Key Insights

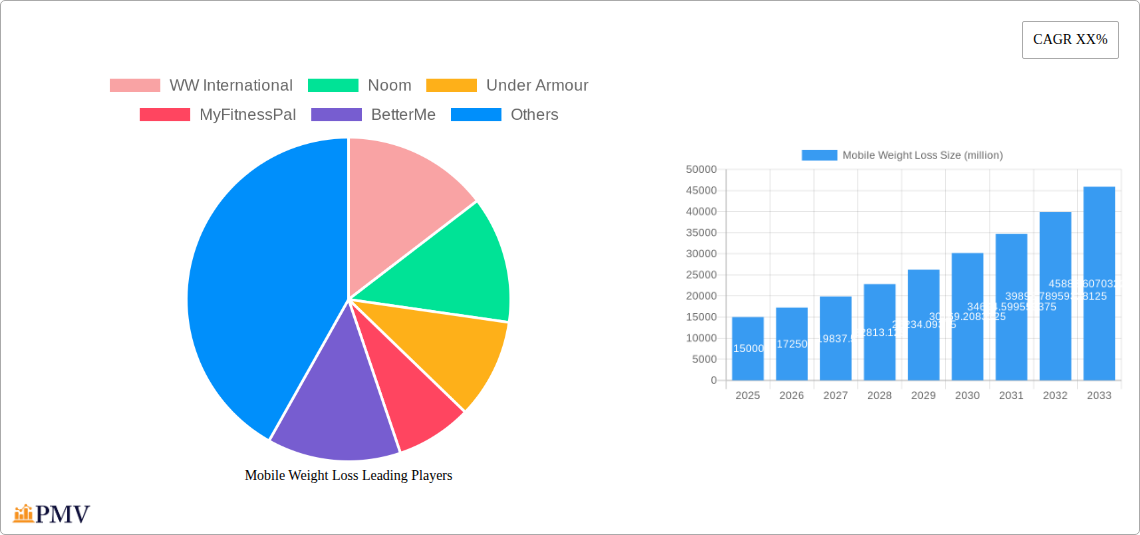

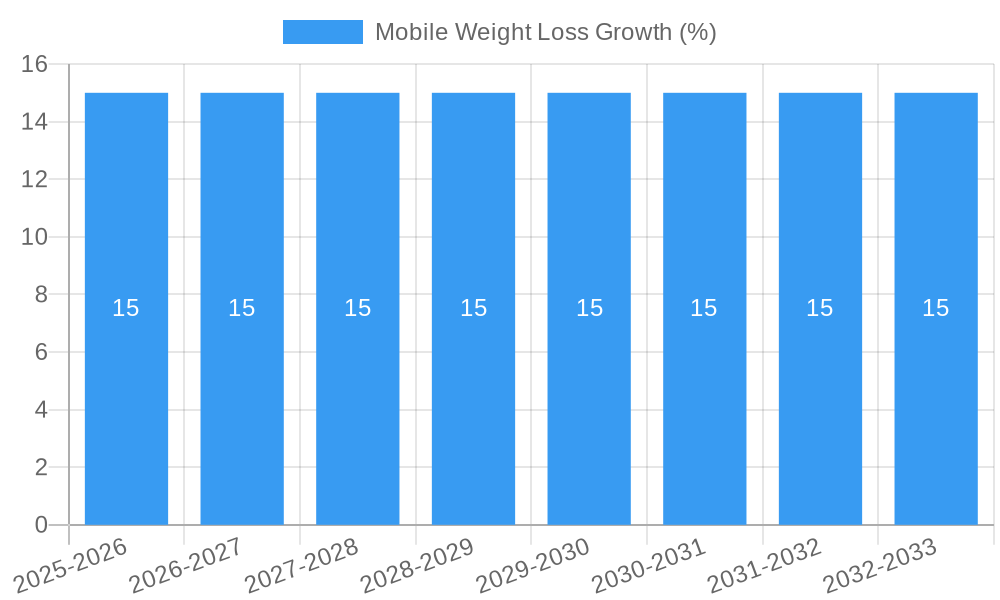

The global mobile weight loss market is poised for significant expansion, projected to reach a substantial market size of approximately $15,000 million by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of around 15% through 2033. This robust growth is primarily fueled by increasing health consciousness among individuals worldwide, a growing prevalence of obesity and related health conditions, and the widespread adoption of smartphones and wearable devices. The convenience and accessibility offered by mobile applications for tracking calorie intake, physical activity, and receiving personalized coaching are major drivers attracting a diverse user base. Furthermore, advancements in AI and machine learning are enabling more sophisticated and tailored weight management programs, enhancing user engagement and adherence, which are crucial for long-term success in this competitive landscape.

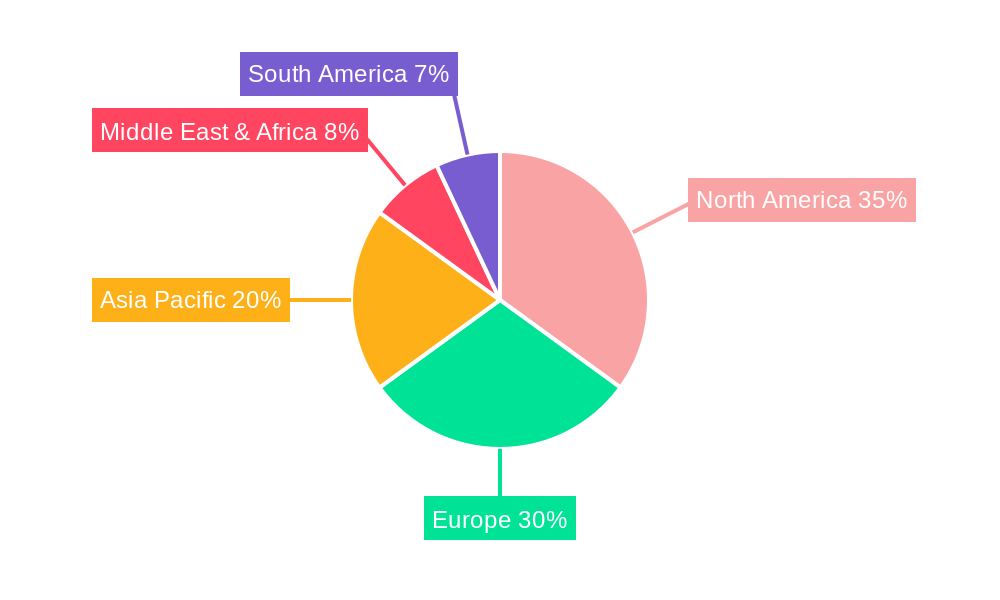

The market segmentation reveals a strong demand across various applications, with both adult and teenage demographics actively seeking digital solutions for weight management. The dominance of streaming media in this sector reflects the shift towards engaging, video-based content and interactive features, which are highly effective in promoting healthy lifestyles. While the market presents considerable opportunities, certain restraints, such as data privacy concerns and the need for continuous innovation to retain user interest, will need to be strategically addressed by key players like WW International, Noom, and MyFitnessPal. Geographically, North America and Europe are expected to lead market share due to high disposable incomes and established digital health infrastructure, but the Asia Pacific region, particularly China and India, is anticipated to exhibit the fastest growth, driven by a rapidly expanding middle class and increasing internet penetration.

Mobile Weight Loss Market Analysis: A Comprehensive Report

This in-depth report provides an unparalleled analysis of the global Mobile Weight Loss market, meticulously dissecting its structure, competitive landscape, emerging trends, and future outlook. Spanning the historical period of 2019–2024 and projecting through 2033, this study leverages proprietary data and expert insights to deliver actionable intelligence for stakeholders. With a base year of 2025 and an estimated year also of 2025, the report offers precise market valuations and growth forecasts. We cover key players like WW International, Noom, Under Armour, MyFitnessPal, BetterMe, YAZIO, Lifesum, Verv, Livongo Health, Omada Health, Lark Health, Dario Health, Oviva, and OurPath, alongside crucial segments such as Adult and Teenagers applications, and types including Streaming Media, Ordinary Media, and Other. Industry developments are thoroughly examined, providing a holistic view of this dynamic and rapidly expanding sector.

Mobile Weight Loss Market Structure & Competitive Dynamics

The global Mobile Weight Loss market exhibits a moderately concentrated structure, with a few key players like WW International and Noom holding significant market share, estimated at over $500 million and $400 million respectively. The innovation ecosystem is robust, driven by continuous advancements in AI-powered personalized coaching, wearable device integration, and gamified user engagement. Regulatory frameworks are evolving, with a growing emphasis on data privacy and the efficacy of digital health interventions, influencing product development and market entry strategies. Product substitutes, primarily traditional in-person coaching and diet programs, are increasingly being disrupted by the convenience and accessibility of mobile solutions. End-user trends highlight a strong demand for personalized, data-driven approaches to weight management, with a growing preference for holistic wellness solutions that extend beyond simple calorie tracking. Mergers and Acquisitions (M&A) activity is a notable feature, with several strategic acquisitions aimed at expanding user bases and technological capabilities. For instance, past M&A deals have reached values exceeding $300 million, signaling consolidation and growth. The overall market penetration is projected to reach over 60% for adult users by 2033.

Mobile Weight Loss Industry Trends & Insights

The mobile weight loss industry is experiencing explosive growth, projected to achieve a Compound Annual Growth Rate (CAGR) of approximately 18% from 2025 to 2033. This surge is fueled by increasing global obesity rates, a growing awareness of health and wellness, and the ubiquitous adoption of smartphones and wearable technology. Technological disruptions are at the forefront, with advancements in AI and machine learning enabling highly personalized nutrition plans, exercise regimens, and behavioral coaching. Companies are increasingly integrating telehealth services and virtual consultations, blurring the lines between digital health and traditional medical care. Consumer preferences are shifting towards convenient, accessible, and engaging solutions. Users are seeking integrated platforms that offer not just diet and exercise tracking but also mental wellness support, sleep monitoring, and community engagement. The competitive dynamics are characterized by intense innovation, with companies vying for market share through unique feature sets, user experience, and strategic partnerships. MyFitnessPal, for example, continues to dominate in user-generated food databases, while Noom excels in its behavioral psychology-based approach. Livongo Health and Omada Health are making significant inroads in the clinical integration of mobile weight loss solutions, targeting chronic disease management. The market penetration for mobile weight loss applications is expected to surpass 55% of the adult population globally by the end of the forecast period. The development of specialized apps for specific dietary needs, such as ketogenic or plant-based diets, further caters to niche market demands. The increasing investment in digital therapeutics is also a significant trend, with mobile weight loss solutions being recognized for their potential in preventing and managing chronic conditions like diabetes and cardiovascular diseases. The integration of IoT devices, such as smart scales and activity trackers, enhances data accuracy and user engagement, providing a more comprehensive health overview. Furthermore, the rise of influencer marketing and social media engagement plays a crucial role in driving user acquisition and brand awareness.

Dominant Markets & Segments in Mobile Weight Loss

North America currently dominates the global Mobile Weight Loss market, driven by high disposable incomes, advanced technological infrastructure, and a strong health-conscious consumer base. The United States, in particular, contributes over $1.2 billion to the market, owing to the high prevalence of obesity and widespread adoption of digital health solutions.

- Application: Adult: The adult segment represents the largest and most dominant application within the mobile weight loss market, accounting for an estimated 85% of the total market share. This dominance is attributed to the higher incidence of weight-related health concerns among adults and their greater purchasing power for health and wellness services.

- Key Drivers:

- Increasing prevalence of lifestyle diseases like diabetes and cardiovascular issues.

- Growing awareness of the link between weight management and overall health.

- Demand for personalized and convenient health solutions.

- Availability of advanced features like AI coaching and wearable integration.

- Employer-sponsored wellness programs encouraging app usage.

- Key Drivers:

- Application: Teenagers: While currently a smaller segment, the teenager application is poised for significant growth, with projections indicating a CAGR of over 20% during the forecast period. This growth is driven by increasing parental concern for childhood obesity and the growing digital literacy of teenagers.

- Key Drivers:

- Rising rates of childhood obesity globally.

- Gamified and engaging app features appealing to younger demographics.

- Parental influence and increasing adoption of digital health tools for family wellness.

- School-based health and wellness initiatives.

- Key Drivers:

- Types: Streaming Media: Streaming Media is a rapidly growing type, particularly for content-driven weight loss programs featuring video workouts, nutritional guidance from experts, and motivational talks. This segment is expected to capture a substantial market share, estimated at $800 million by 2033.

- Key Drivers:

- Demand for interactive and engaging content.

- Flexibility and convenience of on-demand video access.

- Influence of fitness influencers and celebrity endorsements.

- Technological advancements in mobile streaming capabilities.

- Key Drivers:

- Types: Ordinary Media: This category, encompassing features like articles, recipes, and basic tracking tools, maintains a steady presence, serving as a foundational element for many users. It accounts for approximately $600 million in market value.

- Key Drivers:

- Accessibility and ease of use for a broad user base.

- Cost-effectiveness compared to more feature-rich offerings.

- Integration with broader health and fitness content platforms.

- Key Drivers:

- Types: Other: This segment includes niche offerings like gamified challenges, community-based support groups, and specialized dietary tracking, contributing an estimated $500 million.

- Key Drivers:

- Demand for unique and highly specialized solutions.

- Leveraging social dynamics for motivation and accountability.

- Integration with emerging technologies like AR/VR for enhanced experiences.

- Key Drivers:

Mobile Weight Loss Product Innovations

The mobile weight loss sector is witnessing a wave of innovative product developments, centered on personalized AI coaching, advanced behavioral science, and seamless integration with wearable devices. Companies are developing sophisticated algorithms that adapt meal plans and exercise routines in real-time based on user data, biological feedback, and lifestyle changes. Innovations in the streaming media segment include interactive workout sessions with virtual trainers and personalized nutrition dashboards. Product differentiation is increasingly achieved through unique features like genetic-based diet recommendations and mental wellness modules, offering a holistic approach to weight management. The competitive advantage lies in creating highly engaging and effective user experiences that foster long-term adherence and sustainable results, with market adoption for AI-driven features projected to exceed 70% by 2033.

Report Segmentation & Scope

This report comprehensively segments the Mobile Weight Loss market by application and type. The Adult segment, representing the largest market share estimated at $4.5 billion, focuses on individuals seeking weight management solutions for health and lifestyle improvement. Projections indicate sustained growth, reaching over $10 billion by 2033. The Teenagers segment, valued at $500 million, targets younger users addressing early-onset weight concerns, with a high projected CAGR of 22% and an estimated market value of $2 billion by 2033. In terms of types, Streaming Media is a rapidly expanding segment, currently valued at $1.2 billion and expected to grow significantly due to interactive content and virtual coaching, reaching $4 billion by 2033. Ordinary Media, encompassing articles and basic tracking, holds a stable market share of $900 million, projected to reach $1.5 billion. The Other segment, including gamified and community-based solutions, is valued at $700 million and is expected to grow to $2 billion by 2033, driven by niche demands and innovative engagement strategies.

Key Drivers of Mobile Weight Loss Growth

Several key drivers are propelling the growth of the Mobile Weight Loss market. Technologically, the increasing penetration of smartphones and wearable devices, estimated at over 7 billion globally, provides a vast user base. Advancements in AI and machine learning are enabling highly personalized and effective weight management programs. Economically, rising healthcare costs associated with obesity and the growing disposable income for health and wellness services contribute significantly. Regulatory support for digital health solutions and the increasing focus on preventative healthcare further accelerate market expansion. For instance, government initiatives promoting digital wellness platforms are creating a favorable ecosystem for mobile weight loss applications.

Challenges in the Mobile Weight Loss Sector

Despite robust growth, the Mobile Weight Loss sector faces several challenges. Regulatory hurdles related to data privacy and the validation of health claims can impede market entry and product development. Intense competition and the need for continuous innovation to retain user engagement are significant pressures. Supply chain issues, particularly for integrated hardware components in some niche offerings, can also pose constraints. Furthermore, user retention remains a critical challenge, with many users abandoning applications after initial enthusiasm. The estimated user churn rate is around 30% within the first three months, impacting long-term revenue.

Leading Players in the Mobile Weight Loss Market

- WW International

- Noom

- Under Armour

- MyFitnessPal

- BetterMe

- YAZIO

- Lifesum

- Verv

- Livongo Health

- Omada Health

- Lark Health

- Dario Health

- Oviva

- OurPath

Key Developments in Mobile Weight Loss Sector

- 2023/07: Noom launches enhanced AI coaching features for hyper-personalized user journeys.

- 2023/10: WW International announces strategic partnerships with wearable device manufacturers to enhance data integration.

- 2024/01: Livongo Health expands its digital weight management program to include specialized support for individuals with pre-diabetes.

- 2024/03: MyFitnessPal introduces a revamped community feature to boost user engagement and retention.

- 2024/05: Omada Health secures substantial funding for its integrated chronic care management platform, including weight loss.

- 2024/08: BetterMe rolls out a new suite of guided meditation and mindfulness content to complement its fitness offerings.

- 2024/11: YAZIO announces a significant update to its meal planning feature, incorporating AI-driven recipe suggestions.

Strategic Mobile Weight Loss Market Outlook

The strategic outlook for the Mobile Weight Loss market is exceptionally positive, driven by a convergence of technological advancements, growing health consciousness, and supportive economic and regulatory environments. Growth accelerators include the increasing adoption of personalized AI coaching, the integration of telehealth services, and the expanding use of wearable technology for comprehensive health monitoring. Opportunities lie in further segmenting the market to cater to specific demographics and health conditions, developing holistic wellness platforms that address mental health and sleep, and leveraging partnerships with healthcare providers and corporate wellness programs. The market is set for sustained expansion, with substantial potential for innovation and strategic investment over the next decade.

Mobile Weight Loss Segmentation

-

1. Application

- 1.1. Adult

- 1.2. Teenagers

-

2. Types

- 2.1. Streaming Media

- 2.2. Ordinary Media

- 2.3. Other

Mobile Weight Loss Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Mobile Weight Loss REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Mobile Weight Loss Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Adult

- 5.1.2. Teenagers

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Streaming Media

- 5.2.2. Ordinary Media

- 5.2.3. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Mobile Weight Loss Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Adult

- 6.1.2. Teenagers

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Streaming Media

- 6.2.2. Ordinary Media

- 6.2.3. Other

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Mobile Weight Loss Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Adult

- 7.1.2. Teenagers

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Streaming Media

- 7.2.2. Ordinary Media

- 7.2.3. Other

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Mobile Weight Loss Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Adult

- 8.1.2. Teenagers

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Streaming Media

- 8.2.2. Ordinary Media

- 8.2.3. Other

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Mobile Weight Loss Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Adult

- 9.1.2. Teenagers

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Streaming Media

- 9.2.2. Ordinary Media

- 9.2.3. Other

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Mobile Weight Loss Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Adult

- 10.1.2. Teenagers

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Streaming Media

- 10.2.2. Ordinary Media

- 10.2.3. Other

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 WW International

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Noom

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Under Armour

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 MyFitnessPal

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 BetterMe

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 YAZIO

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Lifesum

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Verv

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Livongo Health

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Omada Health

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Lark Health

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Dario Health

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Oviva

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 OurPath

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 WW International

List of Figures

- Figure 1: Global Mobile Weight Loss Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Mobile Weight Loss Revenue (million), by Application 2024 & 2032

- Figure 3: North America Mobile Weight Loss Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Mobile Weight Loss Revenue (million), by Types 2024 & 2032

- Figure 5: North America Mobile Weight Loss Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Mobile Weight Loss Revenue (million), by Country 2024 & 2032

- Figure 7: North America Mobile Weight Loss Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Mobile Weight Loss Revenue (million), by Application 2024 & 2032

- Figure 9: South America Mobile Weight Loss Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Mobile Weight Loss Revenue (million), by Types 2024 & 2032

- Figure 11: South America Mobile Weight Loss Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Mobile Weight Loss Revenue (million), by Country 2024 & 2032

- Figure 13: South America Mobile Weight Loss Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Mobile Weight Loss Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Mobile Weight Loss Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Mobile Weight Loss Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Mobile Weight Loss Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Mobile Weight Loss Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Mobile Weight Loss Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Mobile Weight Loss Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Mobile Weight Loss Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Mobile Weight Loss Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Mobile Weight Loss Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Mobile Weight Loss Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Mobile Weight Loss Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Mobile Weight Loss Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Mobile Weight Loss Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Mobile Weight Loss Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Mobile Weight Loss Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Mobile Weight Loss Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Mobile Weight Loss Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Mobile Weight Loss Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Mobile Weight Loss Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Mobile Weight Loss Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Mobile Weight Loss Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Mobile Weight Loss Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Mobile Weight Loss Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Mobile Weight Loss Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Mobile Weight Loss Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Mobile Weight Loss Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Mobile Weight Loss Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Mobile Weight Loss Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Mobile Weight Loss Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Mobile Weight Loss Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Mobile Weight Loss Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Mobile Weight Loss Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Mobile Weight Loss Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Mobile Weight Loss Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Mobile Weight Loss Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Mobile Weight Loss Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Mobile Weight Loss Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Mobile Weight Loss Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Mobile Weight Loss Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Mobile Weight Loss Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Mobile Weight Loss Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Mobile Weight Loss Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Mobile Weight Loss Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Mobile Weight Loss Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Mobile Weight Loss Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Mobile Weight Loss Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Mobile Weight Loss Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Mobile Weight Loss Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Mobile Weight Loss Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Mobile Weight Loss Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Mobile Weight Loss Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Mobile Weight Loss Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Mobile Weight Loss Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Mobile Weight Loss Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Mobile Weight Loss Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Mobile Weight Loss Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Mobile Weight Loss Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Mobile Weight Loss Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Mobile Weight Loss Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Mobile Weight Loss Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Mobile Weight Loss Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Mobile Weight Loss Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Mobile Weight Loss Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Mobile Weight Loss Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mobile Weight Loss?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Mobile Weight Loss?

Key companies in the market include WW International, Noom, Under Armour, MyFitnessPal, BetterMe, YAZIO, Lifesum, Verv, Livongo Health, Omada Health, Lark Health, Dario Health, Oviva, OurPath.

3. What are the main segments of the Mobile Weight Loss?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3350.00, USD 5025.00, and USD 6700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mobile Weight Loss," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mobile Weight Loss report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mobile Weight Loss?

To stay informed about further developments, trends, and reports in the Mobile Weight Loss, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence