Key Insights

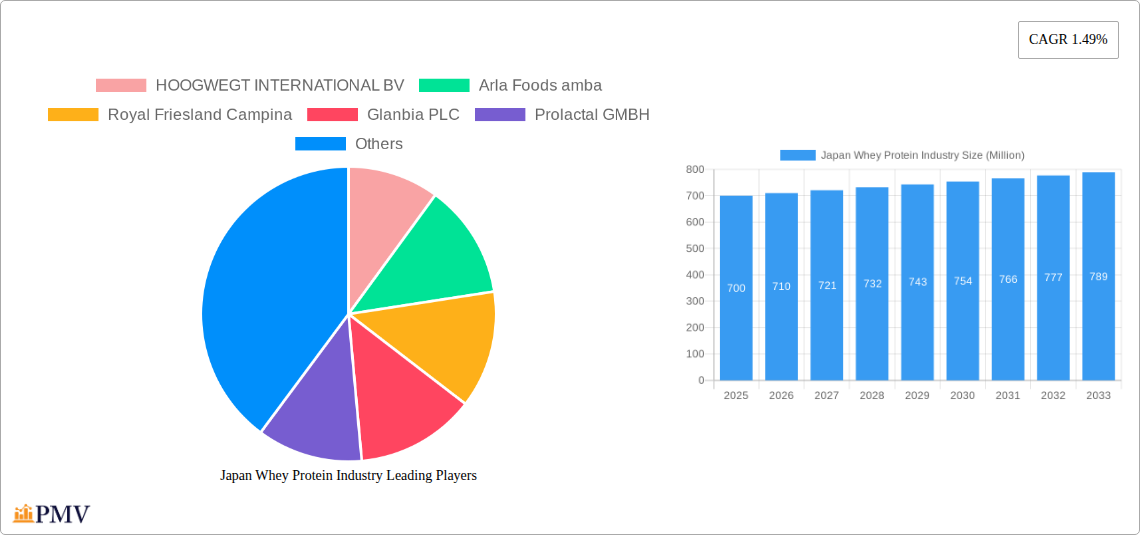

The Japan whey protein market, a segment within the broader Asia-Pacific region, exhibits promising growth potential driven by increasing health consciousness, rising disposable incomes, and a burgeoning fitness culture. While precise market size data for Japan specifically is absent, we can reasonably estimate its value based on the overall Asia-Pacific market size and its economic standing. Considering China and India dominate the regional market, and Japan has a comparatively smaller population but higher per capita income and health awareness, a conservative estimate places Japan's whey protein market size around ¥100 billion (approximately $700 million USD) in 2025. This is predicated on a proportional allocation within the broader Asia-Pacific market considering the factors mentioned above. The market is segmented by product type (whey protein concentrates, isolates, hydrolysates) and application (sports nutrition, infant formula, functional foods), with sports nutrition likely representing the largest share due to the growing popularity of fitness activities. Major global players like Fonterra and Glanbia, alongside domestic players, actively compete in this space.

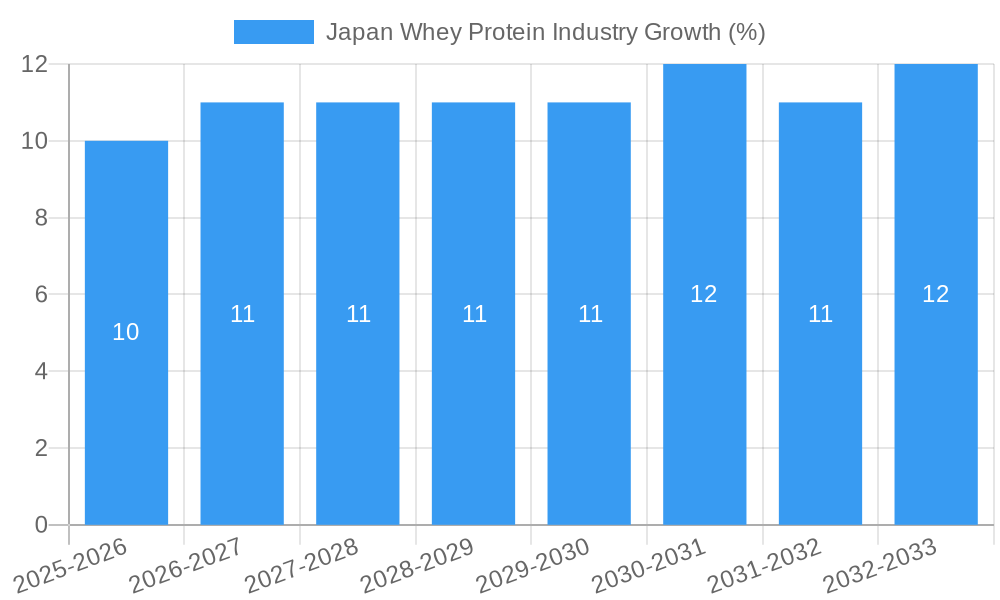

The projected 1.49% CAGR suggests steady, albeit moderate, growth through 2033. This relatively low CAGR might reflect market maturity in Japan compared to other rapidly developing Asian economies. However, factors such as the increasing adoption of plant-based alternatives and evolving consumer preferences regarding protein sources could influence future growth trajectory. Increased focus on product innovation, including functional whey protein formulations targeting specific health benefits (e.g., improved gut health or enhanced muscle recovery), and strategic partnerships to reach wider consumer segments will likely be crucial for market players seeking to capitalize on existing and emerging opportunities. The market faces potential restraints from fluctuating raw material prices and stringent regulatory requirements concerning food safety and labeling.

Japan Whey Protein Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Japan whey protein industry, offering valuable insights for stakeholders seeking to understand market dynamics, competitive landscapes, and future growth opportunities. The report covers the period 2019-2033, with a focus on the 2025-2033 forecast period. The estimated market size in 2025 is projected at xx Million USD. This in-depth study analyzes various segments including Whey Protein Concentrates, Isolates, and Hydrolyzed Whey Proteins, across applications in Sports Nutrition, Infant Formula, and Functional/Fortified Foods. Key players like HOOGWEGT INTERNATIONAL BV, Arla Foods amba, Royal Friesland Campina, Glanbia PLC, Prolactal GMBH, Saputo Inc, Fonterra Co-operative Group Limited, Morinaga Milk Industry Co Ltd, Groupe Lactalis, and Sodiaal Co-operative Group are profiled, providing a thorough understanding of the competitive landscape.

Japan Whey Protein Industry Market Structure & Competitive Dynamics

The Japan whey protein market exhibits a moderately concentrated structure, with several multinational and domestic players vying for market share. The industry is characterized by strong competitive dynamics driven by product innovation, strategic partnerships, and mergers and acquisitions (M&A) activity. While precise market share figures for each player remain proprietary, the leading companies collectively hold a significant portion of the overall market.

Market Concentration: The top 5 players likely account for over xx% of the market share, with a significant concentration of activity in the major metropolitan areas.

Innovation Ecosystems: Japan boasts a robust food technology sector, facilitating continuous innovation in whey protein formulations, processing techniques, and application development. Many companies invest heavily in R&D to develop unique and value-added whey protein products.

Regulatory Frameworks: Japanese food safety regulations are stringent, impacting product development and market entry. Compliance with these standards is crucial for success in the market.

Product Substitutes: Plant-based protein alternatives are emerging as substitutes, though whey protein maintains its dominance due to its superior nutritional profile and established consumer preference.

End-User Trends: Growing health consciousness, increasing demand for high-protein diets, and the rising popularity of sports and fitness activities are driving demand for whey protein.

M&A Activities: While specific deal values are confidential, several M&A activities have reshaped the competitive landscape in recent years. These transactions often involve strategic acquisitions to expand product portfolios, market reach, and technological capabilities.

Japan Whey Protein Industry Industry Trends & Insights

The Japan whey protein market is experiencing robust growth, fueled by several key trends. The Compound Annual Growth Rate (CAGR) during the historical period (2019-2024) is estimated at xx%, with projections of xx% CAGR during the forecast period (2025-2033). Market penetration is currently estimated at xx% and expected to rise to xx% by 2033.

The rising health consciousness among Japanese consumers is a significant driver, leading to increased demand for high-protein diets and functional foods. Technological advancements in whey protein processing and formulation are creating innovative products with improved functionalities and enhanced nutritional profiles. Furthermore, the increasing participation in sports and fitness activities further propels demand for sports nutrition products containing whey protein. The competitive landscape is dynamic, with companies focusing on product differentiation, brand building, and strategic partnerships to maintain a competitive edge.

Dominant Markets & Segments in Japan Whey Protein Industry

The Japanese market is dominated by the urban centers like Tokyo, Osaka, and Nagoya, reflecting higher disposable incomes and greater awareness of health and wellness. Among the various types, Whey Protein Isolates are predicted to hold a dominant position, due to their higher protein content and purity, commanding a premium price point. The Sports and Performance Nutrition application segment is projected to experience the fastest growth, propelled by expanding fitness culture and rising athletic participation.

Key Drivers of Whey Protein Isolates Dominance:

- Superior protein content and purity.

- Higher demand from health-conscious consumers.

- Premium pricing strategy.

Key Drivers of Sports and Performance Nutrition Segment Growth:

- Rising participation in sports and fitness activities.

- Growing awareness of the importance of protein for muscle building and recovery.

- Increasing availability of sports nutrition products containing whey protein.

Other significant segments: The Infant Formula and Functional/Fortified Food segments represent other large and growing market niches. Increased awareness about nutrition amongst parents and the growing demand for functional food are important drivers in these sections.

Japan Whey Protein Industry Product Innovations

Recent years have witnessed significant product innovations in the Japanese whey protein market. Companies are focusing on developing products with enhanced functionalities, such as improved solubility, digestibility, and taste profiles. Technological advancements in micro-particulate technology and other processing techniques are leading to new product formats and applications. This focus on innovation reflects the competitive intensity within the market and the increasing demand for high-quality, specialized whey protein products catering to diverse consumer needs.

Report Segmentation & Scope

This report segments the Japan whey protein market based on type (Whey Protein Concentrates, Isolates, Hydrolyzed Whey Proteins) and application (Sports and Performance Nutrition, Infant Formula, Functional/Fortified Food). Each segment is analyzed based on its market size, growth projections, and competitive dynamics. For example, the Whey Protein Isolates segment is projected to show higher growth than concentrates due to its higher purity and application flexibility. The Sports and Performance Nutrition application segment is expected to grow the fastest, driven by increased fitness awareness.

Key Drivers of Japan Whey Protein Industry Growth

The growth of the Japan whey protein industry is propelled by several factors: a rising health-conscious population embracing high-protein diets, increasing participation in sports and fitness activities stimulating demand for sports nutrition products, and continuous innovation in whey protein processing and formulation leading to improved product functionalities and market expansion. Government initiatives promoting healthy lifestyles and supportive regulatory frameworks also contribute positively.

Challenges in the Japan Whey Protein Industry Sector

The industry faces several challenges, including increasing competition from plant-based protein alternatives, fluctuating raw material prices impacting profitability, and stringent regulatory requirements increasing compliance costs. Supply chain disruptions and logistical complexities also contribute to market uncertainties. These factors can lead to price volatility and affect overall market growth. The overall impact of these challenges is estimated at around xx Million USD annually.

Leading Players in the Japan Whey Protein Industry Market

- HOOGWEGT INTERNATIONAL BV

- Arla Foods amba

- Royal Friesland Campina

- Glanbia PLC

- Prolactal GMBH

- Saputo Inc

- Fonterra Co-operative Group Limited

- Morinaga Milk Industry Co Ltd

- Groupe Lactalis

- Sodiaal Co-operative Group

Key Developments in Japan Whey Protein Industry Sector

- April 2023: Arla Foods Ingredients launched Nutrilac and ProteinBoost, leveraging patented microparticulate technology, catering to the growing demand for high-quality protein in Japan.

- September 2022: Glanbia rebranded its whey protein line as "Tirlan," offering diverse isolates and concentrates for various applications in the Japanese market.

- July 2021: MILEI GmbH (Morinaga subsidiary) inaugurated a new facility for commercial production of its product portfolio, significantly expanding production capacity.

Strategic Japan Whey Protein Industry Market Outlook

The future of the Japan whey protein industry appears promising, driven by continuous innovation, expanding health-conscious consumer base, and rising demand for specialized protein products. Strategic opportunities exist in developing functional and value-added whey protein products, expanding into niche markets, and forging strategic partnerships to enhance market reach and technological capabilities. The market is poised for continued growth, with significant opportunities for companies that can adapt to evolving consumer preferences and technological advancements.

Japan Whey Protein Industry Segmentation

-

1. Type

- 1.1. Whey Protein Concentrates

- 1.2. Whey Protein Isolates

- 1.3. Hydrolyzed Whey Proteins

-

2. Application

- 2.1. Sports and Performance Nutrition

- 2.2. Infant Formula

- 2.3. Functional/Fortified Food

Japan Whey Protein Industry Segmentation By Geography

- 1. Japan

Japan Whey Protein Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 1.49% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing inclination towards fitness and sports participation; Increasing demand for fortified processed food products

- 3.3. Market Restrains

- 3.3.1. Extensive presence of alternative protein products sourced from plant based ingredients

- 3.4. Market Trends

- 3.4.1. Sports and Performance Nutrition Dominates the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Whey Protein Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Whey Protein Concentrates

- 5.1.2. Whey Protein Isolates

- 5.1.3. Hydrolyzed Whey Proteins

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Sports and Performance Nutrition

- 5.2.2. Infant Formula

- 5.2.3. Functional/Fortified Food

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. China Japan Whey Protein Industry Analysis, Insights and Forecast, 2019-2031

- 7. Japan Japan Whey Protein Industry Analysis, Insights and Forecast, 2019-2031

- 8. India Japan Whey Protein Industry Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Japan Whey Protein Industry Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Japan Whey Protein Industry Analysis, Insights and Forecast, 2019-2031

- 11. Australia Japan Whey Protein Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Japan Whey Protein Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 HOOGWEGT INTERNATIONAL BV

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Arla Foods amba

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Royal Friesland Campina

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Glanbia PLC

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Prolactal GMBH

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Saputo Inc *List Not Exhaustive

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Fonterra Co-operative Group Limited

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Morinaga Milk Industry Co Ltd

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Groupe Lactalis

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Sodiaal Co-operative Group

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 HOOGWEGT INTERNATIONAL BV

List of Figures

- Figure 1: Japan Whey Protein Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Japan Whey Protein Industry Share (%) by Company 2024

List of Tables

- Table 1: Japan Whey Protein Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Japan Whey Protein Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Japan Whey Protein Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Japan Whey Protein Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Japan Whey Protein Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Japan Whey Protein Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Japan Japan Whey Protein Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: India Japan Whey Protein Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Korea Japan Whey Protein Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Taiwan Japan Whey Protein Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Australia Japan Whey Protein Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Asia-Pacific Japan Whey Protein Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Japan Whey Protein Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 14: Japan Whey Protein Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 15: Japan Whey Protein Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Whey Protein Industry?

The projected CAGR is approximately 1.49%.

2. Which companies are prominent players in the Japan Whey Protein Industry?

Key companies in the market include HOOGWEGT INTERNATIONAL BV, Arla Foods amba, Royal Friesland Campina, Glanbia PLC, Prolactal GMBH, Saputo Inc *List Not Exhaustive, Fonterra Co-operative Group Limited, Morinaga Milk Industry Co Ltd, Groupe Lactalis, Sodiaal Co-operative Group.

3. What are the main segments of the Japan Whey Protein Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing inclination towards fitness and sports participation; Increasing demand for fortified processed food products.

6. What are the notable trends driving market growth?

Sports and Performance Nutrition Dominates the Market.

7. Are there any restraints impacting market growth?

Extensive presence of alternative protein products sourced from plant based ingredients.

8. Can you provide examples of recent developments in the market?

April 2023: Arla Foods Ingredients, headquartered in Denmark, introduced Nutrilac and ProteinBoost, two cutting-edge whey protein products leveraging patented microparticulate technology. This innovative launch addresses the surging global demand for high-quality protein, particularly in the Japanese market. These versatile products find application in a wide range of dairy and sports nutrition products, including yogurt, desserts, and dairy beverages.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Whey Protein Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Whey Protein Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Whey Protein Industry?

To stay informed about further developments, trends, and reports in the Japan Whey Protein Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence