Key Insights

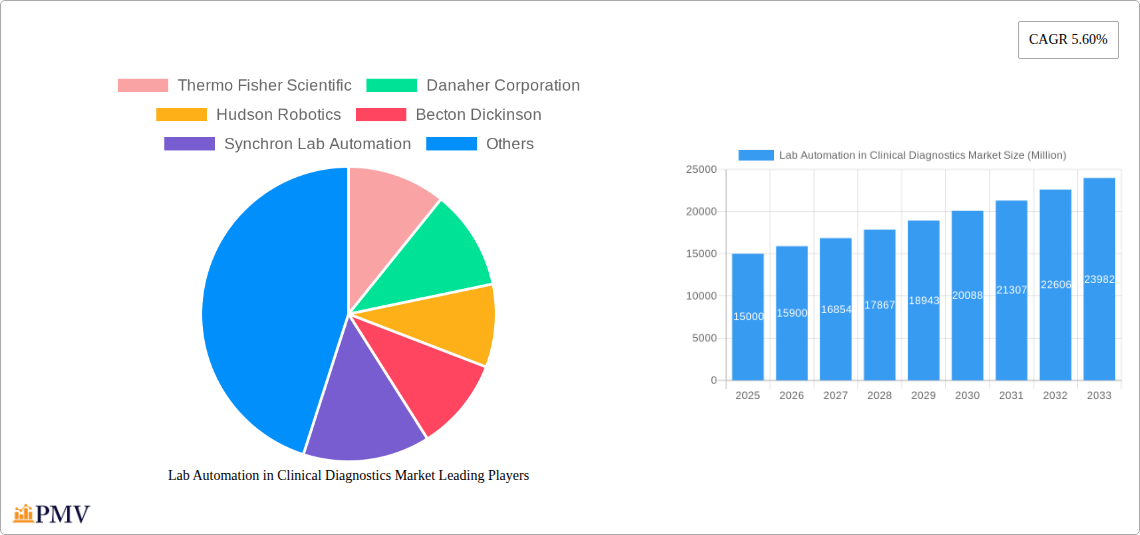

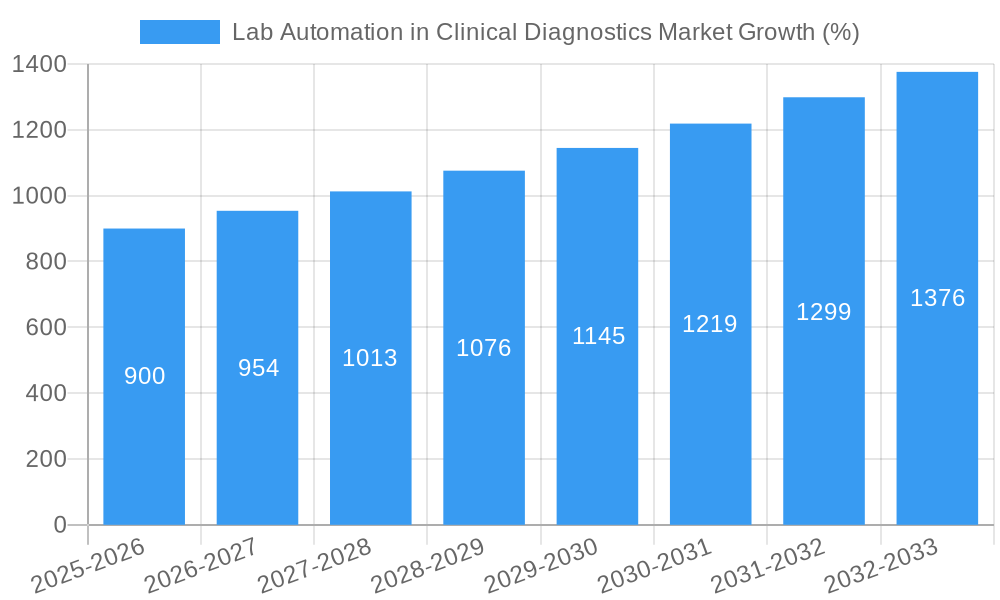

The global lab automation in clinical diagnostics market is experiencing robust growth, driven by the increasing demand for high-throughput testing, improved accuracy and efficiency in diagnostic procedures, and the rising prevalence of chronic diseases. The market's Compound Annual Growth Rate (CAGR) of 5.60% from 2019 to 2024 indicates a significant upward trajectory. This growth is fueled by technological advancements such as the integration of artificial intelligence (AI) and machine learning (ML) into automated systems, leading to faster turnaround times and reduced human error. Furthermore, the increasing adoption of laboratory information management systems (LIMS) and the need for improved workflow management are key factors contributing to market expansion. Major players such as Thermo Fisher Scientific, Danaher Corporation, and Roche Holding AG are actively investing in research and development, fostering innovation and competition within the sector. The market segmentation, while not explicitly detailed, likely includes various automation technologies (e.g., liquid handling, sample preparation, and analysis systems), diagnostic applications (e.g., clinical chemistry, immunoassay, microbiology), and end-user segments (e.g., hospitals, diagnostic laboratories, and research institutions). Regional variations in market size will likely reflect differences in healthcare infrastructure, regulatory frameworks, and disease prevalence across various geographical areas.

Looking forward to 2033, the market is poised for continued expansion. The sustained increase in global healthcare spending, coupled with a growing emphasis on preventative healthcare and personalized medicine, will further stimulate demand for efficient and reliable lab automation solutions. However, the high initial investment cost associated with implementing automation systems and the need for skilled technicians to operate and maintain them could act as potential restraints. The market will likely see ongoing consolidation, with larger players acquiring smaller companies to expand their product portfolios and market share. The focus on developing integrated, modular systems that offer greater flexibility and scalability will be crucial for future market success. This ongoing evolution underscores the dynamic nature of the lab automation in clinical diagnostics market, positioning it for sustained and significant growth throughout the forecast period.

Lab Automation in Clinical Diagnostics Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Lab Automation in Clinical Diagnostics Market, offering actionable insights for stakeholders across the industry. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The forecast period covers 2025-2033, and the historical period encompasses 2019-2024. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Lab Automation in Clinical Diagnostics Market Market Structure & Competitive Dynamics

The Lab Automation in Clinical Diagnostics market is characterized by a moderately consolidated structure, with key players like Thermo Fisher Scientific, Danaher Corporation, and Roche Holding AG holding significant market share. However, the presence of numerous smaller companies and startups fosters a dynamic competitive landscape. Innovation ecosystems are robust, driven by ongoing advancements in robotics, AI, and molecular diagnostics. Regulatory frameworks, particularly those related to FDA approvals and CE marking, significantly impact market entry and product adoption. Product substitutes, while limited, include manual laboratory procedures, posing a challenge to market penetration. End-user trends show a growing preference for automated systems due to increased efficiency, reduced human error, and higher throughput.

M&A activity has been significant, exemplified by Thermo Fisher Scientific's acquisition of QIAGEN N.V. in March 2020 (valued at xx Million), illustrating the strategic importance of expanding capabilities in molecular diagnostics and automation. Overall, the market exhibits a mix of organic growth strategies focused on technological advancements and inorganic growth through mergers and acquisitions. The total value of M&A deals in the market from 2019-2024 is estimated at xx Million. Market share data for key players are as follows (estimated 2025):

- Thermo Fisher Scientific: xx%

- Danaher Corporation: xx%

- Roche Holding AG: xx%

- Others: xx%

Lab Automation in Clinical Diagnostics Market Industry Trends & Insights

The Lab Automation in Clinical Diagnostics market is experiencing robust growth, primarily fueled by the rising prevalence of chronic diseases, increasing demand for high-throughput testing, and the growing adoption of personalized medicine. Technological disruptions, such as the integration of artificial intelligence (AI) and machine learning (ML) in diagnostic workflows, are further accelerating market expansion. Consumer preferences are shifting towards faster, more accurate, and cost-effective diagnostic solutions. Competitive dynamics are intensifying, with companies focusing on innovation, strategic partnerships, and acquisitions to maintain a competitive edge. The market penetration of automated systems is increasing steadily, particularly in developed regions, and is expected to reach xx% by 2033. This growth is supported by government initiatives promoting healthcare infrastructure development and increasing healthcare spending globally.

Dominant Markets & Segments in Lab Automation in Clinical Diagnostics Market

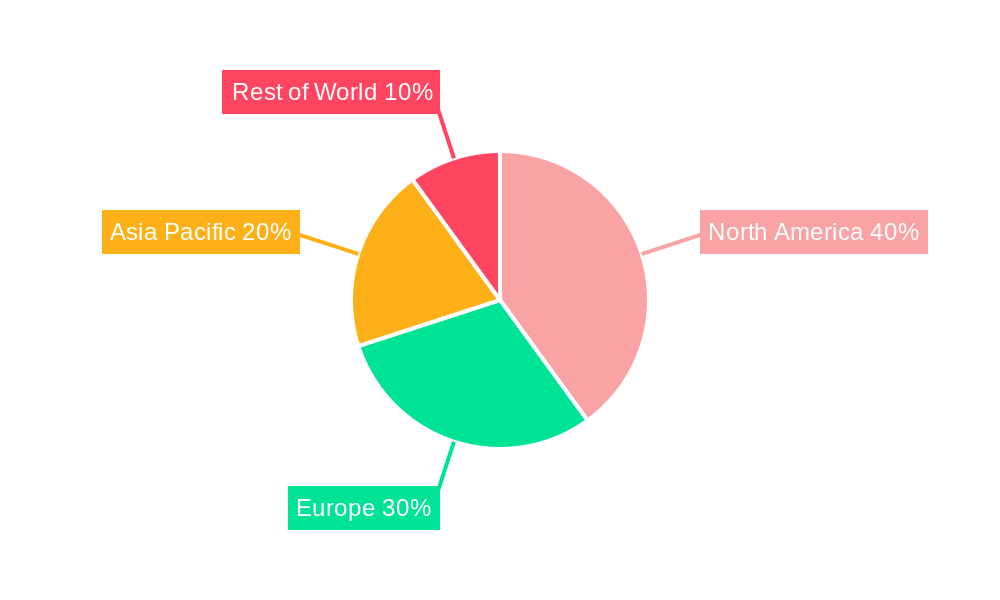

North America currently dominates the Lab Automation in Clinical Diagnostics market, driven by advanced healthcare infrastructure, high adoption rates of advanced technologies, and significant investments in R&D.

- Key Drivers in North America:

- Strong regulatory support and funding for advanced diagnostics.

- High healthcare expenditure and insurance coverage.

- Presence of major market players and robust innovation ecosystems.

- Well-established clinical laboratory infrastructure.

Europe is another significant market, with strong growth projected due to increasing healthcare investments and rising demand for improved diagnostic efficiency. Asia-Pacific is expected to experience rapid growth, fueled by expanding healthcare infrastructure, a burgeoning middle class, and increased awareness of preventive healthcare.

Lab Automation in Clinical Diagnostics Market Product Innovations

Recent product innovations focus on miniaturization, integration of multiple analytical techniques onto single platforms (as seen in Roche's cobas pure), and enhanced data analytics capabilities. These advancements offer improved workflow efficiency, reduced operational costs, and enhanced diagnostic accuracy. The market is witnessing a trend towards modular systems, allowing labs to customize their automation solutions based on specific needs and budgets. This flexibility and adaptability are key competitive advantages in a market with diverse laboratory settings and testing requirements.

Report Segmentation & Scope

The report segments the market based on product type (liquid handling systems, automated analyzers, sample management systems, etc.), application (clinical chemistry, hematology, microbiology, etc.), end-user (hospitals & labs, research centers, etc.), and geography (North America, Europe, Asia Pacific, etc.). Each segment’s growth trajectory is analyzed, considering market size, competitive landscape, and growth projections. For example, the liquid handling segment is expected to grow at a CAGR of xx%, driven by increasing demand for high-throughput screening and automation in various diagnostic assays.

Key Drivers of Lab Automation in Clinical Diagnostics Market Growth

Several key factors are driving the growth of the lab automation market. Technological advancements, particularly in AI, robotics, and miniaturization, enhance efficiency and accuracy. The increasing prevalence of chronic diseases necessitates high-throughput testing capabilities provided by automation. Furthermore, stringent regulatory requirements are pushing labs to adopt automation for improved quality control and reduced human error. Government initiatives promoting healthcare infrastructure and increased healthcare spending also contribute significantly.

Challenges in the Lab Automation in Clinical Diagnostics Market Sector

Despite significant growth, the market faces challenges. High initial investment costs for automation systems can be a barrier for smaller laboratories. Integration complexities between different automated systems can hinder seamless workflows. The need for skilled personnel to operate and maintain these sophisticated systems also presents a challenge. Finally, regulatory hurdles and stringent quality control requirements can add complexity to the market.

Leading Players in the Lab Automation in Clinical Diagnostics Market Market

- Thermo Fisher Scientific

- Danaher Corporation

- Hudson Robotics

- Becton Dickinson

- Synchron Lab Automation

- Agilent Technologies Inc

- Siemens Healthineers AG

- Tecan Group Ltd

- Perkinelmer Inc

- Honeywell International Inc

- Bio-Rad Laboratories Inc

- Roche Holding AG

- Shimadzu Corporation

- Aurora Biomed

- List Not Exhaustive

Key Developments in Lab Automation in Clinical Diagnostics Market Sector

- March 2021: Roche launched cobas pure integrated solutions, simplifying lab operations.

- March 2020: Thermo Fisher acquired QIAGEN N.V., expanding its molecular diagnostics portfolio and automation capabilities.

Strategic Lab Automation in Clinical Diagnostics Market Market Outlook

The future of the Lab Automation in Clinical Diagnostics market is promising, with continuous technological advancements and increasing demand driving growth. Strategic opportunities lie in developing innovative, cost-effective, and user-friendly automated systems catering to the diverse needs of clinical laboratories. Focus on AI-powered diagnostics, integration with electronic health records (EHRs), and expansion into emerging markets will be key to success. The market's growth will be propelled by an increased focus on personalized medicine, point-of-care diagnostics, and the growing need for rapid and accurate diagnostic testing globally.

Lab Automation in Clinical Diagnostics Market Segmentation

-

1. Equipment

- 1.1. Automated Liquid Handlers

- 1.2. Automated Plate Handlers

- 1.3. Robotic Arms

- 1.4. Automated Storage and Retrieval Systems (AS/RS)

- 1.5. Vision Systems

Lab Automation in Clinical Diagnostics Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Lab Automation in Clinical Diagnostics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Flexibility and Adaptability of Lab Automation Systems; Growing Demand from Drug Discovery and Genomics

- 3.3. Market Restrains

- 3.3.1. Flexibility and Adaptability of Lab Automation Systems; Growing Demand from Drug Discovery and Genomics

- 3.4. Market Trends

- 3.4.1. Automated Liquid Handlers is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Lab Automation in Clinical Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Equipment

- 5.1.1. Automated Liquid Handlers

- 5.1.2. Automated Plate Handlers

- 5.1.3. Robotic Arms

- 5.1.4. Automated Storage and Retrieval Systems (AS/RS)

- 5.1.5. Vision Systems

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Equipment

- 6. North America Lab Automation in Clinical Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Equipment

- 6.1.1. Automated Liquid Handlers

- 6.1.2. Automated Plate Handlers

- 6.1.3. Robotic Arms

- 6.1.4. Automated Storage and Retrieval Systems (AS/RS)

- 6.1.5. Vision Systems

- 6.1. Market Analysis, Insights and Forecast - by Equipment

- 7. Europe Lab Automation in Clinical Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Equipment

- 7.1.1. Automated Liquid Handlers

- 7.1.2. Automated Plate Handlers

- 7.1.3. Robotic Arms

- 7.1.4. Automated Storage and Retrieval Systems (AS/RS)

- 7.1.5. Vision Systems

- 7.1. Market Analysis, Insights and Forecast - by Equipment

- 8. Asia Pacific Lab Automation in Clinical Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Equipment

- 8.1.1. Automated Liquid Handlers

- 8.1.2. Automated Plate Handlers

- 8.1.3. Robotic Arms

- 8.1.4. Automated Storage and Retrieval Systems (AS/RS)

- 8.1.5. Vision Systems

- 8.1. Market Analysis, Insights and Forecast - by Equipment

- 9. Rest of the World Lab Automation in Clinical Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Equipment

- 9.1.1. Automated Liquid Handlers

- 9.1.2. Automated Plate Handlers

- 9.1.3. Robotic Arms

- 9.1.4. Automated Storage and Retrieval Systems (AS/RS)

- 9.1.5. Vision Systems

- 9.1. Market Analysis, Insights and Forecast - by Equipment

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Thermo Fisher Scientific

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Danaher Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Hudson Robotics

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Becton Dickinson

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Synchron Lab Automation

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Agilent Technologies Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Siemens Healthineers AG

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Tecan Group Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Perkinelmer Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Honeywell International Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Bio-Rad Laboratories Inc

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Roche Holding AG

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Shimadzu Corporation

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Aurora Biomed*List Not Exhaustive

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.1 Thermo Fisher Scientific

List of Figures

- Figure 1: Global Lab Automation in Clinical Diagnostics Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Lab Automation in Clinical Diagnostics Market Revenue (Million), by Equipment 2024 & 2032

- Figure 3: North America Lab Automation in Clinical Diagnostics Market Revenue Share (%), by Equipment 2024 & 2032

- Figure 4: North America Lab Automation in Clinical Diagnostics Market Revenue (Million), by Country 2024 & 2032

- Figure 5: North America Lab Automation in Clinical Diagnostics Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Europe Lab Automation in Clinical Diagnostics Market Revenue (Million), by Equipment 2024 & 2032

- Figure 7: Europe Lab Automation in Clinical Diagnostics Market Revenue Share (%), by Equipment 2024 & 2032

- Figure 8: Europe Lab Automation in Clinical Diagnostics Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Europe Lab Automation in Clinical Diagnostics Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Asia Pacific Lab Automation in Clinical Diagnostics Market Revenue (Million), by Equipment 2024 & 2032

- Figure 11: Asia Pacific Lab Automation in Clinical Diagnostics Market Revenue Share (%), by Equipment 2024 & 2032

- Figure 12: Asia Pacific Lab Automation in Clinical Diagnostics Market Revenue (Million), by Country 2024 & 2032

- Figure 13: Asia Pacific Lab Automation in Clinical Diagnostics Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: Rest of the World Lab Automation in Clinical Diagnostics Market Revenue (Million), by Equipment 2024 & 2032

- Figure 15: Rest of the World Lab Automation in Clinical Diagnostics Market Revenue Share (%), by Equipment 2024 & 2032

- Figure 16: Rest of the World Lab Automation in Clinical Diagnostics Market Revenue (Million), by Country 2024 & 2032

- Figure 17: Rest of the World Lab Automation in Clinical Diagnostics Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Lab Automation in Clinical Diagnostics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Lab Automation in Clinical Diagnostics Market Revenue Million Forecast, by Equipment 2019 & 2032

- Table 3: Global Lab Automation in Clinical Diagnostics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Lab Automation in Clinical Diagnostics Market Revenue Million Forecast, by Equipment 2019 & 2032

- Table 5: Global Lab Automation in Clinical Diagnostics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Global Lab Automation in Clinical Diagnostics Market Revenue Million Forecast, by Equipment 2019 & 2032

- Table 7: Global Lab Automation in Clinical Diagnostics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Global Lab Automation in Clinical Diagnostics Market Revenue Million Forecast, by Equipment 2019 & 2032

- Table 9: Global Lab Automation in Clinical Diagnostics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Global Lab Automation in Clinical Diagnostics Market Revenue Million Forecast, by Equipment 2019 & 2032

- Table 11: Global Lab Automation in Clinical Diagnostics Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Lab Automation in Clinical Diagnostics Market?

The projected CAGR is approximately 5.60%.

2. Which companies are prominent players in the Lab Automation in Clinical Diagnostics Market?

Key companies in the market include Thermo Fisher Scientific, Danaher Corporation, Hudson Robotics, Becton Dickinson, Synchron Lab Automation, Agilent Technologies Inc, Siemens Healthineers AG, Tecan Group Ltd, Perkinelmer Inc, Honeywell International Inc, Bio-Rad Laboratories Inc, Roche Holding AG, Shimadzu Corporation, Aurora Biomed*List Not Exhaustive.

3. What are the main segments of the Lab Automation in Clinical Diagnostics Market?

The market segments include Equipment.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Flexibility and Adaptability of Lab Automation Systems; Growing Demand from Drug Discovery and Genomics.

6. What are the notable trends driving market growth?

Automated Liquid Handlers is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Flexibility and Adaptability of Lab Automation Systems; Growing Demand from Drug Discovery and Genomics.

8. Can you provide examples of recent developments in the market?

March 2021 - Roche announced the launch of cobas pure integrated solutions in countries accepting the CE mark. This new compact analyzer combines three technologies on a single platform helping to simplify daily operations in labs with limited space and resources.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Lab Automation in Clinical Diagnostics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Lab Automation in Clinical Diagnostics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Lab Automation in Clinical Diagnostics Market?

To stay informed about further developments, trends, and reports in the Lab Automation in Clinical Diagnostics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence