperature Control

- 5.7.1. Non-Temperature Controlled

- 5.8. Market Analysis, Insights and Forecast - by Region

- 5.8.1. North America

- 5.8.2. South America

- 5.8.3. Europe

- 5.8.4. Middle East & Africa

- 5.8.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. North America Nordics Road Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by End User Industry

- 6.1.1. Agriculture, Fishing, and Forestry

- 6.1.2. Construction

- 6.1.3. Manufacturing

- 6.1.4. Oil and Gas, Mining and Quarrying

- 6.1.5. Wholesale and Retail Trade

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by Destination

- 6.2.1. Domestic

- 6.2.2. International

- 6.3. Market Analysis, Insights and Forecast - by Truckload Specification

- 6.3.1. Full-Truck-Load (FTL)

- 6.3.2. Less than-Truck-Load (LTL)

- 6.4. Market Analysis, Insights and Forecast - by Containerization

- 6.4.1. Containerized

- 6.4.2. Non-Containerized

- 6.5. Market Analysis, Insights and Forecast - by Distance

- 6.5.1. Long Haul

- 6.5.2. Short Haul

- 6.6. Market Analysis, Insights and Forecast - by Goods Configuration

- 6.6.1. Fluid Goods

- 6.6.2. Solid Goods

- 6.7. Market Analysis, Insights and Forecast - by Temperature Control

- 6.7.1. Non-Temperature Controlled

- 6.1. Market Analysis, Insights and Forecast - by End User Industry

- 7. South America Nordics Road Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by End User Industry

- 7.1.1. Agriculture, Fishing, and Forestry

- 7.1.2. Construction

- 7.1.3. Manufacturing

- 7.1.4. Oil and Gas, Mining and Quarrying

- 7.1.5. Wholesale and Retail Trade

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by Destination

- 7.2.1. Domestic

- 7.2.2. International

- 7.3. Market Analysis, Insights and Forecast - by Truckload Specification

- 7.3.1. Full-Truck-Load (FTL)

- 7.3.2. Less than-Truck-Load (LTL)

- 7.4. Market Analysis, Insights and Forecast - by Containerization

- 7.4.1. Containerized

- 7.4.2. Non-Containerized

- 7.5. Market Analysis, Insights and Forecast - by Distance

- 7.5.1. Long Haul

- 7.5.2. Short Haul

- 7.6. Market Analysis, Insights and Forecast - by Goods Configuration

- 7.6.1. Fluid Goods

- 7.6.2. Solid Goods

- 7.7. Market Analysis, Insights and Forecast - by Temperature Control

- 7.7.1. Non-Temperature Controlled

- 7.1. Market Analysis, Insights and Forecast - by End User Industry

- 8. Europe Nordics Road Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by End User Industry

- 8.1.1. Agriculture, Fishing, and Forestry

- 8.1.2. Construction

- 8.1.3. Manufacturing

- 8.1.4. Oil and Gas, Mining and Quarrying

- 8.1.5. Wholesale and Retail Trade

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by Destination

- 8.2.1. Domestic

- 8.2.2. International

- 8.3. Market Analysis, Insights and Forecast - by Truckload Specification

- 8.3.1. Full-Truck-Load (FTL)

- 8.3.2. Less than-Truck-Load (LTL)

- 8.4. Market Analysis, Insights and Forecast - by Containerization

- 8.4.1. Containerized

- 8.4.2. Non-Containerized

- 8.5. Market Analysis, Insights and Forecast - by Distance

- 8.5.1. Long Haul

- 8.5.2. Short Haul

- 8.6. Market Analysis, Insights and Forecast - by Goods Configuration

- 8.6.1. Fluid Goods

- 8.6.2. Solid Goods

- 8.7. Market Analysis, Insights and Forecast - by Temperature Control

- 8.7.1. Non-Temperature Controlled

- 8.1. Market Analysis, Insights and Forecast - by End User Industry

- 9. Middle East & Africa Nordics Road Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by End User Industry

- 9.1.1. Agriculture, Fishing, and Forestry

- 9.1.2. Construction

- 9.1.3. Manufacturing

- 9.1.4. Oil and Gas, Mining and Quarrying

- 9.1.5. Wholesale and Retail Trade

- 9.1.6. Others

- 9.2. Market Analysis, Insights and Forecast - by Destination

- 9.2.1. Domestic

- 9.2.2. International

- 9.3. Market Analysis, Insights and Forecast - by Truckload Specification

- 9.3.1. Full-Truck-Load (FTL)

- 9.3.2. Less than-Truck-Load (LTL)

- 9.4. Market Analysis, Insights and Forecast - by Containerization

- 9.4.1. Containerized

- 9.4.2. Non-Containerized

- 9.5. Market Analysis, Insights and Forecast - by Distance

- 9.5.1. Long Haul

- 9.5.2. Short Haul

- 9.6. Market Analysis, Insights and Forecast - by Goods Configuration

- 9.6.1. Fluid Goods

- 9.6.2. Solid Goods

- 9.7. Market Analysis, Insights and Forecast - by Temperature Control

- 9.7.1. Non-Temperature Controlled

- 9.1. Market Analysis, Insights and Forecast - by End User Industry

- 10. Asia Pacific Nordics Road Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by End User Industry

- 10.1.1. Agriculture, Fishing, and Forestry

- 10.1.2. Construction

- 10.1.3. Manufacturing

- 10.1.4. Oil and Gas, Mining and Quarrying

- 10.1.5. Wholesale and Retail Trade

- 10.1.6. Others

- 10.2. Market Analysis, Insights and Forecast - by Destination

- 10.2.1. Domestic

- 10.2.2. International

- 10.3. Market Analysis, Insights and Forecast - by Truckload Specification

- 10.3.1. Full-Truck-Load (FTL)

- 10.3.2. Less than-Truck-Load (LTL)

- 10.4. Market Analysis, Insights and Forecast - by Containerization

- 10.4.1. Containerized

- 10.4.2. Non-Containerized

- 10.5. Market Analysis, Insights and Forecast - by Distance

- 10.5.1. Long Haul

- 10.5.2. Short Haul

- 10.6. Market Analysis, Insights and Forecast - by Goods Configuration

- 10.6.1. Fluid Goods

- 10.6.2. Solid Goods

- 10.7. Market Analysis, Insights and Forecast - by Temperature Control

- 10.7.1. Non-Temperature Controlled

- 10.1. Market Analysis, Insights and Forecast - by End User Industry

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 DB Schenker

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 DFDS Logistics

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 DHL Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Kuehne + Nagel

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Collicare Logistics AS

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Scan Global Logistics

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Stena A

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Allcargo Logistics Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 NTG Nordic Transport Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 FREJA Transport & Logistics A/S

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Danske Fragtmænd A/S

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 DB Schenker

List of Figures

- Figure 1: Global Nordics Road Freight Transport Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Nordics Road Freight Transport Market Revenue (Million), by End User Industry 2024 & 2032

- Figure 3: North America Nordics Road Freight Transport Market Revenue Share (%), by End User Industry 2024 & 2032

- Figure 4: North America Nordics Road Freight Transport Market Revenue (Million), by Destination 2024 & 2032

- Figure 5: North America Nordics Road Freight Transport Market Revenue Share (%), by Destination 2024 & 2032

- Figure 6: North America Nordics Road Freight Transport Market Revenue (Million), by Truckload Specification 2024 & 2032

- Figure 7: North America Nordics Road Freight Transport Market Revenue Share (%), by Truckload Specification 2024 & 2032

- Figure 8: North America Nordics Road Freight Transport Market Revenue (Million), by Containerization 2024 & 2032

- Figure 9: North America Nordics Road Freight Transport Market Revenue Share (%), by Containerization 2024 & 2032

- Figure 10: North America Nordics Road Freight Transport Market Revenue (Million), by Distance 2024 & 2032

- Figure 11: North America Nordics Road Freight Transport Market Revenue Share (%), by Distance 2024 & 2032

- Figure 12: North America Nordics Road Freight Transport Market Revenue (Million), by Goods Configuration 2024 & 2032

- Figure 13: North America Nordics Road Freight Transport Market Revenue Share (%), by Goods Configuration 2024 & 2032

- Figure 14: North America Nordics Road Freight Transport Market Revenue (Million), by Temperature Control 2024 & 2032

- Figure 15: North America Nordics Road Freight Transport Market Revenue Share (%), by Temperature Control 2024 & 2032

- Figure 16: North America Nordics Road Freight Transport Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Nordics Road Freight Transport Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: South America Nordics Road Freight Transport Market Revenue (Million), by End User Industry 2024 & 2032

- Figure 19: South America Nordics Road Freight Transport Market Revenue Share (%), by End User Industry 2024 & 2032

- Figure 20: South America Nordics Road Freight Transport Market Revenue (Million), by Destination 2024 & 2032

- Figure 21: South America Nordics Road Freight Transport Market Revenue Share (%), by Destination 2024 & 2032

- Figure 22: South America Nordics Road Freight Transport Market Revenue (Million), by Truckload Specification 2024 & 2032

- Figure 23: South America Nordics Road Freight Transport Market Revenue Share (%), by Truckload Specification 2024 & 2032

- Figure 24: South America Nordics Road Freight Transport Market Revenue (Million), by Containerization 2024 & 2032

- Figure 25: South America Nordics Road Freight Transport Market Revenue Share (%), by Containerization 2024 & 2032

- Figure 26: South America Nordics Road Freight Transport Market Revenue (Million), by Distance 2024 & 2032

- Figure 27: South America Nordics Road Freight Transport Market Revenue Share (%), by Distance 2024 & 2032

- Figure 28: South America Nordics Road Freight Transport Market Revenue (Million), by Goods Configuration 2024 & 2032

- Figure 29: South America Nordics Road Freight Transport Market Revenue Share (%), by Goods Configuration 2024 & 2032

- Figure 30: South America Nordics Road Freight Transport Market Revenue (Million), by Temperature Control 2024 & 2032

- Figure 31: South America Nordics Road Freight Transport Market Revenue Share (%), by Temperature Control 2024 & 2032

- Figure 32: South America Nordics Road Freight Transport Market Revenue (Million), by Country 2024 & 2032

- Figure 33: South America Nordics Road Freight Transport Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: Europe Nordics Road Freight Transport Market Revenue (Million), by End User Industry 2024 & 2032

- Figure 35: Europe Nordics Road Freight Transport Market Revenue Share (%), by End User Industry 2024 & 2032

- Figure 36: Europe Nordics Road Freight Transport Market Revenue (Million), by Destination 2024 & 2032

- Figure 37: Europe Nordics Road Freight Transport Market Revenue Share (%), by Destination 2024 & 2032

- Figure 38: Europe Nordics Road Freight Transport Market Revenue (Million), by Truckload Specification 2024 & 2032

- Figure 39: Europe Nordics Road Freight Transport Market Revenue Share (%), by Truckload Specification 2024 & 2032

- Figure 40: Europe Nordics Road Freight Transport Market Revenue (Million), by Containerization 2024 & 2032

- Figure 41: Europe Nordics Road Freight Transport Market Revenue Share (%), by Containerization 2024 & 2032

- Figure 42: Europe Nordics Road Freight Transport Market Revenue (Million), by Distance 2024 & 2032

- Figure 43: Europe Nordics Road Freight Transport Market Revenue Share (%), by Distance 2024 & 2032

- Figure 44: Europe Nordics Road Freight Transport Market Revenue (Million), by Goods Configuration 2024 & 2032

- Figure 45: Europe Nordics Road Freight Transport Market Revenue Share (%), by Goods Configuration 2024 & 2032

- Figure 46: Europe Nordics Road Freight Transport Market Revenue (Million), by Temperature Control 2024 & 2032

- Figure 47: Europe Nordics Road Freight Transport Market Revenue Share (%), by Temperature Control 2024 & 2032

- Figure 48: Europe Nordics Road Freight Transport Market Revenue (Million), by Country 2024 & 2032

- Figure 49: Europe Nordics Road Freight Transport Market Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Nordics Road Freight Transport Market Revenue (Million), by End User Industry 2024 & 2032

- Figure 51: Middle East & Africa Nordics Road Freight Transport Market Revenue Share (%), by End User Industry 2024 & 2032

- Figure 52: Middle East & Africa Nordics Road Freight Transport Market Revenue (Million), by Destination 2024 & 2032

- Figure 53: Middle East & Africa Nordics Road Freight Transport Market Revenue Share (%), by Destination 2024 & 2032

- Figure 54: Middle East & Africa Nordics Road Freight Transport Market Revenue (Million), by Truckload Specification 2024 & 2032

- Figure 55: Middle East & Africa Nordics Road Freight Transport Market Revenue Share (%), by Truckload Specification 2024 & 2032

- Figure 56: Middle East & Africa Nordics Road Freight Transport Market Revenue (Million), by Containerization 2024 & 2032

- Figure 57: Middle East & Africa Nordics Road Freight Transport Market Revenue Share (%), by Containerization 2024 & 2032

- Figure 58: Middle East & Africa Nordics Road Freight Transport Market Revenue (Million), by Distance 2024 & 2032

- Figure 59: Middle East & Africa Nordics Road Freight Transport Market Revenue Share (%), by Distance 2024 & 2032

- Figure 60: Middle East & Africa Nordics Road Freight Transport Market Revenue (Million), by Goods Configuration 2024 & 2032

- Figure 61: Middle East & Africa Nordics Road Freight Transport Market Revenue Share (%), by Goods Configuration 2024 & 2032

- Figure 62: Middle East & Africa Nordics Road Freight Transport Market Revenue (Million), by Temperature Control 2024 & 2032

- Figure 63: Middle East & Africa Nordics Road Freight Transport Market Revenue Share (%), by Temperature Control 2024 & 2032

- Figure 64: Middle East & Africa Nordics Road Freight Transport Market Revenue (Million), by Country 2024 & 2032

- Figure 65: Middle East & Africa Nordics Road Freight Transport Market Revenue Share (%), by Country 2024 & 2032

- Figure 66: Asia Pacific Nordics Road Freight Transport Market Revenue (Million), by End User Industry 2024 & 2032

- Figure 67: Asia Pacific Nordics Road Freight Transport Market Revenue Share (%), by End User Industry 2024 & 2032

- Figure 68: Asia Pacific Nordics Road Freight Transport Market Revenue (Million), by Destination 2024 & 2032

- Figure 69: Asia Pacific Nordics Road Freight Transport Market Revenue Share (%), by Destination 2024 & 2032

- Figure 70: Asia Pacific Nordics Road Freight Transport Market Revenue (Million), by Truckload Specification 2024 & 2032

- Figure 71: Asia Pacific Nordics Road Freight Transport Market Revenue Share (%), by Truckload Specification 2024 & 2032

- Figure 72: Asia Pacific Nordics Road Freight Transport Market Revenue (Million), by Containerization 2024 & 2032

- Figure 73: Asia Pacific Nordics Road Freight Transport Market Revenue Share (%), by Containerization 2024 & 2032

- Figure 74: Asia Pacific Nordics Road Freight Transport Market Revenue (Million), by Distance 2024 & 2032

- Figure 75: Asia Pacific Nordics Road Freight Transport Market Revenue Share (%), by Distance 2024 & 2032

- Figure 76: Asia Pacific Nordics Road Freight Transport Market Revenue (Million), by Goods Configuration 2024 & 2032

- Figure 77: Asia Pacific Nordics Road Freight Transport Market Revenue Share (%), by Goods Configuration 2024 & 2032

- Figure 78: Asia Pacific Nordics Road Freight Transport Market Revenue (Million), by Temperature Control 2024 & 2032

- Figure 79: Asia Pacific Nordics Road Freight Transport Market Revenue Share (%), by Temperature Control 2024 & 2032

- Figure 80: Asia Pacific Nordics Road Freight Transport Market Revenue (Million), by Country 2024 & 2032

- Figure 81: Asia Pacific Nordics Road Freight Transport Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Nordics Road Freight Transport Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Nordics Road Freight Transport Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 3: Global Nordics Road Freight Transport Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 4: Global Nordics Road Freight Transport Market Revenue Million Forecast, by Truckload Specification 2019 & 2032

- Table 5: Global Nordics Road Freight Transport Market Revenue Million Forecast, by Containerization 2019 & 2032

- Table 6: Global Nordics Road Freight Transport Market Revenue Million Forecast, by Distance 2019 & 2032

- Table 7: Global Nordics Road Freight Transport Market Revenue Million Forecast, by Goods Configuration 2019 & 2032

- Table 8: Global Nordics Road Freight Transport Market Revenue Million Forecast, by Temperature Control 2019 & 2032

- Table 9: Global Nordics Road Freight Transport Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Global Nordics Road Freight Transport Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 11: Global Nordics Road Freight Transport Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 12: Global Nordics Road Freight Transport Market Revenue Million Forecast, by Truckload Specification 2019 & 2032

- Table 13: Global Nordics Road Freight Transport Market Revenue Million Forecast, by Containerization 2019 & 2032

- Table 14: Global Nordics Road Freight Transport Market Revenue Million Forecast, by Distance 2019 & 2032

- Table 15: Global Nordics Road Freight Transport Market Revenue Million Forecast, by Goods Configuration 2019 & 2032

- Table 16: Global Nordics Road Freight Transport Market Revenue Million Forecast, by Temperature Control 2019 & 2032

- Table 17: Global Nordics Road Freight Transport Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: United States Nordics Road Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Canada Nordics Road Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Nordics Road Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Global Nordics Road Freight Transport Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 22: Global Nordics Road Freight Transport Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 23: Global Nordics Road Freight Transport Market Revenue Million Forecast, by Truckload Specification 2019 & 2032

- Table 24: Global Nordics Road Freight Transport Market Revenue Million Forecast, by Containerization 2019 & 2032

- Table 25: Global Nordics Road Freight Transport Market Revenue Million Forecast, by Distance 2019 & 2032

- Table 26: Global Nordics Road Freight Transport Market Revenue Million Forecast, by Goods Configuration 2019 & 2032

- Table 27: Global Nordics Road Freight Transport Market Revenue Million Forecast, by Temperature Control 2019 & 2032

- Table 28: Global Nordics Road Freight Transport Market Revenue Million Forecast, by Country 2019 & 2032

- Table 29: Brazil Nordics Road Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Nordics Road Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Nordics Road Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Global Nordics Road Freight Transport Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 33: Global Nordics Road Freight Transport Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 34: Global Nordics Road Freight Transport Market Revenue Million Forecast, by Truckload Specification 2019 & 2032

- Table 35: Global Nordics Road Freight Transport Market Revenue Million Forecast, by Containerization 2019 & 2032

- Table 36: Global Nordics Road Freight Transport Market Revenue Million Forecast, by Distance 2019 & 2032

- Table 37: Global Nordics Road Freight Transport Market Revenue Million Forecast, by Goods Configuration 2019 & 2032

- Table 38: Global Nordics Road Freight Transport Market Revenue Million Forecast, by Temperature Control 2019 & 2032

- Table 39: Global Nordics Road Freight Transport Market Revenue Million Forecast, by Country 2019 & 2032

- Table 40: United Kingdom Nordics Road Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Germany Nordics Road Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: France Nordics Road Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Italy Nordics Road Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Spain Nordics Road Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Russia Nordics Road Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Benelux Nordics Road Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Nordics Nordics Road Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Europe Nordics Road Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Global Nordics Road Freight Transport Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 50: Global Nordics Road Freight Transport Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 51: Global Nordics Road Freight Transport Market Revenue Million Forecast, by Truckload Specification 2019 & 2032

- Table 52: Global Nordics Road Freight Transport Market Revenue Million Forecast, by Containerization 2019 & 2032

- Table 53: Global Nordics Road Freight Transport Market Revenue Million Forecast, by Distance 2019 & 2032

- Table 54: Global Nordics Road Freight Transport Market Revenue Million Forecast, by Goods Configuration 2019 & 2032

- Table 55: Global Nordics Road Freight Transport Market Revenue Million Forecast, by Temperature Control 2019 & 2032

- Table 56: Global Nordics Road Freight Transport Market Revenue Million Forecast, by Country 2019 & 2032

- Table 57: Turkey Nordics Road Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Israel Nordics Road Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: GCC Nordics Road Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: North Africa Nordics Road Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: South Africa Nordics Road Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: Rest of Middle East & Africa Nordics Road Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 63: Global Nordics Road Freight Transport Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 64: Global Nordics Road Freight Transport Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 65: Global Nordics Road Freight Transport Market Revenue Million Forecast, by Truckload Specification 2019 & 2032

- Table 66: Global Nordics Road Freight Transport Market Revenue Million Forecast, by Containerization 2019 & 2032

- Table 67: Global Nordics Road Freight Transport Market Revenue Million Forecast, by Distance 2019 & 2032

- Table 68: Global Nordics Road Freight Transport Market Revenue Million Forecast, by Goods Configuration 2019 & 2032

- Table 69: Global Nordics Road Freight Transport Market Revenue Million Forecast, by Temperature Control 2019 & 2032

- Table 70: Global Nordics Road Freight Transport Market Revenue Million Forecast, by Country 2019 & 2032

- Table 71: China Nordics Road Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 72: India Nordics Road Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 73: Japan Nordics Road Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 74: South Korea Nordics Road Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 75: ASEAN Nordics Road Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 76: Oceania Nordics Road Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 77: Rest of Asia Pacific Nordics Road Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Nordics Road Freight Transport Market?

The projected CAGR is approximately 5.98%.

2. Which companies are prominent players in the Nordics Road Freight Transport Market?

Key companies in the market include DB Schenker, DFDS Logistics, DHL Group, Kuehne + Nagel, Collicare Logistics AS, Scan Global Logistics, Stena A, Allcargo Logistics Ltd, NTG Nordic Transport Group, FREJA Transport & Logistics A/S, Danske Fragtmænd A/S.

3. What are the main segments of the Nordics Road Freight Transport Market?

The market segments include End User Industry, Destination, Truckload Specification, Containerization, Distance, Goods Configuration, Temperature Control.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing trade relations; Increased demand for perishable goods.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Cargo theft; High cost of maintainig.

8. Can you provide examples of recent developments in the market?

September 2023: DB Schenker in Norway conducted a test with the electrically powered and highly innovative Volta Zero from Volta Trucks. In 2021, DB Schenker and Volta Trucks announced a partnership. The subsequent pre-order of nearly 1,500 zer-tailpipe emission Volta Zero vehicles was the largest order of medium-duty electric trucks in Europe to date. DB Schenker plans to deploy the all-electric, 16-ton Volta Zero in its European terminals to deliver goods from distribution hubs to urban areas and city centers.September 2023: Scan Global Logistics and Alfa Laval have introduced their first electric truck, as part of their zero-emissions partnership. The truck will enable CO2 savings of 5.3 tons annually. The emission reduction will help Alfa Laval achieve its goal of becoming carbon neutral by 2030, with a target of net zero for scopes 1 and 2 and a 50% reduction for scope 3.July 2023: NTG East AB, NTG Cargorange AB, NTG Continent AB, and NTG Solution AB have decided to join forces and merge. The combined company will change its name to NTG Road AB. The aim is to consolidate services and processes into a convenient one-stop-shop for road freight services to and from Sweden.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Nordics Road Freight Transport Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Nordics Road Freight Transport Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Nordics Road Freight Transport Market?

To stay informed about further developments, trends, and reports in the Nordics Road Freight Transport Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence