Key Insights

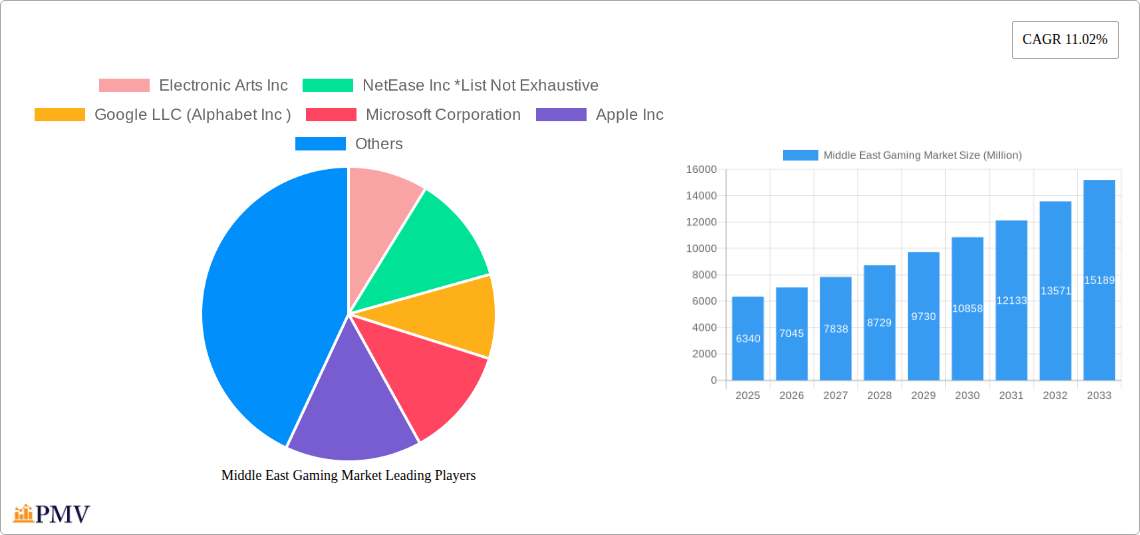

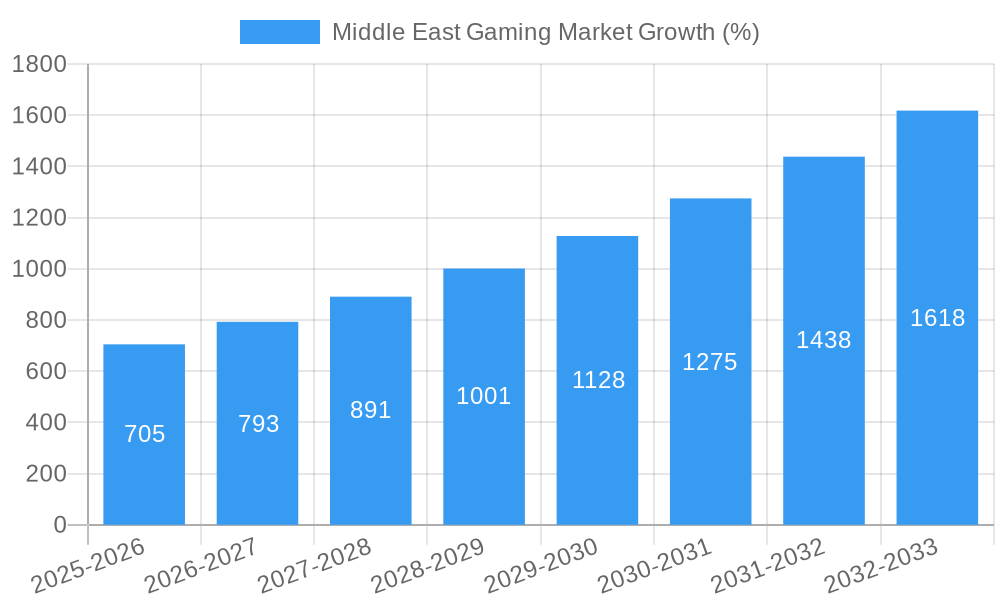

The Middle East gaming market, valued at $6.34 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 11.02% from 2025 to 2033. This surge is fueled by several key factors. The region's rapidly expanding young population, with a high percentage of tech-savvy individuals, forms a significant player base. Increasing smartphone penetration and affordable internet access are democratizing gaming, making it accessible to a wider audience. Furthermore, the rise of esports and the growing popularity of mobile gaming are driving market expansion. Investment in gaming infrastructure, including improved internet connectivity and the emergence of dedicated gaming hubs, further contributes to market growth. Leading companies such as Electronic Arts, NetEase, Google, Microsoft, Apple, and Sony are actively investing in the region, developing localized content and partnerships to capitalize on this burgeoning market.

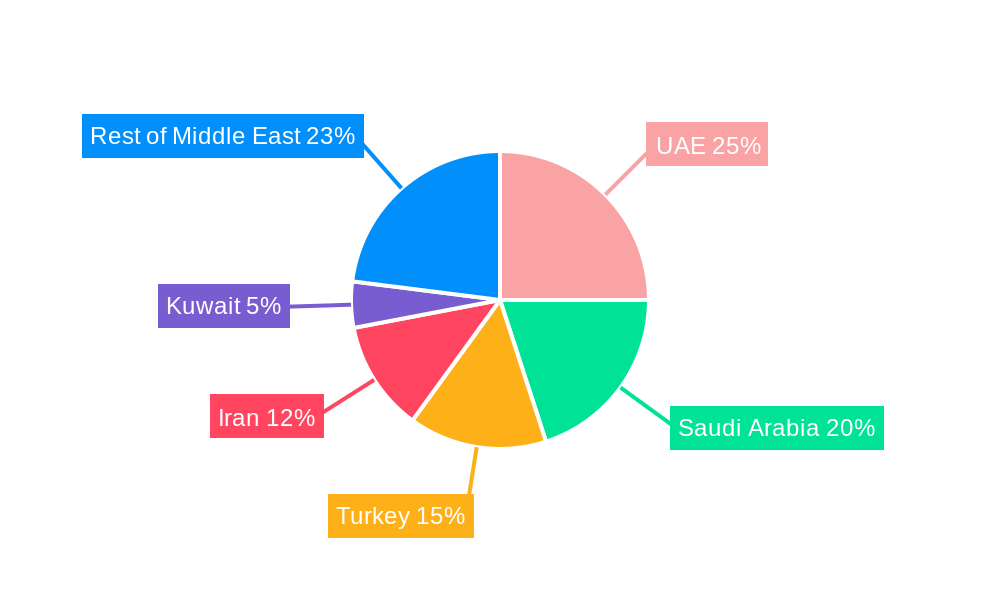

However, challenges remain. Regulatory hurdles related to online gaming and content restrictions in some countries could impede growth. Competition from established international gaming companies necessitates continuous innovation and localized strategies for Middle Eastern players. Economic fluctuations within certain countries in the region can also affect consumer spending on gaming products and services. Despite these constraints, the long-term outlook for the Middle East gaming market remains exceptionally positive, driven by consistent technological advancements, growing disposable income, and a rising passion for gaming within the population. The market's segmentation, encompassing diverse platforms (PC, mobile, consoles) and countries (UAE, Saudi Arabia, Turkey, Iran, Kuwait, etc.), offers opportunities for targeted growth strategies. Strategic partnerships, localization efforts, and addressing regulatory challenges will be pivotal for companies seeking to thrive in this dynamic market.

Middle East Gaming Market: 2019-2033 Forecast Report

This comprehensive report provides an in-depth analysis of the Middle East gaming market, offering invaluable insights for industry stakeholders, investors, and strategists. The study covers the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033. The report segments the market by platform (Browser PC, Smartphone, Tablets, Gaming Console, Downloaded/Box PC) and country (United Arab Emirates, Saudi Arabia, Turkey, Iran, Kuwait, Rest of Middle East), providing granular data and analysis to understand the diverse landscape. Key players such as Electronic Arts Inc, NetEase Inc, Google LLC (Alphabet Inc), Microsoft Corporation, Apple Inc, and Sony Corporation are profiled, highlighting their market share and strategic moves. The report also features in-depth analysis of market size (in Millions), CAGR, and market penetration across various segments.

Middle East Gaming Market Structure & Competitive Dynamics

The Middle East gaming market exhibits a moderately concentrated structure, with a few major international players dominating alongside a growing number of regional developers. Innovation ecosystems are developing rapidly, driven by government initiatives and investments in technology infrastructure. Regulatory frameworks vary across the region, impacting market access and operations. Product substitutes, primarily other forms of entertainment, present ongoing competitive pressure. End-user trends showcase a strong preference for mobile gaming, driven by high smartphone penetration. M&A activities have been significant, with deal values exceeding xx Million in recent years. For example, the partnership between Wemade and the Saudi Ministry of Investment in 2023 signifies the growing interest in blockchain gaming in the region.

- Market Concentration: Moderate, with significant presence of global players and emerging regional players.

- Innovation Ecosystems: Rapidly developing, fueled by government support and technological advancements.

- Regulatory Frameworks: Vary across countries, influencing market access and operations.

- M&A Activity: Significant, with deal values exceeding xx Million in recent years. Notable examples include the Wemade-MISA partnership.

- Market Share: Global players hold a significant majority market share, with regional players growing their presence.

Middle East Gaming Market Industry Trends & Insights

The Middle East gaming market is experiencing robust growth, driven by factors like increasing internet and smartphone penetration, rising disposable incomes, and a young, tech-savvy population. Technological advancements, such as the rise of cloud gaming and esports, are further fueling market expansion. Consumer preferences are shifting towards mobile gaming and free-to-play models. The market has witnessed a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024) and is projected to grow at a CAGR of xx% during the forecast period (2025-2033). Market penetration of gaming within the region is steadily increasing, particularly in countries like the UAE and Saudi Arabia. The rise of esports and the increasing number of gaming tournaments are creating additional revenue streams and further driving market growth. The competitive landscape is evolving rapidly, with both international and regional players competing for market share.

Dominant Markets & Segments in Middle East Gaming Market

The smartphone segment dominates the Middle East gaming market, owing to high smartphone penetration and affordability. Saudi Arabia and the UAE are the leading countries, driven by strong economic growth, supportive government policies, and robust digital infrastructure.

- Leading Region: The Middle East as a whole displays strong overall growth.

- Leading Country: Saudi Arabia and the UAE show the highest market value due to significant investments in infrastructure and a young, digitally-savvy population.

Key Drivers:

- Economic Growth: Strong GDP growth in key markets fuels increased disposable income and spending on entertainment.

- Government Initiatives: Government support for digital infrastructure and gaming ecosystems boosts industry development.

- Technological Infrastructure: High internet and smartphone penetration creates a favorable market environment.

- Young Population: A large young population contributes to a substantial gamer base.

Middle East Gaming Market Product Innovations

Recent product innovations in the Middle East gaming market include the increasing adoption of cloud gaming services, the growth of mobile esports titles, and the emergence of blockchain-based games. These innovations cater to the growing demand for convenient and immersive gaming experiences, tapping into the region's young and tech-savvy demographic. The market is seeing a shift towards more accessible and localized content.

Report Segmentation & Scope

The report segments the Middle East gaming market by platform and country. The platform segment includes Browser PC, Smartphone, Tablets, Gaming Console, and Downloaded/Box PC, each with its own growth projection, market size, and competitive analysis. The country segment includes the UAE, Saudi Arabia, Turkey, Iran, Kuwait, and the Rest of the Middle East, offering detailed market insights for each region. Growth projections for each segment vary based on regional economic conditions and adoption rates of gaming platforms.

Key Drivers of Middle East Gaming Market Growth

Several factors drive the Middle East gaming market's growth. These include increased internet and smartphone penetration, particularly the rise of affordable smartphones; strong economic growth in several countries; government initiatives to promote the digital economy; and a large young population highly engaged with digital media and gaming. The growth of esports and the rise of mobile gaming also contribute significantly.

Challenges in the Middle East Gaming Market Sector

Challenges include varying regulatory frameworks across countries, which can create hurdles to market entry and operation. Supply chain issues for physical games and console hardware can also pose a challenge. The market is quite competitive, with established global companies and local firms vying for market share. These factors can affect overall market growth projections.

Leading Players in the Middle East Gaming Market Market

- Electronic Arts Inc

- NetEase Inc

- Google LLC (Alphabet Inc)

- Microsoft Corporation

- Apple Inc

- Sony Corporation

Key Developments in Middle East Gaming Market Sector

- April 2023: Wemade and the Saudi Ministry of Investment (MISA) signed a Memorandum of Understanding (MoU) to develop Saudi Arabia's gaming and blockchain sectors. This signifies a significant move towards integrating blockchain technology into the gaming market.

- May 2022: Gamerji, an Indian esports platform, expanded into the UAE and Saudi Arabia, indicating growing interest in competitive gaming within the region.

Strategic Middle East Gaming Market Outlook

The Middle East gaming market presents significant opportunities for growth. Continued investments in digital infrastructure, supportive government policies, and the rising popularity of esports and mobile gaming are key accelerators for future market expansion. Companies focusing on localization, mobile gaming, and innovative business models are well-positioned to capitalize on the region's potential. The integration of blockchain technologies also holds significant potential for future market development.

Middle East Gaming Market Segmentation

-

1. Platform

- 1.1. Browser PC

- 1.2. Smartphone

- 1.3. Tablets

- 1.4. Gaming Console

- 1.5. Downloaded/Box PC

Middle East Gaming Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East Gaming Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.02% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Presence of Young and Millennial Consumers; Adoption of Gaming Platforms

- 3.2.2 such as E-sports Betting and Fantasy Sites

- 3.3. Market Restrains

- 3.3.1 Issues like Piracy

- 3.3.2 Laws and Regulations

- 3.3.3 and Concerns Relating to Fraud During Gaming Transactions

- 3.4. Market Trends

- 3.4.1. The Smartphones Segment is Expected to Hold the Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East Gaming Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Platform

- 5.1.1. Browser PC

- 5.1.2. Smartphone

- 5.1.3. Tablets

- 5.1.4. Gaming Console

- 5.1.5. Downloaded/Box PC

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Platform

- 6. United Arab Emirates Middle East Gaming Market Analysis, Insights and Forecast, 2019-2031

- 7. Saudi Arabia Middle East Gaming Market Analysis, Insights and Forecast, 2019-2031

- 8. Qatar Middle East Gaming Market Analysis, Insights and Forecast, 2019-2031

- 9. Israel Middle East Gaming Market Analysis, Insights and Forecast, 2019-2031

- 10. Egypt Middle East Gaming Market Analysis, Insights and Forecast, 2019-2031

- 11. Oman Middle East Gaming Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Middle East Middle East Gaming Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Electronic Arts Inc

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 NetEase Inc *List Not Exhaustive

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Google LLC (Alphabet Inc )

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Microsoft Corporation

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Apple Inc

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Sony Corporation

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.1 Electronic Arts Inc

List of Figures

- Figure 1: Middle East Gaming Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle East Gaming Market Share (%) by Company 2024

List of Tables

- Table 1: Middle East Gaming Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle East Gaming Market Revenue Million Forecast, by Platform 2019 & 2032

- Table 3: Middle East Gaming Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Middle East Gaming Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: United Arab Emirates Middle East Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Saudi Arabia Middle East Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Qatar Middle East Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Israel Middle East Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Egypt Middle East Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Oman Middle East Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Middle East Middle East Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Middle East Gaming Market Revenue Million Forecast, by Platform 2019 & 2032

- Table 13: Middle East Gaming Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Saudi Arabia Middle East Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: United Arab Emirates Middle East Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Israel Middle East Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Qatar Middle East Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Kuwait Middle East Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Oman Middle East Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Bahrain Middle East Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Jordan Middle East Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Lebanon Middle East Gaming Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East Gaming Market?

The projected CAGR is approximately 11.02%.

2. Which companies are prominent players in the Middle East Gaming Market?

Key companies in the market include Electronic Arts Inc, NetEase Inc *List Not Exhaustive, Google LLC (Alphabet Inc ), Microsoft Corporation, Apple Inc, Sony Corporation.

3. What are the main segments of the Middle East Gaming Market?

The market segments include Platform.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.34 Million as of 2022.

5. What are some drivers contributing to market growth?

Presence of Young and Millennial Consumers; Adoption of Gaming Platforms. such as E-sports Betting and Fantasy Sites.

6. What are the notable trends driving market growth?

The Smartphones Segment is Expected to Hold the Significant Market Share.

7. Are there any restraints impacting market growth?

Issues like Piracy. Laws and Regulations. and Concerns Relating to Fraud During Gaming Transactions.

8. Can you provide examples of recent developments in the market?

Apr 2023: Wemade, the South Korean game company behind the worldwide blockchain gaming platform WEMIX PLAY, signed a Memorandum of Understanding (MoU) with the Saudi Ministry of Investment (MISA). The partnership will focus on developing and expanding Saudi Arabia's gaming and blockchain sectors.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East Gaming Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East Gaming Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East Gaming Market?

To stay informed about further developments, trends, and reports in the Middle East Gaming Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence