Key Insights

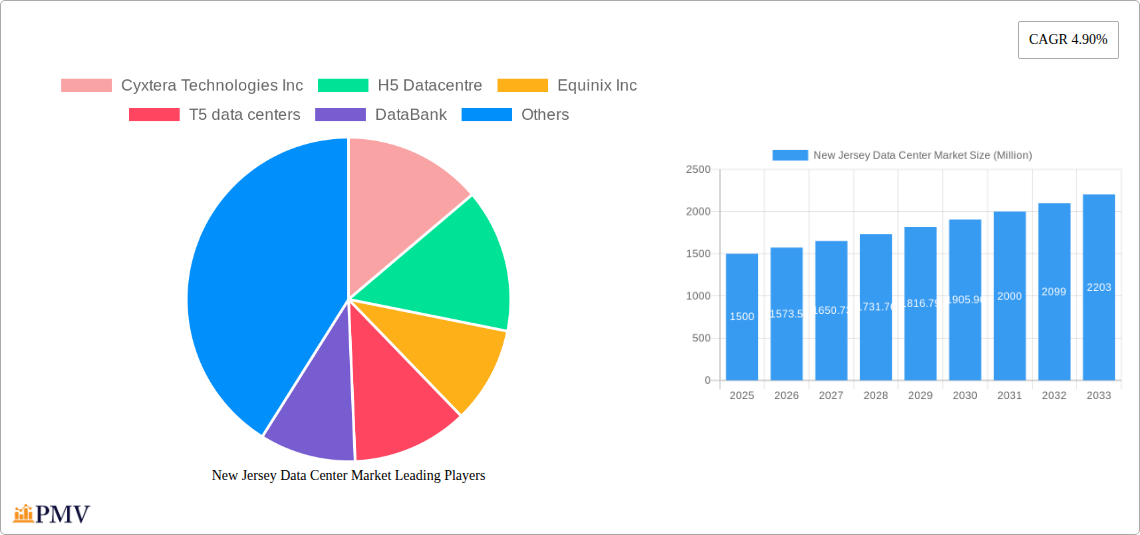

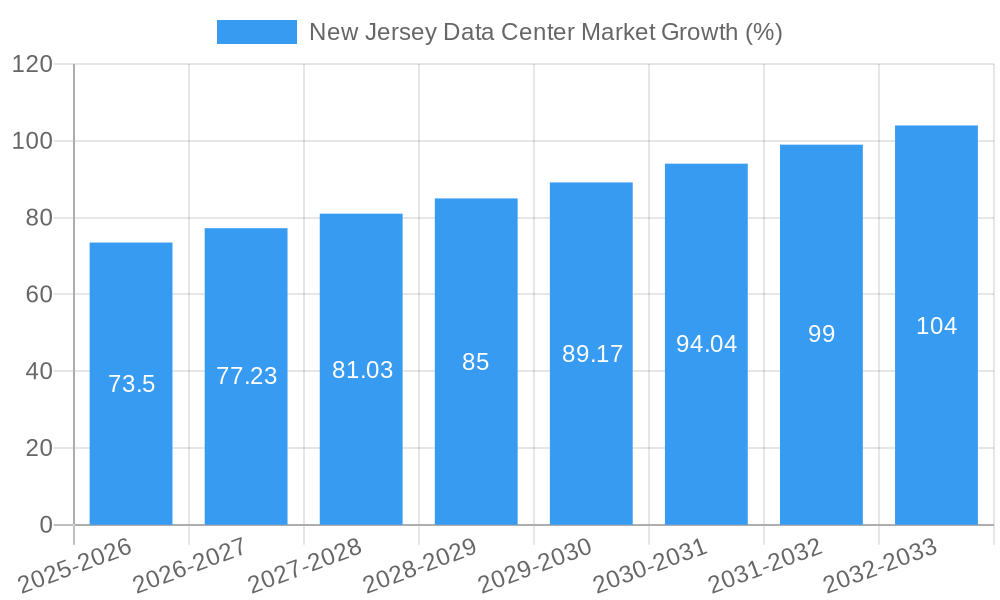

The New Jersey data center market, exhibiting a Compound Annual Growth Rate (CAGR) of 4.90%, presents a compelling investment opportunity. Driven by the burgeoning need for cloud computing infrastructure, increasing digitalization across diverse sectors, and the strategic location of New Jersey within the Northeast Corridor, the market is poised for significant expansion. The robust presence of major financial institutions (BFSI) and media & entertainment companies in the region fuels substantial demand for colocation services, particularly within the large and hyperscale segments. While factors such as high energy costs and land scarcity might act as restraints, the ongoing infrastructure improvements and government initiatives to attract tech investments are mitigating these challenges. The market is segmented by data center size (small to mega), tier type, absorption rate (utilized vs. non-utilized), colocation type (retail, wholesale, hyperscale), and end-user industry. Hyperscale data centers are witnessing significant growth, fueled by the expansion of cloud service providers and the increasing adoption of big data analytics. The wholesale colocation segment is also expected to experience substantial growth due to the increasing demand for large-scale data center deployments. The significant market share of Tier 1 and Tier 3 data centers reflects the preference for high-availability and redundancy among businesses in New Jersey.

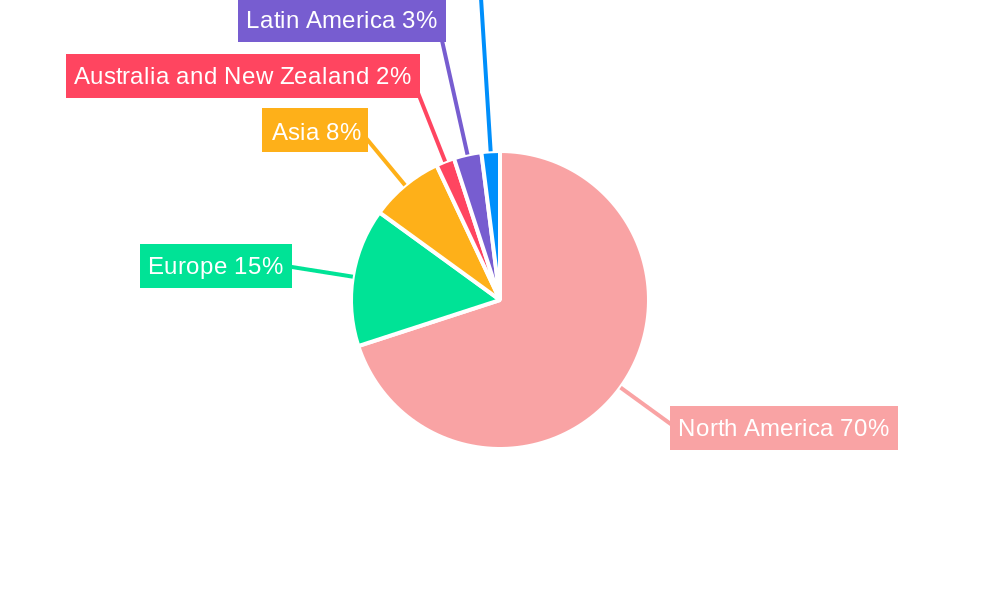

The market's growth trajectory is projected to continue through 2033, with substantial expansion anticipated across all segments. While precise regional market share data is unavailable, we can infer that North America, particularly New Jersey given its strategic location and economic strength, will command a substantial portion of the market. Key players like Equinix, Digital Realty Trust, and other prominent data center providers are actively investing in expanding their capacity within the state, further demonstrating the market's strong growth potential. The continued focus on sustainability and energy efficiency within the data center sector will play a significant role in shaping the market's future. This commitment to environmentally responsible practices will be a crucial factor in attracting new investment and ensuring long-term growth within the New Jersey data center market. The robust pipeline of new projects, coupled with a growing demand for digital infrastructure, paints a picture of sustained expansion in the years to come.

New Jersey Data Center Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the New Jersey data center market, covering market size, segmentation, competitive landscape, growth drivers, and challenges. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The forecast period is 2025-2033, and the historical period encompasses 2019-2024. This report is crucial for businesses, investors, and stakeholders seeking a thorough understanding of this dynamic market.

New Jersey Data Center Market Structure & Competitive Dynamics

The New Jersey data center market exhibits a moderately concentrated structure, with several major players vying for market share. Key players such as Cyxtera Technologies Inc, H5 Datacentre, Equinix Inc, T5 data centers, DataBank, Evocative, CyrusOne, Cologix, CoreSite, and Digital Realty Trust Inc are driving innovation and shaping the competitive landscape. Market share dynamics are influenced by factors like capacity expansion, service offerings, and strategic partnerships. The market is further impacted by a robust regulatory framework ensuring data security and compliance. M&A activities have played a significant role in consolidation, with xx Million in deal values recorded in the past five years. While precise market share figures are proprietary to the full report, the top five players likely control approximately xx% of the total market. End-user trends toward hybrid cloud models and increasing data storage needs further fuel market growth and consolidation. The substitution of legacy infrastructure with modern data center solutions is another contributing factor.

New Jersey Data Center Market Industry Trends & Insights

The New Jersey data center market exhibits robust growth, driven by strong demand from diverse industry sectors. The market is projected to experience a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by technological advancements, including the adoption of edge computing and AI, which necessitate enhanced data center infrastructure. Consumer preference shifts toward cloud-based services and an increase in digital transformation initiatives by businesses also contribute significantly. The heightened focus on cybersecurity enhances the demand for robust data center solutions. The rising penetration of 5G and the Internet of Things (IoT) requires more sophisticated data processing capabilities, further driving market expansion. Competitive dynamics remain intense, with major players expanding capacity and investing in advanced technologies to maintain market leadership. Market penetration rates for various data center services vary greatly. Retail colocation services see significant adoption due to ease of access, while wholesale solutions cater to organizations with large-scale requirements. Overall, the market is expected to witness continuous innovation and evolve in response to the ever-changing technological landscape and user needs.

Dominant Markets & Segments in New Jersey Data Center Market

The New Jersey data center market is characterized by a diverse range of segments, each with distinct growth drivers.

- By DC Size: Large and Mega data centers dominate the market, driven by the needs of hyperscale providers and large enterprises. Small and medium-sized data centers cater to specific niche requirements.

- By Tier Type: Tier III and Tier IV data centers represent a significant portion of the market, offering higher reliability and redundancy features.

- By Absorption: Utilized capacity represents the vast majority of the market, indicating high demand and near-full occupancy rates in established facilities.

- By Colocation Type: Retail colocation is prevalent, with wholesale and hyperscale segments growing rapidly.

- By End User: Cloud & IT, Telecom, and Media & Entertainment sectors are leading the demand, with Government, BFSI, and E-commerce showing significant growth potential. Manufacturing and Other End Users also contribute to overall market size.

The dominance of specific segments stems from several key drivers:

- Economic policies: New Jersey's favorable business environment, tax incentives, and infrastructure investments attract significant investments in data center development.

- Infrastructure: The region's robust power grid, network connectivity, and talent pool are critical factors driving data center growth.

New Jersey Data Center Market Product Innovations

The New Jersey data center market is witnessing significant product innovations, characterized by advancements in energy efficiency, cooling technologies, and increased density. Modular data center designs offer flexibility and scalability, while the integration of AI and machine learning improves operational efficiency and predictive maintenance. These innovations enhance overall performance, reduce operational costs, and improve environmental sustainability. Market fit is strong due to the increasing demand for high-performance, efficient, and secure data center solutions.

Report Segmentation & Scope

This report offers a granular segmentation of the New Jersey data center market, providing detailed insights into various segments.

- By DC Size: Small, Medium, Large, Massive, Mega. Each segment displays distinct growth rates and competitive dynamics.

- By Tier Type: Tier 1, Tier 2, Tier 3, Tier 4. Tier levels reflect different levels of redundancy and reliability, influencing pricing and adoption rates.

- By Absorption: Utilized and Non-Utilized capacity. This provides an accurate picture of market saturation and expansion potential.

- By Colocation Type: Retail, Wholesale, Hyperscale. Each type caters to different customer needs, impacting pricing and service agreements.

- By End User: Cloud & IT, Telecom, Media & Entertainment, Government, BFSI, Manufacturing, E-Commerce, Other End User. This identifies key industries driving market growth. Market size projections and competitive landscapes are detailed for each segment.

Key Drivers of New Jersey Data Center Market Growth

The growth of the New Jersey data center market is fueled by several key factors. These include the increasing adoption of cloud computing and big data analytics, which require robust data center infrastructure. Technological advancements, such as AI and machine learning, necessitate further development and investment in data centers. Furthermore, government initiatives promoting digital transformation and favorable regulatory frameworks enhance market expansion. The strategic location of New Jersey within the northeast corridor provides excellent connectivity and access to major markets, further driving its growth.

Challenges in the New Jersey Data Center Market Sector

The New Jersey data center market faces several challenges. These include the high cost of land and construction, power constraints due to high energy demand, and competition for skilled labor. Regulatory hurdles and environmental concerns, such as energy consumption and waste management, pose further obstacles. Supply chain disruptions impacting equipment procurement and infrastructure development also contribute to the overall challenges faced by this industry.

Leading Players in the New Jersey Data Center Market Market

- Cyxtera Technologies Inc

- H5 Datacentre

- Equinix Inc

- T5 data centers

- DataBank

- Evocative

- CyrusOne

- Cologix

- CoreSite

- Digital Realty Trust Inc

Key Developments in New Jersey Data Center Market Sector

- August 2022: NovoServe launches its first US data center in New Jersey, expanding its bare-metal hosting services to the East Coast. This significantly increases capacity and enhances competition.

- April 2023: Continent 8 Technologies expands its Atlantic City data center by 30%, increasing capacity to meet growing demand within the gambling sector. This reflects strong industry-specific growth within the region.

Strategic New Jersey Data Center Market Outlook

The New Jersey data center market is poised for continued growth, driven by strong demand from various sectors. Strategic opportunities abound for data center providers focusing on sustainability, advanced technologies, and tailored solutions for niche markets. Investing in cutting-edge infrastructure and securing strategic partnerships will be crucial for success. The market's future growth hinges on addressing challenges related to energy consumption, infrastructure limitations, and ensuring continuous innovation.

New Jersey Data Center Market Segmentation

-

1. DC Size

- 1.1. Small

- 1.2. Medium

- 1.3. Large

- 1.4. Massive

- 1.5. Mega

-

2. Tier Type

- 2.1. Tier 1 & 2

- 2.2. Tier 3

- 2.3. Tier 4

-

3. Absorption

-

3.1. Utilized

-

3.1.1. By Colocation Type

- 3.1.1.1. Retail

- 3.1.1.2. Wholesale

- 3.1.1.3. Hyperscale

-

3.1.2. By End User

- 3.1.2.1. Cloud & IT

- 3.1.2.2. Telecom

- 3.1.2.3. Media & Entertainment

- 3.1.2.4. Government

- 3.1.2.5. BFSI

- 3.1.2.6. Manufacturing

- 3.1.2.7. E-Commerce

- 3.1.2.8. Other End User

-

3.1.1. By Colocation Type

- 3.2. Non-Utilized

-

3.1. Utilized

New Jersey Data Center Market Segmentation By Geography

- 1. New Jersey

New Jersey Data Center Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.90% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Adoption of Cloud Services is expected to flourish the market; Increasing Growth in Wholesale Datacenter Multi-tenant Spaces to propel demand (albeit from a lower base); Increased Emphasis on Compliance with Data Regulations and Cost-Effective Nature of Multi-tenant Facilities to Drive Adoption among SME's

- 3.3. Market Restrains

- 3.3.1. Dependence on Regulatory Landscape & Stringent Security Requirements

- 3.4. Market Trends

- 3.4.1. Cloud Computing in BFSI is anticipated to hold a significant share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. New Jersey Data Center Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by DC Size

- 5.1.1. Small

- 5.1.2. Medium

- 5.1.3. Large

- 5.1.4. Massive

- 5.1.5. Mega

- 5.2. Market Analysis, Insights and Forecast - by Tier Type

- 5.2.1. Tier 1 & 2

- 5.2.2. Tier 3

- 5.2.3. Tier 4

- 5.3. Market Analysis, Insights and Forecast - by Absorption

- 5.3.1. Utilized

- 5.3.1.1. By Colocation Type

- 5.3.1.1.1. Retail

- 5.3.1.1.2. Wholesale

- 5.3.1.1.3. Hyperscale

- 5.3.1.2. By End User

- 5.3.1.2.1. Cloud & IT

- 5.3.1.2.2. Telecom

- 5.3.1.2.3. Media & Entertainment

- 5.3.1.2.4. Government

- 5.3.1.2.5. BFSI

- 5.3.1.2.6. Manufacturing

- 5.3.1.2.7. E-Commerce

- 5.3.1.2.8. Other End User

- 5.3.1.1. By Colocation Type

- 5.3.2. Non-Utilized

- 5.3.1. Utilized

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. New Jersey

- 5.1. Market Analysis, Insights and Forecast - by DC Size

- 6. North America New Jersey Data Center Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. Europe New Jersey Data Center Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. Asia New Jersey Data Center Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. Australia and New Zealand New Jersey Data Center Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Latin America New Jersey Data Center Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Middle East and Africa New Jersey Data Center Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Cyxtera Technologies Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 H5 Datacentre

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Equinix Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 T5 data centers

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 DataBank

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Evocative

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 CyrusOne

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Cologix

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 CoreSite

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Digital Realty Trust Inc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Cyxtera Technologies Inc

List of Figures

- Figure 1: New Jersey Data Center Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: New Jersey Data Center Market Share (%) by Company 2024

List of Tables

- Table 1: New Jersey Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: New Jersey Data Center Market Revenue Million Forecast, by DC Size 2019 & 2032

- Table 3: New Jersey Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 4: New Jersey Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 5: New Jersey Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: New Jersey Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: New Jersey Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: New Jersey Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: New Jersey Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: New Jersey Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: New Jersey Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: New Jersey Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: New Jersey Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: New Jersey Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: New Jersey Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: New Jersey Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: New Jersey Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: New Jersey Data Center Market Revenue Million Forecast, by DC Size 2019 & 2032

- Table 19: New Jersey Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 20: New Jersey Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 21: New Jersey Data Center Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the New Jersey Data Center Market?

The projected CAGR is approximately 4.90%.

2. Which companies are prominent players in the New Jersey Data Center Market?

Key companies in the market include Cyxtera Technologies Inc, H5 Datacentre, Equinix Inc, T5 data centers, DataBank, Evocative, CyrusOne, Cologix, CoreSite, Digital Realty Trust Inc.

3. What are the main segments of the New Jersey Data Center Market?

The market segments include DC Size, Tier Type, Absorption.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Adoption of Cloud Services is expected to flourish the market; Increasing Growth in Wholesale Datacenter Multi-tenant Spaces to propel demand (albeit from a lower base); Increased Emphasis on Compliance with Data Regulations and Cost-Effective Nature of Multi-tenant Facilities to Drive Adoption among SME's.

6. What are the notable trends driving market growth?

Cloud Computing in BFSI is anticipated to hold a significant share.

7. Are there any restraints impacting market growth?

Dependence on Regulatory Landscape & Stringent Security Requirements.

8. Can you provide examples of recent developments in the market?

August 2022: NovoServe, based in the Netherlands, will open its first data center in the United States. NovoServe will open the first phase of its New Jersey data center. The bare-metal hosting specialist's US expansion will enable its network customers to serve the US and Canadian East Coast with sub-20ms latency.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "New Jersey Data Center Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the New Jersey Data Center Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the New Jersey Data Center Market?

To stay informed about further developments, trends, and reports in the New Jersey Data Center Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence