Key Insights

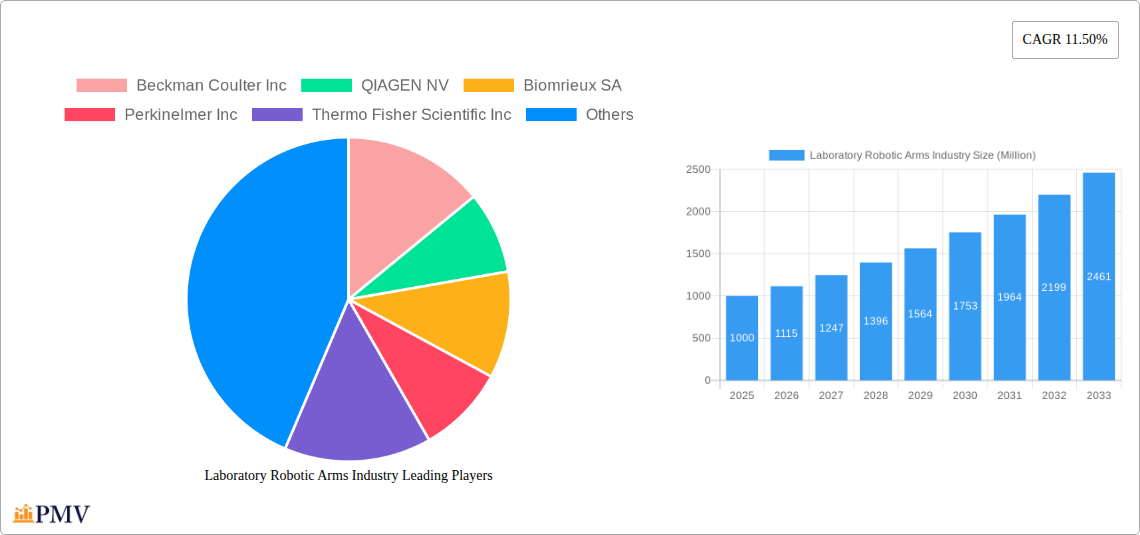

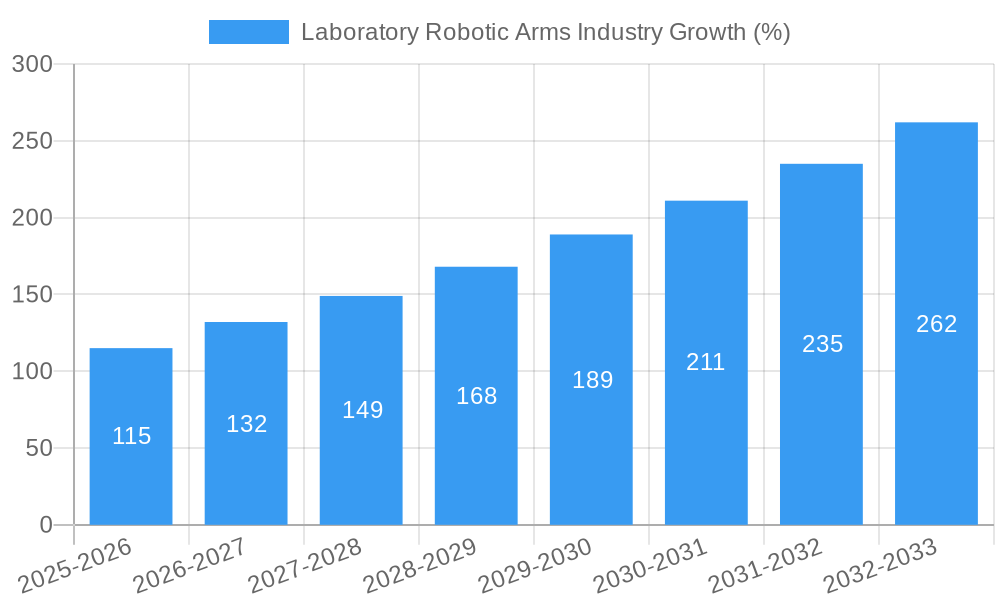

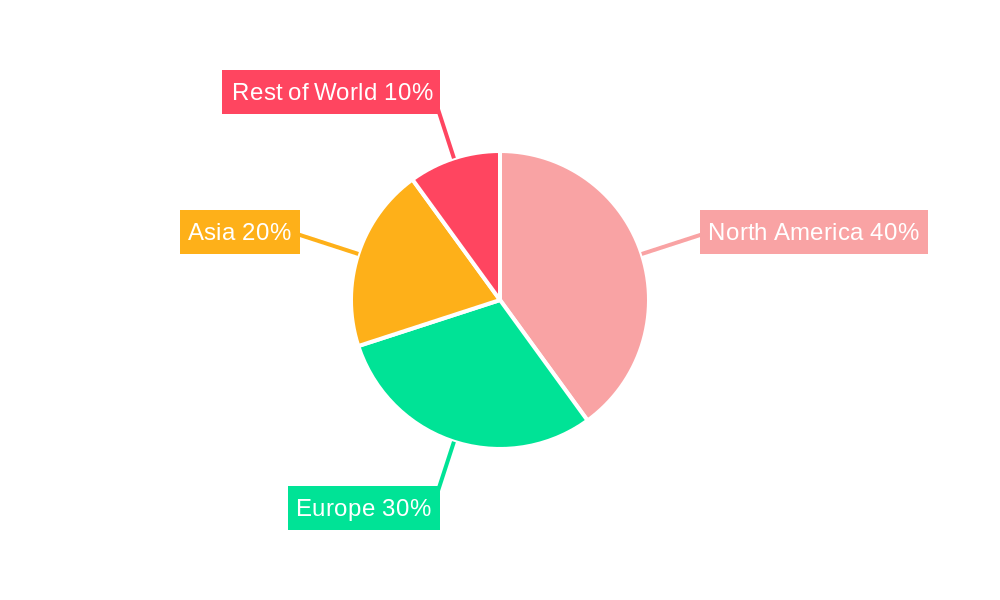

The global laboratory robotic arms market is experiencing robust growth, driven by increasing automation in laboratory settings, the rising demand for high-throughput screening in drug discovery and genomics research, and the need for improved accuracy and efficiency in clinical diagnostics. The market, valued at approximately $XX million in 2025, is projected to exhibit a Compound Annual Growth Rate (CAGR) of 11.50% from 2025 to 2033, reaching an estimated value of $YY million (calculated based on a 11.5% CAGR for 8 years). Key market segments include articulated arm robots, which maintain a significant market share due to their versatility, and dual-arm robots, witnessing increasing adoption due to their ability to handle complex tasks. Significant application areas are drug discovery, leveraging the speed and precision of robotic arms for high-throughput screening and automation of complex assays, and genomics & proteomics, where robotic arms automate sample preparation and analysis. North America and Europe currently dominate the market, attributed to the presence of established research institutions and pharmaceutical companies. However, rapidly developing economies in Asia are expected to fuel substantial growth in the coming years.

Growth is further fueled by advancements in robotic technology, leading to enhanced precision, speed, and flexibility. Miniaturization of robotic arms enables their integration into smaller laboratory spaces, leading to increased adoption across diverse applications. However, the high initial investment cost of robotic systems and the requirement for specialized training pose some restraints to market growth. Nonetheless, the long-term benefits in terms of improved efficiency, reduced human error, and increased throughput are expected to overcome these challenges, ensuring sustained market expansion. Leading players like Beckman Coulter, QIAGEN, and Thermo Fisher Scientific are strategically investing in research and development, focusing on innovative features and expanding their product portfolios to solidify their market positions. The competitive landscape is characterized by both established industry giants and emerging players, resulting in continuous innovation and competitive pricing, further benefiting end-users.

Laboratory Robotic Arms Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Laboratory Robotic Arms industry, offering invaluable insights for stakeholders seeking to navigate this dynamic market. The report covers the period from 2019 to 2033, with a focus on the 2025-2033 forecast period. The global market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period. This detailed analysis covers market segmentation, competitive landscape, technological advancements, and key growth drivers.

Laboratory Robotic Arms Industry Market Structure & Competitive Dynamics

The Laboratory Robotic Arms market exhibits a moderately concentrated structure, with several key players holding significant market share. Beckman Coulter Inc, QIAGEN NV, Biomérieux SA, PerkinElmer Inc, Thermo Fisher Scientific Inc, Siemens Healthineers AG, Anton Paar GmbH, Abbott Laboratories, Hamilton Company, Tecan Group, and Hudson Robotics Inc are among the prominent competitors. Market share is dynamic, influenced by continuous innovation, strategic partnerships, and mergers and acquisitions (M&A) activities. The total value of M&A deals in the sector during the historical period (2019-2024) is estimated at xx Million. Regulatory frameworks, particularly those concerning medical device approvals and data privacy, significantly impact market dynamics. The presence of substitute technologies, such as manual laboratory processes, creates competitive pressure. However, the increasing demand for automation and higher throughput in laboratories drives market growth, offsetting some of this pressure. End-user trends, including the shift toward personalized medicine and increasing demand for high-throughput screening, contribute to the market's evolution.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share.

- Innovation Ecosystems: Strong emphasis on R&D, with collaborations between research institutions and companies driving innovation.

- Regulatory Frameworks: Stringent regulations impacting product approvals and data security, posing challenges for new entrants.

- Product Substitutes: Manual laboratory processes offer a substitute, but automation advantages outweigh limitations for many applications.

- End-User Trends: Growing adoption of automation in clinical diagnostics and drug discovery driving demand.

- M&A Activities: Significant M&A activity observed in recent years, driven by consolidation and expansion strategies.

Laboratory Robotic Arms Industry Industry Trends & Insights

The Laboratory Robotic Arms market is experiencing robust growth, driven by several factors. The increasing demand for automation in laboratories, particularly in clinical diagnostics and drug discovery, significantly fuels market expansion. Technological advancements, including the development of more sophisticated robotic arms with enhanced precision and dexterity, further contribute to growth. This, coupled with the rising adoption of artificial intelligence (AI) and machine learning (ML) in laboratory automation, is enhancing efficiency and accuracy. Consumer preferences are shifting towards faster turnaround times and improved accuracy in laboratory testing, creating a strong impetus for robotic arm adoption. Competitive dynamics remain intense, with companies continuously striving to enhance product features, improve functionalities, and offer comprehensive solutions. The market is witnessing a steady increase in the adoption of cloud-based laboratory information management systems (LIMS), further integrating robotic arms into a more efficient workflow.

Dominant Markets & Segments in Laboratory Robotic Arms Industry

The North American region currently dominates the Laboratory Robotic Arms market, driven by robust healthcare infrastructure, high adoption rates in research laboratories, and the presence of key players. Within segments:

By Type: The articulated arm segment holds the largest market share, driven by its versatility and adaptability to various laboratory applications. Dual-arm robots are gaining traction due to their enhanced capabilities, but are limited by higher costs. Parallel link arms find niche applications in high-speed and high-precision tasks.

By Application: The clinical diagnostics segment represents a significant portion of the market. The drug discovery segment shows rapid growth. Genomics and proteomics applications also contribute considerably.

Key Drivers:

- North America: Strong R&D investments, established healthcare infrastructure, and high disposable income.

- Europe: Growing adoption of automation technologies in pharmaceutical and biotechnology sectors.

- Asia-Pacific: Rapidly expanding healthcare sector and increasing government investments in healthcare infrastructure.

Laboratory Robotic Arms Industry Product Innovations

Recent innovations focus on increasing dexterity, precision, and ease of use. Collaborative robots (cobots) are gaining popularity due to their safe operation alongside human personnel. Integration with advanced software and analytics tools enhances data management and analysis capabilities. The development of smaller, more compact robotic arms reduces the footprint in laboratories and adds flexibility. These improvements align with the growing need for streamlined, efficient workflows in laboratories, enhancing operational efficiency and precision.

Report Segmentation & Scope

This report segments the Laboratory Robotic Arms market by type (Articulated Arm, Dual Arm, Parallel Link Arm, Others) and by application (Drug Discovery, Digital Imaging, Genomics & Proteomics, Clinical Diagnostics, System Biology, Others). Each segment's growth projections, market size, and competitive dynamics are thoroughly analyzed, considering factors such as technological advancements and regulatory changes. The articulated arm segment is projected to dominate, exhibiting a xx Million market value by 2033. Similarly, the clinical diagnostics application is predicted to witness the highest growth within the application segments, reaching xx Million by 2033.

Key Drivers of Laboratory Robotic Arms Industry Growth

Several factors drive the market's expansion: the increasing demand for automation to improve efficiency and throughput in laboratories; advances in robotics technologies, leading to more precise, adaptable, and user-friendly systems; and rising investments in R&D within the healthcare and biotechnology sectors. Government funding and initiatives supporting advancements in medical technology also contribute to the market's growth. The rising prevalence of chronic diseases necessitates high-throughput screening and diagnostics, furthering the demand for automation.

Challenges in the Laboratory Robotic Arms Industry Sector

High initial investment costs for robotic systems, especially for advanced models, can act as a barrier. The complexity of integrating robotic arms into existing laboratory workflows presents a challenge. The requirement for specialized training for technicians and operators also contributes to implementation costs. Supply chain disruptions in the sourcing of components can impact production and lead times. Intense competition among established players and the entrance of new players also shapes the industry dynamics. The need for stringent regulatory compliance for medical devices in many regions adds to operational complexity.

Leading Players in the Laboratory Robotic Arms Industry Market

- Beckman Coulter Inc

- QIAGEN NV

- Biomérieux SA

- PerkinElmer Inc

- Thermo Fisher Scientific Inc

- Siemens Healthineers AG

- Anton Paar GmbH

- Abbott Laboratories

- Hamilton Company

- Tecan Group

- Hudson Robotics Inc

Key Developments in Laboratory Robotic Arms Industry Sector

August 2022: Northwestern University researchers developed Omnid Mocobots, collaborative mobile robots enhancing human-robot interaction in handling delicate payloads. This innovation is anticipated to improve safety and efficiency in handling sensitive samples.

July 2022: Comau launched the Racer-5SE, a six-axis articulated robot specifically designed for the pharmaceutical sector. Its high-grade cleanroom classification and chemical resistance significantly enhance its suitability for demanding laboratory environments. This signals a trend towards specialized robots for particular industry needs.

Strategic Laboratory Robotic Arms Industry Market Outlook

The Laboratory Robotic Arms market presents significant growth potential, driven by technological advancements, increasing automation needs in various laboratory settings, and the growing adoption of automation in healthcare. Strategic opportunities exist in developing specialized robotic arms for niche applications, integrating AI and machine learning for improved decision-making, and focusing on user-friendly and cost-effective solutions to broaden market access. Expansion into emerging markets and strategic partnerships can further enhance market penetration and growth.

Laboratory Robotic Arms Industry Segmentation

-

1. Type

- 1.1. Articulated Arm

- 1.2. Dual Arm

- 1.3. Parallel Link Arm

- 1.4. Others

-

2. Application

- 2.1. Drug Discovery

- 2.2. Digital Imaging

- 2.3. Genomics & Proteomics

- 2.4. Clinical Diagnostics,

- 2.5. System Biology

- 2.6. Others

Laboratory Robotic Arms Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Laboratory Robotic Arms Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Trend of Lab automation; Increasing Focus Towards Work-safety in Laboratories

- 3.3. Market Restrains

- 3.3.1. Expensive Initial Setup

- 3.4. Market Trends

- 3.4.1. Genomics and Proteomics Application is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Laboratory Robotic Arms Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Articulated Arm

- 5.1.2. Dual Arm

- 5.1.3. Parallel Link Arm

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Drug Discovery

- 5.2.2. Digital Imaging

- 5.2.3. Genomics & Proteomics

- 5.2.4. Clinical Diagnostics,

- 5.2.5. System Biology

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Laboratory Robotic Arms Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Articulated Arm

- 6.1.2. Dual Arm

- 6.1.3. Parallel Link Arm

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Drug Discovery

- 6.2.2. Digital Imaging

- 6.2.3. Genomics & Proteomics

- 6.2.4. Clinical Diagnostics,

- 6.2.5. System Biology

- 6.2.6. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Laboratory Robotic Arms Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Articulated Arm

- 7.1.2. Dual Arm

- 7.1.3. Parallel Link Arm

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Drug Discovery

- 7.2.2. Digital Imaging

- 7.2.3. Genomics & Proteomics

- 7.2.4. Clinical Diagnostics,

- 7.2.5. System Biology

- 7.2.6. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Laboratory Robotic Arms Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Articulated Arm

- 8.1.2. Dual Arm

- 8.1.3. Parallel Link Arm

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Drug Discovery

- 8.2.2. Digital Imaging

- 8.2.3. Genomics & Proteomics

- 8.2.4. Clinical Diagnostics,

- 8.2.5. System Biology

- 8.2.6. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Australia and New Zealand Laboratory Robotic Arms Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Articulated Arm

- 9.1.2. Dual Arm

- 9.1.3. Parallel Link Arm

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Drug Discovery

- 9.2.2. Digital Imaging

- 9.2.3. Genomics & Proteomics

- 9.2.4. Clinical Diagnostics,

- 9.2.5. System Biology

- 9.2.6. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Latin America Laboratory Robotic Arms Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Articulated Arm

- 10.1.2. Dual Arm

- 10.1.3. Parallel Link Arm

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Drug Discovery

- 10.2.2. Digital Imaging

- 10.2.3. Genomics & Proteomics

- 10.2.4. Clinical Diagnostics,

- 10.2.5. System Biology

- 10.2.6. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Middle East and Africa Laboratory Robotic Arms Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Articulated Arm

- 11.1.2. Dual Arm

- 11.1.3. Parallel Link Arm

- 11.1.4. Others

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Drug Discovery

- 11.2.2. Digital Imaging

- 11.2.3. Genomics & Proteomics

- 11.2.4. Clinical Diagnostics,

- 11.2.5. System Biology

- 11.2.6. Others

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. North America Laboratory Robotic Arms Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Europe Laboratory Robotic Arms Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Asia Laboratory Robotic Arms Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Australia and New Zealand Laboratory Robotic Arms Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Latin America Laboratory Robotic Arms Industry Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1.

- 17. Middle East and Africa Laboratory Robotic Arms Industry Analysis, Insights and Forecast, 2019-2031

- 17.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 17.1.1.

- 18. Competitive Analysis

- 18.1. Global Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 Beckman Coulter Inc

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 QIAGEN NV

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 Biomrieux SA

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 Perkinelmer Inc

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 Thermo Fisher Scientific Inc

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Siemens Healthineers AG

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 Anton Paar GmbH

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 Abbott Laboratorie

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 Hamilton Company

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 Tecan Group

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.11 Hudson Robotics Inc

- 18.2.11.1. Overview

- 18.2.11.2. Products

- 18.2.11.3. SWOT Analysis

- 18.2.11.4. Recent Developments

- 18.2.11.5. Financials (Based on Availability)

- 18.2.1 Beckman Coulter Inc

List of Figures

- Figure 1: Global Laboratory Robotic Arms Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Laboratory Robotic Arms Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Laboratory Robotic Arms Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Laboratory Robotic Arms Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Laboratory Robotic Arms Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Laboratory Robotic Arms Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Laboratory Robotic Arms Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Australia and New Zealand Laboratory Robotic Arms Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Australia and New Zealand Laboratory Robotic Arms Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Latin America Laboratory Robotic Arms Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Latin America Laboratory Robotic Arms Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: Middle East and Africa Laboratory Robotic Arms Industry Revenue (Million), by Country 2024 & 2032

- Figure 13: Middle East and Africa Laboratory Robotic Arms Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Laboratory Robotic Arms Industry Revenue (Million), by Type 2024 & 2032

- Figure 15: North America Laboratory Robotic Arms Industry Revenue Share (%), by Type 2024 & 2032

- Figure 16: North America Laboratory Robotic Arms Industry Revenue (Million), by Application 2024 & 2032

- Figure 17: North America Laboratory Robotic Arms Industry Revenue Share (%), by Application 2024 & 2032

- Figure 18: North America Laboratory Robotic Arms Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Laboratory Robotic Arms Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Laboratory Robotic Arms Industry Revenue (Million), by Type 2024 & 2032

- Figure 21: Europe Laboratory Robotic Arms Industry Revenue Share (%), by Type 2024 & 2032

- Figure 22: Europe Laboratory Robotic Arms Industry Revenue (Million), by Application 2024 & 2032

- Figure 23: Europe Laboratory Robotic Arms Industry Revenue Share (%), by Application 2024 & 2032

- Figure 24: Europe Laboratory Robotic Arms Industry Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe Laboratory Robotic Arms Industry Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Laboratory Robotic Arms Industry Revenue (Million), by Type 2024 & 2032

- Figure 27: Asia Laboratory Robotic Arms Industry Revenue Share (%), by Type 2024 & 2032

- Figure 28: Asia Laboratory Robotic Arms Industry Revenue (Million), by Application 2024 & 2032

- Figure 29: Asia Laboratory Robotic Arms Industry Revenue Share (%), by Application 2024 & 2032

- Figure 30: Asia Laboratory Robotic Arms Industry Revenue (Million), by Country 2024 & 2032

- Figure 31: Asia Laboratory Robotic Arms Industry Revenue Share (%), by Country 2024 & 2032

- Figure 32: Australia and New Zealand Laboratory Robotic Arms Industry Revenue (Million), by Type 2024 & 2032

- Figure 33: Australia and New Zealand Laboratory Robotic Arms Industry Revenue Share (%), by Type 2024 & 2032

- Figure 34: Australia and New Zealand Laboratory Robotic Arms Industry Revenue (Million), by Application 2024 & 2032

- Figure 35: Australia and New Zealand Laboratory Robotic Arms Industry Revenue Share (%), by Application 2024 & 2032

- Figure 36: Australia and New Zealand Laboratory Robotic Arms Industry Revenue (Million), by Country 2024 & 2032

- Figure 37: Australia and New Zealand Laboratory Robotic Arms Industry Revenue Share (%), by Country 2024 & 2032

- Figure 38: Latin America Laboratory Robotic Arms Industry Revenue (Million), by Type 2024 & 2032

- Figure 39: Latin America Laboratory Robotic Arms Industry Revenue Share (%), by Type 2024 & 2032

- Figure 40: Latin America Laboratory Robotic Arms Industry Revenue (Million), by Application 2024 & 2032

- Figure 41: Latin America Laboratory Robotic Arms Industry Revenue Share (%), by Application 2024 & 2032

- Figure 42: Latin America Laboratory Robotic Arms Industry Revenue (Million), by Country 2024 & 2032

- Figure 43: Latin America Laboratory Robotic Arms Industry Revenue Share (%), by Country 2024 & 2032

- Figure 44: Middle East and Africa Laboratory Robotic Arms Industry Revenue (Million), by Type 2024 & 2032

- Figure 45: Middle East and Africa Laboratory Robotic Arms Industry Revenue Share (%), by Type 2024 & 2032

- Figure 46: Middle East and Africa Laboratory Robotic Arms Industry Revenue (Million), by Application 2024 & 2032

- Figure 47: Middle East and Africa Laboratory Robotic Arms Industry Revenue Share (%), by Application 2024 & 2032

- Figure 48: Middle East and Africa Laboratory Robotic Arms Industry Revenue (Million), by Country 2024 & 2032

- Figure 49: Middle East and Africa Laboratory Robotic Arms Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Laboratory Robotic Arms Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Laboratory Robotic Arms Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Laboratory Robotic Arms Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Global Laboratory Robotic Arms Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Laboratory Robotic Arms Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Laboratory Robotic Arms Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Laboratory Robotic Arms Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Laboratory Robotic Arms Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Laboratory Robotic Arms Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Laboratory Robotic Arms Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Laboratory Robotic Arms Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Laboratory Robotic Arms Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Laboratory Robotic Arms Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Laboratory Robotic Arms Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Laboratory Robotic Arms Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Laboratory Robotic Arms Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global Laboratory Robotic Arms Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 18: Global Laboratory Robotic Arms Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 19: Global Laboratory Robotic Arms Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Global Laboratory Robotic Arms Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 21: Global Laboratory Robotic Arms Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 22: Global Laboratory Robotic Arms Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 23: Global Laboratory Robotic Arms Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 24: Global Laboratory Robotic Arms Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 25: Global Laboratory Robotic Arms Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Global Laboratory Robotic Arms Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 27: Global Laboratory Robotic Arms Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 28: Global Laboratory Robotic Arms Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 29: Global Laboratory Robotic Arms Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 30: Global Laboratory Robotic Arms Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 31: Global Laboratory Robotic Arms Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Global Laboratory Robotic Arms Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 33: Global Laboratory Robotic Arms Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 34: Global Laboratory Robotic Arms Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Laboratory Robotic Arms Industry?

The projected CAGR is approximately 11.50%.

2. Which companies are prominent players in the Laboratory Robotic Arms Industry?

Key companies in the market include Beckman Coulter Inc, QIAGEN NV, Biomrieux SA, Perkinelmer Inc, Thermo Fisher Scientific Inc, Siemens Healthineers AG, Anton Paar GmbH, Abbott Laboratorie, Hamilton Company, Tecan Group, Hudson Robotics Inc.

3. What are the main segments of the Laboratory Robotic Arms Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Trend of Lab automation; Increasing Focus Towards Work-safety in Laboratories.

6. What are the notable trends driving market growth?

Genomics and Proteomics Application is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Expensive Initial Setup.

8. Can you provide examples of recent developments in the market?

August 2022 - Researchers at Northwestern University's Center for Robotics and Biosystems developed new collaborative mobile robots dubbed Omnid Mocobots. They are designed to cooperate with humans to pick up, handle, and transport delicate and flexible payloads. The unique robotic system has a mobile base and a robotic arm. It has three essential features that set it apart from other robots. The first is the robot arms with built-in mechanical compliance. Second, the robot arms have precisely controlled forces at their grippers. Third, the control laws governing the mobile base and manipulator allow teams of Omnids to render a large object weightless to the human.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Laboratory Robotic Arms Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Laboratory Robotic Arms Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Laboratory Robotic Arms Industry?

To stay informed about further developments, trends, and reports in the Laboratory Robotic Arms Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence