Key Insights

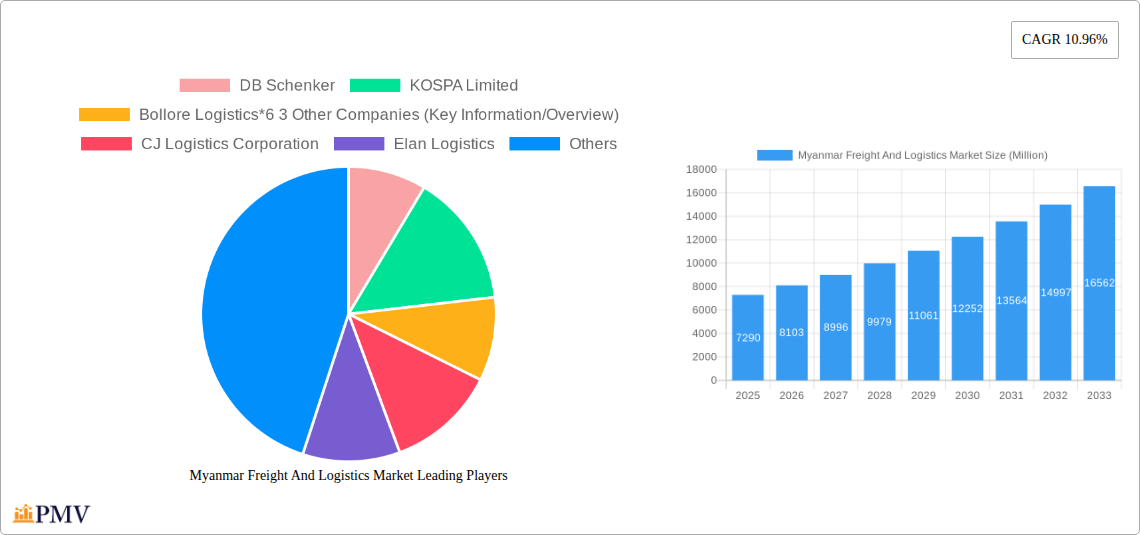

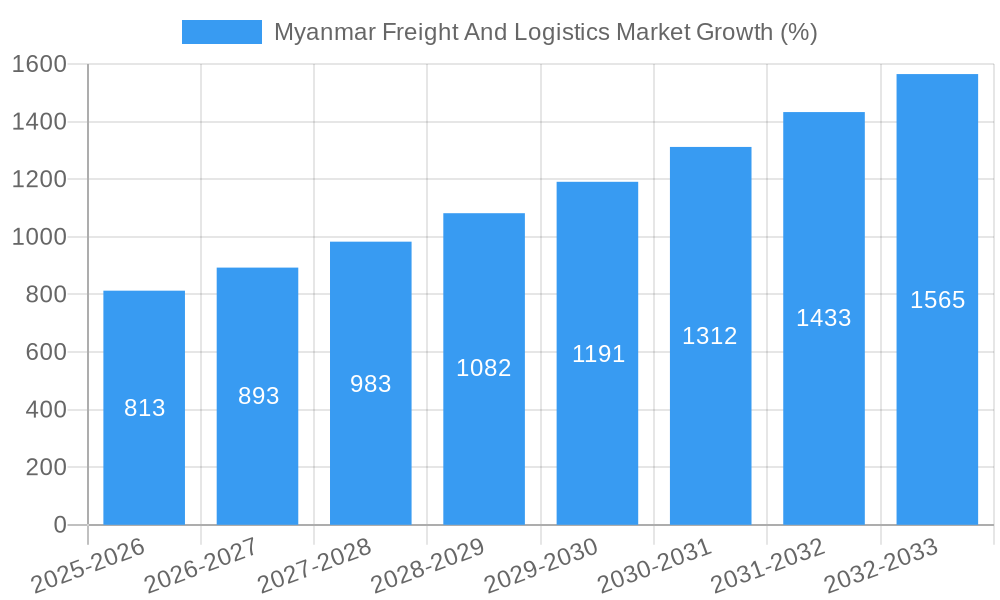

The Myanmar freight and logistics market, valued at $7.29 billion in 2025, exhibits robust growth potential, projected to expand at a compound annual growth rate (CAGR) of 10.96% from 2025 to 2033. This expansion is driven by several key factors. Firstly, Myanmar's burgeoning manufacturing and automotive sectors, coupled with increasing domestic and international trade, fuel demand for efficient transportation and warehousing solutions. The development of infrastructure, albeit still in progress, contributes positively, improving connectivity and reducing logistical bottlenecks. Government initiatives aimed at streamlining customs procedures and promoting foreign investment further stimulate market growth. Growth is also fueled by the increasing adoption of technology within the logistics sector, such as improved tracking systems and digital platforms enhancing supply chain transparency and efficiency. The growth in e-commerce and the rise of organized retail also add significant momentum to this market's expansion.

However, the market faces challenges. Infrastructure limitations, particularly in remote areas, remain a significant constraint, impacting delivery times and costs. Bureaucratic hurdles and regulatory inconsistencies can also create inefficiencies. The relatively underdeveloped technological landscape in certain segments and a lack of skilled workforce in some areas need addressing for sustainable growth. Despite these restraints, the long-term outlook for the Myanmar freight and logistics market remains positive, driven by a growing economy and increasing integration into global trade networks. Companies like DB Schenker, Bolloré Logistics, and CJ Logistics Corporation are already established players, while local firms like Srithai Logistics and Magnate Group Logistics are also contributing significantly to the sector's development. The market presents opportunities for both established international logistics providers and emerging domestic players focusing on specialized services, technology adoption, and addressing specific infrastructural gaps.

This detailed report provides a comprehensive analysis of the Myanmar freight and logistics market, offering invaluable insights for businesses operating in or considering entry into this dynamic sector. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report utilizes a robust methodology, incorporating historical data (2019-2024) and projecting market trends (2025-2033) to deliver actionable intelligence. This report analyzes market size, competitive landscape, growth drivers, challenges, and future opportunities, empowering stakeholders to make informed strategic decisions. The market is segmented by function (Freight Transport, Rail Freight Forwarding, Warehousing, Value-added Services, and Other Functions) and end-users (Manufacturing and Automotive, Oil and Gas, Mining and Quarrying, Agriculture, Fishing and Forestry, Construction, Distributive Trade (including FMCG), and Other End Users (Telecommunications, Food and Beverage, Pharmaceuticals)).

Myanmar Freight and Logistics Market Market Structure & Competitive Dynamics

The Myanmar freight and logistics market exhibits a moderately concentrated structure, with a few large multinational players alongside numerous smaller domestic companies. Market share data reveals that the top five players hold approximately xx% of the overall market (2024 estimate), while the remaining xx% is distributed across a fragmented landscape. This dynamic reflects both the presence of established international players such as DB Schenker and Bolloré Logistics, and the opportunities for local companies. The regulatory framework, while evolving, presents both challenges and opportunities, affecting foreign investment and market entry. Innovation is driven primarily by technological advancements in areas such as warehousing management systems (as seen in DB Schenker's NGW implementation) and digital logistics platforms. Product substitution is minimal, given the specialized nature of many services, though competition focuses heavily on pricing and service quality. M&A activity has been relatively limited in recent years, with deal values totaling approximately xx Million USD between 2019 and 2024. However, increasing foreign investment may spur future consolidation. End-user trends indicate growing demand for efficient and reliable logistics solutions across diverse sectors, driven by economic growth and evolving supply chain needs.

Myanmar Freight and Logistics Market Industry Trends & Insights

The Myanmar freight and logistics market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033, driven by several key factors. Increased foreign direct investment (FDI) is fueling economic growth across various sectors, leading to greater demand for transportation and logistics services. The development of new infrastructure, such as the recently opened port with Indian assistance, significantly improves connectivity and trade efficiency. Technological disruptions, including the adoption of advanced warehousing management systems (e.g., DB Schenker's NextGen Warehouse) and digital freight platforms, enhance operational efficiency and transparency. Furthermore, evolving consumer preferences towards faster delivery times and improved supply chain visibility are shaping the industry's trajectory. Market penetration of advanced logistics technologies remains relatively low, presenting substantial opportunities for technology providers and logistics companies to adopt and implement these solutions. Competitive dynamics are intensifying, with both international and local players vying for market share through strategic pricing, service innovation, and enhanced customer relations. The market’s growth is also influenced by government policies aimed at facilitating trade and improving infrastructure.

Dominant Markets & Segments in Myanmar Freight and Logistics Market

Within the Myanmar freight and logistics market, the Distributive Trade (Wholesale and Retail, including FMCG) segment is currently the dominant end-user, accounting for approximately xx% of the total market value in 2025. This is driven by the growth of the consumer goods sector and increasing demand for efficient distribution networks.

- Key Drivers:

- Rapid expansion of retail and FMCG sectors.

- Rising consumer spending and demand for diverse products.

- Development of modern retail formats.

- Government initiatives to support the retail sector.

The Freight Transport function segment holds the largest share within the functional segmentation of the market, representing approximately xx% of the total market value in 2025, primarily due to the high volume of goods movement across the country. Other significant segments include warehousing and freight forwarding, which are crucial for supporting efficient supply chains.

Myanmar Freight And Logistics Market Product Innovations

Recent innovations in Myanmar's freight and logistics sector have mainly centered on improving efficiency and transparency within warehousing and transportation. The adoption of advanced warehouse management systems (WMS), such as DB Schenker’s NextGen Warehouse system, significantly enhances operational efficiency. These systems optimize inventory management, reduce errors, and improve overall throughput. The integration of technology, including real-time tracking and data analytics, is driving improvements in supply chain visibility and response times. This aligns with the increasing demand for faster and more reliable logistics solutions by businesses and consumers alike.

Report Segmentation & Scope

This report segments the Myanmar freight and logistics market in two primary ways: by function and by end-user.

By Function: The report analyzes market size, growth projections, and competitive dynamics for each functional segment: Freight Transport, Rail Freight Forwarding, Warehousing, Value-added Services (e.g., packaging, labeling, and customs clearance), and Other Functions (e.g., last-mile delivery).

By End-User: The report similarly examines these aspects for key end-user sectors: Manufacturing and Automotive, Oil and Gas, Mining and Quarrying, Agriculture, Fishing and Forestry, Construction, Distributive Trade (Wholesale and Retail including FMCG), and Other End Users (Telecommunications, Food and Beverage, Pharmaceuticals). Each segment's growth trajectory is analyzed, factoring in sector-specific factors and market dynamics.

Key Drivers of Myanmar Freight And Logistics Market Growth

Several factors fuel the growth of Myanmar's freight and logistics market. Economic expansion and increasing FDI are crucial, boosting demand across numerous sectors. Government initiatives to improve infrastructure, such as the development of new ports and transportation networks, significantly enhance connectivity and efficiency. Furthermore, the adoption of advanced technologies in warehousing and transportation optimizes operations and reduces costs. The growing consumer base and evolving consumer preferences for faster and more reliable deliveries also create opportunities within the market.

Challenges in the Myanmar Freight And Logistics Market Sector

Despite the growth potential, several challenges persist. Inadequate infrastructure in certain regions creates bottlenecks and increases transportation costs. Bureaucratic hurdles and regulatory complexities can hinder efficiency and investment. Furthermore, competition among both domestic and international players intensifies, requiring companies to offer innovative and cost-effective solutions. The country's political and economic landscape also presents uncertainty and risk for investors. These factors cumulatively contribute to slowing down the overall growth and making the market somewhat less attractive for both the small and the big investors.

Leading Players in the Myanmar Freight and Logistics Market Market

- DB Schenker

- KOSPA Limited

- Bolloré Logistics

- CJ Logistics Corporation

- Elan Logistics

- Yamato Holdings Co Ltd

- Advantis

- CEA Projects Co Ltd

- Sojitz Logistics Corporation/Premium Sojitz Logistics (PSL)

- Phee Group

- Deutsche Post DHL Group

- Nippon Yusen Kabushiki Kaisha (Yusen Logistics Co Ltd)

- Damco

- Dextra Group Kargo

- DKSH Tigers Logistics

- Indo Trans Logistics Corporation

- Hellmann Worldwide Logistics

- Bee Logistics Corp

- SUZUE Corporation

- SECURE Shipping Services Co Ltd

- Rhenus Logistics

- Srithai Logistics

- Global Gifts Logistics Myanmar

- Hercules Logistics

- Daizen

- Magnate Group Logistics Company Limited

- EFR Group of Companies

Key Developments in Myanmar Freight And Logistics Market Sector

- August 2023: DB Schenker Myanmar migrated a leading consumer company to the NextGen Warehouse (NGW) Management System, showcasing the adoption of advanced IT solutions within the sector.

- May 2023: The opening of a new port, built with Indian assistance, signifies enhanced connectivity and reflects growing economic ties between India, China, and Myanmar, impacting trade volumes and logistics operations.

Strategic Myanmar Freight and Logistics Market Market Outlook

The Myanmar freight and logistics market presents a significant long-term growth potential. Continued infrastructure development, coupled with technological advancements and increasing FDI, will drive market expansion. Strategic opportunities exist for companies offering innovative solutions, efficient operations, and advanced technologies to gain a competitive edge. Focusing on specific niche markets and catering to the evolving needs of end-users will be crucial for success in this dynamic environment. The market is expected to continue its growth trajectory, presenting considerable opportunities for both domestic and international players who can navigate the challenges and leverage the market's inherent potential.

Myanmar Freight And Logistics Market Segmentation

-

1. Function

-

1.1. Freight Transport

- 1.1.1. Road

- 1.1.2. Shipping and Inland Water

- 1.1.3. Air

- 1.1.4. Rail

- 1.2. Freight Forwarding

- 1.3. Warehousing

- 1.4. Value-added Services and Other Functions

-

1.1. Freight Transport

-

2. End Users

- 2.1. Manufacturing and Automotive

- 2.2. Oil and Gas, Mining, and Quarrying

- 2.3. Agriculture, Fishing, and Forestry

- 2.4. Construction

- 2.5. Distribu

- 2.6. Other En

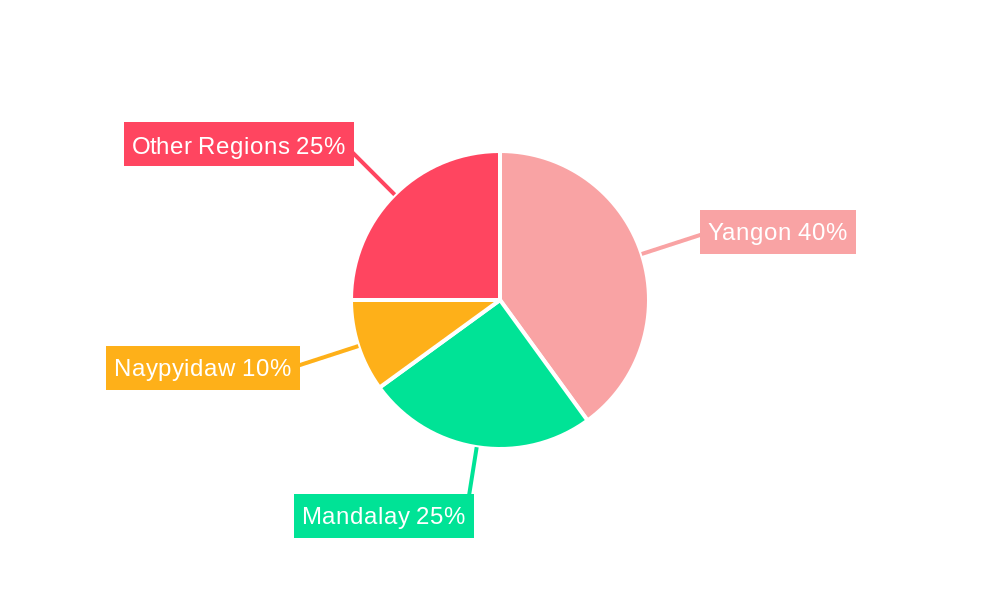

Myanmar Freight And Logistics Market Segmentation By Geography

- 1. Myanmar

Myanmar Freight And Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.96% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rapid E-commerce Growth4.; Development Of Logistics Infrastructure And Connectivity

- 3.3. Market Restrains

- 3.3.1. 4.; Logistics Integration In Last-mile Delivery

- 3.4. Market Trends

- 3.4.1. Road Transport Sector Remains the Dominant Mode of Transportation

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Myanmar Freight And Logistics Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Function

- 5.1.1. Freight Transport

- 5.1.1.1. Road

- 5.1.1.2. Shipping and Inland Water

- 5.1.1.3. Air

- 5.1.1.4. Rail

- 5.1.2. Freight Forwarding

- 5.1.3. Warehousing

- 5.1.4. Value-added Services and Other Functions

- 5.1.1. Freight Transport

- 5.2. Market Analysis, Insights and Forecast - by End Users

- 5.2.1. Manufacturing and Automotive

- 5.2.2. Oil and Gas, Mining, and Quarrying

- 5.2.3. Agriculture, Fishing, and Forestry

- 5.2.4. Construction

- 5.2.5. Distribu

- 5.2.6. Other En

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Myanmar

- 5.1. Market Analysis, Insights and Forecast - by Function

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 DB Schenker

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 KOSPA Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bollore Logistics*6 3 Other Companies (Key Information/Overview)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 CJ Logistics Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Elan Logistics

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Yamato Holdings Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Advantis

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 CEA Projects Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Sojitz Logistics Corporation/Premium Sojitz Logistics (PSL)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Phee Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Deutsche Post DHL Group

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Nippon Yusen Kabushiki Kaisha (Yusen Logistics Co Ltd )

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Damco

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Dextra Group Kargo DKSH Tigers Logistics Indo Trans Logistics Corporation Hellmann Worldwide Logistics Bee Logistics Corp SUZUE Corporation SECURE Shipping Services Co Ltd Rhenus Logistics Srithai Logistics Global Gifts Logistics Myanmar Hercules Logistics Daizen

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Magnate Group Logistics Company Limited

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 EFR Group of Companies

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.1 DB Schenker

List of Figures

- Figure 1: Myanmar Freight And Logistics Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Myanmar Freight And Logistics Market Share (%) by Company 2024

List of Tables

- Table 1: Myanmar Freight And Logistics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Myanmar Freight And Logistics Market Revenue Million Forecast, by Function 2019 & 2032

- Table 3: Myanmar Freight And Logistics Market Revenue Million Forecast, by End Users 2019 & 2032

- Table 4: Myanmar Freight And Logistics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Myanmar Freight And Logistics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Myanmar Freight And Logistics Market Revenue Million Forecast, by Function 2019 & 2032

- Table 7: Myanmar Freight And Logistics Market Revenue Million Forecast, by End Users 2019 & 2032

- Table 8: Myanmar Freight And Logistics Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Myanmar Freight And Logistics Market?

The projected CAGR is approximately 10.96%.

2. Which companies are prominent players in the Myanmar Freight And Logistics Market?

Key companies in the market include DB Schenker, KOSPA Limited, Bollore Logistics*6 3 Other Companies (Key Information/Overview), CJ Logistics Corporation, Elan Logistics, Yamato Holdings Co Ltd, Advantis, CEA Projects Co Ltd, Sojitz Logistics Corporation/Premium Sojitz Logistics (PSL), Phee Group, Deutsche Post DHL Group, Nippon Yusen Kabushiki Kaisha (Yusen Logistics Co Ltd ), Damco, Dextra Group Kargo DKSH Tigers Logistics Indo Trans Logistics Corporation Hellmann Worldwide Logistics Bee Logistics Corp SUZUE Corporation SECURE Shipping Services Co Ltd Rhenus Logistics Srithai Logistics Global Gifts Logistics Myanmar Hercules Logistics Daizen, Magnate Group Logistics Company Limited, EFR Group of Companies.

3. What are the main segments of the Myanmar Freight And Logistics Market?

The market segments include Function, End Users.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.29 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Rapid E-commerce Growth4.; Development Of Logistics Infrastructure And Connectivity.

6. What are the notable trends driving market growth?

Road Transport Sector Remains the Dominant Mode of Transportation.

7. Are there any restraints impacting market growth?

4.; Logistics Integration In Last-mile Delivery.

8. Can you provide examples of recent developments in the market?

August 2023: DB Schenker Myanmar migrated a leading consumer company to the NextGen Warehouse (NGW) Management System. This is DB Schenker’s advanced IT solution for Contract Logistics operations.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Myanmar Freight And Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Myanmar Freight And Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Myanmar Freight And Logistics Market?

To stay informed about further developments, trends, and reports in the Myanmar Freight And Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence