Key Insights

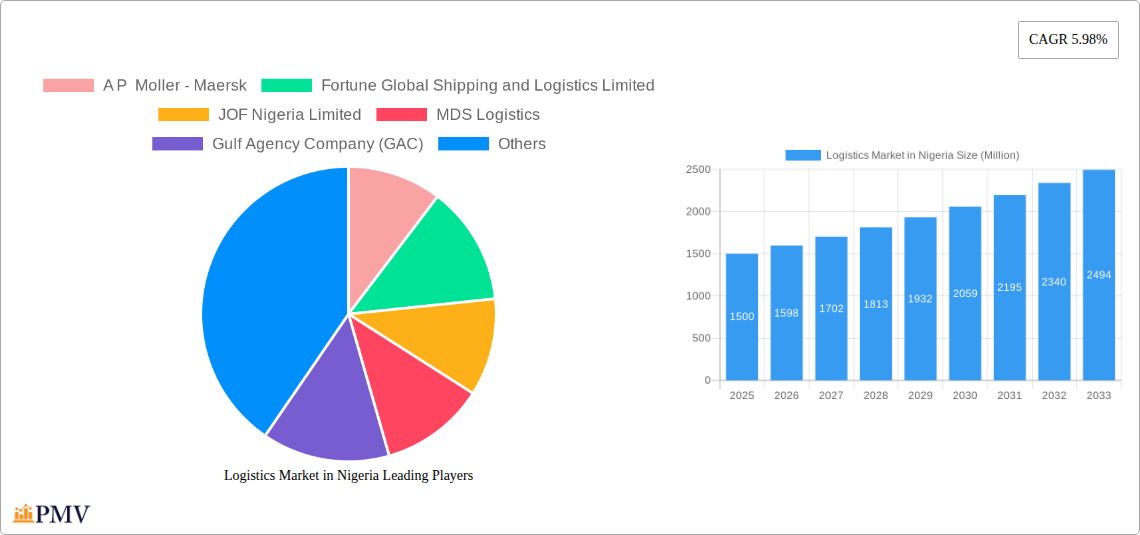

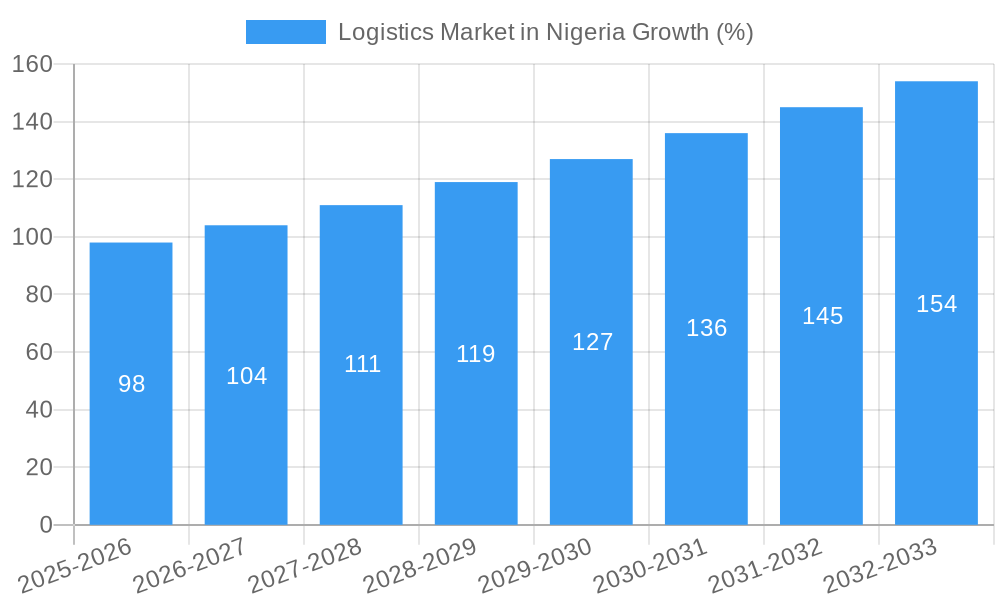

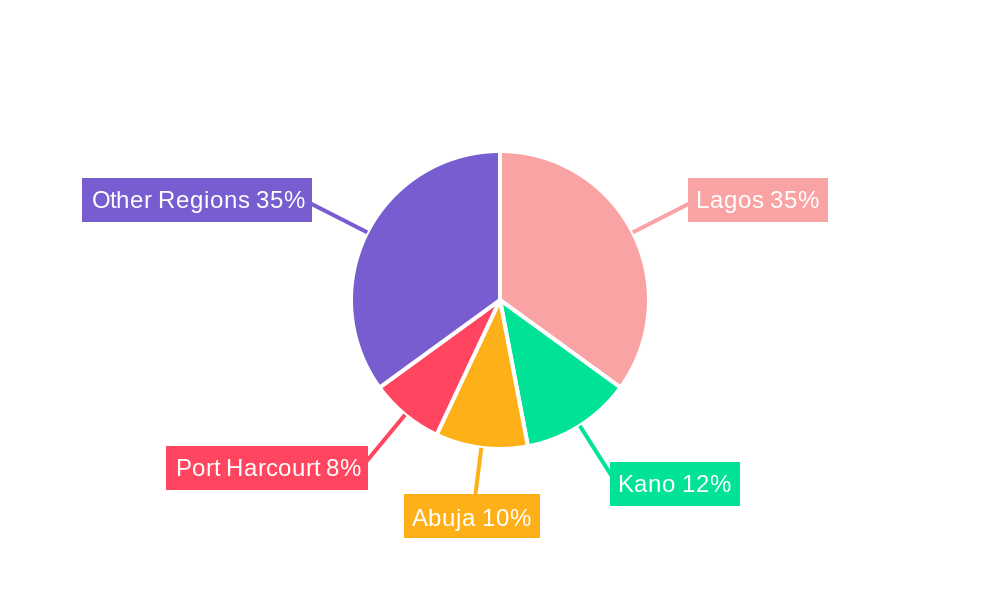

The Nigerian logistics market, valued at approximately $X million in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 5.98% from 2025 to 2033. This expansion is fueled by several key drivers. The burgeoning e-commerce sector in Nigeria is significantly boosting demand for efficient delivery services, particularly in the Courier, Express, and Parcel (CEP) segment. Furthermore, increasing infrastructural development, albeit gradual, is improving transportation networks and facilitating smoother logistics operations. Growth within key end-user industries such as manufacturing, construction, and oil & gas, also contributes significantly to the market's expansion. The diversification of the Nigerian economy and rising consumer spending are further stimulating demand for reliable and timely logistics solutions. However, challenges remain, including inadequate infrastructure (particularly road networks and port facilities), bureaucratic hurdles, and security concerns, which act as significant restraints on market growth. The temperature-controlled segment is poised for substantial growth driven by the need for preserving perishable goods, particularly agricultural products. Competition is fierce, with both international and domestic players vying for market share.

Segmentation analysis reveals that the CEP segment dominates the market, followed by temperature-controlled logistics. Within end-user industries, manufacturing, construction, and oil & gas are major contributors, while the agricultural sector presents significant untapped potential given the need for improved supply chain management for perishable goods. Key players like A P Moller-Maersk, Bolloré Group, and local logistics providers are actively shaping the market landscape through strategic investments in technology and infrastructure. The market's future trajectory will depend on government initiatives to improve infrastructure, streamline regulatory processes, and enhance security across the logistics value chain. This, coupled with continued growth in e-commerce and other key industries, promises strong long-term growth prospects for the Nigerian logistics sector.

Logistics Market in Nigeria: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Nigerian logistics market, offering invaluable insights for businesses, investors, and policymakers. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report unveils the market's structure, competitive landscape, dominant segments, and key growth drivers. The Nigerian logistics market, valued at xx Million in 2025, is poised for significant expansion, driven by factors such as e-commerce growth and infrastructure development. This report presents actionable intelligence, crucial for navigating the complexities of this dynamic sector.

Logistics Market in Nigeria Market Structure & Competitive Dynamics

The Nigerian logistics market exhibits a moderately concentrated structure, with a few large players like A P Moller - Maersk and Bolloré Group holding significant market share, alongside numerous smaller, specialized firms. Market share data for 2024 indicates A P Moller - Maersk holds approximately 15%, Bolloré Group at 12%, and the remaining share is dispersed among other players including Fortune Global Shipping and Logistics Limited, JOF Nigeria Limited and others. Innovation in the Nigerian logistics ecosystem is driven by the need to overcome infrastructure challenges and improve efficiency. The regulatory framework, while evolving, presents both opportunities and challenges, impacting operational costs and ease of doing business. Product substitutes, such as improved internal transportation methods within companies, exist, although their impact is limited in the broader market. End-user trends, especially the growth of e-commerce, are significantly shaping the demand for last-mile delivery and faster delivery times. M&A activity in the Nigerian logistics sector has been moderate, with deal values averaging xx Million in recent years. Some notable recent transactions include the xx Million acquisition of xx by xx in 2023.

- Market Concentration: Moderately concentrated, with a few dominant players.

- Innovation Ecosystem: Driven by need to improve efficiency and overcome infrastructure limitations.

- Regulatory Framework: Evolving, presenting both opportunities and challenges.

- Product Substitutes: Limited impact, with some internal transportation options.

- End-User Trends: E-commerce growth drives demand for faster and more efficient delivery.

- M&A Activity: Moderate activity with varying deal values.

Logistics Market in Nigeria Industry Trends & Insights

The Nigerian logistics market is experiencing robust growth, driven primarily by the burgeoning e-commerce sector, rising consumer spending, and increasing foreign direct investment (FDI). The Compound Annual Growth Rate (CAGR) for the period 2025-2033 is projected to be xx%, indicating significant market expansion. Technological disruptions, such as the adoption of digital platforms for tracking and management, are improving efficiency and transparency. Consumer preferences are shifting towards faster and more reliable delivery services. The rise of third-party logistics (3PL) providers is further transforming the competitive dynamics, offering greater flexibility and cost-effectiveness for businesses. Market penetration of technology-driven solutions remains relatively low, but is expected to grow rapidly as adoption increases. The overall positive economic outlook for Nigeria will also drive growth of the logistics industry.

Dominant Markets & Segments in Logistics Market in Nigeria

Within the Nigerian logistics market, the Wholesale and Retail Trade segment dominates the End-User Industry sector, driven by the rapid growth of e-commerce and increased consumer spending. The Courier, Express, and Parcel (CEP) segment holds the largest share within the Logistics Function category, fueled by the surge in online shopping. Key drivers for these dominant segments include:

- Wholesale and Retail Trade:

- Rapid growth of e-commerce.

- Increased consumer spending.

- Growing middle class.

- Courier, Express, and Parcel (CEP):

- Increased demand for fast and reliable delivery services.

- Growth of online businesses.

- Improved infrastructure in some areas.

The dominance of these segments is further reinforced by supportive government policies promoting e-commerce and logistics development. However, challenges such as inadequate infrastructure in certain regions and security concerns impact market penetration in some areas. The Oil and Gas sector also presents a substantial, albeit potentially volatile market, influenced by global oil prices and domestic policy.

Logistics Market in Nigeria Product Innovations

Recent innovations in the Nigerian logistics market are largely focused on improving efficiency and addressing infrastructure limitations. The adoption of digital platforms for tracking, route optimization, and inventory management is becoming increasingly prevalent. The use of technology solutions such as AI and Machine Learning is emerging as a way to handle large volumes of data associated with logistics, and improve efficiency in routing and resource management. This addresses the need for better visibility and improved communication within complex supply chains. The incorporation of innovative technologies creates competitive advantages by providing enhanced speed, reliability, and cost-effectiveness.

Report Segmentation & Scope

This report segments the Nigerian logistics market based on End-User Industry (Agriculture, Fishing, and Forestry; Construction; Manufacturing; Oil and Gas; Mining and Quarrying; Wholesale and Retail Trade; Others) and Logistics Function (Courier, Express, and Parcel (CEP); Temperature Controlled; Other Services). Each segment's growth projection, market size, and competitive dynamics are analyzed in detail within the report. For example, the Wholesale and Retail Trade segment is projected to experience the highest growth rate due to the booming e-commerce sector. Similarly, the CEP segment is expected to witness substantial growth due to the increasing demand for speedy delivery options.

Key Drivers of Logistics Market in Nigeria Growth

The growth of the Nigerian logistics market is primarily propelled by several interconnected factors. The rapid expansion of e-commerce, driven by rising internet penetration and smartphone usage, significantly boosts demand for last-mile delivery and efficient logistics solutions. Government initiatives aimed at improving infrastructure, such as road construction and port modernization, are enhancing operational efficiency and reducing transportation costs. Furthermore, the increase in FDI and the growth of manufacturing activities in Nigeria are also driving market expansion. A steady increase in consumer spending power also fuels the demands of efficient logistics.

Challenges in the Logistics Market in Nigeria Sector

Despite its substantial growth potential, the Nigerian logistics market faces several challenges. Inadequate infrastructure, including poor road networks and limited port capacity, creates bottlenecks and increases operational costs. Bureaucratic hurdles and regulatory complexities add to the operational burden. Security concerns, particularly regarding cargo theft and highway robbery, pose significant risks to the industry. These challenges lead to increased costs and supply chain inefficiencies which ultimately impact the competitiveness of Nigeria’s businesses. Estimates suggest that these challenges add approximately xx Million in losses annually.

Leading Players in the Logistics Market in Nigeria Market

- A P Moller - Maersk

- Fortune Global Shipping and Logistics Limited

- JOF Nigeria Limited

- MDS Logistics

- Gulf Agency Company (GAC)

- AfriGlobal logistics

- Africa Access 3PL Limited

- GWX Logistics

- Bolloré Group

- GIG Logistics

- Hapag-Lloyd

- Red Star Express PL

- CMA CGM Group

Key Developments in Logistics Market in Nigeria Sector

- September 2022: CEVA Logistics expanded its SKYCAPACITY Program, adding five air freight locations certified under the CEIV Lithium Battery Program, enhancing its capabilities in handling specialized cargo.

- November 2022: GIG Logistics purchased two ATR 72-500 freighters to expand its air freight capacity and meet rising e-commerce demand, a significant investment in its future air freight services.

- March 2023: Maersk announced the divestment of Maersk Supply Service (MSS), focusing its strategy on integrated logistics, signaling a shift in market focus towards core competencies and potentially impacting the offshore services segment within the broader logistics sector.

Strategic Logistics Market in Nigeria Market Outlook

The Nigerian logistics market presents a significant growth opportunity for businesses, driven by e-commerce expansion and infrastructure development. The increasing adoption of technology, such as route optimization software and warehouse management systems, will further enhance efficiency and reduce costs. Strategic investments in infrastructure and technology, coupled with a focus on enhancing security measures, will be crucial to unlocking the market's full potential. The long-term outlook remains positive, supported by continued economic growth and improving regulatory environments. The potential for growth suggests significant opportunities for both domestic and foreign investors.

Logistics Market in Nigeria Segmentation

-

1. End User Industry

- 1.1. Agriculture, Fishing, and Forestry

- 1.2. Construction

- 1.3. Manufacturing

- 1.4. Oil and Gas, Mining and Quarrying

- 1.5. Wholesale and Retail Trade

- 1.6. Others

-

2. Logistics Function

-

2.1. Courier, Express, and Parcel (CEP)

-

2.1.1. By Destination Type

- 2.1.1.1. Domestic

- 2.1.1.2. International

-

2.1.1. By Destination Type

-

2.2. Freight Forwarding

-

2.2.1. By Mode Of Transport

- 2.2.1.1. Air

- 2.2.1.2. Sea and Inland Waterways

- 2.2.1.3. Others

-

2.2.1. By Mode Of Transport

-

2.3. Freight Transport

- 2.3.1. Pipelines

- 2.3.2. Rail

- 2.3.3. Road

-

2.4. Warehousing and Storage

-

2.4.1. By Temperature Control

- 2.4.1.1. Non-Temperature Controlled

-

2.4.1. By Temperature Control

- 2.5. Other Services

-

2.1. Courier, Express, and Parcel (CEP)

Logistics Market in Nigeria Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Logistics Market in Nigeria REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.98% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing trade relations; Increased demand for perishable goods

- 3.3. Market Restrains

- 3.3.1. Cargo theft; High cost of maintainig

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Logistics Market in Nigeria Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Agriculture, Fishing, and Forestry

- 5.1.2. Construction

- 5.1.3. Manufacturing

- 5.1.4. Oil and Gas, Mining and Quarrying

- 5.1.5. Wholesale and Retail Trade

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Logistics Function

- 5.2.1. Courier, Express, and Parcel (CEP)

- 5.2.1.1. By Destination Type

- 5.2.1.1.1. Domestic

- 5.2.1.1.2. International

- 5.2.1.1. By Destination Type

- 5.2.2. Freight Forwarding

- 5.2.2.1. By Mode Of Transport

- 5.2.2.1.1. Air

- 5.2.2.1.2. Sea and Inland Waterways

- 5.2.2.1.3. Others

- 5.2.2.1. By Mode Of Transport

- 5.2.3. Freight Transport

- 5.2.3.1. Pipelines

- 5.2.3.2. Rail

- 5.2.3.3. Road

- 5.2.4. Warehousing and Storage

- 5.2.4.1. By Temperature Control

- 5.2.4.1.1. Non-Temperature Controlled

- 5.2.4.1. By Temperature Control

- 5.2.5. Other Services

- 5.2.1. Courier, Express, and Parcel (CEP)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. North America Logistics Market in Nigeria Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by End User Industry

- 6.1.1. Agriculture, Fishing, and Forestry

- 6.1.2. Construction

- 6.1.3. Manufacturing

- 6.1.4. Oil and Gas, Mining and Quarrying

- 6.1.5. Wholesale and Retail Trade

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by Logistics Function

- 6.2.1. Courier, Express, and Parcel (CEP)

- 6.2.1.1. By Destination Type

- 6.2.1.1.1. Domestic

- 6.2.1.1.2. International

- 6.2.1.1. By Destination Type

- 6.2.2. Freight Forwarding

- 6.2.2.1. By Mode Of Transport

- 6.2.2.1.1. Air

- 6.2.2.1.2. Sea and Inland Waterways

- 6.2.2.1.3. Others

- 6.2.2.1. By Mode Of Transport

- 6.2.3. Freight Transport

- 6.2.3.1. Pipelines

- 6.2.3.2. Rail

- 6.2.3.3. Road

- 6.2.4. Warehousing and Storage

- 6.2.4.1. By Temperature Control

- 6.2.4.1.1. Non-Temperature Controlled

- 6.2.4.1. By Temperature Control

- 6.2.5. Other Services

- 6.2.1. Courier, Express, and Parcel (CEP)

- 6.1. Market Analysis, Insights and Forecast - by End User Industry

- 7. South America Logistics Market in Nigeria Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by End User Industry

- 7.1.1. Agriculture, Fishing, and Forestry

- 7.1.2. Construction

- 7.1.3. Manufacturing

- 7.1.4. Oil and Gas, Mining and Quarrying

- 7.1.5. Wholesale and Retail Trade

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by Logistics Function

- 7.2.1. Courier, Express, and Parcel (CEP)

- 7.2.1.1. By Destination Type

- 7.2.1.1.1. Domestic

- 7.2.1.1.2. International

- 7.2.1.1. By Destination Type

- 7.2.2. Freight Forwarding

- 7.2.2.1. By Mode Of Transport

- 7.2.2.1.1. Air

- 7.2.2.1.2. Sea and Inland Waterways

- 7.2.2.1.3. Others

- 7.2.2.1. By Mode Of Transport

- 7.2.3. Freight Transport

- 7.2.3.1. Pipelines

- 7.2.3.2. Rail

- 7.2.3.3. Road

- 7.2.4. Warehousing and Storage

- 7.2.4.1. By Temperature Control

- 7.2.4.1.1. Non-Temperature Controlled

- 7.2.4.1. By Temperature Control

- 7.2.5. Other Services

- 7.2.1. Courier, Express, and Parcel (CEP)

- 7.1. Market Analysis, Insights and Forecast - by End User Industry

- 8. Europe Logistics Market in Nigeria Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by End User Industry

- 8.1.1. Agriculture, Fishing, and Forestry

- 8.1.2. Construction

- 8.1.3. Manufacturing

- 8.1.4. Oil and Gas, Mining and Quarrying

- 8.1.5. Wholesale and Retail Trade

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by Logistics Function

- 8.2.1. Courier, Express, and Parcel (CEP)

- 8.2.1.1. By Destination Type

- 8.2.1.1.1. Domestic

- 8.2.1.1.2. International

- 8.2.1.1. By Destination Type

- 8.2.2. Freight Forwarding

- 8.2.2.1. By Mode Of Transport

- 8.2.2.1.1. Air

- 8.2.2.1.2. Sea and Inland Waterways

- 8.2.2.1.3. Others

- 8.2.2.1. By Mode Of Transport

- 8.2.3. Freight Transport

- 8.2.3.1. Pipelines

- 8.2.3.2. Rail

- 8.2.3.3. Road

- 8.2.4. Warehousing and Storage

- 8.2.4.1. By Temperature Control

- 8.2.4.1.1. Non-Temperature Controlled

- 8.2.4.1. By Temperature Control

- 8.2.5. Other Services

- 8.2.1. Courier, Express, and Parcel (CEP)

- 8.1. Market Analysis, Insights and Forecast - by End User Industry

- 9. Middle East & Africa Logistics Market in Nigeria Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by End User Industry

- 9.1.1. Agriculture, Fishing, and Forestry

- 9.1.2. Construction

- 9.1.3. Manufacturing

- 9.1.4. Oil and Gas, Mining and Quarrying

- 9.1.5. Wholesale and Retail Trade

- 9.1.6. Others

- 9.2. Market Analysis, Insights and Forecast - by Logistics Function

- 9.2.1. Courier, Express, and Parcel (CEP)

- 9.2.1.1. By Destination Type

- 9.2.1.1.1. Domestic

- 9.2.1.1.2. International

- 9.2.1.1. By Destination Type

- 9.2.2. Freight Forwarding

- 9.2.2.1. By Mode Of Transport

- 9.2.2.1.1. Air

- 9.2.2.1.2. Sea and Inland Waterways

- 9.2.2.1.3. Others

- 9.2.2.1. By Mode Of Transport

- 9.2.3. Freight Transport

- 9.2.3.1. Pipelines

- 9.2.3.2. Rail

- 9.2.3.3. Road

- 9.2.4. Warehousing and Storage

- 9.2.4.1. By Temperature Control

- 9.2.4.1.1. Non-Temperature Controlled

- 9.2.4.1. By Temperature Control

- 9.2.5. Other Services

- 9.2.1. Courier, Express, and Parcel (CEP)

- 9.1. Market Analysis, Insights and Forecast - by End User Industry

- 10. Asia Pacific Logistics Market in Nigeria Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by End User Industry

- 10.1.1. Agriculture, Fishing, and Forestry

- 10.1.2. Construction

- 10.1.3. Manufacturing

- 10.1.4. Oil and Gas, Mining and Quarrying

- 10.1.5. Wholesale and Retail Trade

- 10.1.6. Others

- 10.2. Market Analysis, Insights and Forecast - by Logistics Function

- 10.2.1. Courier, Express, and Parcel (CEP)

- 10.2.1.1. By Destination Type

- 10.2.1.1.1. Domestic

- 10.2.1.1.2. International

- 10.2.1.1. By Destination Type

- 10.2.2. Freight Forwarding

- 10.2.2.1. By Mode Of Transport

- 10.2.2.1.1. Air

- 10.2.2.1.2. Sea and Inland Waterways

- 10.2.2.1.3. Others

- 10.2.2.1. By Mode Of Transport

- 10.2.3. Freight Transport

- 10.2.3.1. Pipelines

- 10.2.3.2. Rail

- 10.2.3.3. Road

- 10.2.4. Warehousing and Storage

- 10.2.4.1. By Temperature Control

- 10.2.4.1.1. Non-Temperature Controlled

- 10.2.4.1. By Temperature Control

- 10.2.5. Other Services

- 10.2.1. Courier, Express, and Parcel (CEP)

- 10.1. Market Analysis, Insights and Forecast - by End User Industry

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 A P Moller - Maersk

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Fortune Global Shipping and Logistics Limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 JOF Nigeria Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 MDS Logistics

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Gulf Agency Company (GAC)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 AfriGlobal logistics

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Africa Access 3PL Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 GWX Logistics

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Bolloré Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 GIG Logistics

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Hapag-Lloyd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Red Star Express PL

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 CMA CGM Group

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 A P Moller - Maersk

List of Figures

- Figure 1: Global Logistics Market in Nigeria Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Nigeria Logistics Market in Nigeria Revenue (Million), by Country 2024 & 2032

- Figure 3: Nigeria Logistics Market in Nigeria Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Logistics Market in Nigeria Revenue (Million), by End User Industry 2024 & 2032

- Figure 5: North America Logistics Market in Nigeria Revenue Share (%), by End User Industry 2024 & 2032

- Figure 6: North America Logistics Market in Nigeria Revenue (Million), by Logistics Function 2024 & 2032

- Figure 7: North America Logistics Market in Nigeria Revenue Share (%), by Logistics Function 2024 & 2032

- Figure 8: North America Logistics Market in Nigeria Revenue (Million), by Country 2024 & 2032

- Figure 9: North America Logistics Market in Nigeria Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Logistics Market in Nigeria Revenue (Million), by End User Industry 2024 & 2032

- Figure 11: South America Logistics Market in Nigeria Revenue Share (%), by End User Industry 2024 & 2032

- Figure 12: South America Logistics Market in Nigeria Revenue (Million), by Logistics Function 2024 & 2032

- Figure 13: South America Logistics Market in Nigeria Revenue Share (%), by Logistics Function 2024 & 2032

- Figure 14: South America Logistics Market in Nigeria Revenue (Million), by Country 2024 & 2032

- Figure 15: South America Logistics Market in Nigeria Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Logistics Market in Nigeria Revenue (Million), by End User Industry 2024 & 2032

- Figure 17: Europe Logistics Market in Nigeria Revenue Share (%), by End User Industry 2024 & 2032

- Figure 18: Europe Logistics Market in Nigeria Revenue (Million), by Logistics Function 2024 & 2032

- Figure 19: Europe Logistics Market in Nigeria Revenue Share (%), by Logistics Function 2024 & 2032

- Figure 20: Europe Logistics Market in Nigeria Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe Logistics Market in Nigeria Revenue Share (%), by Country 2024 & 2032

- Figure 22: Middle East & Africa Logistics Market in Nigeria Revenue (Million), by End User Industry 2024 & 2032

- Figure 23: Middle East & Africa Logistics Market in Nigeria Revenue Share (%), by End User Industry 2024 & 2032

- Figure 24: Middle East & Africa Logistics Market in Nigeria Revenue (Million), by Logistics Function 2024 & 2032

- Figure 25: Middle East & Africa Logistics Market in Nigeria Revenue Share (%), by Logistics Function 2024 & 2032

- Figure 26: Middle East & Africa Logistics Market in Nigeria Revenue (Million), by Country 2024 & 2032

- Figure 27: Middle East & Africa Logistics Market in Nigeria Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific Logistics Market in Nigeria Revenue (Million), by End User Industry 2024 & 2032

- Figure 29: Asia Pacific Logistics Market in Nigeria Revenue Share (%), by End User Industry 2024 & 2032

- Figure 30: Asia Pacific Logistics Market in Nigeria Revenue (Million), by Logistics Function 2024 & 2032

- Figure 31: Asia Pacific Logistics Market in Nigeria Revenue Share (%), by Logistics Function 2024 & 2032

- Figure 32: Asia Pacific Logistics Market in Nigeria Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific Logistics Market in Nigeria Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Logistics Market in Nigeria Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Logistics Market in Nigeria Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 3: Global Logistics Market in Nigeria Revenue Million Forecast, by Logistics Function 2019 & 2032

- Table 4: Global Logistics Market in Nigeria Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Logistics Market in Nigeria Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Global Logistics Market in Nigeria Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 7: Global Logistics Market in Nigeria Revenue Million Forecast, by Logistics Function 2019 & 2032

- Table 8: Global Logistics Market in Nigeria Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United States Logistics Market in Nigeria Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Canada Logistics Market in Nigeria Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Mexico Logistics Market in Nigeria Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Logistics Market in Nigeria Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 13: Global Logistics Market in Nigeria Revenue Million Forecast, by Logistics Function 2019 & 2032

- Table 14: Global Logistics Market in Nigeria Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Brazil Logistics Market in Nigeria Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Argentina Logistics Market in Nigeria Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Rest of South America Logistics Market in Nigeria Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Global Logistics Market in Nigeria Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 19: Global Logistics Market in Nigeria Revenue Million Forecast, by Logistics Function 2019 & 2032

- Table 20: Global Logistics Market in Nigeria Revenue Million Forecast, by Country 2019 & 2032

- Table 21: United Kingdom Logistics Market in Nigeria Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Germany Logistics Market in Nigeria Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: France Logistics Market in Nigeria Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Italy Logistics Market in Nigeria Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Spain Logistics Market in Nigeria Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Russia Logistics Market in Nigeria Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Benelux Logistics Market in Nigeria Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Nordics Logistics Market in Nigeria Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Rest of Europe Logistics Market in Nigeria Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Global Logistics Market in Nigeria Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 31: Global Logistics Market in Nigeria Revenue Million Forecast, by Logistics Function 2019 & 2032

- Table 32: Global Logistics Market in Nigeria Revenue Million Forecast, by Country 2019 & 2032

- Table 33: Turkey Logistics Market in Nigeria Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Israel Logistics Market in Nigeria Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: GCC Logistics Market in Nigeria Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: North Africa Logistics Market in Nigeria Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: South Africa Logistics Market in Nigeria Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Rest of Middle East & Africa Logistics Market in Nigeria Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global Logistics Market in Nigeria Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 40: Global Logistics Market in Nigeria Revenue Million Forecast, by Logistics Function 2019 & 2032

- Table 41: Global Logistics Market in Nigeria Revenue Million Forecast, by Country 2019 & 2032

- Table 42: China Logistics Market in Nigeria Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: India Logistics Market in Nigeria Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Japan Logistics Market in Nigeria Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: South Korea Logistics Market in Nigeria Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: ASEAN Logistics Market in Nigeria Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Oceania Logistics Market in Nigeria Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Asia Pacific Logistics Market in Nigeria Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Logistics Market in Nigeria?

The projected CAGR is approximately 5.98%.

2. Which companies are prominent players in the Logistics Market in Nigeria?

Key companies in the market include A P Moller - Maersk, Fortune Global Shipping and Logistics Limited, JOF Nigeria Limited, MDS Logistics, Gulf Agency Company (GAC), AfriGlobal logistics, Africa Access 3PL Limited, GWX Logistics, Bolloré Group, GIG Logistics, Hapag-Lloyd, Red Star Express PL, CMA CGM Group.

3. What are the main segments of the Logistics Market in Nigeria?

The market segments include End User Industry, Logistics Function.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing trade relations; Increased demand for perishable goods.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Cargo theft; High cost of maintainig.

8. Can you provide examples of recent developments in the market?

March 2023: Maersk announced an intended divestment of Maersk Supply Service (MSS), a provider of global offshore marine services and project solutions for the energy sector. It took this step to help Maersk Supply Service continue further development of new solutions for the green transition of the offshore sector under new long-term ownership. It also marks the completion of its decision to divest all energy-related activities and focus on truly integrated logistics.November 2022: GIG signed up to purchase two ATR 72-500 freighters as it looks to meet growing e-commerce demand and expand its air freight services in Africa.September 2022: CEVA Logistics expanded its owned and controlled SKYCAPACITY Program and added five more stations to its network of air freight locations certified under the CEIV Lithium Battery Program.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Logistics Market in Nigeria," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Logistics Market in Nigeria report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Logistics Market in Nigeria?

To stay informed about further developments, trends, and reports in the Logistics Market in Nigeria, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence