Key Insights

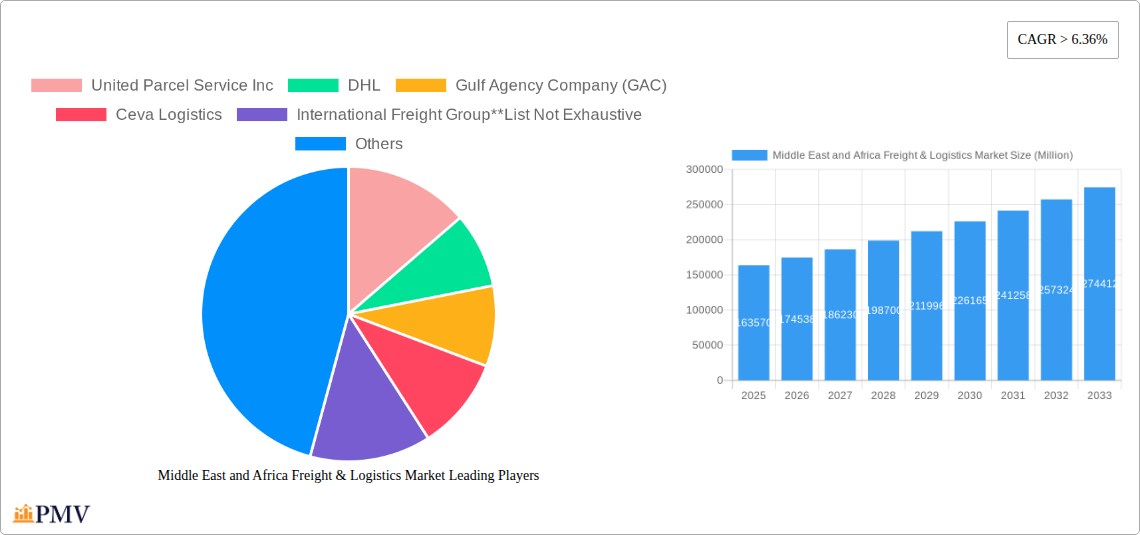

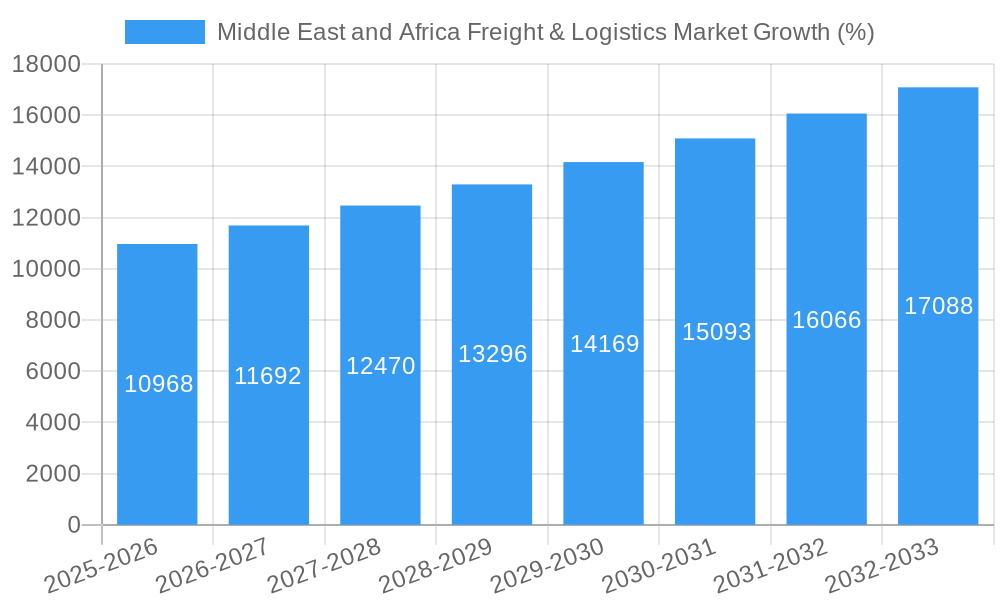

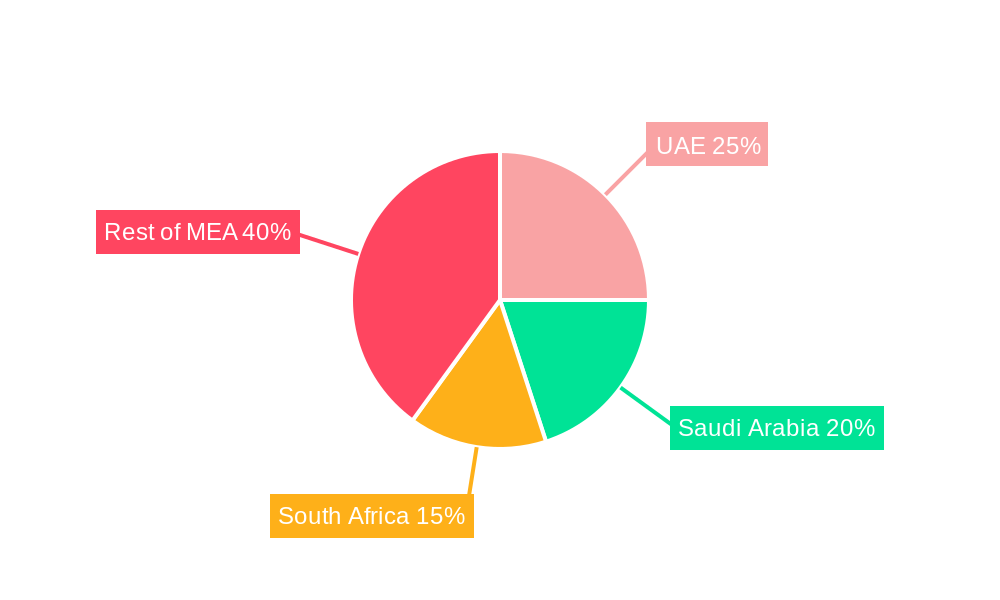

The Middle East and Africa (MEA) freight and logistics market, valued at $163.57 billion in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) exceeding 6.36% from 2025 to 2033. This expansion is fueled by several key factors. The burgeoning e-commerce sector across the region necessitates efficient and reliable logistics networks, stimulating demand for freight transportation, warehousing, and value-added services. Furthermore, significant infrastructure development projects underway in several MEA countries, particularly in the Gulf Cooperation Council (GCC) nations, are bolstering the market. Increased cross-border trade and the expansion of manufacturing and industrial activities, especially within the automotive, oil & gas, and construction sectors, are also contributing to this growth. However, challenges remain, including geopolitical instability in certain regions, infrastructure limitations in some areas, and the fluctuating prices of fuel impacting transportation costs. The market is segmented by function (freight transport, freight forwarding, warehousing, etc.), end-user (manufacturing, oil & gas, retail, etc.), and country, with the UAE, Saudi Arabia, and South Africa representing significant market shares. The competitive landscape is marked by a mix of international giants like UPS, DHL, and FedEx, alongside regional players such as Gulf Agency Company and Al-Futtaim Logistics, showcasing a dynamic and evolving market.

The forecast period of 2025-2033 anticipates continued growth, albeit potentially at a slightly moderated pace due to global economic factors and localized challenges. Strategic partnerships between international and regional players are likely to increase, fostering innovation and enhanced service offerings. Technological advancements such as the adoption of blockchain technology for enhanced supply chain transparency and the increased use of data analytics for improved logistics optimization will shape the market's trajectory. Growth within specific segments will likely vary; for instance, the growth of e-commerce is expected to drive significant demand for last-mile delivery solutions and related services. Government initiatives aimed at improving infrastructure and streamlining customs procedures will further influence the market's development. Overall, the MEA freight and logistics market is poised for considerable expansion over the next decade, presenting substantial opportunities for both established players and emerging businesses.

Middle East & Africa Freight & Logistics Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Middle East and Africa freight and logistics market, offering valuable insights for businesses operating within or planning to enter this dynamic sector. The report covers the period 2019-2033, with a focus on the 2025-2033 forecast period, and includes detailed segmentation by function, end-user, and country. The market is projected to reach xx Million by 2033, exhibiting a robust CAGR of xx% during the forecast period.

Middle East and Africa Freight & Logistics Market Market Structure & Competitive Dynamics

The Middle East and Africa freight and logistics market is characterized by a complex interplay of established multinational players and regional specialists. Market concentration is moderate, with a few dominant players like United Parcel Service Inc, DHL, and FedEx holding significant market share, but numerous smaller companies catering to niche segments. Innovation is driven by technological advancements in areas such as digitalization, automation, and data analytics. Regulatory frameworks vary significantly across countries, impacting operational efficiency and cost. Product substitutes, such as alternative transportation modes and innovative warehousing solutions, constantly challenge established players. End-user trends, particularly the growth of e-commerce and the expansion of manufacturing industries, fuel market growth. M&A activity is relatively frequent, with deal values averaging xx Million in recent years. Key examples include the expansion of Almajdouie Logistics and the partnership between SAL and LTLS. The competitive landscape is dynamic, with companies constantly vying for market share through strategic alliances, investments in technology, and service enhancements. The market structure will likely evolve towards consolidation with a focus on enhancing supply chain resilience and digital capabilities.

- Market Share: Top 3 players hold approximately xx% of the market.

- M&A Deal Value (Avg): xx Million.

- Key Factors: Technological advancements, regulatory changes, and shifting consumer preferences drive market dynamics.

Middle East and Africa Freight & Logistics Market Industry Trends & Insights

The Middle East and Africa freight and logistics market is experiencing significant transformation driven by several key factors. The rapid growth of e-commerce is boosting demand for last-mile delivery solutions and efficient warehousing capabilities. Technological disruptions, such as the adoption of blockchain technology for enhanced supply chain transparency and the integration of artificial intelligence for optimized route planning, are reshaping market dynamics. Consumer preferences for faster, more reliable, and more sustainable logistics services are impacting the operations of logistics providers. The competitive landscape remains intense, with companies constantly seeking new ways to improve efficiency, reduce costs, and gain a competitive advantage. Market growth is fueled by infrastructure development projects, increasing cross-border trade, and the rising demand for specialized logistics services across various sectors. This growth is further influenced by government initiatives aimed at enhancing logistics infrastructure and streamlining regulations. The market is expected to experience significant growth, particularly in emerging economies, driven by improving economic conditions and industrialization. The market penetration of advanced logistics technologies is increasing, though adoption rates vary across countries.

Dominant Markets & Segments in Middle East and Africa Freight & Logistics Market

The United Arab Emirates and Saudi Arabia are currently the dominant markets in the Middle East and Africa freight & logistics sector, driven by their robust economies, advanced infrastructure, and strategic geographical locations. South Africa holds a prominent position in the African region, serving as a gateway for trade with other African countries. Within the segmentation:

By Function:

- Freight Forwarding: Highest market share due to the complexity of international trade.

- Warehousing: Significant growth driven by e-commerce and the need for efficient inventory management.

- Freight Transport: Road transport dominates, with rail gaining traction in some countries.

- Value-Added Services: Growing demand for specialized services like customs brokerage and packaging.

By End User:

- Manufacturing & Automotive: Major driver due to robust industrial activity.

- Oil & Gas: Significant logistical requirements for transportation and storage.

- Distributive Trade (FMCG): High volume, time-sensitive demands.

Key Drivers:

- UAE & Saudi Arabia: Strong economic growth, advanced infrastructure, strategic location.

- South Africa: Gateway to other African nations, growing industrial activity.

- Infrastructure Development: Government investments in ports, roads, and railways.

- Economic Policies: Trade liberalization and supportive regulations.

Middle East and Africa Freight & Logistics Market Product Innovations

Recent innovations in the Middle East and Africa freight and logistics market include the adoption of autonomous vehicles, drone delivery systems, and advanced tracking technologies. These advancements enhance efficiency, reduce costs, and improve transparency throughout the supply chain. The focus is on creating integrated logistics solutions that leverage data analytics and artificial intelligence to optimize operations and meet the specific needs of different industries. The market is witnessing a shift towards sustainable practices, with a growing emphasis on green logistics solutions and eco-friendly transportation modes. The success of these innovations hinges on their ability to address local market challenges and create a positive return on investment.

Report Segmentation & Scope

This report segments the Middle East and Africa freight and logistics market comprehensively, analyzing growth projections and competitive dynamics across:

By Function: Freight Transport, Rail Freight Forwarding, Warehousing, Value-added Services, and Other Functions. Each segment is analyzed based on market size, growth rate, and key players.

By End User: Manufacturing and Automotive, Oil and Gas, Mining and Quarrying, Agriculture, Fishing and Forestry, Construction, Distributive Trade (Wholesale and Retail – FMCG included), and Other End Users (Telecommunications and Pharmaceuticals). Each segment's specific logistical needs and growth potential are examined.

By Country: United Arab Emirates, Saudi Arabia, Qatar, South Africa, Egypt, Morocco, Nigeria, and Rest of Middle East and Africa. Market size, growth potential, and regulatory nuances for each country are covered. The market size for each segment and country is provided for the historical period (2019-2024), the base year (2025), and the forecast period (2025-2033).

Key Drivers of Middle East and Africa Freight & Logistics Market Growth

The growth of the Middle East and Africa freight and logistics market is driven by several key factors. These include: increasing cross-border trade, fueled by regional trade agreements and the growth of e-commerce; government investments in infrastructure development, creating more efficient transportation networks; the expansion of the manufacturing and industrial sectors, leading to higher transportation volumes; and technological advancements, improving efficiency and transparency in logistics operations. The development of special economic zones and the focus on improving ease of doing business further accelerate market expansion.

Challenges in the Middle East and Africa Freight & Logistics Market Sector

The Middle East and Africa freight and logistics market faces several challenges, including infrastructure limitations in some regions, inconsistent regulatory frameworks across countries, security concerns that impact transportation safety, and a lack of skilled labor in certain areas. Supply chain disruptions, particularly as experienced during global events, cause significant delays and cost increases. The competitive pressure from both established and emerging players necessitates continuous innovation and adaptation. These challenges impact operational efficiency and overall market growth.

Leading Players in the Middle East and Africa Freight & Logistics Market Market

- United Parcel Service Inc

- DHL

- Gulf Agency Company (GAC)

- Ceva Logistics

- International Freight Group

- FedEx

- Agility Logistics

- Al-Futtaim Logistics

- Kuehne + Nagel

- Saudi Transport & Investment Co (Mubarrad)

- RAK Logistics

- Almajdouie Group

Key Developments in Middle East and Africa Freight & Logistics Market Sector

- May 2023: Saudi Logistics Services (SAL) and Lufthansa Technik Logistik Services (LTLS) signed an MoU for logistics collaboration in Saudi Arabia.

- April 2023: Almajdouie Logistics expanded its fleet with 30 new Hyundai Xcient trucks.

Strategic Middle East and Africa Freight & Logistics Market Market Outlook

The Middle East and Africa freight and logistics market presents significant growth opportunities for companies that can adapt to the evolving market dynamics. Focus on technological advancements, strategic partnerships, and sustainable practices will be crucial for success. The growing emphasis on e-commerce, infrastructure development, and regional trade agreements create a positive outlook for long-term market expansion. Companies with a strong focus on customer service and supply chain resilience are best positioned to capitalize on the market's potential.

Middle East and Africa Freight & Logistics Market Segmentation

-

1. Function

-

1.1. Freight Transport

- 1.1.1. Road

- 1.1.2. Water

- 1.1.3. Air

- 1.1.4. Rail

- 1.2. Freight Forwarding

- 1.3. Warehousing

- 1.4. Value-added Services and Other Functions

-

1.1. Freight Transport

-

2. End User

- 2.1. Manufacturing and Automotive

- 2.2. Oil and Gas, Mining, and Quarrying

- 2.3. Agriculture, Fishing, and Forestry

- 2.4. Construction

- 2.5. Distribu

- 2.6. Other En

Middle East and Africa Freight & Logistics Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East and Africa Freight & Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 6.36% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise In E-commerce Growth in The Region; Development of Logistic Infrastructure

- 3.3. Market Restrains

- 3.3.1. Poor Infrastruture

- 3.4. Market Trends

- 3.4.1. Development of freight transport segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Freight & Logistics Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Function

- 5.1.1. Freight Transport

- 5.1.1.1. Road

- 5.1.1.2. Water

- 5.1.1.3. Air

- 5.1.1.4. Rail

- 5.1.2. Freight Forwarding

- 5.1.3. Warehousing

- 5.1.4. Value-added Services and Other Functions

- 5.1.1. Freight Transport

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Manufacturing and Automotive

- 5.2.2. Oil and Gas, Mining, and Quarrying

- 5.2.3. Agriculture, Fishing, and Forestry

- 5.2.4. Construction

- 5.2.5. Distribu

- 5.2.6. Other En

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Function

- 6. South Africa Middle East and Africa Freight & Logistics Market Analysis, Insights and Forecast, 2019-2031

- 7. Sudan Middle East and Africa Freight & Logistics Market Analysis, Insights and Forecast, 2019-2031

- 8. Uganda Middle East and Africa Freight & Logistics Market Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania Middle East and Africa Freight & Logistics Market Analysis, Insights and Forecast, 2019-2031

- 10. Kenya Middle East and Africa Freight & Logistics Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa Middle East and Africa Freight & Logistics Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 United Parcel Service Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 DHL

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Gulf Agency Company (GAC)

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Ceva Logistics

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 International Freight Group**List Not Exhaustive

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 FedEx

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Agility Logistics

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Al-Futtaim Logistics

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Kuehne + Nagel

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Saudi Transport & Investment Co (Mubarrad)

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 RAK Logistics

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Almajdouie Group

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.1 United Parcel Service Inc

List of Figures

- Figure 1: Middle East and Africa Freight & Logistics Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle East and Africa Freight & Logistics Market Share (%) by Company 2024

List of Tables

- Table 1: Middle East and Africa Freight & Logistics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle East and Africa Freight & Logistics Market Revenue Million Forecast, by Function 2019 & 2032

- Table 3: Middle East and Africa Freight & Logistics Market Revenue Million Forecast, by End User 2019 & 2032

- Table 4: Middle East and Africa Freight & Logistics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Middle East and Africa Freight & Logistics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: South Africa Middle East and Africa Freight & Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Sudan Middle East and Africa Freight & Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Uganda Middle East and Africa Freight & Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Tanzania Middle East and Africa Freight & Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Kenya Middle East and Africa Freight & Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Africa Middle East and Africa Freight & Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Middle East and Africa Freight & Logistics Market Revenue Million Forecast, by Function 2019 & 2032

- Table 13: Middle East and Africa Freight & Logistics Market Revenue Million Forecast, by End User 2019 & 2032

- Table 14: Middle East and Africa Freight & Logistics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Saudi Arabia Middle East and Africa Freight & Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: United Arab Emirates Middle East and Africa Freight & Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Israel Middle East and Africa Freight & Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Qatar Middle East and Africa Freight & Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Kuwait Middle East and Africa Freight & Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Oman Middle East and Africa Freight & Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Bahrain Middle East and Africa Freight & Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Jordan Middle East and Africa Freight & Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Lebanon Middle East and Africa Freight & Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Freight & Logistics Market?

The projected CAGR is approximately > 6.36%.

2. Which companies are prominent players in the Middle East and Africa Freight & Logistics Market?

Key companies in the market include United Parcel Service Inc, DHL, Gulf Agency Company (GAC), Ceva Logistics, International Freight Group**List Not Exhaustive, FedEx, Agility Logistics, Al-Futtaim Logistics, Kuehne + Nagel, Saudi Transport & Investment Co (Mubarrad), RAK Logistics, Almajdouie Group.

3. What are the main segments of the Middle East and Africa Freight & Logistics Market?

The market segments include Function, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 163.57 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise In E-commerce Growth in The Region; Development of Logistic Infrastructure.

6. What are the notable trends driving market growth?

Development of freight transport segment.

7. Are there any restraints impacting market growth?

Poor Infrastruture.

8. Can you provide examples of recent developments in the market?

May 2023: Saudi Logistics Services (SAL) and Lufthansa Technik Logistik Services (LTLS) have signed an initial Memorandum of Understanding (MoU) to collaborate on the logistics activities of LTLS within Saudi Arabia. Under this MoU, SAL will provide freight forwarding, transportation, and customs brokerage services to support LTLS' maintenance logistics operations for their key customers around Saudi Arabia. As a result, LTLS would subsequently strengthen its logistics services coverage within Saudi Arabia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Freight & Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Freight & Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Freight & Logistics Market?

To stay informed about further developments, trends, and reports in the Middle East and Africa Freight & Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence