Key Insights

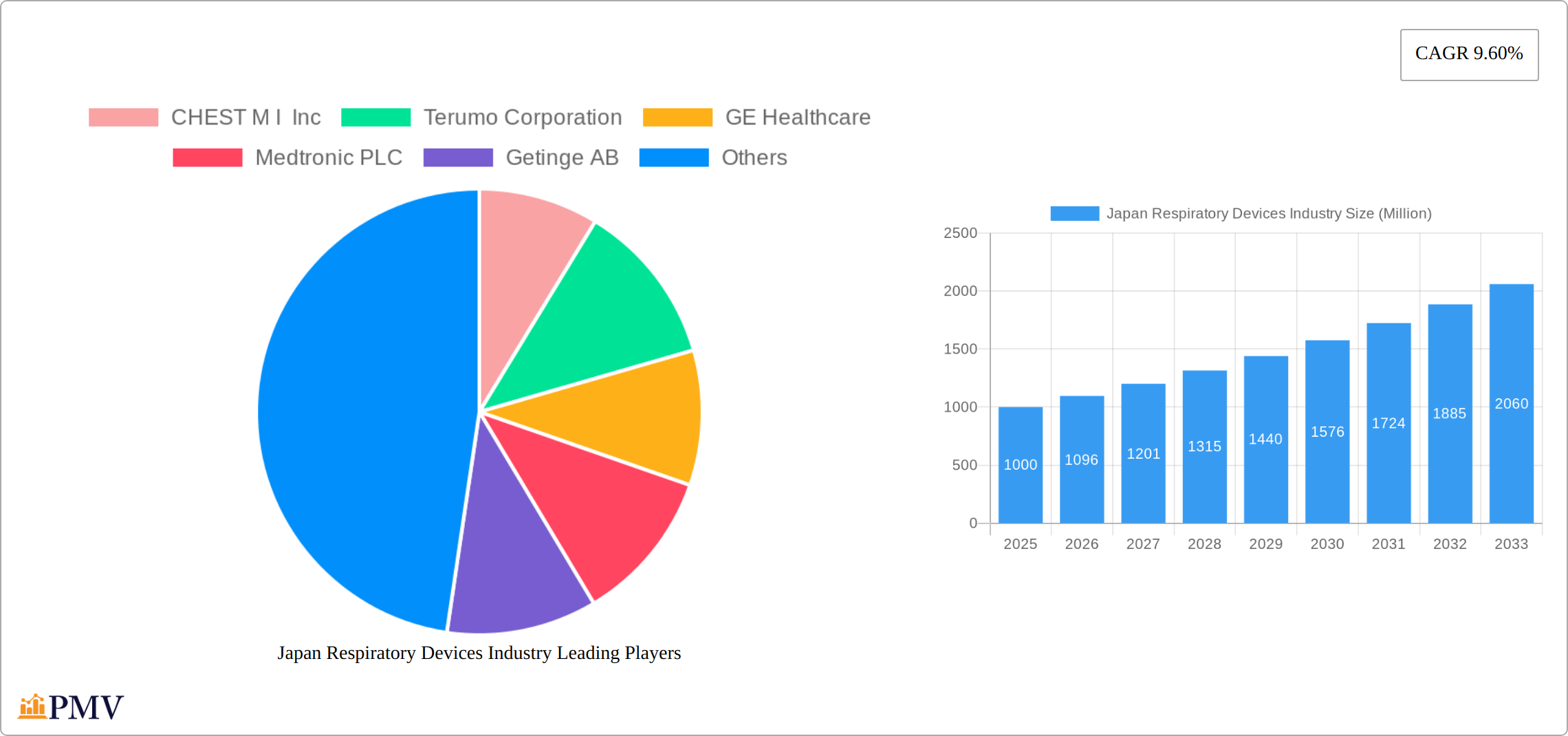

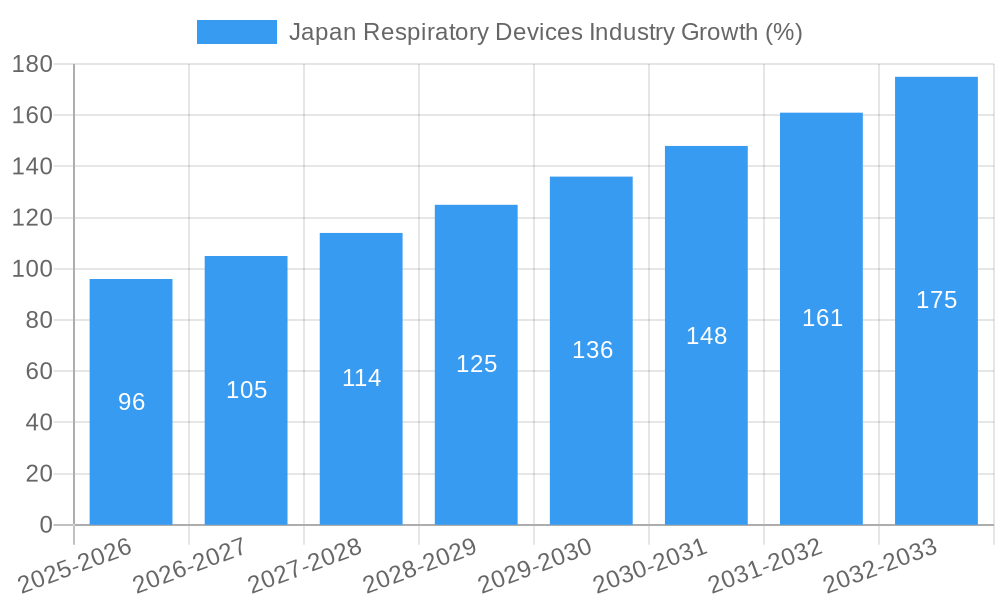

The Japan respiratory devices market, valued at approximately ¥150 billion (USD 1 billion) in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 9.60% from 2025 to 2033. This expansion is driven by several key factors. The aging population in Japan, coupled with a rising prevalence of chronic respiratory diseases like asthma, COPD, and lung cancer, significantly boosts demand for diagnostic and therapeutic devices. Technological advancements, such as the development of miniaturized, portable devices and smart respiratory monitors, enhance patient convenience and treatment efficacy, further fueling market growth. Government initiatives promoting better healthcare access and early disease detection also contribute positively to market expansion. Furthermore, increasing awareness about respiratory health and the availability of advanced treatment options are driving adoption among patients and healthcare providers. The market is segmented by device type (diagnostic and monitoring, therapeutic, disposables) with diagnostic and monitoring devices holding a significant market share due to the increasing focus on early disease detection and preventative care.

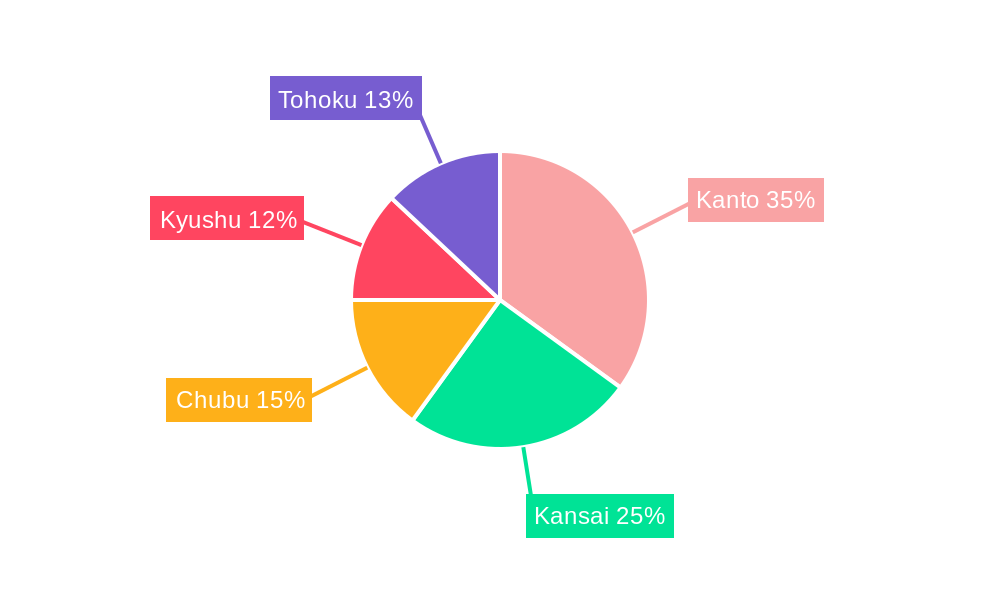

Competitive rivalry is intense, with both domestic and international players vying for market share. Leading companies like Terumo Corporation, GE Healthcare, Medtronic PLC, and ResMed Inc. are actively investing in research and development, strategic partnerships, and expanding their product portfolios to cater to the evolving needs of the Japanese market. Regional variations exist, with the Kanto and Kansai regions expected to maintain a dominant market share due to the higher concentration of healthcare facilities and a larger patient base. However, growth is anticipated across all regions as improved healthcare infrastructure expands access to advanced respiratory care. Despite positive growth projections, challenges remain, including the high cost of advanced devices and the potential for reimbursement hurdles impacting market penetration. Nonetheless, the long-term outlook for the Japan respiratory devices market remains exceptionally promising, fueled by strong underlying demographic trends and technological advancements.

Japan Respiratory Devices Industry: Market Analysis & Forecast 2019-2033

This comprehensive report provides an in-depth analysis of the Japan respiratory devices industry, offering crucial insights for stakeholders across the value chain. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period spans 2025-2033, and the historical period encompasses 2019-2024. The report meticulously examines market size, segmentation, competitive landscape, growth drivers, and challenges, delivering actionable intelligence for informed decision-making. The total market size is projected to reach xx Million by 2033.

Japan Respiratory Devices Industry Market Structure & Competitive Dynamics

The Japanese respiratory devices market exhibits a moderately concentrated structure, with several multinational corporations and domestic players vying for market share. Key players include Terumo Corporation, GE Healthcare, Medtronic PLC, Getinge AB, Koninklijke Philips NV, ResMed Inc, Dragerwerk AG, Fisher & Paykel Healthcare Ltd, CHEST M I Inc, and Metran Co Ltd. The market is characterized by a robust innovation ecosystem, driven by ongoing R&D efforts focused on improving device efficacy, portability, and connectivity.

- Market Concentration: The top 5 players hold an estimated xx% market share in 2025.

- Regulatory Framework: Stringent regulatory approvals from the Pharmaceuticals and Medical Devices Agency (PMDA) influence market entry and product lifecycle.

- Product Substitutes: Competition exists from alternative therapies and treatment modalities.

- End-User Trends: Aging population and rising prevalence of respiratory diseases are key growth drivers.

- M&A Activities: The past five years have witnessed xx Million in M&A deals, primarily driven by strategic acquisitions to expand product portfolios and market reach. For instance, [Insert example of M&A activity if available, otherwise state "Specific deal details are commercially sensitive and unavailable for disclosure"].

Japan Respiratory Devices Industry Industry Trends & Insights

The Japanese respiratory devices market is experiencing robust growth, driven by several factors. The aging population, increasing prevalence of chronic respiratory illnesses like asthma and COPD, and rising healthcare expenditure are contributing to market expansion. Technological advancements, such as the integration of digital health technologies and the development of smart inhalers, are further fueling market growth. The market is projected to register a CAGR of xx% during the forecast period (2025-2033). This growth is also influenced by increased awareness of respiratory health and proactive healthcare management. The market penetration of advanced respiratory devices, particularly those incorporating telehealth capabilities, is steadily increasing, currently estimated at xx% in 2025 and projected to reach xx% by 2033. Competitive dynamics are shaping the market through pricing strategies, product differentiation, and strategic partnerships.

Dominant Markets & Segments in Japan Respiratory Devices Industry

Within the Japan respiratory devices market, the Therapeutic Devices segment currently holds the largest market share, followed by Diagnostic and Monitoring Devices. The Disposables segment is also witnessing significant growth due to the increasing demand for single-use devices.

- Therapeutic Devices: The dominance of this segment is primarily driven by the high prevalence of chronic respiratory diseases requiring continuous therapy. Growth is further fuelled by technological advancements resulting in improved efficacy and patient convenience.

- Diagnostic and Monitoring Devices: This segment is experiencing steady growth driven by the need for early diagnosis and improved monitoring of respiratory conditions. Government initiatives promoting early detection and preventive care are further boosting demand.

- Disposables: The increasing adoption of single-use devices contributes to this segment’s growth. Convenience, hygiene concerns, and the prevention of cross-contamination are key factors driving demand.

The key drivers for dominance in these segments include:

- High Prevalence of Respiratory Diseases: Japan has a high prevalence of asthma, COPD, and other respiratory conditions, driving demand for both diagnostic and therapeutic devices.

- Aging Population: The rapidly aging population contributes significantly to the market growth, as older individuals are more susceptible to respiratory problems.

- Government Initiatives: Government initiatives supporting healthcare infrastructure and promoting preventative healthcare play a crucial role in the market's expansion.

Japan Respiratory Devices Industry Product Innovations

Recent innovations in the Japanese respiratory devices market highlight a strong trend towards integrating digital health technologies. Smart inhalers, connected nebulizers, and remote patient monitoring devices are gaining traction, improving patient adherence and enabling remote care management. These advancements offer enhanced convenience, improved data collection for better disease management, and ultimately contribute to improved patient outcomes. The market is also witnessing the development of more efficient and user-friendly devices designed to improve the overall patient experience.

Report Segmentation & Scope

This report segments the Japan respiratory devices market based on device type:

- Diagnostic and Monitoring Devices: This segment includes spirometers, pulse oximeters, and other diagnostic tools. This segment is projected to experience xx% growth during the forecast period, driven by advancements in diagnostic technology.

- Therapeutic Devices: This category comprises inhalers, nebulizers, ventilators, and other therapeutic equipment. This segment is projected to dominate the market, with xx% growth due to the high prevalence of chronic respiratory diseases.

- Disposables: This includes single-use components such as masks, filters, and cannulas. The disposables segment is expected to grow at xx% due to hygiene concerns and convenience.

Each segment’s analysis includes market size estimates, growth projections, and competitive dynamics.

Key Drivers of Japan Respiratory Devices Industry Growth

Several factors drive the growth of the Japan respiratory devices industry:

- Increasing Prevalence of Respiratory Diseases: The rising incidence of asthma, COPD, and other respiratory illnesses is a primary driver of market growth.

- Technological Advancements: Innovations such as smart inhalers and connected devices enhance patient care and improve treatment efficacy.

- Government Initiatives: Government support for healthcare infrastructure and initiatives focused on preventative healthcare further boost market expansion.

- Rising Healthcare Expenditure: Increased healthcare spending enables greater investment in advanced respiratory devices and technologies.

Challenges in the Japan Respiratory Devices Industry Sector

The Japanese respiratory devices market faces challenges including:

- Stringent Regulatory Approvals: Navigating the stringent regulatory processes can delay product launches and increase development costs. This impacts time to market and overall profitability.

- High Costs: The high cost of advanced respiratory devices can limit accessibility for some patients.

- Competitive Landscape: The presence of established multinational companies and domestic players creates a competitive landscape, impacting pricing and market share.

Leading Players in the Japan Respiratory Devices Industry Market

- CHEST M I Inc

- Terumo Corporation

- GE Healthcare

- Medtronic PLC

- Getinge AB

- Metran Co Ltd

- Koninklijke Philips NV

- ResMed Inc

- Dragerwerk AG

- Fisher & Paykel Healthcare Ltd

Key Developments in Japan Respiratory Devices Industry Sector

- February 2022: Aptar Pharma launched HeroTracker Sense, a smart inhaler, enhancing digital respiratory health solutions. This launch signifies a shift towards connected healthcare and personalized treatment.

- March 2021: PARI Pharma GmbH received authorization for the LAMIRA Nebulizer System for delivering ARIKAYCE (amikacin liposome inhalation suspension) in Japan. This approval expands treatment options for specific respiratory conditions.

Strategic Japan Respiratory Devices Industry Market Outlook

The future of the Japanese respiratory devices market appears promising, driven by continued technological advancements, an aging population, and increased awareness of respiratory health. Strategic opportunities exist for companies focused on developing innovative digital health solutions, expanding into underserved markets, and building strong partnerships within the healthcare ecosystem. The market’s growth potential is significant, promising substantial returns for companies that can successfully navigate the regulatory landscape and meet the evolving needs of patients and healthcare providers.

Japan Respiratory Devices Industry Segmentation

-

1. Type

-

1.1. Diagnostic and Monitoring Devices

- 1.1.1. Spirometers

- 1.1.2. Sleep Test Devices

- 1.1.3. Peak Flow Meters

- 1.1.4. Other Diagnostic and Monitoring Devices

-

1.2. Therapeutic Devices

- 1.2.1. Ventilators

- 1.2.2. Inhalers

- 1.2.3. CPAP Devices

- 1.2.4. Oxygen Concentrators

- 1.2.5. Other Therapeutic Devices

-

1.3. Disposables

- 1.3.1. Masks

- 1.3.2. Breathing Circuits

- 1.3.3. Other Disposables

-

1.1. Diagnostic and Monitoring Devices

Japan Respiratory Devices Industry Segmentation By Geography

- 1. Japan

Japan Respiratory Devices Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Prevalence of Respiratory Disorders; Technological Advancements in the Devices

- 3.3. Market Restrains

- 3.3.1. High Cost of Equipment

- 3.4. Market Trends

- 3.4.1. Inhalers Segment is Expected to Witness Strong Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Respiratory Devices Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Diagnostic and Monitoring Devices

- 5.1.1.1. Spirometers

- 5.1.1.2. Sleep Test Devices

- 5.1.1.3. Peak Flow Meters

- 5.1.1.4. Other Diagnostic and Monitoring Devices

- 5.1.2. Therapeutic Devices

- 5.1.2.1. Ventilators

- 5.1.2.2. Inhalers

- 5.1.2.3. CPAP Devices

- 5.1.2.4. Oxygen Concentrators

- 5.1.2.5. Other Therapeutic Devices

- 5.1.3. Disposables

- 5.1.3.1. Masks

- 5.1.3.2. Breathing Circuits

- 5.1.3.3. Other Disposables

- 5.1.1. Diagnostic and Monitoring Devices

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Kanto Japan Respiratory Devices Industry Analysis, Insights and Forecast, 2019-2031

- 7. Kansai Japan Respiratory Devices Industry Analysis, Insights and Forecast, 2019-2031

- 8. Chubu Japan Respiratory Devices Industry Analysis, Insights and Forecast, 2019-2031

- 9. Kyushu Japan Respiratory Devices Industry Analysis, Insights and Forecast, 2019-2031

- 10. Tohoku Japan Respiratory Devices Industry Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 CHEST M I Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Terumo Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 GE Healthcare

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Medtronic PLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Getinge AB

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Metran Co Ltd*List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Koninklijke Philips NV

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 ResMed Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Dragerwerk AG

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Fisher & Paykel Healthcare Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 CHEST M I Inc

List of Figures

- Figure 1: Japan Respiratory Devices Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Japan Respiratory Devices Industry Share (%) by Company 2024

List of Tables

- Table 1: Japan Respiratory Devices Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Japan Respiratory Devices Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Japan Respiratory Devices Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Japan Respiratory Devices Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Kanto Japan Respiratory Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Kansai Japan Respiratory Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Chubu Japan Respiratory Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Kyushu Japan Respiratory Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Tohoku Japan Respiratory Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Japan Respiratory Devices Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 11: Japan Respiratory Devices Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Respiratory Devices Industry?

The projected CAGR is approximately 9.60%.

2. Which companies are prominent players in the Japan Respiratory Devices Industry?

Key companies in the market include CHEST M I Inc, Terumo Corporation, GE Healthcare, Medtronic PLC, Getinge AB, Metran Co Ltd*List Not Exhaustive, Koninklijke Philips NV, ResMed Inc, Dragerwerk AG, Fisher & Paykel Healthcare Ltd.

3. What are the main segments of the Japan Respiratory Devices Industry?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Prevalence of Respiratory Disorders; Technological Advancements in the Devices.

6. What are the notable trends driving market growth?

Inhalers Segment is Expected to Witness Strong Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Equipment.

8. Can you provide examples of recent developments in the market?

Feb 2022: Aptar Pharma announced the launch of HeroTracker Sense, a novel digital respiratory health solution that transforms a standard metered dose inhaler (pMDI) into a smart, connected healthcare device.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Respiratory Devices Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Respiratory Devices Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Respiratory Devices Industry?

To stay informed about further developments, trends, and reports in the Japan Respiratory Devices Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence