Key Insights

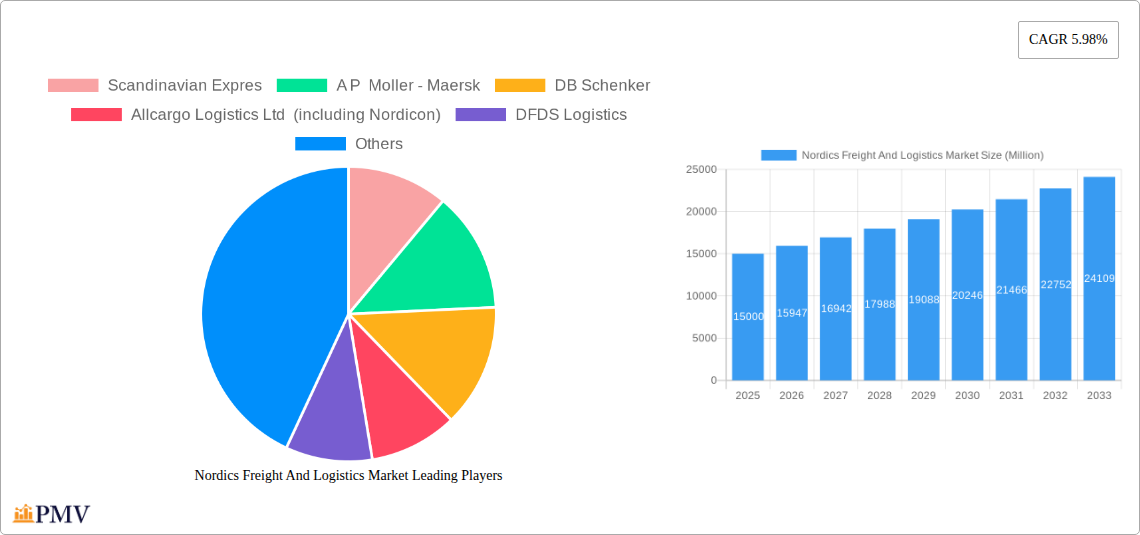

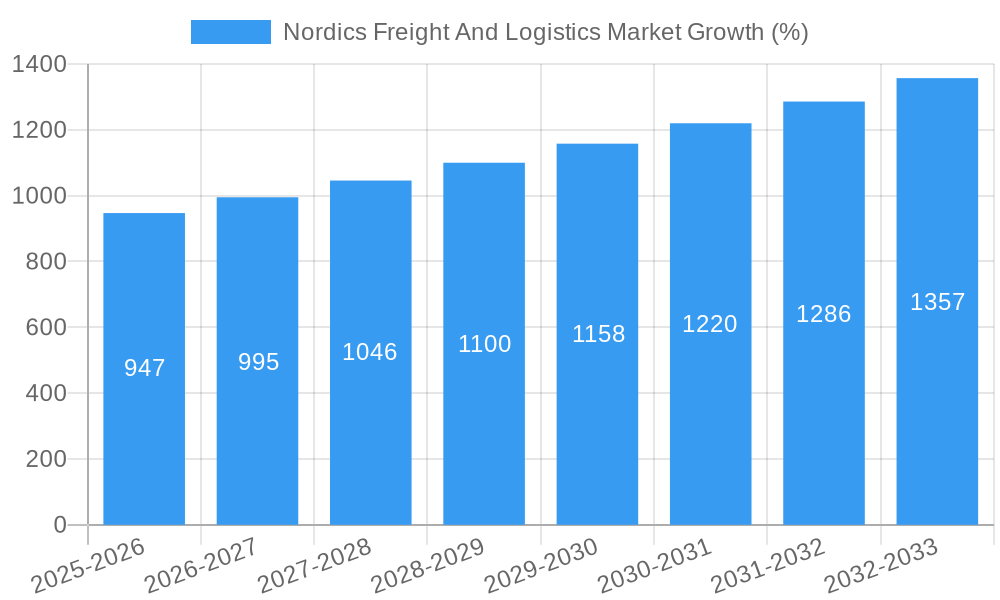

The Nordics freight and logistics market, encompassing Denmark, Finland, Iceland, Norway, and Sweden, presents a robust and expanding opportunity. Driven by the region's strong economic performance, increasing e-commerce activity, and the growth of sectors like manufacturing and renewable energy, the market is projected to experience substantial growth. The 5.98% CAGR suggests a consistent upward trajectory, with significant expansion expected across various segments. The dominance of established players like DSV A/S, Maersk, and DHL highlights the competitive landscape, yet also indicates ample room for niche players specializing in areas like temperature-controlled logistics and sustainable transportation solutions. The diversified end-user industries, including agriculture, construction, and oil & gas, further contribute to market resilience and growth potential. However, challenges exist, particularly related to infrastructure limitations in certain areas and the rising costs of fuel and labor. Overcoming these restraints will be crucial for sustained market expansion.

The forecast period of 2025-2033 is poised for significant market expansion. This growth will be fueled by ongoing investments in infrastructure modernization, the implementation of innovative technologies such as blockchain and AI in logistics operations, and a growing emphasis on environmentally friendly transportation solutions. The market's segmentation, encompassing courier, express, and parcel (CEP) services, temperature-controlled transportation, and other specialized services, offers diverse avenues for investment and expansion. Furthermore, the strategic location of the Nordics as a key gateway to Northern Europe and beyond strengthens the market’s position within global supply chains, enhancing its attractiveness to both domestic and international logistics providers. While competition is intense, the market's overall growth trajectory remains positive, presenting opportunities for companies that can effectively address the evolving needs of various industries and adapt to ongoing market dynamics.

Nordics Freight & Logistics Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Nordics freight and logistics market, encompassing market size, competitive landscape, growth drivers, and future outlook. Covering the period 2019-2033, with a focus on 2025, this report is an essential resource for industry stakeholders, investors, and strategic decision-makers.

Nordics Freight And Logistics Market Market Structure & Competitive Dynamics

The Nordics freight and logistics market exhibits a moderately concentrated structure, with several major players commanding significant market share. Market leaders like A P Moller - Maersk, DSV A/S, and DHL Group compete fiercely, driving innovation and efficiency improvements. The market's competitive dynamics are shaped by factors such as:

- Market Concentration: The top 5 players hold an estimated xx% market share in 2025, indicating a moderately consolidated landscape.

- Innovation Ecosystems: Significant investments in technology, particularly in areas like AI, blockchain, and automation, are fostering innovation and driving process optimization. The development of sustainable logistics solutions also plays a key role.

- Regulatory Frameworks: Harmonized regulations across the Nordic countries facilitate cross-border operations, while specific national regulations impact specific operational aspects within each country.

- Product Substitutes: The increasing adoption of e-commerce and the rise of alternative delivery models are introducing new players and influencing the traditional freight and logistics business.

- End-User Trends: Evolving consumer preferences for faster and more reliable delivery services are pushing logistics providers to enhance their capabilities. The growing demand for sustainable and ethical logistics practices also influences market dynamics.

- M&A Activities: The market has witnessed several significant mergers and acquisitions in recent years, with deal values totaling an estimated xx Million in the period 2019-2024. These consolidations have resulted in increased market share for some players and intensified competition.

Nordics Freight And Logistics Market Industry Trends & Insights

The Nordics freight and logistics market is characterized by robust growth, driven by factors including the expansion of e-commerce, increasing cross-border trade, and the growing focus on supply chain resilience. Key trends shaping the market include:

The market experienced a CAGR of xx% during the historical period (2019-2024) and is projected to maintain a healthy CAGR of xx% during the forecast period (2025-2033). Market penetration of advanced technologies, such as AI-powered route optimization and autonomous vehicles, is expected to increase significantly, reaching an estimated xx% by 2033. Consumer preferences are shifting towards faster, more transparent, and sustainable logistics solutions, impacting service offerings and operational strategies. Intense competition is driving innovation, cost optimization, and service differentiation.

Dominant Markets & Segments in Nordics Freight And Logistics Market

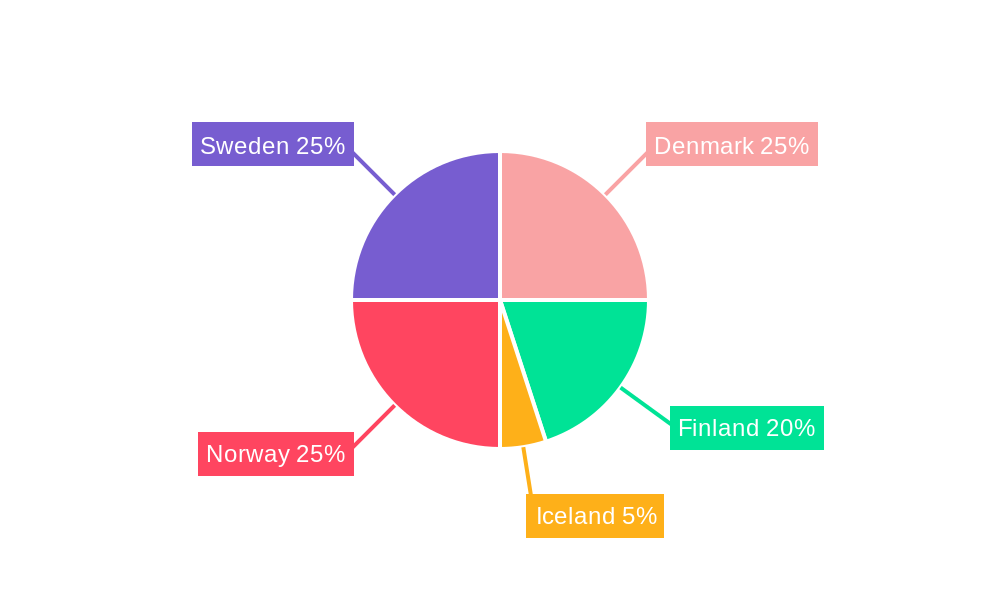

Sweden and Denmark represent the largest markets within the Nordics region, driven by robust economies, extensive infrastructure, and high levels of trade activity. Key segments showing strong growth include:

- Leading Region/Country: Sweden and Denmark are dominant due to advanced infrastructure and high trade volumes.

- Logistics Function: The Courier, Express, and Parcel (CEP) segment is experiencing the fastest growth, fueled by e-commerce expansion. Temperature-controlled logistics is also a significant and growing segment due to increasing demand for perishable goods.

- End-User Industry: The Wholesale and Retail Trade sector is the largest end-user, followed by Manufacturing. Growth in the Agriculture, Fishing, and Forestry sector is also noteworthy.

Key Drivers:

- Strong economic growth in Sweden and Denmark: These nations' robust economies fuel high demand for logistics services.

- Well-developed infrastructure: Efficient road, rail, and port networks facilitate smooth freight movement.

- Government support for logistics innovation: Policies promoting sustainable and technological advancements in the sector.

Nordics Freight And Logistics Market Product Innovations

Recent innovations focus on enhancing efficiency, sustainability, and visibility within the supply chain. Technology plays a central role, with the adoption of AI, IoT, and blockchain solutions improving tracking, optimization, and overall transparency. The development of sustainable solutions, such as electric vehicle fleets and carbon offsetting programs, is gaining traction, driven by growing environmental concerns and regulatory pressures. These innovations are improving service offerings and creating competitive advantages for logistics providers.

Report Segmentation & Scope

This report segments the Nordics freight and logistics market by:

- Country: Denmark, Finland, Iceland, Norway, Sweden. Each country's market size and growth projections are individually analyzed, considering specific economic and infrastructural factors.

- Logistics Function: Courier, Express, and Parcel (CEP); Temperature Controlled; Other Services. Each function's market dynamics, growth rates, and competitive landscape are thoroughly examined.

- End-User Industry: Agriculture, Fishing, and Forestry; Construction; Manufacturing; Oil and Gas; Mining and Quarrying; Wholesale and Retail Trade; Others. The report analyzes each industry's specific logistics needs and preferences. Market size and growth projections are provided for each segment.

Key Drivers of Nordics Freight And Logistics Market Growth

The Nordics freight and logistics market's growth is fueled by several key factors: the rapid expansion of e-commerce, requiring efficient and fast delivery solutions; increasing cross-border trade within the Nordic region and beyond; growing demand for specialized logistics services like temperature-controlled transportation; and continuous advancements in technology, particularly in areas such as automation and AI, enhancing efficiency and optimizing operations.

Challenges in the Nordics Freight And Logistics Market Sector

The sector faces challenges such as labor shortages, impacting operational capacity; increasing fuel costs and fluctuating energy prices impacting profitability; growing pressure to adopt sustainable practices and reduce carbon emissions; and intense competition, requiring continuous innovation and cost optimization. These challenges necessitate strategic adaptation and investment in new technologies and efficient operational models.

Leading Players in the Nordics Freight And Logistics Market Market

- Scandinavian Expres

- A P Moller - Maersk

- DB Schenker

- Allcargo Logistics Ltd (including Nordicon)

- DFDS Logistics

- DHL Group

- DSV A/S (De Sammensluttede Vognmænd af Air and Sea)

- Green Cargo

- Kuehne + Nagel

- Scan Global Logistics

- NTG Nordic Transport Group

- FREJA Transport & Logistics A/S

Key Developments in Nordics Freight And Logistics Market Sector

- September 2023: Kuehne+Nagel and Capgemini formed a strategic partnership to create a supply chain orchestration service, leveraging AI and data-driven decision-making. This expands service offerings and targets large corporations in key sectors.

- October 2023: Kuehne+Nagel launched three new charter connections between the Americas, Europe, and Asia, enhancing its air freight capacity and capabilities, particularly in high-value sectors like healthcare and semiconductors.

- January 2024: Kuehne + Nagel introduced its Book & Claim insetting solution for electric vehicles, furthering its commitment to decarbonization and offering customers carbon reduction claims for road transport services.

Strategic Nordics Freight And Logistics Market Market Outlook

The Nordics freight and logistics market is poised for continued growth, driven by technological advancements, expanding e-commerce, and a focus on sustainable solutions. Strategic opportunities exist for companies focusing on digitalization, automation, and the development of innovative supply chain solutions. Investment in green technologies and the adoption of sustainable practices will be crucial for long-term success in this dynamic market.

Nordics Freight And Logistics Market Segmentation

-

1. End User Industry

- 1.1. Agriculture, Fishing, and Forestry

- 1.2. Construction

- 1.3. Manufacturing

- 1.4. Oil and Gas, Mining and Quarrying

- 1.5. Wholesale and Retail Trade

- 1.6. Others

-

2. Logistics Function

-

2.1. Courier, Express, and Parcel (CEP)

-

2.1.1. By Destination Type

- 2.1.1.1. Domestic

- 2.1.1.2. International

-

2.1.1. By Destination Type

-

2.2. Freight Forwarding

-

2.2.1. By Mode Of Transport

- 2.2.1.1. Air

- 2.2.1.2. Sea and Inland Waterways

- 2.2.1.3. Others

-

2.2.1. By Mode Of Transport

-

2.3. Freight Transport

- 2.3.1. Pipelines

- 2.3.2. Rail

- 2.3.3. Road

-

2.4. Warehousing and Storage

-

2.4.1. By Temperature Control

- 2.4.1.1. Non-Temperature Controlled

-

2.4.1. By Temperature Control

- 2.5. Other Services

-

2.1. Courier, Express, and Parcel (CEP)

Nordics Freight And Logistics Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Nordics Freight And Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.98% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing trade relations; Increased demand for perishable goods

- 3.3. Market Restrains

- 3.3.1. Cargo theft; High cost of maintainig

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Nordics Freight And Logistics Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Agriculture, Fishing, and Forestry

- 5.1.2. Construction

- 5.1.3. Manufacturing

- 5.1.4. Oil and Gas, Mining and Quarrying

- 5.1.5. Wholesale and Retail Trade

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Logistics Function

- 5.2.1. Courier, Express, and Parcel (CEP)

- 5.2.1.1. By Destination Type

- 5.2.1.1.1. Domestic

- 5.2.1.1.2. International

- 5.2.1.1. By Destination Type

- 5.2.2. Freight Forwarding

- 5.2.2.1. By Mode Of Transport

- 5.2.2.1.1. Air

- 5.2.2.1.2. Sea and Inland Waterways

- 5.2.2.1.3. Others

- 5.2.2.1. By Mode Of Transport

- 5.2.3. Freight Transport

- 5.2.3.1. Pipelines

- 5.2.3.2. Rail

- 5.2.3.3. Road

- 5.2.4. Warehousing and Storage

- 5.2.4.1. By Temperature Control

- 5.2.4.1.1. Non-Temperature Controlled

- 5.2.4.1. By Temperature Control

- 5.2.5. Other Services

- 5.2.1. Courier, Express, and Parcel (CEP)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. North America Nordics Freight And Logistics Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by End User Industry

- 6.1.1. Agriculture, Fishing, and Forestry

- 6.1.2. Construction

- 6.1.3. Manufacturing

- 6.1.4. Oil and Gas, Mining and Quarrying

- 6.1.5. Wholesale and Retail Trade

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by Logistics Function

- 6.2.1. Courier, Express, and Parcel (CEP)

- 6.2.1.1. By Destination Type

- 6.2.1.1.1. Domestic

- 6.2.1.1.2. International

- 6.2.1.1. By Destination Type

- 6.2.2. Freight Forwarding

- 6.2.2.1. By Mode Of Transport

- 6.2.2.1.1. Air

- 6.2.2.1.2. Sea and Inland Waterways

- 6.2.2.1.3. Others

- 6.2.2.1. By Mode Of Transport

- 6.2.3. Freight Transport

- 6.2.3.1. Pipelines

- 6.2.3.2. Rail

- 6.2.3.3. Road

- 6.2.4. Warehousing and Storage

- 6.2.4.1. By Temperature Control

- 6.2.4.1.1. Non-Temperature Controlled

- 6.2.4.1. By Temperature Control

- 6.2.5. Other Services

- 6.2.1. Courier, Express, and Parcel (CEP)

- 6.1. Market Analysis, Insights and Forecast - by End User Industry

- 7. South America Nordics Freight And Logistics Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by End User Industry

- 7.1.1. Agriculture, Fishing, and Forestry

- 7.1.2. Construction

- 7.1.3. Manufacturing

- 7.1.4. Oil and Gas, Mining and Quarrying

- 7.1.5. Wholesale and Retail Trade

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by Logistics Function

- 7.2.1. Courier, Express, and Parcel (CEP)

- 7.2.1.1. By Destination Type

- 7.2.1.1.1. Domestic

- 7.2.1.1.2. International

- 7.2.1.1. By Destination Type

- 7.2.2. Freight Forwarding

- 7.2.2.1. By Mode Of Transport

- 7.2.2.1.1. Air

- 7.2.2.1.2. Sea and Inland Waterways

- 7.2.2.1.3. Others

- 7.2.2.1. By Mode Of Transport

- 7.2.3. Freight Transport

- 7.2.3.1. Pipelines

- 7.2.3.2. Rail

- 7.2.3.3. Road

- 7.2.4. Warehousing and Storage

- 7.2.4.1. By Temperature Control

- 7.2.4.1.1. Non-Temperature Controlled

- 7.2.4.1. By Temperature Control

- 7.2.5. Other Services

- 7.2.1. Courier, Express, and Parcel (CEP)

- 7.1. Market Analysis, Insights and Forecast - by End User Industry

- 8. Europe Nordics Freight And Logistics Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by End User Industry

- 8.1.1. Agriculture, Fishing, and Forestry

- 8.1.2. Construction

- 8.1.3. Manufacturing

- 8.1.4. Oil and Gas, Mining and Quarrying

- 8.1.5. Wholesale and Retail Trade

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by Logistics Function

- 8.2.1. Courier, Express, and Parcel (CEP)

- 8.2.1.1. By Destination Type

- 8.2.1.1.1. Domestic

- 8.2.1.1.2. International

- 8.2.1.1. By Destination Type

- 8.2.2. Freight Forwarding

- 8.2.2.1. By Mode Of Transport

- 8.2.2.1.1. Air

- 8.2.2.1.2. Sea and Inland Waterways

- 8.2.2.1.3. Others

- 8.2.2.1. By Mode Of Transport

- 8.2.3. Freight Transport

- 8.2.3.1. Pipelines

- 8.2.3.2. Rail

- 8.2.3.3. Road

- 8.2.4. Warehousing and Storage

- 8.2.4.1. By Temperature Control

- 8.2.4.1.1. Non-Temperature Controlled

- 8.2.4.1. By Temperature Control

- 8.2.5. Other Services

- 8.2.1. Courier, Express, and Parcel (CEP)

- 8.1. Market Analysis, Insights and Forecast - by End User Industry

- 9. Middle East & Africa Nordics Freight And Logistics Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by End User Industry

- 9.1.1. Agriculture, Fishing, and Forestry

- 9.1.2. Construction

- 9.1.3. Manufacturing

- 9.1.4. Oil and Gas, Mining and Quarrying

- 9.1.5. Wholesale and Retail Trade

- 9.1.6. Others

- 9.2. Market Analysis, Insights and Forecast - by Logistics Function

- 9.2.1. Courier, Express, and Parcel (CEP)

- 9.2.1.1. By Destination Type

- 9.2.1.1.1. Domestic

- 9.2.1.1.2. International

- 9.2.1.1. By Destination Type

- 9.2.2. Freight Forwarding

- 9.2.2.1. By Mode Of Transport

- 9.2.2.1.1. Air

- 9.2.2.1.2. Sea and Inland Waterways

- 9.2.2.1.3. Others

- 9.2.2.1. By Mode Of Transport

- 9.2.3. Freight Transport

- 9.2.3.1. Pipelines

- 9.2.3.2. Rail

- 9.2.3.3. Road

- 9.2.4. Warehousing and Storage

- 9.2.4.1. By Temperature Control

- 9.2.4.1.1. Non-Temperature Controlled

- 9.2.4.1. By Temperature Control

- 9.2.5. Other Services

- 9.2.1. Courier, Express, and Parcel (CEP)

- 9.1. Market Analysis, Insights and Forecast - by End User Industry

- 10. Asia Pacific Nordics Freight And Logistics Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by End User Industry

- 10.1.1. Agriculture, Fishing, and Forestry

- 10.1.2. Construction

- 10.1.3. Manufacturing

- 10.1.4. Oil and Gas, Mining and Quarrying

- 10.1.5. Wholesale and Retail Trade

- 10.1.6. Others

- 10.2. Market Analysis, Insights and Forecast - by Logistics Function

- 10.2.1. Courier, Express, and Parcel (CEP)

- 10.2.1.1. By Destination Type

- 10.2.1.1.1. Domestic

- 10.2.1.1.2. International

- 10.2.1.1. By Destination Type

- 10.2.2. Freight Forwarding

- 10.2.2.1. By Mode Of Transport

- 10.2.2.1.1. Air

- 10.2.2.1.2. Sea and Inland Waterways

- 10.2.2.1.3. Others

- 10.2.2.1. By Mode Of Transport

- 10.2.3. Freight Transport

- 10.2.3.1. Pipelines

- 10.2.3.2. Rail

- 10.2.3.3. Road

- 10.2.4. Warehousing and Storage

- 10.2.4.1. By Temperature Control

- 10.2.4.1.1. Non-Temperature Controlled

- 10.2.4.1. By Temperature Control

- 10.2.5. Other Services

- 10.2.1. Courier, Express, and Parcel (CEP)

- 10.1. Market Analysis, Insights and Forecast - by End User Industry

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Scandinavian Expres

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 A P Moller - Maersk

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 DB Schenker

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Allcargo Logistics Ltd (including Nordicon)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 DFDS Logistics

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 DHL Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 DSV A/S (De Sammensluttede Vognmænd af Air and Sea)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Green Cargo

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Kuehne + Nagel

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Scan Global Logistics

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 NTG Nordic Transport Group

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 FREJA Transport & Logistics A/S

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Scandinavian Expres

List of Figures

- Figure 1: Global Nordics Freight And Logistics Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Nordics Freight And Logistics Market Revenue (Million), by End User Industry 2024 & 2032

- Figure 3: North America Nordics Freight And Logistics Market Revenue Share (%), by End User Industry 2024 & 2032

- Figure 4: North America Nordics Freight And Logistics Market Revenue (Million), by Logistics Function 2024 & 2032

- Figure 5: North America Nordics Freight And Logistics Market Revenue Share (%), by Logistics Function 2024 & 2032

- Figure 6: North America Nordics Freight And Logistics Market Revenue (Million), by Country 2024 & 2032

- Figure 7: North America Nordics Freight And Logistics Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Nordics Freight And Logistics Market Revenue (Million), by End User Industry 2024 & 2032

- Figure 9: South America Nordics Freight And Logistics Market Revenue Share (%), by End User Industry 2024 & 2032

- Figure 10: South America Nordics Freight And Logistics Market Revenue (Million), by Logistics Function 2024 & 2032

- Figure 11: South America Nordics Freight And Logistics Market Revenue Share (%), by Logistics Function 2024 & 2032

- Figure 12: South America Nordics Freight And Logistics Market Revenue (Million), by Country 2024 & 2032

- Figure 13: South America Nordics Freight And Logistics Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Nordics Freight And Logistics Market Revenue (Million), by End User Industry 2024 & 2032

- Figure 15: Europe Nordics Freight And Logistics Market Revenue Share (%), by End User Industry 2024 & 2032

- Figure 16: Europe Nordics Freight And Logistics Market Revenue (Million), by Logistics Function 2024 & 2032

- Figure 17: Europe Nordics Freight And Logistics Market Revenue Share (%), by Logistics Function 2024 & 2032

- Figure 18: Europe Nordics Freight And Logistics Market Revenue (Million), by Country 2024 & 2032

- Figure 19: Europe Nordics Freight And Logistics Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Nordics Freight And Logistics Market Revenue (Million), by End User Industry 2024 & 2032

- Figure 21: Middle East & Africa Nordics Freight And Logistics Market Revenue Share (%), by End User Industry 2024 & 2032

- Figure 22: Middle East & Africa Nordics Freight And Logistics Market Revenue (Million), by Logistics Function 2024 & 2032

- Figure 23: Middle East & Africa Nordics Freight And Logistics Market Revenue Share (%), by Logistics Function 2024 & 2032

- Figure 24: Middle East & Africa Nordics Freight And Logistics Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Nordics Freight And Logistics Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Nordics Freight And Logistics Market Revenue (Million), by End User Industry 2024 & 2032

- Figure 27: Asia Pacific Nordics Freight And Logistics Market Revenue Share (%), by End User Industry 2024 & 2032

- Figure 28: Asia Pacific Nordics Freight And Logistics Market Revenue (Million), by Logistics Function 2024 & 2032

- Figure 29: Asia Pacific Nordics Freight And Logistics Market Revenue Share (%), by Logistics Function 2024 & 2032

- Figure 30: Asia Pacific Nordics Freight And Logistics Market Revenue (Million), by Country 2024 & 2032

- Figure 31: Asia Pacific Nordics Freight And Logistics Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Nordics Freight And Logistics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Nordics Freight And Logistics Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 3: Global Nordics Freight And Logistics Market Revenue Million Forecast, by Logistics Function 2019 & 2032

- Table 4: Global Nordics Freight And Logistics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Nordics Freight And Logistics Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 6: Global Nordics Freight And Logistics Market Revenue Million Forecast, by Logistics Function 2019 & 2032

- Table 7: Global Nordics Freight And Logistics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United States Nordics Freight And Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Canada Nordics Freight And Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Nordics Freight And Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Nordics Freight And Logistics Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 12: Global Nordics Freight And Logistics Market Revenue Million Forecast, by Logistics Function 2019 & 2032

- Table 13: Global Nordics Freight And Logistics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Brazil Nordics Freight And Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Nordics Freight And Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Nordics Freight And Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global Nordics Freight And Logistics Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 18: Global Nordics Freight And Logistics Market Revenue Million Forecast, by Logistics Function 2019 & 2032

- Table 19: Global Nordics Freight And Logistics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Nordics Freight And Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Germany Nordics Freight And Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: France Nordics Freight And Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Italy Nordics Freight And Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Spain Nordics Freight And Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Russia Nordics Freight And Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Nordics Freight And Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Nordics Freight And Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Nordics Freight And Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Global Nordics Freight And Logistics Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 30: Global Nordics Freight And Logistics Market Revenue Million Forecast, by Logistics Function 2019 & 2032

- Table 31: Global Nordics Freight And Logistics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Turkey Nordics Freight And Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Israel Nordics Freight And Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: GCC Nordics Freight And Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Nordics Freight And Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Nordics Freight And Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Nordics Freight And Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Global Nordics Freight And Logistics Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 39: Global Nordics Freight And Logistics Market Revenue Million Forecast, by Logistics Function 2019 & 2032

- Table 40: Global Nordics Freight And Logistics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 41: China Nordics Freight And Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: India Nordics Freight And Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Japan Nordics Freight And Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Nordics Freight And Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Nordics Freight And Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Nordics Freight And Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Nordics Freight And Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Nordics Freight And Logistics Market?

The projected CAGR is approximately 5.98%.

2. Which companies are prominent players in the Nordics Freight And Logistics Market?

Key companies in the market include Scandinavian Expres, A P Moller - Maersk, DB Schenker, Allcargo Logistics Ltd (including Nordicon), DFDS Logistics, DHL Group, DSV A/S (De Sammensluttede Vognmænd af Air and Sea), Green Cargo, Kuehne + Nagel, Scan Global Logistics, NTG Nordic Transport Group, FREJA Transport & Logistics A/S.

3. What are the main segments of the Nordics Freight And Logistics Market?

The market segments include End User Industry, Logistics Function.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing trade relations; Increased demand for perishable goods.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Cargo theft; High cost of maintainig.

8. Can you provide examples of recent developments in the market?

January 2024: Kuehne + Nagel has announced its Book & Claim insetting solution for electric vehicles, to improve its decarbonization solutions. Developing Book & Claim insetting solutions for road freight was a strategic priority for Kuehne + Nagel. Customers who use Kuehne + Nagel's road transport services can now claim the carbon reductions of electric trucks when it is not possible to physically move their goods on these vehicles.October 2023: Kuehne+Nagel has introduced three new charter connections between the Americas, Europe, and Asia. It has begun its operations with its own freighter, the B747-8 “Inspire”, from October 23, 2023. It has conducted two additional weekly routings from Atlanta and Chicago to Amsterdam and from there to Taipei. This flight will serve key industries such as healthcare, perishables and semiconductors.September 2023: Kuehne+Nagel and Capgemini have entered into a strategic agreement to create a supply chain orchestration service offering to provide end-to-end services across the supply chain network.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Nordics Freight And Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Nordics Freight And Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Nordics Freight And Logistics Market?

To stay informed about further developments, trends, and reports in the Nordics Freight And Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence