Key Insights

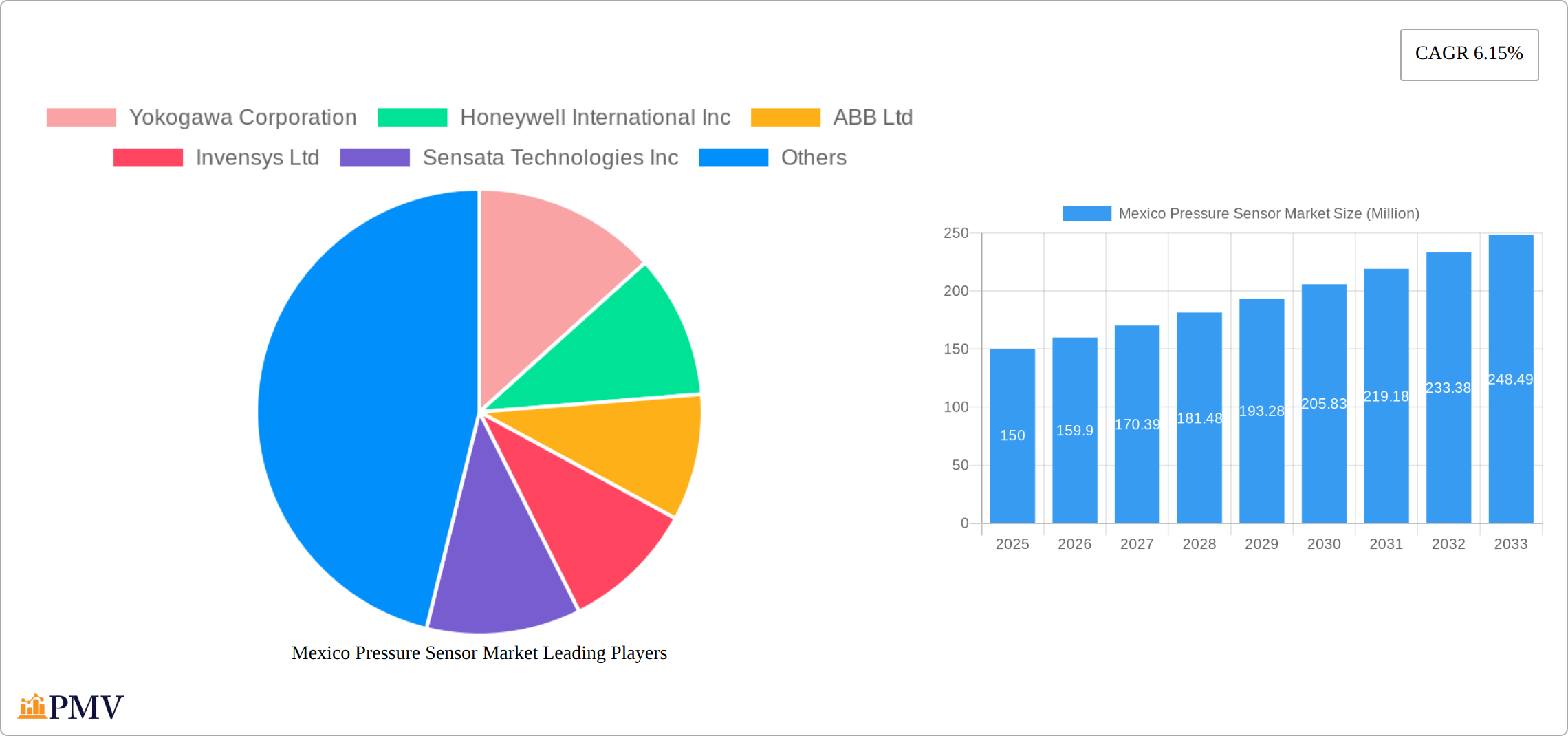

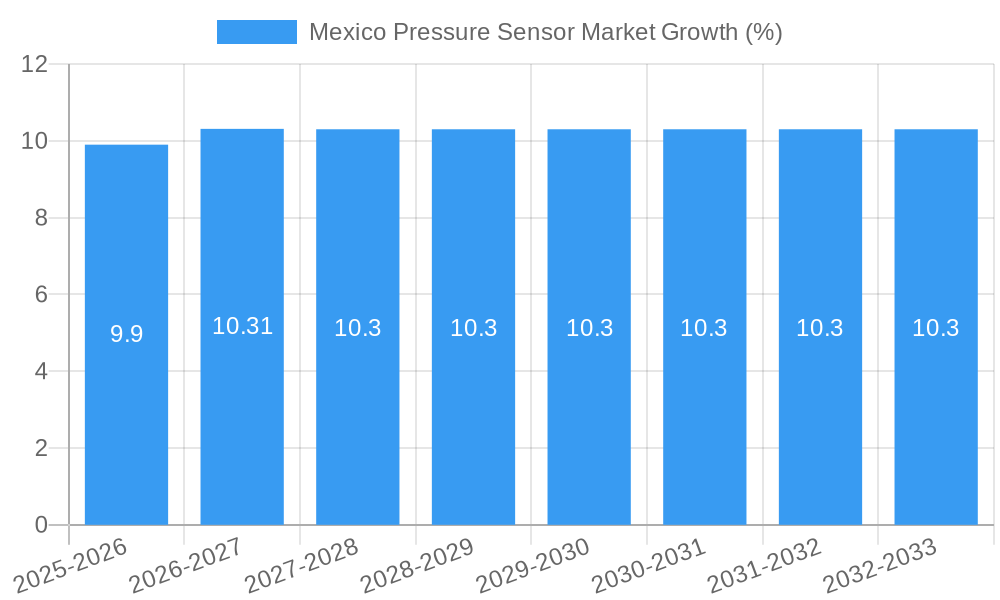

The Mexico pressure sensor market is experiencing robust growth, driven by increasing industrial automation, advancements in automotive technology, and the expansion of the medical device sector. With a Compound Annual Growth Rate (CAGR) of 6.15% from 2019-2024, the market is projected to maintain a similar growth trajectory through 2033. The automotive segment, encompassing applications like tire pressure monitoring, brake systems, and fuel injection, constitutes a significant portion of the market, fueled by the rising adoption of advanced driver-assistance systems (ADAS) and the increasing demand for fuel-efficient vehicles in Mexico. The medical segment demonstrates equally strong growth potential, driven by rising healthcare expenditure and the increasing prevalence of chronic diseases requiring continuous monitoring, such as hypertension and sleep apnea, increasing the demand for CPAP machines and blood pressure monitors.

Further growth is anticipated from the consumer electronics sector, with the proliferation of smartphones and wearable devices incorporating pressure sensors for various functionalities. The industrial sector, particularly manufacturing and process control, also provides a considerable market, driven by automation initiatives and the need for precise pressure measurement in various industrial processes. While challenges like potential supply chain disruptions and price fluctuations for raw materials exist, the overall market outlook for pressure sensors in Mexico remains positive, presenting significant opportunities for both established players and new entrants. The strong government support for industrial development and increasing foreign direct investment further bolster market prospects. The presence of key players like Yokogawa, Honeywell, and ABB, amongst others, indicates a competitive but dynamic market landscape.

Mexico Pressure Sensor Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Mexico pressure sensor market, offering invaluable insights for businesses and investors seeking to navigate this dynamic sector. The report covers the period 2019-2033, with a focus on the forecast period 2025-2033 and a base year of 2025. Market sizing is provided in Millions USD.

Mexico Pressure Sensor Market Market Structure & Competitive Dynamics

The Mexico pressure sensor market exhibits a moderately consolidated structure, with a handful of multinational corporations holding significant market share. The competitive landscape is characterized by intense innovation, driven by the need to meet evolving application demands and technological advancements. Regulatory frameworks, while not overly restrictive, impact market access and product compliance. Several successful mergers and acquisitions (M&A) have reshaped the market, leading to increased consolidation and vertical integration. Substitute technologies, such as optical sensors, pose a competitive threat, although pressure sensors still maintain a dominant position due to cost-effectiveness and proven reliability.

- Market Concentration: The top 5 players account for approximately xx% of the market share in 2025.

- Innovation Ecosystem: Significant R&D investments are fueling the development of highly sensitive, miniature, and smart pressure sensors.

- Regulatory Framework: Mexican regulatory bodies focus on ensuring product safety and quality, especially within sectors like automotive and medical.

- Product Substitutes: Optical and capacitive sensors are emerging alternatives, but traditional pressure sensors remain dominant.

- End-User Trends: Growing adoption in automotive, medical, and industrial applications fuels market expansion.

- M&A Activities: The total value of M&A deals within the Mexican pressure sensor market from 2019 to 2024 was approximately xx Million USD. Several key acquisitions have strengthened the position of leading players.

Mexico Pressure Sensor Market Industry Trends & Insights

The Mexico pressure sensor market is experiencing robust growth, propelled by the increasing adoption of pressure sensors across diverse sectors. The automotive industry, driven by advanced driver-assistance systems (ADAS) and emission control requirements, is a major growth driver. The medical sector presents significant opportunities due to the increasing demand for precise blood pressure monitoring devices and ventilators. Technological advancements such as the integration of IoT, miniaturization, and improved sensor accuracy further contribute to market expansion. The market faces competitive pressures from both established players and emerging entrants, leading to price competition and the constant need for innovation. Consumer preference is shifting towards high-accuracy, low-power-consumption sensors.

- CAGR (2025-2033): xx%

- Market Penetration: The pressure sensor market penetration is estimated at xx% in 2025 for the key applications.

Dominant Markets & Segments in Mexico Pressure Sensor Market

The automotive segment dominates the Mexico pressure sensor market, driven by the robust growth of the automotive industry and increasing vehicle production. This is followed by the medical segment and Industrial sector.

- Key Drivers for Automotive Dominance:

- Stringent emission regulations.

- Growing demand for ADAS.

- Increasing vehicle production in Mexico.

- Key Drivers for Medical Dominance:

- Rising prevalence of chronic diseases.

- Growing demand for advanced medical devices.

- Government initiatives to improve healthcare infrastructure.

- Key Drivers for Industrial Dominance:

- Expanding manufacturing sector.

- Increased automation and process control.

- Demand for precise measurement solutions.

The dominance of these segments is primarily due to a combination of factors, including high volume production, stringent regulatory requirements in the automotive sector, increasing demand for sophisticated medical technology and substantial growth in the industrial sector, resulting in greater pressure sensor application.

Mexico Pressure Sensor Market Product Innovations

Recent product innovations focus on enhancing sensor accuracy, miniaturization, and integration with IoT platforms. The development of smart pressure sensors with embedded microprocessors for data processing and wireless communication is gaining traction. These advancements improve real-time monitoring capabilities and enable predictive maintenance applications. Competitive advantages are achieved through superior sensor performance, smaller form factors, lower power consumption, and robust design for challenging operating environments.

Report Segmentation & Scope

The Mexico pressure sensor market is segmented by application:

- Automotive: This segment encompasses tire pressure monitoring systems (TPMS), brake pressure sensors, fuel system sensors, and other applications. The market is expected to witness strong growth due to the increasing demand for vehicles equipped with advanced safety and emission control features. xx Million USD in 2025 and is projected to reach xx Million USD by 2033.

- Medical: This segment includes sensors for blood pressure monitoring, ventilators, and other medical devices. Growth is fuelled by increasing healthcare expenditure and technological advancements in medical equipment. xx Million USD in 2025 and is projected to reach xx Million USD by 2033.

- Consumer Electronics: This segment is expected to grow steadily, driven by increased adoption of smart home devices and wearables. xx Million USD in 2025 and is projected to reach xx Million USD by 2033.

- Industrial: This segment is witnessing robust growth, propelled by the increasing adoption of automation and process control systems. xx Million USD in 2025 and is projected to reach xx Million USD by 2033.

- Aerospace and Defence: This niche segment is characterized by high-precision requirements and rigorous quality standards. xx Million USD in 2025 and is projected to reach xx Million USD by 2033.

- Food and Beverage: This segment focuses on process control and quality assurance in food and beverage production. xx Million USD in 2025 and is projected to reach xx Million USD by 2033.

- HVAC: This segment uses pressure sensors in heating, ventilation, and air conditioning systems for efficiency monitoring and control. xx Million USD in 2025 and is projected to reach xx Million USD by 2033.

Key Drivers of Mexico Pressure Sensor Market Growth

The growth of the Mexico pressure sensor market is driven by several factors, including the rising adoption of advanced driver-assistance systems (ADAS) in the automotive sector, the growing demand for precise medical equipment, and the increasing need for process automation in various industries. Government initiatives supporting technological advancements and infrastructure development also contribute to market growth. The increasing integration of IoT in various applications further expands market opportunities.

Challenges in the Mexico Pressure Sensor Market Sector

The Mexico pressure sensor market faces challenges such as fluctuating raw material prices, potential supply chain disruptions, and the need to comply with stringent safety and quality standards. Competition from global players and the emergence of substitute technologies pose further hurdles. Economic volatility and infrastructure limitations in some regions also impact market growth.

Leading Players in the Mexico Pressure Sensor Market Market

- Yokogawa Corporation

- Honeywell International Inc

- ABB Ltd

- Invensys Ltd

- Sensata Technologies Inc

- Endress+Hauser AG

- Rockwell Automation Inc

- Kistler Group

- All Sensors Corporation

- GMS Instruments BV

- Bosch Sensortec GmbH

- Rosemount Inc (Emerson Electric Company)

- Siemens AG

Key Developments in Mexico Pressure Sensor Market Sector

- April 2021: Research commenced utilizing an IoT-based wireless sensor network for hydrometeorological data collection and flood monitoring in Colima-Villa de Álvarez, Mexico. The Atmos 41 multisensory system was employed, showcasing the application of pressure sensors in environmental monitoring.

- July 2021: The Nobel Prize in Physiology or Medicine highlighted advancements in pressure sensor technology related to touch and pressure receptors, further driving innovation in the field.

Strategic Mexico Pressure Sensor Market Market Outlook

The Mexico pressure sensor market is poised for substantial growth in the coming years, driven by technological advancements, increasing industrial automation, and expansion in related sectors. Strategic opportunities exist for companies focusing on developing highly accurate, miniaturized, and cost-effective sensors tailored for specific applications. Investing in R&D and forging strategic partnerships will be crucial for success in this competitive market.

Mexico Pressure Sensor Market Segmentation

-

1. Application

- 1.1. Automotive

- 1.2. Medical

- 1.3. Consumer Electronics

- 1.4. Industrial

- 1.5. Aerospace and Defence

- 1.6. Food and Beverage

- 1.7. HVAC

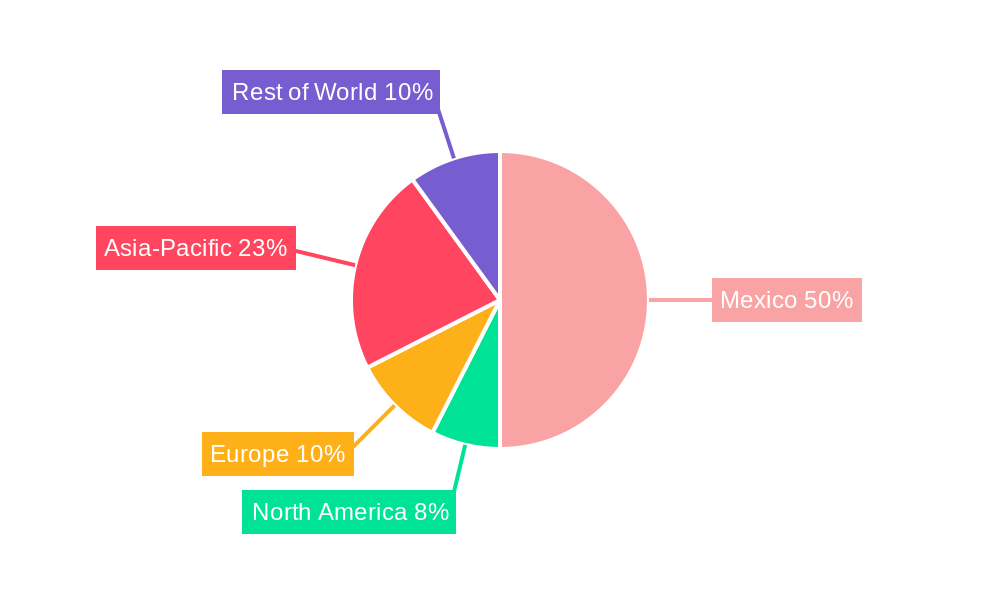

Mexico Pressure Sensor Market Segmentation By Geography

- 1. Mexico

Mexico Pressure Sensor Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.15% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Growth Of End-user Verticals

- 3.2.2 such as Automotive and Healthcare; Increasing Adoption of MEMS and NEMS Systems in the Industry

- 3.3. Market Restrains

- 3.3.1. High Costs Associated with Sensing Products

- 3.4. Market Trends

- 3.4.1. Automotive Industry to Show Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Pressure Sensor Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Automotive

- 5.1.2. Medical

- 5.1.3. Consumer Electronics

- 5.1.4. Industrial

- 5.1.5. Aerospace and Defence

- 5.1.6. Food and Beverage

- 5.1.7. HVAC

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Yokogawa Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Honeywell International Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ABB Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Invensys Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sensata Technologies Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Endress+Hauser AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Rockwell Automation Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kistler Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 All Sensors Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 GMS Instruments BV

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Bosch Sensortec GmbH

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Rosemount Inc (Emerson Electric Company)

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Siemens AG

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Yokogawa Corporation

List of Figures

- Figure 1: Mexico Pressure Sensor Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Mexico Pressure Sensor Market Share (%) by Company 2024

List of Tables

- Table 1: Mexico Pressure Sensor Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Mexico Pressure Sensor Market Revenue Million Forecast, by Application 2019 & 2032

- Table 3: Mexico Pressure Sensor Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Mexico Pressure Sensor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Mexico Pressure Sensor Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Mexico Pressure Sensor Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Pressure Sensor Market?

The projected CAGR is approximately 6.15%.

2. Which companies are prominent players in the Mexico Pressure Sensor Market?

Key companies in the market include Yokogawa Corporation, Honeywell International Inc, ABB Ltd, Invensys Ltd, Sensata Technologies Inc, Endress+Hauser AG, Rockwell Automation Inc, Kistler Group, All Sensors Corporation, GMS Instruments BV, Bosch Sensortec GmbH, Rosemount Inc (Emerson Electric Company), Siemens AG.

3. What are the main segments of the Mexico Pressure Sensor Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growth Of End-user Verticals. such as Automotive and Healthcare; Increasing Adoption of MEMS and NEMS Systems in the Industry.

6. What are the notable trends driving market growth?

Automotive Industry to Show Significant Growth.

7. Are there any restraints impacting market growth?

High Costs Associated with Sensing Products.

8. Can you provide examples of recent developments in the market?

April 2021 - Research is being conducted with the help of the Internet of Things (IoT)-based wireless sensor network for hydrometeorological data collection and flood monitoring for the urban area of Colima-Villa de Álvarez in Mexico. The weather station node retrieves information from the commercial multisensory Atmos 41, which includes 12 weather sensors, solar radiation, precipitation, vapor pressure, relative humidity, among others.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Pressure Sensor Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Pressure Sensor Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Pressure Sensor Market?

To stay informed about further developments, trends, and reports in the Mexico Pressure Sensor Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence