Key Insights

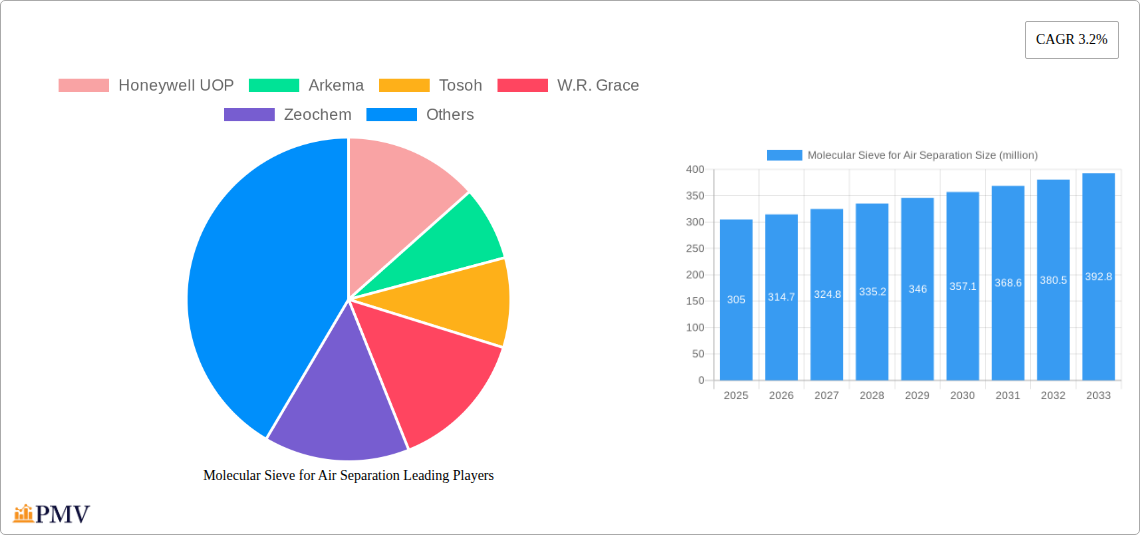

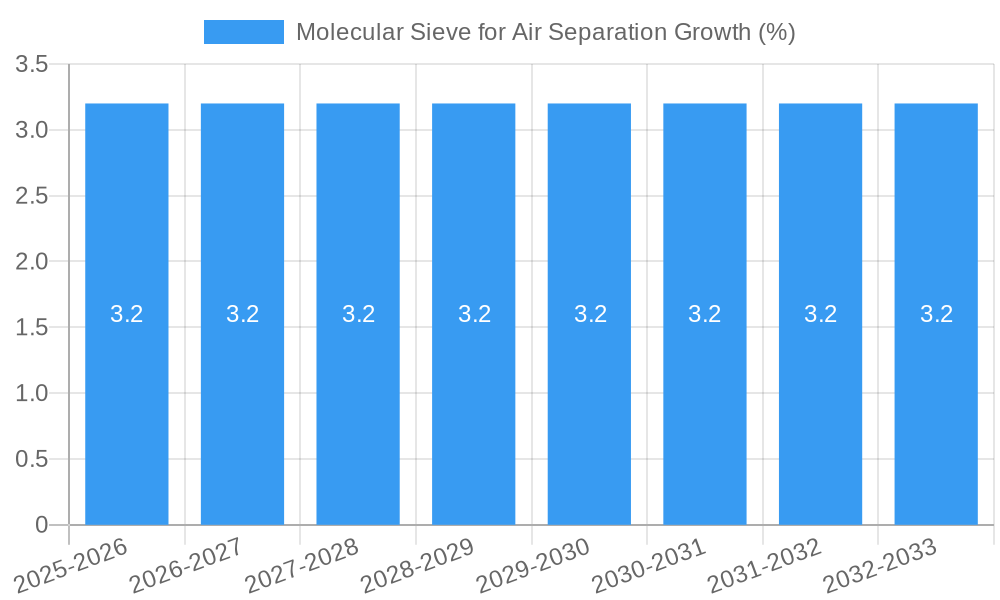

The global market for Molecular Sieves in Air Separation is poised for robust growth, projected to reach approximately $305 million by 2025, with a projected Compound Annual Growth Rate (CAGR) of 3.2% from 2019 to 2033. This expansion is primarily driven by the increasing demand for high-purity nitrogen and oxygen across various industrial applications, including medical, electronics manufacturing, and food and beverage packaging. The growing adoption of advanced air separation technologies, which leverage the superior adsorption capabilities of molecular sieves for efficient gas separation, is a significant catalyst. Furthermore, stringent environmental regulations promoting cleaner industrial processes and the need for energy-efficient separation techniques are further bolstering market adoption. The "Air Purification" application segment is expected to be a major contributor, driven by the escalating global focus on improving air quality in industrial and urban environments.

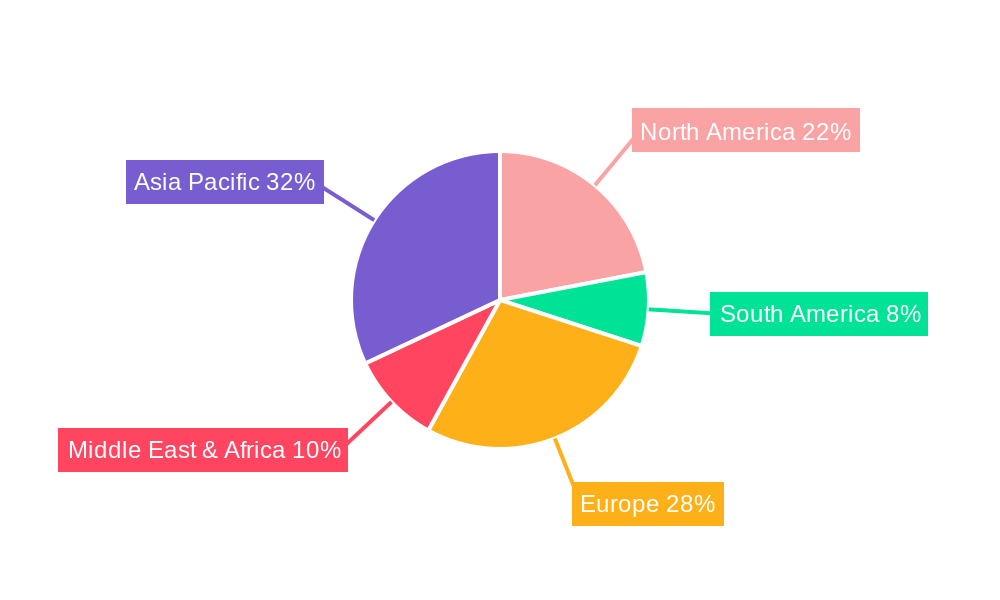

The market is characterized by a dynamic competitive landscape with key players like Honeywell UOP, Arkema, and Tosoh investing in research and development to enhance sieve performance and develop customized solutions for specific industrial needs. Emerging economies in the Asia Pacific region, particularly China and India, represent substantial growth opportunities due to rapid industrialization and increasing investments in critical sectors requiring purified gases. Trends indicate a shift towards more specialized molecular sieve types, such as 5A zeolites, offering enhanced selectivity and capacity for specific gas mixtures. However, challenges such as the fluctuating raw material costs and the need for significant initial capital investment in advanced separation units could moderate the growth pace. Despite these challenges, the fundamental demand for high-purity gases, coupled with ongoing technological advancements, ensures a positive outlook for the molecular sieve market in air separation.

Molecular Sieve for Air Separation Market: Comprehensive Industry Analysis and Forecast (2019-2033)

This detailed report provides an in-depth analysis of the global Molecular Sieve for Air Separation market, offering critical insights into market dynamics, growth drivers, segmentation, and competitive landscapes. Covering the historical period (2019-2024), base year (2025), and extending to the forecast period (2025-2033), this study is an indispensable resource for stakeholders seeking to understand and capitalize on emerging opportunities in air purification, nitrogen-oxygen separation, and other related applications. The report meticulously examines various molecular sieve types, including 3A, 4A, 5A, TypeX, and others, to provide a holistic market view.

Molecular Sieve for Air Separation Market Structure & Competitive Dynamics

The global Molecular Sieve for Air Separation market exhibits a moderate to high level of concentration, driven by a mix of established global players and emerging regional manufacturers. Key companies such as Honeywell UOP, Arkema, Tosoh, W.R. Grace, Zeochem, Chemiewerk Bad Köstritz GmbH, BASF, KNT Group, Zeolites & Allied, Luoyang Jianlong Chemical, Haixin Chemical, Shanghai Hengye, Fulong New Materials, Pingxiang Xintao, Zhengzhou Snow, Henan Huanyu Molecular Sieve, Shanghai Jiu-Zhou Chemical, Anhui Mingmei Minchem, Shanghai Zeolite Molecular Sieve, Shanghai Lvqiang New Material contribute to a dynamic competitive environment. Innovation ecosystems are characterized by continuous research and development focused on enhancing adsorption capacity, selectivity, and regeneration efficiency of molecular sieves for improved nitrogen-oxygen separation and air purification processes. Regulatory frameworks, particularly concerning environmental emissions and industrial safety standards, play a significant role in shaping market entry and product development strategies. Product substitutes, while present in some niche applications, offer limited direct competition for high-performance molecular sieves in demanding industrial air separation. End-user trends indicate a growing demand for on-site nitrogen generation and oxygen enrichment systems, driven by cost-effectiveness and supply chain reliability. Mergers and acquisitions (M&A) activities, with reported deal values in the range of several hundred million dollars annually, are strategically aimed at consolidating market share, expanding product portfolios, and acquiring advanced technological capabilities. Market share distribution is dynamic, with leading companies holding substantial portions of the global market, estimated to be in the range of 20-30% for top players.

Molecular Sieve for Air Separation Industry Trends & Insights

The Molecular Sieve for Air Separation industry is experiencing robust growth, primarily propelled by an escalating demand for high-purity nitrogen and oxygen across diverse industrial sectors. The nitrogen-oxygen separation segment, a cornerstone of this market, is witnessing an increasing adoption of pressure swing adsorption (PSA) and vacuum swing adsorption (VSA) technologies, which rely heavily on advanced molecular sieve adsorbents. This surge is fueled by the expanding applications of nitrogen in food packaging, electronics manufacturing, petrochemical refining, and medical gas production, where its inert properties are crucial for product integrity and process safety. Similarly, the growing requirement for medical-grade oxygen, especially in healthcare facilities worldwide, is a significant market driver. The air purification application, though currently a smaller segment, is poised for substantial expansion driven by stringent environmental regulations and rising awareness regarding air quality, particularly in urban centers and industrial zones. Technological disruptions are a constant feature, with ongoing research focused on developing molecular sieves with enhanced adsorption kinetics, superior water and CO2 tolerance, and extended operational lifetimes. These innovations aim to reduce energy consumption during regeneration cycles and improve the overall efficiency of air separation units, thereby lowering operational costs for end-users. Companies are investing heavily in the development of novel zeolite structures and optimized pore sizes tailored for specific separation challenges. Consumer preferences are shifting towards more sustainable and energy-efficient separation processes, favoring molecular sieve technologies that minimize environmental impact. The competitive dynamics are intense, characterized by price competition, product differentiation through performance enhancements, and strategic partnerships to secure raw material supply and market access. Market penetration for advanced molecular sieves is steadily increasing, with the overall market CAGR estimated at 5-7% during the forecast period. The market size is projected to reach approximately three billion dollars by 2033.

Dominant Markets & Segments in Molecular Sieve for Air Separation

The Asia Pacific region stands as the dominant market for molecular sieves in air separation, driven by its rapidly industrializing economies and expanding manufacturing base. Countries like China and India are at the forefront, with significant investments in petrochemicals, electronics, food processing, and healthcare sectors, all of which are major consumers of industrial gases produced via molecular sieve technology. Government initiatives promoting domestic manufacturing and infrastructure development further bolster demand. Within the application segmentation, Nitrogen-Oxygen Separation unequivocally holds the largest market share, estimated at over 60%, due to the ubiquitous need for pure nitrogen and oxygen in diverse industrial processes. Key drivers for its dominance include:

- Petrochemical Industry: Essential for inerting vessels, blanketing, and purging in refineries and chemical plants.

- Electronics Manufacturing: Critical for creating inert atmospheres during semiconductor fabrication and component assembly, preventing oxidation.

- Food & Beverage Packaging: Used for modified atmosphere packaging (MAP) to extend shelf life and preserve product quality.

- Medical Gas Supply: Direct production of medical-grade oxygen for hospitals and clinics.

- Metallurgy: Employed in heat treatment and welding processes.

The TypeX molecular sieve, particularly variants like 13X, is the leading product type, accounting for an estimated 40% of the market. Its broad adsorption capabilities, including significant capacity for CO2 and water, make it highly versatile for bulk air separation.

- Broad Adsorption Spectrum: Effectively removes water, carbon dioxide, and other impurities from air.

- High Capacity: Offers excellent adsorption capacity for bulk air separation applications.

- Cost-Effectiveness: Generally more economical than specialized sieves for general-purpose separation.

In terms of specific molecular sieve types, 3A and 4A sieves also command significant shares due to their specialized roles in drying and finer purification, respectively. The Air Purification segment, while smaller, is exhibiting the highest growth rate, projected at 8-10% CAGR, driven by increasing urbanization, industrial pollution, and a growing emphasis on indoor air quality. Economic policies supporting cleaner industrial practices and infrastructure development for enhanced air quality monitoring and control are key accelerators.

Molecular Sieve for Air Separation Product Innovations

Product innovations in molecular sieves for air separation are primarily focused on enhancing performance characteristics and expanding their application range. Developments include novel zeolite structures offering superior selectivity for oxygen or nitrogen, improved thermal stability for higher regeneration temperatures, and increased resistance to contaminants like hydrocarbons and sulfur compounds. Advancements in manufacturing processes have led to the production of molecular sieves with more uniform particle size distribution and optimized pore structures, resulting in faster adsorption kinetics and higher capacities. These innovations provide a competitive advantage by enabling more efficient and cost-effective air separation, catering to the growing demand for on-site gas generation and specialized industrial applications. The market is witnessing a trend towards tailor-made molecular sieve solutions designed for specific operational parameters and impurity profiles, offering end-users enhanced performance and reduced operational costs.

Report Segmentation & Scope

This report segments the Molecular Sieve for Air Separation market comprehensively to provide granular insights.

Application Segmentation:

- Air Purification: This segment focuses on molecular sieves used in air filtration systems for removing pollutants and contaminants, contributing to improved air quality in industrial and residential settings. Growth is driven by stringent environmental regulations and health awareness.

- Nitrogen-Oxygen Separation: This is the largest segment, encompassing molecular sieves utilized in PSA and VSA systems for producing high-purity nitrogen and oxygen for industrial, medical, and laboratory applications. Demand is propelled by growth in the electronics, petrochemical, and healthcare industries.

- Others: This category includes niche applications such as the purification of process gases and specialized drying applications.

Type Segmentation:

- 3A: Primarily used for drying applications due to its specific pore size, effectively adsorbing water molecules while excluding larger molecules.

- 4A: A general-purpose molecular sieve ideal for drying and purification tasks where water and CO2 removal are primary requirements.

- 5A: Exhibits a larger pore size, suitable for separating linear paraffins from branched or cyclic hydrocarbons and for general drying.

- TypeX: This broad category includes variants like 13X, known for its high adsorption capacity for a wide range of molecules, making it ideal for bulk air separation.

- Others: Encompasses specialized molecular sieve types developed for unique separation challenges.

Key Drivers of Molecular Sieve for Air Separation Growth

The growth of the Molecular Sieve for Air Separation market is propelled by several key factors. Technologically, continuous advancements in zeolite synthesis and manufacturing processes are yielding molecular sieves with enhanced adsorption capacity, selectivity, and regeneration efficiency. This leads to more energy-efficient and cost-effective air separation units. Economically, the increasing demand for industrial gases, particularly nitrogen for food packaging, electronics, and petrochemical inerting, and oxygen for medical applications, forms a significant growth engine. The global expansion of these end-user industries directly translates into higher demand for molecular sieves. Regulatory factors, such as stricter environmental regulations promoting cleaner industrial processes and improved air quality standards, also drive the adoption of on-site gas generation technologies, which rely heavily on molecular sieves. For instance, the push for reduced greenhouse gas emissions encourages industries to optimize their processes, often requiring precise gas compositions provided by molecular sieve separation.

Challenges in the Molecular Sieve for Air Separation Sector

Despite its robust growth, the Molecular Sieve for Air Separation sector faces several challenges. Regulatory hurdles, particularly in emerging economies, related to environmental compliance and safety standards for industrial gas production can slow down market penetration. Supply chain disruptions, including fluctuations in raw material availability and pricing (e.g., for silica and alumina), can impact production costs and lead times, with potential impacts of 5-10% on manufacturing expenses. Competitive pressures from established players and the emergence of new technologies, though less impactful than molecular sieves in core applications, also necessitate continuous innovation and cost optimization. Furthermore, the high initial investment required for advanced air separation units can be a barrier for smaller enterprises, limiting the adoption of cutting-edge molecular sieve technologies in certain segments. The energy consumption during the regeneration cycle, while improving with new technologies, remains a consideration for energy-intensive industries.

Leading Players in the Molecular Sieve for Air Separation Market

- Honeywell UOP

- Arkema

- Tosoh

- W.R. Grace

- Zeochem

- Chemiewerk Bad Köstritz GmbH

- BASF

- KNT Group

- Zeolites & Allied

- Luoyang Jianlong Chemical

- Haixin Chemical

- Shanghai Hengye

- Fulong New Materials

- Pingxiang Xintao

- Zhengzhou Snow

- Henan Huanyu Molecular Sieve

- Shanghai Jiu-Zhou Chemical

- Anhui Mingmei Minchem

- Shanghai Zeolite Molecular Sieve

- Shanghai Lvqiang New Material

Key Developments in Molecular Sieve for Air Separation Sector

- 2023: Honeywell UOP launches a new generation of molecular sieves for enhanced PSA nitrogen generation, boasting higher capacity and faster kinetics.

- 2023: Arkema expands its production capacity for molecular sieves in Asia, anticipating increased demand from the electronics and medical sectors.

- 2022: W.R. Grace introduces an advanced molecular sieve variant with improved resistance to hydrocarbon contaminants for challenging petrochemical applications.

- 2022: Zeochem announces a strategic partnership with a leading air separation equipment manufacturer to co-develop optimized adsorbent solutions.

- 2021: BASF showcases novel zeolite structures with enhanced selectivity for oxygen separation, targeting the medical and industrial gas markets.

- 2020: The COVID-19 pandemic highlighted the critical importance of medical oxygen, driving significant investment and innovation in related molecular sieve technologies for on-site generation.

Strategic Molecular Sieve for Air Separation Market Outlook

The strategic outlook for the Molecular Sieve for Air Separation market is highly positive, characterized by sustained growth and emerging opportunities. The increasing industrialization in developing economies, coupled with stringent environmental regulations worldwide, will continue to fuel the demand for efficient gas separation solutions. Advancements in molecular sieve technology, leading to higher performance, energy efficiency, and longer lifespans, will remain crucial differentiators. Strategic opportunities lie in expanding market reach in the rapidly growing air purification sector and catering to the evolving needs of the medical gas industry. Furthermore, the development of customized molecular sieve solutions for niche applications and industries experiencing rapid technological advancements, such as advanced battery manufacturing and carbon capture technologies, presents significant untapped potential. Investment in research and development to create adsorbents with even greater selectivity and lower regeneration energy will be key to maintaining a competitive edge and capitalizing on future market expansion.

Molecular Sieve for Air Separation Segmentation

-

1. Application

- 1.1. Air Purification

- 1.2. Nitrogen-Oxygen Separation

- 1.3. Others

-

2. Types

- 2.1. 3A

- 2.2. 4A

- 2.3. 5A

- 2.4. TypeX

- 2.5. Others

Molecular Sieve for Air Separation Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Molecular Sieve for Air Separation REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.2% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Molecular Sieve for Air Separation Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Air Purification

- 5.1.2. Nitrogen-Oxygen Separation

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. 3A

- 5.2.2. 4A

- 5.2.3. 5A

- 5.2.4. TypeX

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Molecular Sieve for Air Separation Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Air Purification

- 6.1.2. Nitrogen-Oxygen Separation

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. 3A

- 6.2.2. 4A

- 6.2.3. 5A

- 6.2.4. TypeX

- 6.2.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Molecular Sieve for Air Separation Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Air Purification

- 7.1.2. Nitrogen-Oxygen Separation

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. 3A

- 7.2.2. 4A

- 7.2.3. 5A

- 7.2.4. TypeX

- 7.2.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Molecular Sieve for Air Separation Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Air Purification

- 8.1.2. Nitrogen-Oxygen Separation

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. 3A

- 8.2.2. 4A

- 8.2.3. 5A

- 8.2.4. TypeX

- 8.2.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Molecular Sieve for Air Separation Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Air Purification

- 9.1.2. Nitrogen-Oxygen Separation

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. 3A

- 9.2.2. 4A

- 9.2.3. 5A

- 9.2.4. TypeX

- 9.2.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Molecular Sieve for Air Separation Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Air Purification

- 10.1.2. Nitrogen-Oxygen Separation

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. 3A

- 10.2.2. 4A

- 10.2.3. 5A

- 10.2.4. TypeX

- 10.2.5. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Honeywell UOP

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Arkema

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Tosoh

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 W.R. Grace

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Zeochem

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Chemiewerk Bad Köstritz GmbH

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 BASF

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 KNT Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Zeolites & Allied

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Luoyang Jianlong Chemical

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Haixin Chemical

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Shanghai Hengye

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Fulong New Materials

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Pingxiang Xintao

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Zhengzhou Snow

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Henan Huanyu Molecular Sieve

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Shanghai Jiu-Zhou Chemical

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Anhui Mingmei Minchem

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Shanghai Zeolite Molecular Sieve

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Shanghai Lvqiang New Material

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.1 Honeywell UOP

List of Figures

- Figure 1: Global Molecular Sieve for Air Separation Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Molecular Sieve for Air Separation Revenue (million), by Application 2024 & 2032

- Figure 3: North America Molecular Sieve for Air Separation Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Molecular Sieve for Air Separation Revenue (million), by Types 2024 & 2032

- Figure 5: North America Molecular Sieve for Air Separation Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Molecular Sieve for Air Separation Revenue (million), by Country 2024 & 2032

- Figure 7: North America Molecular Sieve for Air Separation Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Molecular Sieve for Air Separation Revenue (million), by Application 2024 & 2032

- Figure 9: South America Molecular Sieve for Air Separation Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Molecular Sieve for Air Separation Revenue (million), by Types 2024 & 2032

- Figure 11: South America Molecular Sieve for Air Separation Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Molecular Sieve for Air Separation Revenue (million), by Country 2024 & 2032

- Figure 13: South America Molecular Sieve for Air Separation Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Molecular Sieve for Air Separation Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Molecular Sieve for Air Separation Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Molecular Sieve for Air Separation Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Molecular Sieve for Air Separation Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Molecular Sieve for Air Separation Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Molecular Sieve for Air Separation Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Molecular Sieve for Air Separation Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Molecular Sieve for Air Separation Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Molecular Sieve for Air Separation Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Molecular Sieve for Air Separation Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Molecular Sieve for Air Separation Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Molecular Sieve for Air Separation Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Molecular Sieve for Air Separation Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Molecular Sieve for Air Separation Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Molecular Sieve for Air Separation Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Molecular Sieve for Air Separation Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Molecular Sieve for Air Separation Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Molecular Sieve for Air Separation Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Molecular Sieve for Air Separation Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Molecular Sieve for Air Separation Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Molecular Sieve for Air Separation Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Molecular Sieve for Air Separation Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Molecular Sieve for Air Separation Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Molecular Sieve for Air Separation Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Molecular Sieve for Air Separation Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Molecular Sieve for Air Separation Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Molecular Sieve for Air Separation Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Molecular Sieve for Air Separation Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Molecular Sieve for Air Separation Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Molecular Sieve for Air Separation Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Molecular Sieve for Air Separation Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Molecular Sieve for Air Separation Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Molecular Sieve for Air Separation Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Molecular Sieve for Air Separation Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Molecular Sieve for Air Separation Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Molecular Sieve for Air Separation Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Molecular Sieve for Air Separation Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Molecular Sieve for Air Separation Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Molecular Sieve for Air Separation Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Molecular Sieve for Air Separation Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Molecular Sieve for Air Separation Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Molecular Sieve for Air Separation Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Molecular Sieve for Air Separation Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Molecular Sieve for Air Separation Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Molecular Sieve for Air Separation Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Molecular Sieve for Air Separation Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Molecular Sieve for Air Separation Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Molecular Sieve for Air Separation Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Molecular Sieve for Air Separation Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Molecular Sieve for Air Separation Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Molecular Sieve for Air Separation Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Molecular Sieve for Air Separation Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Molecular Sieve for Air Separation Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Molecular Sieve for Air Separation Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Molecular Sieve for Air Separation Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Molecular Sieve for Air Separation Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Molecular Sieve for Air Separation Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Molecular Sieve for Air Separation Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Molecular Sieve for Air Separation Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Molecular Sieve for Air Separation Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Molecular Sieve for Air Separation Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Molecular Sieve for Air Separation Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Molecular Sieve for Air Separation Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Molecular Sieve for Air Separation Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Molecular Sieve for Air Separation Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Molecular Sieve for Air Separation?

The projected CAGR is approximately 3.2%.

2. Which companies are prominent players in the Molecular Sieve for Air Separation?

Key companies in the market include Honeywell UOP, Arkema, Tosoh, W.R. Grace, Zeochem, Chemiewerk Bad Köstritz GmbH, BASF, KNT Group, Zeolites & Allied, Luoyang Jianlong Chemical, Haixin Chemical, Shanghai Hengye, Fulong New Materials, Pingxiang Xintao, Zhengzhou Snow, Henan Huanyu Molecular Sieve, Shanghai Jiu-Zhou Chemical, Anhui Mingmei Minchem, Shanghai Zeolite Molecular Sieve, Shanghai Lvqiang New Material.

3. What are the main segments of the Molecular Sieve for Air Separation?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 280 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Molecular Sieve for Air Separation," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Molecular Sieve for Air Separation report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Molecular Sieve for Air Separation?

To stay informed about further developments, trends, and reports in the Molecular Sieve for Air Separation, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence